It is true that all big cities have areas of poverty that is visible from…

Britain continues to look like a failed state

Last week, the UK Department of Work and Pensions released a swathe of new – statistics – on poverty rates in Britain. While the Department tried as hard as it could to present the data in a misleading way and lied the facts, once analysed properly, are chilling indeed for a nation that pretends to be advanced and lectures Europe on its own misanthropic policy positions. I am sometimes asked when making public presentations how I judge the success or otherwise of public policy. I respond with a simple rule of thumb. The benchmark is not how rich the policy framework makes society in general but how rich it makes the poor! The conduct of governments in many nations over the last 20 years has not typified what a sophisticated and rich society should be doing to enhance the prospects of the weakest among us. The policies of the British government in recent years are the antithesis of sound public policy. In that sense, I judge Britain to be a failed state.

First, recall this story in the Economist (April 25, 2013) – Fixing the figures – which documented how the Secretary of State for Work and Pensions in the UK, Iain Duncan Smith has been pumping “questionable numbers” out of his office “into the public debate like raw sewage”.

To try to put some positive spin on the British government’s avowed austerity policy which is pushing thousands of people (including 1 in 6 children) into poverty, the Secretary of State and his spinners have been misrepresenting the DWP data.

On April 24, 2013, the Secretary of State released the annual report – Social Justice: transforming lives – one year on – published by the Department of Work and Pensions.

In the forward to the Report, he wrote:

Around one million people have been stuck on a working-age benefit for at least three out of the past four years, despite being judged capable of preparing or looking for work.

The British Tabloid press had a field day with the Secretary of State’s release producing lurid headlines and by-lines leaving the reader in no doubt that the latest data from DWP had found a bevy of bludgers who were living it up on government pensions when they could easily be out there working.

Even the sycophantic (to neo-liberalism) British Labour Party was quoted via MP Liam Byrne issued a – Statement – saying “we need to get these people off benefits and into jobs.” As if the claims by Duncan Smith were accurate.

This was in the context of the Labour Party’s compulsory Jobs Guarantee proposal. I support a Job Guarantee (but not the British Labour Party’s model) but realise that it would only work for those who are fit to work. If a person is not capable of working then they deserve as a right of citizenship (and a member of the human race) to be supported in a manner by the rest of us such that they are not socially excluded.

So the Labour Party was buying into the Duncan Smith narrative and claiming to have a niftier way of getting the bludgers to work and off the job seekers allowance.

The Full Fact site (which aims to promote accuracy in public debate) asked the question on April 24, 2013 – Are a million people fit to work yet living on benefits?.

It found that the evidence provided in the official DWP statistics do not support such a claim.

The UK Guardian (April 24, 2013) – Is Britain a nation of lazy scroungers? – also did some checking and found that:

… about 1 million spent three to four years on benefits. However, 600,000 of these claimants are people not able to work – by the government’s own definition.

The Guardian also noted that:

Duncan Smith is employing a linguistic sleight of hand. He says he is only counting those on working-age benefits who are “judged capable of preparing or looking for work”. But almost everyone’s capable of preparing for work.

So the only people who are capable of looking for work, who Duncan Smith must think have been unwittingly fostering a sense of dependence on the state, are the 395,000 people who found themselves unemployed in March 2012 and had spent between three to four years beforehand on benefits.

But I would have gone further than the Guardian – rather than conceding the last point.

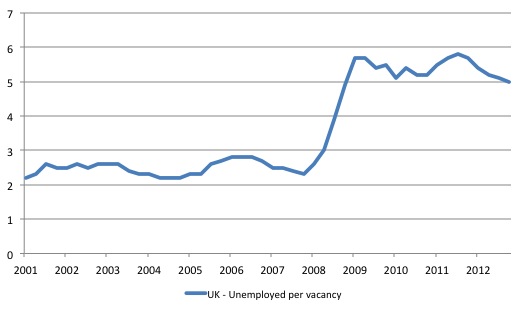

The latest Office of National Statistics data to construct the UV ratio is available – HERE.

The following graph shows the UV ratio since 2001 (up to the March-quarter 2013). In the March-quarter 2013, there were 2.5 millions workers unemployed in the UK with only 503 thousand unfilled vacancies.

You will also note that the ratio jumped sharply in early 2009 as aggregate demand crashed in the UK and real output plunged.

As a note for those inexperienced in dealing with economic data, when I see sudden jumps in a time series that has exhibited relative stability for a lengthy period I am looking for a shock to help me explain the jump.

Shocks can either be demand-side or supply-side in origin (although one can feed into the other quickly enough). To be consistent with the neo-liberal claim that there are a million bludgers out there over the last four years one would expect to see some notable shift in the income support entitlements around 2008-09 which induced such a supply shift (as evidenced in the data).

No such evidence is forthcoming. What we know (unambiguously) is that the British economy encountered a massive negative demand shock which drove the output gap up and unemployment along with it.

The persistence of that output gap, now being perpetuated by the Government’s own policy stance, is locking people into entrenched unemployment.

The other part of this narrative is that the vacancy rate has fallen dramatically since the crisis began. Vacancies are now 26 per cent per cent lower than were in December 2007 (the most recent peak).

Remember my epithet – The unemployed cannot find jobs that are not there!.

And never forget the following Case Study.

Case study: the parable of 100 dogs and 92 bones

Imagine a small community comprising 100 dogs. Each morning they set off into the field to dig for bones. If there enough bones for all buried in the field then all the dogs would succeed in their search no matter how fast or dexterous they were.

Now imagine that one day the 100 dogs set off for the field as usual but this time they find there are only 92 bones buried.

Some dogs who were always very sharp dig up two bones as usual and others dig up the usual one bone. But, as a matter of accounting, at least 8 dogs will return homebone-less.

Now imagine that the government decides that this is unsustainable and decides that it is the skills and motivation of the bone-less dogs that is the problem. They are not skilled enough. They are idlers, bludgers and “bone-shy”.

So a range of dog psychologists and dog-trainers are called into to work on the attitudes and skills of the bone-less dogs. The dogs undergo assessment and are assigned case managers. They are told that unless they train they will miss out on their nightly bowl of food that the government provides to them while bone-less. They feel despondent.

Anyway, after running and digging skills are imparted to the bone-less dogs things start to change. Each day as the 100 dogs go in search of 92 bones, we start to observe different dogs coming back bone-less. The bone-less queue seems to become shuffled by the training programs.

However, on any particular day, there are still 100 dogs running into the field and only 92 bones are buried there!

You can find pictorial version of the parable here (for international readers this version was very geared to labour market policy under the previous federal regime in Australia and was written around 2001). I first screened this at a presentation that preceded a talk by Tony Abbot, the then Federal Employment Minister now Opposition leader gave at the University as my guest.

In the UK there are about 92 bones for every 100 dogs and in Spain 72 bones for every 100 dogs!

The point is that fallacies of composition are rife in mainstream macroeconomics reasoning and have led to very poor policy decisions in the past.

There are simply not enough jobs.

More recently, the DWP published their latest poverty data – Households Below Average Income (HBAI) – which bears scrutiny.

The full publication – Households Below Average Income (HBAI) 1994/95-2011/12 – was published on June 13, 2013.

I will leave it to you to learn about how the different measures are computed and what they can be legitimately used for. The publication explains in some detail with references to external sources of information these matters.

An acknowledged measure of poverty is the threshold – 60 per cent of Households Below

Average Income (HBAI).

1. “someone is considered to be in relative low income if they receive less than 60 per cent of the average income”.

2. “someone is considered to be in absolute low income if they receive less than 60 per cent of average income1 in 2010/11 adjusted by inflation”.

We learn that:

1. “Average income decreased by 3 per cent in 2011/12 in real terms compared with 2010/11, similar to the decrease in 2010/11.”

2. “The percentage of individuals in relative low income, Before Housing Costs (BHC), was 16 per cent … unchanged from 2010/11 … because, in the main, real incomes for households near the bottom of the income distribution fell by roughly the same rate as real incomes for households at the average”. That is, widespread real losses.

The other significant aspect here is that the overall decline in average real income biases the poverty measures downwards. A simple calculation shows, for example, that if the average income from 2010-11 was used instead of the current year, then poverty rates rise sharply.

3. “… the population falling into absolute low income rose”.

4. “income inequality is now at levels last seen in the middle of the last decade having reached historic highs in recent years”.

The really frightening aspect of the data release related to the rising incidence of child poverty in the UK, which is covered in Chapter 4 of the publication.

We learn that (BHC = Before Housing Costs):

The percentage of children in absolute low income BHC increased by 2 percentage points, or 300,000 children, between 2010/11 and 2011/1219. This was the first percentage point increase since the early 1990s, BHC. The recent increase was driven by a reduction in real terms income. The absolute low income threshold was uprated by RPI inflation and so the population falling into low income increased.

Apropos of Point 2 (immediately) above, the Report presents Tables for benchmarks against “contemporary median income” and 2010-11 median income, to allow us to assess the impact of generalised real income declines are having on these measures at the bottom of the income distribution.

So the proportion of UK children living below 60 per cent of the contemporary median income was 27 per cent in both 2010-11 and 2011-12 and the proportion below 70 per cent was a static 37 per cent across both years.

However, when we calibrate against median income in 2010-11, the proportion of UK children living below 60 per cent of the median income rose from 27 per cent to 29 per cent in 2011-12 and the proportion below 70 per cent rose from 37 per cent to 39 per cent.

So in terms of absolute numbers, using contemporary 2011-12 median income as the benchmark there were 3.5 million children below 60 per cent and 4.8 million below 70 per cent.

Using 2010-11 real median income, the numbers were 3.8 and 5.1 million children, respectively in these categories.

Thus, when we consider the overall loss of real income, there were more than 300,000 British children entering absolute poverty in 2011-12 compared to 2010-11 (below 60 per cent).

The other finding that is of interest is that 63 per cent of children below the 60 per cent threshold are living in households where at least one adult is employed. If one examines earlier data, the conclusion is that the incidence of the working poor has risen dramatically since the mid-1990s. In 1996-97, this proportion was around 43 per cent.

The financial crisis and austerity drive has seen the acceleration in working poor households

The Report says that:

For children in workless families, the risk of being in relative low income reduced by 2 percentage points to 40 per cent between 2010/11 and 2011/12, BHC and by 1 percentage point to 67 per cent, AHC … because these workless families received a higher proportion of their income from state support than families with children who had at least one adult in work.

The Report consistently highlights the fact that higher levels of state support reduce the risk of child poverty among the unemployed, which means that attacks on income support schemes push more children into poverty.

Neo-liberalism began by increasing the unemployment pool to shift the balance of power away from workers so that capital could secure increasing shares of the real income generated.

The related phase has been to denigrate the unemployed and attack their income support.

The other prong in the strategy has been to impoverish those who work in the lower-paid occupations. This phase is in full swing.

The related phase is to extend that attack into what has typically been referred to as the middle-class – the 40-80 percentiles of the income distribution.

The neo-liberals are using the current crisis to wipe out the middle class. The only problem is that a significant proportion of that cohort are well-educated and will probably resist the demolition attempts.

At that point, perhaps some class consciousness will emerge and those in their McMansions will realise the bludgers they have been vilifying each time the Daily Telegraph or Daily Mail (or whatever Tabloid is relevant in the particular nation) claims there are millions who can work who refuse to, are more like them than that thought.

All cohorts are being impoverished at different rates.

Conclusion

The DWP datasets are very rich in detail and fascinating (once you suspend anger and misery for a while). They indicate to me that the current policy framework is severely undermining not only the current fortunes of people in Britain, but also, the future prosperity of the nation.

The intergenerational disadvantage is becoming worse and the children in poverty today are the low productivity workers of the future who inherit the disadvantages of their parents.

The evidence is very clear – children denied a chance to realise their potential tend to lead difficult lives with unstable work attachments (even when there are jobs on offer), unstable family lives, and higher incidence of drug and alcohol abuse, mental ill-health and other pathologies.

When the neo-liberals lecture us constantly about the burden that government debt will (allegedly) place on the grand kids and the need for surpluses to “save up” to accommodate the demands of an ageing population, they ignore the most obvious.

Apart from completely misunderstanding the monetary side of the discussion, before their very eyes are growing number of future workers losing attachment with society by being denied adequate education and training and the hope that impels us to achieve higher attainments.

Sure enough the grand children are going to bear a dreadful burden and the future is bleak enough – but that is all the making of the neo-liberal policies.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

In my opinion you can see the dymamics of power in this engagement between a Irish TV broadcaster and the Irish Gov. of the CB two years ago now.

(Ireland is still essentially a branch of British anti politics & society)

VB: And then of course that- On top of the EU/IMF deal they said to you that in addition to that you cannot default on even the unguaranteed debts of the banks.

PH: I think that’s the main reason he was crestfallen.

[moment of silence]

VB: And why did that –

PH: It wasn’t part of the negotiations as such. There was no deal. There was no agreement on that. But there was talk around, about that [gestures circular movement with hands] And eventually the decision was [resolute tone] “No”. I think he was quite discouraged by that.

VB: Was there no room for us to say “Well sorry, we’re not going to finance the unguaranteed debts”

PH: It’s not in the agreement. It’s not in the agreement. I mean you know the way the world works. There’s political room. There’s no political room. No political room was offered to him BY THE PEOPLE.

VB: What political room did he need? The deal was there. The EU/IMF deal was there. You were guaranteed the funds for three years and that was it. And you could have said “No, this isn’t part of the deal, there was no legal or moral or any other obligation, political obligation on us to do this. We won’t do it”

Vincent Browne the famously legalistic and combative journalist never asked the simple question

Who are these people ?

“These People” have therefore unlimited control of politics , of fiat & are beyond critique.

But who are these people ?

I believe these people form at least two lines of power which intersect at a crucial node of state affairs.

A masonic branch or sect and a Talmudic Jewish sect / elite.

Together these two pieces of institutional “people” crucify the simple people on a cross of gold.

Mainly out of pure badness.

The UK is at the center of these forces since Tudor times and to some extent before….certainly after Waterloo these forces became all powerful.

Where has the 19th century American agrarian greenback voices of the past gone ?

Down a very very deep propaganda well.

We ain’t in Kansas anymore.

To “lose attachment with society” is a very good description of what happens to the long term unemployed Bill. I know a welfare case worker who described to me what happens when people are kicked by society while they are down. We become mentally ill very quickly and even stop paying attention to basic personal hygiene, grooming and dress. In the unlikely event a job opportunity arises they present very poorly at a job interview because of low self esteem, lack of confidence. They become not just unemployed but also unemployable and the problem gets worse for the children who have never seen their parents go to work and have no role model for conduct in the working world.

I could not agree more that a job guarantee is what is needed to put an end to this form of human cruelty.

Can I interest Anyone in some new IMF finance courses for the online university ?

BBC News. IMF launching courses on online university

I agree with this completely however it might be useful to consider the political debate currently going on here in the UK. This seemingly minor point is key:

“If a person is not capable of working then they deserve as a right of citizenship (and a member of the human race) to be supported in a manner by the rest of us such that they are not socially excluded”

It turns out that it is a right of EU citizenship rather than UK citizenship. And this is driving intense political debate (and likely crumbling of the Left’s position). The UK has a history of universal benefits, which to my mind are a very good idea. In Europe there is more of a system of contributory benefits. Rightly or wrongly (probably wrongly) the UK is perceived by many in politics and the media as a target for “benefit tourists”. This is used leverage to erode this existing benefits system of the UK.

Universal benefits are good because it removes the “them and us” political stigma.

The EU imposes rules for national benefits which may not be in the best interest of EU citizens.

What is more important however, in my opinion, is creating more work and making work pay by increasing the labour share over capital share.

In this day and age it’s ridiculous to suggest that someone who doesn’t work must necessarily be supported by the rest of us, just as it is that working provides the only access to money. The government can create as much money as is needed when it’s needed and could distribute it nationally as required. Spent properly or in tandem with money similarly created by other countries, there’d be no inflation. Reality intrudes, alarmingly for the likes of Osborne etc. who’s only interest is preserving the status quo and by virtue of the money gifted to them by their parents their status in that particular quo.

This idea that people are being financially supported by taxpayers is ridiculous. If the people don’t accept the currency it has no value, every citizen without their knowledge, is contributing to the wealth of the richest by simply accepting the currency, and as part of that acceptance they deserve to be treated as shareholders, not freeloaders.

A little off topic but I thought Bill might want to respond to this article http://www.guardian.co.uk/commentisfree/2013/jun/19/australia-minimum-wage which appeared in Guardian Australia

Big Bill and James,

It’s not about the finances or tax payers. The real support – the housing, transport, food etc. – does come from “the rest of us”. It comes directly from the people providing those products and services, and indirectly from those that must forgo them – assuming we’re operating at full capacity – in order for those being supported to receive them. And this is as it should be in a society that wishes to think itself humane.

Let us assume, since our money is no longer backed by gold, that it’s backed by the wealth of the nation. That’s what it represents. That’s what we trade on, our reputation and our real wealth. Just as with gold-backed currency, where any increase in the amount of currency in circulation must be matched by an increase in the amount of gold available to back it in order to avoid devaluation of the currency, any increase in wealth-backed currency must similarly be matched by an increase in the wealth of the country. If disabled people need support in the form of specialised equipment and services etc, (perhaps in increased servicees like transport) I’d suggest money may be created to provide that where it’s lacking. There’s no need for someone in good health to forgo their seat on the bus so someone disabled can have it, and never has been. Bring money into circulation along those principles and keep it out of tax havens or long-term storage (perhaps by demurrage?) and we should always have plenty of money for when it’s needed.

Almost all wealth & activity has become focused in & around London.

This is reflected in various transport stats.

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/207006/light-rail-and-tram-statistics-2012-13.pdf

The recent investment plans in Nottingham public transport (forthcoming new tram lines) given its passenger decline as northern people lose tokens to the banking vortex is to be questioned as there is no point in building capacity that will not be used.