I started my undergraduate studies in economics in the late 1970s after starting out as…

Australian PM should take up frisbee

The ABC News today reported that – Newcastle hosts frisbee championships – which means the national frisbee championships will be in my town this week and I will be around. Apparently the championships involve “flinging a frisbee between players on a pitch similar to a football or soccer field” and then “catching the disc in the endzone”. I suggest the Australian Prime Minister take up the sport. It seems an innocuous pastime and she surely couldn’t be any less skilled at it than she is at managing the economy. Her speech yesterday in Perth certainly established she has no understanding of macroeconomics or if she does, then she is deliberately misleading us. Her Finance Minister was also fully engaged in the misinformation exercise about the state of the budget. But then she is in solid company. The German Bundesbank has made public statements telling nations crippled by self-imposed fiscal austerity to forget about growth and balance their budgets. The ugly German stereotype is unfortunately reinforced by these sort of public interventions. And, finally, we have the genius who yesterday was advocating widespread cuts in welfare entitlements today out in the Op Ed pages suggesting that countries who exert their sovereign rights over multinationals are committing suicide despite the particular country in focus having real GDP growth rates that most other nations envy. Its all in a day of neo-liberal madness.

The Australian Prime Minister presented a path-defining speech in Perth yesterday (as I am writing – the official transcript is not available) to the West Australian Chamber of Commerce and Industry. She is well behind in the polls and a federal election later next year will terminate her tenure – as one of our worst leaders who squandered the massive opportunity that the Labor Party was given by the voters in 2007 to overturn the neo-liberal policies that the previous conservative government had put in place.

As I noted the other day – OECD – all smoke and mirrors – the current Australian government is firmly of right-wing and neo-liberal persuasion and practice. Among its more notable policy developments since regaining office in 2007 we note:

1. It imprisons refugees from who land on our coastline having escaped desperate circumstances (some of which our own military has created – Iraq, Afghanistan).

2. It continues to fund elite schools and ensure that public schools are starved for funds. When confronted with a recent report (the Gonski Report) which demonstrated that our public school system is falling dramatically behind world standards (literacy, numeracy etc) and need $A5 billion injected immediately, the Government responded saying its priority was to achieve a budget surplus.

3. It refuses to increase the unemployment benefit which is now well below acceptable measures of the poverty line even though their own budget forecasts predict their policies will increase unemployment.

4. It continues to “occupy” indigenous communities with its punitive “intervention” policy.

5. It is obsessed with achieving a budget surplus even though it is killing economic growth. It says it has to do this to placate the financial markets and preserve its credit rating.

The ABS News story (April 19, 2012) – Gillard pushes the case to cut rates – reported on her Perth speech. She reiterated the mantra that “the Federal Government’s pursuit of a budget surplus is an economic imperative that will leave the Reserve Bank room to ease interest rates”.

Please read this blog – They are all in the same mindless club – for a discussion as to why the RBA doesn’t see it that way. For them, the quest for a budget surplus is damaging aggregate economic activity in Australia and the deflationary consequences will force them to lower interest rates to keep inflation within its 2-3 per cent band.

So far from giving the RBA “more room” to move, the Federal government is forcing the RBA to take more responsibility for economic management by deliberately pushing the economy towards recession. The question then arises as to which is the most effective arm of aggregate policy (monetary or fiscal) to achieve high employment rates. The neo-liberals think it is monetary policy but as the current crisis has demonstrated clearly – fiscal policy is more effective.

Further, the RBA Board is neither elected or accountable to the people. Aggregate policy should also be conducted by democratically elected officials so that they can take responsibility and we (the voters) can cast our judgement on them at each election.

The PM claimed that running budget surpluses was at the:

… very heart of good economic management … Let me make this clear once and for all: a budget surplus is not a political target but a potent economic tool.

Yes, a very potent tool for undermining aggregate spending and income generation at a time when the external sector is draining demand from the national economy (notwithstanding the strong trade situation) and the private domestic sector is returning to more normal saving ratios as they try to reduce the unsustainable debt levels they are carrying as a result of the credit binge leading up to the crisis.

In this context – which is undeniable – attempting to run a budget surplus is tantamount to national economic suicide. It is the opposite of “good economic management”.

In reply to the mounting criticism from all quarters that now is not the time to be trying to run budget surpluses (given the economy is slowing down quickly), the PM – apparently trying to demonstrate leadership, said:

First they said we couldn’t, now they say we shouldn’t. I say we will.

A seemingly petulant defiance but certainly not sound economic leadership.

First, a sovereign government can always try to run a surplus given it controls the discretionary fiscal parameters – spending programs and tax structures. Under certain circumstances the pursuit of a budget surplus is sound economic management. For example, Norway can run budget surpluses because it has a strong external sector which allows it to maintain full employment and supports private saving with high quality public service provision.

Most nations do not enjoy that coincidence of factors. Australia certainly does not and will not in the foreseeable future.

Second, if the economy continues to slow at its recent rate and tax revenue growth continues to lag, then it is highly likely the government will not achieve its much-vaunted surplus. But it will damage the economy attempting such a reckless act.

The PM then put the RBA under political pressure saying:

Should the Reserve Bank consider it appropriate to change the cash rate, this could deliver widespread benefits for households and business, noting that a number of sectors of the economy most under strain are arguably more sensitive to interest rate cuts.

But those sectors are more sensitive to government spending cuts if they cause unemployment. The RBA can cut interest rates whenever it chooses. At present, our rates are too high given inflation is falling and the exchange rate is squeezing the life out of our export sector (bar mining).

The Government is claiming that by running a surplus – inflation will fall. First, inflation is already falling and unproblematic even with the relatively large fiscal intervention in 2008. It is well within the RBA’s target range and heading to the lower end. Second, as noted above, it is not virtuous to create a deflationary environment by imposing a harsh fiscal contraction which increases unemployment, and then to claim this is allowing the RBA to lower rates.

The Opposition is even more idiotic. They are now claiming (courtesy of the ABC report) that:

For the last four years this Government has given us the four biggest deficits in Australian history, and the Prime Minister’s own words accept that this has put serious upward pressure on interest rates that the Government could have avoided.

First, the deficits were the “four biggest” in history but then so is the population, GDP, and every other scale indicator. The budget deficit to GDP ratio were, however, not the largest in history.

Second, the Opposition forgets that the World is in the middle of the worst recession in 80 years. The move back into deficit by the Federal government was an essential part of Australia avoiding recording an official recession.

Third, the deficits put downward pressure on interest rates in a world where bank lending is not reserve constrained (that is, in a flexible exchange rate regime).

The Finance Minister Penny Wong – A fair go for all means continued Budget discipline – wrote an OP Ed (April 19, 2012) trying to bolster the Government’s case for a budget surplus and tie it into some notion that they are pro-equity (a “fair go”).

She claimed that:

Labor’s contribution to fairness over the nation’s history is undeniable. Medicare, equal pay, anti-discrimination laws, paid parental leave and superannuation are among the reforms that come to mind. We also understand that opportunity underpins the notion of a fair go, and that the key to opportunity is education.

The Labor Party used to stand for fairness but in its neo-liberal reincarnation those notions have disappeared from the policy space. They deliberately generate unemployment because they want to satisfy financial markets and then refuse to lift the income support payment to allow the jobless to live above the poverty line. The wedge between the UB and the poverty line has widened under their Government.

There are many other examples of how the priority to appear “fiscally responsible” (read: imposing fiscal austerity) have undermined fairness.

The Finance Minister then tied her claim about delivering fairness into capacity to fund programs:

But delivering these policies … means funding programs today, and ensuring that the nation can keep funding our priorities into the future.

Take aged care as an example. Today the commonwealth spends about $12bn on aged care. But, as many families know, the needs of older Australians outstrip the capacity of the current system. Without reform, this dilemma will worsen as the population ages …

Balancing the budget is not only important for the economy in the medium term; it is also the discipline which grounds sustainable social policy in the years ahead.

As a Labor government we understand that fiscal sustainability is a social responsibility.

It doesn’t get much more misguided than that.

Please read yesterday’s blog – Attacks on the welfare state are misguided and will only worsen things – for more discussion on the ageing society.

Balancing the budget in the Australian context means forcing the private domestic sector overall to be continually increasing its indebtedness given our on-going external deficits. That is not a sustainable policy – short-term, medium-term or any other term.

Social policy will only ever be constrained by the available real resources and then the proration of those real resources will be a political choice. The Australian government will always be able to purchase goods and services that are for sale in Australia dollars to promote their social agenda.

So the question is – will there be ample real goods and services available. Answer: it will depend largely on the productivity of the workforce. That will depend on strong investment in schooling, high levels of employment and strong attachment by teenagers to the schooling and training system.

Trying to run a budget surplus will undermine each of the determinants of future productivity. It is a very ugly future prospect. But the PM and the Finance Minister appear oblivious to all of that.

Which brings me to the BuBa

Bloomberg News (April 18, 2012) carried this story – Bundesbank Says Euro Nations Must Set Aside Growth Concerns.

One of the BuBa Board members, one Andreas Dombret was “briefing reporters ahead of the International Monetary Fund’s meetings in Washington this week” and said:

Putting too much weight on short-term, demand-side risks misjudges the root cause of the current crisis, namely a profound loss of confidence in markets … Taking consolidation plans too lightly might give some relief in the short term, but it also undermines the credibility of medium- term budget goals … In the Bundesbank’s view, the latest rise in risk premia for some euro countries shows the ongoing fragility of the situation … This increase should therefore be an incentive to dispel latent doubts in the markets and create confidence through decisive implementation of economic obligations.

Translate that into real speak and a really shocking indictment of the priorities that pervade the neo-liberal paradigm is revealed.

First, the economic obligations of government are expressed not in terms of the prosperity of the people but rather what delivers the best return to the bond markets.

Second, governments should forget about the real damage that the fiscal austerity is causing (on his own admission) and take directions from the bond markets. Governments are elected by citizens who expect them to use the collective resources to maximise prosperity for all. That is what democracy is meant to be about. The bond markets can easily be eliminated from the picture by sound central banking but the ideological approach of the ECB precludes that.

Third, as Wolfgang Münchau noted in his recent Financial Times article (April 15, 2012) – Spain has accepted mission impossible the fiscal austerity:

… does not square with the experience of the eurozone crisis, notably in Greece. It does not square with what we know from economic theory, or from economic history. And it does not square with the simple though unscientific observation that the periodic episodes of market panic about Spain have always tended to follow an austerity announcement.

Münchau argued that the bond market panic followed new announcements of austerity and the prospect that the EU elites would impose further “haircuts” (read: defaults) on investment portfolios accumulated in good faith. The recent decision to prioritise ECB public debt holdings and subordinate the rest is a classic example of how not to promote confidence in private bond markets.

From my perspective, I cannot fathom why there is any demand for Southern European public debt from the private markets given the risk factors. It would suggest that the banks, who seem to be purchasing this debt with funds from the ECB are acting under instructions. Where they are getting their orders from is unknown but we can speculate.

Altogether, the system is failing because of fiscal austerity. The “root cause” of the on-going Eurozone crisis was not “a profound loss of confidence in markets” but rather the result of a poorly designed monetary system which was incapable of withstanding the large, asymmetric aggregate demand shock that the collapse of the housing markets delivered.

That flawed design had the BuBa written all over it. And the continuation of the crisis is the result of the type of austerity myth that senior officials at the BuBa profess. Of-course, as I noted in this blog – A fiscal collapse is imminent – when? – sometime! – when it comes to the BuBa it is do as I say not as I do.

Last week, the latest 10-year German bond tender “failed”. According to the latest Bundesbank report (April 11, 2012) – Federal bond issue – Auction result data, we learn that Germany’s central bank is doing exactly what it claims is the ECB and other central banks should not do – buy up national government debt in large quantities.

The Issue Volume was 5 billion euros and the Bundesbank purchased 1.13 billion euros worth – you can work out the percentage – just under a quarter. But moreover, the competitive bids were valued at 1.852 billion euros (that is, less than 37 per cent of the Issue Volume). In other words, the private markets are now reluctant to buy even German government debt even though I suspect that is a blip because as the threat of breakup rises, there will be demand for Mark-denominated bonds given that the reasonable expectation will be that the German currency will sharply appreciate once floated.

There is ideology and then there is straight-forward idiocy

Yesterday, I noted a Bloomberg Op Ed written by one Fredrik Erixon from the European Centre for International Political Economy, which claims it is an “independent and non-profit policy research think tank dedicated to trade policy and other international economic policy issues of importance to Europe”.

As I pointed out, this allegedly independent organisation gets “its base-funding from the Free Enterprise Foundation in Sweden and welcomes financial support from individuals, foundations and other organisations sharing our ideas in favour of an open world economic order based on voluntary exchange and free trade”. In other words, it is not an “independent” research organisation but a front for free trade and anti-state viewpoints.

Well Mr Erixon was also in the press again with this European Voice Op Ed – A country on a suicidal war path.

It is hard to understand how an intelligent community of readers can take this sort of offering seriously.

He opened with this:

Yet again Europe finds itself in the unenviable position of having to develop strategies to deal with a populist and erratic government that has nationalised property owned by a European firm.

I love the reference to “populist”. European governments would do well to develop some “populist” policies – that is, policies that are popular with the people.

Here is Erixon’s argument in a nutshell.

1. Argentina has seized “a controlling stake in the oil firm YPF – a subsidiary of the Spanish energy firm Repsol”.

2. There is an increasing energy nationalisation trend in Latin America.

3. Argentina is cutting “its dependence on foreign investors” and closing “its market to foreign firms”.

4. This is throwing “Argentina back to an era of … belligerent economic populism”.

5. They are becoming a “state-centred economy” with “trade-balance requirements obliging companies to export as much as they import”. So big companies like BMW are “dependent on imports to build and sell cars in Argentina”.

6. “… foreign investors and firms are pulling out of Argentina in increasing numbers … Argentina has been challenged by investors before”.

7. Legal challenges in international tribunals will fail because Argentina will not respond.

8. Woe is Europe – “retaliatory actions outside the courtroom will only serve to escalate deteriorating Europe’s trade and investment relation to Argentina”.

So here we have Argentina, who is now fully sovereign in its own currency which floats on the international markets demanding a better deal for its people (apparently “belligerent economic populism”) and using its fiscal authority to push through with that policy agenda.

Its national stocks of oil lies in the ground and so are “owned” by the people of that land. That is the basis of all resource rent taxes etc that the mainstream consider to be reasonable and efficient (in that they can eliminate economic rents). The fact that they have decided to manage their own energy resources is consistent with the reduction in dependency on the OPEC oil cartel which fixes prices to suit the Saudis and screw the rest of us.

The increasing energy nationalisations are a reverse-colonialism – as nations gain confidence in their own self-determination.

Mr Erixon concluded that Argentina was committing suicide. Well they said that in 2001 when the same country demonstrated to all suffering nations that a major default on international debt is manageable and does not cause irrevocable damage to the nation. They also demonstrated that once a nation floats its exchange rate and stops borrowing in foreign currencies it can use fiscal and monetary policy to advance public purpose.

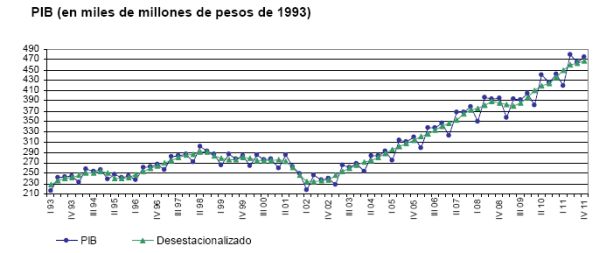

The following graph is taken from the latest quarterly economic data provided by the Ministerio de Economía (Economic Ministry) in Argentina.

It shows – Producto Interno Bruto en miles de millones de pesos de 1993 (real Gross Domestic Product base year 1993) – from 1993 to the fourth-quarter 2011. The blue line is actual and the green seasonally adjusted.

The upward inflexion corresponds to the crisis when they abandoned their peg with the US and floated their own currency and defaulted on the foreign loans. They have been growing since bar the short period while they ingested the crisis in 2008.

I am not holding out Argentina as an exemplar of good economic management. They have high (but relatively stable) inflation and their interest rates are too high. They have significant poverty.

But by continuing to assert their currency sovereignty and gain more control over their own resources they are certainly not committing suicide.

The Europeans are demonstrating to the world how that is done.

Conclusion

So another week done. I had a long chat today with my mate Warren Mosler and we tried to understand the economic policy madness that is getting worse not better. Two years ago I thought this was just the last hurrah of a dying paradigm. Its credibility had been so categorically demolished by the crisis.

I was wrong. There is life in this madness yet. It will fall eventually but in the meantime with governments everywhere being pressured and cajoled by neo-liberal officials in banks, the press etc to impose more austerity

It will get worse before it gets better. Pity the unemployed. Pity our youth.

I might just go and check out the frisbee championships tomorrow!

Music – Remembering Levon Helm

The great Band drummer Levon Helm, died overnight. Here is a great singalong track that featured his beautiful tenor voice.

Saturday Quiz

The Saturday Quiz will be back sometime tomorrow – about as easy as last week!

That is enough for today!

Once a month or so you should write a column for the ABC’s The Drum Unleashed Opinion section Bill.

I’m not certain I share your political views in this piece but I certainly share your economic point of view.

I’ve been attempting to look into Keating’s mid-90s Jobs Compact today. Whilst not a Job Guarantee, it does sound like an improvement.

The Jobs Compact centrepiece was to provide jobs for 6-12 months for those unemployed and receiving a benefit for greater than 18 months.

Clearly not universal like a JG and has its limitations but sounds better than what is out there now.

Letter in Vancouver Sun, April 17 (largest newspaper in Vancouver, Canada)

http://www.vancouversun.com/opinion/Government+spending+needed+slow+economy/6471312/story.html

Government spending needed in slow economy

Re: What would a truly liberal, Liberal party look like?, Column, April 10

Michael Den Tandt wants the Liberals to support balanced-budget legislation, but that is a prescription with no merit whatsoever.

If the private domestic sector wants to save part of its earnings and if we are importing more than we are exporting, then there will be a shortage of demand in the economy that the government must fill, or there will not be enough jobs.

The recent Conservative budget forecasts an average unemployment rate of seven per cent over the next four years, an admission of failure.

Reducing government expenditures in a slow economy is the equivalent of treating a weak patient with bloodletting.

Larry Kazdan Vancouver

© Copyright (c) The Vancouver Sun

Bill, I haven’t voted in twenty years. If you run as an independent in the Senate I will mark ‘1’ next to your name. Hell, I will even campaign for you. I can’t say I share all your economic views but it sure as hell beats anything any Aussie government has done since 1990. fwiw, I whole-heartedly agree with points 1, 4 and 5. If we must have public schools, then I also agree with point 2. If government continues to artificially increase the cost of living then I feel compelled to agree with point 3, also.

Argentina absolutely did the right thing when it defaulted; the PIIGS should take leaf out of its book.

Cheers!

I have to agree that neoliberals are a stubborn lot.

They seem immune to scorn, riducule, facts and common sense.

And still they have this grip on people that should know better. Every time I hear them trotting out the old mantras I think of one of your previous blogs. “Polly wants a cracker !” and that gives me renewed strength to go back and ridicule them some more

So here we have Argentina, who is now fully sovereign in its own currency which floats on the international markets demanding a better deal for its people (apparently “belligerent economic populism”) and using its fiscal authority to push through with that policy agenda.

Argentina’s peso is not floating freely: there is a black market where the US$ is about 10%-20% higher than the official rate.

Real growth in Argentina is overstated as their inflation is understated by the INDEC that you cite, which has been seized by the government party in order to cook the books.

If Argentina stopped borrowing in foreign currency, how come its external debt has been rising steadily, reaching levels higher than the pre-crisis level?

http://www.indexmundi.com/g/g.aspx?c=ar&v=94

Dear MamMoTh (at 2012/04/21 at 5:13)

Thanks for your comment. The data you provide a link to explicitly states that:

You might have mentioned that given that my comment was explicitly about the sovereign government debt. The data also doesn’t square exactly with information from the IMF WEO databases. But we don’t have to dwell on that.

According to the Informe de deuda trimestral (Quarterly Debt Report – March 2011) – http://www.mecon.gov.ar/finanzas/sfinan/documentos/informe_deuda_publica_31-03-11_espanol.pdf

Total Gross National Debt in Argentina was $US173 billion (46.3 per cent of GDP) – which squares with the IMF data (given that the IMF gets its data from national governments).

TOTAL DEUDA PÚBLICA -NETA (total net public debt) = $US153 billion (45.3 per cent of GDP).

As at March 2011, 61 per cent of total national public debt was denominated in foreign currencies (Moneda extraneja) (48 per cent USD; 11 per cent Euro; 1.26 per cent Yen etc) – Paris Club debt 3.8 per cent; Multilateral and bilateral agencies 11 per cent; Normal national public sector agencies 47 per cent. The foreign private sector holds about 36.1 per cent of that debt.

Debt that is subject to the “risk market” (that is, which is not set by formal fixed price agreements) amounts to 16.7 per cent of GDP (which is small by Argentinean historical standards and comparable countries).

http://www.mecon.gov.ar/finanzas/sfinan/documentos/deuda_publica_31-03-2011.xls

The other point to note is that Argentina continues in its process of deleveraging with total debt falling by 2.7 percentage points of GDP between 2010 and 2011. This process has been on-going since 2002.

I know you do not trust the economic data coming from Argentina but the most recent economic indicators provided by the Economic Ministry (http://www.mecon.gov.ar/basehome/pdf/indicadores.pdf) provides this graph of Public debt denominated in foreign currencies against various other macroeconomic aggregates – exports, GDP etc

And this graph shows gross general government debt (local and foreign currencies) and uses the IMF WEO database as the source. The official government data provides the same story as the IMF data (which is what I would expect).

It might give you pause for thought.

best wishes

bill

Total Gross National Debt in Argentina was $US173 billion (46.3 per cent of GDP) – which squares with the IMF data (given that the IMF gets its data from national governments).

TOTAL DEUDA PÚBLICA -NETA (total net public debt) = $US153 billion (45.3 per cent of GDP).

It might give you pause for thought.

After the pause I have to say that figures square with the data I provided which shows that the external debt has been rising since 2007 and reached about $US160 billion in 2011, and that my question about how can the gross external debt rise without increasing borrowing in foreign currencies remains unanswered.

(and no, I don’t trust the INDEC figures for inflation since it was intervened by the government thugs, although I don’t trust the private analysts either)

The Australina Government rigs our inflation and unemployment numbers too. There is not a neoliberal government in the world that does not “cook the books”.

Our unemployment figure is a big lie. True unemployment, including uncounted unemployment, hidden unemployment and under-employment, is at least double the official number. Our inflation figure is rigged too. The government has a perverse incentive to under-state inflation as this caps rises in pensions, unemployment benefit and public service pay thus making them decline in real terms.

Inflation has been fed by excess credit (debt money creation by the banks). Apparently, in neoliberal eyes, it is OK for the private sector to be irresponsible and create inflation and asset bubbles but it is not OK for the government to be responsible and use deficit spending to lift the economy to full capacity and full employment. If the creation of debt money which creates bubbles and inflation was better controlled there would be more room for responsible public spending. This would generate employment and keep inflation under better control.

The idea that we have handed our political economy governance to the international corporations should be anathema to us all. It means we are heading towards Corporate Dictatorship.

Ikonoclast, if you are interested in more realistic unemployment numbers, go to the RoyMorgan website. They have an alternative measure without the absurd ILO definition. RoyMorgan places unemployment at around the 9% mark. Another 8% are underemployed, yielding about 17% of the workforce, or 2 million Australians, as either unemployed or underemployed. The RoyMorgan numbers are volatile coz no seasonal adjustment takes place but if you look at the directional trend over 3 or 4 months it gives you a pretty good idea of the labour market.

In terms of the statistical fakery that is the CPI and jobless rate, governments of all persuasions have participated in this. Have a look at the ShadowStats website to see what the current inflation and unemployment rates are estimated to be based earlier definitions (such as at 1980 and 1990, etc). It should be obvious that there is a systematic understatement of the CPI to keep some sort of a lid on pension benefits – I view this as despicable. GDP numbers are overstated because of hedonic adjustment (i.e., increased quality = increased output even though there is no change in actual output). It doesn’t affect Australia so much coz we don’t have much of a high tech sector. In the US, hedonic adjustment is out of control. It also keeps a lid on the GDP deflator because increased quality is treated as a price fall, even in instances where prices may have risen. Now, back to the footy.

CPI indexes can be easily manipulated or modified to give a lower figure, I agree, and that can happen anywhere. But not to the same extent than in Argentina where “I’m the biggest dick around” Moreno sent his thugs to take over the INDEC literally, and bodyguards ended up working there filling the forms with the prices he had “negotiated” but no one respected instead of the real prices. The guy has even been able to freeze the Big Mac prize!

All that matters is to keep in mind that growth is overstated, and that the Argentina peso is not freely floating, not to mention that the government is more keen to achieve a primary surplus than in Australia, because the know they have no other option.

@MamMoTh:

“After the pause I have to say that figures square with the data I provided which shows that the external debt has been rising since 2007 and reached about $US160 billion in 2011, and that my question about how can the gross external debt rise without increasing borrowing in foreign currencies remains unanswered”

I’m not too familiar with the data, but is it possibly due to compound interest on the external debt?

On a separate matter, we’re blowing another $7b on the IMF. I’d rather it was trasferred into my account. I guarantee AD would strongly increase.

Grigory, whatever the reason, if the stock of external debt is increasing then someone must be borrowing in foreign currencies. Could be that it is mainly the private sector due to the difference in interest rates (Argentina’s is about 11%) as I think Bill is suggesting, I don’t have that data.

What is far more obvious is that the peso in not floating freely:

http://soberlook.com/2012/04/argentina-shadow-fx-rate-shows-total.html

“What is far more obvious is that the peso in not floating freely:”

Or that your belief in how exchange rates move is incorrect – because no solid theory on how they move exists.

“Grigory, whatever the reason, if the stock of external debt is increasing then someone must be borrowing in foreign currencies. ”

As long as its not the government, then it doesn’t matter. Other entities can go bankrupt and somebody outside of Argentina takes the loss via the bankruptcy mechanisms.

The problem with foreign debt obligations for the sovereign is that there is no formal and agreed repudiation mechanism – there is no agreed international mechanism for them to go bankrupt. Hence why MMT strongly suggests that sovereign debt held in a foreign liability is a no-no.

No need to lie Neil. I didn’t mention any theory about how exchange rates move. Just the evidence that the official and unofficial rates are quite difference, which is evidence that the exchange rate is not floating freely. There is no black market in a free market.

As long as its not the government, then it doesn’t matter. Other entities can go bankrupt and somebody outside of Argentina takes the loss via the bankruptcy mechanisms.

Of course it matters. It means the domestic financial sector is at risk.

“Of course it matters. It means the domestic financial sector is at risk.”

Then they go bankrupt and shut, and the system is resolved via the administration procedure – which may require the sovereign to capitalise new banks.

Banks have to be able to go bust.

What do you think they should be doing about it? Should they aim for a surplus?