The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

Australian inflation plummets as the fiscal vandals undermine the economy

The Australian Bureau of Statistics released the Consumer Price Index, Australia data for the March 2012 quarter today and the inflation rate has plummetted in the face of a slowing economy. The trend over the second half of 2011 was for inflation to ease. But the plunge in the first three months of 2012 that today’s data reveals is pointing to a very sick economy. The annual inflation rate is now estimated to be 1.6 per cent with a downward trend. As I noted last September if the trend that was apparent then continued, then the annualised rate would fall below the Reserve Bank of Australia’s (RBA) lower inflation targetting bound. That has now happened in today’s data, which means that the RBA has to consider inflation to be “too low” now and significant monetary policy easing (via their own logic) should be forthcoming next Tuesday when the RBA Board meets again. You might ask whether the “bank economists” (the private sector mavens who always think inflation is about to accelerate out of control) predicted that the March quarter inflation rate would be 0.1 per cent. The answer is that they predicted that inflation for the March would be running at 7 times the actual rate (0.7 per cent), which raises the question yet again – why does the mainstream media rely on their input to guide the public on where the economy is heading. Today’s data signals that the Australian economy is not in robust shape and the major cause of this slowdown is the irresponsible fiscal policy obsession that the Government has with achieving a budget surplus in the coming fiscal year. It is an act of vandals.

The summary results for the March 2012 quarter are as follows:

- The All Groups CPI rose by 0.1 per cent in the March quarter 2012 compared with no change in the December quarter 2011.

- The All Groups CPI rose by 1.6 per cent over the 12 months to the March quarter 2012, a dramatic fall from the annualised rise of 3.1 per cent over the 12 months to December quarter 2011.

- The largest price rises for the quarter were for pharmaceutical products (+14.1 per cent), secondary education (+7.7 per cent), automotive fuel (+2.5 per cent), medical and hospital services (+2.1 per cent), tertiary education (+4.7 per cent) and rents (+1.0 per cent).

- The most largest price falls were for fruit (-30.0 per cent), international holiday travel and accommodation (-4.8 per cent), furniture (-6.0 per cent), audio, visual and computing equipment (-6.3 per cent) and domestic holiday travel and accommodation (-2.0 per cent).

The ABC News report today (April 24, 2012) headlined with – Rate cut on horizon as inflation dives – and said that:

Consumer prices rose just 0.1 per cent in the first quarter of the year, falling well short of expectations and leaving the Reserve Bank plenty of room to ease the official interest rate next month.

The latest Consumer Price Index from the Bureau of Statistics shows that Australia’s annual inflation rate fell sharply to 1.6 per cent, down from 3.1 per cent on the previous year.

It also added the fact but didn’t express the obvious that with the latest outcome being well “below the central bank’s target range of 2 to 3 per cent”, the central bank must now consider the fall in inflation to be a problem.

The Bank economists were once again way off the mark – they “had expected a rise of 0.7 per cent for the quarter, with a fall in the annual rate to 2.2 per cent” – it seems to take this group, which get most of the media coverage when it comes to economic commentary, some time indeed to spot a slowing economy with rising unemployment and declining inflation.

The Sydney Morning Herald article – Rate cut looms large as prices barely budge – also ran the RBA reaction function angle:

An official rate cut next week seems all but a certainty after official inflation data showed prices barely budged in the March quarter.

They quoted a bank economist who said that:

I think the RBA has been slow to react to the lower pace of domestic economic growth and a clear downward trend in inflation.

In neither story from the main press outlets (ABC, Fairfax) was the inflation outcome linked to the fiscal policy settings. The press are so conditioned to relate the narrative to the inflation-interest rates connection, rather than take a broader view of what is actually going on at present.

It is amazing how the rhetoric has shifted in the last 12 months. A year ago the “bank economists” and media commentators generally were all supporting the view that the Australian economy was in the midst of a once-in-a-hundred year mining boom and that the government had to act quickly to get its budget back into surplus to stop inflation accelerating out of control.

The bank economists were also urging the RBA to put up interest rates to ease the inflation rate. The Government played along with this narrative claiming that the Australian economy was close to or at full employment and public spending cuts were required to keep inflation under control.

The Government has clearly demonstrated its incapacity to come to terms with the situation that it is creating. In the 2011-12 Budget Speech – the Treasurer told us that:

But with the investment pipeline ramping up and unemployment falling, the boom will test our economy and our workforce, and price pressures will re-emerge.

That’s why we have strict spending limits – so that we don’t compound these pressures – and why this Budget will help get more Australians into better jobs, improving productivity and participation.

He has continued with that line throughout the last 12 months despite the economy slowing before our eyes.

The following Table is taken from the 2011-12 Budget Paper No 1 (Table 2: Major economic parameters) and shows the forecasts that the Government was operating with when it framed the goal of achieving a budget surplus in the coming year – a fiscal shift unprecedented in our history in terms of the magnitude of the swing from deficit to surplus.

Some accompanying text in the 2011-12 Budget Paper No. 1 said that:

The unemployment rate is forecast to fall from around 5 per cent currently to 4¾ per cent in late 2011-12 and 4½ per cent in late 2012-13. Underlying inflationary pressures are expected to remain contained, but increase gradually as the labour market tightens and the economy approaches capacity.

Their forecasts have proven to be grossly inaccurate which brings into question whether they really know what is going on. Their models need to be seriously revised to recognise the fact that when private domestic spending growth is modest (as deleveraging from record debt levels continues) and the external sector continues to drain demand, that a fiscal withdrawal will cause the economy to slow.

Here is the reality check relative to the Budget forecasts:

1. Real GDP growth will be lucky to make 2 per cent rather than the 4 forecasted in 2011-12 (in the December 2011 quarter the annualised growth rate was 2.4 per cent and slowing quickly).

2. Employment growth last year was zero and so far this year has not shown much sign of improvement.

3. Unemployment and underemployment have risen over the last year and unemployment is well above the forecast.

4. Inflation over the last year is 1.6 per cent and falling rather than 2.75 per cent as per the forecast for 2011-12.

The Australian government revised these forecasts down in the – Mid-Year Economic and Fiscal Outlook – indicating that they were starting to realise that the once-in-a-hundred-years mining boom was not living up to the rhetoric (read: beat-up) that it would drive the economy so hard that inflation was just about to break out everywhere.

But even though they adopted a more pessimistic view in the MYEFO they maintained their obsessive mantra that a fiscal surplus was an economic imperative.

The reason the “markets” and the bank economists keep being “surprised” is because they have bought into the hype about government deficits causing inflation and that the Australian economy is being excessively stimulated by the deficit in the face of the record level terms of trade. We are continually being told how much the mining sector is driving growth.

The reality not often mentioned is that the growth is going overseas – the current account is still in deficit and so the growing export income is allowing imports to grow and the overall contribution of the external sector to local GDP growth is negative.

If the commentators really delved into what has been going on in the labour market – near zero employment growth, rising labour underutilisation and no significant wages growth, then they would not be surprised at all by the moderating inflation. They would have realised that the small spike in inflation in the earlier part of 2011 was almost all down to rising agricultural prices as a consequence of the natural disasters.

This time last year, surrounded by claims of the vast majority of economists noted above, I told various journalists and radio interviewers said that the spike in inflation was solely the result of a shortage of food supplies (principally fruit) due to the floods earlier in 2011 and that this rise would be relatively short-lived because the underlying inflation rate was falling as the economy was slowing.

The faster the economy slowed, the more quickly the CPI inflation would plummet. 12 months later that is what has happened.

If you go back through my commentary on the local scene you will find a consistent argument contesting the “full-employment-boom-accelerating-inflation” story. It has been clear that the fiscal stimulus was withdrawn far too early and growth slowed in 2010. The labour market has barely created any new (net) jobs over the course of this year.

It was also clear that the modest inflation push was due to special (one-off) events like floods and cyclones and that the underlying inflation trend (that is, the inflation driven by core factors) was for moderation.

Unemployment and underemployment is rising and there is a general gloomy mood.

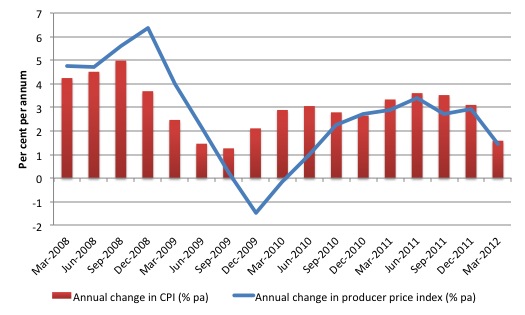

CPI and Producer Prices

On Monday (April 23, 2012), the ABS had released the latest Producer Price Indexes, Australia data which shows that the index fell by 0.3 per cent in the March quarter 2012, and rose by only 1.4 per cent in the 12 months to the March quarter 2012.

The annual rate was down sharply on the 2.9 per cent recorded in the December quarter 2011.

The Producer Price Index (PPI) records the prices that firms are paying for raw materials and is influential in the development of price contracts. It is also a reasonable indicator of where the CPI inflation rate will be heading.

The following graph shows the annual growth in the CPI and the Producer Price Index (PPI) since the March quarter 2008, which was when the current crisis started to impact on the Australian economy.

The sharp decline in both measures of inflation accompanying the downturn is apparent as is the recovery following the fiscal stimulus which really started to impact on economic activity in late 2009.

Inflation was steady at long-term averages once the economy started to regain speed on the back of the stimulus packages.

The economy started to slow again as the fiscal stimulus was withdrawn (prematurely) and now the impacts on aggregate demand that were shown in the December quarter 2011 National Accounts data are evident in the March quarter PPI and CPI data. The economy is slowing substantially.

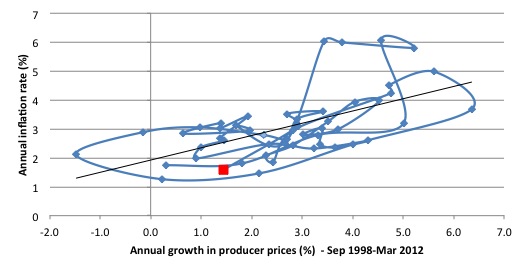

The next graph show the growth rates in scatter plot form with the annual change in the PPI on the horizontal axis and the annual growth in the CPI on the vertical axis. The data sample is from September quarter 1998 to the March quarter 2012. The red marker is the current quarter (March 2012).

The black line is a simple regression (which ended up just as good as more complex ARMA type configurations I ran earlier today – for those who know about time series modelling).

The current observation is below the regression line and at the head of a downward loop that accompanies a slowing economy. The lower loop described the trajectory of the economy in 2008-09 as the downturn really hit. The recovery saw the relationship stablise around the regression line.

Trends in inflation

The headline inflation rate increased by 0.1 per cent in the March quarter translating into an annualised increase of 1.6 per cent for the year to March 2012 which is down from the December quarter 2011 result of 3.1 per cent.

What does it mean for monetary policy?

The Consumer Price Index (CPI) is designed to reflect a broad basket of goods and services (the “regimen”) which are representative of the cost of living. You can learn more about the CPI regimen HERE.

The ABS say that:

The CPI is a temporal price index for consumption goods and services acquired by Australian resident households. It is an important economic indicator, providing a general measure of price change … The principal purpose of the Australian CPI is to measure inflation faced by consumers to support macroeconomic policy decision making. This is achieved by providing a measure of household consumer inflation by the acquisitions approach.

There are various ways of assessing the general movement in prices depending on the purpose that the measure is being used for. The document I linked to above details some of the approaches. One of these approaches – the “acquisitions approach” – attempts to measure “household consumer inflation” and defines the basket of goods and services as “consisting of all consumer goods and services actually acquired by households during the base period.” The ABS use “market prices for goods and services” (including taxes etc) and make no imputations for “non-monetary transactions” (such as imputed rents). They also exclude “interest rate payments”.

So is a headline rate of CPI increase of 0.1 per cent for the March quarter significant? To examine its lasting significance we have to dig deeper and sort out underlying structural inflation pressures and ephemeral price facts. As the introductory summary shows the price rises are being driven largely by ephemeral factors (and once-off type adjustments – utility prices etc).

The RBA’s formal inflation targeting rule aims to keep annual inflation rate (measured by the consumer price index) between 2 and 3 per cent over the medium term. Their so-called “forward-looking” agenda is not clear – what time period etc – so it is difficult to be precise in relating the ABS data to the RBA thinking.

What we do know is that they do not rely on the “headline” inflation rate. Instead, they use two measures of underlying inflation which attempt to net out the most volatile price movements. How much of today’s estimates are driven by volatility?

To understand the difference between the headline rate and other non-volatile measures of inflation, you might like to read the March 2010 RBA Bulletin which contains an interesting article – Measures of Underlying Inflation. That article explains the different inflation measures the RBA considers and the logic behind them.

The concept of underlying inflation is an attempt to separate the trend (“the persistent component of inflation) from the short-term fluctuations in prices. The main source of short-term “noise” comes from “fluctuations in commodity markets and agricultural conditions, policy changes, or seasonal or infrequent price resetting”.

The RBA uses several different measures of underlying inflation which are generally categorised as “exclusion-based measures” and “trimmed-mean measures”.

So, you can exclude “a particular set of volatile items – namely fruit, vegetables and automotive fuel” to get a better picture of the “persistent inflation pressures in the economy”. The main weaknesses with this method is that there can be “large temporary movements in components of the CPI that are not excluded” and volatile components can still be trending up (as in energy prices) or down.

The alternative trimmed-mean measures are popular among central bankers. The authors say:

The trimmed-mean rate of inflation is defined as the average rate of inflation after “trimming” away a certain percentage of the distribution of price changes at both ends of that distribution. These measures are calculated by ordering the seasonally adjusted price changes for all CPI components in any period from lowest to highest, trimming away those that lie at the two outer edges of the distribution of price changes for that period, and then calculating an average inflation rate from the remaining set of price changes.

So you get some measure of central tendency not by exclusion but by giving lower weighting to volatile elements. Two trimmed measures are used by the RBA: (a) “the 15 per cent trimmed mean (which trims away the 15 per cent of items with both the smallest and largest price changes)”; and (b) “the weighted median (which is the price change at the 50th percentile by weight of the distribution of price changes)”.

While the literature suggests that trimmed-mean estimates have “a higher signal-to-noise ratio than the CPI or some exclusion-based measures” they also “can be affected by the presence of expenditure items with very large weights in the CPI basket”.

The authors say that in the RBA’s forecasting models used “to explain inflation use some measure of underlying inflation (often 15 per cent trimmed-mean inflation) as the dependent variable”.

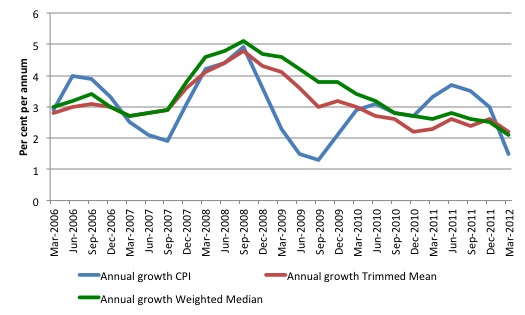

The special measures that the RBA uses as part of its deliberations each month about interest rate rises – the trimmed mean and the weighted median – also showed moderating price pressures.

So what has been happening with these different measures?

The following graph shows the three main inflation series published by the ABS – the annual percentage change in the all items CPI (blue line); the annual changes in the weighted median (green line) and the trimmed mean (red line). The RBAs inflation targetting band is 2 to 3 per cent. The CPI measure of inflation is now below the lower limit while the RBAs preferred measures have been within the band for some quarters now.

In seasonally adjusted terms, the annual growth in the weighted median fell to 2.1 per cent in the March quarter (from 2.5 per cent in the December 2011 quarter). The trimmed mean fell to 2.2 per cent in the March quarter (from 2.6 per cent in the December quarter). The trend in each series is down.

First, it is clear that the RBA-preferred measures are now at the bottom end of their inflation-targeting band and falling. That is why the currency fell after today’s ABS announcement – the markets expect the RBA to lower interest rates next Tuesday and therefore reduce the profitability of Australian-dollar denominated financial assets.

Second, the underlying price pressures (say from wages) are declining as the economy slows. There is no inflation threat in Australia at present. The problems are all real – that is declining growth and rising unemployment. They should be the policy emphasis.

The Treasurer’s obsession with getting the federal budget back into surplus is now well and truly out of kilter with what is happening in the broader economy. One of the big risks that commentators claim was behind the alleged need to withdraw the fiscal stimulus – inflation – is declining. The other risk – higher interest rates (notwithstanding that the RBA sets the rates anyway) – are now looking like they will fall.

The indications are that the budget deficit should be higher not lower – given that 12.5 per cent of available workers in Australia are either unemployed or underemployed. That is not to mention the fact that teenage employment has contracted overall since February 2008, when the crisis started to impact negatively on the Australian economy.

What is driving inflation in Australia?

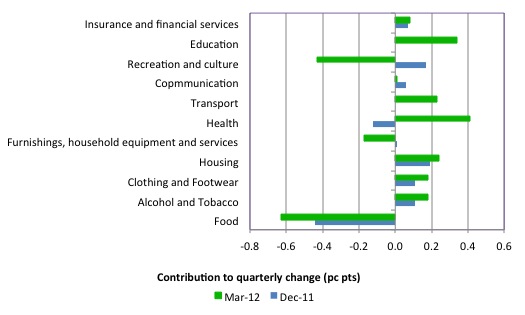

The following bar chart compares the contributions to the quarterly change in the CPI for the December 2011 quarter (blue bars) to the March 2012 quarter (green bars).

The ABS reports that for the March 2012 quarter, the largest price rises were for pharmaceutical products (+14.1 per cent), secondary education (+7.7 per cent), automotive fuel (+2.5 per cent), medical and hospital services (+2.1 per cent), tertiary education (+4.7 per cent) and rents (+1.0 per cent).

The ABS reports that for the March 2012 quarter, the larger price falls were for fruit (-30.0 per cent), international holiday travel and accommodation (-4.8 per cent), furniture (-6.0 per cent), audio, visual and computing equipment (-6.3 per cent) and domestic holiday travel and accommodation (-2.0 per cent).

In 2011, food prices were a significant driver of inflation as a result of the floods and cyclone but that impact has now dissipated and improved farm supplies are driving major declines in food prices.

International travel is being aided by the high value of the dollar.

At present, there is no evidence that demand pull factors emanating from within Australia are driving the inflation trend.

Conclusion

After falling steadily over the last half of 2011, the Australian inflation rate dropped significantly in the March quarter 2011 as the transitory push factors such as natural disasters and external factors (petrol prices) dissipated and the full impact of the declining real growth rate in the economy started to impact.

Related data shows there are no significant generalised wage pressures in the economy at present.

While such a sudden drop in the annualised inflation rate might signal that a revision is coming next quarter as the ABS refines the data, I suspect that the data is providing an accurate signal of what is happening with aggregate demand growth in the economy at present.

The much-vaunted pipeline of investment that the Government keeps boasting about seems to have got clogged up and the expenditure flow is certainly slowing. It is highly likely that business firms are now holding off their investment plans as they see the damage that the fiscal contraction is causing.

It is clear that the overall economy is slowing and more commentators are finally getting the message that the Australian economy is not overheating and facing an inflationary spiral.

Today’s result certainly places the recent statements by the Treasurer that the push to surplus is giving the RBA “room” to lower rates in a poor light. Given how damaging the fiscal austerity is for growth, inflation has dropped right through the bottom of the RBA’s inflation targetting band. According to their own logic (which I do not share), the RBA has to lower rates to safeguard the economy from recession.

That is a perverse way to conduct fiscal policy.

The madness in Europe at present is also conditioning a negative outlook.

That is enough for today!

Good story Bill but I think you missed the other key reason (other than fiscal poilcy) for the result – dutch disease. Look at the split-out between tradeables and nontradeables. It sticks out like dogs b####. It also showed up nicely from the PPI.

“You might ask whether the “bank economists” (the private sector mavens who always think inflation is about to accelerate out of control) predicted that the March quarter inflation rate would be 0.1 per cent. The answer is that they predicted that inflation for the March would be running at 7 times the actual rate (0.7 per cent)”

This one made me laugh. There seems to come a point where one ceases to despair over the stupidity and begins to think it funny, at least for me.

Hi Bill,

By now you must be well aware that I do not subscribe to certain theories you try to explain here. As I am not really that familiar with all the MMT theories, it is sometimes hard to find the real hook in your ideas. Nevertheless, I like to use the words of someone who is definitely better qualified than me to put your policy recommendations under a question mark, if you allow, as these words represent my convictions. I would hope you to give me some feedback if possible.

Well known hedge fund manager Mark Spitznagel has published an editorial in the WSJ last week, in which he basically makes the argument that the policy of expanding the money supply leads to higher wealth inequality.

“A major issue in this year’s presidential campaign is the growing disparity between rich and poor, the 1% versus the 99%. While the president’s solutions differ from those of his likely Republican opponent, they both ignore a principal source of this growing disparity.

The source is not runaway entrepreneurial capitalism, which rewards those who best serve the consumer in product and price. (Would we really want it any other way?) There is another force that has turned a natural divide into a chasm: the Federal Reserve. The relentless expansion of credit by the Fed creates artificial disparities based on political privilege and economic power.

David Hume, the 18th-century Scottish philosopher, pointed out that when money is inserted into the economy (from a government printing press or, as in Hume’s time, the importation of gold and silver), it is not distributed evenly but “confined to the coffers of a few persons, who immediately seek to employ it to advantage.”

In the 20th century, the economists of the Austrian school built upon this fact as their central monetary tenet. Ludwig von Mises and his students demonstrated how an increase in money supply is beneficial to those who get it first and is detrimental to those who get it last. Monetary inflation is a process, not a static effect. To think of it only in terms of aggregate price levels (which is all Fed Chairman Ben Bernanke seems capable of) is to ignore this pernicious process and the imbalance and economic dislocation that it creates.

As Mises protégé Murray Rothbard explained, monetary inflation is akin to counterfeiting, which necessitates that some benefit and others don’t. After all, if everyone counterfeited in proportion to their wealth, there would be no real economic benefit to anyone. Similarly, the expansion of credit is uneven in the economy, which results in wealth redistribution. To borrow a visual from another Mises student, Friedrich von Hayek, the Fed’s money creation does not flow evenly like water into a tank, but rather oozes like honey into a saucer, dolloping one area first and only then very slowly dribbling to the rest.

The Fed doesn’t expand the money supply by uniformly dropping cash from helicopters over the hapless masses. Rather, it directs capital transfers to the largest banks (whether by overpaying them for their financial assets or by lending to them on the cheap), minimizes their borrowing costs, and lowers their reserve requirements. All of these actions result in immediate handouts to the financial elite first, with the hope that they will subsequently unleash this fresh capital onto the unsuspecting markets, raising demand and prices wherever they do.”

“The Fed is transferring immense wealth from the middle class to the most affluent, from the least privileged to the most privileged. This coercive redistribution has been a far more egregious source of disparity than the president’s presumption of tax unfairness (if there is anything unfair about approximately half of a population paying zero income taxes) or deregulation.

Pitting economic classes against each other is a divisive tactic that benefits no one. Yet if there is any upside, it is perhaps a closer examination of the true causes of the problem. Before we start down the path of arguing about the merits of redistributing wealth to benefit the many, why not first stop redistributing it to the most privileged?”

@Linus Huber

I’m not certain what aspect of Bill’s post you are objecting to. His point is that Neo-liberal models have once again vastly overstated the dangers of inflation. Could you be a little more specific?

Hi Linus,

“The Fed doesn’t expand the money supply by uniformly dropping cash from helicopters over the hapless masses.”

The Fed doesn’t expand the money supply by dropping money from helicopters, or by any other method. Expansion (and contraction) of the money supply takes place in the commercial banking sector.

See Bill’s articles “Money multiplier-missing feared dead” and “Money multiplier and other myths”

https://billmitchell.org/blog/?p=10733

https://billmitchell.org/blog/?p=1623

I think your friend Mark Spitznagel has it badly wrong.

Hi John

The FED increases or inflates its balance sheet extremely which is the part the FED has control over. I am not advocating that we have massive inflation as measured under the cpi, whereas one should be careful to trust the official figures (the real rate of inflation in the USA is probably 5% higher than the official one). The FED has been successful in reinflating some of the past bubbles (e.g. stock markets, commodities etc.) but in the area of the largest asset of the middle class, namely housing, the FED has not been successful.

We have a major problem with wealth distribution that will gain in importance when going forward as it does take purchasing power from those who would spend it to the top 1% who spend relatively little of their income.

Bill’s recommendations include the increase of public debt in order to enhance the employment situation. Such increases automatically will require the support of the Central Bank with the above described effect on wealth distribution.

@Linus Huber

“The FED has been successful in reinflating some of the past bubbles (e.g. stock markets, commodities etc.)”

The Fed has no capacity to inflate as it does not control the money supply. QE is not money printing and does not affect aggregate demand. I suggest you read the links John provided.

Hi Ben

I did not state that the Fed has the ability to control the money supply but their actions still provide additional liquidity mainly to the banking sector who are able to influence the value of a number of investment areas. An even worse aspect to all of this is the fact that banks continue to be allowed to value their assets according to model instead of market prices.

Obviously is the total volume of credit in the system is mainly determined by the parties who decide to acquire additional debt or repay their debt.

However to simply ignore the role of Central Banks in their endeavour to avoid the liquidation of malinvestments is certainly not reasonable.

Linus,

Some of the large financial institutions were insolvent and were bailed out by the government – is this what you are referring to when you write ‘avoid the liquidation of malinvestments’?

Whenever you have policies in place that promote the build up of bubbles you produce malinvestments. Those malinvestments will be recognized once the bubble bursts. As we live in a general credit bubble, a number of what one might call sub-bubbles were/are produced. The underlying collateral will loose unproportionally once it bursts leaving behind unsustainable debt that should be written off.

would anyone like to have a guess at how this mess will end.