I started my undergraduate studies in economics in the late 1970s after starting out as…

They are all in the same mindless club

The Australian Bureau of Statistics (ABS) released the latest – Building Activity data today (April 18, 2012) which shows that in the December 2011 quarter real activity continued to contract. This is the most recent data release that reinforces the conclusion that the Australian economy is starting to slow down and is now well below the pre-crisis trend growth rates of somewhere between 3 and 3.5 per cent. Within this environment we would expect the federal government as the currency-issuer to be showing leadership and providing fiscal stimulus to support higher growth and allow the private sector to continue deleveraging given their excessive debt levels. The problem is that governments these days do not seem to know what good economics is. Our government thinks responsible fiscal management is to deliberately undermine spending growth (when inflation is falling) and push unemployment up. The only thing that we can say about that is that they are in good company. The governments that are imposing damaging fiscal austerity on their economies are in the same mindless club.

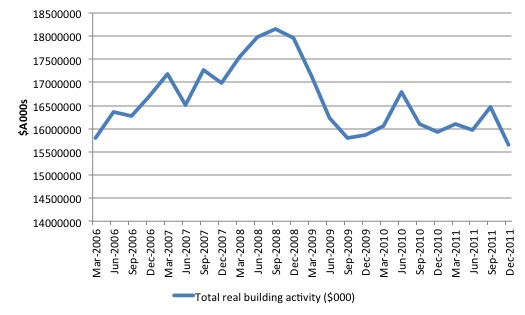

The following graph shows real total building activity in Australia from the March-quarter 2006 to the December-quarter 2011 (in $A000’s). The building industry is a reliable indicator of the direction of the cycle.

All expenditure components fell. Total building work done fell by 4.9 per cent in the December quarter (seasonally adjusted) while the value of new residential building work done fell by 1.7 per cent and the value of non-residential building work done fell by 9.1 per cent.

You can see the impact of the crisis and then the comeback (relative) upon the back of the fiscal stimulus in 2010 and then the decline after the stimulus was progressively withdrawn. The state of the industry is now worse than was experienced at the trough of the crisis (pre-stimulus).

Despite this downward trend, the Australian Treasurer was at it again yesterday at a – Press Conference – where he was asked to respond to the new leader of The Greens demand that the Government abandon their obsessive pursuit of a budget surplus in the coming year in the face of a slowing economy. He said:

The Government will not be in any way deterred from doing the right thing by the Australian people and getting the economic settings right for the future. Coming back to surplus is an economic imperative. When you look around the world, when you look at all of the global uncertainty, when you look at the changing nature of the global economy, when you look to Europe and see what is happening there in terms of sovereign debt and problems in the financial system, the right thing to do in this environment is to send a message to the world about the strength of public finances in this country and that you’ve got a Government with the guts and determination to implement a medium-term fiscal strategy which is what the world is crying out for in other developed economies.

Ms Milne said that we shouldn’t be coming back to surplus and said that she based that comment on some of the commentary from the IMF. Well, I’ve got to tell you, I’ll be seeing Christine Lagarde from the IMF and I know her view would be that a country in our circumstances should be bringing its budget back to surplus in the circumstances in which we find ourselves. So we’re doing it because it’s the right thing given the global circumstances. It’s the right thing in an economy where growth is around trend, where unemployment is 5.2 [per cent] and where there is a big investment pipeline. On top of all of that, it provides maximum flexibility to the Reserve Bank to cut interest rates should it deem it necessary.

That has been the Government’s mantra for some time now even though real GDP growth is slowing dramatically and our main driver of export growth (China) is also slowing.

I have recently considered some of the Treasurer’s claims in this blog – Keynes would not support fiscal austerity.

The Reserve Bank of Australia (RBA) released the – Minutes of the Monetary Policy Meeting – yesterday (for its April 3, 2012 meeting). The meeting held interest rates constant although signalled that the direction is probably down.

The RBA Minutes tell us that the Treasurer’s depiction of causality is amiss. While the Treasurer keeps claiming that the pursuit of the budget surplus “provides maximum flexibility to the Reserve Bank to cut interest rates should it deem it necessary” the reality expressed in the Minutes tells a different story.

There we read – in as many words – that the Government’s pursuit of the surplus will damage the economy and force it to ease monetary policy to stop the economy from contracting rapidly.

The Minutes say:

Members noted that the national accounts for the December quarter had shown an increase in real GDP of 0.4 per cent in the quarter and 2.3 per cent over the year, which were both lower than expected … While business surveys suggested that overall conditions remained at average levels, there were significant differences across sectors and business confidence remained somewhat below average … recent surveys of business intentions suggested that non-mining investment was likely to remain sluggish for some time. Business credit growth had increased slightly over recent months, but remained low … Labour market conditions remained subdued, with employment falling by 15,000 in February and showing little change for much of the preceding year … The Board had eased monetary policy late in 2011. Since then members had lowered their assessment of the pace of growth somewhat. If slower growth in demand could be expected to result in a more moderate inflation outcome, then a case could be made for a further easing of monetary policy.

The last sentence is the giveaway and confirms that the RBA will lower rates because growth is lagging as a consequence of slower growth in demand. The RBA is not about to come out openly and pin the budget surplus endeavour of the Government to that slow down. But that is what it means.

The other observation is that while the Treasurer keeps saying that the economy is operating at around trend growth – or moving toward that – the RBA does not make that (factually wrong) claim. They note that they underestimated the decline in the real GDP growth rate.

Yesterday, the ABS also published the latest – Government Finance Statistics for 2010-11, which provides the definitive source of spending and taxation data.

They allow us to see the impact that the crisis has had on the both sides of the budget.

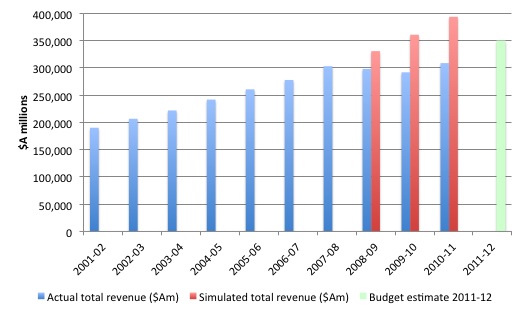

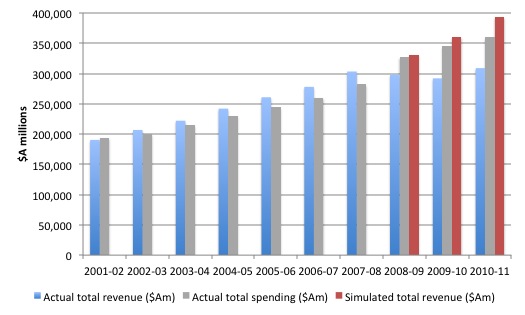

The following graph shows the evolution of total federal government revenue (taxation and other sources) for the financial years 2001-02 to 2010-11 (blue bars).

The red bars are simulated using the growth in revenue for 2007-08 (9.1 per cent). So the red bars show what would have been the case had total revenue continued to grow at 9.1 per cent over the next three years from 2008-09 (that is, ignoring the crisis and any other factors that might be present).

The 2011-12 Budget estimate for the current fiscal year is shown by the green bars and this assumes based on the actual data now available from the ABS that total revenue would grow 13.2 per cent in the current year.

The graph gives a very crude view of how the crisis has impacted on the revenue side of the government budget. I will come back to that because there are other factors that have also been present that need to be considered.

There were other factors present that suggest that the growth in taxation revenue would have slowed a little without the crisis. For example, the current government ratified the significant tax cuts proposed by the out-going conservative government in the 2007-08 Budget.

The Federal treasury boss Martin Parkinson gave a speech on March 7, 2012 – Introductory Remarks to the Australia-Israel Chamber of Commerce – where he explained some of the factors that were driving revenue growth.

The tax-to-GDP ratio has fallen by 4 percentage points since the GFC, and is not expected to recover to its pre-crisis level for many years to come. This reflects a combination of cyclical and structural factors. Capital gains tax has been hit hard in the aftermath of the crisis. Households are more cautious in their spending pattern, dampening indirect taxes in the process. Meanwhile, the resources boom and the increasing importance of the mining sector is having significant impact on tax revenues. Mining companies account for about a fifth of gross operating surplus, yet only around a tenth of company tax receipts, primarily because tax receipts from the industry are affected by the high levels of investment occurring in the sector and the consequent level of depreciation deductions. Finally, the historically high Australian dollar hurts profits in, and taxes from, the non-mining export, and import-competing, sectors.

It remains that the major driver of the decline in revenue has been the cyclical impacts of the crisis on growth (that is, the automatic stabilisers).

What is often forgotten is that this is a balance sheet recession which will require years of private deleveraging to restore the sustainability of private balance sheets. The result – a very drawn out period of subdued private spending overall.

Under those conditions, sustained budget deficits are required to support aggregate demand growth, which in turn, helps the private sector regain confidence.

But in a period of balance sheet adjustment, private spending will remain flat because the main task is reducing debt to sustainable levels.

Please read my blog – Balance sheet recessions and democracy – for more discussion on this point.

So there are very good reasons why we should expect private spending to remain relatively subdued for some time.

But there is more to it than that. It is clear the households are lifting their saving ratio out of disposable income and private investment is strong in mining but weak elsewhere.

This is, in part, a long-term adjustment back to what we might consider to be more normal or typical behaviour once we appreciate the historical record.

The long period after the Second World War up to the beginning of the neo-liberal period (around the late 1970s) was characterised by several features in most advanced nations:

- Relatively continuous use of fiscal deficits.

- Stable personal saving ratio of around 7-8 per cent of personal disposable income.

- A consumption share of around 65 per cent of GDP.

- Real wages growing in line with labour productivity – so that consumption could be driven by real wages growth rather than credit.

When you appreciate that historical record, then it is clear that the recent period of neo-liberal dominance has been, in fact, the outlier – an atypical period. Which makes the claims by those who hold out that governments should return to surplus as a demonstration of fiscal responsibility rather difficult to understand.

Please read my blog – The Great Moderation myth – for more discussion on this point.

In many cases, where actual budget surpluses were recorded, the economies went into recession soon after. The important point though is that the surpluses were made possible by the unsustainable growth in private credit which drove private spending and boosted tax revenue.

In the Eurozone, Spain and Ireland recorded budget surpluses in the lead up to the crisis and were held out as the exemplar of fiscal prudence and financial management. History has a way of showing nonsense for what it is. Their ridiculous real estate booms drove the surpluses. The surpluses, in fact, squeezed the capacity of the private sectors to maintain reasonable saving ratios – which would have ensured better private risk management.

The same can be said for Australia in the period leading up to the crisis. While the current political debate holds our budget surpluses as being the exemplar of fiscal purity and responsibility the reality is that the Australian government was only able to achieve surpluses in the recent past on the back of unsustainable private sector borrowing.

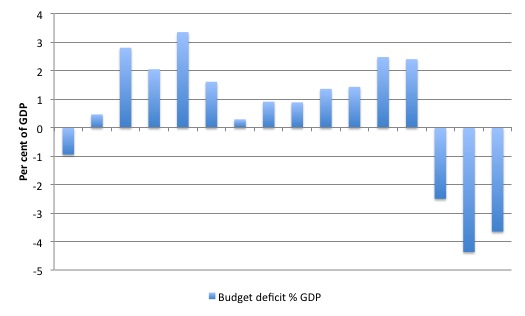

The following graph shows the history of the budget outcome (negative equals deficit) since the 1995-96 fiscal year. The bars show the headline budget outcome as a percent of GDP. The continuous budget surpluses under the previous conservative government were accompanied by a record buildup in private sector indebtedness.

It is thus highly likely that we are returning to a more normal or typical environment now where the private sector are attempting to save more out of disposable income and reduce its reliance on credit.

While the Government is obsessed with achieving budget surpluses, it should seek to understand these underlying trends and appreciate the implications of them.

If the private consumption growth is returning to more normal levels then two things follow and for the extended future private deleveraging will see more measured private demand growth then:

- The government will more likely have to run budget deficits of some magnitude indefinitely – as in the past.

- Real wages growth will have to be more closely aligned with productivity growth to break the reliance on credit growth. That is, there has to a fundamental shift in the distribution of national income back towards wages, which will constitute a reversal of the neo-liberal trend towards increasing profit shares via real wages growth suppression.

When the nature of the balance sheet adjustments that are going on at present are included in the assessment these two points become amplified.

Governments should be promoting and supporting the private sector deleveraging by ensuring that aggregate demand (spending) is growing as fast as the real capacity of the economy can absorb.

This makes the quest for fiscal austerity mindless and very destructive. Where will growth ever come from if consumers are returning to higher saving ratios, firms are very cautious, all countries are eroding each other’s export markets, and governments are adding to the malaise?

The answer is obvious.

And increasingly private sector economists, who usually support the surplus mantra are coming out and criticising both sides of politics for the budget surplus obsession.

In the Australian Financial Review (AFR) this morning (sorry it is a subscription article – I read it on the plane!) there was a story – Surplus at all costs is “mindless”.

The AFR article noted that:

The federal government’s “mindless” pursuit of a budget surplus – not banks’ interest rate rises – poses the biggest threat to the economy …

Admittedly, the article was recounting an interview with a former leading banker, who has an interest in defending the recent disgraceful behaviour where the private banks are pushing the spread between their lending rates and the RBA policy rate up on the back of arguments that their funding costs have risen.

Even the RBA minutes show that funding costs have been falling in recent months and so the oligopoly that is Australian banking is doing what an oligopoly does – fix prices and gouge profits – all under the safe umbrella of government guarantees. I will write more about this another day.

The AFR article quoted the banker who terms the commitment by the Government to return to surplus in the coming year “mindless” and that:

… there are currently extenuating circumstances that militate against this … Another year of a modest deficit is not going to have a significant impact on Australia compared to a surplus at any cost.

Going back to yesterday’s Government Financial data release by the ABS I did some tinkering.

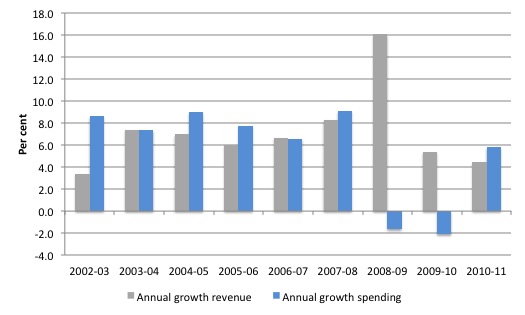

First, the following graph shows the growth in total federal government revenue and spending (per cent per annum) since the 2002-03 fiscal year. The impact of the crisis on both sides of the budget is pronounced. The rapid rise in spending in 2008-09 is due to the fiscal stimulus which prevented the economy from falling into recession although it was not large enough to prevent unemployment and underemployment from rising. At the same time, growth in tax revenue was negative.

The fiscal withdrawal is seeing spending growth falling well below its recent (pre-crisis) rates.

The following graph shows in level terms ($A millions) the evolution of total federal revenue (blue bars) and spending (grey bars) over the same period, with the simulated revenue for the last three years added (red bars).

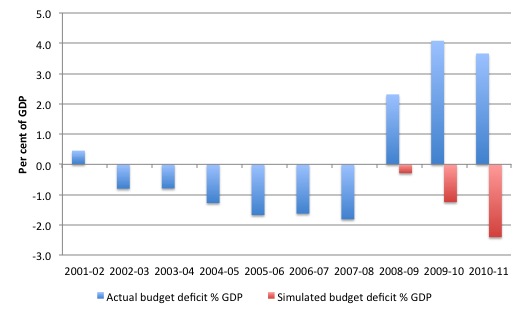

If we recalculated the federal government budget outcome for the years since the crisis using the simulated revenue (shown in the diagram above) the following result would be derived. The blue bars are the actual deficit as a per cent of GDP and the red bars is the simulated (net of “cycle”) budget outcome.

Now we should not interpret this literally as if the difference between the two is purely cyclical (see discussion above). But it suggests to me that the current structural budget position, given the state of the economy, is likely to contractionary and definitely undermining growth.

The graph should certainly provoke you to think about how the crisis has impacted on the budget outcome and what might happen should growth return to its previous trend rates.

I was asked by a journalist today what will happen when the government goes back into surplus in the coming fiscal year. I said that the actual question was what will be the consequences of the government trying to return to surplus, recognising that the actual budget outcome is largely beyond the control of the government.

The process of trying to achieve a surplus will damage growth and probably undermine the government’s revenue side to such an extent that the cyclical effects (pushing the deficit up) will swamp the discretionary intent (cutting spending etc) and the result will be that they will fail to achieve their goal.

The other point is that it is the goal that is flawed. If the government was capable of acknowledging that their responsibility is not to deliver deficits or surpluses as a matter of choice but, rather, to ensure that aggregate demand is strong enough to drive strong employment growth and reduce unemployment to irreducible mininum levels while at the same time not pushing demand beyond the real capacity of the economy to absorb it in a non-inflationary manner.

There was an interesting article in the Financial Times the other day (April 15, 2012) – Spain has accepted mission impossible – by Wolfgang Münchau. He noted that:

European policy makers have a tendency to treat fiscal policy as a simple accounting exercise, omitting any dynamic effects. The Spanish economist Luis Garicano made a calculation, as reported in El País, in which the reduction in the deficit from 8.5 per cent of GDP to 5.3 per cent would require not a €32bn deficit reduction programme (which is what a correction of 3.2 per cent would nominally imply for a country with a GDP of roughly €1tn), but one of between €53bn and €64bn. So to achieve a fiscal correction of 3.2 per cent, you must plan for one almost twice as large.

This is because falling growth means that the government’s fiscal austerity program starts chasing it taxation tail down the drain. As taxation revenue falls with the declining growth – caused by the fiscal austerity – the neo-liberals propose even harder cuts in net spending. And the chase continues as unemployment rises and poverty spreads.

In this recent blog – Back off austerity and give growth a chance – I reflect on some arithmetic pertaining to Australia.

Wolfgang Münchau reflecting on this current obsession with austerity says that “(w)hen you miss the target, you must overcompensate to hit it next time. The target is the goal – the only goal”,

Obsession is bad policy and a denial of history.

Wolfgang Münchau says the pursuit of surpluses at all costs:

… does not square with the experience of the eurozone crisis, notably in Greece. It does not square with what we know from economic theory, or from economic history. And it does not square with the simple though unscientific observation that the periodic episodes of market panic about Spain have always tended to follow an austerity announcement.

In the Mid-Year Economic and Fiscal Outlook the Australian Government was forecasting real GDP growth would be 3.25 per cent for 2011-12. It is already around 2.4 per cent (as at December 2011 quarter) and falling fast. It will be lucky to come in above 2 per cent by the time the fiscal year is out (June 2012).

The May 2011 Budget forecast employment growth at 1.75 per cent and this was revised down to 1 per cent in the December review. However, employment growth in 2011 was zero and has not shown much signs of improving in the first three months of 2012.

Most of the other real-sector forecasts were overly optimistic which is something I said at the time before the data had come out.

The Treasury in framing the surplus estimate for 2011-12 assumed that real economic growth would be booming – 4.5 per cent in the coming year. There is no chance of that occuring.

The impact is that tax revenue continues to slump which led the Treasury Secretary to conclude that “surpluses are likely to remain at best razor-thin without deliberate efforts to significantly increase revenue or reduce expenditure”.

I would go further and say that the Government will not be able to achieve a surplus in the coming year given the current economic activity.

The Spanish mission is clearly impossible. Wolfgang Münchau says that:

It is one of the biggest fiscal adjustments ever attempted by a large industrial country. It is perfectly rational for investors to be scared.

I will discuss his article in detail another day.

But think about what the Australian government is proposing. To get back into surplus in the coming fiscal year they are proposing we move from a deficit of around 2.5 per cent of GDP to a surplus of around 0.5 per cent of GDP.

The Australian ambition is not far removed from that of the Spanish government and while our economy is in much better shape than the Spanish economy the impact will be the same – both austerity programs will damage growth and drive Australia towards, if not into recession, and Spain into the mire.

Wolfgang Münchau says of Spain:

Spain’s effort at deficit reduction is not just bad economics, it is physically impossible, so something else will have to give. Either Spain will miss the target, or the Spanish government will have to fire so many nurses and teachers that the result will be a political insurrection.

Conclusion

As we approach the Budget night (early May) the Treasurer and the Prime Minister are out every day claiming how it is an economic imperative that the budget gets back into surplus come-what-may.

Each week new data comes out that suggests the economy is really struggling. Fiscal austerity is not indicated in this environment. Even the bank economists are starting to come out against the surplus obsession.

There is absolutely no economic or financial justification for it!

That is enough for today!

Totally agree.

Do we reckon this religious madness is coming to a head?

The Spanish Inquisition was ended by the revolution of 1820. Is the Eurozone Inquisition going to end two centuries later by the same mechanism?

It might be ended by the Rapture, or by socialists in France implementing tax hikes on the wealthy.

It’s easy to believe that in Spain the unemployed will turn to the only employment available, rioting in the streets.

The French presidential election would seem to be the last hope for a non-revolutionary end to the madness.

The Rapture could do it too. Isn\’t material wealth meant to be a sign of God\’s favour in those theologies? So all the creditors will just be spirited off to heaven one day. Instant debt jubilee !

Bill,

Any thoughts on how real wages growth can match with productivity growth?

In the UK total pay (including bonuses) rose by 1.1 per cent on a year earlier, down 0.2 on the three months to January 2012 whilst the official inflation figure is now 3.5% hence real wages still falling at 2.4% so little hope of economic revival !

The unanswered question for me is whether Swan actually believes what he’s saying or believes he has to deliver a surplus because Labor governments are painted as “fiscally irresponsible” by the right. I’ve met Wayne Swan and he’s a typically venal political operator. I can well believe that he understands that achieving a surplus will do harm, but hopes that he can get re-elected on the back of a very thin surplus and pressure the RBA into cutting rates to lessen the pain.

It’s very gloomy for the left here in Australia. We have a rightwing government bent on destroying our economy, which has continued to pursue policies that have fed a massive debt binge and hollowed out what little industry we had, but if we kick them out, we replace them with much worse.

@Dr. Zen, Sounds a lot like the US.

I can agree with above analysis if the author can show me that he was warning repeatedly and seriously about the housing bubble being created partly due to government’s policies over the last 20 years. If, however, the author did not criticise those stimuli and excesses that led to an explosion of credit in the system, well, then I consider it simply a defence of a ponzi scheme.