The other day I was asked whether I was happy that the US President was…

Cyprus – Greece or Iceland? Obvious

It is a public holiday in Australia today like everywhere. So this is a relatively short blog. In the last week, the tiny nation of Cyprus has committed itself to a path that will see it stagnate for years to come and real living standards will fall. It will lose its banking sector and will find it hard to stimulate its tourism sector given it is unable to alter its exchange rate. Domestic wages and costs will have to fall dramatically before there will be any significant stimulus to tourism. The government is unable to support domestic demand growth because the Troika will not let them increase their discretionary budget deficits. And sooner or later some German or another will start demanding they sell their island to pay their bills (remember Greece). In other words, they are following the Greek path to destructive oblivion. Apparently this is because there is no better alternative. The Euro elites have spent a lot of effort telling everyone that there is no alternative to harsh austerity and the destruction of another economy. But for anyone who keeps their eyes on the data you will know that there is an alternative. A small island state – Iceland – issues its own currency and allowed their exchange rate to move with relative currency demand has emerged damaged but not in Depression. The vital signs in Iceland are positive.

In a spare moment at the weekend I watched a documentary on SBS (a national TV channel which provides a multicultural focus and a lot of foreign language programs) on the death of Heinrich Himmler in 1945 as he tried to escape justice. A diary was discovered a few years ago written by one of the British soldiers who was at the scene of Himmler’s death. This soldier died in 2010 but after the War had moved to Australia and lived a few kilometres from my homein Newcastle!

Himmler surely epitomised the ugly German. That stereotype is increasingly being resurrected as German politicians and the less couth elements of the German media make dreadful statements about the people in Southern Europe, who have been led into an ambush, which is the Eurozone.

Certainly, Herr Schäuble has been at the forefront of this syndrome – see – ‘I Don’t Accept Insults to My Country by Mr. Schäuble’

However, I prefer not to think of all this in ethnic or racial terms. Rather, the bullying German politicians etc are just demonstrating the ideological arrogance that pervades neo-liberals and their bullying is because they have power and the Greeks and the Cypriots are small, weak, vulnerable and in trouble. Bullying is not a trait confined to Germans.

But the German elites certainly don’t help their cause. Herr Schäuble made another one of his inimitable remarks during an interview with the German newspaper – Bild (March 30, 2013) – Wird Italien das neue Zypern, Herr Schäuble? – (Is Italy the new Cyprus, Mr Schäuble?).

Bild is a right-wing, populist newpaper and has been described by its rival Der Spiegel in this article (April 25, 2006) – Sex, Smut and Shock: Bild Zeitung Rules Germany – as

For German politicians, it’s a necessary evil. For German journalists, it’s mandatory daily reading. For the German desperate, it’s a daily dose of high-resolution soft porn. And for millions of Germans, it’s the primary source of news.

Bild, which is “Germany’s answer to the British tabloids the Sun and the Daily Mirror, serves up tripe, trash, tits and, almost as an afterthought, a healthy dose of hard news seven days a week.”

Its motto is “Bild Dir Deine Meinung” or as De Spiegel notes is “we form your opinion so you don’t have to”.

Any way, at the end of the interview after asserting that it is more important to keep all the nations in the Eurozone (“Nein, wichtiger ist, dass wir stark genug sind, alle im Boot zu halten”) he was asked whether the Cyprus “solution” would allow Europe to grow together or whether the existence of the Euro would eventually split the continent (“Wächst auch Europa jetzt zusammen, oder spaltet der Euro den Kontinent?”).

He replied;

Der Euro bewährt sich auch in der Krise. und bis jetzt ist alles viel besser gelaufen, als die vielen Experten vorhergesagt haben. Ich sage: Wir werden in den Geschichtsbüchern lesen, dass diese Krise Europa noch stärker zusammengebracht hat. Wenn man betrachtet, wie es zu meiner Jugendzeit in Deutschland und Europa aussah, muss man doch sagen: Wir leben in einer sehr glücklichen Zeit.

Which translates (more or less) to “the Euro has proven itself in the crisis and so far has gone much better than many experts have predicted. The history books will show that the crisis had brought added to Europe. If you look at what it looked like in my youth in Germany and Europe, we have to say. Ours is a very happy time”.

Which is why I started with the reference to Herr Himmler. Wolfgang Schäuble was born three years before Himmler’s death and at a time where the manic designs of Hitler were starting to come unstuck. Life in Germany around then and later was dire. For the displaced in Europe it was also a terrible time.

So I suppose things are rosier compared to what the Russians found when they first came across the – Majdanek Concentration Camp – the first to be liberated and one of the few that the Nazis failed to destroy as part of their withdrawal in the face on the Russian advance.

I suppose 55 per cent youth unemployment in Spain and Greece is better than the 6.4 million odd Jews, gypsies, homosexuals, communists, mentally and physically disabled etc who were tortured, gassed and had awful experiments done on them before being exterminated.

I suppose wrecking one of the two big industries in Cyprus (banking) is better than the large-scale destruction of Europe’s productive infrastructure during the Second World War.

And countless more analogies to boot!

The point is that I think the Euro leadership is severely out of touch with the reality of the situation they are making. What they have now is a disaster, the costs of which will linger for generations to come. An unemployed teenager in Greece or Spain may now have been unemployed the entire latter part of their teenage years. A rising proportion of them will now be young adults – with no work experience, limited education and a sense of betrayal. What is their future and, by definition, the future of their nations looking like?

The other resonating feature of last week’s discussions about Cyprus was the insinuation by the elites and the hordes of commentators that the Bail-in Mk II might have bad but it was the best choice available.

For example, Clive Crook’s article (Bloomberg Op Ed, March 28, 2013) – Cyprus’s Plan B Is Still a Disaster – tell us:

The first attempt to bail out Cyprus was such a shambles that the second looks smart by comparison. It’s getting generally favorable press, too — the best available option under the circumstances, and so on. Yes, it’s an improvement. It’s hard to think of anything that wouldn’t be. That doesn’t make it a good plan.

The Cypriot President told his people during a national TV broadcast (March 25, 2013) that:

The agreement we reached is difficult but, under the circumstances, the best that we could achieve.

It won’t surprise you to read that I beg to differ. Leaving the Eurozone would have been the best thing Cyprus could do given the circumstances. Never having joined the Eurozone in the first place would have been the better. The “bail-in” is one of the worst things the nation could agree to inflict on itself.

There was an interesting article (March 22, 2013) in the UK Telegraph – Cyprus’s choice: Iceland or Greece? – written by the conservative UK Member of the European Parliament (Daniel Hannan).

His view is that the EU is “making its constituent nations poorer, less democratic and less free” – which is an assessment I agree with.

Daniel Hannan writes that Cyprus has a “far better option”:

… an option offered by another thinly populated island on the fringes of Europe whose financial sector had outgrown its economy. Cyprus could copy Iceland, let its banks collapse, and leave their shareholders and bondholders to sustain the loss.

Also an assessment I agree with.

A recurring misconception is that Modern Monetary Theory (MMT), as part of the “Post Keynesian” family should eschew the notion that exchange rate depreciation provides a fillip for exports and discourages imports. Apparently that notion is “neo-classical” and should be abandoned.

All sorts of issues are raised to claim that the current account doesn’t respond to large exchange rate changes. For example, there are apparently: (a) lags in adjustment; (b) dominance of income over substitution (relative price) effects; (c) dominance of capital flows over trade in goods and services etc.

I agree that all these things are part of the real world. Currency prices are largely driven by movements in financial capital in world foreign exchange markets, which reflect speculation (often irrational in its motivation) in the face of uncertainty.

I agree that income effects (the loss or gain of income when a price changes) are stronger, usually, than substitution effects. In this case, a depreciation undermines real income in a nation to the extent that import prices are higher. But there are also boosts to real income if exports improve.

Further, trade adjustments if they occur take time (so-called adjustment curves) and it is entirely possible that following an exchange rate depreciation the current account increases before it decreases due to valuation effects on outstanding contracts etc.

There was a view in the Cambridge model of Godley and Cripps that real wage resistance would eliminate any competitive gains arising from depreciation.

All of the above a acceptable propositions. But they don’t lead to the conclusion that it is strictly a neo-classical view to consider that if something becomes much cheaper then other things equal the volume demand for it will rise over time, and vice-versa. Post Keynesians would accept that proposition just as much as a mainstream economist would accept it.

The other proposition that often gets raised against MMT ideas is that the depreciation will be so severe that it destroys the currency.

I intend to do a more detailed blog about the way Iceland has adapted since the crisis. But I am short of time today and it is a public holiday after all – although my main problem is that I have deadlines to meet when the offices open up again tomorrow after the Easter break.

Further, the WWW site of Statistics Iceland is currently down. I accessed it earlier today and learned the following:

1. Real wages fell after the crisis and the closure of the banks but have started rising again. They are still below their peak but getting closer.

2. Real GDP has grown steadily in the last two years.

3. Private consumption has recovered in the last two years and is driving growth along with Business investment.

4. The public deficit remains supporting growth.

5. The exchange rate depreciation has been large but finite and is now starting to unwind. Further, the initial spike in domestic inflation has subsided.

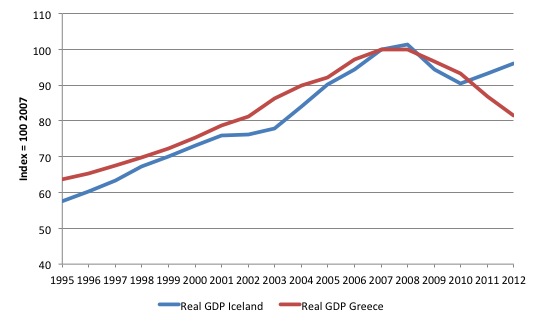

Here are three graphs to consider (using IMF WEO data) comparing Greece and Iceland over the period 1995 to 2012.

The first graph shows real GDP indexed to 100 in 2007. You can see that prior to the crisis the growth rates in the two nations were about the same.

The crisis caused a sudden drop. Since Iceland asserted its currency sovereignty and allowed its exchange rate to fall and didn’t bailout its bankrupt banks, real GDP is in recovery mode. Greece is going further south by the month.’

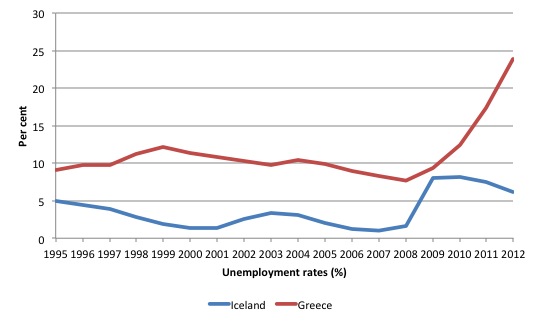

The next graph shows the movements in the official unemployment rates. Again, the same pattern – a sudden rise in unemployment coinciding with the crisis and then a sudden parting of the ways. Iceland’s unemployment rate is now at 4.7 per cent (February 2013) while Greece’s unemployment rate is topping 25 per cent. The relative fortunes of the youth in each nation doesn’t bear comparison.

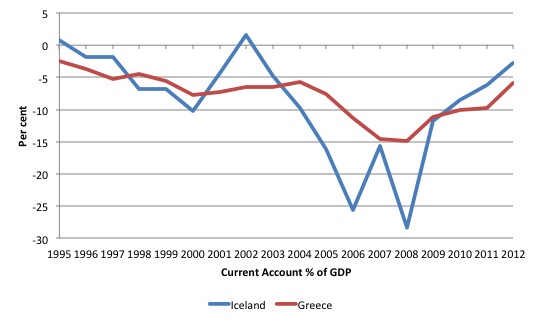

The third graph shows the current account as a percent of GDP. The pre-crisis period was marked by an increase in the current account deficit in each nation. Following the crisis, the current account deficits in both nations have fallen.

But in the case of Iceland that has been accomplished with a now rising real wage rate (with net exports growing) – both exports and imports are on the rise again. In Greece’s case, the real wage is being devastated while exports are rising and imports have fallen.

The Greek path to current account reductions is via domestic deflation because it cannot alter its nominal exchange rate having surrendered its currency sovereignty. It has to scorch domestic real wages and entitlements to try to get the same changes in international competitiveness that Iceland was able to gain without the same domestic pain.

Further, Greece has reduced import demand because national income growth continues to be negative.

The upshot?

Real Gross Domestic Product per capita fell by 12 per cent in Iceland between 2007 and 2010. By 2012 it has grown with the total decline being 8.7 per cent at present.

In Greece, real GDP per capita continues to fall and by end of 2012 was around 20 per cent below its 2007 peak.

Conclusion

There is no question that Cyprus will follow the path of Greece as a result of its Bail-In deal with the Troika. Life will get very tough in that nation for the average person and below. They are now firmly on the the path to an extended Depression.

To the north-west, Iceland is slowly but surely picking itself up after the severe pain that neo-liberalism wrought on that nation.

The difference – currency sovereignty and a floating exchange rate.

Oh, and I forgot – a leader or two that had the temerity to stand up against the neo-liberal European elites and cared about his country.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Is it the case that the correct response to a currency devaluation by a government should be a real response to manage the real reduction in standard of living that implies.

So, in extremis, would that mean import controls to ensure that needed items are imported (and matched to the foreign currency earned by exports) first, and where that is insufficient rationing of needed items.

(Needed items being things like food and power. Unneeded items being things like crates of fripperies destined for the ‘luxury’ market).

Well put, Bill. The mood in Cyprus is quite interesting. There is a dichotomy between those who explicitly lost money and those who didn’t. Many ‘losers’ were quite elderly, who had began working during primary school, and who by their seventies built up cash savings of between 150 and 500 thousand euros (depending on if they had land to sell to retiring poms). These people, who had been dis-saving in the latter stages of their lives, who were perhaps funding the tertiary education of grandchildren, are now facing destitution. Meanwhile, those with savings below 100,000 euros seem to have rather mixed emotions. They seem relieved, apprehensive and (like my neighbour’s dog) hopelessly optimistic. I suspect that optimism will fade over the coming weeks and months.

the cynical amongst us would say that the first Cyprus bailout was purposely draconian so that a second slightly less draconian one would be allowed to pass.

Sure ….Greece Ireland Cyprus – indeed all of them are better outside the eurozone but Icelands primary industry is a much bigger part of its domestic economy.

Iceland only needs diesel for its fishing boats ……it imports no nat gas or heating oil.

There needs to be a critical mass of countries to leave the eurozone so as to drive down the price of gas & oil which is kept high by a Euro and its central role to promote wasteful inter & transcontinental trade via its global entrepot activities.

But there is a deep reason for this albeit brutally inefficient austerity.

The true master of the eurozone is asserting itself and it ain’t even in the eurozone.

ACEA

“Two months into the year, Germany (-9.6%) and Spain (-9.7%) performed similarly, compared to the same

period a year earlier. France (-13.5%) and Italy (-17.3%) recorded a double-digit downturn, while demand was

sustained in the UK (+10.3%)”

They have had to implement capital controls for all the wrong reasons, so why does Cyprus not follow through and reinstate their own currency – it couldn’t be a better time.

Aprils Fools I guess but one never really knows in Europe – its such a sick joke of the place with socialists “Up North” just desperate to join the club of “real currencies”

http://icelandreview.com/icelandreview/daily_news/?cat_id=29314&ew_0_a_id=399048

It needed to be said. Well done Bill. Good blog.

ps Surprised Ramanan hasn’t posted yet.

To mix Schaeuble and Himmler is wholly unnecessary. Schaeuble’s youth (5 – 25 = 1947 – 1967) goes in parallel with the German “Wirtschaftswunder”, a period of extraordinary (European) economic expansion. I think you might have had to say more interesting stuff about this part of the equation than pulling out nazi stuff.

I agree with Hans Suter. “Pulling out Nazi stuff” as he puts it, is thoroughly childish.

Re Neil’s point about some sort of administrative control of imports etc so as to make devaluation work better, that’s a possibility. But equally there is an equivalent system that would make the current austerity imposed on Euro periphery countries achieve it’s objective much quicker (the objective being improved competitiveness). It’s a sort of temporary period of central economic planning, as follows.

Wages in a periphery country would be cut by 30% or whatever. Prices would also be cut by about the same amount (though that would depend in the case of each sector of the economy on what proportion of their inputs came from imports).

The net result would be the same as the devaluation of the currency of a country that issued its own currency: little change in living standards, but a big improvement in competitiveness. That would be an administrative nightmare. But the existing “solution” to periphery problems is nightmare anyway.

Sujie,

They might be taking their lead in this regard from the Irish Government, who flag all sorts of outlandish measures in the lead-up to the annual Budget, only to display their noblesse oblige by saddling us with slightly less barmy ‘belt-tightening’ measures. All with the aid of a pliant media, only too happy to report Government spin.

Even Iceland can’t escape the plutocrat’s notice. They WILL join the euro … or else … (or else their Sr politicians won’t get cushy retirements in Brussels).

The Icelandic Putsch

http://bollier.org/blog/icelandic-putsch

I agree that MMT style prescriptions would assist most countries struggling in the Euro zone. They should leave the Euro, float their currencies and implement other MMT policies.

However, I have a hard time believing Cyprus (especially partioned Cyprus) would be independently viable under any conditions. It is an exhausted, rocky island with minimal resources and about 1 million people. It has major water supply problems. Tourism seems to be the only “industry” of any note. Tourism potential is clearly limited by the water crisis. One might also note that tourism is not an industry as such. It is mere consumption though it can effect money transfers in from countries that the tourists come from. Tourism is a “fair-weather” industry in all senses. As soon as times get tough, conflicts threaten or real resources get short, tourism will collapse.

Current account deficit of almost 30% GDP reflects what these unrestrained capital flows can do. They are highly destructive to world trade because they drive large swings in currency movements and therefore render export sector’s periodically to eiher competitive or uncompetitive position.

Leniant attitude MMT has towards open capital accounts is a mistake in my opinion.

Dear PZ (at 2013/04/03 at 0:09)

You said:

But in my writings you will find I would declare all speculative capital flows that are not providing a risk insurance to real producers illegal.

I would ban banks from engaging in speculation.

That is, my version of Modern Monetary Theory and is consistent with all the discussions I have had with the original proponents. If the world economy will not impose these financial changes then a nation has to introduce capital controls. I have written blogs about that in the past as well.

So you might update what you think MMT proposes in this regard. A flexible exchange rate is not the same thing as open slather for hedge funds.

best wishes

bill

Ikonoclast, Singapore seems to do very well and yet they are just perched on a tiny Island. Singapore’s only natural resource is its access to the ocean and Cyprus has that. I wonder whether the only resource a country needs are people who are willing to work together. What is more small countries can be prosperous if there is free trade (and by free trade I’m not meaning giving free reign to speculative capital flows).

At the time of the founding fathers the USA had a population smaller than Cyprus has now didn’t it?

Bill, have a look at this:

IreIceRealGDP

i couldn’t upload it here, it’s a chart showing Iceland and Ireland Real GDP

seems like using the euro didn’t harm Ireland more than using the krona harmed Iceland

Although utterly off-topic, I think Prof. Mitchell and a handful of other economists deserve recognition for their efforts and honesty.

I hope the following link may provide further inspiration:

http://anticap.wordpress.com/2013/04/02/economist-of-the-day-69/

Stone:

Innocuous Fact check: I have looked at several sources online, and found that in 1776, the population of the 13 colonies was something under 3 million. See

http://merrill.olm.net/mdocs/pop/colonies/colonies.htm

It appears that the population of Cyprus is now something over 1 million (with obviously higher population density).

Apart from that I agree with you.

With strict capital controls, like they exist in Iceland, it is difficult to see if these figures of GDP are correct or not. The Krona is held stronger than it would be without the controls.

Under the current capital controls, exporter have to exchange currency to krona at the “official” Central Bank rate.

Foreign registered capita(can be Icelanders living abroad or their companies) l can be brought to Iceland through a special Investment-Approach (Fjárfestingarleið). This is an “auction” in which inflowing capital is exhanged at a discount rate of about 25-35%. So every euro gives you about 205 kronur while exporters just receive 158 krónur.

If this is not selling the country to foreign capital, I don’t know.

Just don’t tell anybody to go the Icelandic way. It is not the way to go.

Thomas Bergbush, thanks for putting me right on that.

However, I have a hard time believing Cyprus (especially partioned Cyprus) would be independently viable under any conditions. It is an exhausted, rocky island with minimal resources and about 1 million people. It has major water supply problems. Tourism seems to be the only “industry” of any note. Tourism potential is clearly limited by the water crisis.

This week I am visiting Aruba, a tiny volcanic island with limited natural resources. Tourism has been the main industry here for 70 years. Fresh water is obtained from desalination. Despite the closure of the island’s only petroleum refinery, the economy is holding steady (about 8% unemployment).

I wonder if there are any lessons Cyprus could take from islands like Aruba?