In the annals of ruses used to provoke fear in the voting public about government…

Another day – and some more evidence against fiscal austerity

Eurostat released the second-quarter 2012 National Accounts data for the Europe yesterday and, predictably, the recession is deepening in many countries. The Southern European nations saw their performance worsen and data shows that Spain’s house prices fell by 11.2 per cent last month (Source) and have fallen by 31 per cent since the crisis began in 2008. The deflationary impact of that alone would push the economy into recession. The Euro elites claim they will do everything to resolve the situation. And anything they do undertake – just makes it worse. Meanwhile, across the Atlantic, the Romney camp has put out a very suspect economic paper – authored by some notable suspects in the propaganda campaign the neo-liberals are sponsoring to prevent governments from acting responsibly. The economic paper has been categorically demolished – even in the mainstream media. So it is another day – some more evidence against fiscal austerity – and still the criminals maintain their grip on the throne.

The Eurostat publication – Flash Estimate for Second Quarter of 2012 – reports that:

GDP fell by 0.2% in both the euro area (EA17) and the EU27 during the second quarter of 2012, compared with the previous quarter … In the first quarter of 2012, growth rates were 0.0% in both zones.

Compared with the same quarter of the previous year, seasonally adjusted GDP fell by 0.4% in the euro area and by 0.2% in the EU27 in the second quarter of 2012, after 0.0% and +0.1% respectively in the previous quarter.

During the second quarter of 2012, GDP increased by 0.4% in the United States compared with the previous quarter (after +0.5% in the first quarter of 2012) and by 0.3% in Japan (after +1.3%).

Compared with the same quarter of the previous year, GDP rose by 2.2% in the United States (after +2.4% in the previous quarter) and by 3.6% in Japan (after +2.8%).

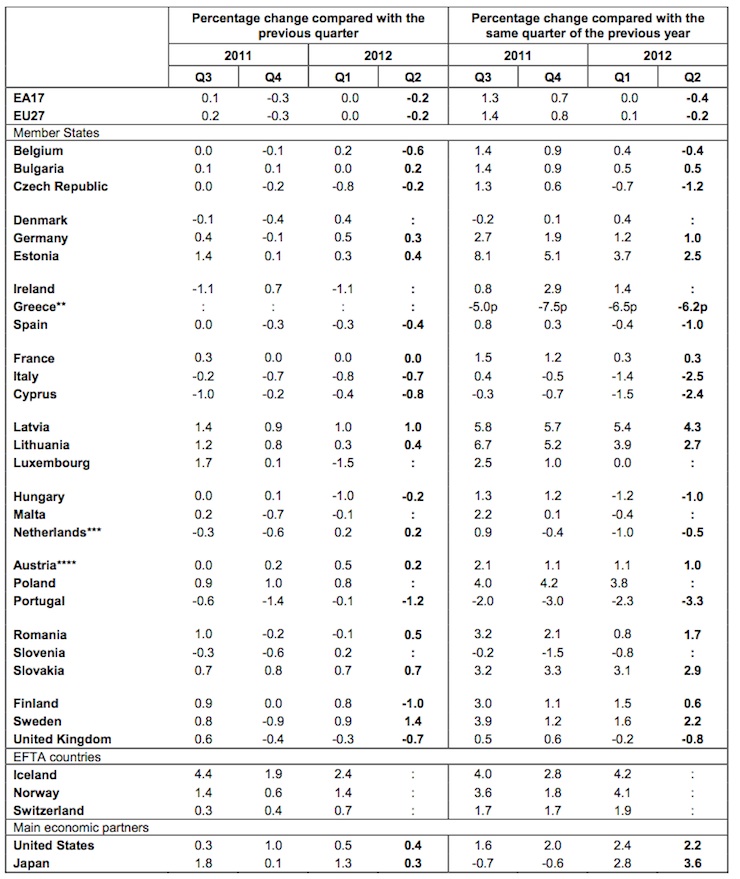

The following Table is taken from the Eurostat publication and shows quarterly growth rates and annualised rates (per quarter) for the European nations and main economic partners (Japan and the US).

The more detailed breakdown of the expenditure components are not yet available but the early reports are that business investment and exports are weakening.

The Vice-President of the European Commission Olli Rehn was wheeled out to give the usual commitments to do anything required. He should have taken better note of his own economy (he is a Finish politician) which contracted sharply in the second-quarter 2012 (by 1 per cent). Its annual growth has fallen from 3 per cent in the third-quarter 2011 to 0.6 per cent in the June-quarter 2012. That annual growth will evaporate in the third-quarter 2012 on current trends.

But he told the US CNBC that the Euro “is irreversible and it is essential that we will maintain the unity of the euro”, that Italy should remain committed to “its stable fiscal path”, and that:

… both the European Union, and I dare to say the ECB, are ready to take action once certain conditions are met.

How can a country be on a “stable fiscal path” when its real GDP growth rate is declining by 0.8 per cent per quarter and its last four annualised real GDP growth results have been 0.4 per cent (September-quarter 2011), -0.5 per cent (December-quarter 2011), -1.4 per cent (March-quarter 2012), and a staggering -2.5 per cent in the June-quarter 2012?

A stable fiscal path is one that ensure there is sufficient growth to deliver full employment. A contractionary fiscal strategy that pushes an economy into recession and then makes the recession worse is unstable and irresponsible.

Further, the EU and the ECB need to take one significant policy action – agree that nations like Italy, Greece, Spain, Cyprus, Belgium, the Czech Republic, Hungary, Portugal – at the least need significant and swift fiscal stimulus interventions from their governments. Given the flawed structure of the Eurozone that means the ECB has to fund the rising deficits.

The EC bossed can help by spending their time redrafting the Fiscal Compact to reflect basic macroeconomic reality – spending equals income.

The European data also provides further evidence to refute the claims made by the mainstream of my profession that fiscal stimulus has made the problem worse and fiscal austerity is the sure way to growth.

For example, in the US, the Romney campaign has just put out an economic paper – The Romney Program for Economic Recovery, Growth, and Jobs – written by Stanford’s John B Taylor, Harvard’s Greg Mankiw, Columbia’s Glenn Hubbard and Kevin Hassett from the crazy American Enterprise Institute. It has caused quite a stir with the mainstream at war with each other over some of the claims and attributions.

The Romney economists claim that:

America took a wrong turn in economic policy in the past three years. The United States underperformed the historical norm shown in the administration’s own forecasts, and its policies are to blame …

These short-term stimulus packages were ineffective, leaving the nation with higher debt, which acts as a drag on long-term growth because households and businesses understand that the administration must raise taxes significantly to pay off that debt.

They also claim that it is “uncertainty over policy” (by which they mean the large deficits and the private fear of large tax hikes) which is preventing a sound recovery in private spending. This has been a common theme among the conservatives since the governments decided to deploy fiscal stimulus.

The basic macroeconomic rule – spending equals income – is being ignored by governments who have been captured by the neo-liberal dogma that self-regulating private markets will deliver prosperity to all if only governments reduce regulation and run budget surpluses with low taxation.

There have been scores of mainstream economic lies that this crisis has exposed including deficits cause inflation; deficits cause interest rates to rise; there is a money multiplier; etc.

But the most basic neo-liberal lie is that if governments cut their spending the private sector will fill the gap. Mainstream economic theory claims that that private spending is weak because we are scared of the future tax implications of the rising budget deficits. But, the overwhelming evidence shows that firms will not invest while consumption is weak and households will not spend because they scared of becoming unemployed and are trying to reduce their bloated debt levels.

It has also been a major justification for the fiscal austerity that has been imposed in Europe. Ireland used it to justify their austerity – they were the first off the rank in early 2009. Some three years later they are still mired in recession with no blue sky in sight. The UK used it even though they had none of the Eurozone burdens (that is, they issued their own currency). Two and a bit years later – with the worse of the austerity still to hit – the UK economy contracted by 0.7 per cent last quarter and the pace of decline is accelerating.

Most of the UK decline is in private spending with the public spending cuts yet to really impact directly. So it the very spending agents that were meant to become confident and drive growth that are undermining it. The reason: because they are highly indebted and want to save; because they fear unemployment or are unemployed; because there is enough productive capacity to service the diminished real GDP levels and so there is little incentive to invest in new capital. And … they fear the impact of the public sector job and spending cuts.

But the Romney economists claims that drastic public spending cuts, further deregulation, reductions in welfare entitlements and revenue-neutral tax cuts (that is, cutting some rates and increasing others):

… will increase GDP and job creation, both going forward and now.

There is no way the Romney plan will increase growth in the current world climate. It will undermine domestic growth and with the rest of the world contracting no export-led growth surge would replace the lost domestic spending.

Mainstreamer Paul Krugman attacked the Romney paper in his recent Op Ed (August 10, 2012) – Culture Of Fraud – accusing it of “flat-out, undeniable professional malpractice” where the Romney scribes cited “the work of other economists, claiming that it supports … [their] … position, when it does no such thing”.

Other economists waded in attacking Taylor et al. for selling their souls to a political campaign “that has made fraudulence part of its standard operating procedure”.

John B. Taylor attempted a reply (August 13, 2012) – Paul Krugman is Wrong – but the Washington Post investigation (August 8, 2012) – Economists to Romney campaign: That’s not what our research says – which had been examining the veracity of the citations in the Romney economic paper before Krugman had attacked it, clearly destroyed the credibility of the Romney economists.

The Washington Post contacted various economists cited by Taylor et al. and asked them to verify whether the research being cited supported the conclusions that that Romney team claimed had authority in that research.

One after another the cited authorities rejected the way that the Romney economists had used their work.

For example, 13 out of 15 recent studies on the impacts of the US fiscal stimulus “found the stimulus had a positive effect”. The Washington Post notes that:

… the Romney campaign only names two studies. One is by John Taylor, a Stanford economist who advises Romney and is, as luck would have it, one of the economists the Romney campaign tapped to coauthor this brief. That leaves one study that is not by a Romney-affiliated economist: Amir Sufi and Atif Mian’s look at the “Cash for Clunkers” program.

Taylor, of-course is one of the Romney authors. The Washington Post found that the other paper cited didn’t “show a negative effect for ‘the administration’s stimulus policies'”. Amir Sufi told the Post that “Most of the research is pretty positive on stimulus”.

The Post article cites other economists who similarly were used by Taylor et al. as authorities for their fiscal austerity claims. All denied the validity of the Romney claims.

The Post concluded that:

So even the studies that the Romney campaign’s economists handpicked to bolster their case don’t prove what the Romney campaign says they prove. And some of the key policy recommendations that flow from those studies are anathema to the Romney campaign. And in perhaps the key policy area highlighted by these studies, the Romney campaign doesn’t have a formal policy. If this is the best they can do in support of their economic plan, well, it’s not likely to quiet the critics.

I thought that was a productive piece of investigative reporting by the Post.

The data also provides a reality check for those still lulled by the recent Olympics games, which suspends the everyday experience of most to concentrate on the other-worldly (and massively publicly-subsidised) exploits of a few.

While the British politicians are claiming the Olympic spirit will deliver benefits for Britain, the reality is that Britain contracted in real terms by 0.7 per cent in the second-quarter 2012. The spending surge of the Olympics is largely over.

There is also a renewed call for voluntarism to become a central new feature of British life. The same was said after the Sydney Olympics, which were similarly run by a bevy of volunteers, who make the accounting look better (no pay!).

But once again the reality is that volunteers don’t earn an income which can be used for spending. A society built on replacing legitimate jobs that the public sector could be generating with an army of volunteers is not building the capacity to growth. Growth needs spending. Spending needs income.

The volunteer society might please our sense of collective and belonging although the neo-liberals talk this up because for them promoting volunteerism is a means to cutting public budgets while maintaining, in some form and quality, some of the public services that would other wise have been lost with the job.

An article in the UK Guardian (August , 2012) –

The busted British economy needs more than just Olympic spirit – touches on the Olympics and austerity.

Simon Jenkins writes that the British government

… has indeed shown it can spend lavishly when it chooses, hundreds of millions spent on a few buildings, on winning medals and entertaining the world. If government can dare £9.3bn to stimulate a transient event, surely it can do likewise to stimulate the economy. This is not a matter of bankers going for gold in lending to businesses or Whitehall officials shooting regulations out of the sky. The daring of which Blair speaks should be deployed intellectually in unblocking the logjam now afflicting the Treasury and the Bank of England …

British economic policy is like the Olympic Park without the athletes. It is barren of activity and incident. More than £325bn has been “injected into the economy” by the Bank of England, money that has gone nowhere near the economy. It is sitting in a bank vault. My Olympics legacy would be to get it out and inject it properly. With the economy deep in a liquidity trap, it needs an inventive genius like Boyle, who can blow £60m in just three hours of happiness. As Bob Geldof would have said, had he been invited, “just spend the effing money” …

It would require the printing of some £20bn of new money, not far off what the Olympics probably cost in spending and lost economic activity. But it would feed directly into the economy where it’s most needed: in boosting high street spending. It would aid a demand-starved economy, and certainly keep that Olympic smile on every face.

We can excuse him for the crass “printing” of new money characterisation – recognising that governments do not spend by printing money. Rather, they credit bank accounts electronically.

But the sentiment is sound. Spending generates and equal flow of income which stimulates private sector confidence and leads to job creation. ALl of which is absent in the UK at present.

Conclusion

As the data continues to come in the message is clear – fiscal austerity generally makes things worse (it can be consistent with growth if the external sector is strong).

The continued fiscal contraction

PS: New Zealanders – I will update my Alternative Olympic Tally at the weekend when I get more time to reflect the elevation of NZ in the rankings after the drug exposure. I have been travelling every day this week so far.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

More importantly, it can be consistent with growth if private sector saving is strongly negative.

“We can excuse him for the crass “printing” of new money characterisation”

Not really. He should have looked in the Bank of England published accounts first.

So at least £20bn is sat there waiting in a cash account already – apparently for a rainy day. I can’t seem to get any UK journalist interested in asking the Chancellor how much more rainy it has to get before this cash is spent into the economy.

It’s like they can’t believe that much is sat there gathering dust.

Guess you’re keeping an eye on QLD with the Liberals attempt at austerity at state level. Seems to working well so far with 5.8% unemployment and the biggest jump in the country.

Some local (& slightly funny) evidence of pent up demand withen Southern France.

SNCF put on a 1 Euro fare structure between Nimes & the beech resort of Le Grau-du – Roi.

It appeared to attract the street urchins of Nimes to the displeasure of the local traders….

It went so far as the local supermarket closing before the train arrives.

The local paper covers the story

http://www.midilibre.fr/2012/07/25/du-grau-du-roi,539134.php

It now looks like they have come up with a solution of sorts – under 16s must be accompanied by a Adult and 16 -18s must get a letter from their perents – don’t ask me how this will work.

Google translate

This room and it laughs hard on the train between Nimes and Le Grau-du-Roi. Five lads romp on one of the benches of 12 h 51 (two oars or five hundred seats). A train under heavy guard. Railway police patrol cars.

One of five teenagers took out his cell phone, connect the speaker and will loop the latest hits to his buddies laughing. One of the SNCF agents pass a smile to the kids and waved off the speaker. The warning was not enough. This time, one of the officers, in uniform, of Suge (monitoring rail) intervenes. A first and a second reprimand … “Next time, it is outside,” the officer tells her hefty.

The teenager is in a tight front of his buddies and then complied. Minutes later, the incident is already forgotten and the laughter and jokes begins again.

Since the return of warm weather, the train from sea to € 1 refueling, or overflow , weekends or Wednesdays. Saturday, 12 h 51 was stormed. Eight hundred people for five hundred seats have arrived at the Gare du Grau du Roi less than an hour later.

And the last two scheduled return from 17 hours were very difficult. “It was borderline unmanageable,” said one witness. At the station, Suge and guards present at each departure were hard pressed to contain the crowd. And the railway police had to intervene on one or even two early fights on the train. Faced with this influx, the SNCF had to adapt its service until the summer (more trains, including a return later) which will begin July 7.

“Oddly enough, on Sunday evening, it is often much quieter,” says a regular. Yesterday, the return of 17 h 12 went off without incident. A dozen officers and gendarmes watched Suge grain at the Gare du Grau du Roi .”

Dork -This illustrates the tensions building between the poor and not so poor as the rich flee to Corsica for the Summer.

The tensions between Black and white.

The tensions between the disenfranchised Young and the Old approaching Pension age.

On a more practical level it illustrates how SNCF needs a massive fiscal subsidy if it is to fill its rail cars and utilise its capital to the maximum extent.

This will save more oil imports then the tradional environmentalists can ever hope to achieve via a UK style de industrialisation programme.

People are simply not having any fun now –

http://www.youtube.com/watch?v=e3BPN2pMaGo

It all begs the question really of how can anyone expect the authorities to pursue fraud practiced in the private sector when those seeking government readily and brazenly engage in it.

Professor, once again you have demonstrated what should be obvious to all.

There is no doubt hat austerity policies are devastating, yet those in power, continue to pursue them.

Hopefully, the great unwashed masses will wake up and move to change this paradigm.

I thought one of the reasons for the recession in Spain was the huge amount of debt-financed construction, both by government organisations and private investors. You know, the new airports that never saw a plane land, the satellite towns where no-one moved in. There may be austerity there, but they’re still building and renewing and so on. It seems crazy when you see half-finished, abandoned apartments at one end of a street, and at the other workers busy constructing others.