The other day I was asked whether I was happy that the US President was…

Australia might join the Eurozone, apparently

Australia has a grand Greek tradition. My hometown of Melbourne is the third-largest Greek speaking city in the World as a result of the Post World War 2 migration. In 2011, Thessaloniki – Greece’s second largest city had a population of 1,104,460 (the overall Metropolitan Area). According the last Australian Census of Population and Housing (2011), there were 123,462 Males and 128,755 Females (total 252,217) who spoke Greek at home although 378,270 people of Greek ancestry were accounted for. Most of them live in Melbourne. Growing up in Melbourne meant there was always a ‘Greek’ element present in my childhood particularly at school as new migrants arrived. But that cultural affinity with Greece is about as close as Australia will ever come to mimicking it. Australia can never become “Asia’s version of Greece” because we do not use an “Asian currency”, we retain total control over our central bank (the currency issuer), and we do not issue public debt in a foreign currency (like the euro as Greece does). The only way we could become like Greece is if we were to join the Eurozone … and then pigs might fly!

Yet, one ‘expert’ journalist, one Andrew Critchlow felt compelled to pose a very deep-sounding question yesterday (July 20, 2015) – With the boom years over, could Australia be the new Greece?

The article is not even good fiction. How our national daily newspapers and the subsequent discussion on radio and talkshows could conceive of this article as anything more than ignorant, ill-informed, misleading, moronic rubbish is beyond me.

This will be the worst article of 2015 and there have been many.

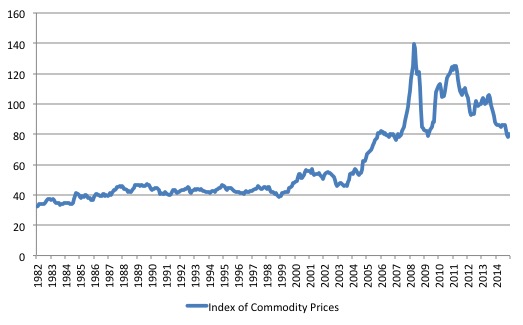

The background to the article can be summarised by the following graph which draws on the RBA Commodity Prices data.

The Index of Commodity Prices (Base year 2013/14 = 100) shows the early stages of Australia’s mining boom after 2003, leading to the historically record peak in October 2008, the decline in the early months of the GFC, the rebound after China’s fiscal stimulus pushed up their growth rates, and the steady decline mid-2011.

The shift since October 2008 has been a spectacular 42.7 per cent drop. Over the last 12 months to June 2015, the decline has been 9.2 per cent and over the last 24 months commodity prices have fallen by 19.6 per cent.

The latest edition of the BRW Rich 200 List (which parades the wealthy out before the population as some sort of envy play) recorded that the richest Australian, a mining heiress, lost $5.99 billion in 2014 “due to falling iron ore prices” but still had the top wealth of $A14.02 billion (Source).

Other mining wealth holders recorded a similar tale – large losses but still spectacular fortunes.

But whichever way you understand this data, the rise and fall in commodity prices, given Australia is a primary commodity exporter, has been substantial.

The question then is what are the implications of the decline?

According to our esteemed journalist, the decline raises the question:

Could a prolonged period of depressed commodity prices turn Australia into Asia’s version of Greece, with China being its banker of last resort instead of the European Union?

Which would have been a question I would never ask. It is so ill-informed and idiotic. But the response by local radio and TV programs has been staggering – the response being to give the story any further oxygen without any accompanying critical scrutiny.

I received E-mails yesterday and this morning asking me whether our banking system was safe given we could become Asia’s Greece. These sort of articles scare those who have bought into the neo-liberal trail of lies and half-truths.

Despite our grand Greek tradition, we can never become like Greece.

The journalist wrote that:

This colossal collapse in wealth is symptomatic of the wider economic problem now facing Australia, which for years has been known as the lucky country due to its preponderance in natural resources such as iron ore, coal and gold. During the boom years of the so-called commodities “super cycle” when China couldn’t buy enough of everything that Australia dug out of the ground, the country’s economy resembled oil-rich Saudi Arabia.

While the mining boom brought large wealth increases to a small cohort of Australians and a larger cohort of foreign-owners of the mining assets, the same sort of largesse cannot be said to have filtered throughout Australian society.

Real GDP per capita rose by only 13 per cent between the March-quarter 2004 and the March-quarter 2015.

Real net national disposable income per capita only rose by 16 per cent over the same period. It has fallen by 4 per cent since the September-quarter 2011 (it previous peak).

Even at the top of the last cycle (February 2008) there were still 9.8 per cent of willing and available workers either unemployed or underemployed. That figure has now risen to 15 or so percent in mid-2015.

Since 2004, the wage share in national income has fallen by 1 percentage point (54.3 per cent to 53.3 per cent).

Recent data from the – Poverty in Australia Report 2014 – shows that 1 in 7 Australians live below the accepted poverty line and the number and proportion of people in this state has increased “substantially between 2003 and 2007” as the mining boom was in full swing.

So we are overall ‘better off’ in material terms since the beginning of the mining boom but not overly so. Certainly, large shares of the booty have been expropriated by the top end of the income distribution as income inequality has increased fairly significantly over the same period.

The mining boom saw increased poverty rates as a small number of people enjoyed the gains. While the Mining Industry groups continually try to ignore, the Mining sector is small in terms of employment and contribution to overall national income.

The journalist appears oblivious to the facts. He claims:

While the rest of the world suffered from the aftermath of the global financial crisis, Australia’s economy – closely tied to China – appeared impervious, with full employment and a healthy trade surplus.

First, we avoided recording an official recession (two consecutive quarters of negative GDP growth) because our national government introduced a very timely and substantial fiscal stimulus package in late 2008 and early 2009.

The mining sector contracted during this period and the fiscal policy initiative saved the economy. From the November-quarter 2008 to the May-quarter 2009, the Mining sector shed 14.7 per cent of its total employment. That is a massive contraction.

It is an absolute lie to say that the Mining sector saved Australia from recession during the GFC.

Second, China also introduced a major fiscal stimulus package which allowed our export sector some degree of recovery later in 2009 and beyond. Have another look at the graph above and see the cyclical swings in the commodity price index as the GFC ensued.

Third, how one can construct a Broad Labour Underutilisation rate of around 14 to 15 per cent which has been for some years now as being representative of “full employment” is beyond me.

That has been one of the more offensive neo-liberal claims – the denial of the mass unemployment and rising underemployment – that has been part of Australia’s last three decade history.

Over the course of the GFC and its aftermath, Australia was nowhere near to being at full employment.

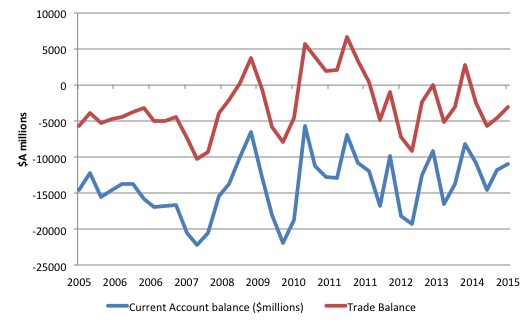

Fourth, Australia did not enjoy a “healthy trade surplus” over the during the aftermath of the GFC. The following graph shows the movement in the trade balance (difference between goods and services credits and debits) since the March-quarter 2005 (red line) and the overall Current Account balance ($A millions) over the same period (blue line).

Exports and imports plunged in early 2009 and for a relatively short period export growth recovered more quickly than import growth and there were trade surpluses. They disappeared in early 2012.

But the story for Australia is the Current Account because of the high levels of foreign ownership and the net drain in income that occurs as a result of repaying debts and sending profits abroad. The external sector has been an overall drain on national spending (and income) over the entire period show.

It is true that the rising export revenue allows us to import more than we would otherwise be able to do. And in that sense, we are materially better off.

It is true that with declining commodity prices our export revenue is now falling and our current account balance will widen somewhat.

So what?

Well the journalist using terms like a trade deficit that has “ballooned” (which is one of the metaphorical buzz words they like to use to invoke alarm), thinks that:

… these dramatic falls in prices are almost impossible to absorb without inflicting wider damage. The drop in foreign currency earnings has seen Australia forced to borrow more in order to maintain government spending.

It has not done anything of the sort of course. The correct statement is that the decline in earnings from the mining sector has reduced the tax revenue received by the national government, which has then chosen to match the rising fiscal deficit with debt issued to the private sector.

There is no force or coercion. The Australian government is a volunteer in its debt issuance program. It could have instructed the central bank (RBA) to credit its spending accounts with or without some token paper to account for the credits being placed on the assets side of the bank.

The fact that it hasn’t reflects and ideological preference rather than a technical constraint.

After all the Australian government, of which the central bank is a institutional part, is the currency-issuer.

The journalist then claimed (quoting an “Australian economist”) that there are “dangers” in the:

… escalating levels of foreign debt could present for future generations. Could a prolonged period of depressed commodity prices even turn Australia into Asia’s version of Greece, with China being its banker of last resort instead of the European Union.

We are presuming he is referring to Australian government issued debt denominated in Australian dollars and held by foreigners as part of their asset portfolios.

If so, there is no danger at all for the Australian government or the nation as a whole.

We do not rely on Chinese bond purchases for our government’s on-going capacity to spend. The Australian government issues the Australian dollar not the Chinese bond buyers.

Lets take a step back.

Clearly a decline in exports can occur in two ways – the volume exported can drop and/or the price per unit can drop. While volumes may stay up for a while, our falling terms of trade (export prices relative to import prices) has undermined domestic growth.

It is also increasingly unlikely that the fiscal forecasts (surplus down the track) will be achieved given the decline in tax revenue that is on-going. It brings into relief the key insight that pro-cyclical fiscal policy strategies (in this case, fiscal austerity) will rarely achieve their targets because they undermine the very thing that is required for the strategy to work – increased tax revenue via economic growth.

This also highlights why the fiscal balance should not be a policy target in its own right. The government in fact has very little control over the final fiscal outcome in any period.

It is non-government spending and saving decisions that drive the fiscal balance. The government can try as it might to reduce its deficit via spending cuts but if private sector spending does not increase commensurately to offset the loss of aggregate demand then it is likely the deficit will increase (or not fall by as much as intended). And what is left is rising unemployment and stagnant growth.

Greece is in the parlous situation at present because it surrendered its currency sovereignty when it joined the Eurozone in 2001. At that point it began to use a foreign currency (the euro) and was unable to guarantee the liquidity of its banking system.

It was forced to issue public debt in the foreign currency to match its fiscal deficits and because the debt attracted credit risk (because the government could no longer guarantee its repayment in the foreign currency), the bond traders had the upper hand and could drive yields up according to their assessment of the risk attached to that debt.

The GFC hit the nation hard and the fiscal deficits rose sharply as a result of the automatic stabilisers. But given the increasing risk of the debt, the Government was unable to access bond markets to fund itself. Then the bailouts came and things went downhill sharply as the Troika imposed the insane and extremely damaging austerity onto the nation.

All of that could have been prevented and the GFC hit on national spending contained if the Greek government had not entered the Eurozone and had instead retained sovereignty over its own currency.

That is what Australia, for example, proved in 2009 when it introduced its massive fiscal stimulus which stopped the decline in real GDP in its tracks within one quarter.

The fact that Australia is slowing again is not only due to the decline in commodity prices. The obsession that successive national governments have had since around 2012 with achieving fiscal surpluses at a time when non-government sector spending is weak has been instrumental in pushing the growth rate to well below its trend rate.

But Australia can never become like Greece (in the economic sense) because we issue our own currency and the Government can always spend it into existence to redress any sharp decline in non-government spending, whether that come from the external sector or the private domestic sector.

The danger is that if policy makers adopted the irrational view that Australia could become like Greece, the national government will change policy parameters and undermine growth and employment and bring on a recession and/or period of persistently high unemployment.

Australia is now slowing – which means aggregate demand is deficient. But the private domestic sector is carrying record levels of debt courtesy of the relatively unfettered credit binge that the financial free-for-all fostered. So that sector overall has to tighten its belt.

Private capital formation has declined sharply and is expected to be lower again next year. With consumption growth fairly modest at present, there is no incentive for firms to engage in large scale investment plans. There is plenty of excess capacity in the economy still waiting to be brought back into productive use.

But with a growing current account deficit draining growth and the private domestic sector having to tighten its belt, the only way growth can be maintained is if the government deficit expands. The government should definitely not be belt tightening.

Australia, as a currency-issuer, can ‘afford’ whatever public debt it cares to issue. There is never a shortage of willing purchasers of the debt lining up for their dose of corporate welfare.

However, to wean the bond markets off their corporate welfare hit (the purchase of risk free Australian government debt with a guaranteed flow of income), the Australian government should stop issuing public debt altogether and just credit bank accounts (government spending) as usual and do some accounting entries with the central bank so the books balance.

That is, get the central bank to ‘fund’ the deficit spending.

When assessing the desirable ‘level’ of government spending at any point in time the only question that is of relevance is how close the economy is to full employment (the inflation barrier). If it is close then that is about the right level of government spending relative to non-government spending decisions.

If there are still concerns about equity at that point, then the composition of net spending has to change to redistribute more to those in need.

Of-course, that is not what has happened to Greece, Spain and Italy and the other recessed Eurozone nations. The three Eurozone nations are not even comparable themselves bar the fact they all surrendered their currency sovereignty.

Greece is in trouble now because basic rules of macroeconomic policy have been deliberately violated. They were forced into Depression because the fiscal capacity that can arrest a sharp decline in private aggregate demand was denied to them.

It is clear that the current account can only remain in deficit for as long as foreigners seek to accumulate financial claims in the currency of the nation in question. That desire can change – and sharply at times.

But while the trade component remains in deficit a nation enjoys the real terms of trade in their favour – which means it has to ship less real goods and services abroad to get more from abroad, presumably of things they do not produce themselves and which bring use.

From an Modern Monetary Theory (MMT) perspective, it is the local residents that are ‘financing’ the foreign desire to accumulate financial claims in the local currency, not the other way around.

If that desire changes then the real terms of trade can turn quickly against the local nation. That can be painful and reduce the real living standards of the nation.

But those movements do not negate the fact that the government can always maintain sufficient aggregate demand to avoid recessions and sustain high employment levels.

It is the failure of governments to fulfill that responsibility in Greece that is the problem. And then you ask why? And the internal failures of the Euro monetary system become the main topic of discussion.

Only with the ECB’s explicit consent (via funding the net spending) could the Eurozone nations offset major private sector spending collapses. The politics of the Eurozone are currently preventing that commonsense fiscal option from being pursued and the consequences are obvious and tragic in their fullness.

But Australia does not face these problems. The Australian government always has the capacity to run deficits to offset non-government surpluses and maintain growth should it so choose.

It is impossible on financial grounds for us to become like Greece. It is possible that our standard of living might decline in real terms if our rising dependency ratio is not met with plans to increase the productivity of the workforce. But that is an entirely separate issue.

Even if Greece was highly productive it would still be in bad shape given it is facing a full frontal attack from the Troika on its aggregate demand growth.

From another perspective, it would be relatively easy for Australia to become like Greece.

First, we could join a currency union with say New Zealand. Second, we could scrap the RBA (and the RBANZ) and introduce a new central bank which was unaccountabile to any elected government in the union.

Third, we could impose rules that say that budget deficits must remain below a threshold that is incapable of even coping with cyclical swings in net spending (driven by the automatic stabilisers).

Then we could make sure the new central bank joins forces with foreign institutions, which are equally unaccountable and impose harsh pro-cyclical fiscal austerity conditions of us at a time when non-government spending has collapsed.

Come to think of it we would have to invite China or Japan to join in the union to ensure the currency remained strong as we imposed a Depression on ourselves.

Conclusion

Jokes aside, the only lessons that can be drawn from Europe are those outlined above – spending equals income equals output. If you cut overall spending you cut growth. If the non-government sector spending cannot support growth then government spending has to fill the gap. Beyond those simple macroeconomic facts there are no lessons for Australia from the Euro crisis.

We issue our own currency and float it on international markets.

As I said earlier the Telegraph article discussed here will probably be the worst article for 2015. It is mind-boggling the sort of hysteria that gets published as headline pieces in our national media.

Advertising: Special Discount available for my book to my blog readers

My new book – Eurozone Dystopia – Groupthink and Denial on a Grand Scale – is now published by Edward Elgar UK and available for sale.

I am able to offer a Special 35 per cent discount to readers to reduce the price of the Hard Back version of the book.

Please go to the – Elgar on-line shop and use the Discount Code VIP35.

Some relevant links to further information and availability:

1. Edward Elgar Catalogue Page

2. You can read – Chapter 1 – for free.

3. You can purchase the book in – Hard Back format – at Edward Elgar’s On-line Shop.

4. You can buy the book in – eBook format – at Google’s Store.

It is a long book (512 pages) and the full price for the hard-back edition is not cheap. The eBook version is very affordable.

Bill I saw that article headline reprinted in fairfax papers and completely skipped reading it and went straight to the comments. The comments were similarly confused I mean can you blame them when the paper published this garbage. What a wasted opportunity to actually try and educate people instead of further confusing them for the fun of the writer. I got in a comment to at least help sway people but it’s such a hard task when an article uses disinformation as its premise. I can only hope some day that I can get MMT concepts out there in actual policy and hope we can talk to the population about the concepts too possibly one day.

Bill,

I’m not sure if you’re aware but the present leadership in Greece — especially the present finance minister Tsakalatos — firmly believe in what might be called the ‘Mitterrand myth’. You’ve probably heard this one yourself from lefties. Basically it goes like this: “the left lined up behind Mitterrand as the great hope of a left-wing Europe but when he was elected he was undermined by ‘globalisation’/’international capital flows’/whatever; what we learned from this is that we must work together in Europe to build a left alternative”. As you argue in your book this is the opposite of the truth. In fact, Mitterrand was undermined BECAUSE he tried to “work together” with a system run by the ordoliberal Bundesbank. Could you please do a blog post on this? I think it needs to be exposed as a myth so that it doesn’t weigh down another generation of European leftists. I know you address it in your book but you more than anyone know the power of blogging to spread the word.

Cheers,

Phil

Bill, it is interesting that you mention the possibility that some idiotic Australian government could legislate to prevent deficit spending, as that is one of the possibilities that Osborne is considering, possibly. He is considering implementing legislation that will prevent a government from engaging in deficit spending, or as he sees it ensuring it is always in surplus, unless circumstances dictate otherwise. But given the behavior of his government over the past five+ years, it is difficult to see what circumstances would drive a Tory government to engage in deficit spending. Moreover, one of the Labour leadership candidates has imitated this mantra and said that government should run surpluses, vaguely qualifying this later on. It has become not unlike a scene from The Manchurian Candidate, where a particular kind of economic brainwashing is the rule. Another leadership candidate knows that austerity doesn’t work but has given no indication that he knows really why this is so, hence, is unable to defend his position economically. The brainwashing hasn’t worked in his case, but, in part because it hasn’t, the knives are out. And because his defense of his economic stance will be weak or oblique (say, based on ethical considerations alone, which are not inconsiderable but insufficient), some of the knives may find their mark.

“And do some accounting entries at the Central Bank so the books balance” this may be really pig ignorant of me ,but is even that process truly required /necessary?

Jake, the govt run overdraft at the central bank. Am I right Bill?

In order to convert Australia into another Greece, they want to raise the GST exactly when the mining sector is slowing. At least the housing bubble may finally burst, China or no China. I have to admit that there is a great potential for “creative destruction” here in Australia. Some “baby bummers” and “retardees” who voted Liberal will also feel the immense pain (or rather “Pyne”) in their wallets.

Phil: I agree this is a very important myth – and glad you coined a name for the Mitterrand Myth. Bill covers it in Options for Europe – Part 25. Thanks for pointing this out, it can be hard to keep up with him! He is probably too generous to Mitterrand, who was largely play-acting at expansion, and the austerity was planned from the beginning.

See:

Jean-Gabriel Bliek, Alain Parguez, “Mitterrand’s Turn to Conservative Economics: A Revisionist History,” Challenge 51.2 (2008): 97-109.

Robert Eisner, “Which way for France?” Challenge (1983): 34-41.

Eisner’s paper was the outcome of a study commissioned by the French government itself, which it completely ignored when it did not yield the pro-austerity results and recommendations the government desired and which false socialist Mitterrand put into effect.

Leo Panitch recycled the Mitterrand Myth just now in The Denouement, and I replied there. It’s always used to excuse surrender to “international capital”, as in Tsipras’s fiasco. The problem is that people actually believe this junk.

Some Guy,

Yes, Panitch is currently one of the defeatist loser lefties peddling this junk. Any time they screw up they always just look back to Mitterrand and say, “oh no… defeated by International Capital again… oh dearie me…”. Pathetic. Then they usually wheel out some Utopian nonsense about ‘getting people mobilied’ to ‘change the structure of the state’. It’s leftist politics played like a hippie commune. The ’68 generation. What are they good for? Absolutely nothing.

“What are they good for? Absolutely nothing.”

They are the swing voters.

They like to screw young people over with ever rising land (house) prices, which are a zero or negative sum game. Much like the Blair voters in the UK.