The other day I was asked whether I was happy that the US President was…

European Court of Justice effectively rules that Eurozone is a shambles

On June 2015, the – Court of Justice of the European Union – issued a press release summarising their decision with respect to the ECB’s Outright Monetary Transactions (OMT) programme – Judgment of the Court of Justice in Case C-62/14 Gauweiler and Others. The decision (No.70/2015) is a devastating indictment of the Eurozone and the elites that designed it and maintain its capricious and destructive behaviours. The latest events in Greece highlight how neo-liberal Groupthink can extend into the realm of venal fantasy in defiance of reality. The European Court of Justice decision ruled that the ECB was not acting unlawfully in implementing its bond buying program, despite the German Constitutional Court ruling otherwise. The point of the ruling is that the Court has decided to take a convenient line because the economic policy making institutions in the Eurozone are so parlous that the role of the ECB can be blurred to mean anything. What a shambles.

The case had been brought to the European Court of Justice by a group of Germans led by one Peter Gaulweiler, a lawyer, who was previously a German politician representing the Bavarian Christian Social Union (a conservative outfit). He recently resigned his position in the Bundestag. He has been a serial litigant in the German Constitutional Court aiming to curb EU powers and reduce what he considers to be German sovereignty.

From an Modern Monetary Theory (MMT) perspective, Germany abandoned its sovereignty when it entered the Eurozone and surrendered its capacity to issue its own currency.

In recent years, he has lost several cases that aimed to derail the Greek bailout packages and to curtail the ECB’s capacity to act as a lender of last resort in the Eurozone.

The most recent case he brought sought a declaration from the German Constitutional Court that the ECB’s bond-buying program was in violation of European Union treaties (the legal framework that governs the operations of the Union).

In an extraordinary move, the German Constitutional Court sought an opinion from the European Court of Justice. This was the first time that the German Court had referred a matter to the European Court of Justice.

For background to the case see the Spiegel article (February 10, 2014) – Europe or Democracy? What German Court Ruling Means for the Euro.

Essentially, the German Constitutional Court on February 7, 2014, ruled “that the ECB’s program to save the European common currency is contrary to European law”. The decision meant that the Court “could forbid Berlin from contributing to efforts to save the euro or even force Germany to leave the currency zone entirely”.

However, instead of taking responsibility itself, it pushed the matter up to the European level, presumably because it wanted the the decision it had taken to be considered European practice, rather than German dominance.

The referral reflected the reality that BVerfG knows the operations of the ECB have to be assessed with the legal structure of the Treaties rather than the German Basic Law. That alone amounted to a rejection of the Bundesbank position, which had opposed the OMT program.

While the BVerfG found that there was a good case to be made that the program was outside of the ECB’s legal charter, it also recognised that the European Court of Justice, known for its ‘federalist’ type interpretations, could find the OMT program to be legal.

The BVerfG considered the program could be construed as an economic policy intervention rather than the ECB’s claim that it was a liquidity management operation.

Interestingly, it was the inclusion of the ‘conditionality’, which clearly went beyond any notion of liquidity management, that provoked the Court’s concern that the program was infringing on the core Treaty responsibilities of the Member States.

Of further relevance, under the heading ‘Violation of the Prohibition of Monetary Financing of the Budget’, paragraphs 84-98 of the Decision make it clear that the BVerfG considered that any ECB measures which have the same impacts as the purchase of a primary bond issue (for example, holding down bond yields) should be treated as ‘dem unmittelbaren Erwerb von Staatsanleihen gleichkommt’ (‘equivalent to the direct purchase of government bonds’).

[Reference: German Constitutional Court (2014) ‘Entscheidungen: über die Verfassungsbeschwerde … gegen 1 den Beschluss des Rates der Europäischen Zentralbank vom 6. September 2012 betreffend Outright Monetary Transactions (OMT) und die fortgesetzten Ankäufe von Staatsanleihen auf der Basis dieses Beschlusses und des vorangegangenen Programms für die Wertpapiermärkte’ (Securities Markets Programme – SMP), BvR 2728/13, 7 February – Judgement – the European Court of Justice announced that:

… it had adopted certain decisions concerning a programme1 authorising the European System of Central Banks (ESCB) to purchase on secondary markets government bonds of Member States of the euro area, provided that certain conditions were met.

Their interpretation of “secondary market” purchases is that they are “not directly from public authorities and bodies of the Member States concerned, but only indirectly, from market operators who have previously purchased them on the primary market.”

The German Court requested for clarification as to:

… whether the programme is within the powers of the ESCB, as defined by the EU Treaties, and is also uncertain about whether the programme is compatible with the prohibition of monetary financing of the Member States.

In reply, the European Court of Justice said:

… the EU Treaties permit the ESCB to adopt a programme such as the OMT programme.

They pointed to “Articles 119 TFEU, 123(1) TFEU and 127(1) and (2) TFEU and Articles 17 to 24 of Protocol (No 4) on the Statute of the European System of Central Banks and of the European Central Bank.”

There were various elements to the decision and I will only summarise them here.

1. The Court ruled that the OMT program was an act of monetary policy and therefore consistent with the ECB’s charter under the EU Treaties.

2. The program was consistent with its “primary objective, which is to maintain price stability”, which it does by sending out “impulses” to the money market. So the OMT is seen as part of the regular open market operations transmission mechanism that central banks use to manage liquidity in the cash market and therefore maintain their current interest rate position.

This is a stretch of anyone’s imagination.

When the ECB introduced the precursor to the OMT, the Security Markets Program (SMP) in May 2010, a number of ECB’s official members gave speeches claiming that the program was necessary to maintain “a functioning monetary policy transmission mechanism by promoting the functioning of certain key government and private bond segments” (see Speech by José Manuel González-Páramo, Member of the Executive Board of the ECB, The ECB’s monetary policy during the crisis, October 21, 2011)).

This was a representative claim by ECB officials.

In other words, by placing the SMP in the realm of normal weekly central bank liquidity management operations, they were trying to disabuse any notion that they were funding government deficits.

This was to quell criticisms, from the likes of the Bundesbank and others, that the program contravened Article 123 of the EU Treaty.

But whatever spin one wants to put on the SMP and the current OMT, the actions by the ECB unambiguously constituted a fiscal bailout package.

The SMP and the OMT amounted to the central bank ensuring that troubled governments could continue to function (albeit under the strain of austerity) rather than collapse into insolvency.

Whether it breached Article 123 is moot but largely irrelevant.

The SMP reality was that the ECB was bailing out governments by buying their debt and eliminating the risk of insolvency. The SMP demonstrated that the ECB was caught in a bind.

It repeatedly claimed that it was not responsible for resolving the crisis but at the same time, it realised that as the currency issuer, it was the only EMU institution that had the capacity to provide resolution. At the time, the SMP saved the Eurozone from breakup.

In this vein the European Court of Justice, rather remarkably, ruled that “the OMT programme cannot be equated with an economic policy measure”.

They then suggested, also in apparent contradiction of that last statement, that:

… since it is apparent from the EU Treaties that, without prejudice to the objective of price stability, the ESCB is to support the general economic policies in the Union.

So what is a monetary policy as opposed to an economic policy?

This discussion extended into its ruling in relation to the Treaty “Prohibition of monetary financing of Member States”.

The Court ruled that:

… this prohibition does not prevent the ESCB from adopting a programme such as the OMT programme and implementing it under conditions which do not result in the ESCB’s intervention having an effect equivalent to that of a direct purchase of government bonds from the public authorities and bodies of the Member States.

They considered that the ECB could legally purchase bonds from the “creditors” of a Eurozone nation as long as those purchases were not designed to circumvent the prohibition on primary market purchases.

Their logic was not compelling. First, they concluded that the ECB board would determine “the scope, the start, the continuation and the suspension of the intervention envisaged by the OMT programme” which meant Member States could not rely on this funding to underwrite their fiscal policy decisions.

Second, “a minimum period is observed between the issue of a security on the primary market and its purchase on the secondary market”, so that bond dealers who had purchased the primary issue could not rely on a straightforward sale to the ECB and would therefore have to carry the risk.

But with the volumes of government securities being purchased by the ECB, the astute dealer would not take long to realise that it could enjoy capital gains by tendering for the primary issue and then off-loading the bonds in the secondary market at higher prices.

The higher prices after all reflect the logic of Quantitative Easing, which is indistinguishable from the OMT. The central bank pushes up the bond prices so as to reduce the yields and condition future bond tender outcomes.

Third, the ECB would “refrain from making any prior announcement concerning either its decision to carry out such purchases or the volume of purchases envisaged”.

Yes, but the bond dealers soon work out who is buying what and with what frequency.

But, the point of the blog is not to examine the logic of the European Court of Justice. Rather, it is to reflect on what it means for the extraordinary conduct we are witnessing from the Troika.

As I explain in my current book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale (published May 2015) – the ECB saved several Eurozone governments from insolvency in 2010.

Later in 2012, when ECB boss Mario Draghi announced it would do whatever it took – which meant the ECB would buy unlimited quantities of government bonds to prevent a Eurozone collapse, he reaffirmed the massive fiscal capacity that the central bank had and the absence of a properly constituted fiscal capacity within any elected Eurozone body (such as a Eurozone Parliament).

The fact that the national governments do not have the fiscal capacity to defend their economies and banking systems without the largesse of the ECB was the terminal design fault in the creation of the monetary union. The fact that the design fault was actually deliberate and constructed by the neo-liberals as a design strength in 1991 beggars belief.

The GFC has shown, without qualification or nuance, how bad that ideological decision was.

The European Court of Justice’s decision effectively sanctions the ECB to continue to be the fiscal agency within the Eurozone, an extraordinary outcome if one recognises that the ECB has no political justification – it is made up of unelected officials who are not directly accountable to any citizen in any country, unlike an elected government.

The lender of last resort function carried by central banks in a federation has to be seen as part of the overall powers of the elected national government at the head of such a federal structure. The central banks in these situations act under legislative rules at the behest of the elected government, which can change the laws to suit the need.

The ECB is immune to such national government interventions, which the elected legislatures deem to be in the best interests of their citizens.

The fact that the ECB joined the Troika, which included the IMF, a non-European, non-elected, non-accountable organisation, is evidence of how far removed from a democratically-organised federation the Eurozone is.

I have no doubt that the ECB is acting as a fiscal authority, which the European Treaties explicitly banned. The fact that the European Court of Justice has conveniently overlooked the aberrant behaviour by the ECB, is like all things Eurozone, ad hoc.

Everyone knows that if the Bundesbank was to get its way, the Eurozone would have collapsed long ago. So the officials work at the margins to keep their ugly system alive and the European Court of Justice conveniently plays along to allow them to do that – while the elephant in the room – the lack of a true fiscal authority at the federal level – stomps on millions of unemployed and pensioners, and, in the case of Greece, destroys the viability of a nation.

Some time in the future, humanity will look back on this period as a Dark Age overseen by megalomaniacs parading as the Eurogroup or the IMF etc. All pushing the neo-liberal Groupthink and denying reality.

The European Court of Justice ratification of the ECB behaviour tells us that democracy is dying in the Eurozone as currently constituted and enforced by the Troika.

The role of the IMF in all this is amazing. The Fairfax article (June 28, 2015) – IMF’s Christine Lagarde must go over shameful Greek failings – makes it clear that the IMF has failed – again – and the leaders should take responsibility and resign.

I would add that senior IMF officials who approved research outcomes and predictions which conditioned the austerity programs and were later found to be ‘wrong’ (to say the least) should be prosecuted for criminal negligence and imprisoned.

Please read my blog – Friday lay day – Greece has only one viable path – exit – for more discussion on this point.

The fact that Madame Lagarde is now claiming the referendum on Sunday is irrelevant because there is no agreement to consider just confirms that she is miffed that the IMF may have overstepped its mark just once too often.

In effect, the decision by the Greek government to go back to the people takes the initiative away from the Troika, who like all bullies, doesn’t like to be upstaged.

The Fairfax article said that in the face of the Greek disaster:

… a number of judgments can already be made; one is that a large part of the blame for this ever deepening debacle lies at the doors of the International Monetary Fund, which from the very beginning has had both its priorities and its analysis of the situation hopelessly wrong.

If this were any normal organisation, the IMF’s managing director, Christine Lagarde, would be forced to resign and someone with less of a vested interest in propping up the folie de grandeur of European Monetary Union installed in her place.

One cannot avoid agreeing with that.

When we read the statements by the Dutch head of the Eurogroup Jeroen Dijsselbloem that the Eurogroup is an “informal body” which can decide what it likes, we know that democracy is in danger in Europe. Especially, when the Eurogroup takes instructions from the IMF.

The Greek people are being asked to reject the austerity imposed on them.

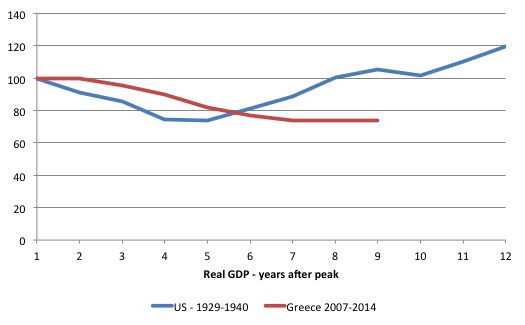

Here are two graphs. The first compares the movement in real GDP in the US from 1929 (indexed to 100) through to 1940 with the real GDP path for Greece from 2007 to 2014. The starting points were the peak output levels before the crisis hit.

We called the US experience in the 1930s the Great Depression. Greece has hit the same low – 26.3 per cent loss of real GDP – that is the size of the economy has shrunk that far – in the US case it came in 1933 (after the 1929 peak), in the Greek case it came in 2013.

But while the US recovered fairly quickly after that (with the ridiculous 1937 hiccup as the conservatives tried to cut into the fiscal deficit), the Greek situation is deteriorating.

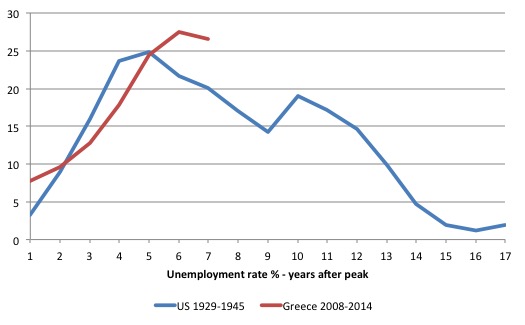

The second provides a similar comparison (slightly different time spans) for the unemployment rate evolution in each nation. The rates are the actual rates (per cent).

Greece is clearly caught up in a Depression of the magnitude of the Great Depression. The conservatives of the day were wrong to insist the US government introduce harsher public spending cutbacks. Fortunately, the US government chose an alternative course (New Deal) which restored prosperity, albeit slowly.

The same flawed logic is dominating the current times.

Conclusion

Only a fool or an ideologue intent on destroying the prosperity of a nation would insist that Greece cut net spending any further.

While the details of the offers made by the Troika to Greece, which have been rejected, are sketchy, it is clear they wanted more austerity for longer.

There is no economic justification for that insistence, which as I have argued (with many others) before, means that Troika were not about defending the interests of the Greek people.

For the Troika, the Greek people are largely irrelevant pawns in their greater desire to maintain their hegemony and inflict their neo-liberal austerity bias on all Member States.

It is failing and the Greek decision to hold a referendum next Sunday and cut the Eurogroup out of the situation might just be signalling that there is life in democratic forces yet in Greece and that the nation will provide a model for the rest of Europe to abandon this destructive era and jettison this generation of policy makers.

Hope springs eternal!

Blue Mountains Politics in the Pub – Saturday, July 4, 2015

I will be giving a presentation at the above event organised by the – Blue Mountains Union Council this coming Saturday.

The event will coincide with the – Annual Winter Magic Festival – in Katoomba up in the Blue Mountains, west of Sydney.

The Festival usually attracts over 20,000 visitors.

The Politics in the Pub event will run from 14:30 until 16:30 on Saturday 4th July in the dining room of the Family Hotel, 15 Parke Street, Katoomba.

There is car parking at the rear of the pub, access via Cascade Street which runs parallel to Park St.

If you get sick of listening to MMT on a (hopefully sunny) Saturday afternoon, then you can attend a drumming workshop or some other event attached to the festival.

I hope to see a lot of people there.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Can anyone please explain: If the ECB can buy govt. bonds of various countries at will, why can’t they buy Greek Govt. bonds and the problem would go away (or have I missed something?)

@totaram

It would solve the problem, but only if they were offering to fund ongoing deficits, unconditionally and forever, otherwise the problem reappears at some point. And they simply won’t do this because this would be complete anathema to the neo-liberal ideology inherent to the whole EMU design. And maybe they also shouldn’t do it, because the ECB is not democratically elected, and therefore does not have any mandate from the other peoples of the EMU to impose fiscal transfers (because that’s what ECB funding would amount to in the end).

And there is the question of whether it is the right thing for Greece (or any country for that matter) to stay in the EMU and rely on the ECB’s goodwill rather than take back control of their monetary (and therefore fiscal) sovereignty.

Flipping the unemployment graph so that good = up, would make the point more clearly

I like this description in this blog I saw today;

http://www.dailyimpact.net/2015/06/22/the-crash-of-2015-on-track-behind-schedule/

“The fact resistant strain of humans now in charge of the world…..”

http://www.newyorker.com/humor/borowitz-report/scientists-earth-endangered-by-new-strain-of-fact-resistant-humans

It might be comedy but it’s no laughing matter!

Bill, the age URLs link is broken with error “The requested URL /blog/www.theage.com.au/business/imf-heads-must-roll-over-shameful-greek-failings-20150628-ghzrpg was not found on this server.”

I’m going to try and get up to Katoomba this weekend too.

Worth mentioning that 37% of Greece’s exports are refined petrochemicals, most of which goes to the rest of the eurozone (none to the UK as far as I can make out). It might make other eurozone nations sit up if they suddenly find that is cut off.

Is there any entity that is officially placed in the fiscal role by the eurozone treaty? Was there any entity that may not have been placed in the role officially but which was de facto performing the role prior to the crisis?

Dear Jason H. (at 2015/06/29 at 23:39)

Thanks for the scrutiny. The link is fixed now.

best wishes

bill

Dear Dudley (at 2015/06/29 at 23:55)

1. The national governments

2. Disciplined (austerity bound) by the Stability and Growth Pact and its related rules (Two- and Six Pack and the Fiscal Compact) overseen by the European Commission.

Everyone outside the Groupthink knew in 1991 that it was recipe for disaster. And that knowledge has been realised while the Groupthink captives remain in denial.

best wishes

bill

Hi Bill. Thanks for another insight that seems to escape our political leaders. Any chance you will do a “pub talk” in Tasmania?

Best

Roy

“The script of the play calls for Greece, the ‘birthplace of democracy,’ to flee the ‘anti-democratic’ West and join the ‘BRICS rebellion against the evil Western central bankers.'”

Taken from the Redefining Blog which has been surprising accurate so far.

The globalists want us to recoil from the old new world order of the IMF /Us of A and co (see the Eu experiment) and run headlong into the arms of the New new world order of the Shanghai club.

The plan is not all that complex really.

Perhaps its execution which perhaps depends on the extensive cooperation of mid and lower level masonary.

To witness this constant production of slurry is indeed impressive.

bill, thank you for your reply. I should have made it clearer that I meant over and above the national governments is there anyone in the fiscal role. But you have answered my question, thank you.

Hi Bill,

I came up to the event at Katoomba yesterday, and enjoyed the presentations and Q&A sessions from both yourself and Dr Quirk. Very glad I made the effort to attend.

A question – and I welcome responses from anyone – I’m looking for recommendations on digestible materials for introducing and explaining both MMT and JG schemes to newbies. I’ve read and recommended Mosler’s 7DIF, and even though as far as I’m concerned it’s excellent and very accessible, it still runs to a hundred pages. Any tips?