The other day I was asked whether I was happy that the US President was…

Very unintelligent indeed

I had a long flight today and other things to catch up on after the Easter period. But the stunning news yesterday from Eurostat that the EU17 unemployment rate has now risen (in February 2013) to 12 per cent. Each month’s Labour Force data sets a new record peak for the Eurozone. Each month that unemployment rises, the real GDP losses that are being deliberately created by the existing policy regime mount. As I show in this blog, those losses are enormous and will never be regained – that income has been lost forever. The human dimensions of the crisis are also huge. And the evidence mounts that the conceptual underpinning of the policy framework doesn’t hold water. This is an extraordinary period of history where a flawed theoretical approach which doesn’t stack up when confronted with the data, is being used to create a flawed monetary system design, which has failed categorically when judged against any reasonable criteria of social purpose, and then the leaders impose even worse policy designs over that failure. Sometime in the future, humans will judge the current generation to be very unintelligent indeed.

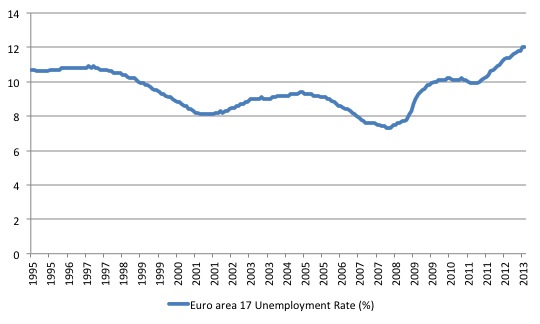

This is the latest Euro area 17 unemployment rate, which is a narrow measure of the labour wastage in that monetary system. This graph is all the information you need to conclude that the monetary system in Europe is deeply flawed and that the policy settings among the member nations are completely wrong. I know about adjustment lags and changing expectations and all the rest of – which means it can sometimes be argued that unemployment, for example, might rise for a time, even though the underlying fundamentals are moving in the right direction.

But ladies and gentleman – this crisis is now into its fifth year. All the signs are that things are getting worse not better. No adjustment process (of this type) takes that long to reveal itself.

The unemployment rate reached a low of 7.3 per cent in March 2008. The latest Labour Force data released by Eurostat yesterday (April 2, 2013) – Euro area unemployment rate at 12.0% – shows that in February 2013 the unemployment rate had risen to 12.0 per cent. Each month it tops the previous month’s record peak.

The first part of that rise was between March 2008 until May 2010. Then with the rising budget deficits some stability was provided to aggregate demand and unemployment started to fall. The Eurozone would have then slowly recovered and followed the path of the US economy (probably).

But the second round of increasing unemployment was entirely policy induced. The policy makers, hiding behind the flawed fiscal rules, deliberately pursued fiscal policy changes which everyone knew would drive unemployment up. There will be no end in the process until they reverse the policy stance.

This is a monumental failure and all the talk of having to consolidate and achieve fiscal sustainability is meaningless when there has been no coherent analysis presented by any of the government agencies (anywhere) to show the temporal paths of the costs and benefits of their actions. It is clear to see the massive costs – they are staring us in the face and are mounting every day. There can be no benefits great enough to justify this social massacre.

Today, I also decided to repeat yesterday’s US output gap calculations for the EU17 area. Please read my blog – US problems are cyclical not structural – for more discussion on what I did.

The following graph shows the actual real GDP level from 2000Q1 for the EU17 and my estimates of potential real GDP up to the fourth-quarter 2012.

The potential series is a simple extrapolation with the projection starting at the most real GDP peak (March-quarter 2008).

The projected rate of growth was the average quarterly growth rate between 2001Q1 and 2008Q1, which was a period (as you can see in the graph) where real GDP grew steadily (at 0.52 per cent per quarter) with no major shocks. If the global financial crisis had not have occurred it would be reasonable to assume that the economy would have grown somewhere along the red line.

The gap between actual and potential GDP in the fourth-quarter 2012 is around 294,720 million Euros. Whatever it actually is the gap is enormous and represents a massive permanent loss of national income every day the gap continues.

If we start at 2008Q1 and consider the incremental output gap since then, by the fourth-quarter 2012 the implied gap is 12.2 per cent of potential GDP. Somewhere around that is a reasonable estimate. It is an incremental output gap because we would hardly have called the position the EU17 was in during the March-quarter 2008 to be representative of a fully employed state given the unemployment rate was still 7.3 per cent.

Further, just like in the US, when an economies real GDP level falls off a cliff as it did in the EU17 in the first half of 2008, it is difficult to construct that decline in so-called “structural” terms. As I noted yesterday, structural deterioration is gradual and cumulative not sudden and sharp.

The quarterly losses are accelerating. Overall, the EU17 has lost in cumulative terms something like 3,501,604 million Euros in foregone output and income. These costs will resonate for generations now.

That is for certain given the parlous employment situation of Europe’s 15-24 year olds.

It is just not possible to expect smooth social conditions and a high productivity workforce in the future when nations such as Spain, Greece, Italy and Portugal have massive proportions of their youth in jobless states.

Eurostat estimates that there were 5,694 millions 15-24 years unemployed in the EU27 area and 3,581 million in the EU17 (Euro area) in February 2013.

196,000 more EU27 15-24 years were added to the unemployment queue over the 12 months to February 2013, the vast majority of them (188,000) coming from the Euro area.

The highest rates were Greece – 58.4 per cent in December 2012 and rising; Spain 55.7 per cent in February 2013 and rising, Portugal 38.2 per cent and rising; and Italy 37.8 per cent and rising.

On the plane back to Darwin today I was reading the latest publication from the European Commission’s Employment, Social Affairs, and Inclusion Directorate – ahr

The Commission kindly posts me a hardcopy version which I find very useful.

Here is the electronic copy – Employment and Social Developments in Europe 2012 – which I just noted has been downloaded by only 9802 people. That appears to be an extraordinarily low number given that the Report focuses on the key problem in Europe – lack of employment and excessive unemployment.

I will steadily provide analysis of the Report over time. It is a very dense (deep) document with masses of data and so it takes time to really absorb and consider at the level it deserves.

Chapter 5 considers “Wage developments in the European Union during a severe downturn”. Towards the end of that Chapter they consider factors which impact on the demand for and supply of labour, in particular “the impact on employment of changes in wages” – the issue that has led to bitter paradigmatic divisions within the economics profession for as long as the debate has been alive.

Here is some brief background to understand the measures used. At the macroeconomic level (and stop thinking micro at this stage) – the nominal wage (W), paid by employers to workers, is determined in the labour market – by the contract of employment between the worker and the employer. The price level (P) is determined in the goods market – by the interaction of total supply of output and aggregate demand for that output although there are complex models of firm price setting that use cost-plus mark-up formulas with demand just determining volume sold.

The real wage (w) tells us what volume of real goods and services the nominal wage (W) will be able to command and is obviously influenced by the level of W and the price level. For a given W, the lower is P the greater the purchasing power of the nominal wage and so the higher is the real wage (w). We write the real wage (w) as W/P.

The relationship between the real wage and labour productivity relates to movements in the unit costs, real unit labour costs and the wage and profit shares in national income.

The wage share in nominal GDP is expressed as the total wage bill as a percentage of nominal GDP. Economists differentiate between nominal GDP ($GDP), which is total output produced at market prices and real GDP (GDP), which is the actual physical equivalent of the nominal GDP.

To compute the wage share we need to consider total labour costs in production and the flow of production ($GDP) each period. Employment (L) is a stock and is measured in persons (averaged over some period like a month or a quarter or a year.

The wage bill is a flow and is the product of total employment (L) and the average wage (w) prevailing at any point in time. Stocks (L) become flows if it is multiplied by a flow variable (W). So the wage bill – W.L – is the total labour costs in production per period.

The wage share is thus the total labour costs expressed as a proportion of $GDP – (W.L)/$GDP in nominal terms, usually expressed as a percentage. We can actually break this down further.

Labour productivity (LP) is the units of real GDP per person employed per period. Using the symbols already defined this can be written as:

LP = GDP/L

This tells us what real output (GDP) each labour unit that is added to production produces on average. Nominal GDP ($GDP) can be written as P.GDP, where the P values the real physical output.

To summarise the concepts:

- Employment is measured in persons and is a stock.

- Labour productivity is the units of output per person employment per period.

- The wage and price level are in nominal units; the real wage is the wage level divided by the price level and tells us the real purchasing power of that nominal wage level.

- The wage bill is employment times the wage level and is the total labour costs in production for each period.

- Real GDP is thus employment times labour productivity and represents a flow of actual output per period; Nominal GDP is Real GDP at market value – that is, multiplied by the price level. So real GDP can grow while nominal GDP can fall if the price level is deflating and productivity growth and/or employment growth is positive.

- The wage share is the share of total wages in nominal GDP and is thus a guide to the distribution of national income between wages and profits.

- Unit labour costs are in nominal terms and are calculated as total labour costs divided by nominal GDP. So they tell you what each unit of output is costing in labour outlays; Real unit labour costs just divide this by the price level to give a real measure of what each unit of output is costing. RULC is also the ratio of the real wage to labour productivity and through algebra I would be able to show you (trust me) that it is equivalent to the Wage share measure (although I have expressed the latter in percentage terms and left the RULC measure in raw units).

To help you follow the logic here are the terms developed and be careful not to confuse $GDP (nominal) with GDP (real):

- Wage share = (W.L)/$GDP

- Nominal GDP: $GDP = P.GDP

- Labour productivity: LP = GDP/L

- Real wage: w = W/P

By substituting the expression for Nominal GDP into the wage share measure we get:

Wage share = (W.L)/P.GDP

We can write as an equivalent:

Wage share = (W/P).(L/GDP)

Now if you note that (L/GDP) is the inverse (reciprocal) of the labour productivity term (GDP/L). We can use another rule of algebra (reversing the invert and multiply rule) to rewrite this expression again in a more interpretable fashion.

So an equivalent but more convenient measure of the wage share is:

Wage share = (W/P)/(GDP/L)

That is, the real wage (W/P) divided by labour productivity (GDP/L).

I could also express this in growth terms such that if the growth in the real wage equals labour productivity growth the wage share is constant. The algebra is simple but we have done enough of that already.

That journey might have seemed difficult to non-economists (or those not well-versed in algebra) but it produces a very easy to understand formula for the wage share.

Two other points to note. The wage share is also equivalent to the real unit labour cost (RULC) measures that Treasuries and central banks use to describe trends in costs within the economy.

RULCs is a ratio and is influenced by movements in the numerator and the denominator. For example, RULC cannot fall without productivity growth, other things equal. The only other way to accomplish this is to ensure that nominal wages fall faster than the price level falls. In the historical debate, this was a major contention between Keynes and Pigou (an economist in the neo-classical tradition who best represented the so-called “British Treasury View” in the 1930s.

The Treasury View thought the cure to the Great Depression was to cut the real wage because according to their erroneous logic, unemployment could only occur if the real wage was too high.

Keynes argued that if you tried to cut nominal wages as a way of cutting the real wage (given there is no such thing as a real wage that policy can directly manipulate), firms will be forced by competition to cut prices to because unit labour costs would be lower. He hypothesised that there is no reason not to believe that the rate of deflation in nominal wage and price level would be similar and so the real wage would be constant over the period of the deflation. So that is the operating assumption here.

The wage share was constant for a long time during the Post Second World period and this constancy was so marked that Kaldor (the Cambridge economist) termed it one of the great “stylised” facts. So real wages grew in line with productivity growth which was the source of increasing living standards for workers.

The productivity growth provided the “room” in the distribution system for workers to enjoy a greater command over real production and thus higher living standards without threatening inflation.

Since the mid-1980s, the neo-liberal assault on workers’ rights (trade union attacks; deregulation; privatisation; persistently high unemployment) has seen this nexus between real wages and labour productivity growth broken. So while real wages have been stagnant or growing modestly, this growth has been dwarfed by labour productivity growth.

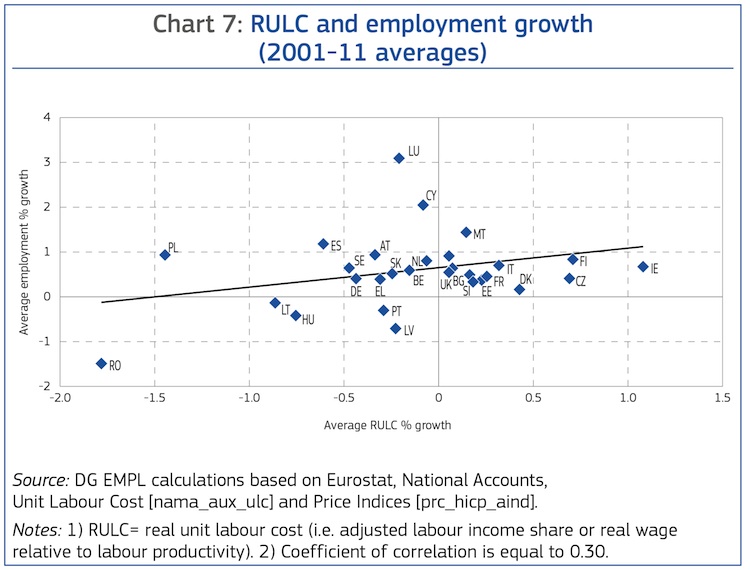

The EC Report chose to analyse the relationship between RULC and employment growth for 2010-11 (averaged). There reasoning went like this.

1. “On the supply side, the real unit labour cost captures the discrepancy between real wages and productivity … Under the classical paradigm, firms are willing to hire workers until their marginal product equals their marginal costs, that is, when labour costs equal productivity levels. In other words, an increase (decrease) in the real unit cost results in a decrease (increase) in labour demand, all other factors being equal”.

2. “On the demand side, the real unit labour cost measures the labour income share … When the labour income share increases (which also implies a decrease in the capital income share), consumer demand can be expected to rise and investment to fall, all other factors being equal. The latter two effects point in opposite directions with respect to their impact on aggregate demand so that a judgement cannot be made a priori as to which effect will dominate”.

This two-fold perspective of RULC resonates with the Keynes versus Classics debate in the 1930s. The Classics could not see that wages impacted on both the supply-side by pushing up costs and the demand side by impacting on incomes.

The construction of that argument (which earlier writers such as Marx had also seen clearly) was one of the contributions of Keynes and exposed the deep flaws in the Classical employment theory. I should add that the current neo-liberal view of employment policy, which dominates, is largely based on Classical labour market analysis. The wheel turned back to a flawed and discredited theoretical approach such is the myopia and memory failures among policy makers.

The Report produced a graph – Chart 7 (large format) – which I reproduce below. It shows the relationship between RULC and employment growth (2010-11 averages) for the EU nations.

Commenting on the graph, the EU Report concludes:

… one could argue that the net outcome will depend on the specific characteristics of the economy which are applicable at the time of the impact assessment. For instance, if investment prospects are low because demand is low, an increase in the labour income share should stimulate house- hold demand which in turn will stimulate investment, generating a virtuous circle of mutually reinforcing outcomes yielding a rise in aggregate demand and employment, all other factors being equal. Of course, if household spending is also constrained due to a lack of confidence or high indebtedness despite a rise in the labour income share, then this increase will not be effective in stimulating aggregate demand.

Ultimately, the determination of the net impact of changes in the real unit labour cost on employment is an empirical matter. A first look at the data in Chart 7 shows a positive correlation between the average growth in the real unit labour cost and employment over the 2001-11 period, suggesting that developments in the demand side of real unit labour cost dominated supply side effects over this period …

That is, a lack of demand. The demand for labour is derived from the demand for goods and services, which is a function of the level and growth in aggregate demand. It is impossible for aggregate demand to grow when the components of spending are failing. When the non-government sector spending cannot support adequate employment growth then there is only sector left – the government sector.

Concepts of fiscal sustainability that define ratios etc which do not include real world things such as employment growth and youth unemployment rates are irrelevant to the basic function of government – to advance social welfare.

Please read the following introductory suite of blogs – Fiscal sustainability 101 – Part 1 – Fiscal sustainability 101 – Part 2 – Fiscal sustainability 101 – Part 3 – to learn how Modern Monetary Theory (MMT) constructs the concept of fiscal sustainability.

Conclusion

I was also intending to comment on the leaked document that the Cypriot press published on Monday (April 1, 2013) – Memorandum of Understanding on Specific Economic Policy Conditionality – which sets out the Troika’s demands on Cyprus as per last week’s agreement.

The document has a warning – “Contains sensitive information, not for further distribution”. Yes, is highly sensitive. I discloses in great detail the socio-pathic behaviour of those who drafted it or instructed the drafting of the document.

It will go down in history as one of those documents that define an era – an era of incompetence and venality.

It is hard not to conclude that the member states in the Eurozone are being governed by maniacs who have lost all sense of common purpose and have become so entrenched in their ideological madness that they are oblivious to the incredible costs that are arising around them (manifesting as massive human damage).

This raises questions of why are people who are being most damaged putting up with this extraordinary behaviour. It is a question that Gramsci was deeply engaged in when he wrote his Prison Notebooks (the first sort of blog – without the b). He analyses consent for hegemony in great detail and I will come back to the insights he provided.

It is particularly prescient in the current situation.

But I have ran out of time now.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

raises questions of why are people who are being most damaged putting up with this extraordinary behaviour

Indeed, this phenomenon is most perplexing. One answer that has been given is that it hasn’t been bad enough, meaning that the situation hasn’t reached the levels of the thirties with its soup kitchens, children running around in bare feet, the emergence of shantytowns (Hoovervilles), and the like. While this may be part of the answer, I don’t think it is sufficient for a decent causal account of the seemingly passive behavior we see in the face of what can only be described as a war on the poor, not unlike what took place in the very early thirties in the US, whose most potent exemplar is Andrew Mellon, the Secretary of the Treasury under Hoover.

Here’s the problem: People look at government social programs and see much to criticize. But what is actually needed in an economy with a government backed usury cartel is government MONEY, not government social programs – to extinguish the aggregate interest which otherwise must created as additional debt or earned via exports.

So abolish most government social programs and just hand out new fiat via a BIG, I suggest. Remember when, G.W. Bush, a conservative Republican sent out those “stimulus checks.” Who complained? Anybody?

Your blog is very stimulating and informative, consistently! Thank You!

That said, to simply say we have a “lack of demand”, is oversimplifying our economic problem. The real problem is how to have all our citizens contribute meaningfully toward our economic pie.

Ideally, every exchange of money for goods and services is truly an exchange. Printing money is not an exchange at the initial transfer, but is a trade of real value for freely created paper . I agree that after the initial exchange, later exchanges must be real work traded for real work via the convenient money medium.

The path of initial money creation and distribution is the sticking point for many people.

“So abolish most government social programs and just hand out new fiat via a BIG, I suggest. ”

The economy has failed to ‘naturally’ produce enough jobs.

So how is it ‘naturally’ going to produce a standard of living?

The only way for a field to produce a decent yield of corn is for it to be farmed. That is an active process.

For a discussion of psychopathic and sociopathic behavior and how it relates to the current economic crisis, see my blog at http://rescipe.wordpress.com/2013/04/03/sociopathic-behavior-the-economic-crisis/.

Social processes of the sort we have been talking about re this blog inevitably tend to end at their lowest point rather than their highest. I think there may be a simple reason for this. The explanation concerning why social processes inevitably end at their low points as opposed to their high points which I would propose is this. It is because the low points are the situations of greatest entropy or disorder. The entire process constitutes a kind of social implementation of the second law of thermodynamics.

It underscores the notion that social, including economic, processes are non-ergodic, as has been contended many times, which means that the variation or volatility inherent in social processes, among other things, can not be deduced by means of a sufficiently long series of social instances. Which is a more incisive and informative way of saying that the future can’t be predicted based on information about the past (including the present, which in a moment will be part of the past).

The economy has failed to ‘naturally’ produce enough jobs. Neil Wilson

There is nothing natural about a government-backed banking cartel which, btw, lends when credit isn’t needed and refuses to lend when it is. Fiscal spending, otoh, creates no need for all the fiat spent to be returned, much less with interest.

Most people with adequate resources such as land and an income do work that is meaningful to them. So in addition to a BIG, perhaps a new Homestead Act is needed too.

Bill fails to see how specialized the market state has become.

Europe is the plantations owners house.

The rest of the world is the cotton fields.

There is a minor productive function of spinning euro yarn under the roofs but that productivity is a yield for the UK owner who sits atop this global satanic mill.

The euro servants are trained for service or entrepot activities ………they simply can no longer do those messy primary & secondary jobs without huge energy inputs.

The concentric post war capital export onion rings can no longer expand and yet can no longer contract without setting off huge implosions within this bankers dolls house we call the Earth.

In the immortal words of W.

THIS SUCKER IS GOING DOWN.

European policy goal number 1.

OECD oil Demand based on Adjusted Preliminary Submissions – January 2013

Germany 2.24 MBD , +5.2 % PA growth

UK 1.45MBD , +0.5 % PA growth

France 1.7 MBD , – 2.6 % PA

Italy 1.14MBD , – 9.8 % PA !!!!

Spain 1.23MBD , – 6.2 % PA

The banking system seeks to push resources upwards as that is what it has always done.

It will not stop……..

“This raises questions of why are people who are being most damaged putting up with this extraordinary behaviour. ”

I’m old enough to see how all this developed.

Beginning with Thatcher’s TINA(There is no alternative) all the major political parties have worked from the same playbook. Like AFL football coaches their only answer is to increase the intensity of the “medicine”(ie: train harder/take steroids/endure austerity), rather than review the strategy.

The people who are being most damaged are mostly not economists and only know they are hurting. They may lash out in disruptive or violent ways, but without a political movement working from a different play book,they will fail to capitalize on on the strength of any political momentum they may develop( eg: the occupy movements).

@F Beard

A mortgage jubilee has been suggested, most particularly by Ann Pettifor. The authorities have taken no notice. Just as they have not prosecuted anyone for the massive fraud which helped to generate much of the profiteering that brought about the economic crisis we are now faced with. Virtually no one has gone to jail, principally I would argue because the event has been rationalized for the benefit of the well-off. Were there many successful prosecutions, more than a few wealthy investors would lose their shirts as a consequence.

Therefore, so far, everything is being done in order to ensure that this does not happen. Even to the disbenefit of the various societies themselves — such as the US, the UK, all the countries of the Eurozone even Germany. Some German banks are known to have engaged in control fraud. How many prosecutions have their been of top officials?

In the S&L crisis in the US, around a thousand people went to jail. The social and cultural climate seems to have altered dramatically since then.

A universal bailout with new fiat (e.g. Steve Keen’s “A Modern Debt Jubilee”) is much more fair than a conventional debt Jubilee since credit creation cheats non-debtors too (via negative real interest rates, especially in real estate). A universal and equal fiat distribution would also fix everyone from the bottom up in nominal terms including the banks and state and local governments. Even in real terms, price in(de)flation could be precluded by a temporary ban on credit creation (the cause of the problem anyway!) and by metering the fiat distribution to just replace existing credit as it is repaid since credit repayment DESTROYS deposits.

Bill;

It has gone on much longer than that:

” Barbara Garson, “Down the Up Escalator: How the 99 Percent Live Today.”

Interesting discussion with the author on WNYC’s Leonard Lopate Show. Don Pesca is the host for this interview.

She admitted that she actually approached her topic, ‘why are the children of the Boomer and preceding generations doing so less well that their parents and grandparents’, in some confusion. She said it became painfully clear that it comes down to the fact that since the 1970’s there has simply been no increase in income for the middle and working classes. Their income has stagnated.

This is not news to many here at Billy Blog, but for lots of Americans, living in the Panglossian image of American life as painted by their many forms of media, it is huge and disturbing news.

Ms. Garson realized that all the profits are flowing inexorably upward, with employers forcing workers downward in their living standards. But banks flush with cash became careless and put out money on chancey schemes to try to make more and more money. Easy credit was necessary to keep people with no increase in income able to make purchases. Otherwise, the manufacturers would have been downsizing and going out of business years ago.

”

INDY

mammoth has a point

we should not conflate two problems

ecb refusal to support euro investors

and the euro disaster in general

its inability to support aggregate demand

and the cruel fate of paticularly the young unemployed