In the annals of ruses used to provoke fear in the voting public about government…

Brexit doom predictions – the Y2K of today

The UK Guardian has been publishing a ‘Brexit Watch’ page for some months now claiming it is is a “look at key indicators to see what effect the Brexit process has on growth, prosperity and trade”. They wheel out some economists who typically twist whatever data is actually analysed into fitting their anti-Brexit obsession. The problem is that the data or issue they choose to highlight is usually very selective, and, then, is often partial in its coverage. I commented on the way the Brexit debate is distorted by these characters in this blog post – How to distort the Brexit debate – exclude significant factors! (June 25, 2018) and specifically on the ‘Brexit Watch’ distortions in this post – The ‘if it is bad it must be Brexit’ deception in Britain (May 31, 2018) among others. Yesterday’s UK Guardian column by Larry Elliot (August 27, 2018) – Britons seem relatively relaxed in the face of Brexit apocalypse – does provide some balance by discussing why the general public is not taking these economist ‘beat ups’ about Brexit very seriously at all. This is a case of a profession that systematically makes extreme predictions and forecasts which rarely come to pass. The general public works out fairly quickly that when a mainstream economist says the sky is about to fall in it is time to get the beach gear out because it will be fine and sunny!

I last wrote about this topic in this blog post – Brexit propaganda continues from the UK Guardian (July 4, 2018).

And before that – The ‘if it is bad it must be Brexit’ deception in Britain (May 31, 2018).

In that blog post, I discussed the ridiculous article the Guardian published on May 29, 2018 – ‘Brexit is scaring businesses to death’ – experts debate the data.

The debate was over the first-quarter GDP data for Britain published by the Office of National Statistics – Second estimate of GDP: January to March 2018 (released May 25, 2018), which showed that the British economy (based on the latest updated data) increased by 0.1 per cent in the first-quarter 2018.

One of the commentators – a Guardian regular – David Blanchflower clearly wanted to lump the slowdown together with Brexit.

He claimed that:

We should expect this decline to continue, which will be bad for British productivity. Recall that the French still produce in four days what the UK produces in five and this is not going to change any time soon. The UK continues to be the sick man of Europe.

And as you read further into his article, you see similar statements:

– “real wages are still 6.5 per cent below where they were in February 2008, just before the great recession started”.

– “Continuing and reckless austerity means living standards have fallen further – especially at the low end, because of cuts in benefits and public services and especially for those at the low end. People are hurting.”

Which when you consider the temporality of the phenomenon cited indicates that the vote for Brexit has had nothing much to do with the malaise that the trends in the data are indicating.

Which is why I questioned the whole ‘Brexit Watch’ page logic.

The Guardian was clearly lumping all negative economic data that was being published in Britain under its ‘Brexit Watch’ ambit to give the impression that the vote to free itself from the right-wing, corporatist cartel called the European Union was going to be a disaster for Britain.

The July 2018 ‘Brexit Watch’ entry was July 24, 2018 and contained three columns all with lurid headlines such as “Brexit is the biggest risk to the UK economy, bar none” and “Brexit economy: rate rise looms amid signs of slowdown”.

So “bar none” – even bigger than the slow-burn austerity and the neoliberal mindset of the government – that even the likes of David Blanchflower acknowledged was “continuing and reckless”.

I guess an updated set of ‘Brexit Watch’ articles will be published in the coming day or so, given they promise a monthly update.

Well I wonder whether they will choose to publish analysis for the Second-quarter National Accounts data published by ONS – Gross domestic product index: CVM: Seasonally adjusted.

The latest data shows that the British economy grew by 0.4 per cent, which was slightly faster than the growth of the 19 Eurozone Member States (0.36 per cent).

In fact, ONS revised the first-quarter growth estimates up from 0.1 per cent to 0.2 per cent when the updated data came in.

The second-quarter growth rate of 0.4 per cent, though modest by any standards and reflects the on-going austerity being imposed by the national government, doubled the first-quarter performance.

The annualised growth rate rose from 1.2 per cent in the first-quarter 2018 to 1.3 per cent in the June-quarter. It is still pretty dismal but not collapsing, which is the point.

If you were expecting David Blanchflower to address that fact this month – that is to apologise for his doom and gloom prediction that “We should expect this decline to continue” – then you would be overly optimistic.

He was completely wrong? Not just a little bit wrong – but completely wrong.

In summarising the data release, ONS wrote:

UK gross domestic product (GDP) is estimated to have increased by 0.4% in Quarter 2 (Apr to June) 2018, up from 0.2% in the previous quarter … This pick-up in growth following a weak Quarter 1 (Jan to Mar) was in line with market expectations.

So the ‘market’ didn’t agree with David Blanchflower. There were also some “adverse weather conditions in Quarter 1” that ONS indicated had some negative impacts on the growth rate in the March-quarter.

In the latest – Brexit Watch – published today (August 28, 2018) – there are again three columns.

One Column – Brexit economy: turning up the heat of household finances – focuses on the fact that household finances are being squeezed and a “as the mounting risk of a no-deal Brexit turns up the pressure on household finances”.

It then documents the low pay growth (which started years ago) and rising petrol prices (nothing to do with the June 2016 Referendum).

And then the author writes:

Britain recorded the biggest budget surplus in July for 18 years, giving Philip Hammond more wriggle room … [to spend more] ….

Where do these people get their ideas from?

The obvious link, ignored by the journalist and the economists he quotes (regulars Andrew Sentance and Blanchflower), is that the fiscal surplus is squeezing the hell out of households and forcing them to increase their indebtedness to maintain consumption growth.

I last discussed that link in this blog post – The fundamental realignment of British society via fiscal austerity (July 30, 2018).

In another of the ‘Brexit Watch’ columns – Talk of a no-deal Brexit and an interest rate rise dampen the economy – Blanchflower says that:

Surveys point to a slowing of the UK economy. The purchasing manager indices for manufacturing and services were weak.

Very selective indeed.

Why didn’t he (and the ‘Brexit Watch’ analysis) discuss the latest press release from the Confederation of British Industry (CBI) published last week (August 21, 2018) – Manufacturing output and orders remain robust – which confirms that British manufacturing “output growth … in the three months to August … remained well above the long-term average.”

We learn that “13 out of 17 sub-sectors reporting growth” and that “Manufacturers expect output growth to continue at a similarly firm pace over the next three months” and “expectations for output price inflation remained steady”.

That doesn’t sound like a collapse does it?

It is true that “the underlying trend in real GDP is one of slowing growth” in Britain but the trend turned mid-way in 2014, some two years before the Brexit vote and has much more to do with the slow-burn austerity than anything else.

I wonder why the ‘Brexit Watch’ pages didn’t bother earlier in the year to comment on the fact that the innovative sectors in Britain were likely to boom.

The UK Independent article – UK tech sector enjoys record investment in 2017 despite Brexit uncertainty (January 5, 2018) – reported that “UK firms attracted almost four times more funding in 2017 than Germany, and more than France, Ireland and Sweden combined”.

Where was that on ‘Brexit Watch’?

Oh, the editor might say it was not Brexit related. Well, if the first-quarter national accounts data is related then why isn’t the fact that “A record amount of money flowed into the UK tech sector last year, particularly fuelled by venture capitalists splashing cash in London despite uncertainty around the implications of Brexit …”

The article also indicated “that several global tech behemoths pledged their long-term commitment to the capital last year. Amazon, Apple and Google all announced major investments … music streaming service Spotify said that it would expand its research and development operations in London and double its staff headcount in the capital.”

None of that was reported on ‘Brexit Watch’.

To bolster the anti-Brexit message in between the monthly publication of ‘Brexit Watch’, the UK Guardian thinks it is useful to have William Keegan continue his relentless articles about the dire costs of Brexit.

Cracked record.

His latest (August 26, 2018) – The mood on Brexit is turning. Labour can turn too – claims he is concentrating on the “economic damage”.

The article then considers no economic data. He rather just berates the British Labour Party for not demanding a second referendum.

A nothing article that just keeps getting publishing space at the expense of views that actually look at the data since June 2016.

At least the UK Guardian’s Larry Elliot presents some balance in his article (August 27, 2018) – Britons seem relatively relaxed in the face of Brexit apocalypse.

He also notes that “the UK grew faster than the eurozone in the second quarter and is doing a lot better than the Treasury predicted before the EU referendum” and that “There has been no collapse in house prices, no 500,000 increase in unemployment, no two-year recession.”

The valid point that Larry Elliot makes is that the British people have become inured to the shocking incompetence of the mainstream economics profession in predicting anything accurate about the real world.

Normally, the mainstream of my profession cover up their incompetence by appealing to ‘additional factors’ and that sort of ad hoc response to anomaly type strategy. The sort of “oh, it hasn’t been given a chance to work yet” when public spending cuts devastate the economy. That sort of thing.

But the GFC was a monumental clusterf*!k for the New Keynesians. Their cosy “Great Moderation” pipedream came crashing down just as the core MMT economists had been predicting for some time.

The more extreme among this group tried to even deny that there was a major crisis.

Remember the – Interview with Eugene Fama – that the New Yorker’s John Cassidy published on January 13, 2010.

I covered that in this blog post – Mainstream macroeconomics – exudes denial while purporting to be progressive (February 20, 2017) among others.

Other New Keynesians became obsessed with the zero-bound claims – that monetary policy was very effective but with interest rates at zero it could not work properly.

Yet, they were still predicting massive inflationary effects from the various QE programs the central banks ran.

It didn’t happen. It never was going to happen. They were wrong. Why? Because their theoretical framework is wrong.

Then we go to Brexit and my profession, both within the academy and across the institutional arms (Bank of England, IMF, HM Treasury, and think tanks – the ridiculous NIESR), went crazy with their dire predictions.

As Larry Elliot points out none of the apocolyptic predictions have come close to occurring.

The only thing that was correctly anticipated – and it didn’t need economic theory to know it would happen – was that the exchange rate fell.

But as the CBI point out in their most recent briefing:

Manufacturing growth remains strong, supported by the lower level of sterling and strong global economy.

And Thomas Fazi and I wrote about that in this Jacobin article (April 29, 2018) – Why the Left Should Embrace Brexit – which caused social media havoc because we dared to argue that Project Fear pushed by the Guardian and the Left commentariat was struggling with the reality of the evidence.

Some commentators demanded that Jacobin take the article down – poor darlings, thinking that if you suppress a good argument the reality it reflects also goes away and they could sip latte with their mates and wax lyrical about how bad Brexit will be.

I responded to the feedback from that article in this blog post – The Europhile Left use Jacobin response to strengthen our Brexit case (May 22, 2018).

This issue of poor forecasting plagues the mainstream economics profession who cannot seem to understand reality is not what their ‘models’ tell them it is.

David Blanchflower, the regular ‘Brexit Watch’ commentator, berated economic and political forecasters in his column (November 9, 2016) – Experts get it wrong again by failing to predict Trump victory.

He said:

Economic and political forecasters failed to predict the fall of the Berlin Wall and the 2008 recession – and this year has been even worse …

It must be said that this has been a disastrous decade for professional forecasters of the economic and political varieties.

He cites some examples and includes the fact that:

In 2008, the advanced countries all fell into a recession that the field of economics, and every government and central bank, had failed to anticipate.

Why would that surprise anyone, given that the mainstream macroeconomic models that policy makers were seduced into using (DSGE, New Keynesian etc) didn’t even have a financial sector built in to them.

How could they understand balance sheet imbalances when they had no banks, no credit, no speculative hedge funds, in their reasoning?

The problem though is that David Blanchflower then tries to gain the superior ground by asserting that:

Trump’s stunning victory and the Brexit vote in the UK are the inevitable responses to the weak recovery from recession. The one positive take for me is that in both countries austerity is dead and buried. Keynes was right. Fiscal stimulus here we come. No wonder experts have been getting such a hard time.

Really?

Well the latest ONS data release for – Public sector finances, UK: July 2018 (published August 21, 2018) – tells a very different story doesn’t it.

We learn that:

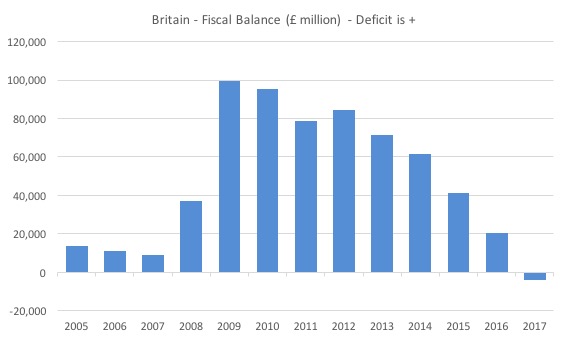

1. “Borrowing in the latest full financial year (April 2017 to March 2018) was the lowest financial year borrowing for 11 years.”

2. “So far in this financial year (April 2018 to July 2018), the public sector has borrowed £12.8 billion; that is, £8.5 billion less than in the same period in 2017; again, this represents the lowest year-to-date borrowing for 16 years.”

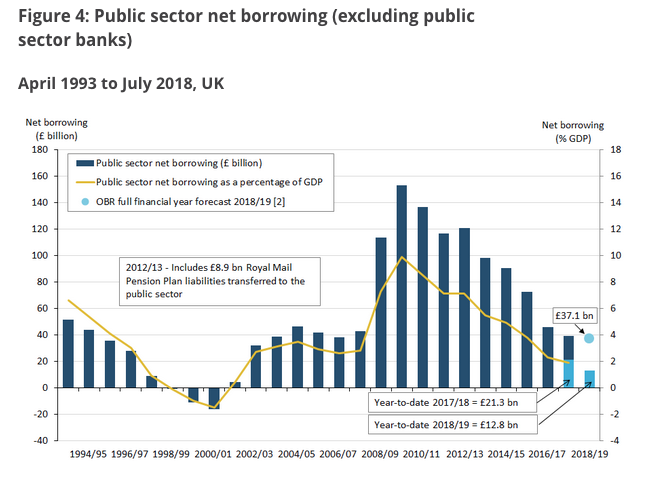

Here is the British fiscal balance from 2005 to 2017 (deficit is positive) in £ million.

The contraction between 2016 and 2017 was massive – and it is what one calls fiscal austerity given the private spending cycle was slowing.

Here is the public sector net borrowing history since 1994/95 to 2018/19 (Figure 4 in the ONS release).

A very harsh austerity is indicated especially given the slow overall growth.

Why haven’t David Blanchflower and the fellow ‘Brexit Watch’ participants highlighted those trends?

Answer: They would not be able to beat up a Brexit crisis and make ridiculous statements that “Brexit is the biggest risk to the UK economy, bar none”.

The biggest crisis ahead for Britain is that the obsession with fiscal surpluses and flat wages growth are forcing the household sector into further debt to sustain consumption spending.

In turn, the slow (imbalanced) growth is retarding business investment because businesses rightly conclude they have all the capital stock in place that they need to maintain output consistent with the weak demand.

This all pre-dates the Brexit vote by some years.

That reliance on private debt to maintain growth is unsustainable. That is the main danger. And it is quite separate from the mess that the Tories are making of the Brexit negotiations.

Remember the Y2K beat up. As it turned out there were only minor problems encountered. A solid planning environment was all that was needed to avoid the obvious issues.

We seem to be learning though.

As Larry Elliot concluded:

Expert forecasting is discredited. Life is a bit better than it was a year ago. There is still an expectation that London and Brussels will orchestrate a political fix. For all these reasons, people don’t really believe that at the end of March 2019 there will be no food in the shops, hospitals will be running short of medicines and that planes will be prevented from flying. A no-deal Brexit is seen as another millennium bug.

Conclusion

Anyway, the August edition of ‘Brexit Watch’ has come out now and didn’t disappoint.

The manic anti-Brexit bias continues.

Very little understanding of the impact of the irresponsible fiscal strategy is demonstrated. The same hacks get a ‘guernsey’ and prophesies of doom abound.

Meanwhile, the reliance on consumer credit to maintain growth in household consumption in the context of flat wages growth, and the fact that Britain is now growing faster than the dysfunctional Eurozone, are largely ignored.

There is no doubt that Britain is in relatively poor shape. But it is the result of poorly conceived and executed fiscal policy (austerity) rather than anything that happened in June 2016.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

n the grand abstract terms of the Enlightenment, the legitimacy of government derives from the consent of the governed, and therefore no government should have the right to hand over its authority to some external body which is not democratically accountable to its own people. So when the framers of the EU arranged for the nations of Europe to do exactly that, they were repudiating two centuries of political struggle for the rights and liberties of ordinary citizens and of governance “of the people, by the people and for the people.”

As the UK hasn’t actually left the EU yet I find analysis either way fairly redundant, although you rightly show that the forecasted doom based on pre-Bexit (lack of) confidence hasn’t come true or can be attributed to the government’s ideological austerity.

However much of the Brexit doom I read is now focused on the consequences of a “no deal” Brexit. What would be the implications of this? Is the doom overstated? And what does the British economy look like in this scenario?

Surely any analysis up until this point is just analysis of Britain in the EU. I would like a greater understanding, from an MMT perspective, why we shouldnt fear Brexit when we actually leave.

I worry about Larry Elliot. He has, as far as I am aware, maintained a consistent scepticism about the supposed perils of Brexit that is entirely contrary to the editorial line. I hope his job is safe. I hope the patronising gits running the Guardian at least have the gumption to realise he contributes a credibility to the paper that is scarcely warranted by many of its other contributors. I stopped buying the Guardian a while ago. If it employed more people like Elliot I’d be inclined to buy it again. They wouldn’t have to be pro-Brexit or even ambivalent about it. A willingness to speak truth to (editorial) power plus empathy with normal British people would be sufficient.

If you check out Lawyers for Britain they recently carried out a direct comparison between EU tariffs and WTO tariffs, although a limited number of items are covered, the news isn’t all that bad, in most cases a lot better. There is no such thing as a no deal Brexit we leave under WTO terms (we are now an independant nation under their charter and so these can come into effect day 1 ) the terms for trading with a former customs union partner are – wait for it – the same , this is listed in WTO GATT treaty Article 24 (although quite longwinded) basically if we are in agreement we can continue searching for a FTA with the EU on the same terms as we are now for up to 10 years. In fact having seen treasury figures I just keep thinking – why are we paying these morons?

I realize that the following is not on topic; and you do not normally place much emphasis to that side of the world, but I was listening to Phillip (Uncle Fester) Adams of ABC fame talking about the dire situation in Venuzuela – both politically and economically. He had a Latino guest on his ‘Late Night Live’ show last night discussing the hyper inflation (purported to be running at 1 million percent). My mind immediately jumped to those two hoary old chestnuts: Weimar & Zim.

He also addressed the mass emigration of many hundreds of thousands and the problems that is causing in nearby countries with images of the Syrian exodus.

Graft and corruption (and maybe the resources curse) appears to be a major part of the cause but I would like to learn how you – and MMT – would handle its resolution.

This sort of problem must be a huge concern to all the neighbours, as well as the rest of us.

Finally, why is it that countries with their first letter at the far end of the alphabet seem to share that disease?

So the point is that Brexit can work if the UK government managed the economy differently. The neoliberal, low wage and austerity promoting current government and those likely to be in charge post- Brexit are not likely to change these policies. Labour’s John McDonnell and Mr Corbyn seem to use neo-liberal speak regularly. Labour’s policies will be better for the general welfare but they seem not prepared to be transparent. Labour support for a referendum would show they have faith in their ideas.

The UK is still in the EU so growth now and three months in the future tells us what? Investment in the tech sector could could be disaster capitalism at work in that a lot of high tech talent will be available in a low tax enviroment post-Brexit.

“As it turned out there were only minor problems encountered. A solid planning environment was all that was needed to avoid the obvious issues.”

Solid planning and a lot of money to hire retired experts for a lot of hours. I don’t think you’re trying to be dismissive, but many still think it was always a non-issue.

Heim,

The point is that the British economy won’t change too much based on Brexit alone.

I was impelled to shout obscenities at the TV again, when the BBC newsreader prefaced the news about the ‘biggest budget surplus for 18 years’ with the phrase “We’re in the money!”.

Unbelievable. No wonder the population is so misinformed about where money comes from with the BBC and other media parroting such nonsense.

“The general public works out fairly quickly that when a mainstream economist says the sky is about to fall in it is time to get the beach gear out because it will be fine and sunny!”

Although I found it funny – and thankfully many non-economists make fun of mainstream economists’ (or economists in general) predictions – the fact is that the general public does believe in the public debt apocalypse or in the inflation apocalypse so discussed by the mainstream…