In the annals of ruses used to provoke fear in the voting public about government…

Brexit propaganda continues from the UK Guardian

Its Wednesday, so a relatively short blog post today. We are just about finished the final responses to the editors from Macmillan on the manuscript for the next Modern Monetary Theory (MMT) textbook, which I am now reliably informed will be published in February 2019. Today, two short topics. First, the disgraceful and on-going propaganda from the UK Guardian about the “Brexit process”. Second, a report released today in Australia showing the damaging effects of a financial sector that is not properly regulated. And then some event announcements and then some music to restore our equanimity.

Brexit Watch disgrace

The UK Guardian’s Brexit Watch is one of the most ridiculous exercises in propaganda that a newspaper could engage in.

Last week (June 26, 2018), the Brexit Watch posted a heap of economic data under the heading – How has the Brexit vote affected the UK economy? June verdict.

The article’s sub-heading read:

Each month we look at key indicators to see what effect the Brexit process has on growth, prosperity and trade

Okay. So one would presume that the ‘indicators’ would be directly linked in some theoretical manner to the Referendum vote and the process that has followed. That is, that some direct causality could be established where the Brexit process impacts on the economy.

Well we see that the sterling has fallen against the US dollar a little in recent months but is still around the level it held in June 2016 when the Referendum occurred and after its initial fall.

And it has been stable against the Euro for most of the last year (as the process gathered pace – if you can call it that).

So this tells us nothing about the “Brexit process”.

Then we see a graph entitled “FTSE 100 rocked by world trade fears” and the write up is all about Donald Trump and his impact on “global stock markets”.

Why is that included?

It tells us nothing about the “Brexit process”.

The third series is inflation which we are told is “Better than expected” and holding “steady despite rising petrol prices”.

So what does that say about the “Brexit process”. Nothing. Why include it?

Then the next graph shows that the “Trade deficit rises to second highest on record”. But the graph shows that the “Trade Balance, £bn” is now recording a smaller deficit than before the June 2016 Referendum.

Their graph doesn’t match the description.

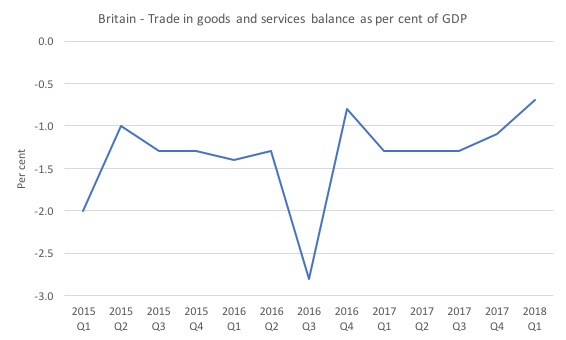

So here is the graph for the latest ONS data (released June 29, 2018) for the Balance of Trade in goods and services as a percentage of GDP. It was a deficit of 0.7 per cent in the first-quarter 2018. In the June-quarter 2016 it was a deficit of 1.3 per cent.

And here is the overall Current Account balance as a per cent of GDP over the same period. The difference between the two graphs is the net income flows.

Conclusion: the headline in the UK Guardian’s Brexit Watch page is highly misleading. They want the reader to believe a smaller external deficit is better and the headline reinforces the view that the Brexit process must be damaging.

Neither is true.

The external position of a nation is neither good nor bad. But putting that to one side, the data shows that the Trade balance and overall external balance is now much smaller than at the time of the Referendum.

Would we then be able to conclude that the “Brexit process” has improved things? No. Just as we cannot say the opposite.

Then we get a graph of the “All sector PMI”, which shows a rather significant improvement since the Referendum.

Even the UK Guardian is forced to admit that the data shows that:

UK’s dominant services sector expanded more quickly than expected in May … in a sign that Britain could have come through the worst of this year’s slowdown … activity in the sector, which includes banks, restaurants and hotels, recovering to a three-month high. The construction and manufacturing sectors also recorded stronger-than-expected growth.

So how can they then justify the caption on the graph “Service sector stages recovery, yet Brexit fears loom”.

Totally unsubstantiated and inconsistent with the trends in the data.

We then encounter two paired graphs – unemployment and wages growth, which tell us nothing about the “Brexit process”.

The fact that “earnings growth” is lagging despite the falling and relatively low unemployment rates is a world-wide problem and is not unique to Britain.

It has nothing at all to do with the “Brexit process”.

A graph showing retail “sales rose by 1.3% in May from a month earlier, comfortably beating expectations for a rise of just 0.5%” and “greater hopes for more spending ahead” is next.

“Brexit process” – irrelevant. Weather, weddings, World Cup etc are driving that data.

Then, a graph captioned “Government borrowing falls more than expected”, which tells us that austerity is alive and well in Britain, given the slowdown in growth in recent quarters.

Yet, the UK Guardian has been running consistent running stories from ‘experts’ predicting that public finances would be in free fall because of the “Brexit process”.

Graphs showing house prices rising “beating economists’ expectations” and a US-China real GDP graph prediction (based on the damage the trade war is meant to cause follow.

Neither tells us anything at all about the Brexit process.

If that wasn’t enough, the UK Guardian’s Brexit Watch page then ran an accompanying article on June 26, 2018, which carried the headline – ‘Brexit is scaring businesses to death’ – experts debate the data – with regular scaremonger David Blanchflower once again being given an open forum to talk about the “disastrous Brexit vote” that is “scaring business to death”.

He claimed that:

It appears that the Brexit vote has already cost the UK between £20bn and £40bn.

This was echoing the extremely poor CER study released in the past fortnight.

He has never shown this slowdown to be causally related to the “Brexit process”. How does it “appear that the Brexit vote”?

How much has the slowdown been due to the fiscal shift (increased austerity) since the June 2016 Referendum? Lots. But Blanchflower and his hysteria merchants choose to stay silent on that.

Please read my blog post – How to distort the Brexit debate – exclude significant factors! (June 25, 2018) – for more discussion on why the CER study should be largely disregarded.

He notes the “GDP growth was 0.1% in the first quarter” but this figure has been revised upwards (see below).

He writes that the “The pound is worth more than 10% less now than on the eve of the Brexit vote. The bad news continued with the trade deficit rising to the second highest on record.”

See my comments and graphs above on that.

The rest of his article relates to the slow earnings growth and the low unemployment and he correctly implicates the rising underemployment in the break in the nexus between earnings growth and official unemployment (the traditional Phillips curve relationship).

But that trend has been long established and has nothing at all to do with the “Brexit process” and cannot support his earlier claim about businesses being scared to death or that “the fall out” from the Brexit vote has been “disastrous”

The UK Guardian also ran another accompanying article (June 26, 2018) – Brexit economy: UK consumers continue to spend despite job fears – summarising the other two but continuing the emphasis on “mounting fears of jobs losses from a hard Brexit” (not established, just asserted).

They saw fit to give Blanchflower more space – just repeating his inane scaremongering.

All of that data they graphed (above) apparently “paints a mixed picture” although on the face of it I could see nothing that was bad which could be clearly related to the “Brexit process”.

The fact that a few days later, the ONS revised their previous GDP estimate and are now saying that Britain’s GDP growth was double the original estimate (albeit low) and currency markets zoomed upwards in sterling yet the ‘Brexit Watch’ said nothing.

Overall, a very tawdry media intervention into the public debate.

Credit card woes in Australia

I regularly get E-mails (particularly, it seems from Citibank) urging me to transfer credit balances to their new card at low rates.

Or inviting me to increase my credit limit.

Or some other ploy.

It seems like these tactics work as Australian consumers are drowning in high-interest charges for unsustainable credit balances.

The Australian Securities and Investments Commission (ASIC) released a report today (July 4, 2018) – Credit card lending in Australia – which examines “consumer debt outcomes over this period, the effect of balance transfers, and the operation of key reforms for credit cards that commenced in 2012”.

They also published an interesting summary – Infographic – to accompany the full Report.

ASIC is “Australia’s corporate, markets and financial services regulator” and has been criticised for adopting a ‘light touch’ to the financial sector.

At present, there is a Royal Commission running into Banking and financial services, which is exposing extensive criminality and unethical conduct by our leading banks and financial institutions.

This conduct, which in some cases is breathtaking, gives credence to the conjecture that ASIC has allowed the financial markets to run amok.

In their credit card Report, however, they have cut to the chase.

They report that:

1. “18.5% of consumers are struggling with credit card debt.”

2. “credit cards … present a debt trap for more than one in six consumers.”

3. “Consumers are also being provided with credit cards that don’t meet their needs” – particularly noted is the push to secure consumers on “high interest rate products, when lower-rate products would save them money.”

4. “Consumers could have saved approximately $621 million in interest in 2016-17 if they had carried their balance on a card with a lower interest rate.”

5. “There are a number of failures by lenders to act in the interests of consumers”.

6. ASIC changed rules for credit card debt in 2012 which “helped reduce the interest charged on credit card debt” but “our lenders (Citi, Latitude, American Express and Macquarie) have retained old rules for grandfathered credit cards open before June 2012” resulting in “525,000 consumers” paying “more interest as a result”.

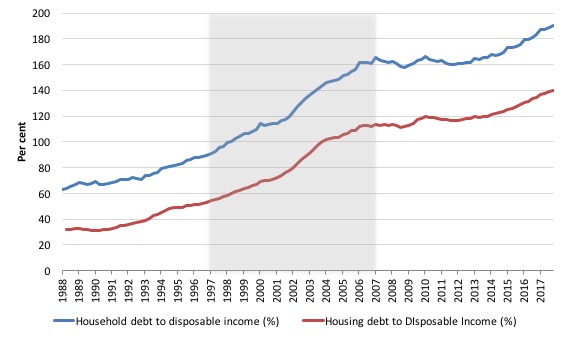

The following graph shows household debt as a proportion of disposable income in Australia from the September-quarter 1988 to the March-quarter 2018. The red line is the debt associated with housing mortgages (both owner-occupied and investment).

The grey area is the period of fiscal surpluses under the conservative Howard-Costello government. The fiscal squeeze combined with the earlier financial market deregulation and the rise of the ‘financial engineer’ (that nefarious character that banks started to employ to push credit down peoples’ throats) saw the ratio rise rapidly.

The GFC offered a temporary respite as households became worried about their debt exposure.

But in more recent times, with real wages growth flat to negative, and rising energy and other utility costs, households have started adding debt at a faster rate than disposable income has been growing.

The fragility of the household sector balance sheet is pronounced now and small changes in interest rates will send thousands of consumers bankrupt.

The widening gap between the two time series relates to ‘other personal debt’ and includes credit card debt.

The current situation in Australia is unsustainable and is the result of lax oversight of a sector that has been deregulated too far.

There has to be a rebuff of the banks as a result of the disgraceful conduct being revealed in the Royal Commission (I will write about it when it concludes and reports) and credit card practices have to be reformed significantly.

Event – The second international MMT Conference in New York

The second international MMT Conference will be held in New York between September 28-30, 2018.

I will be speaking and most (if not all) the founding MMT group will be in attendance, contributing in one way or another.

The Conference Home Page has been launched and you can register for the conference through that page.

It will be great to see as many of you as possible at that event.

In the two weeks following, I will be giving talks in London, Dublin, Galway, Lisbon, Glasgow and Wurzburg and helping to launch the new Gower Institute for Monetary Studies (Friday, October 5 in London).

I will have more details of that lecture tour in due course.

Event – Launch of Anti-Privatisation Book – Sold Off Sold Out, Sydney, August 2

I will be speaking in Sydney on August 2, 2018 to launch the new edition of Sold Off Sold Out – which exposes the costs of privatisation in Australia.

The promotion page says:

Over the past 30 years, there has been a massive sell-off of public assets to private corporations right across Australia. For the public there is no upside. We have been robbed in multiple ways by privatisations.

You can find details – HERE.

I look forward to seeing Sydney readers at the event as a show of support for Greens Senator Lee Rhiannon, who has been a consistent opposition voice in this area of public contest.

The conservative Greens hierarchy, which has largely sold out to the neoliberals on economic policy, have demanded she resign claiming the “need for renewal”.

They just don’t like her consistent Left message.

Augustus Pablo – RIP

This album by Augustus Pablo seems to regularly turn up on my turntable while I am working.

Augustus Pablo died at the age of 44 in 1999 of a lung illness.

He was the pioneer of dub music and refined the art.

He was a multi-instrumentalist and featured the Melodica among other instruments on his albums.

On this track his Clavinet playing is a delight.

This track is Thunder Clap and is Track 7 on the 1979 Original Rockers album, which was recorded at Dynamic Sounds and Channel One studios mixed by King Tubby’s in Jamaica.

The song features Robbie Shakespeare on bass guitar and Earl “Chinna” Smith on guitar

It is a sampled version of Bill Wither’s Ain’t no Sunshine.

As long as this album keeps playing I will play it.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

King Tubbys Meets Rockers Uptown is one of my favourite albums.

The Graun is a joke of a newsite, becoming almost unreadable of late.

Not sure what’s any better though – my son recommends the FT, but unless you have a student or corporate subscription, it’s a bit pricey for a hard-up civilian!

You get the feeling that today’s article must have been published through gritted teeth too, but they couldn’t resist shoehorning “Brexit concerns” in, despite the good news!

https://www.theguardian.com/business/2018/jul/04/uk-economic-growth-service-sector-interest-rates

Dear MrShigemitsu (at 2018/07/04 at 8:15 pm)

Yes, the data is not helping their narrative at all.

And King Tubbys Meets Rockers Uptown is an often played album at my place. A really defining collection of music.

best wishes

bill