I grew up in a society where collective will was at the forefront and it…

Demand and supply interdependence – stimulus wins, austerity fails

My Phd research, was in part, exposing the myths in conventional or mainstream economics arguments that claim that structural imbalances in the labour market arise independently of the economic cycle and hence, aggregate spending. The mainstream used this assertion to draw the conclusion that government policy could little to bring unemployment down when mass unemployment was largely ‘structural’ in nature. Instead, they proposed that supply-side remedies were necesary, which included labour market deregulation (abandoning employment protection etc), minimum wage and income support cuts, and eroding the influence of trade unions. At the time, the econometric work I undertook showed that so-called structural imbalances were highly sensitive to the economic cycle – that is, the supply-side of the economy was not independent of the demand-side (the independence being an article of faith of mainstream analysis) and that supply imbalances (for example, skill mismatches) rather quickly disappeared when the economy operated at higher pressure. In other words, government fiscal policy was an effective way of not only reducing unemployment to some irreducible minimum but, in doing so, it increased the effectiveness of the labour force (via skill upgrading, higher participation rates etc) – that is, cleared away the so-called structural imbalances. A relatively recent paper from researchers at the Federal Reserve Board in Washington – Aggregate Supply in the United States: Recent Developments and Implications for the Conduct of Monetary Policy – finds new US evidence to support the supply-dependence on demand conditions. It is a case of stimulus wins whereas austerity fails.

The Federal Reserve Board paper found that:

… the level of potential GDP as of 2013:Q1 is now estimated to be about 6 percent below the trajectory that appeared to be in place based on the average pace of growth estimated over the 2000-2007 period; the model projects the shortfall to widen to 63⁄4 percent by 2013:Q4.

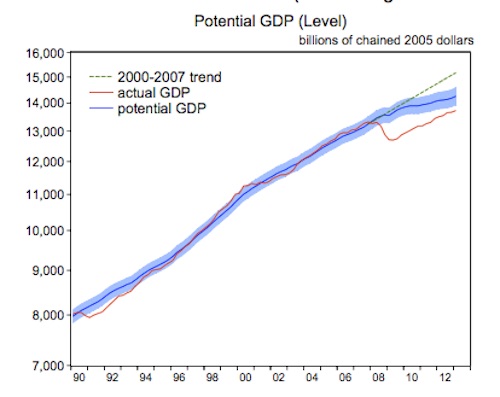

The following graph is one of the panels in their Figure 1.1 and shows Potential real GDP and actual real GDP up until the first-quarter 2013. The dotted line is an extrapolated potential capacity path had the pre-crisis trend (2000-2007) been maintained. The shading around the estimated solid blue Potential real GDP line are 95 per cent confidence limits.

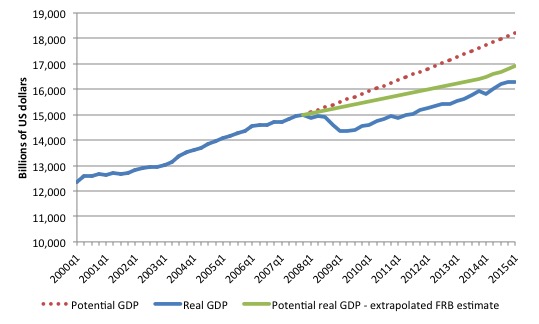

I did some analysis and based on the discussion in the paper, I extrapolated their estimates out to the first-quarter 2015 (so at least five quarters of extra observations). The following graph is what I came up with.

The green line is a linear version of the FRB estimates up until the fourth-quarter 2013 and then my own extrapolations after that. Note also my constant price estimates are in terms of 2009 US dollars, whereas the FRB uses the older benchmark of 2005 dollars to create their real series. Hence my levels are higher.

That would give an output gap of around 3.5 per cent in the first-quarter 2015. The Congressional Budget Office (CBO) current estimate is 2.1 per cent. Their methodology biases the measures of the gap between actual and potential GDP downwards (and as a consequence understates the cyclical impact on the fiscal balance).

The concept of a potential GDP in the CBO parlance is not to be taken as a fully employed economy. Rather they use the standard dodge employed by mainstream economists where the the concept of full employment is not constructed as the number of jobs (and working hours) which satisfy the preferences of the available labour force but rather in terms of the unobservable Non-Accelerating-Inflation-Rate-of-Unemployment (NAIRU).

The problem is that policy makers then constrain their economies to achieve this (assumed) cyclically invariant benchmark. Yet, despite its centrality to policy, the NAIRU evades accurate estimation and the case for its uniqueness and cyclical invariance is weak. Given these vagaries, its use as a policy tool is highly contentious.

I cover that issue in some detail in the blog – Australia output gap – not close to full capacity.

As a note, the CBO believes that inflation is about to rise in the US as a result of labour market pressures given that the US Bureau of Labor Statistics estimates the unemployment rate in April 2015 to be 5.4 per cent and the CBO’s estimate of the NAIRU (where inflation is steady) is 5.4 per cent. Any further drop in the unemployment rate, according to the mainstream economic theory the CBO utilises, will trigger accelerating inflation (quite apart from raw material shocks etc).

Any understanding of inflation dynamics (and inflation expectations) in the US will tell one that there is a threat of deflation not accelerating inflation.

But the accuracy of the output gap measures or the threat of inflation is not the point of this blog. The blog is about supply and demand interdependence and what it means for the conduct of government policy.

What does the FRB paper tell us?

First, I won’t go into the methodology used or the underlying economic model that the authors deploy. That would be too technical an exercise and guaranteed to bore. I would only say that the economic theory deployed is orthodox and therefore highly contestable, to the point of being erroneous.

The statistical/econometric approach, an unobserved components model and state-space estimation techniques, while fairly standard is in my view acceptable. I have used this approach myself in the past.

But the fact that the authors find quite unorthodox results using a theoretical framework that is biased to reinforcing the orthodox theoretical predictions, however, erroneous they might be, is interesting in its own right.

In other words, it cannot be said by the mainstream that the results are flawed because they disagree with the theoretical structures that underpin them.

They find that:

1. By the end of 2013, the “level of potential GDP” was “below the trajectory that appeared to be in place based on the average pace of growth estimated over the 2000-2007 period” by some 6.75 per cent.

2. The “growth rate” of potential real GDP “has been less-severely affected, because … a substantial portion of the hit to potential GDP since 2007 … reflect … one-time adverse shocks to the level of the natural rate, labor force participation, and trend multifactor productivity.”

3. Driving the fall in potential GDP since 2007 in the US has been “an unusually slow pace of capital deepening-a factor whose contribution to growth should pick up substantially over time as the recovery in business investment and the broader economy proceeds.”

If you calculate the private investment ratio (as a per cent of GDP) you find that its most recent peak was in 2000 (19.8 per cent) and in 2014 was 16.4 per cent having risen from a recent low of 13 per cent in 2009.

4. Why has potential GDP fallen? The authors find that:

The largest contribution to the slowdown in potential output growth is from trend labor productivity … the trend growth rate of labor input … has also slowed in recent years … and a steepening of the trend decline in the labor force participation rate … Even with the estimated slowdown in potential growth, the model’s estimate of the cycle … is consistent with a sharp drop in resource utilization in 2008 and 2009 and only a gradual and still-incomplete recovery thereafter.

In other words, the great recession caused the fall in potential GDP.

The authors identify the “supply-side damage in labor markets”, which they say carries “special significance in light of the full-employment leg of the Federal Reserve’s dual mandate”.

They identify “three potential sources of labor market damage”:

(1) difficulties in reallocating labor across different segments of the economy (industry, occupation, or geographic) associated with the distribution of the demand shock caused by the financial crisis and deep recession; (2) a more general deterioration in the efficiency of the matching process between available workers and available jobs; and (3) long-term damage in labor markets (often referred to as hysteresis) associated with the substantial rise in the number of long-term unemployed and a possible reduction in the employability of affected workers.

To be clear, the research is indicating that these typical ‘structural’ characteristics are being driven by the aggregate economic spending cycle, rather than non-cyclical impediments, which are usually identified by mainstream economists as the source.

They find that “the industry-specific shocks to labor demand in the recent recession were more persistent than in the past” given the severity of the recession.

In turn, this meant that it was much harder for workers to move from declining industries and/or regions to areas where there might have been better opportunities. There was a generalised malaise in the US labour market which caused the usual mobility of workers to stall.

Further, the “rate of permanent job loss … rose sharply during the recession” and was much higher than the previous recessions (1982 and 2000). This is sometimes interpreted in terms of a rise in ‘structural unemployment’ but the authors suggest that “further improvements in economic activity and job opportunities will lead to further reductions” in the pool of workers impacted.

In other words, long-term unemployment is not necessarily an impediment or bottleneck to non-inflationary growth. Expanding the economy with more spending also can absorb those workers who suffered permanent job loss (their jobs, firms, etc disappeared).

The authors also recognise that the relationship between unemployment and vacancies has shifted outwards in the US during the recession, which would typically lead mainstream economists to conclude that “structural unemployment” has increased.

However, they note that:

But before drawing that conclusion, it is important to note that the Beveridge curve can shift for a variety of reasons, some of which are cyclical rather than structural in nature.

Their explanation is not convincing even if the observation is correct.

I consider that issue in some detail in these blogs – Latest Australian vacancy data – its all down to deficient demand and Cutting unemployment benefits in the US will not decrease unemployment.

In summary, the UV (or Beveridge) curve shows the unemployment-vacancy (UV) relationship, which plots the unemployment rate on the horizontal axis and the vacancy rate on the vertical axis to investigate these sorts of questions. It is a downward sloping relationship.

The logic is that movements along the curve are cyclical events and shifts in the curve are alleged to be structural events. So a movement down to the south-east suggests a decline in the number of jobs available due to an aggregate demand failure, while a movement up the curve to the north-west indicates improved aggregate demand and lower unemployment. If unemployment rises in an economy where there are movements along the UV curve it is referred to as “Keynesian” or “cyclical” unemployment – that is, arising from a deficiency in aggregate demand.

The mainstream literature claims that “shifts in the curve” (out or in) indicate non-cyclical (structural) factors largely due to the labour market becoming less efficient in matching labour supply and labour demand and vice versa for shifts inwards.

The factors that allegedly “cause” increasing inefficiency are the usual neo-liberal targets – the provision of income assistance to the unemployed (dole); other welfare payments, trade unions, minimum wages, changing preferences of the workers (poor attitudes to work, laziness, preference for leisure, etc).

The problem is that this view is at odds with the evidence.

As is the case in most advanced countries, the shift in the curve occurred during a major demand-side recession – that is, it has been driven by cyclical downturns (macroeconomic events) rather than any autonomous supply-side shifts.

This is what the FRB paper finds.

Their explanation is that the provision of unemployment benefits increases the attractiveness of leisure when there are no jobs, which pushes out unemployment for each recorded vacancy.

The upturn in economic activity and the retrenchment of extended unemployment benefits leads workers to offer more hours of work than before at the same real wage and vacancy levels. Apparently, they get sick of leisure and gain a renewed appetite for earned income. As a result the UV curve shifts back in.

This suggests that the quit rate should fall as employment falls. The evidence is overwhelming. When the unemployment rate rises, the quit rate falls. Exactly the opposite to that predicted by the supply-side story which means that their claim that causality runs from unemployment benefits to higher quits to higher unemployment is unsupported.

But the shared understanding between the FRB authors and a reasonable interpretation of what is going on is that the so-called structural imbalances embodied in the shift in the UV curve are cyclical in nature and will be reversed as a result of stronger economic activity rather than attempting to address them with microeconomic policy changes like reducing income support for the unemployed, attacking wage levels etc.

In other words, austerity is exactly the opposite solution to the problem. Stimulus is needed.

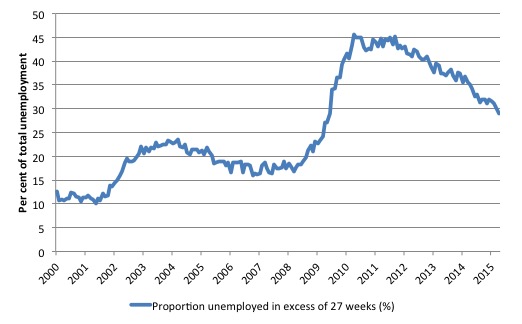

The FRB authors also address the issue of long-term unemployment, which has risen dramatically in the US since the onset of recession. It should be noted that the US Bureau of Labour Statistics’ definition of – long-term unemployment “refers to individuals who have been looking for work for 27 weeks or more.”

In many other nations, long-term unemployment relates to spells of unemployment exceeding 52 weeks.

The latest estimates – Unemployed persons by duration of unemployment – shows that in April 2015, there were 29 per cent of the unemployed who had been in that state for more than 27 weeks.

The following graph shows the evolution of long-term unemployment as a proportion of total unemployment in the US from January 2000 to April 2015.

It is clear that as economic growth resumed, the proportion of long-term unemployed as fallen dramatically.

What does this mean?

The FRB authors state that:

Long-term unemployment is of particular concern because individuals out of work for extended periods of time may find that their skills, reputations, and networks deteriorate, resulting in a persistently higher level of structural unemployment or a steeper downtrend in the labor force participation rate.

At this stage, they introduce the notion of “hysteresis”, which was a central topic of my PhD thesis. Please read my blog and the links referred to in it – The intergenerational consequences of austerity will be massive – for more discussion on this point.

This is the crucial point.

The mainstream economics literature (text books, most of the New Keynesian models etc), which dominates the academy and the policy makers, considers the supply-side of the economy to be independent of the demand-side. The main models used in textbooks and policy advice continue to cast the supply-side of the economy as following a long-run trajectory which is independent of where the economy is at any point in time in terms of actual demand and activity.

What does that mean in English? Simply, that the path the economy takes is ultimately dependent on the growth in capital stock and population and the spending side of the economy will typically adjust through price flexibility. In other words, it doesn’t really matter if spending falls below the level required to fully engage the productive capacity of the economy at some point in time.

There will be temporary deviations from the potential growth path but soon enough, market adjustments (price and income shifts) will restore the level of spending (for example, prices fall and consumers spend more, which, in turn, stimulates more private investment spending etc). But the supply-side momemtum continues – and that defines the growth path of the economy.

A classic application of the separation of the supply and demand sides in mainstream economics is the claim that a wage cut will increase employment. They only consider wages to be a cost and so claim that if workers in a firm offer themselves at lower wages, unit costs will fall and firms can expand their sales by lowering prices accordingly.

That might happen at a firm-level because the drop in income from the wage cut is unlikely to have much effect on the sales levels of the firm in question. If true, then the supply side (the supply of labour and its cost) will be largely independent of the demand-side (total sales volume).

Even if true at that micro level, the problem is that at the macroeconomic level wages are not only a cost of production but they are also a major component of total income. If all wages are cut, national income will fall because workers will have less purchasing power and the sales of all firms will decline. As a result, the demand and supply sides of the economy are interdependent.

The FRB authors find that interdependence is strong in the US economy.

Hysteresis is a term drawn from physics and is defined by the Oxford Dictionary as:

… the phenomenon in which the value of a physical property lags behind changes in the effect causing it, as for instance when magnetic induction lags behind the magnetizing force.

In economics, we sometimes say that where we are today is a reflection of where we have been. That is, the present is path-dependent.

I argeud in my early work in the mid-1980s that many perceived “structural imbalances” were, in fact, of a cyclical nature. Accordingly, a prolonged recession may create conditions in the labour market which mimic structural imbalance but which can be redressed through aggregate policy without fuelling inflation.

The mainstream orthodoxy at the time positive that the persistently high unemployment was the result of supply-side shifts in the labour market – for example, changing attitudes of workers to search intensity (that is, workers were lazy and preferred to take subsidised leisure in the form of income support payments from government) – and that aggregate demand policies aiming to stimulate the economy would not reduce this unemployment.

Accordingly, micro economic reform was necessary in the form of attacks on welfare payments to the unemployed (for example, increased stringency of activity tests) if governments wished to reduce unemployment.

My conjecture at the time was that any structural constraints that emerge during a large recession (for example, skill mismatched) can be wound back by strong fiscal policy stimulation.

For example, recessions cause unemployment to rise and due to their prolonged nature the short-term joblessness becomes entrenched long-term unemployment. The unemployment rate behaves asymmetrically with respect to the business cycle which means that it jumps up quickly but takes a long time to fall again.

There is robust evidence pointing to the conclusion that a worker’s chance of finding a job diminishes with the length of their spell of unemployment. When there is a deficiency of aggregate demand, employers use a range of screening devices when they are hiring. These screening mechanisms effectively “shuffle” the unemployed queue.

Among other things, firms increase hiring standards (for example, demand higher qualifications than are necessary) and may engage in petty prejudice.

A common screen is called statistical discrimination whereby the firms will conclude, for example, that because, on average, a particular demographic cohort has higher absentee rates (for example), every person from that group must therefore share those negative characteristics. Personal characteristics such as gender, age, race and other forms of discrimination are used to shuffle the disadvantaged workers from the top of the queue.

The long-term unemployed are also considered to be skill-deficient and firms are reluctant to offer training because they have so many workers to choose from.

But to understand what happens during a recession we need to consider the cyclical labour market adjustments that occur.

The hysteresis effect describes the interaction between the actual and equilibrium unemployment rates. The significance of hysteresis is that the unemployment rate associated with stable prices, at any point in time should not be conceived of as a rigid non-inflationary constraint on expansionary macro policy. The equilibrium rate itself can be reduced by policies, which reduce the actual unemployment rate.

The idea is that structural imbalance increases in a recession due to the cyclical labour market adjustments commonly observed in downturns, and decreases at higher levels of demand as the adjustments are reserved. Structural imbalance refers to the inability of the actual unemployed to present themselves as an effective excess supply.

The non-wage labour market adjustment that accompany a low-pressure economy, which could lead to hysteresis, are well documented. Training opportunities are provided with entry-level jobs and so the (average) skill of the labour force declines as vacancies fall. New entrants are denied relevant skills (and socialisation associated with stable work patterns) and redundant workers face skill obsolescence. Both groups need jobs in order to update and/or acquire relevant skills. Skill (experience) upgrading also occurs through mobility, which is restricted during a downturn.

In a recession, many firms disappear all together, particularly those who were using very dated capital equipment that was less productive and hence subject to higher unit costs than the best practice technology.

The skills associated with using that equipment become obsolete as it is scrapped. This phenomenon is referred to as skill atrophy. Skill atrophy relates not only to the specific skills needed to operate a piece of equipment or participate in a firm-specific process.

Long-term unemployment also erodes more general skills as the psychological damage of unemployment impacts on a worker’s confidence and bearing. A lot of information about the labour market is gleaned informally via social networks and there is strong evidence pointing to the fact that as the duration of unemployment becomes longer the breadth and quality of an unemployed worker’s social network falls.

Further, as training opportunities are typically provided with entry-level jobs it follows that the (average) skill of the labour force declines as vacancies fall.

New entrants to the labour force – into the unemployment pool because of a lack of jobs – are denied relevant skills (and socialisation associated with stable work patterns).

As a result, both groups of workers – those made redundant and the new entrants – need to find jobs in order to update and/or acquire relevant skills. Skill (experience) upgrading also occurs through mobility, which is restricted during a downturn.

Therefore, workers enduring shorter spells of unemployment, other things equal, will tend to be more to the front of the queue. Firms form the view that those who are enduring long-term unemployed are likely to be less skilled than those who have just lost their jobs and with so many workers to choose from firms are reluctant to offer any training.

However, just as the downturn generate these skill losses, a growing economy will start to provide training opportunities as the unemployment queue diminishes. This is one of the reasons that economists believe it is important for the government to stimulate economic growth when a recession is looming to ensure that the skill transitions can occur more easily.

The long-run is thus never independent of the state of aggregate demand in the short-run. There is no invariant long-run state that is purely supply determined.

By stimulating output growth now, governments also help relieve longer-term constraints on growth – investment is encouraged and workers become more mobile.

The supply-side of the economy (potential) is influenced by the demand path taken. Hysteresis means that where you are today is a function of where you were yesterday and the day before that.

However, the longer a recession (that is, the output gap) persists the broader the negative hysteretic forces become. At some point, the productive capacity of the economy starts to fall (supply-side) towards the sluggish demand-side of the economy and the output gap closes at much lower levels of economic activity.

Potential real GDP assumes some constant growth in productive capacity driven by a smooth investment trajectory. When there is an aggregate demand failure, the output gap opens up quickly as real GDP departs from the potential real GDP line.

Any persistence of the output gap starts to undermine investment plans as firms become pessimistic about the future state of aggregate demand.

At some point, investment starts to decline and two things are observed: (a) the recovery in real output does not accelerate due to the constrained private demand; and (b) the supply-side of the economy (potential) starts to respond (that is, is influenced) by the path of aggregate demand takes over time.

Hysteresis means that where you are today is a function of where you were yesterday and the day before that. The pessimism by firms begins to reduce the potential real output of the economy.

The entrenched recession is thus not only caused major national income losses while the output gap was open but is also made that the growth in national income possible in this economy is much lower and the nation, in material terms, is poorer as a consequence.

Moreover, the inflation barrier (that is, the point at which nominal aggregate demand is greater than the real capacity of the economy to absorb it) occurs at lower actual real output levels.

The estimated costs of the recession and fiscal austerity are much larger than the mainstream will ever admit. The point of the diagram is that the supply-side of the economy (potential) is influenced by the demand path taken.

Those who advocate austerity and the massive short-term costs that accompany it fail to acknowledge these inter-temporal costs.

It is interesting that the FRB authors are now writing about this – some 30 or so years after the literature initially identified hysteresis.

What does the FRB paper believe all this means?

They state that while:

… major financial crises tend to reduce a nation’s productive potential … what is commonly presumed because much of the supply-side damage could be an endogenous response to weak aggregate demand. If so, then an activist monetary policy may be able to limit the amount of supply-side damage that occurs initially, and potentially may also help to reverse at a later stage a portion of such damage as does occur. By themselves, such considerations militate toward a more aggressive stance of policy and help to buttress the case for a highly aggressive policy response to a financial crisis and associated recession.

The emphasis on monetary policy is just what one would expect from central bankers.

But the general point is very important – stimulating potential output and pushing out the inflation barrier can be achieved by stimulating aggregate (total) spending in the economy to ensure economic activity rises rather than trying to address the supply-side imbalances with a combination of aggregate austerity and so-called structural reforms (for example, internal devaluation as in the Eurozone).

The issue then becomes one of the relative merits of monetary policy viz fiscal policy for achieving that stimulus. But the general point is that stimulus wins and austerity fails in these circumstances.

Conclusion

What the hysteresis literature – both theoretical and applied – teaches us is that governments should do everything within their capacity to avoid recessions.

Not only does a strategy of early policy intervention avoid massive short-run income losses and the sharp rise in unemployment that accompany recession, but the longer term damage to the supply capacity of the economy and the deterioration in the quality of the labour force can also be avoided.

A national, currency-issuing government can always provide sufficient aggregate spending in a relatively short period of time to offset a collapse in non-government spending, which, if otherwise ignored, would lead to these damaging short-run and long-run consequences.

The ‘waiting for the market to work’ approach is vastly inferior and not only ruins the lives of individuals who are forced to disproportionately endure the costs of the economic downturn, but, also undermines future prosperity for their children and later generations.

The point is that:

… weak real activity may give rise to long-lived hysteresis effects in labor markets, thereby providing a strong motivation for governments to implement policies (fiscal or otherwise) to both check the magnitude of economic downturns and so limit the supply-side damage that occurs, and to later boost the pace of activity as the economy recovers to repair whatever damage has occurred.

Meanwhile the Eurozone continues to take exactly the opposite path and then turn the blame on ‘lazy Greeks who have excessively low public transport fares’ and a range of other (irrelevant) benefits.

A superb read, Bill.

I find it painful enough trying to point out this interdependence to people, it must be absolutely devastating as a professional economics professor to watch supposed intellectuals not understand what amounts to a very simple concept. I honestly don’t know how you do it.

Dear Bill

I knew a Croat from Bosnia who arrived in Canada in the 1990’s. He has a degree in mining engineering from the University of Sarajevo, but was unable to find a job in his field and ended up driving a cab. Well, about 2 years ago, he did find a job as a mining engineer. What happened? Did his skills improve? Did his experience grow? Was his degree suddenly seen as adequate? Of course not, what happened is that, due to the commodities boom, demand for mining engineers increased and this engineer suddenly became employable. People do lose some human capital when they are out of work, but if aggregate demand is high enough, companies will hire people who only need some retraining, as in the case of this Croat mining engineer.

There are limits of course. No economic boom will induce a firm to hire a complete innumerate as an accountant or an illiterate as a secretary. The preference of employers is for people who don’t need any training, the second option is to hire people who only need some retraining, and the third option should be to hire people who have easy trainability, which could be determined by an aptitude test.

Your argument that lowering all wages will not lead to increased employment because wages are an important component of aggregate demand is quite convincing. It is an example of the fallacy of composition. However, there is an exception. A country could increase employment in the export sector through wage restraint because it leads to lower unit labor costs. To make that work, the exchange rate should not be allowed to rise so that imports don’t increase. It is a policy of job creation through a trade surplus. It can work in a monetary union because within a monetary union the exchange rate between the members of the union is of course fixed. This is what countries like Germany and the Netherlands have done. It is of course a policy that has to fail in the end because no country can run large trade surpluses forever. When the trade surpluses end, the bloated export sector will shrink, and unemployment will increase.

Regards. James

“no country can run large trade surpluses foreve”

They can. But for every trade surplus there is an equal and opposite deficit. External balances sum to 0.

Hey bill, are you going to publish your thoughts on the 2015 Budget fairly soon? Looking forward to it, cheers.

Thoroughly and deeply scrutinised article again.

I wonder if that word “stimulus” is not part of the problem. Stimulants for many people have a bad emotional connotation, associations with things like crack cocaine and amphetamines and criminal drug pushing and the like.

Perhaps it would be better to talk about “putting the economy on an exercise program”, or “body building the economy” or something like that which, to my mind at least, is a rather better analogy to what government does when it injects money into the economy by things like infrastructure spending and job guarantees. Money, it seems to me, is rather like blood, it needs to be circulating to be effective. So perhaps instead of “giving the economy a stimulus” we might say we are “giving the economy a blood transfusion”.

Just idle thoughts…

James, with reference to your comment May 18, 14:34; here are some thoughts:

What seems to get lost when people are unemployed or underemployed for a time, are the skills basic to presenting oneself as an employable person. In the extreme example of someone who is a second or third generation welfare recipient, this can mean something as simple as an absence of learned basic personal grooming habits or presentable clothing. This is based on observations made by people who work in fields that place them in regular contact with those so disadvantaged.

There is a difference between a worker who has earned proffesional credentials, technical or otherwise, and someone without such credentials. The general knowledge gained through post secondary learning, in most cases remains relevant over a long time scale and most professionals keep up with advances in their field by following journals, taking courses, etc.

In the case of non credentialed workers however, the work environments and their requirements are in a state of continual flux. Even the changing regulatory environment places restrictions on who may perform certain tasks in the modern workplace. New certifications which did not exist in the past and seem to multiply by the day, represent impediments that grow by the day for unemployed workers. In the tight labor markets seen today, having a particular ticket which is usually obtained for free when working makes the difference between getting the job and not getting the job.

Also in this vein is the threat posed to labor by the complete loss of an entire industry which can occur in prolonged downturns, if you are an engineer in field x and field x suddenly does not exist in your country any more you must move to pursue that profession elsewhere, probably for less income. If you were an uncredentialled worker in field x who gained experience starting from scratch in field x were you worked for 25 years, it’s probable that you are SOL because you don’t have the option the engineer had and you find yourself among the unemployed pool of workers described above.

In the example you provided, an engineer driving a cab for many years was a tragic loss of output from that individual.

On the last point, I don’t think you could justify giving up monetary sovereignty simply to benefit from occasional trade surplus opportunities. The automaticity of the free floating currency as a universal balancing mechanism just seems far to effective to give up.

These idiots (supply side monetarists like our current government) are driving us into recession. With no change in this policy we will become like Greece, in total depression. It will only take about another decade of these policies to do this to Australia. I wonder if they will persist with these policies as our dive into permanent depression becomes manifest and obvious?

See the IFS report about Scotland and full fiscal autonomy what would be Scotland’s

debt to GDP ratio %

deficit to GDP ratio %

In 2020 if we took the IFS figures for arguements sake ?

Anyone any idea ?

Dear Derek Henry (at 2015/05/19 10:14)

And why would any of those ratios matter?

Wouldn’t it more interesting and relevant to wonder what their unemployment rate would be?

best wishes

bill

Dear J. Christensen

Some time ago, there was a real boom in a New England state. It became very easy to find a job there. The joke went that you can find a job in State X if you can pass the breathing test. In a very tight labor market, employers will become less choosy. Of course, when marginal people will be hired, their productivity can’t be very high. This is precisely the reason why neoliberals don’t like a tight labor. It increases the bargaining power of labor.

It is of course sad when skills become redundant or when a region is no longer attractive to investors. However, in a tight labor market, it becomes much easier to change one’s profession or move to another region.

As to trade surpluses, I’m strongly opposed to them. I merely pointed out that they can be used to reduce unemployment, but a condition is that the exchange rate is kept low, so that increased imports won’t destroy the jobs created by increased exports. It is a foolish policy, but not an impossible one, as the Dutch and Germans demonstrated since joining the euro.

Regards. James

“He shows that the proper handling of credit creation is the key to producing steady economic growth and recovery.

Werner, Richard (2005), New Paradigm in Macroeconomics, Basingstoke: Palgrave

Macmillan”

Dear James Schipper, in my reply to your first comment were I referred to a “tight labor market”, that should read tight job market, my mistake sorry.

My point is, that from my experience Bill correctly associates longterm unemployment with declining competitive ability of the workers. From an employers perspective this diminishes the pool of capable labor available. It’s a lose-lose scenario for labor and productive industry both. The greater good depends on building upon skills all around not letting them erode.

Employers obviously understand this because in my experience, they show a marked preference to hire workers away from another employer rather than hire either a worker fresh out of school or an experienced worker who has been unemployed for some time.

The net effects of the neo liberal political support for cheaper labor and zero responsibility for employers helping in maintaining a productive workforce are declining workforce productivity, loss of output, a decline in the quality of that output, declining markets for products, and increasing income inequality. These are all indications of declining economic conditions not improvements or progress.

Bill

I was wondering because if they are stupid enough to join the Eurozone in the future. They would have to run a below 60% of GDP debt ratio and sub 3% defict ratio.

Also I thought these figures are important. I’m sick of people throwing around the £7 billion figure without actually putting that figure into the correct context. The right wing press will use that figure against the SNP when it asks for Full fiscal powers. To try and scare Scottish voters from it.

Can you point me to some learning material that explains why the unemployment figure is more important than the debt and defict figures. As I thought the defict figure would be more important as under MMT would allow us to reduce unemployment if used correctly ?

Thanks

Derek.

“you point me to some learning material that explains why the unemployment figure is more important than the debt and defict figures. ”

You give tax cuts to the rich. They save it. Not much happens. Bigger ‘deficit.’ Govt borrows back the bank reserves voluntarily and swap cash for bonds.

If a good economy require 10% surpluses or 15% deficits it will need it.

Stop thinking about money. It’s always about *real resources* and we need to run our economy at full employment to make use of it. Money is but the lubricant on the wheels that turns the cogs.

Bob

Yeah that’s going to sell.

We are talking about 95% of the Scottish people not knowing how money is created.

What I want to see and hear is a concrete proposal from MMT theorists that they can understand. That rips the IFS a new arsehole.

For example

When the right wing press and other political parties attack the SNP and say full fiscal autonomy won’t work because by 2020 you will have a £20 billion black hole because the IFS says so. 95% of the Scottish people will believe that scenario.

I want the truth in simple terms to get out there that says the following..

Ignore the IFS it doesn’t matter what they say that £20 billion is only 10% of GDP with a defict % of X. Scotland can easily afford a 50% debt to GDP ratio as long as that extra spending is spent to achieve full employment and we print our own money, have our own central bank and full functional finance. As long as that extra spending does not go on raising asset prices we’ll be okay.

Something easy along those lines that stops the right wing press and their propaganda in their tracks.

Derek, I think you answered your own question.

Matthew

I’m not so sure I have.

If that is the debate the right wing press will win.

It needs to be explained in a way the 95% will understand it. The IFS needs to be explained away in the same way as the family run on tokens explains how money is created or how Warren monitises a room.

Also full fiscal autonomy still means us Scots will be under a system of the Bank Of England printing the money. We will be like the PIGS in the Eurozone.

“Also full fiscal autonomy still means us Scots will be under a system of the Bank Of England printing the money. We will be like the PIGS in the Eurozone.”

Nobody here is advocating it other than you James.