Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

The Weekend Quiz – April 21-22, 2018 – answers and discussion

Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

If the real interest rate (difference between nominal interest rate and inflation) is constant, then a currency-issuing government, which matches its net spending $-for-$ with debt issuance, could double its fiscal deficit without pushing up the public debt ratio.

The answer is True.

Again, this question requires a careful reading and a careful association of concepts to make sure they are commensurate. There are two concepts that are central to the question: (a) a rising fiscal deficit – which is a flow and not scaled by GDP in this case; and (b) a rising public debt ratio which by construction (as a ratio) is scaled by GDP.

So the two concepts are not commensurate although they are related in some way.

A rising fiscal deficit does not necessary lead to a rising public debt ratio. You might like to refresh your understanding of these concepts by reading this blog – Saturday Quiz – March 6, 2010 – answers and discussion.

While the mainstream macroeconomics thinks that a sovereign government is revenue-constrained and is subject to the government fiscal constraint, Modern Monetary Theory (MMT) places no particular importance in the public debt to GDP ratio for a sovereign government, given that insolvency is not an issue.

The mainstream framework for analysing the so-called “financing” choices faced by a government (taxation, debt-issuance, money creation) – the so-called ‘government budget constraint’ – is written as:

Which you can read in English as saying that Budget deficit = Government spending + Government interest payments – Tax receipts must equal (be “financed” by) a change in Bonds (B) and/or a change in high powered money (H). The triangle sign (delta) is just shorthand for the change in a variable.

Remember, this is merely an accounting statement. In a stock-flow consistent macroeconomics, this statement will always hold. That is, it has to be true if all the transactions between the government and non-government sector have been corrected added and subtracted.

So from the perspective of MMT, the previous equation is just an ex post accounting identity that has to be true by definition and has not real economic importance.

For the mainstream economist, the equation represents an ex ante (before the fact) financial constraint that the government is bound by. The difference between these two conceptions is very significant and the second (mainstream) interpretation cannot be correct if governments issue fiat currency (unless they place voluntary constraints on themselves to act as if it is).

That interpretation is inapplicable (and wrong) when applied to a sovereign government that issues its own currency.

But the accounting relationship can be manipulated to provide an expression linking deficits and changes in the public debt ratio.

The following equation expresses the relationships above as proportions of GDP:

So the change in the debt ratio is the sum of two terms on the right-hand side: (a) the difference between the real interest rate (r) and the GDP growth rate (g) times the initial debt ratio; and (b) the ratio of the primary deficit (G-T) to GDP. A primary fiscal balance is the difference between government spending (excluding interest rate servicing) and taxation revenue.

The real interest rate is the difference between the nominal interest rate and the inflation rate. If inflation is maintained at a rate equal to the interest rate then the real interest rate is constant.

A growing economy can absorb more debt and keep the debt ratio constant or falling. From the formula above, if the primary fiscal balance is zero, public debt increases at a rate r but the public debt ratio increases at r – g.

So if r = 0, and g = 2, the primary deficit ratio could equal 2 per cent (of GDP) and the public debt ratio would be unchanged. Doubling the primary deficit to 4 per cent would require g to rise to 4 for the public debt ratio to remain unchanged. That is entirely possible.

So a nation running a primary deficit can obviously reduce its public debt ratio over time or hold them constant if growth is stimulated. Further, you can see that even with a rising primary deficit, if output growth (g) is sufficiently greater than the real interest rate (r) then the debt ratio can fall from its value last period.

Furthermore, depending on contributions from the external sector, a nation running a deficit will more likely create the conditions for a reduction in the public debt ratio than a nation that introduces an austerity plan aimed at running primary surpluses.

Clearly, the real growth rate has limits and that would limit the ability of a government (that voluntarily issues debt) to hold the debt ratio constant while expanding its fiscal deficit as a proportion of GDP.

The following blog may be of further interest to you:

Question 2:

A government in any nation that achieves positive net exports can push for a primary fiscal surplus knowing it will not compromise growth.

The answer is False.

This question requires an understanding of the sectoral balances that can be derived from the National Accounts. But it also requires some understanding of the behavioural relationships within and between these sectors which generate the outcomes that are captured in the National Accounts and summarised by the sectoral balances.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

(1) GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

Expression (1) tells us that total income in the economy per period will be exactly equal to total spending from all sources of expenditure.

We also have to acknowledge that financial balances of the sectors are impacted by net government taxes (T) which includes all tax revenue minus total transfer and interest payments (the latter are not counted independently in the expenditure Expression (1)).

Further, as noted above the trade account is only one aspect of the financial flows between the domestic economy and the external sector. we have to include net external income flows (FNI).

Adding in the net external income flows (FNI) to Expression (2) for GDP we get the familiar gross national product or gross national income measure (GNP):

(2) GNP = C + I + G + (X – M) + FNI

To render this approach into the sectoral balances form, we subtract total net taxes (T) from both sides of Expression (3) to get:

(3) GNP – T = C + I + G + (X – M) + FNI – T

Now we can collect the terms by arranging them according to the three sectoral balances:

(4) (GNP – C – T) – I = (G – T) + (X – M + FNI)

The the terms in Expression (4) are relatively easy to understand now.

The term (GNP – C – T) represents total income less the amount consumed less the amount paid to government in taxes (taking into account transfers coming the other way). In other words, it represents private domestic saving.

The left-hand side of Equation (4), (GNP – C – T) – I, thus is the overall saving of the private domestic sector, which is distinct from total household saving denoted by the term (GNP – C – T).

In other words, the left-hand side of Equation (4) is the private domestic financial balance and if it is positive then the sector is spending less than its total income and if it is negative the sector is spending more than it total income.

The term (G – T) is the government financial balance and is in deficit if government spending (G) is greater than government tax revenue minus transfers (T), and in surplus if the balance is negative.

Finally, the other right-hand side term (X – M + FNI) is the external financial balance, commonly known as the current account balance (CAD). It is in surplus if positive and deficit if negative.

In English we could say that:

The private financial balance equals the sum of the government financial balance plus the current account balance.

We can re-write Expression (6) in this way to get the sectoral balances equation:

(5) (S – I) = (G – T) + CAD

which is interpreted as meaning that government sector deficits (G – T > 0) and current account surpluses (CAD > 0) generate national income and net financial assets for the private domestic sector.

Conversely, government surpluses (G – T < 0) and current account deficits (CAD < 0) reduce national income and undermine the capacity of the private domestic sector to add financial assets.

Expression (5) can also be written as:

(6) [(S – I) – CAD] = (G – T)

where the term on the left-hand side [(S – I) – CAD] is the non-government sector financial balance and is of equal and opposite sign to the government financial balance.

This is the familiar MMT statement that a government sector deficit (surplus) is equal dollar-for-dollar to the non-government sector surplus (deficit).

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)) plus net income transfers.

All these relationships (equations) hold as a matter of accounting and not matters of opinion.

So what economic behaviour might lead to the outcome specified in the question?

If the nation is running an external surplus it means that the contribution to aggregate demand from the external sector is positive – that is net spending injection – providing a boost to domestic production and income generation.

The extent to which this allows the government to run a surplus depends on the private domestic sector’s spending decisions (overall). If the private domestic sector runs a deficit, then the Troika’s strategy will work – inasmuch as the goal is to reduce the fiscal deficit without compromising growth.

But this strategy would be unsustainable as it would require the private domestic sector overall to continually increase its indebtedness.

Assume, now that the private domestic sector (households and firms) seeks to increase its overall saving and is successful in doing so. With the government contracting (and going into surplus), the only way the private domestic sector could successfully net save is if the injection from the external sector offset the drain from the domestic sector (public and private). Otherwise, income will decline and both the government and private domestic sector will find it difficult to reduce their net spending positions.

Take a balanced fiscal position, then income will decline unless the private domestic sector’s saving overall is just equal to the external surplus. If the private domestic sector tried to push its position further into surplus then the following story might unfold.

Consistent with this aspiration, households may cut back on consumption spending and save more out of disposable income. The immediate impact is that aggregate demand will fall and inventories will start to increase beyond the desired level of the firms.

The firms will soon react to the increased inventory holding costs and will start to cut back production. How quickly this happens depends on a number of factors including the pace and magnitude of the initial demand contraction. But if the households persist in trying to save more and consumption continues to lag, then soon enough the economy starts to contract – output, employment and income all fall.

The initial contraction in consumption multiplies through the expenditure system as workers who are laid off also lose income and their spending declines. This leads to further contractions.

The declining income leads to a number of consequences. Net exports improve as imports fall (less income) but the question clearly assumes that the external sector remains in deficit. Total saving actually starts to decline as income falls as does induced consumption.

So the initial discretionary decline in consumption is supplemented by the induced consumption falls driven by the multiplier process.

The decline in income then stifles firms’ investment plans – they become pessimistic of the chances of realising the output derived from augmented capacity and so aggregate demand plunges further. Both these effects push the private domestic balance further towards and eventually into surplus

With the economy in decline, tax revenue falls and welfare payments rise which push the public fiscal balance towards and eventually into deficit via the automatic stabilisers.

If the private sector persists in trying to increase its saving ratio then the contracting income will clearly push the fiscal balance into deficit.

So the external position has to be sufficiently strong enough to offset the domestic drains on expenditure. For Greece at present that is clearly not the case and demonstrates why the Troika’s strategy is failing.

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Question 3:

Assume that inflation is stable, there is excess productive capacity, and the central bank maintains its current interest rate target. If on average the government collects an income tax of 20 cents in the dollar, then total tax revenue will rise by 0.20 times $x if government spending increases (once and for all) by $X dollars and private investment and exports remain unchanged.

The answer is False.

This question relates to the concept of a spending multiplier and the relationship between spending injections and spending leakages. It is designed to help you think about how the automatic stabilisers linked to tax revenue respond to growth.

We have made the question easy by assuming that only government spending changes (exogenously) in period one and then remains unchanged after that – that is, a once and for all increase.

Aggregate demand drives output which then generates incomes (via payments to the productive inputs). Accordingly, what is spent will generate income in that period which is available for use. The uses are further consumption; paying taxes and/or buying imports.

We consider imports as a separate category (even though they reflect consumption, investment and government spending decisions) because they constitute spending which does not recycle back into the production process. They are thus considered to be “leakages” from the expenditure system.

So if for every dollar produced and paid out as income, if the economy imports around 20 cents in the dollar, then only 80 cents is available within the system for spending in subsequent periods excluding taxation considerations.

However there are two other “leakages” which arise from domestic sources – saving and taxation. Take taxation first. When income is produced, the households end up with less than they are paid out in gross terms because the government levies a tax. So the income concept available for subsequent spending is called disposable income (Yd).

In the example we assumed an average tax rate of 20 cents in the dollar is levied (which is equivalent to a proportional tax rate of 0.20). So if $100 of new income is generated, $20 goes to taxation and Yd is $80 (what is left). So taxation (T) is a “leakage” from the expenditure system in the same way as imports are.

You were induced to think along those lines. The relevant issue to resolve though is – What is the new income generated? The concept of the spending multiplier tells us that the final change in income will exceed the initial injection (in the question $X dollars).

Finally consider saving. Households (consumers) make decisions to spend a proportion of their disposable income. The amount of each dollar they spent at the margin (that is, how much of every extra dollar to they consume) is called the marginal propensity to consume. If that is 0.80 then they spent 80 cents in every dollar of disposable income.

So if total disposable income is $80 (after taxation of 20 cents in the dollar is collected) then consumption (C) will be 0.80 times $80 which is $64 and saving will be the residual – $26. Saving (S) is also a “leakage” from the expenditure system.

It is easy to see that for every $100 produced, the income that is generated and distributed results in $64 in consumption and $36 in leakages which do not cycle back into spending.

For income to remain at the higher level (after the extra $100 is created)in the next period the $36 has to be made up by what economists call “injections” which in these sorts of models comprise the sum of investment (I), government spending (G) and exports (X). The injections are seen as coming from “outside” the output-income generating process (they are called exogenous or autonomous expenditure variables).

For GDP to be stable injections have to equal leakages (this can be converted into growth terms to the same effect). The national accounting statements that we have discussed previous such that the government deficit (surplus) equals $-for-$ the non-government surplus (deficit) and those that decompose the non-government sector in the external and private domestic sectors is derived from these relationships.

So imagine there is a certain level of income being produced – its value is immaterial. Imagine that the central bank sees no inflation risk and so interest rates are stable as are exchange rates (these simplifications are to to eliminate unnecessary complexity).

The question then is: what would happen if government increased spending by, say, $100? This is the terrain of the multiplier. If aggregate demand increases drive higher output and income increases then the question is by how much?

The spending multiplier is defined as the change in real income that results from a dollar change in exogenous aggregate demand (so one of G, I or X). We could complicate this by having autonomous consumption as well but the principle is not altered.

So the starting point is to define the consumption relationship. The most simple is a proportional relationship to disposable income (Yd). So we might write it as C = c*Yd – where little c is the marginal propensity to consume (MPC) or the fraction of every dollar of disposable income consumed. We will use c = 0.8.

The * sign denotes multiplication. You can do this example in an spreadsheet if you like.

Our tax relationship is already defined above – so T = tY. The little t is the marginal tax rate which in this case is the proportional rate (assume it is 0.2). Note here taxes are taken out of total income (Y) which then defines disposable income.

So Yd = (1-t) times Y or Yd = (1-0.2)*Y = 0.8*Y

If imports (M) are 20 per cent of total income (Y) then the relationship is M = m*Y where little m is the marginal propensity to import or the economy will increase imports by 20 cents for every real GDP dollar produced.

If you understand all that then the explanation of the multiplier follows logically. Imagine that government spending went up by $100 and the change in real national income is $179. Then the multiplier is the ratio (denoted k) of the Change in Total Income to the Change in government spending.

Thus k = $179/$100 = 1.79.

This says that for every dollar the government spends total real GDP will rise by $1.79 after taking into account the leakages from taxation, saving and imports.

When we conduct this thought experiment we are assuming the other autonomous expenditure components (I and X) are unchanged.

But the important point is to understand why the process generates a multiplier value of 1.79.

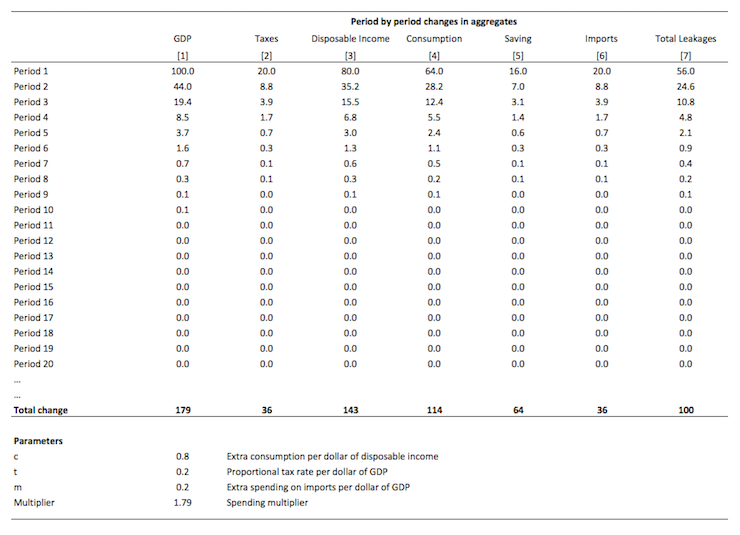

Here is a spreadsheet table I produced as a basis of the explanation. You might want to click it and then print it off if you are having trouble following the period by period flows.

So at the start of Period 1, the government increases spending by $100. The Table then traces out the changes that occur in the macroeconomic aggregates that follow this increase in spending (and “injection” of $100). The total change in real GDP (Column 1) will then tell us the multiplier value (although there is a simple formula that can compute it). The parameters which drive the individual flows are shown at the bottom of the table.

Note I have left out the full period adjustment – only showing up to Period 20. After that the adjustments are tiny until they peter out to zero.

Firms initially react to the $100 order from government at the beginning of the process of change. They increase output (assuming no change in inventories) and generate an extra $100 in income as a consequence which is the 100 change in GDP in Column [1].

The government taxes this income increase at 20 cents in the dollar (t = 0.20) and so disposable income only rises by $80 (Column [3]).

There is a saying that one person’s income is another person’s expenditure and so the more the latter spends the more the former will receive and spend in turn – repeating the process.

Households spend 80 cents of every disposable dollar they receive which means that consumption rises by $64 in response to the rise in production/income (Column [4]). Households also save $16 of disposable income as a residual (Column [5]).

Imports also rise by $20 given that every dollar of GDP leads to a 20 cents increase imports (by assumption here) and this spending is lost from the spending stream in the next period (Column [6]).

So the initial rise in government spending has induced new consumption spending of $64. The workers who earned that income spend it and the production system responds. But remember $20 was lost from the spending stream via imports so the second period spending increase is $44. Firms react and generate and extra $44 to meet the increase in aggregate demand.

And so the process continues with each period seeing a smaller and smaller induced spending effect (via consumption) because the leakages are draining the spending that gets recycled into increased production.

Eventually the process stops and income reaches its new “equilibrium” level in response to the step-increase of $100 in government spending. Note I haven’t show the total process in the Table and the final totals are the actual final totals.

If you check the total change in leakages (S + T + M) in Column [7] you see they equal $100 which matches the initial injection of government spending. The rule is that the multiplier process ends when the sum of the change in leakages matches the initial injection which started the process off.

You can also see that the initial injection of government spending ($100) stimulates an eventual rise in GDP of $179 (hence the multiplier of 1.79) and consumption has risen by 114, Saving by 29 and Imports by 36.

The total tax take is thus $36 after the multiplier process is exhausted. For those who are familiar with algebra, the total change in teax revenue is equal to 0.2*1.79*$X, which in English says equals the tax rate times the multiplied initial change in aggregate demand.

So while the overall rise in nominal income is greater than the initial injection as a result of the multiplier that income increase produces leakages which sum to that exogenous spending impulse. At that point, the income expansion ceases.

The following blogs may be of further interest to you:

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

Thank you Bill for posting about debt and interest. So what to do when interest on debt grows to large? The new era of lower growth based on 70% private consumtion with high private debts and low rates which are bound for higher levels.

https://d33wjekvz3zs1a.cloudfront.net/wp-content/uploads/2018/04/US-National-Debt-as-GDP.jpg

What really happened in the US after 1980? Yes we know there was the dollar-gold window that was abolished 1971-73 and deregulations in finance(consumer debt i.e). Inflation from the oil-embargo 1973 was curbed by the FED raising funds rate to 23%(the embargo was lifted earlier).

I guess the most important thing was that the US went from a balanced trade country to a net importer(efficient Japan and Germany)manifistated by the strengthening of the dollar from late 70´s until the Plaza Accord 1985. Current account was again balanced 1991 but started thereafter to grow negative long term.

https://tradingeconomics.com/united-states/current-account

https://tradingeconomics.com/united-states/currency

What about a military spending leveling on a permanent plataeu of 5-6% of GDP(officially). Have the multiplier effects changed in a more negative way here, let´s say compared to the Vietnam-war period?

Ref to Question 1:

Understanding how the debt-ratio can stay unchanged(or fall) while having a constant deficit is of critical importance of cource. But should not the part-expression (r-g) involve growth i real terms, not nominal GDP? Real interest minus real growth in GDP?

And if we would return to high(er) inflation again(or 70´s stagflation) couldn´t there be “incentives”

to “manage” interest-levels that are negative in real terms? Wouldn´t that be very bad for i.e savers and pensions? Certainly that is the aim of the ECB keeping the EMU together(and the EU)!!

Question 1:

During the non-financial era 1945-1980 the growth was high and the welfare-sectors grew. Then came stagflation induced by explosive energy-costs(supply-side). Until then no large negative financial shocks set the economies on fire. Instead we had big competetive challenges(unemployment) in different national industrial sectors. In my view more due to technological disadvantages than cost-relations(aka skills) in the first stages but later as the world-economy grew cost-relations also had large impacts(the new economies).

When the financial era started we also started to grow private debt and when financial break-downs occur on a regular basis real-economies get hurted. Automatic stabilizers then grew deficits. And with deficits larger interest-expenses. So even if we can manage to reach higher real growth relative the real interest rate i.e over a business cycle a large financial crash every now and then will risk expanding the government debt levels well above long term sustainable levels considering the interest-expendidures on that “extra debt”. The EMU have had a double impact of debt. First borrowing free(PIIGS i.e) in a “foreign currency” than the GFC with stabilizers followed by austarity but no chance of currency-adjusting(at least not internally).

Thorleif, MMT shows that the government does not need, for any economic reason, to issue debt in its own currency in the first place. And that if the government does issue debt, it can control the interest rate and set it where it wants to as a policy tool. So keeping that in mind, what is your real concern about when you say interest on the debt grows too large? Is it that the interest payments are income to debt holders and that extra income is causing excess demand and inflation? Is it that the interest payments generally go to the more wealthy and that is making society less fair than we would like? These would be legitimate concerns according to MMT whereas a fear that the government will not be able to pay off any debt denominated in the fiat currency it issues is not.

Jerry, I know what you are saying but try to look at reality in the US i.e. Look at the outstanding debt and pretend inflation runs up to 5-7% again. Cb´s can´t control moneysupply or long-term rates. Yes they could of cource set the funds rate to a real rate of say minus 3-5% and start buying all long term debt(QE)again for refunding interest to government. I wonder what pensionfunds and markets(savers) would say about that? Real high inflation is always a possibility which of cource could put a lid on potential growth. What would do you think will happen with the government budget if rates would go to nom. 8-9% on a 5-10 year tsys?

So with high inflation comes higher interest-expenditures on government debt. Do you mean monetizing the interest would be the natural solution? And even monetize new debt like Japan?

Jerry, you must not think I am against MMT. On the contrary, but I like to find arguments that could possibly weaken the theory. Of cource higher inflation doesn´t mean that we won´t see parallell high growth as well. Inflation has many faces and imported supply-sided inflation could maybe be the worst kind to deal with.

Jerry; instead of issuing debt you could of cource let the cb set “extra high” deposit-rates on reserves that otherwise would intervene on their funds-rate. Could the private sector in the future be able to deposit money at differerent longer term maturities directly at the cb? Or would the banks be able to transmit/mediate such a scheme?

“So if total disposable income is $80 (after taxation of 20 cents in the dollar is collected) then consumption (C) will be 0.80 times $80 which is $64 and saving will be the residual – $26. Saving (S) is also a “leakage” from the expenditure system.”

I think it should read “$16” not $26. ;-). But then I am no maths wizz…

Bill, thank you for that fantastic demonstration of the multiplier. That really helped to clarify for me how it works. I could really follow the flows in each period. Best description I’ve read.

For the question about the debt ratios – do you use decimals for the r and g?

So for NZ – we have a debt/gdp ratio of about 23% or 0.23.

So if we assume an r of 0 and a g of 3% (about what we have in NZ) combined with a sudden Labour decision to spend a bit more – say deficit of 2% – we’d get the following change in debt:

Change in BD/YT = 0-0.03 (0.23) + 0.02

= -0.03 (0.23) + 0.02

= -0.0069 + 0.02

= 0.0131

Which means a 1% increase in the debt ratio despite the growth rate being higher than the deficit ? So the new BD/Yt would be 0.0131+0.23 = 0.2431?

But as you say, it doesn’t really matter anyway cause its just a number ;-).

If inflation occurs because of excess demand, MMT says the government must reduce that excess demand. It can do that by spending less itself, by taxing more, or by making it more difficult and expensive to borrow for consumption and investment through interest rate policy, which has some income effects which make it less than a perfect tool, or financial regulations. Possibly, the government could make it more desirable to save in the currency rather than spend. It could also strengthen the automatic stabilizers in the system by implementing a Job Guarantee. This is what MMT prescribes for inflation, at least to my knowledge.

I don’t particularly care what pension funds and savers think about not being able to extract an income from risk-free ‘investment’, which is what US government debt is. They can go invest their savings in the real economy where the result might be new technologies and business that improves well being in which case they will make some money. And if they invest in stupid things well, the chances are they will lose some money. That’s how capitalism is supposed to work.

Mostly, it seems to me that when you talk about this ‘imported inflation’ you are mistaking what may be a real supply side negative hit to living standards, (say an oil embargo, which neither MMT or any other school of economics finds completely solvable), with regular excess-demand inflation that might occur when an economy is already at or near full employment and cannot produce more. If there is a war or some environmental disaster that reduces production, MMT does not tell us how to avoid the resulting decline in living standards. That the price of the items affected goes up after such an event is not ‘inflation’ as economics would understand it. Not that it isn’t a serious problem- it is probably more serious than ordinary inflation.

Jerry; Yes but how would MMT deal with outstanding debt(US) if rates are say 8%(=inflation) and when 40% of the debt are owned by foreigners(multiplier-effect) and not reinvested. And government wants to control the interest-rates as of today.

post 18:06 above

More explicitly I meant “dealing with the government budget interest-expenditures”!

Question 1 and question 3

I thought these boiled down to ” Savings”

Domestic savings

Foreign savings

Are we now saying we can predict the amount both are going to save and for how long for ?

I always thought borrowing forecasts were not worth the paper they were written on because nobody knows in advance how much people are going to save.

One of the huge problems around this issue is how do you get both to spend their savings in the economy rather than hoard them as gilts. Nobody has come up with a definitive answer to this especially when the foreign sector is concerned.

Thorleif

Debt would, it is held, eventually reach levels that cause lenders to balk with taxpayers threatening rebellion and default ?

This fear arises in part from observing crises in which capital-poor countries have had difficulty in meeting obligations denominated in a foreign currency, incurred in many cases to finance imports and ultimately requiring servicing and repayment in terms of exports, the crisis often arising because of a collapse in the market for the exports. In the case at hand the debt is intended to supply a domestic demand for assets denominated in the domestic currency, and in the absence of a norm such as a gold clause, there can be no question of the ability of the government to make payments when due, albeit possibly in a currency devalued by inflation. Nor can there be any question of balking by domestic lenders as long as the debt is limited to that needed to fill a gap created by an excess of private asset demand over private asset supply.

It is not intended that the domestic government debt should be held in any large quantity by foreigners. But should foreigners wish to liquidate holdings of this debt or any other domestic assets, they can only do so as a whole by generating an export surplus, easing the domestic unemployment problem, releasing assets to supply the domestic demand, and making it possible to get along with smaller deficits and a less rapidly growing government debt. The same thing happens if domestic investors turn to investing in foreign assets, thereby reducing their drain on the domestic asset supply.

In a panicky market it might happen that the market price of assets might fall sufficiently rapidly so that the total market value of the assets available to meet the domestic demand might fall. In such a case a temporary increase in government deficits rather than a decrease would be in order. Arranging this on short notice may be difficult, and the danger of overreacting or poor timing is real. Something more than mere pious declarations that the economy is fundamentally sound, however, is called for. Nevertheless one cannot entirely rule out the possibility of this becoming a panic-generating self-fulfilling prophecy derived from concentrating attention on the financial symbols rather than the underlying human reality. In Roosevelt’s terms, the main thing to fear is fear itself.

This is the received wisdom, yes. Paul Volker “tamed” inflation by increasing the Fed Funds rate to 20%. This was followed by a recession and 10% unemployment. A “hero”? He is still regarded as such by some; perhaps many.

But I’ve seen an alternative argument put that inflation was “cured” by the opposite of what had caused it in the first place: The “Oil Shocks” of the 1970s triggered high inflation. Then in the 1980s, Carter (I think it was) deregulated the gas industry, and energy prices generally came down significantly. Eventually OPEC had to cave in and oil prices came down. Then inflation started coming down. Unfortunately, I can’t give you a source (but maybe it was in Bill’s blog). It should be findable, no doubt along with counter-arguments.

No doubt the silly interest rates that Volker used had some effect on the economy…mostly destructive as far as I can see. But as Bill has said more than once, the effect of interest rates on the macroeconomy is uncertain and unpredictable, at best. And MMT (at least Bill and Randy Wray AFAIC) favour a zero interest rate policy, with no “borrowing”. I don’t know if it’s strictly MMT, but in my opinion there would have to be direct control of commercial bank lending to ensure that it was only used for productive and non-speculative purposes. This would probably be enforced by the central bank with government authority, but if the central bank failed to act in the national interest, the government would have to intervene with some sort of direct banking control department or agency.

House price inflation could be countered by a 100% tax on property sale profits.

However, although I don’t quite support all of your arguments Thorlief, I do wonder how effective a government acting along MMT lines would be in controlling inflation generally, without causing unemployment. If it cuts back on stimulus to reduce aggregate demand, then presumably the number of permanent jobs would fall, which would normally lead to unemployment. But with JG in effect, it would mean people moving from permanent jobs into JG jobs. But what if (demand-pull) inflation continued to rise, while the number of permanent jobs reduced, and the number of JG jobs increased? Would the government eventually have to cut back on its JG jobs, i.e. allow unemployment to rise?

It could increase taxation, but that would likely further cause permanent jobs to fall.

Thorleif, what I have been trying to explain is that the interest rate on that debt is a policy choice made in the past- not a market determined interest rate. If the interest rate was 8% it is because the people at the Fed thought it needed to be 8% otherwise it wouldn’t be 8%. The US Federal Government can always pay any US Dollar denominated obligation it has agreed to pay- it can not run out of US Dollars unless it wants to. That fact does not change no matter who it owes the Dollars to, or what interest rate it has decided to pay.

Jerry; Ok and I agree, but still we have the fact, we pretend, at some point in the future, (rate and) inflation is 8% and outstanding debt is what we have today or more logical a lot larger. Interest-expenditures will start to crowd out other more vital budget needs and it could accelerate(+ compounding). Reaching 8% has also been a process during several years of cource. See chart on my 1st post above.

And yes no government bills will be bounced etc.

What policy-choices will MMT see(say high inflation for “some time” is awaited)? As MMTérs we have to answer such a question from our opponents..or? That was my point! Not just telling them resources are infinitive when government have a budget containing exploding interest-payments.

We have to address this practical policy-problem for the people.

Thorleif: Your scenario as I understand it is logically impossible. In particular, “when government have a budget containing exploding interest-payments” is not possible – unless the government decides to “have a budget containing exploding interest payments” as Jerry has been explaining. Interest is under government control. Governments during WWII and after followed the MMT policy of controlling interest rates- rather successfully. Pro & anti-Keynesian economists back then favored or opposed the policy, but nobody argued that it was not possible.

Interest expenditures could crowd out more vital needs, but they could NOT accelerate beyond control. That is one reason why governments DID control interest rates and payments, to prevent this crowding out. Realistically, the likelihood of a cause for inflation comparable to enormous WWII spending is very small. “MMT” dealt with that practical policy-problem in the 1940s just fine, in part by keeping interest rates way below 8%. So what you are describing is not a practical problem.

Mike Ellwood, I think that the available real resources will always set a limit on any promise. So if the government funds a job guarantee program the remuneration in real terms has to be within the capacity of the economy to create the goods and services demanded. If it turns out that the original JG wage was set too high then there will be inflation for a time. But that should level off by itself as long as the JG wages do not automatically rise with the price level. While the government can always offer a job to everyone who is willing to work for that amount of currency, it will never be able to absolutely promise that those particular wages will afford a certain standard of living. So no- the government would not have to cut back on the number of JG jobs offered, but it might have to allow the real wage that it offered for those jobs to drop to a level that the economic production of the country could support. But that is kind of a worst case scenario I think, where JG jobs added no production to the economy and also caused an initial spike in prices.

Thorleif, I am sorry but I think if my previous comments did not answer your question, then I am just not able to answer your questions. Last week in a reply to your questions I posted a link to a Bill Mitchell article that I think provides a good answer. I recommend reading that post and the post from the day before it and the day after it. Bill is a much better authority on MMT than I am so you might as well read it straight as he wrote it.

Thorleif

Horror-story projections in which per capita debt would become intolerably burdensome, debt service would absorb the entire income tax revenue, or confidence is lost in the ability or willingness of the government to levy the required taxes so that bonds cannot be marketed on reasonable terms, reasonable scenarios protect a negligible or even favorable effect on the fisc. If full employment is maintained so that the nominal GDP continues to grow at say 6%, consisting of about 3% inflation and 3% real growth, the equilibrating debt would have to grow at 6% or perhaps at a slightly higher rate; if the nominal interest rate were 8%, 6% of this would be financed out of the needed growth in the debt, leaving only 2% to be met out of the current budget. Income tax on the increased interest payments would offset much of this, and savings from reduced unemployment, insurance benefits and welfare costs would more than cover the remainder, even aside from substantial increases in tax revenues from the more prosperous economy. Though much of these gains would accrue to state and local governments rather than to the Federal government, this could be adjusted to through changes in intergovernmental grants. A fifteen trillion debt will be far easier to deal with out of a full employment economy with greatly reduced needs for unemployment benefits and welfare payments than a five trillion debt from an economy in the doldrums with its equipment in disrepair. There is simply no problem.

The central bank can cut the interest rate which is a price cut right across the economy and a price cut will bring inflation down.

As Russia has proved over the last few years when they started cutting the interest rate.

Russia’s inflation rate and interest rate was 17% in 2015 none of the nightmares happened that you see.

They monopoly price setter started cutting the interest rate. Now the interest rate is 7.25% and the inflation rate is 2.4%.

The 1970s oil crisis was mentioned above.

In the early/mid 1970s, there was an ensuing burst of high inflation (supply/cost push) accompanied by a collapse in output and employment in the West. The fall in output in the West was the result of a massive and sudden transfer of income from oil consumers to oil producers. Hence the West endured a period of stagflation.

So what policy response would MMT prescribe in this situation?

Is seems to me, if inflation is to be contained, a large fall in output would have to be accepted, at least initially. The fall in employment would be countered with a PSE scheme. However, with reduced output and employment levels and consequently demand being held up, inflation control will remain problematic.

I presume the saviour of the situation would be that the initial fall in output would leave unused capacity which would be eventually directed to meet demand from fully employed labour?

@Henry Rech,

I can’t remember if I posted this thought earlier on, but I remember wondering earlier on what an MMT aware government might have done in the wake of the 1970s “Oil Shock(s)”.

I’d wondered, for example, whether it could have subsidised the price of oil to consumers (including industrial and business customers) by government-created money. E.g. the government could have bought up oil directly from importers, and sold it on to customers at highly subsided prices. (Lots of scope for corruption there I imagine, but let’s assume that could have been dealt with).

One problem would have been that the full import price would still have had to have been paid in dollars.

Also, the UK government at the time still behaved as though it had to defend the exchange rate – even though it didn’t really need to. I don’t think we floated until some time later.

Anyway, I don’t know if the subsidising idea would have worked. Would be interested to know what Bill thinks.

One thing an MMT-aware government could definitely have done would be to heavily support alternatives and technology to reduce the need for conventional fuels. That was hardly mainstream thinking in those days.

Jerry; I will follow your advice and read the link you proposed, thanks

Derek Henry 23:02

My post was not really about the level of outstanding bonds but about the level of inflation on existing debts. How to deal with exploding interest-expenditures in the budget? What policy-choices do we have?

You said: “It is not intended that the domestic government debt should be held in any large quantity by foreigners. ”

Maybe so but large mercantilist nations like Japan, China, Germany and also Sweden likes to keep i.e their centralbank currency-reserves(export-net) with interest. The dollar is also the world´s main trade/exchange currency(still).

As long as a nation keeps it´s debts in it´s local currency they can absorb sellings. But as you say countries with large imports-needs need foreign exchange and for that they take risks. The US is not such a country.

Mike Ellwood 23:40

I did not mean Volker really was responsible(or a hero) for taming the inflation. I just meant he symbolized the end of the inflation-period in retrospective. The oil-embargo enhanced an inflation already running at 10%. Goverment used wage- and pricecontrols which we later understood was just worsening the situation. The US oil-producing capacity was also maximized(topped 1970) and oil-price kept on rising even when embargo was lifted(already in 1974) until 1980(Iran revolution 1979). http://www.macrotrends.net/1369/crude-oil-price-history-chart

Yes I also read about the US natural gas-deregulation. I am sure it had positive contributions to taming inflation as well. http://naturalgas.org/regulation/history/

You said “the effect of interest rates on the macroeconomy is uncertain and unpredictable, at best”(quotes from Bill and Randy). That depend on a lot of other factors I would say. To my mind the swedish politicians i.e deregulated bank&finance and made banks be profit-maximizers while the Basel-rules from the 90´s were almost unchanged. Of cource zirp(negative) rates will create a housing boom(bust?) together with an old time builders oligopol-situation(builders price-index have been running 2% above cpi since the 50´. Sweden is an expensive country to live in and the swedish krona is used to maximize our exports.

Having a zirp-environment long term when having inflation above ++2% is for me not comprehensible. Where can I read about this MMT-policy recommendations? Jerry gave me a link to read about how MMT deals with some of the issues. Maybe I find what I am looking for there?

Some Guy;

I wrote about such a situation here before. Government bonds are issued with coupons which means they have to be paid out to owners whatever the inflation, market-rates or the Fed Funds rate are! Existing debt with high rates will therefore not expand government expenditure. Only new debt.

If MMT-policy takes over in times when inflation runs high I guess they(FED) have the option to start buying(QE) new issues with higher rate coupons on the secondary market and refund the interest to Treasury! Monetizing new debt?

Another option according to MMT is to choose not to issue debt at all. Such a scheme involves setting the interest-rates to zero(forever?) even in a high inflation scenario. To compare this with the wars of WW2(a few years)and the short period of “normalizing”after the war I find almost breathtaking. During the wartimes trade-activity in the world was running low. Today world economy is very interconnected to say the least. So are interest-rates are they not? The (inter-)banking-system of today is a rather complex system using different collaterals in large chains of rehypothecations. Banks lives on borrowing short and lending long term. Government have to find a ways not to frontload the financial system with a strong bias of short framed borrowing(by markets not only banks). The GFC was a reminder what could happen even if the FED saved the markets(but not the real economies).

Would MMT set the yield-curve to a new “fix”? Meaning the whole curve will always be positive including the short end? Is MMT on the road to alter how the banking system works?

Of course an MMT monetary sovereign could simply stop issuing debt that it doesn’t need to begin with. Existing debt could be retired. Interdepartmental debt could be retired. Deficit spending would continue directly (Overt Monetary Finance), thus there would be no loss of ability to spend. The real economy would flourish. But the wasteful financial economy would, it is hoped, shrink to manageable levels.