The other day I was asked whether I was happy that the US President was…

When does the experiment end?

It is a public holiday in Australia today remembering our First-World War soldiers who died during the ill-fated invasion of the Gallipoli peninsular in Turkey. Anzac Day is part of the Australian legend about heroism and the ideals of mateship that are (dubiously) prominent in our culture. However, this part of our history (and legend) is now being scrutinised by historians and more documentary evidence emerges and it is clear that the conventional history of the campaign that Australia was fighting a heroic struggle in service of the British Empire is not supportable (for example, see this Op Ed for one of the alternative viewpoints that make the Gallipoli story rather mirky). I also have a lot of travel coming up later today and so my blog will be relatively short. I have been rounding up the latest data – surveys, national statistical office releases, bank statistics – from Europe and the UK, to see how the fiscal austerity experiment is actually going. The neo-liberal proponents of austerity all promised us that the private sector was ready and willing to fill any spending gap left by government net spending cuts (and then some) so that the austerity would actually increase growth. Any reasonable person disputed that promise pointing out that spending equals income and private spending was going no-where fast. The evidence is increasingly supporting the latter view. The question is – given the massive damage the austerity policies are having is – when does the experiment end?

The British Office of National Statistics released the March 2012 – Public Sector Finances – data yesterday (April 24, 2012), which showed that the

The ONS present two datasets:

One set includes the temporary effects of financial interventions made in response to the financial crisis that began in 2007, such as the establishment of public ownership/control of several major banking groups. An alternative set of indicators, the so-called ‘ex-measures’, excludes the temporary effects of financial interventions.

The British government prefers the ex-financial intervention data as a cleaner measure of what the underlying policy choices are.

In terms of that data for March 2012:

- The budget deficit was higher deficit than in March 2011.

- Government net borrowing was higher than in March 2011

- Public sector net debt at the end of March 2012 was £1022.5 billion (66.0 per cent of GDP) compared to £905.3 billion (60.5 per cent of GDP) at the end of March 2011.

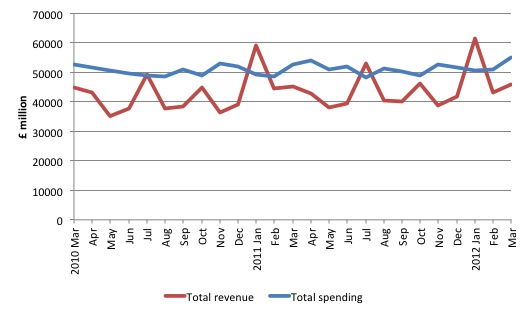

The following graph uses the ONS data and shows the monthly evolution of total government revenue and spending since March 2010 in £ million. Two things are very clear.

First, total spending increased in March and the Government has not been able to make any significant reductions in overall nominal spending.

Second, total revenue fell, mainly due to a very sharp fall (-9.1 per cent) in income and capital gains tax receipts. When we try to understand how the movements in this sort of data provides intelligence about what is going on in the general economy, the fluctuations in tax revenue is a fairly reliable indicator.

Movements in tax revenue are directly related to the labour market changes (higher employment equals higher earnings), spending patterns in the product market and the profitability of firms.

An examination of these individual components reveals that all three were fell in March. Income tax receipts fell by 19.3 per cent in March, Corporate tax receipts fell by a staggering 44.3 per cent and VAT collections fell by 0.5 per cent. This repeated the pattern revealed in February 2012.

So for two months the main indicators of economic activity have been falling – which is not a good sign. Further, these results are in nominal terms and so if you consider they include the impact of inflation, the outcome indicates a very weak private sector.

The net result is that the British government had to borrow more than expected and has risen over the last 12 months. The combination of rising spending and declining tax revenue means that the central government is still supporting growth in aggregate demand and might be the difference between today’s GDP estimates recording a recession or not. It is clear that the private sector is slowing.

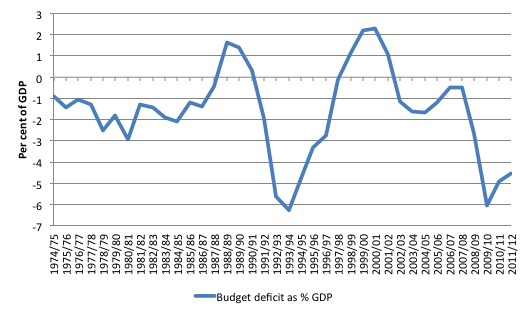

The following graph shows the budget deficit as a per cent of GDP for fiscal years 1974/75 to 2011/12. The likelihood is that the budget deficit ratio will rise in coming months as the economy slows further and tax receipts continue to plunge.

The data shows the familiar pattern that many nations have experienced – budget surpluses tend to be followed by recessions which

then push the deficit much higher than its steady state values were. The surpluses are often driven unsustainable private sector behaviour – for example, the recent credit binge.

The current situation shows that the deficit is falling as a per cent of GDP (modestly) even though the actual deficit (in absolute terms) has risen.

The Markit Household Finance Index (HFI) for the UK was released on April 23, 2012 and showed that household finance continues downward in April. The spokesperson for Markit (which compiles the Survey) said:

UK households faced an even greater uphill challenge to maintain their living standards in April as squeezed disposable incomes meant finances deteriorated at the fastest pace for three months.

This is consistent with the indications provided by the public finance data.

I will be flying when the ONS release the latest National Accounts data later today which will tell us what has been happening in the first quarter of 2012.

The public finance data suggests that real GDP growth will be falling and close to zero.

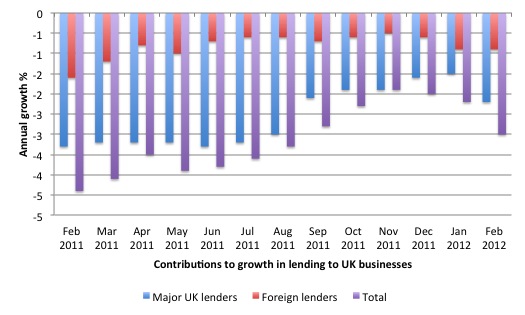

All the current data releases are indicating that a recession or close to it will be revealed. Earlier this week (April 23, 2012), the Bank of England released their latest – Trends in Lending data for April 2012. The data reveals that

There was zero net lending on credit cards between October 2011 and February 2012, loans for house purchases and remortgaging fell in March 2012, lending to businesses continued to fall in the March quarter 2012.

The net lending (monthly) is now at 2-year lows and has fallen in every month since the Coalition government was elected.

It is likely that the lending figures are all demand-side driven – that is, firms do not wish to borrow because they can service the current demand for goods and services from current capacity and are pessimistic about the future growth in overal spending.

The economy thus finds itself in a catch 22 situation. The lack of borrowing means that investment is stifled (for all but the larger firms which may have cash reserves). The stifled investment not only undermines current growth but also reduces the potential growth path for the economy relative to the growth in the labour force.

The existence of these hysteresis effects, which reveal themselves in the aftermath of a drawn-out downturn, provide a strong reason for swift and significant government intervention to short-circuit any decline in private sector spending growth.

Trying to impose fiscal austerity at a time when private investment is fragile compounds the already serious problem for not only current growth but also future growth prospects.

The following graph shows the contributions to growth in lending to UK businesses over the last 12 months (Twelve-month growth, percentage points) which is indicative.

If you then combine this information with the recent Flash Business and Consumer Survey data from the European Commission’s Economic and Financial Affairs unit the gloom deepens.

The Consumer Survey data for the EU and euro area shows that:

In April 2012, the DG ECFIN flash estimate of the consumer confidence indicator declined in both the EU (to -20.1 from -19.3 in March 2012) and the euro area (to -19.8 from -19.1 in March 2012).

The general Economic Sentiment Indicator (ESI):

… decreased in March by 0.8 points in the EU and by a marginal 0.1 points in the euro area, to 93.2 and 94.4 respectively.

That suggests to me that the British economy will not be able to rely on net exports to sustain growth in the coming year. That viewpoint was also reinforced when I saw the latest European Purchasing Managers’ Index (PMI) survey data earlier this week.’

When the data was released I sent out a tweet saying “Latest PMI data for EZ and Germany signal major slowdown – esp. in manufacturing. Jobs collapsing. When will their mindless experiment end?”

The Markit Germany PMI revealed that economic activity in Germany is grinding to a halt.

The PMI showed that:

New order volumes across the German private sector as a whole declined for the second month running in April. In line with the trend for output, the rate of new business contraction was the sharpest for five months. Sector data showed a near-stagnation of new work in the service economy, while manufacturing firms saw a sharp deterioration in their new order books.

Further, the manufacturing respondents reported a “steep drop in new export business during April, thereby extending the current period of decline to ten months”.

The labour market is also showing signs of weakening. The PMI survey revealed substantial underutilised productive capacity in April 2012 and “private sector employment levels were reduced for the first time in just over two years”.

The Markit spokesperson said of the data release:

Germany’s economy continued to rest on a knife edge of recession in April, with modest service sector growth only just counterbalancing the escalating manufacturing downturn. The overall manufacturing performance was the weakest since mid-2009 as shrinking export demand reverberated through the sector. While firms reported resilient export sales to Asian emerging markets and clients in the US, weakness in trade flows closer to home put the brakes

on the manufacturing sector.

The corresponding Eurozone PMI showsed that the two largest Eurozone economies are faltering. France also “saw output fall for the second month in a row, with the rate of decline accelerating to the fastest since October”. France’s manufacturing and service sectors, both, deteriorated sharply.

France also saw employment contract for the second month. The Eurozone PMI notes, however, that across the rest of the Eurozone “job cutting continued at the same severe pace as reported in March”.

You can read about France in more detail HERE.

If that wasn’t bad enough, the Eurozone PMI notes that:

The big-two euro countries nevertheless continued to outperform the rest of the region where output fell sharply, down for the eleventh successive month and at the fastest pace for four months. Steep declines in both manufacturing output and services activity were seen in the periphery.

It appears that incoming new business continues to fall (as it has for the last 9 months). Manufacturing activity is falling off a cliff.

The Markit spokesperson said the data release:

… signalled a faster rate of economic contraction in the Eurozone during April, extending what appears to be a double-dip recession into a third consecutive quarter … Germany saw growth weaken to near-stagnation, while France saw a worryingly steep downturn … The rate of decline … regained momentum in the periphery, which will inevitably raise concerns about the impact of deficit-fighting austerity measures. Prospects also do not look good. Business confidence slumped lowe and companies cut headcounts at the fastest rate since early-2010 ….

These are the facts. They are telling us a story about what is actually happening on the ground in these nations. The question that any reasonable person has to ask themselves is what is driving this data – the causal mechanisms.

Further, one has to ask – which economic theories predicted these trends and which theories suggested otherwise.

Modern Monetary Theory (MMT) predicted that as a result of the fiscal austerity plans, the British economy would slow down again as private consumers and firms cut back on their own spending driven strongly by the fear of unemployment and flat sales conditions that accompany that situation.

Mainstream theory pushed the notion of Ricardian Equivalence which claims that that private spending is weak because we are scared of the future tax implications of the rising budget deficits.

So if the government spends and borrows, consumers and firms will allegedely anticipate higher future taxes and spend less now, which has the effect of offsetting the stimulus.

The modern “founder” of the idea, Robert Barro claimed that if the individual perceives that the government has spent $500 this year but proposes to tax him/her next year at such a rate that the debt will be cleared then the person will still be poorer over their lifetime and will probably cut back consumption now to save the money to pay the higher taxes.

So the government spending has no real effect on output and employment irrespective of whether it is “tax-financed” or “debt-financed”. That is the Barro version of Ricardian Equivalence.

Please read my blog – Pushing the fantasy barrow – for more discussion on this point.

Every time this notion is advanced to predict real world events, the Ricardian Equivalence models have got it exactly wrong. There has never been any predictive capacity in the models.

Once again this was an example of a mathematical model built on un-real assumptions generating conclusions that were appealing to the dominant anti-deficit ideology but which fundamentally failed to deliver predictions that corresponded even remotely with what actually happened.

Barro’s RE theorem has been shown to be a dismal failure regularly and should not be used as an authority to guide any policy design.

Please read my blog – Deficits should be cut in a recession. Not! – for more discussion on this point.

The overwhelming evidence shows that firms will not invest while consumption is weak and households will not spend because they scared of becoming unemployed and are trying to reduce their bloated debt levels.

While the politicians on both sides of the English Channel promoted Ricardian notions – either explictly or implicitly – the recent data is once again showing that the concept of a “fiscal contraction expansion” is deeply flawed.

MMT is about the real world and starts with some basic macroeconomic principles like – spending equals income.

This basic macroeconomic rule is being ignored by governments who have been captured by the neo-liberal dogma that self-regulating private markets will deliver prosperity to all if only governments reduce regulation and run budget surpluses with low taxation.

There have been scores of mainstream economic lies that this crisis has exposed including deficits cause inflation; deficits cause interest rates to rise; there is a money multiplier; etc.

But the most basic neo-liberal lie is that if governments cut their spending the private sector will fill the gap.

When will this experiment end?

Conclusion

I will check the UK National Accounts data later. Given that the government has not been able to cut its spending significantly over the last year I expect the data will show a further slowing towards total stagnation if not modest recession.

But if the policy choices remain in place then it is certain that the UK economy will follow the path of its European neighbours, which are deliberately undermining any chance that their economies will grow any time soon.

The data is not just about inanimate facts. It records a mounting human tragedy as the elites play out their fantasies and ideologies at the expense of the rest of us. At the bottom of the heap, poverty rates are rising and other dysfunctional pathologies (family breakdown, suicide, drug and alcohol abuse, crime and the rest of them) are rising rapidly.

When will this experiment end?

That is enough for today!

“The neo-liberal proponents of austerity all promised us that the private sector was ready and willing to fill any spending gap left by government net spending cuts (and then some) so that the austerity would actually increase growth.”

domestic private sector, foreign private sector (increase net exports), or both?

“Any reasonable person disputed that promise pointing out that spending equals income and private spending was going no-where fast.”

But does spending in the present equal income in the present? I believe you need to add medium of exchange and time there.

I reckon the fuel scare in the last days of Q1 plus the unseasonably warm weather will have provided sufficient pull forward from Q2 to avoid the technical recession in the UK.

Essentially the UK government dropped a clanger and ended up generating a large chunk of economic activity.

You couldn’t make this up.

Quick note, the UK is back in recession and George Osborne is quoted as saying”The one thing that would make the situation even worse would be to abandon our credible plan and deliberately add more borrowing and even more debt.”

So the quick answer is that the UK is syuck with this rubbish policy, at least for the time being as he has no intention of changing course”

Sorry, forgot to add that its -0.2%

Bill,

“When will this experiment end?”

Not soon – see the following links.

George Osbourne interviewed by Faisal Islam has claimed: “We have completely won the argument on austerity” – see http://blogs.channel4.com/faisal-islam-on-economics/chancellor-we-have-completely-won-the-argument-on-austerity/16684

While Mario Draghi has said today:

See http://www.bbc.co.uk/news/business-17839985

Regarding the UK’s return to technical recession, even though government consumption increased, general government’s contribution to gross fixed capital formation has declined between 2010 and 2011 by much more than this – probably due to cuts to the “Schools for the Future” stimulus implemented by the last government. This reduction in public investment was emphasised in the ONS briefing today.

Kind Regards

Would you like that comment deleted Neil ?

@ Neil

Have to wonder what the Q3 is going to look like, isnt going to pretty.

Neil,

What does ”drop a clanger” mean? I’m going to England this summer, maybe I can use it!

George Osborne is quoted as saying”The one thing that would make the situation even worse would be to abandon our credible plan and deliberately add more borrowing and even more debt.”

According to MMT sovereign governments do not borrow because they can not borrow back their own IOU’s, but they still go into debt. It would be helpful to explain, on a philosophical level, what is the difference between sovereign government debt and other kind of debts because clearly there is some difference.

Maybe a new word would be in order to avoid confusion?

PZ ~ From an accounting viewpoint:

The debt is incurred when the currency is first created. When it is subsequently “borrowed” by the sovereign, a debt swap (or asset swap, depending upon where you’re standing) takes place, with “bond money” being swapped for “currency money”. (Currency is a bond that pays no interest; bonds are currency that does.) The “borrowed” currency money is then used to offset (zero out) the initially-created liability for that currency, and as a result, no new net liability (other than interest) is incurred during the “borrowing”.

However! Because the sovereign now thinks it has money to spend that it didn’t before (that’s why it was borrowing, after all), it now goes ahead and spends the money it thought it got from that borrowing. What is actually happening at this point however is that brand new money is being created, and with it, brand new liabilities (debt) for that money.

So it is actually during the spending event and not during the borrowing event that the new liability happens, and if you look carefully enough, you’ll see that the before and after liabilities are identical regardless of whether or not the borrowing event occurred. The borrowing event is therefore superfluous, at least from the perspective of total government debt.

PZ

Can I recommend Randall Wray’s book. Understanding Modern Money?

There is a clear distinction between bank money which are IOUs issued by private banks and State money, most of which is bank reserves that basically backs or guarantees the bank money by ensuring there are enough reserves for those banks to meet their settlement obligations on a daily basis.

Payment of taxes requires a reduction of reserves, as does payment for Govt bonds and those reserves can’t be removed unless they have been spent into existence through deficit spending in the first place.

Yes the original spending or bank deposits created is still out there but Govt money has just been swapped for bonds. I’ve probably got that wrong but I do recommend the book which definitely gets it right.

Trying again. neo liberal austerity, private sector ready part (1st paragraph).

private sector domestic increase, private sector foreign increase (increase net exports), or both?

About spending equals income and private spending nowhere fast.

But does present spending equal present income (time related)? Does medium of exchange and time need to be added there?

“What does “drop a clanger” mean? I’m going to England this summer, maybe I can use it!”

Apologies for the colloquialism.

“to say something by accident that embarrasses or upsets someone”

As in Francis Maude suggesting ‘A bit of extra fuel in a jerry can in the garage is a sensible precaution to take’ ahead of a possible fuel tankers strike.

One woman near me ended up with 40% burns due to decanting petrol into a Jerry Can in her kitchen with the gas cooker on. Admittedly that’s a bit Darwin Award, but nevertheless unnecessary suffering.

” It would be helpful to explain, on a philosophical level, what is the difference between sovereign government debt and other kind of debts because clearly there is some difference.”

Sovereign government debt is a mere liability. Simple as that.

The only debt that costs in real terms is one denominated in a liability controlled by a third party.

No sweat and atoms have to be given up to deal with sovereign debt. It is just an accounting construct.

Lovely post. I was, strangely enough, thinking about the First World War yesterday as a result of your post “The left — entranced by the fiscal austerity mantra”, although I had no idea that today is Anzac Day. (Canada’s myth-making around the First World War is blindly nationalistic: conservatives proudly announce that Canada came into existence on Vimy Ridge and at Passchendaele, which has just enough truth to it to make us forget our earlier nation building, including the development of responsible government in the first part of the 19th century.) A large number of Newfoundlanders were killed at Gallipolli (although they were not yet Canadians), before the Royal Newfoundland Regiment was wiped out on the Somme.

In economic terms, there seem to me two parrallels that one can draw from the First World War. First, one need not ascribe conspiratorial behaviour to decision makers who make a mess of things out of venal incompetence and pride. I am no Gallipoli expert, but it seems to me that there was sufficient incompetence all around (e.g. failure to land at Brighton Beach), on the allied side, that the geopolitical considerations raised in the article you point to seem unlikely, especially since they require one to believe that the British leadership felt constrained by their tractations with the Russians. The parrallel with the sheer mediocrity and self-regard of today’s acolytes of austerity is obvious.

Second, and much more important, is the length to which our political leaders will go to defend their crumbling vision of the world (this is what your post on the failure of the left made me reflect on). What we have now, in Holland, and Flanders, in France, Italy and Germany, is, instead of propaganda about “the war to end all wars”, peddled to the troops to keep them fighting, “the cuts to end all cuts”, a campaign of “austerity to end all austerity”. Like the Koreans sacrificing unnecessarily their household hoards of gold in 1997, we are all now exhorted to do our bit for the deficit-cutting war. Tax the poor, tax the rich, cut public services, whatever. Most people would rather make these unnecessary sacrifices (everyone “doing their bit”) than believe all their sacrifices have been for nought. That is the communications challenge MMT faces.