The other day I was asked whether I was happy that the US President was…

Finland would be better off outside the Eurozone

Towards the end of last year, I wrote a blog – Finland should exit the euro. I had been undertaking some detailed research on the plight of this relatively small Eurozone nation for a number of reasons. First, it had recently undergone a major industrial decline as Nokia/Microsoft missed market trends and went from world leader to irrelevance. Second, Finland was a vocal proponent of the view that Greece should be pillaried into oblivion by the Troika – to ‘take their medicine’ (more crippling austerity). Third, the data trends were unambiguously pointing to Finland descending into the Eurozone ‘basket case’ category itself as its own conservative government imposed harsh fiscal austerity on the tiny, beleagured nation. Two things are clearer than ever about the Eurozone. First, it is a dysfunctional mess and efforts to reform it so far have only made matters worse. Second, any single nation (and all together) would be unambigously better off exiting the mess and restoring their own currency sovereignty and letting their exchange rate take up some of the adjustment. The following text covers an article that I have written for a Finnish Report coming out in May 2016 to be published by the Left Forum Finland, which is a coalition formed by the political party Left Alliance, the People’s Educational Association (KSL) and the Yrjö Sirola Foundation.

LONG BLOG FOLLOWING

The European Project – overextended and in the thralls of neo-liberal Groupthink

Thrall … slavery, bondage … a state of servitude or submission. (Merriam Webster online dictionary)

Groupthink … a pattern of thought characterized by self deception, forced manufacture of consent, and conformity to group values and ethic. (Merriam Webster online dictionary)

———————————–

In my recent book, Eurozone Dystopia: Groupthink and Denial on a Grand Scale, I trace the origins of the Eurozone back to the desire in the immediate Post Second World War period to end the destructive Franco-German rivalry that had caused several major military conflicts, which culminated in German aggression in 1939.

The great European visionaries in the immediate post World War II period did not desire to put the European economies into a straitjacket of austerity and hardship. Rather they aimed to achieve peacetime prosperity.

Europe’s political leaders devised the ‘European Project’ as an ambitious plan for European integration to ensure that there were no more large scale military conflicts fought on continental European soil. The Project began at a time when the advanced nations had embraced a broad Keynesian economic policy consensus with governments committed to sustaining full employment.

The Keynesian era emerged out of the Great Depression, which taught politicians that without major government intervention, capitalism is inherently unstable and prone to delivering lengthy periods of unemployment.

Full employment came only with the onset of World War II as governments used deficit spending to prosecute the war effort. The Keynesian era of macroeconomic policy that followed was thus marked by government deficits supplementing private spending to ensure that all workers who wanted to work could find jobs.

The broad political and economic consensus that emerged after the war brought very low levels of unemployment in most Western nations, which persisted until the mid 1970s, although some European nations had bouts of sustained higher unemployment as a consequence of having to defend their weaker currencies.

Within this broad policy consensus, the discussions about integration were conditioned by Franco-German rivalry. France was determined to create institutional structures that would stop Germany from ever invading it again. It saw an integrated Europe as a way of consolidating a dominant role in European affairs but was determined to cede as little national sovereignty as possible to achieve these aims.

France was also resentful of the influence that the US was exerting in Europe, particularly through the Marshall Plan, which intrinsically tied West Germany to the US.

The Germans, suffering a deep shame for their past militarism and associated deeds, had only their economic success including the ‘discipline’ of the Bundesbank to generate national pride.

As well as a need to expand its export markets, Germany wanted to be part of the ‘European Project’ to demonstrate a rejection of its ugly history.

But an obsessive fear of inflation meant that this participation had to be on German terms, which meant that the new Europe had to eventually accept the Bundesbank culture. This became a grinding process.

Within the German ‘stability’ environment, it was seemingly overlooked that Germany, in fact, relied on robust import growth from other European nations for its prosperity. The fact that not all nations in a Bundesbank centric ‘stability environment’ could have balance of trade surpluses was ignored.

After World War II, the advanced nations also agreed to fix their exchange rates relative to the US dollar, which in turn was linked to the price of gold, because they believed this would bring economic stability.

But the so-called Bretton Woods system, established in July 1944, was under pressure from the start because countries with trade deficits always faced downward pressure on their currencies.

In order to maintain their exchange rates they had to: buy their own currencies in the foreign exchange markets using their foreign currency reserves; push up domestic interest rates to attract capital inflow; and constrict government spending to restrain imports.

The nations with weaker currencies were thus often faced with recessed growth rates, higher unemployment, and depleted foreign reserves, and this created political instability. The effective operation of the system required the nations to have more or less similar trade strength, which was of course an impossibility and ultimately proved to be its undoing.

The Franco-German rivalry structured a series of less than effective compromises on the way to monetary union. The 1957 Treaty of Rome was heavily biased in favour of the occupied France at the expense of the aggressors Germany and Italy.

But Germany’s growing industrial and export strength became an increasingly significant threat to the French economy. German industrial ambition eventually required France to compromise on its own fierce resistance to ceding any national sovereignty to a European level entity.

The early experience with the Common Agricultural Policy (CAP), introduced in 1962 as the first major initiative of the newly formed EEC, should have taught the European nations that entering a currency union would be a fraught exercise.

France wanted to protect French farmers and Germany wanted to expand its industrial export market. To achieve their goals, the Germans agreed to provide subsidies through the CAP to French farmers: a gnawing tension that remains today. But the administrative viability of the CAP required a very stable exchange rate environment because a multitude of agricultural prices had to be supported across the Community.

Once the Member States locked in the CAP they were also trapped into pursuing the impossible task of maintaining fixed exchange rates.

The German mark became the strongest currency in the 1960s as Germany’s export strength grew, which put France and Italy under constant pressure of devaluation and domestic stagnation and undermined the CAP.

The various agreements to maintain fixed parities between the European currencies all largely failed because of the different export strengths of the Member States. But instead of taking the sensible option and abandoning the desire for fixed exchange rates, the European political leaders accelerated the move to a common currency when the Bretton Woods system collapsed in 1971. The lessons from the Bretton Woods fiasco were not learned.

The 1970 Werner Report outlined a comprehensive timetable for the creation of a full economic and monetary union by the end of the decade. The Committee made it clear that monetary and fiscal policy would have to be centralised with the “centre of decision of economic policy … [to] … be politically responsible to a European Parliament” (Werner Report, 1970: 13).

A later study by the MacDougall Committee in 1975 also emphasised that an effective economic and monetary union would require a strong fiscal presence at the federal level. They assessed that “It is most unlikely that the Community will be anything like so fully integrated in the field of public finance for many years to come as the existing economic unions we have studied” (MacDougall Report, 1977: 11).

There are many competing explanations as to why Werner’s plan failed to materialise, but the basic reason is that in an era of growing currency instability the French fear of German dominance and their unwillingness cede power to supranational institutions, combined with the German inflation obsession, stood in the way.

The two nations could clearly find ways to cooperate on a political level but trying to form an economic and monetary union was difficult.

In 1972, the Governor of the Danish Central Bank said, “I will begin to believe in European economic and monetary union when someone explains how you control nine horses that are all running at different speeds within the same harness” (McAllister, 2009: 58).

What eventually allowed the ‘nine horses’ to be harnessed together was not a diminution in Franco-German national and cultural rivalry but rather a growing homogenisation of the economic debate.

The surge in Monetarist thought within macroeconomics in the 1970s, first within the academy, then in policy making and central banking domains, quickly morphed into an insular Groupthink, which trapped policy makers in the thrall of the self regulating, free market myth.

At that point, the ‘European Project’ entered its denial phase and started to overextend itself and pursued monetary integration in defiance of the insights provided in the previous reports (Werner and MacDougall).

The introduction of the Monetarist inspired Barre Plan in 1976 showed how far the French had shifted from their Gaullist ‘Keynesian’ days.

Across Europe, unemployment became a policy tool aimed at maintaining price stability rather than a policy target, as it had been during the Keynesian era up until the mid 1970s.

Unemployment rose sharply as national governments, infested with Monetarist thought, began their long-lived love affair with austerity.

The Delors Report (1989), which informed the Maastricht conference, disregarded the conclusions of the Werner and MacDougall Reports about the need for a strong federal fiscal function because they represented ‘old fashioned’ Keynesian thinking, which was no longer tolerable within the Monetarist Groupthink that had taken over European debate.

The new breed of financial elites, who stood to gain massively from the deregulation that they demanded, promoted the re-emergence of the free market ideology that had been discredited during the Great Depression.

The shift from a Keynesian collective vision of full employment and equity to this new individualistic mob rule was driven by ideological bullying and narrow sectional interests rather than insights arising from a superior appeal to evidential authority and a concern for societal prosperity.

The Monetarist (neo-liberal) disdain for government intervention meant that the proposed Economic and Monetary Union (EMU) would suppress the capacity of fiscal policy and no amount of argument or evidence, which indicated that such a choice would lead to crisis, would distract Delors and his team from that aim.

But Delors knew that he could appease the French political need to avoid handing over policy discretion to Brussels by shrouding that aim in the retention of national responsibility for economic policy making.

He also knew that the harsh fiscal rules he proposed that restricted the latitude of the national governments would satisfy the Germans. Monetarism had bridged the two camps.

While refusing to create a ‘federal’ fiscal authority to ensure there was an institution aligned with the currency-issuing central bank and which could respond to asymmetric spending declines across the Member States, the planners then set about ensuring that the Member States, themselves, would be incapable of responding effectively in an economic crisis.

They imposed arbitrary fiscal rules – the so-called Stability and Growth Pact (SGP) – which ensured neither growth or stability. The rules were plucked out of the air as another French-German compromise and were not justified by any economic theory.

Their effect was to ensure that most Member States would breach the rules if a significant non-government spending collapse occurred. The rules then ensured that these States would be forced to impose austerity at the very time economic theory would advise in favour of discretionary expansion of public spending and/or tax cuts.

The whole process had a surrealistic air about it at the time.

The Groupthink advanced by Delors and his cronies erected a wall of denial and the European politicians successfully convinced people that by maintaining price discipline, economic growth would be maximised.

The Global Financial Crisis (GFC) exposed how ridiculous that mantra was. But those who dared question the Monetarist supremacy at the time, and instead advocated Keynesian remedies to reduce the entrenched European unemployment, were met with derision from the bulk of the profession who had embraced the new economic theory and its policy implications.

By insisting on economic and monetary union under these terms, and then imposing self-defeating austerity onto the nations suffering the most from that dysfunctional design, the European political elites have undermined the long-standing European Project.

Germany had successfully reinvented itself as a good European citizen, after its disastrous and criminal behaviour during World War II.

But as the perceived ‘enforcer’ of austerity, Germany is now vilified again: the ‘ugly German’ has returned.

The unelected economic mandarins in Brussels and Frankfurt, aided and abetted by the unaccountable officials from the IMF, now have influence on who remains in political office in some nations (for example, the appointment of Lucas Papademos in Greece).

The citizens were initially bullied into accepting the euro and all that went with it by their political leaders and now the same leaders are seen to go cap in hand to the Troika to preserve their hegemony, while imposing untold social and economic hardship on their citizens.

Open expressions of racism are proliferating (for example, the ‘lazy Greek’ narratives).

The media and politicians now regularly engage in the language of retribution, with cooperation giving way to hostility, resentment, and a breakdown in the social order.

The 2014 European Parliament elections demonstrated that anti-austerity parties at the extremes of the political spectrum enjoyed stunning success in several countries.

The 2015 election of Syriza in Greece invoked hope that the people were finally expressing their anti-austerity voice. But its brutal crushing by the Troika has shown that the ‘European Project’ has now become an anti-democracy exercise, where the preferences of the ‘people’ come a poor second to the desires of the elites to maintain their hegemony with the support of financial capital.

These instabilities will only deepen as the ‘European Project’ disintegrates. The right-wing parties promote anti-immigration policies, which are becoming increasingly popular.

Economic austerity has morphed into a very nasty confection.

And then the migration disaster arrived and has paralysed the increasingly dysfunctional European Union. It is time for a major rethink of the whole exercise and, in the first instance, that has to start with dismantling the unworkable monetary union.

The dysfunctional Economic and Monetary Union

The Eurozone is now locked down in a straitjacket of economic austerity, driven by an economic ideology that is blind to the evidence of its own failure.

The neo-liberal policies of deregulation and the demonisation of the use of discretionary fiscal deficits (government spending greater than tax revenue) created the crisis in the first place, and now the same sorts of policies are prolonging it.

The current policy approach has institutionalised economic stagnation, widespread retrenchment, and the deterioration of working conditions and retirement pensions.

We are now into the eighth year of the crisis!

Millions of European workers are now unemployed, youth jobless rates are still around 50 per cent in some advanced nations, inequality and poverty rates are rising, and massive daily losses of national income are being endured.

The dramatically high youth unemployment rates will ensure that the damage will span generations and undermine future prosperity as a cohort of jobless youth enter adulthood with no work experience and a growing sense of dislocation from mainstream societal norms.

The Eurozone political elites claim that there is no alternative (TINA) but to impose more austerity by cutting fiscal deficits and enforcing widespread cutbacks to social welfare systems.

The major political parties in most nations, whether in government or opposition, have unquestionably accepted the dominance of neo-liberal ideology, which has not only homogenised the political debate but also obscured the only credible routes to recovery.

A correct assessment of the current state indicates that fiscal deficits have to increase. Austerity is exactly the opposite of the policy response that is required.

A sustained recovery in the Eurozone and elsewhere requires a categorical rejection of mainstream macroeconomic theory and practice and a reorganisation of the institutional structures to allow deficits to increase. The assessment is that this can only be done if the union is dismantled.

A progressive politics should reject the TINA mantra, which has been a powerful organising framework for conservatives to promote the myth that fiscal discipline and widespread deregulation will allow a free market to maximise wealth for all.

The neo-liberal economic framework promoted vigorously by many economists, the multinational agencies such as the International Monetary Fund (IMF) and the Organisation for Economic Co-operation and Development (OECD), and conservative politicians including the Eurozone establishment in Brussels and Frankfurt, blinds the public eyes to realistic alternatives by confining the boundaries of the public debate through the use of selective priorities, wrongful causalities, and scandalous misrepresentations of reality.

The European policy making elites – the politicians, the supporting bureaucracies, the central bankers and expert consultants – remain trapped in neo-liberal Groupthink that created the euro monster in the first place.

It is a group dynamic that resists change and explains the arrant disregard of viable alternative policy paths that could restore growth.

It was obvious that the Eurozone was doomed from the start and now the same neo-liberal ideology is masquerading as the solution. G

Groupthink suppresses alternative thinking and evidence that is contrary to the dominant viewpoints.

The current policy options are thus not working and will not underpin sustained prosperity.

Eventually, the European economies will stabilise and start growing again, but the residual damage from the austerity will be massive and span generations.

Millions will be poorer and without reasonable opportunities as a result. The neo-liberal political leaders will rejoice and claim success but they won’t advertise the low base from which the growth has resumed.

The EMU is a flawed system and has to change. The question is what changes are necessary to overcome the flawed design that now works against prosperity?

One option is to to establish a true federation, with a European level fiscal capacity to ensure that total spending in the Eurozone is sufficient to generate enough jobs to satisfy the desire of the workers. This is the Werner and MacDougall Committee option.

However, the differences between the European nations are so great that such a choice is highly unlikely.

Why Finland should exit the euro

Finland has been one of the Eurozone nations taking a hardline on Greek austerity and has consistently refused to support on-going bailouts of Greece.

It is also now one of the worst performing Eurozone nations.

The real GDP collapse

The latest data from Eurostat (published February 12, 2015) shows that Finland has been mired in stagnation since the second-quarter 2012. Since the June-quarter 2015, Finland has recorded negative growth in 10 of the 15 subsequent quarters. In the December-quarter 2015, it reentered official recession having recorded two consecutive quarters of negative growth (-0.6 per cent in the September-quarter and -0.1 per cent in the December-quarter).

Its most recent peak real GDP came in the fourth-quarter 2007, and eight and a quarter years later, the economy is 7.4 percentage points below that level of output and the situation is deteriorating.

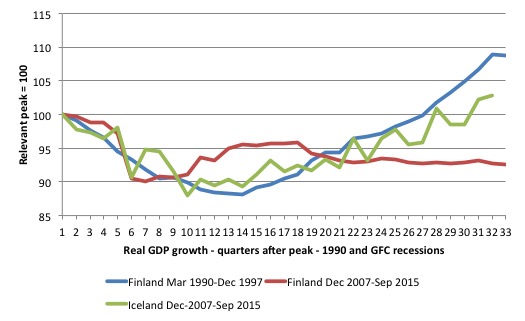

Consider the following graph, which shows indexed real GDP growth (the indexes are set to 100 to correspond with each respective peak) for Finland between the March-quarter 1990 and the December-quarter 1997 (that is, its so-called Great Depression period), and for Finland and Iceland between the December-quarter 2007 and the December-quarter 2015 (noting Iceland has not yet released the fourth-quarter 2015 National Accounts data).

The horizontal axis indicates quarters (each three months) after the peak real GDP was reached.

The results show us that each recession was severe in its magnitude and the adjustments in the aftermath of the crises were drawn out.

Following the 1990 recession, Finland did not cross the 100 line again until the December-quarter 1996 (that is, 28 quarters or 7 years). By the March-quarter 1998, the Finnish economy was 8.7 per cent larger than it was at the previous peak.

In the GFC recession, Iceland took the same number of quarters (28) before its real GDP index once again regained the peak level in the December-quarter 2007. The adjustment path followed a similar pattern to Finland’s recovery after the 1990 recession.

However, in the current crisis, Finland’s real GDP continues to diverge from its December 2007 peak.

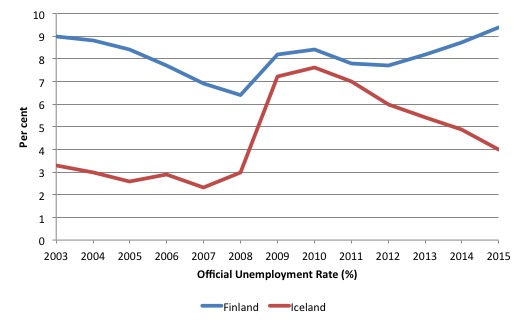

Consider the relative unemployment rate performances of Finland and Iceland in the current crisis. The following graph shows that Finland’s unemployment rate at the end of 2015 was considerably higher than it was at the outset of the GFC. Iceland also recorded a sharp spike upwards as a result of the crisis but the labour market quickly was on a recovery path, while Finland’s labour market continues to deteriorate.

As at January 2016, Iceland’s unemployment rate had fallen back to 2.8 per cent compared to Finland’s unemployment rate of 9.3 per cent and rising.

The reason I have juxtaposed Finland with Iceland is simple.

Two significant things were different in 1990 in Finland and in 2008 in Iceland relative to 2008-2015 in Finland.

1. Finland has been constrained by the unworkable fiscal austerity imposed by the European Commission in the current episode. While Iceland didn’t embark on a fiscal splurge it did alternate fiscal policy in such a way that household disposable income was increased.

2. The exchange rate can no longer adjust for Finland.

The unit labour cost obsession

The exchange rate issue is very important. The European Commission and the Finnish government has characterised Finland’s dilemma in terms of a collapse in international competitiveness.

In the most recent – Country Report Finland 2016 – released as part of the – European Semester 2016 (February 2016) – the European Commission says that the “low growth trajectory seems to be mainly driven by structural factors” (p.1).

The ‘official’ narrative is then dominated by discussions about excessive unit labour costs (ULCs) and excessive fiscal deficits, the latter, are alleged to impede the move to higher productivity and increased international competitiveness.

First, some conceptual development. ULCs are calculated as the total wages costs divided by output. So if the economy produces goods and services worth $1000 and total wages equal $200 over the same period then ULCs would be 20 cents. Each unit of production costs the economy 20 cents of labour to produce.

The real equivalent of ULCs is called Real Unit Labour Costs (RULC) and deflates the nominal wage costs by some measure of the price level.

ULCs can fall if productivity growth outstrips wages growth. The current obsession in the Eurozone is to reduce ULCs by cutting wages in the hope that productivity growth will not be affected. The problem is that this so-called ‘internal devaluation’ approach (referring to the fact that the exchange rate is fixed for each Member State and so variations in the real exchange rate can only come from altering the inflation in domestic costs relative to other nations) also, typically, undermines productivity growth.

An extensive research literature tells us that when firms attack the working conditions of their workers, morale sags and productivity often drops. In other words, ULCs may not fall at all and the nation in question is on the path in a race to the bottom.

Further, as a result of the wage cuts, domestic demand is likely to fall further, deepening the recession that the nation finds itself in. The recession further undermines productivity growth as firms cut back on investment and innovation.

History tells us that a far more effective way to engender a reduction in ULCs is to push GDP growth faster than employment growth, which means faster productivity growth and greater prosperity. The role for expanding fiscal deficits in this context cannot be understated.

When non-government spending is insufficient to push growth along, then the only option is to expand the net spending of the government to support growth and give the non-government sector time to recover from its pessimism.

We also should understand that the internal devaluation approach is subject to a logical error known as the ‘fallacy of composition’, which, in this context, operates at two levels.

First, at the international level, if all nations are engaging in austerity and internal devaluation (which is the Eurozone mantra) then they just chase each other down the drain without any relative gains.

This is especially significant given the importance of intra-Eurozone trade. Finland’s case is a bit different because its exports are heavily exposed to some non-Eurozone nations such as Sweden (the top export market) and Russia (third top). Germany is its second largest export market.

Exports to Russia have slumped (it was previously the second largest market for Finnish exports) because of EU sanctions against Russia over Ukraine. That slump has nothing at all to do with competitiveness considerations.

Further, Finland’s external position would improve if Germany stopped suppressing domestic demand in its economy. There is a strong income effect operating here which has nothing to do with price competitiveness. Should Germany stimulate its own economy then Finnish GDP growth would improve immediately with no change required in its current ULCs.

Second, there is also an internal fallacy of composition operating with respect to the internal devaluation approach.

A single firm in Finland might take the view that cutting its wage levels would not seriously impact on its sales volumes overall and would therefore increase its profitability. Whether that translates into higher employment and output or just higher profits is moot.

But if all firms in Finland hacked into wage levels (which is what internal devaluation is about) then there will be a serious negative impact on domestic demand. Wages are a cost (supply-side concept) and an income (demand-side concept). At the aggregate level the collapse in workers’ incomes as the government cut into wages would likely undermine domestic demand.

Then the reduction in costs to firms would be swamped by the reduction in sales and prosperity suffers.

Internal devaluation is really a casino game. The attack on workers’ incomes reduce domestic spending and introduces deflationary forces, not to mention the increase in unemployment.

The population also faces a reduction in its capacity to meet its nominal debt obligations (such as mortgages) and has to reduce spending on other goods and services to ensure they have enough nominal income left over to meet these obligations.

At the margin, some proportion of debtors do not have enough flexibility in their nominal budgets and they default, which causes further problems in the domestic economy.

The casino aspect of the strategy is that the government is really trading off the rate at which the domestic economy contracts against the rate at which exports might grow as a result of the domestic deflation in costs.

Empirical evidence suggests that for most countries the pace of contraction in the domestic economy is greater than any positive growth in exports.

Further, internal devaluation is relatively indiscriminate in its impact, attacking the wages and conditions of workers in the traded-goods and non-traded goods sector alike.

So the question arises: How does the attack on the wages of teachers, hospital workers, welfare officers, bus drivers etc who all work in the non-traded goods sector feed through to stimulate export competitiveness?

The European Commission (2016) claims that given “the non-tradable sector” is “a provider of inputs to the tradable sector – a price-taker in international markets – rising costs in the non-tradable may have damaged cost competitiveness in the tradable sectors”.

However, the links would appear to be rather circuitous if at all. Attacking public sector wages would appear to have very little impact on the costs of technology firms. Such wage cuts would appear to be more about redistributing national income to business profits generally rather than directly stimulating firms that compete in the export sector.

There is a strong body of evidence that suggests that the growth in a nation’s living standards is driven by domestic productivity growth rather than how its exports compete in international markets.\

International competitiveness and exchange rate flexibility

The empirical evidence is also damning. While the European Commission claims that unit labour costs are rising in Finland, its own data shows that they have risen by 11.3 per cent since 2010 compared to Germany 10.2 per cent and Iceland 31.7 per cent (AMECO database).

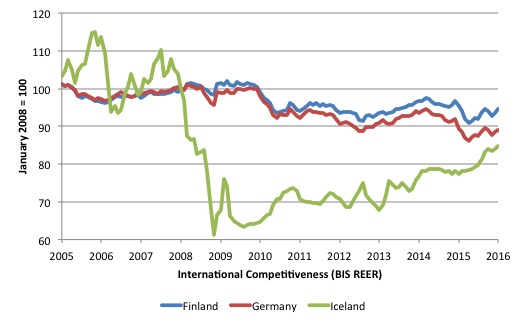

The accepted measure of international competitiveness is the monthly – Effective exchange rate indices – (REER), which are published by the Bank of International Settlements (BIS).

Klau and Fung (2006: 51) say that:

An effective exchange rate (EER) provides a better indicator of the macroeconomic effects of exchange rates than any single bilateral rate. A nominal effective exchange rate (NEER) is an index of some weighted average of bilateral exchange rates. A real effective exchange rate (REER) is the NEER adjusted by some measure of relative prices or costs; changes in the REER thus take into account both nominal exchange rate developments and the inflation differential vis-à-vis trading partners. In both policy and market analysis, EERs serve various purposes: as a measure of international competitiveness …

If the REER rises (falls) then we conclude that the nation is less (more) internationally competitive.

The following graph shows the Bank of International Settlements (BIS) measure of real effective exchange rates for Finland, Germany and Iceland between January 2005 and January 2016.

It is clear that Finland and Germany are moving in lock step and so gains from measures that might be taken internally in Finland will have very little effect in terms of internal Eurozone trade.

But Iceland is the interesting case. It had a huge collapse in 2008-09. But its government did not engage in widespread internal devaluation. Instead, the exchange rate fell sharply which gave the nation instant gains in international competitiveness.

Once the crisis subsided, and Iceland began to recover, its exchange rate appreciation has reduced some of the fall in its REER.

But the point is that gains to international competitiveness are better achieved by allowing the exchange rate to move in response to external imbalances rather than attacking workers’ wages and working conditions.

First, exchange rate depreciation impacts on all import prices. The nation as a whole has to take a real income loss and then the question is how is that shared.

Notwithstanding the fact that exports then become more attractive to foreigners, the depreciation also gives domestic residents and firms an incentive to substitute away from those goods where possible.

So when the Australian dollar, for example, is weaker, its citizens tend to take holidays within Australia rather than travel abroad. This boosts domestic demand and sustains employment.

Firms also have an incentive to alter production or engage in new product innovations.

Second, depreciation does not alter nominal incomes within the domestic economy, whereas internal devaluation does. This is quite a significant difference.

Most liabilities are specified in nominal terms (for example, mortgages). If real income levels are being reduced, people who hold nominal liabilities have to reduce expenditure on some items to ensure their nominal incomes can meet their liabilities.

Depreciation of the currency in international markets provides scope for domestic residents to make those sorts of shifts in spending.

But internal devaluation directly reduces nominal incomes and makes it much harder to rearrange household spending patterns to ensure all nominal liabilities can be serviced.

It is therefore a much more damaging path to improving competitiveness and its impact on the latter is dubious.

Finally, Finland clearly needs higher spending overall. Private spending (particularly capital formation) is weak. Internal devaluation will further suppress domestic demand.

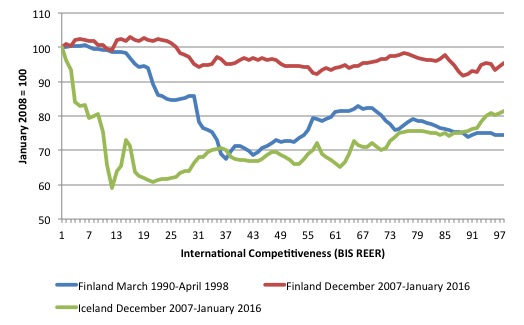

Now consider the following graph, which shows the Bank of International Settlements (BIS) measure of real effective exchange rates for Finland between March 1990 in April 1998 (blue line), Finland between December 2007 and January 2016 (red line), and Iceland between December 2007 and January 2016 (green line).

The numbers on the horizontal axes refer to the months after the peak in real GDP corresponding to each period.

The results are rather stunning. The graph should also be understood in terms of the graph above which compared real GDP performance over the same time periods.

Before Finland entered the Eurozone its exchange rate was clearly able to adjust to provide stimulus to the economy as noted above. The adjustment for Finland in the early 1990s was not as rapid as it was for Iceland in 2008, but the ultimate depreciation (the sustained change) was clearly similar.

Conversely, within the Euro, Finland has had no room to move in this regard, which means that a key adjustment process for a sovereign currency is deliberately excluded.

In an article written by Tuomas Malinen (December 7, 2015) – Why Finland Would Be Better Off Without the Euro – we read:

The period of the floating markka was described by monetary calm and very fast economic growth. During this period, Finland also made a qualitative leap from resource-based economy to knowledge-based one with the ICT as the leading sector.

This demonstrates the sort of structural shifts that occur when exchange rates are flexible rather than fixed.

Malinen also argues that:

All historical facts point to the same conclusion: Finland should never have joined the euro. If Finland would have its own (floating) currency, it would depreciate against other currencies when there would be fall in global demand, the exchange rate of her main export partners would depreciate or when there would be an increase in the domestic production costs (e.g., wages). When Finland joined the euro, it gave up this instrument …

In the history, monetary unions have always broken down (either partially or completely) without a functional federal structure.

Even if I have serious misgivings about some of his analysis, the quoted statements above are clearly correct.

The Nokia and Newsprint saga

The demise of Nokia has clearly been a major loss to the Finnish economy. But a close examination suggests that the decline of the telecommunications company and its takeover by Microsoft was not related to excessive wages or the fiscal deficit. Nokia did not lose market share because wage rises undermined its ability to compete despite the popular neo-liberal claims.

The reality is that we can trace a lineage of massive corporate failures of companies that were the first-movers and then lost it. Think about Sony Walkman -> Kodak -> Nokia -> Blackberry – which are all similar stories and unrelated to changes in cost competitiveness.

The companies in question failed to anticipate the shifts in consumer sentiment. Nokia was characterised by ‘too many candy bars’ (referring to the shape of their very popular phone handsets) and failed to see that the big market shifts were in favour, first, of flip-top handsets, and then, the software innovations (touch screen etc) that Apple brought to the market.

Nokia could have cut their wages to the bone and it still would have lost its market share.

Michael McQueen wrote in his article – How bad calls led to Nokia’s demise (September 4, 2013) that:

… the Finnish phone giant grew dangerously intoxicated on its own success during the late 1990s and early 2000s. Having ridden so high for so long, it is perhaps no surprise that a degree of complacency and arrogance crept in just as had happened at Kodak and Motorola … Such success intoxication left Nokia highly vulnerable to disruption, which soon came in the form of the smartphone … a third causal factor in Nokia’s demise was its stifling levels of bureaucracy … [it refused to introduce] … color touch screens, mapping software and e-commerce functionality …

McQueen’s analysis is consistent with many investigations into Nokia’s failure. They all carry a similar theme – management failure rather than greedy trade unions undermining the competitiveness of an able company.

The other major Finnish sector to fall behind in recent years is the pulp and paper industry. Finland has always been a major producer of pulp and paper given its massive forest resources. The forestry industry overall delivers about 15 per cent of Finland’s total exports.

But in recent years the output and exports from those industries have been falling. Has that been due to competitiveness issues? The evidence tells us that the decline is more related to structural shifts in end products that rely on paper as input.

Reuters reported (April 9, 2013) – Finnish paper exports to fall on shift to online media -report – that:

Finland’s paper exports are set to fall this year and next as more European consumers and advertisers abandon print and turn to online media due to economic uncertainty

The acceleration in the shift away from paper products has been due to “Europe’s recession” rather than cost competitiveness factors within Finland.

Exit is the best option

The exit option is the only viable way that nation’s such as Finland can regain its sovereignty and rebalance its economy.

The historical and cultural realities of Europe preclude any move to a ‘federal’ fiscal authority.

It would be ideal if the Eurozone nations agreed to an orderly dismantling of the common currency and a restoration of the individual currency sovereignty for each nation. In lieu of such an unlikely turn of events, exit remains the superior option for an individual nation such as Finland, acting unilaterally.

There is nothing irrevocable about the euro or the Eurozone. While there are no formal exit mechanisms established in the relevant Treaties, short of military occupation, Finland and any other nation can do what it likes.

European politics and policy making is caught in two very powerful and destructive vices at present. The first is the age-old Franco-German rivalry. A corollary to this rivalry is a disdain for the ‘Latinos’ who by geographic proximity cannot be ignored, much to the angst of those further north.

The second is the domination of free market economics, the Groupthink, which though empirically deficient and riddled with internal theoretical inconsistencies, still rules the academy and through its graduates, the policy making sphere. The GFC has exposed the deep flaws in mainstream economics. It should not guide policy decision making.

The rise of Monetarism, which originated out of the academy in the US, created a ‘post national’ tension among the politicians, which cut across the old state based rivalry between the nations in Europe.

Whereas the early discussions about union placed the national state at the forefront, by the time Delors and his Committee met, the global capture by the financial elites of the policy process was well entrenched and the promotion of Monetarist economic ideology aided their agenda.

The old national rivalries have persisted but their expression has become increasingly channelled by the free market narrative, which created the monster that is the EMU.

Neither of these vices will release their destructive grip on European affairs easily.

The cultural and historical aspects of the Franco-German rivalry are permanent constraints on European progress. These differences suggest that both of the large European nations would be better off pursuing their own economic destinies. But they can only do that if they also free themselves from the vice-like grip of neo-liberal economics.

The dominance of free market thinking has so perverted the European Project, that the failure of the economic plan is now endangering the beneficial political and legal aspects that have accompanied the formation of the European Union.

Any exit scheme has to address the same issues:

1. How to handle the euro denominated public and private debt that is outstanding;

2. How to handle bank deposits denominated in euros within the exiting nation;

3. How to ensure financial stability is maintained;

4. How to introduce the new currency (for example, unilaterally or as an interim dual currency);

5. How to manage the inevitable large currency depreciation and to minimise the resulting inflation risk and protect real living standards;

6. How to reduce speculative capital flows (for example, using capital controls);

7. How to deal with any changes to the legal framework governing cross-border trade if the nation also is expelled from the EU, among other issues.

I deal with these questions in detail in my current book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale.

The estimated likely overall consequences that have been put forward also, crucially, depend on the economic framework that underpins them. Neo-liberal macroeconomics, which downgrades the importance of fiscal policy and currency sovereignty, not surprisingly, provides the basis for the catastrophe predictions.

These economists project massive and ongoing currency depreciation leading to an uncontrollable surge in inflation, which debases the currency.

They predict the nation’s banking system would collapse in the face of large capital outflows, debt delinquency and the state’s incapacity to defend the capital base of its banking system.

They predict that there would be massive outflows of skilled labour, which would undermine the future productivity of the nation.

They predict that the nations would have to default on their debt obligations, which would not only force the nation into a costly, drawn out legal morass, but would also see it being shunned by international capital markets.

As a consequence, they claim that the government would not be able to fund itself and would run out of money.

Further, they predict that credit would also become unavailable to the private sector, and businesses and the housing market would collapse.

The catastrophe scenario sees the nation mired in depression, poverty and isolation. Civil anarchy would erupt and give way to totalitarian regimes with vicious secret police departments enforcing order through torture and death squads. This future would surely be many times worse than a future within the Eurozone.

All of these predictions have been rehearsed in the literature. Almost every day someone will write something along those lines.

Conversely, building on an understanding of Modern Monetary Theory (MMT) and cosnidering the capacity of the national government as the issuer of a floating currency as the basis for analysis would lead to dramatically different projections. It should be made clear that no one really knows for sure what would happen. It would be hard to project the costs of the exit.

But we can deduce several things based on historical experience. It is highly likely that the benefits of exit would outweigh the costs, if the exit decision is, simultaneously, accompanied by a decision to reject the flawed neo-liberal, austerity approach in favour of a fiscally active policy stance that seeks to maximise wellbeing of the citizenry.

If the exiting nation continues its idolatry of financial markets and considers it can ‘do’ austerity in a more gradual manner, then the exit will likely be even more costly than provided for by the current outlook.

Abandoning the culture of austerity and restoring currency sovereignty would provide the exiting government with numerous opportunities to bring idle resources, including the unemployed, back into productive use.

Real economic growth would be immediate.

The bond markets would become supplicant when faced with a currency issuing nation because the central bank could control interest rates and force investors out of the market whenever it chose.

Whether investors chose to buy any new public bonds issued in the new currency would become irrelevant.

The newly empowered state would still be able to spend and purchase anything that was available for sale in its own currency, including all idle labour.

The new state would be able to protect the capital of its banking system and guarantee deposits in the local currency.

It is often argued that the exiting country would face hyperinflation. Most of the commentary surrounding the risk of hyperinflation following an exit concentrates on scenarios where the government is unable to access private debt markets as a result of a depreciating currency (and other stability concerns), and instead enters the ‘taboo’ world of the central bank directly funding government spending.

Any increase in spending, whether it is private or public, carries a risk of inflation if it pushes the economy beyond its capacity to respond by increasing the production and sales of goods and services.

For nations mired in recession with large quantities of idle resources, it is highly unlikely that increased deficits will invoke a major inflationary spiral. That situation certainly describes the state of many European nations in the aftermath of the GFC and the imposed austerity.

The main source of inflation would be the rising prices of imported goods and services in terms of the local currency as a result of any currency depreciation, once the government floated it.

History tells us that such depreciations are short and sharp. Argentina is an example. However, more recent ‘European’ experience is also available to guide our thinking. When Iceland’s financial system collapsed in 2008, the government refused to bail out the private banks and instead restructured domestic bank deposits within newly nationalised banks, pushing all foreign exposure into the bankruptcy process.

The Icelandic disaster was another demonstration of the perils of neo-liberalism. Its banking crisis had its roots in deregulation and privatisation of the banks which saw massive expansions in their balance sheets between 2004 and 2008.

International markets started to get the jitters in early 2008 and capital inflow dried up, which led to a weakening of the króna, and inflation began to accelerate due to the rising price of imports including petrol. The bank collapse exacerbated the currency crisis and the króna depreciated by 50 per cent over 2008 in terms of the euro.

But the decline was finite. In the first half of 2010, the króna had appreciated by nearly 10 per cent and by October 2010, the inflation rate, which had peaked at 21.9 per cent in January 2009, was back down to the central bank’s threshold bank of 4 per cent.

The Icelandic government, realising it was partially constrained by an IMF program, freed up rules relating to private pension savings, and relative to GDP, which had the effect similar to a fiscal stimulus – in other words, blanket austerity was not imposed on the economy and the spending growth led to an early recovery.

The data presented above suggests that Iceland has come out of the crisis in much better shape than Finland.

References

Klau, M. and Fung, S.S. (2006) ‘The new BIS effective exchange rate indices’, BIS Quarterly Review, March, 51-66.

European Commission (1970) Report to the Council and the Commission on the Realization by Stages of Economic and Monetary Union in the Community, Luxembourg, 8 October, also known as the Werner Report.

European Commission (1977) Report of the Study Group on the Role of Public Finance in European Integration, Volume 1: General Report, Brussels, April, also known as the MacDougall Report.

European Commission (1989) Collection of Papers Submitted to the Committee for the Study of Economic and Monetary Union, 17 April, also known as the Delors Report Appendix.

European Commission (2016) Country Report Finland 2016, Commission Staff Working Document, February 26, 2016.

McAllister, R. (2009) European Union: An Historical and Political Survey, New York, Taylor & Francis.

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

Dear Bill

Sweden and Denmark were wise enough never to join the Eurozone, and Norway isn’t even a member of the EU. If Finland abandons the euro, the entire North of Europe will be euro-free. To be accurate, the wisdom of Sweden and Denmark lay with the people, not with the establishment. The euro was favored by the political and economical elite of Sweden and Denmark but then rejected in a referendum. Sometimes the masses are wiser than their rulers.

Regards. James

Bill,

May I thank you for such a masterful piece of writing. Just when I am being swayed (again!) to believe (again!) that Grexits, Brexits and Fixits would be a total disaster, you manage to drag me back from the brink.

Beyond the threatened economic implosion and emotional appeals for unity (et al) that the pro EU “democrats” reel out as they describe the consequences of the catastrophe scenario, your analysis is logical, down-to-earth and factual. We need more of this to either allay our fears or bolster our resolve.

Unfortunately, at least here in Europe, our political Left, Right and Centre, are basically pursuing the same economic policies. For the life of me I cannot understand why a “real” alternative strategy has not emerged. It seems to make no difference for which political party we vote for anymore, since we are going to end up exactly where we were, before the election. Maybe it is this aspect of our “democratic” process that is turning people into apathetic zombies.

The challenge for the political “Left” to come up with an “Alternative Plan for Europe” is proving harder to actually execute than write & talk about. Many clever ideas are tossed around, but no progress is made.

The politicians, activists and democratic disciples have now had a good couple of years to come up with workable solutions and we are now fully aware of how the scorecard reads. Maybe the time has come to pull the plug on this whole EU/Euro fiasco and start from scratch, whatever the consequences.

@James Schipper

The elite of Denmark may not have succeeded in bringing Denmark into the Eurozone fold but they did manage to get the Danish kroner pegged to the Euro, which is almost as bad. It’s considered an article of faith by almost all political parties there, sadly.

That strange hybrid,sterile creature,the EU/EMU, is determined to commit cultural and economic suicide.

The English speaking nations would do well to keep well clear of this dangerous creature until it comes to it’s senses and,meanwhile, not holding their breath waiting for that to happen.

Peter Smith-as a UK resident I’m swinging like pendulum on this vote which is between a rock and a hard place- I’m so disgusted with the EU’s degradation of its own populations that I want out but realise that here in the UK, given the appalling failure of the Left, there might well be an emboldening of austerity if we leave – this Tory Government might well run riot dismantling social welfare on an even bigger scale than it’s happening now – of course this could trigger a big backlash which could create change but with the populace so dumbed-down, narcoleptic and victim of decades of fallacy of composition myths about Government spending I don’t hold out much hope of that!

Bill,

I find it puzzling that the forces for disintegration are always overwhelmed by the forces of integration.

Perhaps the forces of integration do go back to the notion of preventing the internecine hostilities of past history. Given that at the centre of these hostilities there has been either a deluded ambitious German or a deluded ambitious Frenchman (overlooked from a distance by an equally deluded ambitious Russian), Europe looks like a sanitarium for such people – a place where they can monitored and kept in check.

It seems that the country that has benefited the most economically from the the EU/EZ is Germany. The inept management of the Southern European economy has kept the Euro low – Germany being the most internationally competitive of the Euro bunch, benefits the most. So in a perverse way it benefits from financial dislocation beyond its southern border. Perhaps this is the reason Germany hangs in? Of course German isn’t totally off the hook – it has financed the economic misdemeanours of its southern cousins, however, the Germans have adroitly put this to use to enhance their European overlord status.

Why anybody would want to belong to this European madhouse is beyond me.

Simonsky, I fear you may well be right. If you have a look at Thomas Frank’s soon to be published Listen, Liberal, what he says about the Democrats could almost as easily be about the Labour Party. His treatment doesn’t transfer completely without modification, but when he talks about Bill Clinton, he might as well be discussing Tony Blair. A recent article in the Guardian gives the gist of his analysis — “The issue is not Hillary Clinton’s Wall Street links but Democrats’ core dogmas” (16 February 2016). Rather depressing, as this may well be true of Labour. He doesn’t think Sanders can alter this in the time he has got.

Hello Simonsky

You said “I’m so disgusted with the EU’s degradation of its own populations that I want out but realise that here in the UK, given the appalling failure of the Left, there might well be an emboldening of austerity if we leave ”

The EU is the one dishing out the ‘austerity’… economic policy is enshrined in the EU’s Treaties and Acquis, and driven by the Commission.

In the May 2010 election the Labour party said they would have massive cuts too, just not as massive or as soon as the Conservatives. In what way is the EU holding the Conservatives back from their cuts?

More importantly, democracy is far more important than economic policy. No-one can vote out the EU’s Commissioners, but we can vote out our MPs. The so-called left don’t like the results they get from local democracy, and they think that being in the EU means they don’t have to win elections anymore to impose their policies on the UK.

Saying that we should stay in the EU so as to undemocratically override the UK public’s democratic choices is, frankly, despicable. Unfortunately, the so-called ‘Left’ prefer the EU to run the UK rather than have a local democracy in which they keep losing elections. This is the real ‘rock and a hard place’ for the public.

The EU is a neoliberal’s wet dream. It’s all about massive corporate power, and remote bureaucratic governance of society, untouchable by elections and referenda. The EU has nothing to do with the values of the genuine left. It never did. It never will.

The only way to re-focus the UK government’s nasty economic policies and simultaneously re-focus the EU’s commitment to bureaucratic government, is by leaving and helping to sway the continent in a freer direction. We can do that easily in the coming referendum by giving the UK political ‘elites’ and their EUropean counterparts the wake-up call they’ve been evading for decades. Two birds, one stone. Clean, crisp and decisive. Job done.

Alternatively, voting to stay in the EU endorses both the UK’s and the EU’s direction of travel by empowering Cameron and Osborne as well as Merkel, Hollande and the others, and gives them a green light to keep going full pelt, unchallenged, reinvigorated and with a smile on all their faces.