The other day I was asked whether I was happy that the US President was…

Fiscal austerity undermines welfare now and then things get ugly in the future

The latest – EU Employment and Social Situation: Quarterly Review was released yesterday (March 26, 2013). The Press Release – summarises the main results. I will look into the full document in more detail another day. Today (March 27, 2013), the Australian Productivity Commission released a major study – Trends in the Distribution of Income in Australia – which provides a fairly detailed analysis of the “composition of the income distribution”. The connection is that fiscal austerity not only causes unnecessary damage now to the prosperity of the nations afflicted with these incompetent leaders, but it also undermines the future growth path of the nation. One of the many ways in which growth potential is being undermined is through the impact of unemployment and falling participation rates has on income inequality. The latter impact also negates key propositions that mainstream economists teach their students every day that there is a negative trade-off between efficiency and equity. So policies that promote more equitable income distributions are alleged to undermine economic growth. The evidence is exactly the opposite.

I will report more fully on the income distribution analysis in due course but there was an interesting appendix – How does Australia compare internationally? – which provides insights that have relevance for the findings in the EU Quarterly Review.

It also has relevance for an assessment of the latest – World Bank Strategy for Timor Leste – but analysis of that will also have to wait for another day.

The – EU Employment and Social Situation Quarterly Review – found that:

Over the four years to the last quarter of 2012, 2.3 % of jobs disappeared in the EU across all sectors, although the intensity of net job losses varied between 7.9 % in industry and 15.1 % in construction on the one hand, and 2.2 % in the trade sector on the other

The spatial distribution of those job losses is skewed with some countries losing significant employment slots in the last year. For example, “Greece (-6.5%), Bulgaria (-4.9%), Cyprus (-4.8%), Spain (-4.5%) and Portugal (-4.3%)”.

The Review finds that “Employment at EU level has been trending down since mid-2011, with positive developments only noticeable in part-time work”.

Predictably, in an environment of fiscal austerity, “the share of people running into debt continues to rise steadily”. The lack of overall economic growth (now contracting again) means that the capacity of the non-government sector to save overall and run-down debt levels left over after the credit-binge prior to the crisis.

Unless there is a major positive net export contribution to growth, the private domestic sector cannot engage in successful deleverage while there is major contractionary fiscal shifts being engineered. National income and employment growth is what gives when both sectors attempt these strategies under the current circumstances.

Apart from the Eurozone being chronically prone to collapse as a result of its flawed design, the trigger problem is private rather than public debt. The EU fiscal strategy is thus completely the opposite to what is required to meet the underlying problem they face, design faults notwithstanding.

The EU Quarterly Review confirms that:

Fiscal tightening has affected employment through both direct (public sector employment) and indirect (aggregate demand) channels … Changes to the tax and benefits systems and cuts in public sector wages have led to significant reductions in the level of real household incomes, putting a heavy strain on the living standards of low income households in particular.

All the indicators spell out a bad future for Europe and the negative consequences of the fiscal mismanagement and flawed monetary union will reverberate for decades to come. I haven’t seen one paper that attempts to justify how the current fiscal strategy will deliver net benefits any time soon or any time in the next decade.

Th EU Quarterly Review notes that:

1. Unemployment continues to rise and has reached record EU levels.

2. “The gap in terms of unemployment rates between the south and periphery of the euro area, and the north of it reached an unprecedented 10 pps last year”.

3. “Long-term unemployment in the EU reached another historical high in the third quarter of 2012 at 11.2 million. This is 86 % higher than four years earlier and represents 4.6 % of the active population”.

4. “Youth unemployment in the EU has reached a new peak” with “more than 55% in Greece and Spain.” Youth employment has fallen, with the decline observed for all forms of employment except part-time work. “This poses serious risks for the young generation, rendered even more alarming by the rising number of young people who are neither in employment nor in education or training (NEET), now accounting for roughly 8 million young people under the age of 25”.

5. “Labour productivity continued to weaken in most Member States of the euro area”.

6. “the employment outlook is very bleak, with unemployment foreseen to remain at a very high level up until 2014”.

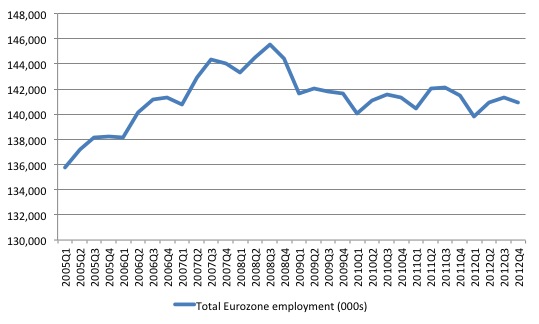

The following graph uses Eurostat Labour Force Data and shows the evolution of Eurozone employment since the March-quarter 2005 to the fourth-quarter 2012. The latest – Eurostat – labour force data allows us to track quarterly employment up until the fourth-quarter 2012.

The peak came in 2008Q3 (145,518 thousand) and it has been largely downhill since then. By the end of 2012, total employment was 140,917, which means that the Eurozone has shed more than 4.6 million jobs over that period.

As the EU Quarterly Review notes – the situation is getting worse and the contraction is estimated to at least persist to the end of next year. Unless there is a dramatic change in policy, the problem will continue well beyond that horizon.

That is the deficit that matters – the jobs deficit. Progressives should hammer on about the deficit of jobs and not get lured into discussions about financial deficits. They are just a reflection, in part, of the massive and rowing jobs deficit.

None of these results are of any surprise given the policy strategy that is being followed. But when you start thinking of the costs of this – not only in terms of foregone national income but also the family and individual tragedies and the devastating inter-generational consequences that will reverberate for decades, one would want a pretty sound framework for justifying the approach.

My short conclusion – there is no possible way that this enormous waste of human potential can be justified in economic terms. I use the term “economic” because that is the terrain that is frequently used as an authority to this mass carnage.

Europe seems to have recurring periods of madness when socio-pathological leaders wreak havoc on the human population under the guise of some mad ideological purity or another. I am sure cultural historians can help us understand why the European society periodically brings forth these human tragedies under the hand of these leaders.

You will obviously appreciate the parallels I am drawing here although I do not want to infer there is a “league table” of human carnage. That is, I am not buying into which heinous act is worse. But I am saying that the current policy regime in the Eurozone is a heinous act carried out by an elite, whose fortunes are not linked to the consequences of their actions.

How does an Australian Productivity Commission report on – Trends in the Distribution of Income in Australia – tie into this discussion.

There are many ways, but the focus in the time I have left today is on the role that unemployment plays in increasing income inequality (the substantive theme today) and the relationship between income inequality and economic growth (a lesser theme today).

There is a solid body of evidence that shows that a nation’s growth potential is negatively impacted by rising income inequality. This means that fiscal austerity not only directly reduces growth by its attack on spending, which is the only driver of growth despite what the supply-siders will try to tell you, but also indirectly undermines future growth by its impact on income distribution.

Mainstream economists have long taught students (to their detriment) that there is a trade-off between efficiency and equity.

Efficiency, is narrowly defined by economists as being a state where a society’s resources are put to their best use to ensure that output is maximised. From a cost perspective it refers to states where you get the most from the least.

Of-course it is a loaded term and fails, usually to consider braoder concepts of “efficiency”, which incorporate social concerns. As an aside, I was at a meeting with some Green politicians today who were seeking help to defend a local community against the wholesale privatisation of public assets and outsourcing of services (to mates presumably) by a conservative administration.

They told me that in the briefing to this government, a consultant hired to give financial advice, announced, as if he was an authority on the matter, that “the local government should only borrow if they can make a commercial profit”.

Since when is a government a business? Since when is it the primary role of governments to produce goods and services for profitable sale? That is how sick this neo-liberal lobby has become – that these idiots can get up in public as experts and influence the direction of policy in a way that undermines the basic reason we have governments in the first place.

I will report more about this particular case in the future as I do more analysis. It is a shocking indictment of Australian politics that these views can get oxygen in any serious debate or forum.

Anway, allegedly, equity interventions – that are designed to redistribute the economic pie – come at a costs – that is, they reduce the size of the pie. So the policy choice is always constructed as a trade-off, you cannot have one without damaging the other. That is the mainstream economic position that is rammed homedaily to students in economics in our universities.

It is called mis-education but then no-one gets punished for pumping out this misleading propaganda.

The problem is that there is little evidential basis for this assertion. There is a solid body of evidence that tells us that income inequality and economic growth are negatively related. Rising inequality undermines the growth potential of a nation.

Nations that enjoy the longest periods of growth are those that are also moving toward greater equality of income and wealth. The evidence is fairly clear that rising inequality undermines the capacity of nations to grow in sustainable ways.

Even the IMF (April 8, 2011) – Inequality and Unsustainable Growth: Two Sides of the Same Coin? – concluded that:

… longer growth spells are robustly associated with more equality in the income distribution.

A prerequisite for resolving the unsustainable imbalances that led to the financial crisis will be to dramatically redistribute income back to workers – so that real wages growth closely tracks productivity growth and workers in sectors with little union representation are able to similarly participate in national productivity gains.

So fiscal interventions that not only work to ensure there is sufficient aggregate demand to sustain high levels of employment but also aim to dramatically reduce income inequality are both growth-friendly strategies. That is, there is no trade-off of the variety that dominates undergraduate textbooks in economics.

The IMF admit as much in this paper – IFM working Paper, 08/168 – The Distributional Impact of Fiscal Policy in Honduras:

At least for the IMF, the potential tension between equity and efficiency can be avoided by promoting and engendering high-quality growth-that is, “growth that is sustainable in the face of external shocks; accompanied by adequate investment (including in human capital, to lay the basis for future growth); respectful of environmental and national concerns; and, last but not least, consistent with policies that reduce poverty and improve equity” …

While they do not practice what they preach – given they are one of the major promoters of fiscal austerity which undermines equity, erodes the incentives to invest in human capital and provides no room for funding green developmental strategies (just ask what happened to the forests in Mali, for example).

Please read my blog – Fiscal policy should sustain full employment and reduce inequality – for more discussion on this point.

The Productivity Commission in Australia found some interesting impacts of unemployment and casualisation, all casualties of fiscally-constrained economies, on income inequality.

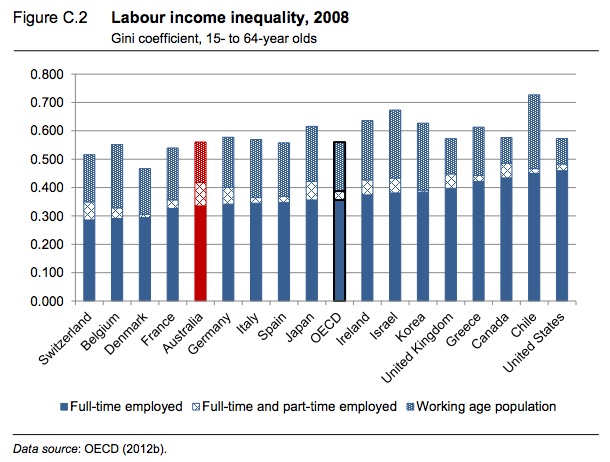

In terms of labour income, the Report produced the following graph (Figure C.2 on Page 127).

The graph shows the – Gini Coefficients – for labour income, decomposed by full-time and part-time work, for various nations.

The Gini coefficient is a summary measure of statistical dispersion within a frequency distribution. To interpret the values shown, a “coefficient of zero expresses perfect equality, where all values are the same (for example, where everyone has an exactly equal income)”.

At the other extreme, a “coefficient of one … expresses maximal inequality among values (for example where only one person has all the income).”

The PC Report shows that “among the OECD countries, North and South American countries tend to have the widest income distribution for full-time work, whereas Australia … [lies] … “below the average Gini coefficient estimates for full time workers in 2008”.

But if we then add part-time workers to the picture the nations with higher part-time work ratios (to total employment) experience, in some cases, sharp, increases in their Gini coefficients.

The PC Report says that:

Australia’s Gini coefficient is increased substantially with the inclusion of part-time workers compared to other OECD countries … due to its relatively high rates of part-time work …

While the Eurozone is shedding jobs overall and, as we will see this increases income inequality significantly, Australia’s fiscal austerity, which is more moderate in terms of the scale of the output gap experienced, is manifesting, initially, in the form of a bias towards part-time work as employment growth slows.

There is also a further bias in Australia, in part due to the legislative environment that both major parties have pursued which attacks workers’ job security, undermines the trade union capacity to protect workers and reduces that capacity of workers to secure real wages growth, towards casual work.

Not only has part-time work accelerated relative to total employment but an increasing proportion of part-time jobs are casual in nature in Australia with the commensurate surrendering of security, wages and conditions that are associated with full-time or permanent part-time work.

These have all increased income inequality in Australia and undermined our growth potential.

The PC Report then broadens the analysis to include the impact on the income distribution of the unemployed and people who are not in the labour force (to take into account drops in participation as a result of the rise of hidden unemployment as workers, who would take a job immediately if one was offered, give up active search in labour markets where there are to few jobs available.

They say that these inclusions:

… increase … [the] … estimates of the Gini coefficient as the low income end of the market income distribution extends down to zero. The countries with the highest unemployment and lowest participation rates tend to have their Gini coefficient most affected by the inclusion of this group.

So, while Europe has traditionally been much more inclusive in terms of income support coverage for its citizens across various categories of welfare, the current period is not only eroding welfare but will also be undermining future growth as a result of the rising inequality that the mass unemployment will engender.

Not only has the fiscal austerity deliberately constrained aggregate demand but it is being manifested in the form of entitlements cuts, which historically act as automatic stabilisers, in the sense that they provide some income and spending buffers when unemployment rises.

The European elites are undermining this capacity at present with long-lasting negative consequences that I am sure they have not calculated in any meaningful and authoritative sense.

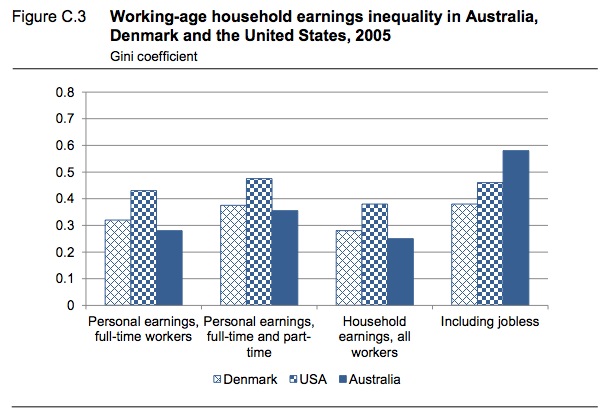

The PC Report also provided a very interesting comparison of income inequality at the household level in Denmark, the USA and Australia.

The following graph (their Figure C.3) shows the working-age household earnings inequality in 2005 for these nations as expressed by the Gini coefficient. The categories shown go from full-time personal earning in the households to the broader groups including the jobless households.

The results are obvious.

The PC Report says that:

Countries where joblessness is concentrated within particular households …. will see a disproportionate impact on household income inequality when the entire population is considered compared to countries where joblessness is more spread … a significant component of the difference in Australia’s measured household income inequality compared to other OECD countries is due to the higher rates of jobless households than seen in some other countries. For example, when comparing Australia’s labour income distributions to Denmark (which has low household disposable income inequality) and the USA (which has high household disposable income inequality) … Australia’s labour income inequality … [was] … lower than both when only the employed are considered. When people not in paid employment are included in the calculation Australia’s labour income Gini

coefficient jumps above both Denmark and the USA …

The PC Report draws on the results of Whiteford, P. (2012) ‘Inequality and Redistribution in the Australian Welfare State, 1981-82 to 2007-08, NATSEM Seminar Series, Canberra.

Conclusion

The tie-in between the PC Report on influences on labour income inequality, the literature of growth potential of nations and the EU Quarterly Review is clear.

Fiscal austerity is not only causing unnecessary damage now to the prosperity of the nations afflicted with these incompetent leaders, but it is also undermining the future growth path.

One of the many ways in which growth potential is being undermined is through the impact of unemployment and falling participation rates on income inequality.

The frameworks used to justify the fiscal authority are the same mainstream economic models that assert there is a negative trade-off between efficiency and equity. it is a flawed framework.

Growth and equity are positively and causally interrelated and fiscal austerity not only kills the present prosperity but ensures nations are poorer into the future.

Tragic Comedy in Australia

The Australian comedy show – the Chaser – has a habit of bailing up politicians and humiliating them. That process, by the way, is different to bailing out or bailing-in!

This little snippet (ht to Steve K) involves the Chaser and the leader of the Federal Opposition, Tony Abbott. The latter is almost certainly going to become our next Prime Minister given the incompetence and corruption displayed by the current party in power.

Anyway, have some fun but be really scared that Tony will be in charge. I should add – to ensure no-one thinks I am politically biased towards the other main political party in Australia – that the current Federal Treasurer and Prime Minister would not have fared any better.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Would it be possible to come up with a counter to the NAIRU in the same sort of format? Call it the NAILE (non-accelerating inflation level of equality). Say that the government has the duty to ensure no involuntary unemployment and also price stability. If wealth equality is sufficient, then profits get spent and so custom is available to ensure full employment without inflation (neither asset price inflation nor CPI inflation). If wealth equality is insufficient then the government is at risk of causing either asset price inflation or CPI inflation as a side effect of having to use deficits in meeting the obligation to avoid anyone being involuntarily unemployed. If asset price inflation kicks in then more resources get switched to the FIRE sector and the spiral gets worse (hence the “accelerating inflation” bit)- so rather than getting new productive real assets built (such as renewable energy systems etc) we get the prices of pre-existing assets bid up.

Great video clip. I needed a laugh after I was forced to sit through an episode of Home & Away.

The true leaders (it was always the banks) of Europe and indeed the wider west are not incompetent.

They have ditched the concept of the nation.

That is what the European project was all about.

“In 2000, Germany’s Foreign Minister Joschka Fischer referred to the Peace of Westphalia in his Humboldt Speech, which argued that the system of European politics set up by Westphalia was obsolete: “The core of the concept of Europe after 1945 was and still is a rejection of the European balance-of-power principle and the hegemonic ambitions of individual states that had emerged following the Peace of Westphalia in 1648, a rejection which took the form of closer meshing of vital interests and the transfer of nation-state sovereign rights to supranational European institutions”

They can now simply direct global physical resources towards creating credit bubbles in other areas if a deflation of sufficient size is created in the eurozone no matter how inefficient it is in the use and maximization of a former nations domestic resources.

The elite make wealth from the real gap between consumption & productivity of conduit asset people.

That is what they do.

That is what they have always done.

Why else is there so much extra claims popping up in these absurd little islands such as Cyprus & Ireland ?

What gives them more power then in the past is that people have become trapped in a suburban cage…….

It just takes the pressing of a few buttons , a few words to the media by the central banks and their suburban “Neighbours” life is over.

Its in stark contrast to post Napoleonic bust /debt crisis in Ireland.

Despite the Brits total military control the place erupted into disorganized agrarian disorder which required much increased investments (input costs) in garrisons and barracks for another 100 years.

This debt crisis is so easy as people are easy meat.

Another example of the global banks (which control the west treasuries) wishing to push resources upwards beyond the nation state & interference from local elites.

http://www.youtube.com/watch?v=7NHc4CwphG4

The people behind these banks are not fools & must realize there will be a catastrophic implosion as all resources finally reach the top layer without any redundancy remaining.

When you have all the money in the world money has no meaning.

These people do not seek money.

They seek power , total power.

Notice those Algerians in those modern consumption temples.

The IMF just loves to see happy consumers in the early stages of market state colonization.

They are not too far removed from these characters now.

http://www.youtube.com/watch?v=bV3tfauw3vQ

What happens to those people when they can no longer run away from themselves ?

“Europe seems to have recurring periods of madness when socio-pathological leaders wreak havoc on the human population under the guise of some mad ideological purity or another. I am sure cultural historians can help us understand why the European society periodically brings forth these human tragedies under the hand of these leaders. ”

The current issue of Australian Skeptics (sorry, subscription only) has an article on Tribalism by retired academic Paul Prociv wherein he suggests a “nice correlation” between the general prevalence of alpha males, aggressive sociopaths, and bipolar individuals in a population, and “Dunbar’s number”, a basic unit of measurement for the size of stable social groups.

Dr Prociv’s observation, combined with Dunbar’s number suggests that 1 in 150 could have the pre-requisite mental instability to qualify for a well-paid job in the Brussels cabal so there’s no shortage of candidates even after eliminating all those without a formal qualification in economics.

In short sentence. Purpose of government is to provide good customers to businesses, not to support corporations directly. If businesses are not capable of surviving in great customer environment then they should not exist. That does not apply to whole industries that are under attack from overseas.

Policies that provide good customers are redistributive tax and strong safety net and full employment guarantee, besides usual education

this is why I favour near universal welfare explicitly unfunded by tax and bond issue

as opposed to a job guarantee

a stimulus directed directly and progressively

as it could double the available spending power of the low paid

while have a progressively less effect on the spending power of the wealthier

and governments could concentrate on the logistics of providing services and

high skilled well paid labour for the public purpose

ideally if maximum wages could be made to work

the cut of I would wish for in my universal welfare would be

that which takes earrings above the maximum

government sector issued fiat in the form of universal welfare could

1 end poverty

2 provide stimulus to aggregate demand to facilitate full voluntary employment

3 progressively predistribute income

Kevin Harding, I thought along the same lines as you and concluded that replacing all current taxes with a tax on all assets ( cash, real estate, bonds, stocks etc etc) and replacing means tested welfare with a citizens’ dividend would be the best set up for those aims. Having the rule of law and a state to enforce it means that someone such as Warren Buffet can receive billions each year as revenue from what he owns. An asset tax would mean that he would be paying proportionately. A citizen’s dividend could tide people over whilst they set up employee owned enterprises to employ themselves or did whatever they considered best. Because it would also be paid equally to rich and poor people, it would enable the moderately rich to use the citizen’s dividend to partly offset the increased tax burden that came from the asset tax being inherently so much more progressive than any income or sales tax system (asset distribution is very skewed to the rich).

Michal Kalecki advocated an asset tax and called it a “capital tax”. He wrote:

” the inducement to invest in fixed capital is not affected by a capital tax because it is paid

on any type of wealth. Whether an amount is held in cash or government securities or

invested in building a factory, the same capital tax is paid on it and thus the comparative

advantage is unchanged.”

stone

for national governments

I am quite happy with an income tax as opposed to an asset tax

when people cash out on their assets their new income can be taxed

we already have property taxes at the local level

I would like those local property taxes to be levied more progressively

I would like central government income tax levied more progressively

ditch employee tax national insurance or payroll tax

I agree with MMT

the downside of increased government spending whether through universal welfare

or government job guarentee is potential demand pull inflation

but inflation is a sectorial conflict

universal welfare and a maximum wage do not increase any costs

but do firmly side with 99% in that inflationary sectorial conflict

Kevin Harding, the thing is that unrealized capital gains confer financial power and that directs the direction of our economy and our political system. There is so so much more going on than deferred consumption.