The other day I was asked whether I was happy that the US President was…

The left – entranced by the fiscal austerity mantra sold to them by the conservatives

There is increasing evidence that the manic obsession with fiscal austerity instead of employment-generating growth is not only further de-stabilising the EU economy and foreshadowed the next chapter in the crisis but is also undermining the political accords that were the rationale in the first place for political and economic “integration”. The news from France yesterday that Marine Le Pen received close to 20 per cent of the first-round vote in the Presidential election and the impending collapse of the Dutch coalition government as Geert Wilders torpedoed the fiscal austerity negotiations – outrightly refusing to agree to the cuts, tells me that the political scene is polarising and extreme right candidates are coming to the fore. The mainstream left parties stand indicted for embracing the neo-liberal economic myths and then trying to sell a softer vision for Europe. The reality is that Europe will only be able to implement and sustain progressive social agendas if the neo-liberal malaise is abandoned. That will mean that nations abandon the Euro and use fiscal policy to promote employment growth. However, the various political outcomes that we are witnessing in Europe indicate that we can expect no leadership from the mainstream left on any of these issues. They are entranced by the fiscal austerity mantra sold to them by the conservatives. Which gives credibility for the incredulous demands of Le Pen and Wilders!

In Australia (and elsewhere) a “six-pack” refers to a package of beer bottles or cans.

In “official” Europe, it refers to the new so-called “reinforced Stability and Growth Pact (SGP)”, which was agreed upon on December 13, 2011. In the Official Memorandum we read that the “Six-Pack” is “made of five regulations and one directive” and according to the EU elite spin:

… represents the most comprehensive reinforcement of economic governance in the EU and the euro area since the launch of the Economic Monetary Union almost 20 years ago … [and] … brings a concrete and decisive step towards ensuring fiscal discipline, helping to stabilise the EU economy and preventing a new crisis in the EU.

In fact, the Six-Pack has further de-stabilised the EU economy and as I noted in the introduction is also undermining the political accords that were the rationale in the first place for political and economic “integration”.

The Six-Pack recognised that “23 out of the 27 Member States are in the so-called “excessive deficit procedure” (EDP), a mechanism established in the EU Treaties obliging countries to keep their budget deficits below 3% of GDP and government debt below (or sufficiently declining towards) 60% of GDP”.

These 23 have to undergo formal reviews and “must comply with the recommendations and deadlines decided by the EU Council to correct their excessive deficit”.

The components of the Six-Pack are that more rigourous imposition of financial sanctions will be followed if a nation fails to “comply with the specific recommendations” to get their deficits below 3 per cent of GDP. Further, if the “60% reference for the debt-to-GDP ratio is not respected” then the EDP will begin “even if its deficit is below 3%” and the nation will have to reduce “gap between its debt level and the 60% reference … by 1/20th annually (on average over 3 years).”

There will be “expenditure benchmarks” which will enforce “a cap on the annual growth of public expenditure according to a medium-term rate of growth”.

And a series of interventions under the so-called “Excessive Imbalances Procedure (EIP)” which aims to reduce macroeconomic imbalances (particularly unit costs etc) and will force nations to submit “a clear roadmap and deadlines for implementing corrective action”. The whole system will be subjected to a huge surveillance operation (EU monitoring) with “rigorous enforcement” (fines equal to 0.1 per cent of GDP) and central intervention in a nation’s budgetary process.

It all reeks of a nasty controlling, big brother sort of world where the worker in the village in Greece or the Netherlands will basically be casting a vote in futility if their respective governments stay in the Eurozone – because at any time an EU official will be able to intervene and coerce the elected government into following EU dictates rather than their elected mandate.

It seems from the recent political events in Europe that the people are getting wind of this abrogation of their democratic rights and are voting accordingly. But the choices now as so poor.

In France, the real left candidate Jean-Luc Mélenchon was outpolled around 2 to 1 by the far-right candidate Marine Le Pen. But even he thinks that the Eurozone should survive.

The main contenders (Hollande and Sarkozy) are in my view neo-liberals despite some social policy differences. While the headlines are suggesting there has been a swing to the left, I don’t believe that for one moment.

François Hollande might be heading for the Presidency in May but in terms of the economic policies that will ensue don’t expect any significant changes. All the talk about taxing the rich etc – even if more than idle talk to win the left over – will be a minor change.

The real issues – the Euro, the SGP, the fiscal compact which make up France’s membership of the EMU will remain virtually untouched.

Both Sarkozy and Hollande support the EU elites in Brussels and the maintenance of the Euro and the use of the bailout funds. In other words, neither of the main candidates understands what the basis of the problem in Europe is. For Hollande, he needs to understand that it isn’t a matter of taxing the rich more to get the funds to reduce the deficit.

The problem is that the deficit is too small per se, It might be sensible to redistribute the personal income distribution away from the high income earners, although in inequality rankings France is more equal than many nations, but the macroeconomic urgency at present is to escape the austerity mindset and get growth going.

I see that the press are forecasting that Merkozy will become Mellande after the next round of the Frence Presidential elections in May.

The only serious anti-Euro contender, Marine Le Pen got around 20 per cent of the vote in the first-round. She clearly appeals to the areas where unemployment is intrenched (the industrial north) and espouses some sensible economic policies when appraised from the perspective of a sovereign, currency-issuing government.

The problem is that she clearly doesn’t understand the full implications of abandonding the Euro and restoring one’s own currency. So she considers full employment to be one of the main responsibilities of government and that the state should use its fiscal authority to achieve that goal. Further, she wants to

make it legal for the government to borrow at zero interest from the central bank (Banque de France).

She is opposed to privatisation of the large French public utilities and favours substantial re-regulation of the banking sector including the separation of commercial and investment banks.

All of those policy positions would be consistent with Modern Monetary Theory (MMT). But then you read that she favours an international currency and fixed exchange rates, which is the anathema of MMT.

I will write more in the coming days about the implications of different exchange rate regimes for banking and the government from an MMT perspective.

More worrying, the rest of the right’s agenda is unsupportable in an advanced society. Her social policies – reducing immigration, autocratic schooling policies, and the rest of it – are draconian and unnecessary. They might at present appeal to those oppressed by the neo-liberal austerity onslaught but they are not the basis of a sophisticated society.

So as I noted – French electors who would benefit from a government who really understood MMT and prioritised full employment and sustainable growth have very little meaningful choice.

The same goes for the Netherlands.

The right-leaning Dutch newspaper (for the hoy polloi) – Algemeen Dagblad – carried the headline – “Niemand binnen PVV wist van besluit Wilders” (No-one knew that PVV leader Wilders would pull out).

The former Catholic paper (now left-leaning and aimed at the well-read) – de Volkskrant – headlined with “(hoe) gaat het kabinet-Rutte verder?” (How much longer for the Rutte government); “Politieke verlamming dreigt” (Political paralysis threatens); “Wat er ook gebeurt, aan de Brusselse 3 procent valt niet te ontkomen” (Whatever happend, for Brussels the 3 per cent is inescapable).

The story about the reaction from Brussels is interesting.

We read that:

De eventuele val van het kabinet-Rutte geeft Nederland geen enkel excuus om de hand te lichten met de Europese begrotingsregels, beklemtonen EU-ambtenaren en diplomaten. Net als de nieuwe Griekse regering en de nieuwe Franse president straks hun bezuinigingsbeloften moeten nakomen, geldt dat voor Den Haag: ‘3 procent is 3 procent, dat is keihard’, zegt een nauw betrokken ambtenaar.

3 per cent is 3 per cent, that is tough! The EU commented on the collapse of the talks and said (in the quote above) that the downfall of the Rutte government does not gives the Netherlands any excuse to avoid the cuts that will generate the 3 per cent deficit by 2013 as per the current EDP, that was imposed on the Netherlands by Brussels.

If the proposed fiscal austerity cuts are blocked by the PVV in the Netherlands, then the EU claims they will fine them up to 1.2 billion Euros.

It is noted that the new harsher rules (the Six-Pack) were signed by all nations and tightening of the SGP was “mede onder Nederlandse druk” (under Dutch pressure).

The article says that:

Nederland was de grootste pleitbezorger voor het opwaarderen van eurocommissaris Rehn tot ‘mister Euro’. Brusselse ambtenaren en diplomaten noemen het een gotspe dat PVV-leider Wilders de 3-procentsregel neerzet als een ‘dictaat van Brussel’. Zij wijzen erop dat Wilders zich nimmer heeft verzet tegen aanscherping van de regels. Noch heeft hij clementie gevraagd voor Griekenland, Portugal, Ierland, Spanje en Italië.

Wat wel zal veranderen door de mogelijke val van het kabinet is hoe Nederland tot voor kort de zuidelijke eurolanden de les las. De Jager moet een toontje lager zingen als hij zelf geen volwaardige (door de Kamer gesteunde) begroting kan presenteren.

That is, the Netherlands was the strongest advocate for tightening the rules and increasing the power of EU Commissioner Rehn to “Mr Euro”.

Geert Wilders told the press that he say the new SGP as a “dictaat van Brussel” (dictate from Brussels). The Associated Press article Dutch prime minister says government austerity talks collapse quoted Wilders, who happily took the blame for the downfall of the talks, as saying he:

… would not accept that the elderly in the Netherlands have to pay for nonsensical demands from Brussels … We don’t want to bow to Brussels … We don’t want our pensioners to suffer for the sake of the dictators in Brussels.

The critics suggest Wilders is being opportunist because – “Noch heeft hij clementie gevraagd voor Griekenland, Portugal, Ierland, Spanje en Italië” – He didn’t ask for leniency for Greece, Portugal, Ireland, Spain and Italy.

The failure of the current Dutch government to push the proposed fiscal austerity plans through – which will lead to general elections – strikes at the core of the Eurozone. The Netherlands is considered one of the powerhouses of the region.

The AP article (noted above) says that “Once considered one of Europe’s strongest economies, the Netherlands is suffering from high levels of personal debt, mostly mortgage related”.

When you actually understand what has been happening in The Netherlands over the last decade you gain a better appreciation of why the obsession with fiscal austerity is extremely dangerous.

It is clear that the fiscal ratios (budget deficit and public debt to GDP) are now above the SGP requirements and as I discussed in this blog – The lessons of history – subtitled – are the Dutch printing guilders? – there is zero chance of the nation achieving the fiscal targets that are currently being monitored by the EDP.

The Central Planning Bureau (the government’s economic analysis bureau – CPB) recently published its updated – Main Economic Indicators 2011-2015 in the light of its slowing economy.

The CPB say that the Dutch economy is now likely to worsen on their most recent forecast (December 2011) “mainly due to the unfavourable economic developments … a decrease of consumer spending levels, most likely due to lower consumer confidence levels, deteriorated (pension fund) wealth and decreasing housing prices”.

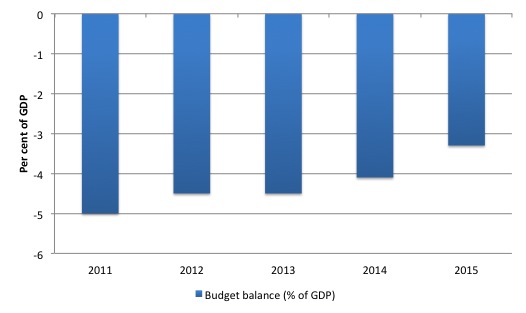

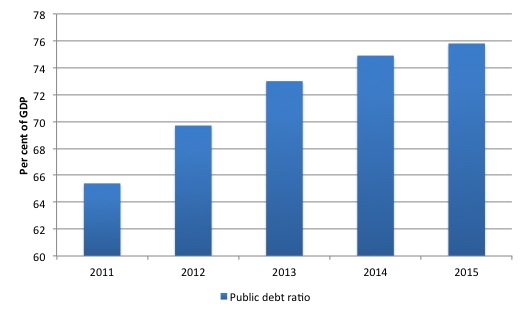

The failing economy will impact on the forecast budget deficit as a result of operation of the automatic stabilisers. The CPB forecasts for the budget deficit and public debt (as a percentage of GDP) for the period 2012-2015 are shown in the following graphs.

The first graph shows the budget deficit forecasts which makes it clear that the SGP deficit requirement will be violated through to 2015 at least. If more fiscal austerity is imposed on the nation courtesy EU dictates then the blue bars will head further south.

The second graph shows the public debt ratio forecasts. Again, from the EU perspective, the austerity push in the Netherlands is sending the financial ratios in the opposite direction to that intended.

Anyone with a basic understaning of MMT would predict the trends being shown.

The CPB says that:

The forecasted budget deficit in 2013 is 4.5 percent. This means that the EMU-ceiling of 3 percent budget deficit will be passed by 9 billion euros. Should public policies remain unchanged the deficit will be 4.1 percent in 2014 and 3.3 percent in 2015. Unemployment increases to 6 percent in 2013, which amounts to 545.000 persons.

So not only will the Dutch economy violate the SGP rules as they presently are, but they have no hope within the next three years at least of getting close to the fiscal compact rule that they themselves have been vehemently promoting.

As the Wall Street Journal article (April 22, 2012) – The Dutch Collapse – noted:

A Dutch downgrade would be greeted with no small degree of Schadenfreude in certain South European capitals. Dutch officials have been among the most forceful advocates of budget consolidation in the euro-zone “periphery,” a category that seems increasingly meaningless with the club of troubled sovereigns closing in around Germany. But with Europe’s political class still committed as ever to its model of poor-country bailouts funded by rich countries, it’s hardly consolation for any European government to watch the ranks of the creditworthy paymasters culled one by one.

The problem for the Dutch is that the household sector is holding massive levels of mortgage debt. Data from the De Nederlandshe Bank (the central bank) shows that total household debt is around 249 per cent (which the WSJ says is the “highest in the euro zone”).

I visit the Netherlands each year (my research centre has a branch in Maastricht) and last year I was astounded by the weakness in the real estate market. I saw For Sale signs up in well-to-do neighbourhoods for the first time and I have been going there annually for more than two decades. When I asked the reason for the signs, I was told that typically the better houses sell without advertising. Now it is a different story.

There are also ghost-like new developments (Irish style) in the Netherlands as a result of the real estate expansion that went bust.

The private deleveraging that is going on at the moment make it imperative for the budget to remain firmly in deficit (and definitely above the fiscal rules of the EU).

The WSJ article certainly doesn’t understand that imperative. It says:

… with the stakes so high, Dutch lawmakers couldn’t agree on cuts and savings worth €14 billion-no small change but not insurmountable.

The 14 billion will further cripple growth.

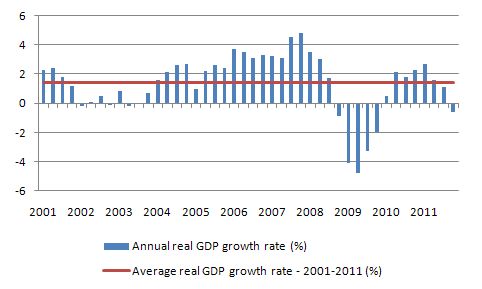

The following graph taken from the De Nederlandshe Bank data shows real GDP growth (quarterly but annualised) since the March-quarter 2001. The red line is the average real GDP growth over that period (1.4 per cent per annum). Since the crisis started to impact (September 2008), the Dutch economy has average real GDP growth rates of -0.1 per cent per annum.

It is clear that it is heading back into recession now as first-quarter 2012 data will confirm when it is published.

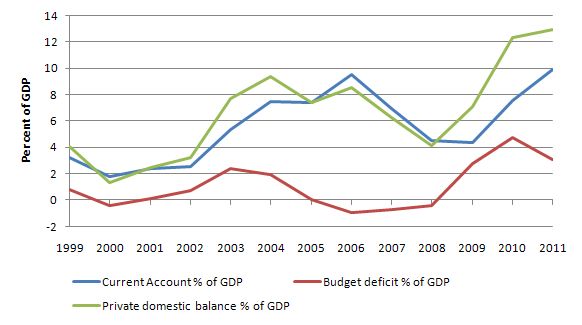

The Dutch economy has a significant external surplus. The following graph shows the annual sectoral balances since 2001 to 2011. Please read my blog – Saturday quiz – April 21, 2012 – answers and discussion – Answer to Question 4 for the derivation if you are unsure.

The sectoral balances view of the national accounts are written as:

(S – I) = (G – T) + (X – M)

The three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (S – I) – positive if in surplus meaning the sector is saving overall (which is different to the household sector saving, and thus denotes that the sector is spending less than their income.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP

ratios sum to zero.

The balances are accounting statements. In an upcoming blog I will address the claims that I often read that MMT is more focused on accounting than behaviour. The statement is false but I will explain what it means and how it can be addressed.

I have also received many E-mails asking me to explain derivations that are abroad in the Internet that suggest there is meaning in the equation S = I + (S – I). There is very little meaning in that statement – no more than saying that 2^2 = 2^2. I don’t intend to comment any further on that issue though.

The red line shows the budget deficit as a % of GDP and it is now firmly in deficit and CPB predicts those deficits will increase over 2012.

You can see that when the budget was balanced (2005) the external surplus was adding enough aggregate demand to offset the private domestic saving overall (green line) and so the fiscal position did not undermine growth. The impact of the crisis on all aggregates is clear.

You can also see that the private domestic deleveraging is now in earnest and the aggregate demand drain involved (spending less than income) is outstripping the rising external surplus. At the current growth rate, that pushes up the deficit (via the automatic stabilisers exclusively if austerity is being purused).

Aiming for a fiscal surplus in this situation is crazy. A fiscal surplus means the government would be spending less than it was “earning” and that would further drive the drain on aggregate demand and would constrain the ability of the economy to grow.

The external surpluses will not be strong enough, especially with the rest of Europe now slowing also. Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

It is clear that the private domestic deleveraging has to be supported to allow the real estate market to stabilise and the economy to grow in the face of the private domestic demand drain.

Fiscal austerity will not only undermine growth but dramatically reduce the capacity of the private domestic sector to get its balance sheet back into some sustainable position.

Conclusion

Since the crisis began we have witnessed a swing to the right in the political debates around the world. It is unfortunate that the main left parties have sold out to the neo-liberal economic myths and left the fight against this scourge to parties on the fringes who also advocate dysfunctional social policies (not to mention their flawed understanding of economics).

What I am viewing at present is that in asserting this manic economic travesty – the EU elites are actually undermining what is good about Europe – the political integration and tolerance that marked the period leading up to the establishment of the Eurozone.

That is enough for today!

“The mainstream left parties stand indicted for embracing the neo-liberal economic myths . . . ”

Before the great recession, most countries had a relatively unprecedented increases in GDP per capita. Rightly or wrongly this was put down to neo-liberal economics?

If their policies had ensured economic ‘success’ then it is only ‘sensible’ to follow their prescriptions when their economies went into recession?

The left have embraced mainstream economics lock, stock and barrel. There doesn’t appear to be an equivalent to Paul Krugman in offering Europeans a whisper of dissent with regard to economics or policy prescriptions. Over the long haul the EU economy will recover from the ashes and the suffering endured by citizens will be viewed as having been ‘unavoidable and necessary’. Rather depressing to contemplate.

Our dear leader Angela, the hypocrite. First she proclaims herself to the modern-day Brüning of the Eurozone and then she comments on the good performance of Marine Le Pen with “very worrying”.

Whenever you find yourself agreeing with a Le Pen and calling anything that they say is “sensible”, you know have gone off the deep end.

No, Andrei. You know almost everyone else has gone off the deep end. It is tragic, or at least deeply disturbing, that mainstream politicians are creating a vacuum which extremists like Le Pen can fill, by their pig-headed ignorance with respect to how real world monetary economies work.

Why won’t they listen? Because mainstream economists are advising them. Why won’t the mainstream change direction? It was the same for Keynes as it is today for MMTists:

‘The ideas which are here expressed so laboriously are extremely simple and should be obvious. The difficulty lies, not in the new ideas, but in escaping from the old ones, which ramify, for those brought up as most of us have been, into every corner of our minds.’ (Preface to the General Theory)

They have been thoroughly brainwashed and won’t even consider changing their views, regardless of the evidence.

I am not really that familiar with MMT and would like to ask a question here.

How exactly will MMT increase the component demand/consumption which is obviously lacking at this point in time?

Thanks in advance for your help.

@Postkey: “Before the great recession, most countries had a relatively unprecedented increases in GDP per capita.”

If there are five people in a room, and I give one of them $100, their per capita holdings of dollars just rose $20, but four of them have not in fact been enriched.

In fact, a closer analogy would be that each of the other four borrowed $25 to give to the other guy.

No, Andrei. You know almost everyone else has gone off the deep end. It is tragic, or at least deeply disturbing, that mainstream politicians are creating a vacuum which extremists like Le Pen can fill, by their pig-headed ignorance with respect to how real world monetary economies work.

What “void”? Exactly 10 years ago, before the global financial crisis, before the soverign debt crisis and before Merkozy, Papa Le Pen achieved the same percentage of votes as his daughter did today, and unlike her, even managed to get into the knockout round with Chirac. There is no void, there is just the more or less constant percentage of population that responds to the Le Pen mish-mash message of right-wing authoritanism, racism, xenophobism and retardonomics.

It seems from the recent political events in Europe that the people are getting wind of this abrogation of their democratic rights and are voting accordingly. But the choices now as so poor

Well, for starters the only two democracies in Europe are SWITZERLAND and LIECHTENSTEIN…No unaccountable strongmen there; just Democracy.

Furthermore, the notion that picking personalities equals “democracy” is laughable. Consider a simple case of preferences:

– Candidate A advocates Policy X and Policy Y;

– Candidate B advocates Policy not-X and Policy not-Y; and

– a voter – perhaps many voters – prefer Policy X and Policy not-Y.

There is simply no way such voters can have their preferences directly reflected or counted. To call this “democratic” is just paternalistic gobbledegook. The underlying problem which paternalists generally refuse to acknowledge is that “government-by-politician” is undemocratic and always will be.

Or, to rephrase the slogan:

“Whoever you vote for, a politician wins.”

The void or vacuum is the absence of any mainstream or left wing political party with any idea of how the monetary system works. The crisis in Europe is an entirely unnecessary one. The austerity programmes are completely stupid and self defeating. Her support base is changing. Half of her voters were between 25 and 44. Racist parties do not and should not normally get this level of support and it is dangerous. It is deeply disturbing. France should leave the Euro-zone, set up a job guarantee scheme, and demonstrate the truth that governments face only real constraints and not financial ones. The necessary government spending would increase the monetary base, but would not cause inflation. It would allow for improved private sector balance sheets without a recession. It would greatly reduce Le Pen’s following and enhance prosperity and social stability in France. It is folly to give up your monetary sovereignty. It if foolish to take policy advice any longer from discredited New Keynesians and their close associates the completely delusional Newclassicals. The sooner the mainstream politicians wake up to this the better. The longer they take, the more pain and unrest there will be across Europe.

MMT advocates, mostly young, seldom talk about the third attribute of sound money, i.e. a store of value. Why is this so? Are they foolish enough to believe the state will support them in retirement? Or that inflation will be so small that savings over their working years will be enough to support them?

“Are they foolish enough to believe the state will support them in retirement? ”

That’s what happens at the moment. What do you think the government bonds backing pensions in payments are? Chickens?

‘Private Pensions’ are largely a myth. Just look at the assets backing annuities to see why.

It is great to finally see the point that Marine Le Pen’s economic policies are very close to those championed by MMT. What I don’t understand is the MMT attitude towards immigration, if there even is one. It seems the most logical immigration policy is that when unemployment is high, immigration should be low and vice versa. So in light of France’s high unemployment, why what is the problem with Le Pen’s calls for a reduction in immigration?

This brings up a more fundamental question of whether an increasing welfare state is compatable with open borders. MMT’ers often advocate a guaranteed jobs program. But they never address the issue of whether this program is possible with open borders. Wouldn’t these programs act as a magnet for illegal immigration as eventually happened in Argentina with the jefes / jefas program? MMT’ers often emphasize the importance of sovereignty over their currency, less often do they discuss sovereignty over borders.

Dear Kevin de Bruxelles (at 2012/04/25 at 18:22)

Marine Le Pen’s economic policies are not “very close” those championed by MMT. She proposes an international currency arrangement with fixed exchange rates. That is the anathema to MMT. You didn’t read the blog carefully enough.

I might write a separate blog about sovereignty of borders.

best wishes

bill

Sorry I wasn’t clear, I meant very close in a relative sense. If you created a scale with perfect MMT policies on one side and then plotted the positions of the various French candidates, Marine Le Pen would be by far the closest to the MMT ideal.

But indeed she is not perfect. I did read your post carefully and I am quite aware of her policies. I have always been amazed that the various MMT blogs never mentioned the fact that she was cribbing their notes. There is no doubt that her calls for an international metallic standard are anathema to MMTers. But here we have to take a more cynical approach since on the international level she has no power. These calls of hers for an international gold or silver standard are most likely not serious and instead political posturing to avoid attacks from the mainstream parties over the lack of constraints within her policies on printing money. Once in power she would most certainly not face any such constraints since on the international level we are a long way from going back to the gold standard.

But her domestic economic policies, those over which she would actually have control if she were elected, are indeed very close to MMT ideas. I sense that MMTers are not comfortable with this which is quite a shame. Finally someone takes your ideas seriously and for some reason you are downplaying this.

Anyway, I look forward to your post on border sovereignty!