At the moment, the UK Chancellor is getting headlines with her tough talk on government…

Options for Europe – Part 87

The title is my current working title for a book I am finalising over the next few months on the Eurozone. If all goes well (and it should) it will be published in both Italian and English by very well-known publishers. The publication date for the Italian edition is tentatively late April to early May 2014.

You can access the entire sequence of blogs in this series through the – Euro book Category.

I cannot guarantee the sequence of daily additions will make sense overall because at times I will go back and fill in bits (that I needed library access or whatever for). But you should be able to pick up the thread over time although the full edited version will only be available in the final book (obviously).

Part III – Options for Europe

[THIS IS THE LAST SUBSTANTIVE CHAPTER – IT INTRODUCES THE APPROACH THAT THE EURO LEADERS HAVE TAKEN AND WHY A DRAMATIC CHANGE IN POLICY IS REQUIRED – IT LEADS INTO THE FINAL SEVERAL CHAPTERS WHICH DISCUSS THE SPECIFIC OPTIONS – WHICH YOU HAVE ALREADY READ. I WILL FINISH THIS CHAPTER BY THE END OF THE WEEKEND AND THEN NEXT WEEK WRITE THE INTRODUCTION AND START CHECKING]

Chapter 18 The European Groupthink – failing to take the correct path

[PRIOR MATERIAL HERE]

[NEW MATERIAL TODAY]

Appeasing the bond markets

The willingness of the political leaders in Europe to go as supplicants to the altar of the bond markets became a repetitive theme from the early days of the crisis. The ECB boss Jean Claude Trichet claimed that the “first necessary” thing the euro-zone nations had to do was “to adopt a fiscal policy that would enable them to convince all market participants”. Austerity was promoted as the only way to keep bond markets investing in the governments. The corollary of this view, also often repeated to the point of nauseum, was that Country X (say America) would soon be heading down the Greek path if it didn’t radically cut its fiscal deficit. The so-called historian Nial Ferguson was often featured by the conservative media claiming that the “situation of the United Kingdom in fiscal terms is in fact worse than the situation of Greece … Britain has a massive fiscal crisis that is just about to break” (Daily Dish, 2010). The commentators were so focused on misnomer that they successfully prevented the public from understanding the real nature of the problem – which was the euro itself rather than the size of the deficits.

As the hysteria reached crescendo proportions, a London banker Steven Major wrote in the Financial Times that a spreading of euro-zone public debt crisis to countries such as the US, UK and Japan was “not going to happen … because the obsession with public debt ratios fails to distinguish between different levels of sovereignty. The US, UK and others can maintain high public debt ratios for longer, especially given the amount of deleveraging being carried out by the private sector.” The likes of Ferguson and company had consistently demonstrated a flagrantly ill-conceived view of how monetary systems operate. The reason that the ‘UK cannot turn into Greece’ is that “US, UK, Japan and Canada are examples of what I call ‘true sovereigns’. For these countries there is zero default risk. Investors should not worry about credit fundamentals, as they will always receive their coupons and original investment on redemption” (Major, 2010). In Chapter 17, we introduce the notion of a sovereign nation, which issues its own currency at will and floats it on international currency markets. Liabilities issued by such a government are risk free and the central bank can always usurp the demands for higher yields from the private bond markets on debt being issued. Further, as we discuss in Chapter 21, such a government doesn’t even need to issue debt in order to spend its own currency.

The eurozone national government debt ‘spreads’ (the interest they had to pay bond investors relative to that paid by the German government on their issued bonds) rose sharply as the crisis unfolded because the bond investors knew that such debt carries default risk. Major (2010) concluded that “The countries that adopted the single currency immediately relinquished some policy sovereignty”. The problem was (and is) the euro and the flawed way in which the monetary system was designed and the unworkable restrictions that were placed on governments within it. Given the overriding ‘cultural’ loathing of any ECB support for deficits, the EMU is a system where national fiscal deficits cannot go high enough to provide stability and maintain viable banking systems, in the face of a major collapse in private spending.

The bailouts – on a hiding to nothing

On a hiding to nothing … “to be trying to do something when there is no chance that you will succeed” (Cambridge Dictionary, Cambridge University Press).

Faced with nations unable to fund themselves but with pending liabilities maturing and the obvious need to keep such nations solvent, the focus turned to bailouts. These interventions were marked by their counterproductive conditionalities and the trampling of the democratic rights of citizens by unelected and unaccountable multilateral institutions such as the IMF. A new European bully formed – the so-called Troika (the European Union, the ECB and the IMF), to spearhead the austerity push. On May 9, 2010, the European Council (through Ecofin) resolved to create the European Financial Stability Facility (EFSF), which would be its bailout vehicle in co-operation with the IMF. It was replaced in October 2012 by the permanent rescue vehicle, the European Stability Mechanism (ESM). Both institutions share the same flaws.

The very idea of a bailout seemed at odds with Article 125 of the Treaty – the ‘no bailout’ clause. The question then was why impose one of the Treaty rules (the SGP) yet violate another, especially when the rule being enforced will have severe consequences for economic growth and living standards? Such inconsistencies were rife during this period of European history as the ideologues who designed the rules came against the reality of the system collapsing altogether. Ultimately, pragmatism reigned supreme (providing funds to troubled nations) but it was so tainted by the ideology (insistence on unsustainable conditionality) that the interventions just made matters worse.

The first major bailout came in May 2010, when Greece was given a three-year €110 billion loan from the Troika with strict conditions attached. Greece was compelled to reduce its deficit by 15 per cent of GDP within three-years, which was nearly an impossible task. The terminology was that the fiscal policy changes were “frontloaded with measures of 71⁄2 percent of GDP in 2010, 4 percent of GDP in 2011, and 2 percent of GDP in 2012 and 2013, each, to turn around the fiscal position and help place the debt ratio on a downward path” (IMF, 2010: 1). It was likely that the austerity plan would, in fact, increase the deficits given the loss of tax revenue that would accompany the output and employment losses.

The austerity package was breathtaking in its severity. Reflecting on the bailout conditions, astute British journalist Larry Elliot wrote that “Deadly riots. Public sector unions taking to the streets. An austerity package of mouthwatering severity. The news from Athens last week could mean only one thing: the International Monetary Fund had been in town.” (Elliot, 2010). The Troika demanded that public sector pay be cut by around 18 per cent and pensions cut by 10 per cent, that wages and pensions be subject to a three-year freeze, that taxes on fuel, alcohol and tobacco be increased by 10 per cent and across-the-board VAT increases of 2 per cent be imposed, among other measures. When announcing the terms of the bailout to the Greek people, Prime Minister George Papandreou wore a dark purple coloured tie, the colour that Greeks wear to funerals. In a short-time, the Troika would get rid of Papandreou and put one of ‘their men’ into the role – the central banker Lucas Papademos. Never mind what the people who vote might think!

Key personnel in the Troika were unflinching in their belief that austerity would be good for Greece. Soon after the bailout was pushed onto Greece, the centre-left Parisian daily newspaper published an interview with ECB President Jean-Claude Trichet. He was asked whether the austerity plans “pose the risk of killing off the first green shoots of growth” (Quatremer, 2010), to which he replied:

It is an error to think that fiscal austerity is a threat to growth and job creation. At present, a major problem is the lack of confidence on the part of households, firms, savers and investors who feel that fiscal policies are not sound and sustainable. In a number of economies, it is this lack of confidence that poses a threat to the consolidation of the recovery. Economies embarking on austerity policies that lend credibility to their fiscal policy strengthen confidence, growth and job creation.

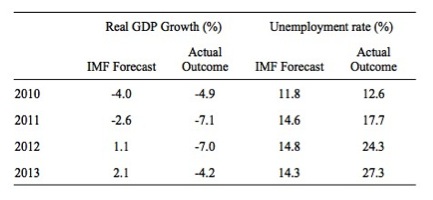

The IMF had the audacity to put numbers to this Ricardian nonsense and predicted that by 2012, Greece would return to increasingly robust growth. The IMF (2010: 8-9) predicted growth would follow a “V-shaped pattern” and that “the frontloaded fiscal contraction in 2010-11 will suppress domestic demand in the short run; but from 2012 onward, confidence effects, regained market access, and comprehensive structural reforms are expected to lead to a growth recovery. Unemployment is projected to peak at nearly 15 percent by 2012”. As Table 16.1 shows the the IMF growth forecasts were for a contraction of 4.0 per cent in real GDP in 2010, followed by minus 2.6 per cent in 2011 with a 1.1 per cent positive growth rate in 2012. For unemployment, the IMF forecasted that the unemployment rate would be 11.8 per cent in 2010, 14.6 per cent in 2011, 14.8 per cent in 2012 then falling to 14.3 per cent in 2013. What actually happened? The forecasts they had use to justify their harsh austerity package for Greece were not even in any reasonable ballpark. Moreover, the actual outcomes shown in the Table were more in keeping what a reasoned assessment of the situation would have provided. Cuts that deep and that quick would devastate both public and private spending and lead to a Depression with very high unemployment. Even in April 2014, the Greek national unemployment rate remains at 26.5 per cent.

Table 16.1 IMF forecasts for Greece and reality

Source: IMF (2010), Eurostat.

There is a sequel to this part of the story. As the Troika were busily imposing austerity on beleaguered European nations, such as Greece and Portugal, the IMF consistently claimed that their ‘modelling’ showed that if governments cut their fiscal deficits quickly, private sector spending would respond and growth would soon return. In the IMF’s October 2012 World Economic Outlook, we learned that their past recommendations for fiscal austerity in Europe, which conditioned, for example, the harsh terms embedded in the Greek bailout packages, were based on ‘modelling errors’. They admitted, “that actual fiscal multipliers have been larger than forecasters assumed” (IMF, 2012: 43). Fiscal multipliers tell us what will happen to total spending (both public and private together) for every extra $1 of public spending. The IMF had assumed that they were very low (below 1) so that cutting public spending would actually lead to higher total spending. In October 2012, they admitted that the ‘multipliers’ were well in excess of 1, which means that if the government cuts spending by 1 Euro, the total decline in spending and output will be well in excess of that. The reality told us that would be the case. More credible economic modelling (such as that by MMT economists) told us that would be the case. But the neo-liberal biases in the IMF models simply refused to allow that to be the case because it would have been inconvenient to their ideologically motivated desire to cut deficits and reduce the size of government. So the combination of some shoddy spreadsheet manipulation, incompetence from the IMF, and the usual European Groupthink justified policies that have led to millions of people losing their jobs – unnecessarily!

In June 2013, the IMF released a suite of new reports on Greece. At the press conference accompanying the release the head of the IMF Greek Mission Poul Thomsen was asked “Is it true that the IMF admits mistakes on the Greek bailout?” (IMF, 2013a). Thomsen replied:

Sure. There is in this bundle of papers, there is a discussion of the past and, in the context of the Article IV Consultation, a full report … And, sure, in reviewing what we have done the whole time, there are certainly things we could have done differently. We already had that debate six months ago on these multipliers and that if we should do it again, we would not use the same multipliers.

The accompanying report (IMF, 2013b) admitted that the IMF had altered its own rules in order to provide the bailout. It was clear to them from the outset that the austerity program would not reduce the Greece’s public debt ratio, which was one of four criteria that the IMF rules dictate must be satisfied in order to provide funding. They proceeded not as a result of any concern for what the austerity would do for Greece but “because of the fear that spillovers from Greece would threaten the euro area and the global economy” (p.10). Defending the interests of international capital has always been a priority of the IMF even if the welfare of ordinary citizens is compromised. Extraordinarily, the IMF also admitted that in retrospect Greece actually failed to meet three of the four criteria for funding (p.29), which indicates how poor the initial assessment was, in part, because the “negotiations took place in a very short period of time” (p.49). The IMF has a history of parachuting officials into nations who within a day or so come up with radical structural adjustment programs, which ravage the local economy. The neo-liberal free market paradigm is seen as being a ‘one-sized-fits-all’ solution, irrespective of the circumstances.

Finally, the huge IMF forecasting errors in relation to Greece were not one-off incidents. While forecasting errors are a fact of life, the IMF and other major neo-liberal inspired organisations produce systematic errors, which means they consistently make the same errors, which are easily traced to the underlying ideological biases, which shape the way they create their economic models. Thus, the IMF typically overstates the benefits of austerity and understates the costs. Further, they also overstate the inflationary impact of fiscal deficits. Each systemic error reinforces their free market approach. Yet, each systematic error also demonstrates the poverty of that approach. As we noted earlier, any major professional group exhibiting this level of incompetence would be stripped of their right to practice and open to major legal suits for damages and imprisonment. In the case of Greece, the damage caused by the IMF errors were massive. Some IMF officials, at the very least, should have gone to jail given that the damage that the institution has caused dwarfs that of fraudsters such as Bernie Madoff who was sentenced to 150 years imprisonment for his criminality.

The Greek government also committed to a €50 billion privatisation program. And it was here that things turned decidedly nasty with the ugly German coming to the fore. While the Greek government was hacking into the welfare of its people in return for the bailout funds, the Germans considered the austerity measures were “das nicht mal ein Tropfen auf den heißen Stein” (“not even a drop in the bucket”) (Bild, 2010). The headlines in the downmarket German tabloid Bild headlines screamed “Die Regierung in Athen will jetzt kräftig sparen – aber was, wenn das nicht reicht?Verkauft doch eure Inseln, ihr Pleite-Griechen … und die Akropolis gleich mit!” (Bild, 2010), which demanded that Greece should not stop at selling its islands but should also sell the Acropolis! Josef Schlarmann, a senior politician in Angela Merkel’s Christian Democrats, captured the German sentiment when he likened the Greek situation to that of a bankrupt individual. He told the press that “Ein Bankrotteur muss alles, was er hat, zu Geld machen – um seine Gläubiger zu bedienen. Griechenland besitzt Gebäude, Firmen und unbewohnte Inseln, die für die Schuldentilgung eingesetzt werden können” (Bild, 2010), and so Greece should sell its buildings, companies and uninhabited islands. Obviously, Dr Schlarmann didn’t realise that a nation can never be like a company because regardless of any (imprudent) voluntary arrangements the government has entered into – such as pegging its currency, borrowing in foreign currency, dollarising, joining a monetary union with a single currency – the nation can withdraw from those arrangements at any time by reintroducing its own floating currency and restructuring all its liabilities in that currency. That was an option the Germans didn’t want Greece to take, given the exposure of the German (and French) banks to the Greek government debt. By 2011, this “crass populism” (Economist, 2011) had become the standard ‘sell, sell, sell’ rhetoric of Europe’s finance ministers, led by none other than Christine Lagarde. The IMF were relatively silent at this point given that its boss, Dominique Strauss-Kahn was languishing in an American jail on sexual assault charges. But its delegation to Greece earlier in the year had stressed that more “structural reforms” were required and that an acceleration of the “privatization program” was essential (IMF, 2011).

[TOPICS LEFT TO COVER IN THIS CHAPTER – THE BAILOUTS, THE FISCAL COMPACT AND THE EXPORT-LED GROWTH MANIA]

Additional references

This list will be progressively compiled.

ABC (2010) ‘Interview with Christine Lagarde’, This Week, October 10, 2010. http://abcnews.go.com/ThisWeek/video/interview-christine-lagarde-france-finance-minister-christiane-amanpour-stimulus-europe-11844525

ABC (2011) ‘Europe on verge of fiscal union: Merkel’, Australian Broadcasting Commission, December 2, 2011. http://www.abc.net.au/news/2011-12-02/europe-on-verge-of-launching-27fiscal-union27/3710252

Australian Treasury (2009) ‘The Return of Fiscal Policy’, Presentation to the Australian Business Economists Annual Forecasting Conference, Sydney, December 8, 2009. http://www.treasury.gov.au/documents/1686/HTML/docshell.asp?URL=Australian_Business_Economists_Annual_Forecasting_Conf_2009.htm

Barber, L. and Barber, T. (2008) ‘Barroso warns on protectionist pressures’, Financial Times, March 2, 2008. http://www.ft.com/intl/cms/s/0/3ab2bf90-e8a1-11dc-913a-0000779fd2ac.html

Bild (2010) ‘Verkauft doch eure Inseln, ihr Pleite-Griechen’, October 27, 2010. http://www.bild.de/politik/wirtschaft/griechenland-krise/regierung-athen-sparen-verkauft-inseln-pleite-akropolis-11692338.bild.html

Blinder, A. and Zandi, M. (2010a) ‘How the Great Recession Was Brought to an End’, July 27, 2010. https://www.economy.com/mark-zandi/documents/End-of-Great-Recession.pdf

Blinder, A. and Zandi, M. (2010b) ‘Stimulus Worked’, Finance and Development, December, 14-17. http://www.imf.org/external/pubs/ft/fandd/2010/12/pdf/Blinder.pdf

Blyth, M. (2013) Austerity: The History of a Dangerous Idea, New York, Oxford University Press.

Boone, P. and Johnson, S. (2010) ‘Irish Miracle – or Mirage?’, New York Times, May 20, 2010.

Cassidy, J. (2010) ‘Interview with Eugene Fama’, The New Yorker, January 13, 2010. http://www.newyorker.com/online/blogs/johncassidy/2010/01/interview-with-eugene-fama.html

Cassidy, J. (2013) ‘Why is Europe so messed up? An illuminating history’, The New Yorker, May 20, 2013. http://www.newyorker.com/online/blogs/johncassidy/2013/05/austerity-an-irreverent-and-timely-history.html

Cochrane, J. (2009) ‘Fiscal Stimulus, Fiscal Inflation, or Fiscal Fallacies?’, mimeo, February 27, 2009. http://faculty.chicagobooth.edu/john.cochrane/research/papers/fiscal2.htm

Congressional Budget Office (2011) ‘Estimated Impact of the American Recovery and Reinvestment Act on Employment and Economic Output from October 2010 Through December 2010’, Washington, D.C., February. http://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/120xx/doc12074/02-23-arra.pdf

CSO (2013) ‘Population and Migration Estimates’, CSO statistical release, August 29, 2013. http://www.cso.ie/en/releasesandpublications/er/pme/populationandmigrationestimatesapril2013/#.U3lhlsdy4qw

Daily Dish (2010) ‘Is The UK Worse Than Greece?’, The Atlantic, Published May 3, 2010. http://www.theatlantic.com/daily-dish/archive/2010/05/is-the-uk-worse-than-greece/187479/

ECB (2010) Monthly Bulletin, June 2010. http://www.ecb.europa.eu/pub/pdf/mobu/mb201006en.pdf

Economist (2010) ‘Fear Returns: Governments were the solution to the economic crisis. Now they are the problem’, May 27, 2010. http://www.economist.com/node/16216363

Economist (2011) ‘Sell, sell, sell’, May 16, 2011. http://www.economist.com/blogs/charlemagne/2011/05/greece_and_euro_1

Elliot, L. (2010) ‘IMF has one cure for debt crises – public spending cuts with tax rises’, The Observer, May 9, 2010. http://www.theguardian.com/business/2010/may/09/greece-debt-crisis-imf-european-commission

European Commission (2008) ‘Autumn economic forecast 2008-2010’, IP/08/1617, Brussels, November 3, 2008. http://europa.eu/rapid/press-release_IP-08-1617_en.pdf

European Council (2010) ‘Statement by the Heads of State and Government of the Euro Area’, Brussels, March 25, 2010.

Federal Reserve Bank (2007a) ‘Press Release’, August 7, 2007. http://www.federalreserve.gov/newsevents/press/monetary/20070807a.htm

Federal Reserve Bank (2007b) ‘Press Release’, August 10, 2007. http://www.federalreserve.gov/newsevents/press/monetary/20070810a.htm

Federal Reserve Bank (2007c) ‘Press Release’, August 17, 2007.

http://www.federalreserve.gov/newsevents/press/monetary/20070817b.htm

Feyrer, J. and Sacerdote, B. (2011) ‘Did the Stimulus Stimulate? Real Time Estimates of the Effects of the American Recovery and Reinvestment Act’, Working Paper 16759, National Bureau of Economic Research.

G20 (2009) ‘G-20 Leaders Statement’, The Pittsburgh Summit, September 24-25, 2009. http://www.oecd.org/g20/meetings/pittsburgh/G20-Pittsburgh-Leaders-Declaration.pdf

G20 (2010a) ‘G-20 Toronto Summit Declaration’, June 26-27, 2010. https://www.g20.org/sites/default/files/g20_resources/library/Toronto_Declaration_eng.pdf

G20 (2010b) ‘Communiqué, Meeting of Finance Ministers and Central Bank Governors’, Gyeongju, Republic of Korea October 23, 2010. https://www.g20.org/sites/default/files/g20_resources/library/Communique_of_Finance_Ministers_and_Central_Bank_Governors_Washington_D.C._USA_April_23.pdf

G20 (2010c) ‘The G-20 Seoul Summit Leaders’ Declaration’, November 11-12, 2010. https://www.g20.org/sites/default/files/g20_resources/library/Seoul_Summit_Leaders_Declaration.pdf

Guardian (2010) ‘Germany joins EU austerity drive with €10bn cuts’, June 7, 2010. http://www.theguardian.com/business/2010/jun/06/germany-deficit-greece-privatisations

ILO (2010) Recovery and growth with decent work, International Labour Conference, 99th Session, 2010, Geneva, June 18, 2010. www.ilo.org/wcmsp5/groups/public/—ed_norm/—relconf/documents/meetingdocument/wcms_140738.pdf

IMF (2010) ‘Greece: Staff Report on Request for Stand-By Arrangement’, IMF Country Report No. 10/110, May. http://www.imf.org/external/pubs/ft/scr/2010/cr10110.pdf

IMF (2011) ‘Statement by the European Commission, the ECB and IMF on the Fourth Review Mission to Greece’, Press Release No.11/212, June 3, 2011. http://www.imf.org/external/np/sec/pr/2011/pr11212.htm

IMF (2012) World Economic Outlook (WEO) October 2012, Washington D.C. http://www.imf.org/external/pubs/ft/weo/2012/02/pdf/text.pdf

IMF (2013a) ‘Transcript of a Conference Call on Greece Article IV Consultation’, Washington, D.C., June 5, 2013. http://www.imf.org/external/np/tr/2013/tr060513.htm

IMF (2013b) ‘Greece: Ex Post Evaluation of Exceptional Access under the 2010 Stand-By Arrangement’, IMF Country Report No. 13/156, June. http://www.imf.org/external/pubs/ft/scr/2013/cr13156.pdf

Issing, O. (2010) ‘Europe cannot afford to rescue Greece’, Financial Times, February 15, 2010.

Major, S. (2010) ‘True sovereigns’ immune from eurozone contagion’, Financial Times, August 16, 2010. http://www.ft.com/intl/cms/s/0/e8a3cc8c-a958-11df-a6f2-00144feabdc0.html

Morris, N. and Andrew Grice, A. (2009) ‘Brown’s assignment for next G20 meeting: a blueprint for IMF reform’, The Independent, April 4, 2009.

Münchau, W. (2009) ‘Diverging deficits could fracture the eurozone’, Financial Times, October 4, 2009.

Osborne, G. (2006) ‘Look and learn from across the Irish Sea’, The Times, February 23, 2006.

Quatremer, J. (2010) ‘Interview with Libération’, July 8, 2010. http://www.ecb.europa.eu/press/key/date/2010/html/sp100713.en.html

Sheehan, P. (2010) ‘Greece laid low by its decadence’, Sydney Morning Herald, May 15, 2010. http://www.smh.com.au/federal-politics/political-opinion/greece-laid-low-by-its-decadence-20100516-v66z.html

Sinn, Hans-Werner (2010) ‘How to Save the Euro’, The Wall Street Journal, April 20, 2010.

Traynor, I. (2010) ‘Eurozone leaders lock horns over whether to rescue Greece’s economy’, The Guardian, March 25, 2010. http://www.theguardian.com/business/2010/mar/24/eurozone-leaders-greece

Trichet, J.C. (2010a) ‘Stimulate no more – it is now time for all to tighten’, July 22, 2010. http://www.ft.com/cms/s/0/1b3ae97e-95c6-11df-b5ad-00144feab49a.html

Trichet, J.C. (2010b) ‘Central banking in uncertain times: conviction and responsibility’, Speech at the symposium on Macroeconomic challenges: the decade ahead, Jackson Hole, Wyoming, August 27, 2010. www.ecb.int/press/key/date/2010/html/sp100827.en.html

UNCTAD (2010) ‘Trade and Development Report, 2010, United Nations Conference on Trade and Development, New York. http://unctad.org/en/Docs/tdr2010_en.pdf

Walker, M. and Davis, B. (2010) ‘Germany Backs European Version of IMF’, Wall Street Journal, March 8, 2010. http://online.wsj.com/news/articles/SB10001424052748704706304575107814218903120

World Bank (2010) Global Economic Prospects 2010, International Bank for Reconstruction and Development/The World Bank, Washington, D.C. http://siteresources.worldbank.org/INTPROSPECTS/Resources/334934-1322593305595/8287139-1322593351491/GEP2010bFullText.pdf

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

This Post Has 0 Comments