The other day I was asked whether I was happy that the US President was…

Currency sovereignty is what matters

There is a literature emerging that suggests that a Eurozone nation would be no better off with its own currency then and is within the monetary union. The claim is that these nations have not performed any worse than nations outside the Eurozone during the current crisis. A recent paper by an American economist (Andrew Rose) – Surprising Similarities: Recent Monetary Regimes of Small Economies – is being used as the authority to support this claim. The intent is clear – to deny that the Eurozone as a monetary system is inferior to systems where the nation issues its own currency and sets its own interest rates. However, these studies skate over the currency sovereignty issue and cast the differences between nations in terms of exchange rate arrangements or whether their central bank targets inflation or not. The real issue is whether the monetary system is characterised by the government facing a financial constraint or not in its spending – that is, whether it issues its own currency, sets its own interest rates and resists issuing debt in a foreign currency. Once you consider those basic aspects of the monetary system then it becomes obvious that the Eurozone nations as a whole have performed worse than other advanced Non-Eurozone nations which have enjoyed more fiscal flexibility.

The Rose paper contrasts the “choice of monetary regime” in terms of nations with “hard exchange rate fixes” and those which float and pursue an inflation target.

The question asked:

Did one monetary regime provide more insulation from the GFC than the other?

He concluded that:

1. “monetary regimes have remained stable and unchanged during the GFC and its aftermath for a large number of countries, those of hard fixers and inflation targeters”.

2. “while both hard fix and inflation targeting countries have experienced (for instance) lower inflation than other countries, the business cycles, capital flows, current accounts, government budgets, real exchange rates, asset prices and so forth do not seem to vary significantly between the two regimes”.

I won’t go into the detail of the methodology etc – you can read the paper if you are interested (I wouldn’t if I was you).

Economists such as Antonio Fatas think the study validates his claims that the Eurozone nations are not specifically disadvantaged – see The Euro Counterfactual.

He considers the crucial difference between the Eurozone nations now and before is that they gave up their exchange rate. He constructs the argument that considers this difference matters in terms of the single Euro exchange rate denies each nation a “stabilization tool”, which means that “when a crisis that is asymmetric in nature comes along you suffer a prolonged crisis as the only way out is to let prices and wages fall (internal devaluation), a painful and inefficient process”.

He rejects the argument that the Euro is the problem.

The problem is that the Rose study doesn’t get to the nub of the problem. The crucial differences between the Eurozone nations now and before extend well beyond the common exchange rate.

The causa sine qua non as opposed to the causa causans is the surrendering of the currency sovereignty – a matter not explicitly investigated by the Rose study.

The decision to enter the Eurozone had three linked consequences:

1. The nations surrendered their own currency and immediately started using a foreign currency which meant they became financially constrained in their spending decisions and faced solvency risk. They could no longer issue risk-free public debt.

2. These nations surrendered their own central banking capacity and with it the capacity to act as a lender of last resort to their own banking system (and government for that matter – linked to 1).

3. They abandoned their own currency parity in favour of a single exchange rate (which logically follows 1 and 2) and so any current account imbalances had to be resolved via very harsh internal devaluation – the evidence of which is clear.

It is the combination of those 3 consequences that have set the Eurozone nations apart. Where the crisis has hit hardest, those differences (from nations that remained sovereign, irrespective of whether their monetary policies were formally pursuing an inflation target or not), have magnified the negative outcomes.

Further, even given the three consequences noted above, the Eurozone could have reduced the consequences of the asymmetric negative aggregate demand shock if its central bank (the ECB) had have behaved as if it was a federal fiscal authority.

However, the imposition of the Stability and Growth Pact fiscal rules and later the Fiscal Compact as drivers of policy and an unwillingness of the ECB to fund national deficits of sufficient proportions to attenuate the demand shocks has exacerbated the lack of Euro nation currency sovereignty.

Change in Unemployment Rates 2008-13

The data used in this section is taken from the latest IMF World Economic Outlook dataset (as at October 2013).

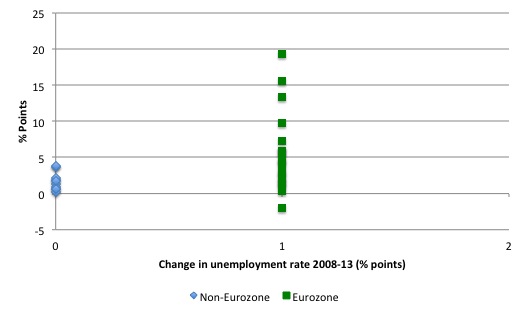

The following graph shows the change in unemployment rate between 2008-13 (% points) for a large selection of nations (see accompanying table for countries and values).

I divided the sample into Non-Eurozone (vertical axis value 0) and Eurozone (vertical axis value 1) to separate out the different monetary systems. I included the Baltic nations as being part of the Eurozone given their currency pegs.

I use the change in the unemployment rate because clearly some nations such as Spain started the crisis with high levels of unemployment.

The mean change between 2008-13 for the Non-Eurozone sample was 1.7 percentage points and 5.6 points for the Eurozone sample. You see that the nations that maintained currency-sovereignty also had a much lower variation in rates around the mean whereas the disparity across the Eurozone was stark.

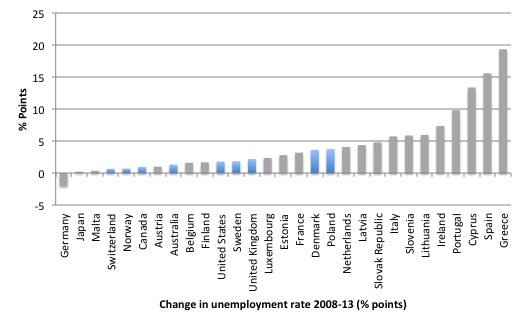

The next graph provides another way of looking at the same data. The grey bars are the Eurozone nations and the blue bars denote Non-Eurozone nations.

Among the non-Eurozone nations, Poland experienced the largest rise in its unemployment rate (3.765 points), which, when compared to the Eurozone nations puts it between France (3.178 points) and the Netherlands (4.07 points).

Then there is a large number of Eurozone nations that have seen much higher increases in their unemployment rates.

This would appear to be a non-random sorting of data – which means the two samples (Eurozone and Non-Eurozone) are different.

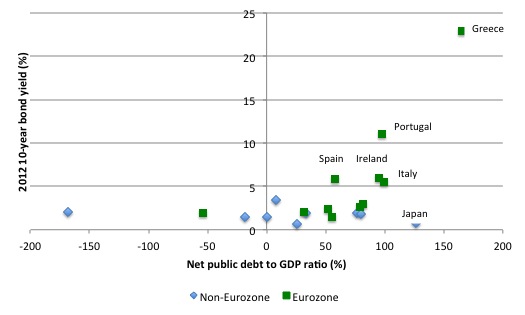

Debt ratios and bond yields

The following graphs used data taken from the recent paper – Crunch Time: Fiscal Crises and the Role of Monetary Policy – by David Greenlaw, James D. Hamilton, Peter Hooper and Frederic S. Mishkin. The data is presented in their Table 3.2.

I had to laugh when I read the author notes, which state (apart from other things) that “Disclosure of Mishkin’s outside compensated activities can be found on his website at http://www0.gsb.columbia.edu/faculty/fmishkin/”.

Mishkin was one of the those “stars” of the movie – Inside Job – as a consequence of the paid work paid work that he did for the Iceland Chamber of Commerce. Here is the Report that he co-authored with an Icelandic academic economist in May 2006 – Financial Stability in Iceland.

Charles Ferguson (director of the “Inside Job”) wrote in The Chronicle of Higher Education (October 3, 2010) – Larry Summers and the Subversion of Economics that:

Frederic Mishkin, a professor at the Columbia Business School, and a member of the Federal Reserve Board from 2006 to 2008. He was paid $124,000 by the Icelandic Chamber of Commerce to write a paper praising its regulatory and banking systems, two years before the Icelandic banks’ Ponzi scheme collapsed, causing $100-billion in losses. His 2006 federal financial-disclosure form listed his net worth as $6-million to $17-million.

The payment for his Iceland Report was not initially disclosed and thus the paper could have been confused as being independent academic research, which gave it considerably more gravitas than if we had known it was job-for-bobs deal. That discrepancy – producing work that looked like it was independent academic research but was, in fact, commissioned by vested interests who directly benefitted from the research results and policy recommendations – was widespread in the economics profession. It is one of the themes of the movie.

After the crisis broke, Mishkin was sprung changing his CV by renaming the paper “Financial Instability in Iceland and when asked about this in the interview (see below) he stumbled, in a dissembling fashion – and eventually managed to get it out that it must have been a “typo”. Pure comedy.

Here it is if you haven’t already seen it. Have a laugh – it is good for your soul.

Anyway, he is now apparently disclosing the work for which he receives consulting income although his spelling is about as good as his monetary theory (see capture from his homepage).

But that was a digression. The data is from the IMF and other standard sources.

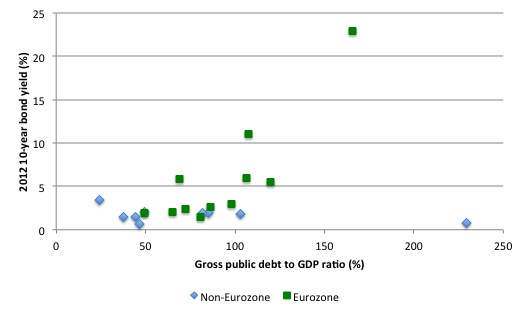

The data is average 10-year bond rate during 2012, the average gross and net public debt to GDP ratios for 2011, and the average current account deficit to GDP ratio between 2007-2011.

The first graph compares the average 10-year bond yield during 2012 with the average gross public debt to GDP ratio for 2011. The Sample is split between non-Eurozone countries (blue markers) and the Eurozone countries (green markers).

I could add other Non-Eurozone nations to the dataset and the patterns would not be terribly different. that is not appear to be any particular relationship between the two variables.

However, when we consider the Eurozone countries in their sample, the relationship appears to indicate higher debt ratios are associated with higher 10-year on yields.

That makes sense because the bond markets understand that currency-issuing countries have no default risk (other than the nonsensical political games that the US Congress has been playing – and even then the bond market saw through it, understanding that the GOP are wimps).

Equally, the bond markets know that every Eurozone country uses a “foreign” currency (the Euro) and therefore carries the risk of insolvency should its tax base and/or borrowing capacity fall short of its current spending commitments.

In the case of a significant collapse in aggregate demand, leading to a major contraction in real output and national income of the magnitude that we witnessed in 2008 and 2009, it is no surprise that some of the worst-hit Eurozone countries faced significantly higher bond yields.

Such a calamity for a currency-issuing nation remains largely a real (that is lost output in income and rising unemployment) rather than moving into the financial sphere.

At the heart of the differences between the Non-Eurozone and Eurozone nations in this regard is not the exchange rate arrangements per se, but the currency issuing arrangements.

Countries such as Greece and Portugal and Spain would not have contracted in real terms as much as they did if they had retained their own currency. Further, they would not have faced the bond market hostility that occurred because it would have been clear that they could always honour there own liabilities.

Whether we use gross or net public debt is irrelevant. Same story. It is also clear that difference between gross and net debt is smaller for the Eurozone nations in this sample. But that does not alter the relationship between the public debt ratio and the average 10-year bond yield.

Conclusion

There is no doubt that if the deficits in the Eurozone had have risen further and not been constrained by harsh fiscal austerity, the differences in the change in unemployment rates would have been minimal.

But that would have required the ECB ratifying the higher deficits (as the currency-issuer) – a sensible role that it refused.

Further, there is no doubt that once the ECB started buying debt in the secondary bond markets the yields for Eurozone nations under siege dropped markedly.

Had the ECB just guaranteed all the debt (as the currency-issuer) then, once again, the differences observed between Eurozone and Non-Eurozone nations would have been minimal.

Even better would have been the nations using their own currencies and pursuing domestic policy goals aimed at keeping employment high. There is no doubt these nations would be better off now, even if it had have required a major default on the Euro-denominated debt they would have inherited as they shifted back to their own currencies.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Dear Bill

Unit labor costs are now 20% higher in France than in Germany because of Germany’s mercantilistic policy of wage moderation. This means that the French euro has undergone a real upvaluation. If the French still had their franc, the franc could have undergone a nominal devaluation and thereby avoided a real upvaluation. It is hard to believe that there is no difference between fixed and flexible exchange rate. Fixed exchange rates only make some sense if all countries always have the same inflation rate.

Regards. James

I started reading the Andrew Rose paper after Paul Krugman linked to it, but I couldn\’t finish, because it was too silly.

For a start the Eurozone is explicitly excluded, because according to the definition of the paper the zone is a single, large, monetary regime, never mind the fact that it has lots of separate economies embedded in it (some of them quite small). So the paper\’s finding cannot, by definition, be extended to the Euro countries. Then, for the authors, the Eurozone has a floating exchange rate, so if they had considered Europe, they would have taken its troubles as evidence against the usefulness of a floating currency.

Their headline finding (no difference between hard fix and inlation targetting countries) could be seen as prima facie evidence of the uselessness of their categories, but I didn\’t read far enough to discover if they considered this possibility.

Hi Bill,

Out of interest, was this post’s seed Paul Krugman’s blog a few days ago or do great minds just think alike? 😉 http://mobile.nytimes.com/blogs/krugman/2013/10/19/do-currency-regimes-matter/

The states of Europe, from Ireland to Russia and Norway to Malta are – well, sovereign. Like, they each have their own sovereign, elected parliaments voted in by their own citizens. Never mind that they all (bar two pairs) have different national languages, different social customs, histories and laws. Labour mobility is lowish. Except from the poorer Eastern EU countries to the more prosperous ones in the West. Sound familiar?

How about if each Aus state elected its own sovereign parliament (there was no federation). Each spoke a different national language, issued its own currency and raised its own taxes and budgets, and had little inter-state labour mobility. And now someone is trying to tell me that if you gave these critters a single currency, everything would be sweetness and light. “Well, pull my other leg, its got a bell on it!” But a lot of folk bought into this fantasy.

As for ever getting lower un-employment rates – sure, it might be possible but our populations would need to decline significantly and nothing else changed. And, if we all spoke the same language things would be even rosier.

The Euro was indeed a good idea – but it should be still on the drawing board. There is a great deal of politicking to be settled first. Might be a long time! We’re well up the Sh*tty Billabong, and we’ve no paddles!

The EU was,originally, a natural response to the horror,murder and mayhem of World Wars 1 & 2 both of which originated in Europe. There was certainly a need to put in place some sort of mechanism to prevent national quarrels from getting out of hand. But the present close embrace appears to be many steps too far.

Now, of course, there are vested interests and a vast bureaucracy propping up what is obviously a failed experiment.The whole conglomeration is like an empire where the centre feeds on the periphery and all empires fail,sooner rather than later.

The present close embrace will inevitably end in recrimination and divorce. Whether it will be an amicable or a nasty divorce remains to be seen.

Great blog Bill.

Nothing more clearly demonstrates the importance of currency sovereignty than the utter failure of the first modern currency union to deal with economic crises. The strength of an economy must be measured on it’s ability to sustain shocks without collapsing and the EU has categorically failed to do this – though as you say this is much a failure of the peak body to effectively control monetary policy as anything else. Typical that orthodoxy choose to purposely misrepresent information to make it appear less broken than it is.

Out of curiosity, how do you wind up a currency union?

Wasn’t a 4th problem with the conversion to the euro the fact that countries converted debt instruments that they had issued in their earlier sovereign currencies directly into debt instruments now owed in a foreign currency, i.e. euros? They immediately put themselves into a debt hole by taking on an obligation to repay euros that they hadn’t borrowed in the first place.

Dear Bill-

Thank you so much for the insight into the European economy. Being from the United States we also have our issues.

Thanks-

Michael C Craven