My blog is on holiday until Tuesday, January 6, 2026. We are planning to finish…

Travelling back

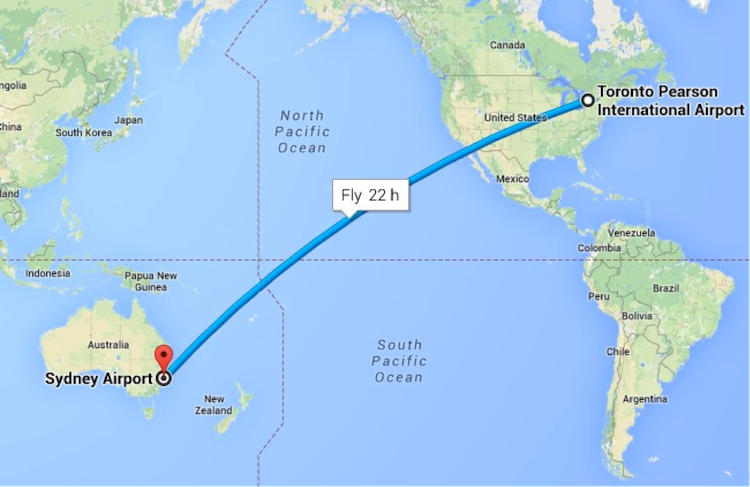

In case you are wondering why there is no update to my blog today – the answer is that I am travelling all day.

I have been travelling to Canada today and blogs for the next week might appear at strange times – given the time difference and my other commitments.

In the next 24 hours or so I will have limited capacity to respond to E-mails and moderate any comments. I moderate all comments which contain links so if it is sitting in the queue for some time you will understand why.

iNET Panel session

While in Canada I was an invited speaker at the – 2014 Annual Plenary Conference – of the Institute of New Economic Thinking.

The session was entitled – Integration, Currency Unions and Balance Payments. This video covers the whole session including the discussion at the end moderated by CBC’s Amanda Lang.

My formal presentation starts around the 11:30 minute mark.

The speakers in order are:

- Peter Temin – MIT

- William Mitchell – University of Newcastle and CDU

- Richard Koo – Nomura

- Martin Wolf – Financial Times

I will be back in action Tuesday, April 15.

Bill, I think your presentation was excellent. There was a very little evidence of jet-lag fog early on then you rapidly got into your stride. Why do I consider it excellent?

(1) The presentation was well paced. Many presenters actually go a bit slow. A brisk presentation without garbling keeps the listener interested; no time to get bored. I rate myself as a layperson in economics albeit one who takes a lot of interest in historical and contemporary economics. I possibly equal a passed first year economics student in general knowledge without the maths component and without some of the technical knowledge and jargon. At that level your presentation made perfect sense to me and was well paced.

(2) The placing of the whole Euro enterprise in historical context made matters much more illuminating. One could understand why things happened, why they occurred at certain times and why they followed in their particular sequences. I subscribe to the view that the real object of study here is political economy not merely economics. Painting the historical and national contexts of developments assists in developing the holistic picture of events. I also agree with the idea of including a general view of geopolitical and geostrategic influences on economics.

(3) I also found the presentation well structured. The stages of the argument were clear and each stage logically followed previous stages.

(4) We are all a little prone (as audiences) to find technical details dry and human interest material interesting. Historical detail, national detail and mention of key historical figures, all in the service of giving the necessary historical context, help carry us along because it lends human interest to the economic story. Perhaps it even does something more important than that. It humanises economics which of course is exactly what needs to happen to modern economics. We need to remember it is really about people and not about national balance sheets.

Thanks for an excellent presentation. I will soon watch the presenters coming after you.

Actually, the point that stood out the most, for me, was the “hypocrisy & austerity” promoted & led by the largest German industrial, Volkswagen, against it’s own citizens & employees – in the form of an “internal devaluation” of labor wages.

And the vaunted German trade unions accepted serfdom, “on behalf” of their working class members.

And all for what? To maintain Germany’s right to send things to other countries?

These people can build CERN, and they can’t figure out anything better to do with themselves than the S&G pact? That smacks of a pack of Central Planners failing, and urging one another to “slow down” the serfs, Tsar-style.

As the other comments (here & at MNE) indicate, the original issue runs far deeper than just the economics profession. Nevertheless, the main tool in the farce seems to be the systematic misuse of “economic theory” to miseducate whole electorates, and trap them into lower adaptive rates.

What, exactly, are they afraid of? The future? None of this makes any sense.

Except as another setback for SETI. In retrospect, it’s downright embarrassing.

Superb presentation Bill.

Can’t wait for the book.

In a recent article, Martin Wolf hinted that he is coming out in support of government use of money creation (last line):

http://www.ft.com/intl/cms/s/0/46a1ce84-bf2a-11e3-a4af-00144feabdc0.html?siteedition=intl

Given his position, as editor of the Financial Times, this seems to be a Very Big Deal – that could contribute quite a lot to advancing MMT-type views into the mainstream; what do you make of that? (did you get a chance to talk to him at all?)

“Given his position, as editor of the Financial Times, this seems to be a Very Big Deal”

That depends. The political elite in the UK prefer the government to be servile to an autocratic ‘Cabal of the Elite’ that actually hold the purse strings.

So really its the next stage of ‘independent central banks’, except that rather than setting just the interest rate, they try and set the quantity of money again in a centralised fashion – with a bunch of Very Clever People sitting there deciding what needs doing.

It fails the ‘Wisdom of Solomon’ test (there isn’t anybody with it, so don’t design a system that requires it), as well as #5 in Tony Benn’s ‘questions of power’ (How do I get rid of them?). And it is that question that defines whether you live in a democracy or not.

We already have a decision making body in a democracy. It’s called parliament, and whatever budget or directives parliament passes should be implemented without question by the monetary system. Because parliament is the democratically elected representative of the people.

The overwhelming nature of progressive politics, certainly in the UK, is towards increased centralisation and neutralisation of democratic institutions. Whether that is by size (like the EU project), or by delegating significant chunks of governments responsibility to autocratic unelected bodies.

In other words towards more Authoritarianism – as defined by the Political Compass – which has been the general trend in political thinking over recent decades.

Incisive comment as always, Neil. Why not flesh it out in a post at your place. It is the central issue of the time and the basis of neoliberalism, which is liberal in name only. It’s a subterfuge for elite rule and creeping authoritarianism, and it is the elite agenda for globalization that avoids the pesky issue of democracy for them. It’s based on the conservative principle that some are better than others and deserve more wealth and power.

Reply to Neil Wilson. All the things you say are true. Do they not indicate that we have a bourgeois democracy not a true democracy? I agree with Prof. Richard D. Wolff. We will not have democracy until we have workplace democracy and worker co-operatives not capitalist corporations. There is no need for an owning class and there is no need for a managerial class. The workers need to be the owners and managers. Only then will democracy be truly establised. How is a society democratic when a key, defining and sustaining part of everyday life, namely paying work, is spent being autocratically controlled by owners and managers?

Neil Wilson: Interesting comment, but I’m curious, once the idea of government use of money creation becomes credible (which seems to be the direction Martin Wolf is heading), would it not allow a reversal of neoliberal privatization, now that the usual “government can not afford ‘x’, so must privatize services and sell assets” line of argument would become obsolete?

So, I don’t understand how where Martin Wolf is heading, may lead to the next stage of ‘independent central banks’ – rather than something approaching an abolition of them?

“now that the usual “government can not afford ‘x'”

The process is more nuanced than that. There is still an attempt at separation in the proposals between ‘Money Creator’ (aka the central bank) and ‘government’ (aka the Treasury with an account at the central bank under instruction from the government of the day).

The proposals as they stand denigrate politicians. They are Not To Be Trusted (™). So what you have instead are a bunch of unelected Very Clever People at the central bank who determine how much money will be put into the Treasury’s bank account.

The implication is that even though the government has had its Finance Bill passed in the House of Commons (the UK’s primary chamber), and even though the constitution of the UK states that the Upper House *will not stand in the way of the elected government’s Finance Bill* (they just wave it through), the bunch of Very Clever People at the central bank can refuse to release the money for it. Essentially they can bounce the government’s cheques.

That is one of two things: a recipe for a constitutional crisis, if the bouncing of the cheque is a genuine threat, or pointless theatre involving paying some people a rather large amount of money to sit in a room and produce grand sounding reports that have no teeth (much like the ‘Office of Budget Responsibility’, or the US ‘social security’ fund) if ultimately the central bank is going to pay whatever Treasury demands.

The correct approach is for the members of parliament to obtain the reports of Very Clever People *prior* to the vote in the Commons and enter it into the debate in the Chamber. And then if the Commons votes on the Finance Bill despite that, the monetary system should just execute the will of parliament without question – whatever the consequences. The elected members will then answer for their actions at the ballot box.

It needs to be made clear to the country that the government is in charge and no unelected bureaucrat can legitimately stand in the way of the elected will of the people. Because the unelected bureaucrats have no more idea about what is going to happen in the economy than anybody else.

Neil, again true although the UK does not have a written constitution.

“Unlike many other nations, the UK has no single constitutional document. This is sometimes expressed by stating that it has an uncodified or “unwritten” constitution. Much of the British constitution is embodied in written documents, within statutes, court judgments and treaties. The constitution has other unwritten sources, including parliamentary constitutional conventions (as laid out in Erskine May) and royal prerogatives.” – Wikipedia.

You haven’t addressed my statement that we (meaning all so-called democracies) do not have genuine democracy yet but still bourgeois democracy. Whilst wealth and privilege continue to have a distorting effect and diluting effect on representative democracy and while the entire workaday world is autocratically run not democratically run then we are not genuine democracies.

“Neil, again true although the UK does not have a written constitution.”

I’m well aware of that. It’s deliberately unwritten so that the conventions can change over time – much as precedents adjust the interpretation of the law. That way you don’t have obsolete elements getting in the way of progress (the ‘right to bear arms’ for example).

If you live in the UK and watch these things then the current constitution is fairly clear in the way people behave and the way it changes subtly over time is quite interesting as well. But the primacy of the elected chamber is never in question.

Neil: Very interesting points, I’ve never thought about how government use of money creation could ‘go wrong’ like that, and end up being reconfigured into a system which still allows undemocratic control/restrictions over money creating powers.

Is there somewhere I can read more on this – descriptions/examples of the different ways, trying to achieve monetary reform (or government use of money creation), could be hijacked and used to bolster current powers still?

It’s an interesting topic, and probably one that is important to be discussed more widely, now that ideas behind monetary reform seems to be gaining more ground.

totally agree with johnb and tom hickey above. would be nice if you, neil, would “flesh it out” further on your blog.

i think that what you discuss above is THE PROBLEM and it would be nice if MMT’ers could deal with this in a comprehensive way to show why things are the way they are today.

Ikonoclast: “You haven’t addressed my statement that we (meaning all so-called democracies) do not have genuine democracy yet but still bourgeois democracy. Whilst wealth and privilege continue to have a distorting effect and diluting effect on representative democracy and while the entire workaday world is autocratically run not democratically run then we are not genuine democracies.”

The US Constitution has been considered the paradigm for liberal democracy almost since the inception of the US. However, the US Constitution instituted a republic that the record of debate during the process shows that the founders intentionally constructed a republic that would be controlled by a propertied elite for fear that a more popular and participatory democracy would result in mob rule under a rabble. During the subsequent setting up of principal institutions, there was also a controversy over centralization (Alexander Hamilton) and decentralization (Thomas Jefferson and James Madison). Hamilton won the argument by arguing that a strong national government was required to address international issues. Madison was largely won over but Jefferson never agreed. These issues have affected not only the subsequent development of the US and are also still to the fore today. This is true not only in the US but globally as “the American way” dominates globalization.

Here is part of comment I posted on this at MNE this am.

In the final analysis, I think that the US Constitution is a product of its time and therefore obsolescent. It’s the obsolescence that is resulting in many contemporary problems that ongoing interpretation has not been able to overcome.

Moreover, the judicial process has now been thoroughly politicized so that the system of checks and balances is breaking down. I think that SCOTUS acted suicidally in Bush v. Gore. It’s lost credibility as impartial justice. This is a raging topic in philosophy of law and constitutional law now.

The US Constitution has more or less been the paradigm for liberal democracy for several hundred years and conservatives think that it just remain the paradigm for globalization since it guarantees the class structure and power structure that ensure their continuing control of the political process nationally and globally.

A great deal of this debate is yet to be conducted but it will be as the East and West merge into a global culture that reflects the values of both.

But we need to begin having it now rather than thinking that we just need a few tweaks here and there to make the process work when the process is broken beyond repair.

Yuu Kim: “it would be nice if MMT’ers could deal with this in a comprehensive way to show why things are the way they are today.”

MMT can only address this partially. Even economics as a discipline can only address it partially. This is in issue in social and political philosophy that has been debated for millennia. The present solution, neoliberalism, now that communism has been eliminated as an option is simply assumed, and it is assumed because it has been imposed and rationalized by the elite it benefit through an intelligentsia that it rents and institutions like education and the media that it controls.

The issue is what kinds of societies are possible. According to neoliberalism, there is no practical alternative to neoliberal social, political and economic theory, as Margaret Thatcher announced while holding up a copy of Hayeks’ The Road to Serfdom. Case closed, discussion over. The neoliberal economists that control conventional economics have also announced that the economic debate is now over and the orthodox have won. There is no need to argue methodology with the heterodox.

Of course that it self-serving nonsense. There are many possibilities other than neoliberalism both within capitalism broadly construed and other systems. Moreover, there is a huge body of literature in overlapping field of social science including economics showing the deficiencies in neoliberal theory, practice and results. Neoliberalism is essentially an ideologically that functions as a front for social Darwinism that pretends to be meritocratic but is actually exploitive and parasitical on society.

Socially and politically, it’s an issue about what kind of governance a people wishes to establish for themselves. For this criteria are needed for evaluating different views. The historical debate has been over reconciling personal freedom, equality of rights and responsibilities, and community. Different countries have approached this politically from different angles, but generally speaking it is those at the top of the class structure and power structure than have the loudest voice in determining outcomes.

Economically, it’s essentially a distribution issue. The neoliberal view is that progress is the most important criterion and the measure of progress is growth defined as per capita GDP irrespective of distribution based on trickle down. efficiency of capital is paramount and intrusion of government reduces this efficiency and therefore market should be left to themselves in a market society. This takes the cap off capital accumulation, which what the grand acquisitors desire.

Obviously there are other ways to cut the pie, but neoliberals claim that this necessarily results in a smaller pie and less for all. It’s up to others to show why and how this is not so, and that it is actually possible to have more equally distributed prosperity without unduly restricting individual freedom, while maintaining egalitarian rights and responsibilities, and enhancing community through public purpose.

MMT has a lot to say about this and certainly Bill has said a lot already. The basic message is that affordability is not the economic issue but real resources and their distribution. There are many political options and these should be matters of informed choice, which requires an informed public and a level enough playing field to implement political choices after they are made. That’s not available now. So more education is needed.

I do think that a book is needed that presents this as a whole. There is a lot that has already been generated but it’s scattered in blogs and papers and a few books. I would suggest an MMT collaboration with James K. Galbraith to update John K. Galbraith’s The Good Society and integrating his Economics and The Public Purpose.

BTW, this debate already took place long ago between Walter Lippmann representing what would later become neoliberalism – it was classical liberalism then – and John Dewey representing social democracy and social liberalism as a middle way between Locke’s classical liberalism based on the fundamental right being that of private property and Marx, who advocated abolishing that right. Dewey held that this is the wrong focus. To be effective – Dewey was a pragmatist ‚ the focus needs to be on human rights, human potential and self-actualization of individuals, which is only possible in a socially liberal society where opportunities and resources are available to all.

It’s not like this debate anything new. Classical liberals had been in control leading up to the Great Depression, after which social liberalism can back into power under FDR. Then the worm turned again with the rise of neoliberalism spearheaded by the Chicago School and Mont Pelerin Society, and then neoliberal think tanks and neoliberal dominance of economics departments and news media. See, for example, Karl Polanyi’s The Great Transformation and the literature it has spun.

Well done as always Bill!

I live in Toronto and was disappointed that members of the public couldn’t attend.

My main take away, from Bill’s presentation, was how well he documented how the “Euro project” was first considered impractical because of the needed fiscal stabilizers would not work because of the political integration that would involved. Then, with the change in mainstream economic thought to only the money supply matters, the Euro became possible.

Take care, Glenn