My friend Alan Kohler, who is the finance presenter at the ABC, wrote an interesting…

The IMF and the Germans wreaking havoc in Northern Africa

Some years ago, I started collecting information about the so-called Maghreb countries, which typically refers to the region spanned by Algeria, Morocco, and Tunisia, although sometimes Libya and Mauritania are also included in the aggregation. You will find it referred to as the Barbary Coast in English literature. I was interested (as a long-term project when I get old :-)) to write a book about how nations broke away from the yoke of colonialism only to fall into the hands of the IMF and the World Bank, which over time were becoming the leading attack dogs for the neoliberal domination of governments. That book is coming in the future. But I have also been interested in the way the Eurozone Member States have moved into Northern Africa to extract as much surplus as they can from exploiting the resources these African nations have. You know a nation is in trouble when there are nightly riots which were motivated by economic desperation and a pernicious new (so-called) Finance Law, which became law on January 1, 2018. I am, of course, talking about Tunisia. With high levels of unemployment and underemployment and a lack of job opportunities particularly severe in the interior regions, the IMF decided, in its infinite neoliberal stupidity, to force the Tunisian government to impose a harsh austerity program including pushing up value added taxes which have had the effect of driving up medicine, food and energy prices and impacting on those most affected by the lack of jobs. Smart thinking! The riots have now followed.

Tunisia was the only ‘democracy’ to emerge out of the hope 2011 Arab Spring (which in Tunisia was referred to as the Dignity Revolution.

But then the IMF came along!

Now the nation is riddled with protest and chaos because unemployment and underemployment has skyrocketed (courtesy of an enforced IMF austerity program) and opportunities for a previously hopeful youth have been destroyed by the technocrats.

Tunisia has long endured large spatial disparities in economic opportunities.

The coastal fringe is relatively provisioned with infrastructure (roads, transport, etc) and the interior areas have little investment, poorly developed infrastructure, high unemployment rates, and the rule of law is difficult to apply.

A little trip along the coastal settlements might leave one with the impression that this nation is one of the richer members of the Maghreb.

But the situation in the interior is more than grim.

The Financial Times article (March 11, 2016) – Tunisia: After the revolution – reported that:

Brandishing a blood-spattered job application that he blames for his son Reda’s death, Othman Yahyaoui is beyond grief. Reda was carrying the nondescript document when he was electrocuted in January after clambering up a pylon in the Tunisian town of Kasserine to protest against unemployment and corruption in the allocation of state jobs.

A commentator concluded that “It was not the electricity that killed him but the pen that crossed out his name from the list of those to be given jobs.”

Those disparities can be traced back to the period when the Ottoman’s ran the place from around the C16th. Then the French took over in 1881 after a deal with the British, which ceded control of Cyprus to the latter. Tunisia became a French colony.

Eventually, the creation of the independent nation in 1956 relied on a fragile cooperation between the Arab nationalists who dominated and the elites who were French-educated with Western values.

In the 1950s, Tunisia was in poor economic and social shape, considering that more than 30 per cent of the willing labour force was unemployed and underemployment was rife.

There is an excellent account of this period available in the 1972 article by late French-based economist André Tiano – ‘Human Resources Investment and Employment Policy in the Maghreb’, International Labour Review, 105(2), February, 109-133.

Tiano provides a detailed account of the scale of the labour underutilisation problems in the Maghreb nations and how governments desperately needed to invest in their human resources. He also analysed the policies that the French administration introduced to alleviate the waste of labour.

The article might be difficult to access given the on-line archive for this journal only goes back to the 1990s. But it is worth reading because it indicates the value of providing paid employment in troubled times.

To stabilise growing social unrest, the French colonial administration had established the so-called “chantiers de lutte contre le chômage” (“work groups to attack unemployment”).

To appease different factions and to try to provide work in a stagnating economy to the young population, the new independent government quickly expanded the public sector and, in turn, created a middle class within a largely rural society.

This policy became known as the “chantiers de lutte contre sousdéveloppement” (“under-development”) which then morphed into a government-supported rural cooperative movement during the 1960s.

Despite these interventions, elevated levels of unemployment have always plagued Tunisia because successive governments have not allowed their net spending to be sustained at the required levels for long enough.

But there been a tradition established early in its independence for the public sector to assume some responsibility for employment creation.

It also has to be said that the Government has feared the urbanised educated middle class more than it has been concerned with the rural population. As a result, the state has historically pacified the Tunisian middle class through opportunities for public employment, various subsidies (principally food and fuel) and quality public services.

The provision of these state benefits has exacerbated the inequalities across space and income group.

The long-serving Ben Ali exacerbated the inequalities, by concentrating public investment in the coastal regions as tourism was promoted. The neglect of the interior regions continued to heighten the disadvantage of those areas.

Recent history

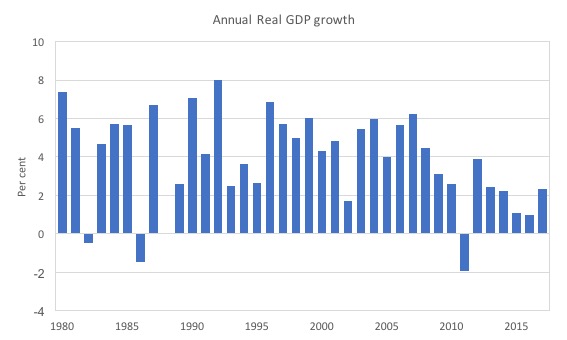

The first graph shows annual real GDP growth for Tunisia from 1980 to 2017 (per cent). In the 1980s, real GDP growth averaged 3.6 per cent per annum. The 1990s saw this annual average rise to 5.2 per cent; 2000-09 4.5 per cent and since 2010 1.7 per cent per annum.

The consequence of this post 2010 slowdown was the rapid rise in unemployment.

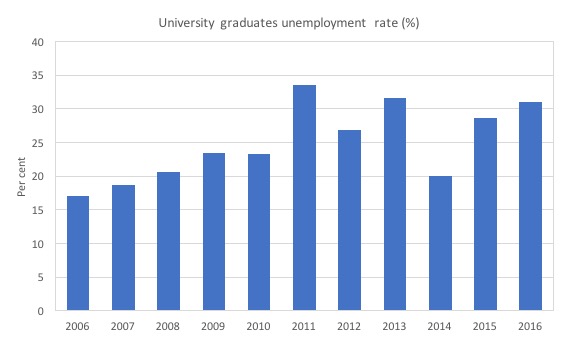

But worse, the rise in unemployment impacted heavily on the youth of Tunisia.

The following graph shows the overall and youth unemployment rates since 1991. However, even though there are 35 per cent of youth unemployed overall, the rate in the less prosperous interior regions and cities is very high.

In addition, as the next graph shows, the employment opportunities for university graduates is poor with the rate of unemployment among this cohort rising over 30 per cent in 2016.

Within this context of rising hardship and slower rates of growth, the World Bank Report No. 82712-TN (November 2013) – Towards greater equity : energy subsidies, targeting and social protection in Tunisia – (Towards greater equity: Energy Subsidies, Targetting and Social Protection in Tunisia) – studied the effectiveness of fuel subsidies compared to alternative policies.

The World Bank found that the low- to middle income cohorts bore disproportionately high unemployment and struggled to survive.

In the context of state aid, the World Bank found that “Les inégalités sont très marquées” (very marked inequalities).

They found (translating from the French):

1. “The lowest-income households received only 2 per cent of the fuel and diesel subsidies, while the highest-income households received 67 and 60 per cent, respectively”.

2. “In the case of electricity subsidies, the lowest-income households receive 13 per cent of subsidies while the highest income households receive 29 per cent.”

3. “Finally, for LPG, 15 percent of benefits go to the lowest income quintile, while 21 percent go to the highest income earner.”

So not exactly fair and the problem facing the Government was that once the IMF entered the fray and forced the Government to impose austerity measures the previous welfare support for the organised and educated middle classes became threatened.

That was a significant source of the unrest in 2010 and 2011.

Statistiques Tunisie (the national statistics agency) data shows that between 2010 and 2014, 155,686 new public sector jobs were added. This was clearly to pacify the middle class discontent.

In 2011, public employment stood at 444,905. Bu 2012, this rose to 2012 (a rise of 88,164) and then to over 600,000 workers an increase of around 35 per cent.

In addition, there were many new positions created at the executive level of the public service.

Related evidence suggests that the recruitment process was politically biased towards the ruling elite and compromised past rules designed to ensure more equity in the public sector employment selection.

Further, the 2011 peoples’ revolt brought the Ben Ali regime down after 23 years and the new secular government sought to redress the discontent in the interior by expanding the commitment to ‘les chantiers’ – it introduced a large-scale employment program for youth concentrated in the disadvantaged regions.

This ECFR article (January 13, 2017) – Peripheral Vision: How Europe can help preserve Tunisia’s fragile democracy – summarises Arabic language research saying:

… the number of workers hired through the programme leapt from 62,875 in 2010 to 125,000 in 2011. With approximately 100,000 workers in 2015, the ‘les chantiers’ is a crucial instrument in addressing the lack of economic opportunities and to manage social anger in the periphery … Centres of the popular uprising, the regions of Sidi Bouzid and Kasserine represent a total of 37 percent of people hired through it. In total, 77 percent of the workers hired through this programme are from the periphery regions.

The problem is that these programs are considered temporary and do not provide a sustainable solution, especially given the paucity of private sector employment in the interior regions.

The reality is that Tunisia needs to sustain much larger fiscal deficits (as a percent of GDP) than other nations because of the neglect of the interior regions by successive governments and a lack of private sector economy in the interior.

Temporary stimulus programs are useful but do not solve the problem of underdevelopment beyond the coastal areas.

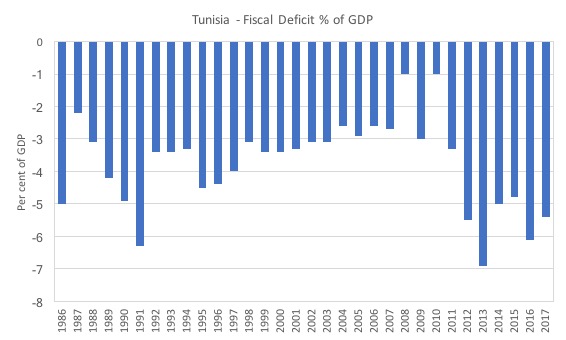

Data from the , the Tunisian Ministère des Finances allows us to understand the shifts in the fiscal parameters.

The first graph is the fiscal deficit from 1986 to 2017, which grew following the revolution and the stimulus measures that the new government took to reduce unemployment (which were successful).

On its own, it is impossible to draw any conclusions because as we know – context is everything in understanding the fiscal position. It is no surprise that the fiscal deficit rose after 2011 given the economic growth rate dropped dramatically and unemployment rose sharply.

It would have been irresponsible not to allow that to happen.

However, fiscal policy has to achieve goals beyond just stimulating aggregate spending. The lack of equity in the public deficits (as above) means that the nation is not getting the best out of the fiscal capacity of its government.

The Tunisian government has been running a IMF-favoured mindset for too long and the subdued fiscal deficits have reflected that mentality – with elevated labour underutilisation being the result.

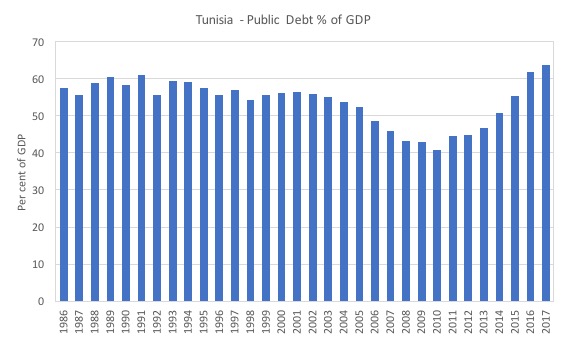

The second graph shows the evolution of public debt over the same period. Clearly, in an institutional setting where the government matches its net spending with debt-issuance, the patterns of the fiscal balance and the public debt ratio will be similar.

Tunisia does not have a clean float of its currency, the dinar. The central bank pegs the dinar against a trade-weighted basket which includes the USD, the Yen and the euro. The central bank targets a particular Real Exchange Rates (adjusting the nominal rates by relative inflation rates).

It also intervenes to ‘manage’ the peg, when it sees fit. It would be far better to let the dinar float freely to better align it with the underlying trade fundamentals.

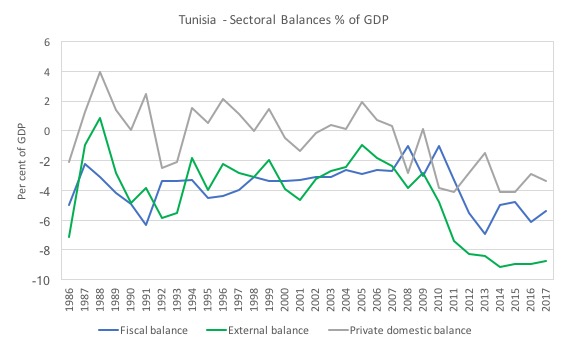

The next graph shows the sectoral balances for Tunisia to further understand the fiscal pattern. The private domestic sector was able to save overall while the fiscal deficit was providing spending support to national income growth at the rate at which the external deficit was draining that growth.

In more recent years, the external deficit has grown (partly due to the decline in tourism as a result of increased terrorist activity) and the slower growth in the fiscal deficit has pushed the private domestic sector into deficit.

The Tunisian-based Observatoire Tunisien de l’Economie (OTE), which is a NGO founded in 2012 by a “group of researchers, analysts and activists interested in Tunisian public policies in the aftermath of the 2011 revolution, has reported that the economic slowdown has caused the Tunisian government problems.

OTE is particularly interested in examining the influence of IFIs (“Institutions Financières Internationales”) on public policymaking and the well-being of the people – more below on that.

On December 15, 2017, OTE released its Data Analysis No 12 – Public Debt: Will Tunisia overcome the “Wall of Debt”? – which documents the changing debt service obligations on the Tunisian government as a result of its public debt liabilities.

OTE say that:

Debt service has almost always been the largest item of expenditure of the State with an average of 19% of public expenditure over the period of 2008-2018.

By 2018, that proportion will be around 22 per cent and external debt liabilities have risen under IMF guidance.

In 2017, the proportion of the debt payments that were repaying principle rose significantly.

And as the Central Bank of Tunisia has become ‘independent’ (another IMF demand), local interest rates have risen increasing the debt servicing volumes that have to be paid on internal debt.

OTE have referred to the growing demands on interest servicing under the IMF program as “the Wall of Debt”.

The problem with this sort of narrative is that it is ill founded and leads to further wrong conclusions.

On April 15, 2016, the IMF released a statement – IMF Reaches Staff-Level Agreement with Tunisia on a Four-Year US$2.8 Billion Extended Fund Facility.

The neoliberals within Tunisia had pressured the government to engage in a so-called structural reform process and the IMF provided a ”

The Tunisian government, under pressure from the IMF agreed to a “48-month Extended Fund Facility (EFF) for 375 percent of Tunisia’s quota in the IMF (about $2.8 billion).”

The so-called ‘reform’ agenda aimed to cut the public sector, provide incentives for private investment (corporate welfare while cutting personal welfare to the most disadvantaged), deregulate the financial sector and engage in extensive privatisation (of state-owned banks and other enterprises).

Apparently, the fiscal deficit was judged to be ‘too high’ even though labour underutilisation was at elevated levels.

The IMF claimed that austerity would allow Tunisia to:

… better placed to address economic challenges and mitigate risks that could arise from a worsening international economic environment or rising regional security tensions.

So by increasing poverty rates and denying opportunities to the already disadvantaged interior area the policy, somehow, reduces the attraction of terrorist recruitment.

A reasonable hypothesis would suggest the opposite.

The 2017 fiscal austerity program also froze wages (reneging on a previous deal with the unions) and increased taxes. The plan was initially rejected by the powerful Tunisian General Labor Union (UGTT).

The situation was exacerbated when the IMF froze support as a result of the lack of cooperation by the unions.

Reuters reported (February 26, 2017) – Tunisia to accelerate reforms as IMF freezes loan: minister – that the IMF had “demanded” the government sell its “three state-owned banks … and cut up to 10,000 public sector jobs” in order to get the “second tranche of a loan”.

The IMF loan was claimed to be an essential means of attracting foreign investment.

But the stupidity was that the investment community believed that to sustain the burgeoning democracy the government has to impose harsh austerity and cut public sector activity.

This is typical neoliberal stupidity.

In a nation that is so unbalanced in opportunity and with a growing propensity to riot to pursue justice, how do these idiots think the democracy will survive if more inequality and disadvantage is imposed.

Again, the opposite conclusion is indicated.

As part of the IMF demands, the government introduced the new Finance Law, which became operational on January 1, 2018.

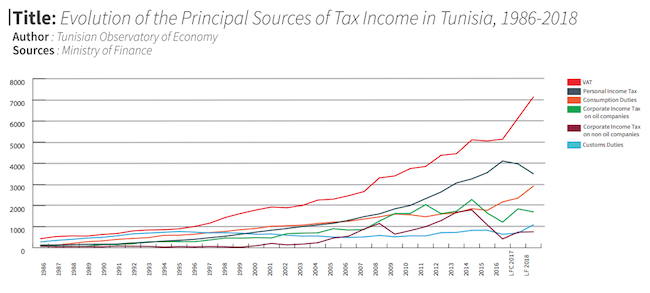

OTEs Data Analysis No 13 – Tax justice: The core issue in the Finance Law – examines the new Finance Law within the context of the growing debt.

It produced the following graph which is self-explanatory. The red (top line) is for VAT:

OTE concludes that:

Faced with a wall of debt, the question of tax justice is returning to the center of debates … Civil servants and businesses have not been carrying their weight for the additional tax burden tied to the increase in debt repayment … Consumers who earn the least are the ones who are carrying the greatest proportional weight of this tax burden.

We learn that the “because of the IMF’s categorical refusal for a salary raise for civil service members”, the Government has bought industrial piece with its own workforce by granting tax credits to public servants in lieu of pay rises.

Further, the corporate sector has attempted to insulate itself from the IMF austerity program by pressuring the Government to grant company tax concessions.

The Government’s response has been to increase corporate taxes selectively (increasing the burden on supermarkets, for example, while cutting company taxes elsewhere, which has not increased its tax return but pushed up prices on consumer goods.

Under IMF pressure, the Government also pushed up the VAT on consumer goods.

So it is “the consumers who earn the least who will pay the bill, proportional to their income, from the structural adjustment imposed on Tunisia by the IMF.”

Which is a significant reason why the riots began in earnest in January.

Enter the Germans!

During World War 2, the Germans tried to dominate the Maghreb nations but the British and Australia armies defeated them in 1942 in Egypt (Tobruk, al-Alamein) and Rommel was driven to the west into Tunisia. He was eventually routed in May 1943, and the allies used Northern Africa as the base to invade Sicily and rout the Germans from the south.

While Rommel was driven out of Tunisia in the 1940s, the Germans are back in a big way, undermining prosperity for these regions.

There was a very interesting report from the German Foreign Policy WWW site (January 15, 2018) – Pushed into a Dead End – which provides an update on what has been happening in Tunisia with respect to the new German ‘occupation’.

The German Foreign Policy WWW site “is compiled by a group of independent journalists and social scientists who observe, on an ongoing basis, Germany’s renewed attempts to regain great power status in the economic, military and political arena.”

The article discusses the “new Finance Act”, which the “IMF had imposed … on the country”.

While a lot has been written about the way the German industrialists have headed to Eastern Europe to tap into low wage labour markets, little analysis has been provided of the way the German manufacturers are increasingly attracted to Tunisia as one of their low wage production destinations.

We learn that Germany has contributed to the “structural crisis” in Tunisia:

German enterprises and the German government have contributed to Tunisia’s focusing its production on but a few export sectors – particularly the textile and cable production – which cannot offer any real possibilities for the country’s development. Because of its heavy dependence on foreign enterprises, Tunis was forced to grant investors tax benefits, which helped drive that country into a dept trap … Within the framework of the G20-“Compact with Africa,” Berlin is shaping Tunisia to fit the interests of German investors.

So this is the problem in a nub:

1. The nation endures economic crisis, in part due to the world slowdown and also due to increased terrorism undermining confidence in the tourism industry.

2. The IMF pressures the nation to accept a loan and in return it forces the nation to accept a harsh austerity program.

3. But the IMF also pressure the local government into granting all sorts of ‘incentives’ (plain speak – handouts) to foreign companies to relocate activity there.

4. The foreign production provides very little benefit to the local economy – suppressing wages and failing to generate sufficient jobs.

The gap between GNP and GDP has been widening in favour of GDP, which means that more of the local income generated is being extracted by foreigners.

The Germans are being very pro-active in Tunisia – sending “so-called transformation teams to Egypt and Tunisia, Berlin is seeking to enhance its economic influence in North Africa” (Source).

To overcome investor fears that these nations “could become insecure for their low-wage investments”, the German government transformation teams aim to build pro-German capacity within the national governments to supplement the IMF austerity programs.

Last year, the German Minister of the Economy Philipp Roesler announced that:

… the primary objective of this measure is the establishment of free competition, the reduction of subventions and bureaucracy and new stimulation for small and medium-sized enterprises.

So the full (neoliberal) monty!

The IMF money is siphoned off to provide incentives to these firms and the people have to endure higher tax burdens, wage cuts and less employment opportunities.

Further the German industrialists demand that there is a “rapid ‘stabilisation'” in local manufacturing plants, which is code for taking harsh action against “sit-ins” that “are staged by the unemployed seeking work”.

As the German Foreign Policy article (cited above) notes:

However, the real causes of Tunisia’s current crisis lie not only in its recent economic slump, but have deeper structural roots.

This refers to Tunisia’s entry into “global value chains” which are overly concentrated on “only a few export sectors” and “which are clearly ‘predominated by European companies'” (the inner quote is from a Rosa Luxemburg Foundation study (in German) – Leere Taschen in Tunesien (‘Empty Pockets in Tunisia, released January 16, 2018).

And of those foreign countries:

German companies are playing a prominent role. Around 250 companies from Germany have invested a total of €350 million in Tunisia … foreign investors are aiming at ‘the maximization of profits by way of cost reduction’. Profits were regularly – and presumably, not always legally – transferred from Tunisia to the foreign investors’ main headquarters. The investors make no contribution to Tunisia’s further economic development.

Tunisia is also being pressured by the IMF to maintain a “low taxation policy (tax dumping)” to “attract foreign investors” while imposing higher taxes on local consumers.

The combination of tax giveaways to foreign corporations and heavy export subsidies have led to the increase in public debt.

Which then the IMF uses as a pretext to impose further harsh austerity measures. It is a vicious cycle that only benefits the rich European industrialists and bankers.

The German Foreign Policy article finds that that out of the $US2.9 billion Tunisia received from the IMF in 2016, 1.7 billion of it has already been earmarked against earlier IMF debts.

This is the IMF modus operandi.

They trap a nation in a sequence of interlocked debt obligations and then allow foreign capitalists to pillage the nation’s real resources, leaving the local population none the better off.

Finally, the German Foreign Policy article notes that:

While the population continues its protests, Tunis can rely on German weaponry for their suppression. For example, last year, the German government issued permits raising the amount of weaponry exported to Tunisia to more than €58 million. Twelve automatic rifles from the southern German Heckler & Koch gunsmiths were delivered. The Germans are also implementing numerous training programs for Tunisian police officers, who are to particularly serve to intensify the fortification of the border, as well as other purposes. The German government has announced its intention to train Tunisia’s police, also in the future.

Total capture really.

Conclusion

This is a case of nation with its own currency and large numbers of idle resources (mostly people) being destroyed by the European Union and the IMF.

It is another example of how the pernicious neoliberal machine uses fake knowledge – for example, that Tunisia’s deficit was too high and that it needed IMF loans to survive – to run an ideological agenda that favours corporations from the richest nations.

Tunisia could have survived without the IMF loan and has all the fiscal capacity it needs to improve the circumstances of its people. Unfortunately, the politics prevent that from occurring at present.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

Surprisingly, there is no mention of rapid population growth in Prof. Mitchell’s analysis.

Tunisia population:

1955 3.943 million, 31% urban

1990 8,232 million, 31% urban

2018 11,659 million, 57% urban

I am not surprised by Germany getting involved in Africa, again. Last century, if I remember rightly, they complained that they were being prevented from having a requisite number of colonies that, in their view, comparable, important nation states were accumulating, notably Spain and Britain. They saw themselves as being hard done by, the poor dears. Perhaps they are exercising what they perhaps see as a justifiable right of value extraction, given their economic power.

This may not be unlike the contemporary revolt of the elite under the guise of neoiberalism, who have always seen the New Deal and related programs as a kind of theft of their god-given right to extract value from the less advantaged.

Tunisia is on a hiding to nothing in their current situation. Who is going to actually help them out?

Shaming the IMF, World Bank etc may make a bit of difference, but it appears the government just isn’t sophisticated enough to parry all the woes it faces. Someone like you, Bill, is needed to steer the ship.

I’m really supprised that you don’t make much mention of the fact that Tunisian government debt is 70% denominated not in their own local currency but in foreign currency. I thought that that was the most crucial part of this tradgedy. If they had all of their government debt denominated in their own currency, then they would have the fiscal freedom to ensure full employment and provide the public services they so desperately need. They also would have no need for the IMF. Am I misunderstanding this?

As in Greece, there does not seem to be anyone in a power position to face off against the IMF. Money talks everyone else walks. I figure the Tunisian government, like Greece, is bought and paid for. I’d like professor Mitchell’s take, or someone else with the requisite knowledge, on the Venezuela debacle, if he has the time.

“The long-serving Ben Ali exacerbated the inequalities Under Ben Ali,” one Ben Ali has to go, at least here where we can make him go.

Dear Hansrudolf Suter (at 2018/02/06 at 2:33 am)

Yes. We have rid the blog of one of the Ben Alis.

Thanks.

best wishes

bill

Are historical GDP growth numbers meaningful if not per capita? Tunisia like other MENA and Africa have had very high population growth since 1950.

The global capital can’t wreck countries if they haven’t local elite to collude with.

Borrowing in foreign currency is dangerous, private or public, somehow the private tab always ends up on the public tab. Capital controls is probably essential for developing countries, can’t let the local private sector run up at tab in foreign currency for luxury stuff and so on.

It will end in the global capital will send in their “Luca Brasi” in the form of IMF/WB and give an offer they can’t refuse.

South Korea did for long time have death penalty on capital flight.

Great article.

Mind-blowing stuff. Vultures picking apart Tunisia.