I started my undergraduate studies in economics in the late 1970s after starting out as…

Fat cat bankster wants to make the unemployed even more desperate

My university office is far from clean so next week when I get back there I suspect I will find some more old insightful articles in the boxes remaining to be sorted to comment on. I haven’t much time today as I am in transit. But there are two interesting developments in Australia that are worth commenting on while the iron is hot. The first is that one of Australia’s fat cat banksters, fresh from enjoying the benefits of the federal government’s loan guarantees is now advocating cuts in the unemployment benefits to make the unemployed more desperate for work. The benefit is already well below Australia’s poverty line and there are 3.6 odd unemployed for every vacancy not to mention the 8 per cent of workers who are underemployed. The bankster thinks that by pushing them further into poverty they might up house, pack their cars and travel across the other side of the continent to work in the mining sector. Little does he know. The second piece of news was that two major mining projects have been shelved by BHP as the outlook for the sector deteriorates.

On June 26, 2012 the Australian Senate (our upper house in Federal Parliament – the “states house”) commenced an The adequacy of the allowance payment system (long-name is The adequacy of the allowance payment system for jobseekers and others, the appropriateness of the allowance payment system as a support into work and the impact of the changing nature of the labour market).

The Senate referred this matter to the Senate Education, Employment and Workplace Relations Committee for inquiry and report.

The Committee will report back on November 1, 2012.

The Australian Government made a submission to the Senate Inquiry – Submission to the Senate Inquiry on the adequacy of the allowance payment system for job seekers and others – which is as long-winded as it is dissembling.

The Government’s Submission sets the scene for its argument by saying that:

… the fundamentals of the Australian economy continue to be strong and the outlook remains positive … Prospects continue to be underpinned by strong growth in our regional trading partners and an unprecedented pipeline of mining investment …

It is crucial to enhance the employment prospects of job seekers, including those on allowances. This is achieved by arrangements which ensure that the design of allowances, supplementary payments to recipients, employment and skills development programs and strategies to support productivity work in concert to increase employment opportunities and actively encourage and support recipients of allowances to transition to work.

You can see they make no mention of their responsibility to ensure there are enough jobs available despite them being signatories to various international treaties (UN and ILO declarations) that say it is the their responsibility to ensure there is full employment.

The narrative is clear – supply-side.

On Page 11, the Government’s Submission discusses the “effectiveness of the payment system as an incentive into work” and notes that the Newstart Allowance (the unemployment benefit) is “meeting its fundamental and longstanding purpose as a transitional payment, designed to incentivise work engagement”.

I must have missed something in the history of my country during my own lifetime but the unemployment benefit was fundamentally designed to provide income support for those who fell into unemployment in an environment where long-term unemployment was rare (and defined as 12 weeks or more rather than 52 weeks or more as it is now) and the nation enjoyed true full employment.

At that time, spells of unemployment were short and most people could quickly find a new job if they were unlucky enough to become unemployed. Unfilled vacancies were usually above the level of unemployment which meant that firms were always looking for workers and provided training slots with job offers to ensure they could fill vacancies.

To repeat – unemployment benefits were designed to be short-term income support.

The incentivise narrative entered much later as the neo-liberals were looking for victims to blame for the mess that their austerity policies were creating – that is, the high unemployment that they created by abandoning active fiscal policy and relying monetary policy to use unemployment as a policy tool to keep inflation low.

It was introduced when unemployment to vacancy ratios rose – sometimes to around 10 to 1 – currently around 3.75 and that is not counting the mass underemployment that is a more recent manifestation of the failure of the economy to produce enough jobs. It was obvious the economy was not producing enough jobs yet to disguise that a full-blown attack began on the unemployed and the narrative shifted to claims their allowances were too high and were undermining incentives to work.

Quite simply, it was argued that our disadvantaged citizens preferred the pittance that the government provided them by way of unemployment benefits to working despite the fact that the former life opened the person to public humiliation, vilification from the media and civic leaders, and – poverty.

Somehow, successive governments were able to convince us that these characters were lazy and living high on the hog and should be working like us. The argument relied on a sort of collective denial or ignorance of the reality – the data – the UV ratio, the lack of jobs – whatever you want to call it.

When those arguments were raised, relevant Government Ministers would perjure themselves with creative stories such as “there are plenty of jobs it is just that the firms have stopped advertising them because they know the dole bludgers won’t take them anyway”. Outright lies. When it was pointed out (by yours truly many times and others) that such a scenario would imply the firms all had long order books and the evidence didn’t support that – the relevant person would resort to vilification and suggest university academic were socialists or worse.

Given the state of poverty among the unemployed, which I examine in these blogs – Why are we so mean to the unemployed? and The plight of the unemployed – under growth and decay and Our pathological meanness to the unemployed is just bad economics – many welfare groups and people like me have been arguing that if the government is not going to create work then it should at least increase the unemployment benefit above the poverty line.

Here is an update. The Newstart Allowance is adjusted every March and September. Poverty line data is available on a quarterly basis from the Melbourne Institute of Applied Economic and Social Research.

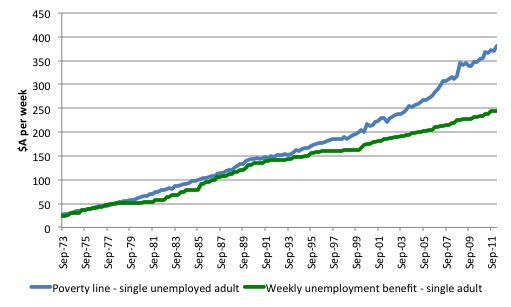

The following graph shows the evolution of the Single Unemployment Benefit and the Single Unemployed Poverty Line since 1973 until March-quarter 2012.

The single unemployment benefit stands at $34.90 a day which is well below any reasonable estimate of the poverty line in Australia. There is not very much you can buy with $34.90 a day after paying accommodation (even if you can afford accommodation).

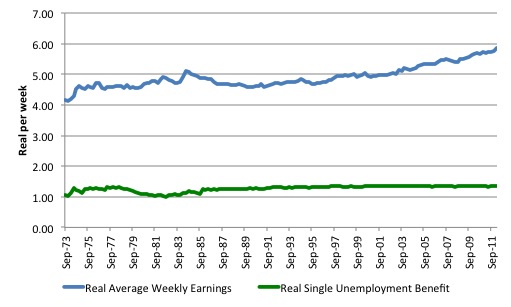

The next graph shows real average weekly earnings and the real single unemployment benefit over the same period as the previous graph. The RBA statistics section is good for quick access to Consumer Price Index -G2 and Labour Costs – G6.

I should note that productivity has been rising well above the rate of real average weekly earnings since the early 1980s so there has been a massive redistribution of national income away from workers generally over the last 30 years to profits.

But even with that dynamic unfolding, real average weekly earnings have grown modestly since the early 1980s whereas the real standard of living for the unemployed has barely changed.

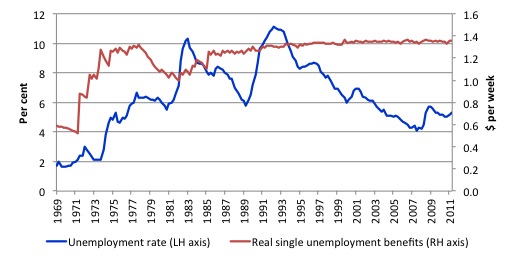

The following graph shows the real single unemployment benefit (right-hand axis) (using CPI with base=100 at 1989-90) and the unemployment rate (left-hand axis) since September 1969. You can see the cyclical pattern of the unemployment rate after the step increase in the mid-1970s as major public spending cutbacks occurred. The step rise in real unemployment benefits in 1972 coincided with the election of the Whitlam Labor Government which had been out of power for 23 years.

With the conservatives out of power for the first time in a generation, the Labor Government, which was social-democratic in leaning, set about making changes to a range of entitlements and pay scales.

However, real benefits fell sharply in the early years of the conservative government that took over from Whitlam and during the 1982 recession which it oversaw, real benefits fell sharply at the same time unemployment sky-rocketed. After some initial realignments in benefits by the 1983-elected Hawke Labor government which saw real unemployment benefits rise, that Government’s neo-liberal colours started to shine brightly and from then until they lost office in 1996 (with Keating as Prime Minister) the unemployment enjoyed on minuscule real growth in entitlements.

Then the bad years under the immediate past conservatives (1996 to 2007) has seen virtually no real growth at all in the single unemployment benefit (and related scales) despite unemployment persisting at high levels throughout this period (only slowly declining during the commodities boom).

And then in 2007, a new Labor government was elected just before the onset of the worst global downturn since the Great Depression. Without knowing how badly the Australian economy was going to be affected, the recession budget in May 2009 failed to provide any increase in unemployment entitlements. This resulted in real benefits remaining unchanged since the beginnning of the crisis in March 2008. By way of comparison, the real aged pension for singles over the same period has increased by some 23 odd per cent.

How can that disparity be justified?

While the Government refuses to encounter direct public sector job creation it is forcing the rising number of unemployed to live on below poverty line incomes.

The Government’s Submission rejects that argument. They say in relation to calls to increase the unemployment benefit to bring it back closer to the poverty line that:

Any increase of this nature would have a substantial fiscal cost which would need to be balanced against other government spending priorities and fiscal objectives. In addition, an increase would not assist in maintaining the fundamental character of Newstart Allowance as a payment that predominantly supports work re-engagement. As the OECD acknowledges, an increase in the base rate of Newstart Allowance has the distinct disadvantage of reducing employment incentives, especially for those who can only obtain low paying employment.

Aside from the work disincentive effect associated with options that involve lifting base allowances by a significant amount, it may not be necessary, as around 60 per cent of recipients have left Newstart Allowance within 12 months of commencement on the payment. Given this, an increase in the base rate is arguably a very costly option for this group. Reforms which support productivity and participation continue to be a policy priority. In a climate of fiscal constraint, it remains important to consider expenditures on income support alongside other public expenditure priorities and to note that the position of people out of work is also assisted through investment in taxation measures, employment services and broader social policy and program reforms.

This is what the OECD actually said on the matter. In the – OECD Economic Survey, Australia 2010 (see an overview of the Survey HERE) the OECD said that:

The transfer system could better tackle poverty, while strengthening incentives to work … additional attention given to disadvantaged groups should not lead to worsening of services provided to less disadvantaged unemployed. Over time, the adequacy of Newstart Allowance should be examined, taking into account both fiscal constraints and community expectations. An option would be to increase the Newstart Allowance for the initial period of unemployment to provide a more adequate safety net, but job search requirements should be maintained and the impact on the incentive to work should be assessed.

That is quite different from the spin the Government has put on it in its official Submission to the Senate Inquiry.

Clearly, the OECD was playing up to its usual tricks by and large in claiming that there are fiscal constraints on providing adequate income support to the unemployed. There reality is that there are no fiscal constraints on the Australian government increasing the unemployment benefit (Newstart Allowance).

The only issues relate to equity (and this group is living in poverty as a result of mean-spirited government policy) and the risk of inflation (will the rises blow out nominal aggregate demand growth?).

If the answer to the second question is yes and the first is that more equity is required then a combination of unemployment benefit increase and rising taxes on higher income earners would be indicated. In fact, there is no inflation threat that would arise from restoring some relative equity between income support recipients and this would require a significant increase in the unemployment rate.

The Australian Government could increase the unemployment benefit with the stroke of a computer keyboard. It issues the currency after all. Even if the computer keyboard operator fumbled and put an extra zero on the end of the new benefit there would be no financial constraints on the payment being honoured.

But the point here is that even the OECD can see that the unemployment benefit has become a joke in Australia as successive governments (conservative and so-called progressive) have allowed the levels to lag behind income movements elsewhere in the economy (including the aged pension).

The Federal Employment Minister’s spokesperson said that the Minister “had little sympathy for the OECD’s arguments” and that “best way to help the unemployed was (Source):

… to assist them to find employment, not to increase income support payments.

Some will retort that the because income support recipients in Australia receive rental assistance, for example, the problem is less severe than I have suggested. That is correct but the scale of assistance for the unemployed is short of pitiful.

The shift to the provision of rental subsidies in Australia was part of the ideological shift away from the government taking responsibility for social policy.

In the past, the Federal government (in liaison with the states) provided public housing to low income earners. While in short supply and of a fairly rudimentary quality, most lost income earners could expect to be given access to a secure, affordable home.

That changed when the neo-liberal ideology became dominant and the Government moved progressively to providing rent subsidies to private market suppliers.

There is a large literature which analyses the consequences of this shift for low income earners, which is tangential to this blog. But the major conclusions are as follows:

1. Commonwealth Rental Assistance (CRA) is capped and so as housing costs have risen the the value of the subsidy has been undermined.

2. This erosion in value has meant that single unemployed people find it almost impossible to rent in the private markets in the major capital cities such as Melbourne and Sydney which means that the spatial concentration of disadvantage rises and the unemployed are forced to live in areas where there is less job creation (notwithstanding the overall lack of job creation in Australia per se.

3. CRA relies on an adequate provision of affordable housing being made available by private providers. It is clear that supply has been lagging well behind demand for a number of reasons including the incentives given via the tax system to high income earners to invest in higher valued investment housing as tax dodges under negative gearing. This high income-earner welfare is a major source of inequity in the Australian system.

4. Many unemployed are forced to live in group (shared) housing and the maximum CRA entitlement is then dramatically reduced.

Please read my blog – – for more discussion on this point.

Our pathological meanness to the unemployed is just bad economics – for a more detailed analysis of rental assistance and the unemployed.

Why am I raising all this today? Answer – some galoot has claimed that the unemployment benefit is holding back our national prosperity.

The West Australian newspaper article (August 22, 2012) – Cutting dole would ease labour crisis: bank chief – gave space to the CEO of one of the big four banks yesterday – one Mike Smith.

Here he is – well fed indeed – demonstrating leadership!

The major banks in Australia were beneficiaries of the federal government loan guarantee scheme at the start of the financial crisis which effectively lowered their borrowing costs and allowed them to skate over the crisis without impinging on their profits. Without that guarantee the banks would have been in significant trouble in 2008.

But its bankster boss is now claiming that unemployment benefits should be cut:

… to encourage workers to move to labour-starved, booming mining States like WA as part of a radical rethink of how Australia overcomes its increasingly high-cost economy

He was quoted as saying:

One of the issues you are going to have with the high dollar is global competitiveness … How do you reduce that cost base? Surely one of the ways to do that is you put labour where it is needed, rather than fly-in, fly-out, or compromise as we do at the moment … Instinctively, mobility in Australia feels low compared with, say, the US. In the US if you don’t move, your house goes and you don’t eat. So that is the difference. The welfare net (in Australia) is such that it doesn’t provide an incentive for people to move.

Perhaps Mr Smith might like to study the data and consider some realities. There are at present there are 275 thousand people employed in the Mining sector in Australia. In Western Australia there are 114 thousand of these workers employed in Mining.

There are around 635 thousand people who are unemployed in Australia. At least another 100 thousand are outside the workforce as hidden unemployed because they have given up looking for work due to a lack of jobs being available.

The bankster wants to cut benefits for 330 thousand recipients of Newstart (not all the unemployed receive income support – (Source) but at best employment growth in Mining is growing at an average rate over the last 5 years of around 10 per cent (which is strong).

He thinks that the current difference between an unemployment benefit that is well below the poverty line with all its attendant disadvantages and the high pay (well above average weekly earnings) that the mining boom is affording to those who want to go out to the remote North West of Australia is not large enough.

How low would it have to go? To the point where this cohort cannot even maintain adequate nutritional standards? And what of the remaining unemployment benefit recipients who the Mining sector did not absorb each year (given its growth is low relative to the pool of unemployed)?

And where are they going to live? For overseas readers, the reason the companies went to “fly-in, fly-out” was because it was cheaper for them to do that compared to building cities in the remote NW to make it worthwhile for workers to move there. It is very remote, very rough, very hot and families find it hard to live there.

It is mind-blowing that a overpaid bankster would suggest such a thing.

But then we got the news yesterday that BHP has abandoned one of its large investment plans in the outback – an open cut copper mine – because the mining boom is weakening and the flow of investment that has driven it is now finite.

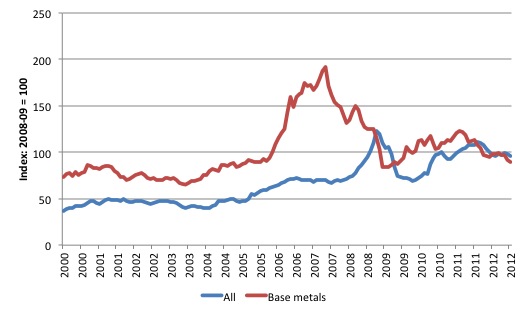

The Reserve Bank of Australia publishes its – RBA Index of Commodity Prices – G5 – which tells the story really.

The following graph shows the index for All Commodities and for Base metals since January 2000. The boom in base metal prices was unprecedented and has fuelled a major investment program in the mining and related industries. The crisis saw the index come off a bit but the Chinese fiscal stimulus allowed the sector to rebound relatively quickly.

But that rebound has been short-lived and it is clear that commodity prices have peaked for this cycle and with China now slowing down the mining sector overall will start to feel the pinch.

How much of a pinch remains to be seen. The BHP announcement was met with calls that the “mining boom is over” by all and sundry. The reality is a bit different.

First, while BHP has suspended around $A40 billion in investment plans it still has around billions of investment already flowing in the pipeline.

Second, China is slowing but that just means it is moving from intense growth to somewhat less intense growth – still 4 times faster that we are growing. It is in a process of industrialisation and urbanisation that will continue for many years to come.

It is hard to predict how much impact that slowdown will have on our real growth rate but it will be significant.

All mining booms end and usually they end badly – with a major recession and sky-rocketing unemployment. 1982 cries out loudly. But the on-going development processes in China that I referred to before will probably mean that this mining boom will have a long tail rather than fall off a cliff (as has happened in the past).

That means that while the slowdown will reduce our growth rate there won’t be a sudden collapse. One reason is that the gains from the boom are not coming from the traded aspects (the sale of the minerals etc) but rather from the capital formation (investment). The external sector continues to drain demand from the domestic economy (our current account remains negative). But there has been a strong growth in investment which will slow but not suddenly terminate.

The point about investment is that it is based on past decisions relating to expected conditions that prevailed at that time. So the flow of expenditure in the pipeline is unaffected by unexpected events today.

For macroeconomics students, that is why IS-LM models which claim investment is a negative function of today’s interest rate fail badly to pick up the dynamics of capital formation.

What BHPs decision signals is that the falling commodity prices and slowing Chinese economy are influencing what goes into the pipeline now. So aggregate demand will slow once the decisions of the past run (planned investment already flowing) exhaust.

The impact of the decision will also cause serious problems for the South Australian economy, where the Olympic Dam is located. It is already a fragile economy and the South Australian government is currently implementing a fiscal austerity plan which is undermining growth. It has seen its tax revenue decline since the GFC and has responded by proposing government spending cutbacks. Exactly the wrong response.

I am currently working on a project for the unions in South Australia helping them make a case against widespread public hospital job losses that the SA government is proposing as part of its austerity plan.

The BHP decision will further undermine the state’s tax base and probably prompt more calls for fiscal rectitude. They should learn from the mistakes of other governments in this respect and use its limited fiscal capacity (it is a state – that is, it doesn’t issue its own currency) and stimulate the local economy to insulate the labour market from the BHP job losses.

There was an interesting political sidelight to the BHP announcement. The Federal Opposition leader Tony Abbott jumped on the announcement and starting claiming in press stops and interviews that the decision was the result of the recent introduction by the Federal Government of a carbon and mining tax (two separate taxes).

BHP issued its – Olympic Dam Update – yesterday (August 22, 2012) – which didn’t mention the tax environment as being part of the decision.

Indeed in subsequent interviews the CEO of BHP responded to press questions as to whether the Federal government’s Mineral Resources Rent Tax (MRRT) and the carbon tax had played a role in the decision to suspend the Olympic Dam project he said:

The decision is almost wholly associated with, in the first instance, capital costs … The MRRT only covers coal and iron ore not copper, not gold and not uranium.

He also said that (Source)

The tax environment for this particular project has not changed at all since we started working on it six or seven years ago.

In other words, no impact at all.

In his – interview last night on the national ABC program – 7.30 Report – he was taken to task about his statements and accused of being loose with the truth.

You will cringe watching the way he tries to dodge and weave and get out of the obvious. He revealed in that Interview when asked “Have you actually read BHP’s statements?”:

No, but I’ve also got again the statement of … [BHP chairman] … Jacques Nasser, who says, ‘While we’re still evaluating the impact of the carbon tax, but it just makes it more difficult’.

Today, the ABC carried a story – Abbott now says he did read BHP briefing document – which says that Abbot denies his version of events in last night’s interview. Very unsatisfactory for a man who wants to be our Prime Minister.

Conclusion

The attack on unemployment benefits from a fat cat bankster, who enjoyed the welfare provided by the government during the early period of the crisis, is symptomatic of how corrupted our society has become.

Never mind that the government is already holding the unemployed in limbo – not creating work – paying well below the poverty rate – holding that low real standard of living constant for 20 odd years – and then subjecting them to a on-going process of harassment (which it calls activity tests etc).

Never mind that the private banks are a protected species which will always receive government assistance at the slightest sign of trouble.

Never mind that there is no infrastructure out in the mining areas to support major new residential influxes.

Never mind any of that – just cut their pittance further. Push them into hunger and make them desperate.

All that will do is plunge them further into poverty and disadvantage their families (and children) even further ensuring that the intergenerational disadvantage that accompanies long-term unemployment intensifies.

If any of my readers have ANZ bank accounts I urge you to close them immediately and transfer into a community building society or bank.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

Bill,

the fear of unemployment up here around the Queensland coalfields is palpable. I suspect that the ending of the boom may be more significant that you are alluding to. China doesn’t appear interested in keeping this thing afloat any longer.

Cutting the dole is ridiculous. Highlighting Mike Smith’s patent obesity does little though to add to the argument. Indeed I have met many fat unemployed men and women. It’s no fun being unemployed (I am currently underemployed and fwiw I am using my increased spare time to do more voluntary work).

It’s particularly difficult if you have a family to support and you don’t mind a ciggie and a drink. There must be a welfare net that does not require an acrobatic act to fall into it. The main cause of unemployment seems to be government – everything from unnecessary fiscal tightening (which hurts aggregate demand, at least in the short to medium term), to absurd labour market rules and regulations, to special favours to big business and big labour at the expense of the vast majority.

The dole should increase in line with the cost of living – not the CPI – the cost of living. The CPI is deliberately understated so goverment can avoid its obligations to pensioners et al.

Cheers!

It is part of the pathological hatred of ordinary working people, except ordinary working people can be encouraged to join in on this one.

Wages are just an inconvenient cost to these people.

But I do mind! 🙂

We really should aim to kill banking. A combination of Steve Keen’s universal bailout (to provide the new reserves for 100% reserve lending in addition to being just restitution for theft), a Postal Savings Service to deny the private banks those reserves, an MMT spending policy for government money, the allowance of genuine private money alternatives for private money and the abolition of ALL government privileges for the banks (including deposit insurance and a legal tender lender of last resort) should do the trick.

All booms go bust because they are not sustainable.The current mining boom is no exception as China is not sustainable.

In any case,why the hell are we selling off our childrens birthright at this furious pace? In the case of coal and gas it is also adding to the spectre of catastrophic climate change.

But of course the risible fools who are our ruling heirarchy are wilfully blind to the real issues.

In the final analysis, pitchforks are the only cure for that malady.