Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

The Weekend Quiz – March 10-11, 2018 – answers and discussion

Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

A sovereign national government can run a balanced fiscal position over the business cycle (peak to peak) as long as it accepts that, after all the spending adjustments are exhausted, the private domestic balance will mirror the external balance. That means a country running an external deficit will have an increasingly indebted private domestic sector.

The answer is True.

Note that this question begs the question as to how the economy might get into this situation that I have described using the sectoral balances framework. But whatever behavioural forces were at play, the sectoral balances all have to sum to zero. Once you understand that, then deduction leads to the correct answer.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

(1) GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

Expression (1) tells us that total income in the economy per period will be exactly equal to total spending from all sources of expenditure.

We also have to acknowledge that financial balances of the sectors are impacted by net government taxes (T) which includes all tax revenue minus total transfer and interest payments (the latter are not counted independently in the expenditure Expression (1)).

Further, as noted above the trade account is only one aspect of the financial flows between the domestic economy and the external sector. we have to include net external income flows (FNI).

Adding in the net external income flows (FNI) to Expression (2) for GDP we get the familiar gross national product or gross national income measure (GNP):

(2) GNP = C + I + G + (X – M) + FNI

To render this approach into the sectoral balances form, we subtract total net taxes (T) from both sides of Expression (3) to get:

(3) GNP – T = C + I + G + (X – M) + FNI – T

Now we can collect the terms by arranging them according to the three sectoral balances:

(4) (GNP – C – T) – I = (G – T) + (X – M + FNI)

The the terms in Expression (4) are relatively easy to understand now.

The term (GNP – C – T) represents total income less the amount consumed less the amount paid to government in taxes (taking into account transfers coming the other way). In other words, it represents private domestic saving.

The left-hand side of Equation (4), (GNP – C – T) – I, thus is the overall saving of the private domestic sector, which is distinct from total household saving denoted by the term (GNP – C – T).

In other words, the left-hand side of Equation (4) is the private domestic financial balance and if it is positive then the sector is spending less than its total income and if it is negative the sector is spending more than it total income.

The term (G – T) is the government financial balance and is in deficit if government spending (G) is greater than government tax revenue minus transfers (T), and in surplus if the balance is negative.

Finally, the other right-hand side term (X – M + FNI) is the external financial balance, commonly known as the current account balance (CAD). It is in surplus if positive and deficit if negative.

In English we could say that:

The private financial balance equals the sum of the government financial balance plus the current account balance.

We can re-write Expression (6) in this way to get the sectoral balances equation:

(5) (S – I) = (G – T) + CAD

which is interpreted as meaning that government sector deficits (G – T > 0) and current account surpluses (CAD > 0) generate national income and net financial assets for the private domestic sector.

Conversely, government surpluses (G – T < 0) and current account deficits (CAD < 0) reduce national income and undermine the capacity of the private domestic sector to add financial assets.

Expression (5) can also be written as:

(6) [(S – I) – CAD] = (G – T)

where the term on the left-hand side [(S – I) – CAD] is the non-government sector financial balance and is of equal and opposite sign to the government financial balance.

This is the familiar MMT statement that a government sector deficit (surplus) is equal dollar-for-dollar to the non-government sector surplus (deficit).

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)) plus net income transfers.

All these relationships (equations) hold as a matter of accounting and not matters of opinion.

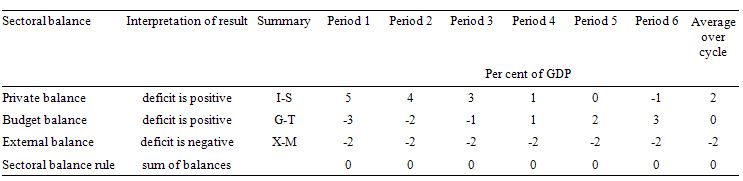

To help us answer the specific question posed, the following Table shows a stylised business cycle with some simplifications. The economy is running a surplus in the first three periods (but declining) and then increasing deficits. Over the entire cycle the balanced fiscal rule would be achieved as the fiscal balances average to zero. So the deficits are covered by fully offsetting surpluses over the cycle.

The simplification is the constant external deficit (that is, no cyclical sensitivity) of 2 per cent of GDP over the entire cycle. You can then see what the private domestic balance is doing clearly. When the fiscal balance is in surplus, the private balance is in deficit. The larger the fiscal surplus the larger the private deficit for a given external deficit.

As the fiscal position moves into deficit, the private domestic balance approaches balance and then finally in Period 6, the fiscal deficit is large enough (3 per cent of GDP) to offset the demand-draining external deficit (2 per cent of GDP) and so the private domestic sector can save overall. The fiscal deficits are underpinning spending and allowing income growth to be sufficient to generate savings greater than investment in the private domestic sector.

On average over the cycle, under these conditions (balanced public fiscal position) the private domestic deficit exactly equals the external deficit. As a result over the course of the business cycle, the private domestic sector becomes increasingly indebted.

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Question 2:

A nation that manages its currency via a currency board (for example, Estonia and Latvia) has to have sufficient foreign reserves to match the outstanding central bank liabilities (reserves and cash outstanding). Under this arrangement it can always guarantee 100 per cent convertibility but has to endure deflationary tendencies unless it runs external surpluses.

The answer is True.

In a currency board system, the central bank only creates liabilities (reserves, currency or loans) if it has gold or foreign currency reserves to match.

The other characteristic is that the central bank pegs the national currency at a fixed rate to some other foreign currency (or currencies if a basket is used). In this way, the central bank guarantees that there is 100 per cent convertibility of its own currency into the currency that it is pegged against given that the local currency is fully backed by reserves in the other currency.

The currency board proponents argue that by maintaining currency convertibility and a fixed exchange rate it generates confidence in the local currency which they argue stabilises the economy.

The central bank stands by to guarantee this convertibility at a pegged exchange rate against the so-called anchor currency. So this part of the proposition outlined in the question is true.

Currency board systems also typically ban the central bank from lending to the treasury which forces government to fully fund its fiscal policy spending from the private bond markets.

A further characteristic which is often implemented is that the central bank does not try to manage reserves and thus allows the overnight interest rate and the term structure (the longer rates on the yield curve) to be purely market-determined. But if banks face a squeeze on their reserves (in the domestic currency) then the only way this can be resolved is for interest rates to rise to attract the funds.

All these characteristics are present in the Estonian case.

As an aside: a pure currency board arrangement involves the creation of a separate institute (called the “currency board”) which is independent of government (particularly the central bank). Its sole function is to provide foreign reserves to match the central bank liabilities. Modern currency boards, however, blur this distinction and allow the central bank to serve both functions.

Estonia pegs its currency at 15.60 krooni per Euro (after joining the European Exchange Rate (ERM) system in June 2004. Latvia pegs its currency at 0.71 lat per Euro and joined the ERM in 2005. Estonia initially pegged against the German mark when the Soviet system collapsed and they abandoned the rouble. Latvia switched their currency anchor from the IMF Special Drawing Rights bask to the Euro on January 1, 2005.

So Estonia and Latvia are both running currency systems similar to Argentina in the 1990s which ultimately collapsed and led to its default in 2001 (Argentina pegged against the US dollar).

A currency board thus requires that a nation always have sufficient foreign reserves to ensure at least 100 per cent convertibility of the monetary base (reserves and cash outstanding).

And most importantly it forces the treasury to run tight fiscal policy because it is always subject to the discipline of the private domestic bond markets.

The currency board arrangement in Estonia only guarantees 100 per cent convertibility of the monetary base. So it does not cover the broader monetary expansion that the banks generate by lending. In this context, there are problems when a financial panic occurs which leads to a bank run. If the depositors try to convert their demand deposits into the reserve currency the banks have a problem.

They can use their own store of foreign currency reserves or borrow the currency in international markets. But both these options are short-term at best and when exhausted the crisis becomes critical. The problem stems from the fact that the central bank does not pay a lender of last resort role to the commercial banks in this system.

Now has does external trade impact on a nation running a currency board – which addresses the second part of the question?

A nation running a currency board can only issue local currency in proportion with the foreign currency it holds in store (at the fixed parity). If such a nation runs an external surplus, then reserve deposits of foreign currency rise and the central bank can then expand the monetary base.

Currency board nations are heavily dependent on successful export-led growth strategies with suppressed domestic (private and public) consumption.

A nation running a currency board can run external deficits (on the current account) for a time as long as their are sufficient foreign reserves so that the central bank does not need to contract the monetary base (its liabilities). In particular, if investment is targeted at productive ventures building extra export capacity and if the nation has enough foreign reserves then a current account deficit for a time can be beneficial in the longer term.

But persistent current account deficits become particularly problematic for a nation running a currency board. The nation faces the continual drain of its foreign reserves which has two impacts. First, the peg comes under pressure. Second, the central bank has to contract the monetary base (its liabilities) which has a negative impact on aggregate demand

With an external deficit, the monetary base has to contract (so no sterilisation of the reserve outflow) which forces up interest rates because there is a dearth of bank reserves to keep the payments system running. While the higher rates may attract foreign capital inflow they are also deflationary. Proponents of this arrangement argue that the deflation starts a process of internal devaluation (wages and prices fall) and increase the competitiveness of the export sector. So exactly what the EMU want Ireland and Greece etc to do.

But it is clear that currency board arrangements, which eliminate the capacity of the central bank to run discretionary monetary policy, lead to pro-cyclical policy outcomes. So in boom times, with exports strong, the monetary base expands and interest rates fall. So monetary policy reinforces the demand boom.

But if exports fall and thus aggregate demand weakens and/or foreign capital outflow occurs then the monetary base contracts and interest rates rise therefore causing a further contraction. Moreover, when times are bad, the treasury may not be able to fund its current fiscal position (if in deficit) and so fiscal policy has to contract which worsens the situation.

Currency boards collapse when there is a major collapse in export growth and hence a loss of capacity to build foreign currency reserves and support local demand.

The problem is that in those cases a crisis quickly follows because the economy has engineer a sharp domestic contraction to reduce imports but also runs out of reserves and has to default on foreign currency debt (either public or private). It is a recipe for disaster.

Overall, the answer is true.

The following blogs may be of further interest to you:

- A fiscal consolidation plan

- When a country is wrecked by neo-liberalism

- The further down the food chain you go, the more the zealots take over

- Modern monetary theory in an open economy

- Gold standard and fixed exchange rates – myths that still prevail

Question 3:

Modern Monetary Theory (MMT) allows for the possibility that trade union power can cause mass unemployment.

The answer is True.

In this blog post – What causes mass unemployment? – I outline the way aggregate demand failures causes of mass unemployment and use a simple two person economy to demonstrate the point.

I also presented the famous Keynes versus the Classics debate about the role of real wage cuts in stimulating employment that was well rehearsed during the Great Depression.

The debate was multi-dimensioned but the role of wage flexibility was a key aspect. In the classical model of employment determination, which remains the basis of mainstream textbook analysis, cuts in the nominal wage will increase employment because it is considered they will reduce the real wage.

The mainstream textbook model assumes that economies produce under the constraint of the so-called diminishing marginal product of labour. So adding an extra worker will reduce productivity because they assume the available capital that workers get to use is fixed in the short-run.

This assertion which does not stack up in the real world, yields the downward sloping marginal product of labour (the contribution of the last worker to production) relationship in the textbook model. Then profit maximising firms set the marginal product equal to the real wage to determine their employment decisions.

They do this because the marginal product is what the last worker produces (at the margin) and the real wage is what the worker costs in real terms to hire.

So when they have screwed the last bit of production out of the last worker hired and it equals the real wage, they have thus made “real gains” on all previous workers employed and cannot do any better – hence, they are said to have maximised profits.

Labour demand is thus inverse to the real wage. As the real wage rises, employment falls in this model because the marginal product falls with employment.

The simplest version is that labour supply in the mainstream model (and complex versions don’t add anything anyway) says that households equate the marginal disutility of work (the slope of the labour supply function) with the real wage (indicating the opportunity cost of leisure) to determine their utility maximising labour supply.

So in English, it is assumed that workers hate work and but like leisure (non-work). They will only go to work to get an income and the higher the real wage the more work they will supply because for each hour of labour supplied their prospective income is higher. Again, this conception is arbitrary and not consistent with countless empirical studies which show the total labour supply is more or less invariant to movements in the real wage.

Other more complex variations of the mainstream model depict labour supply functions with both non-zero real wage elasticities and, consistent with recent real business cycle analysis, sensitivity to the real interest rate. All ridiculous. Ignore them!

In the mainstream model, labour market clearing – that is when all firms who want to hire someone can find a worker to hire and all workers who want to work can find sufficient work – requires that the real wage equals the marginal product of labour. The real wage will change to ensure that this is maintained at all times thus providing the classical model with continuous full employment. So anything that prevents this from happening (government regulations) will create unemployment.

If a worker is “unemployed” then it must mean they desire a real wage that is excessive in relation to their productivity. The other way the mainstream characterise this is that the worker values leisure greater than income (work).

The equilibrium employment levels thus determine via the technological state of the economy (productivity function) the equilibrium (or full employment) level of aggregate supply of real output. So once all the labour markets are cleared the total level of output that is produced (determined by the productivity levels) will equal total output or GDP.

It was of particular significance for Keynes that the classical explanation for real output determination did not depend on the aggregate demand for it at all.

He argued that firms will not produce output that they do not think they will sell. So for him, total supply of GDP must be determined by aggregate demand (which he called effective demand – spending plans backed by a willingness to impart cash).

In the General Theory, Keynes questioned whether wage reductions could be readily achieved and was sceptical that, even if they could, employment would rise.

The adverse consequences for the effective demand for output were his principal concern.

So Keynes proposed the revolutionary idea (at the time) that employment was determined by effective monetary demand for output. Since there was no reason why the total demand for output would necessarily correspond to full employment, involuntary unemployment was likely.

Keynes revived Marx’s earlier works on effective demand (although he didn’t acknowledge that in his work – being anti-Marxist). What determined effective demand? There were two major elements: the consumption demand of households, and the investment demands of business.

So demand for aggregate output determined production levels which in turn determined total employment.

Keynes model reversed the classical causality in the macroeconomy. Demand determined output. Production levels then determined employment based on the current level of productivity. The labour market is then constrained by this level of employment demand. At the current money wage level, the level of unemployment (supply minus demand) is then determined. The firms will not expand employment unless the aggregate constraint is relaxed.

Keynes also argued that in a recession, the real wage might not fall because workers bargain for money or nominal wages, not real wages. The act of dropping money wages across the board would also reduce aggregate demand and prices would also fall. So there was no guarantee that real wages (the ratio of wages to prices) would therefore fall. They may rise or stay about the same.

Falling prices might, however, depress business profit expectations and so cut into demand for investment. This would actually reduce the demand for workers and prevent total employment from rising. The system interacts with itself, and an equilibrium of full employment cannot be achieved within the labour market.

Keynes also claimed that in a recession it should be clear that the problem is not that the real wage is too high, but rather that the prices are too low (as prices fall with lower production).

However, in Keynes’ analysis, attempting to cut real wages by cutting nominal wages would be resisted by the workers because they will not promote higher employment or output and also would imperil their ability to service their nominal contractual commitments (like mortgages). The argument is that workers will tolerate a fall in real wages brought about by prices rising faster than nominal wages because, within limits, they can still pay their nominal contractual obligations (by cutting back on other expenditure).

A more subtle point argued by Keynes is that wage cut resistance may be beneficial because of the distribution of income implications. If real wages fall, the share of real output claimed by the owners of capital (or non-labour fixed inputs) rises. Assuming such ownership is concentrated in a few hands, capitalists can be expected to have a higher propensity to save than the working class.

If so, aggregate saving from real output will increase and aggregate demand will fall further setting off a second round of oversupply of output and job losses.

It is also important to differentiate what happens if a firm lowers its wage level against what happens in the whole economy does the same. This relates to the so-called interdependence of demand and supply curves.

The mainstream model claims that the two sides of the market are independent so that a supply shift will not cause the demand side of the market to shift. So in this context, if a firm can lower its money wage rates it would not expect a major fall in the demand for its products because its workforce are a small proportion of total employment and their incomes are a small proportion of total demand.

If so, the firm can reduce its prices and may enjoy rising demand for its output and hence put more workers on. So the demand and supply of output are independent.

However there are solid reasons why firms will not want to behave like this. They get the reputation of being a capricious employer and will struggle to retain labour when the economy improves. Further, worker morale will fall and with it productivity. Other pathologies such as increased absenteeism etc would accompany this sort of firm behaviour.

But if the whole economy takes a wage cut, then while wage are a cost on the supply side they are an income on the demand side. So a cut in wages may reduce supply costs but also will reduce demand for output. In this case the aggregate demand and supply are interdependent and this violates the mainstream depiction.

This argument demonstrates one of the famous fallacies of composition in mainstream theory. That is, policies that might work at the micro (firm/sector) level will not generalise to work at the macroeconomic level.

There was much more to the Keynes versus the Classics debate but the general idea is as presented.

MMT integrates the insights of Keynes and others into a broader monetary framework. But the essential point is that mass unemployment is a macroeconomic phenomenon and trying to manipulate wage levels (relative to prices) will only change output and employment at the macroeconomic level if changes in demand are achieved as saving desires of the non-government sector respond.

It is highly unlikely for all the reasons noted that cutting real wages will reduce the non-government desire to save.

MMT tells us that the introduction of state money (the currency issued by the government) introduces the possibility of unemployment. There is no unemployment in non-monetary economies. As a background to this discussion you might like to read this blog – Functional finance and modern monetary theory .

MMT shows that taxation functions to promote offers from private individuals to government of goods and services in return for the necessary funds to extinguish the tax liabilities.

So taxation is a way that the government can elicit resources from the non-government sector because the latter have to get $s to pay their tax bills. Where else can they get the $s unless the government spends them on goods and services provided by the non-government sector?

A sovereign government is never revenue constrained and so taxation is not required to “finance” public spending. The mainstream economists conceive of taxation as providing revenue to the government which it requires in order to spend. In fact, the reverse is the truth.

Government spending provides revenue to the non-government sector which then allows them to extinguish their taxation liabilities. So the funds necessary to pay the tax liabilities are provided to the non-government sector by government spending.

It follows that the imposition of the taxation liability creates a demand for the government currency in the non-government sector which allows the government to pursue its economic and social policy program.

The non-government sector will seek to sell goods and services (including labour) to the government sector to get the currency (derived from the government spending) in order to extinguish its tax obligations to government as long as the tax regime is legally enforceable. Under these circumstances, the non-government sector will always accept government money because it is the means to get the $s necessary to pay the taxes due.

This insight allows us to see another dimension of taxation which is lost in mainstream economic analysis. Given that the non-government sector requires fiat currency to pay its taxation liabilities, in the first instance, the imposition of taxes (without a concomitant injection of spending) by design creates unemployment (people seeking paid work) in the non-government sector.

The unemployed or idle non-government resources can then be utilised through demand injections via government spending which amounts to a transfer of real goods and services from the non-government to the government sector.

In turn, this transfer facilitates the government’s socio-economics program. While real resources are transferred from the non-government sector in the form of goods and services that are purchased by government, the motivation to supply these resources is sourced back to the need to acquire fiat currency to extinguish the tax liabilities.

Further, while real resources are transferred, the taxation provides no additional financial capacity to the government of issue.

Conceptualising the relationship between the government and non-government sectors in this way makes it clear that it is government spending that provides the paid work which eliminates the unemployment created by the taxes.

So it is now possible to see why mass unemployment arises. It is the introduction of State Money (defined as government taxing and spending) into a non-monetary economy that raises the spectre of involuntary unemployment.

As a matter of accounting, for aggregate output to be sold, total spending must equal the total income generated in production (whether actual income generated in production is fully spent or not in each period).

Involuntary unemployment is idle labour offered for sale with no buyers at current prices (wages). Unemployment occurs when the private sector, in aggregate, desires to earn the monetary unit of account through the offer of labour but doesn’t desire to spend all it earns, other things equal.

As a result, involuntary inventory accumulation among sellers of goods and services translates into decreased output and employment.

In this situation, nominal (or real) wage cuts per se do not clear the labour market, unless those cuts somehow eliminate the private sector desire to net save, and thereby increase spending.

So we are now seeing that at a macroeconomic level, manipulating wage levels (or rates of growth) would not seem to be an effective strategy to solve mass unemployment.

MMT then concludes that mass unemployment occurs when net government spending is too low.

To recap: The purpose of State Money is to facilitate the movement of real goods and services from the non-government (largely private) sector to the government (public) domain.

Government achieves this transfer by first levying a tax, which creates a notional demand for its currency of issue.

To obtain funds needed to pay taxes and net save, non-government agents offer real goods and services for sale in exchange for the needed units of the currency. This includes, of-course, the offer of labour by the unemployed.

The obvious conclusion is that unemployment occurs when net government spending is too low to accommodate the need to pay taxes and the desire to net save.

This analysis also sets the limits on government spending. It is clear that government spending has to be sufficient to allow taxes to be paid. In addition, net government spending is required to meet the private desire to save (accumulate net financial assets).

It is also clear that if the Government doesn’t spend enough to cover taxes and the non-government sector’s desire to save the manifestation of this deficiency will be unemployment.

Keynesians have used the term demand-deficient unemployment. In MMT, the basis of this deficiency is at all times inadequate net government spending, given the private spending (saving) decisions in force at any particular time.

Shift in private spending certainly lead to job losses but the persistent of these job losses is all down to inadequate net government spending.

But in terms of the question – after all that – it is clear that excessive real wages could impinge on the rate of profit that the capitalists desired and if they translate that into a cut back in investment then aggregate demand might fall.

Note: this explanation has nothing to do with the standard mainstream textbook explanation. It is totally consistent with MMT and the Keynesian story – output and employment is determined by aggregate demand and anything that impacts adversely on the latter will undermine employment.

The following blogs may be of further interest to you:

- Functional finance and modern monetary theory

- What causes mass unemployment?

- Modern monetary theory in an open economy

- Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

Variations of question #3 have been on a number of quizzes. So far the answers have done a great job explaining how mass unemployment is the responsibility of government policy. That theoretically, by issuing a currency and imposing taxes in that currency, it is government itself that causes the category of ‘unemployment’ to even exist in the first place. A very good and convincing argument is made that mass unemployment occurs because of a dereliction of duty by the government. That duty is to spend enough of the fiat currency so that mass unemployment does not exist. It is a great argument!

But then we get these quizzes with the ‘correct’ answers being that mass unemployment can be caused by situations like capitalists desiring higher returns on their capital, or countries deciding to protect the foreign exchange rate of their currency rather than ensuring full employment. Or the latest- labor power causes unemployment- which really seem inconsistent with the seemingly straightforward idea- “MMT then concludes that mass unemployment occurs when net government spending is too low.” Why absolve government of its responsibilities because of the profit desires of the capitalists?

The interesting thing about Q3 is that MMT still leaves room for microeconomic reform doesn’t it.

Clearly no one here likes union busting but as a basic principle, if unions over price labour, then private sector demand for it will in all probability fall!

Monopolies continue to charge excessive prices, which restricts output and hinders job creation.

You don’t have to gettison everything you learned in microeconomics

Or Philip, since wages constitute a large portion of income, will the higher wages lead to increased demand?

True the extra spending power in workers’ pockets will stimulate demand for goods and services and labour.

So you’ve got two forces running in opposite directions.

Somehow, I suspect the effect of an increase in the price of a key factor of production like labour would out weigh the effect of an increase in household expenditure on the demand for labour.

I’m assuming households would want to save some of the extra income earned for a start. The paradox of thrift would have to be overcome. Also, some of the extra expenditure will go on imports and stimulate demand for labour somewhere else! Two leakages are working against equivalence.

Maybe I’m too orthodox but the idea that higher wages stimulates demand for labour is beginning to sound as likely as a contractionary fiscal stimulus did when that idea was was first explained to me!

Greeks didn’t go “Hey Maria, we’ve both lost our government jobs. That means our taxes are going to go down and our lifetime income has gone up. Let’s spend up big at IKEA!”

I don’t think labour is a Giffin Good, mores the pity!

Philip, perhaps the answer is “it depends”. Which is always a bit unsatisfactory, but probably accurate. I think I can imagine a situation where wages had been at subsistence level, and where imported goods were not allowed or available, and where the economy suffered due to a lack of aggregate demand where wages increase above the pre-existing market level due to labor power or government decree forced wages up and it turned out to both increase supply and overall well being. But maybe I’m just an optimist.

If labour doesn’t save, doesn’t pay tax or buy imports, is the only factor of production so there is no possibility of substitution or labour productivity gains to compensate for the higher wages and if employers don’t pass the wage increase on in the form of higher prices so that all of the wage increase flows through to an increase in real expenditure then you’ll have no spending power/demand for labour leakages and all of the wage increase would flow through into an increase in the demand for labour.

It’s a pretty artificial construct isn’t it?

Yes Philip it might be somewhat artificial, but compared to Ricardian Equivalence or the Loanable Funds theory it seems quite reasonable. Income is one of the determinates of demand or at least effective demand and the idea has at least some basis. If some guy with a PhD in economics can tell me that R.E. is a reasonable hypothesis then I think it is more than reasonable to argue that total demand will increase along with labor income.

Jerry

I think you have a valid point there

Just a minor correction. The Baltic states have joined the euro. Estonia 2011, Latvia 2014 and Lithuania 2015.

Question 3 – wages – demand – unemployment – how about historical evidence?

When real wages and labour income share were higher we had something much more like true full employment in NZ. The NZ where “both unemployed persons” were known personally to the Minister or some such quip?

The NZ I have never known as I sit here underutilized.

It’s really simple isn’t it cs.

Put spending power in the pockets of those who are more likely to spend it and the economy grows quickly enough to keep all of its resources fully employed.

I don’t care how rich you are. You only need one haircut a month, can only eat three meals a day.