I started my undergraduate studies in economics in the late 1970s after starting out as…

Back off austerity and give growth a chance

The Australian Treasurer wrote an Op Ed in the Melbourne Age today (April 4, 2012) – Return to surplus is the right move at the right time – trying to defend his obsessive pursuit of a budget surplus in the next financial year. It was in direct response to an article yesterday (April 3, 2012) from the Melbourne Age economics editor Tim Colebatch – Budget cuts will bring on recession. Tim Colebatch’s commentary was a followup to his article last week (March 30, 2012) – Swan’s foolish surplus fetish – which I considered in this blog – A seriously reckless act. The pressure is mounting on the Government to abandon their reckless pursuit of the surplus. Even the conservative State premiers have expressed concern (States warn Wayne Swan over budget cuts. It is clear that the forecasts that the surplus were based on have no hope of being realised over the relevant horizon. The Australian economy is performing well below what the Treasury expected and deteriorating. The surplus obsession is based on these overly optimistic forecasts. The Government would be advised to assume the worst case scenario at present and calibrate its May Budget accordingly, rather than persist with the myth that the Treasury has it right.

Some commentators are claiming that the decision by the Reserve Bank yesterday to keep rates on hold and probably lower them next month vindicates the Treasurer’s strategy.

For example, Fairfax economics writer Peter Martin = Budget boost for Swan as RBA aims to cut rates in May – wrote:

BARRING surprises, the Reserve Bank board will cut official interest rates at its next meeting on May 1. The move will deliver the Treasurer, Wayne Swan, an endorsement of his strategy a week before the May budget and open the way for a further cut at the board’s June meeting.

I agree with the first sentence but not the conclusion. The Treasurer will claim endorsement but the reality is different.

In yesterday’s Statement by Glenn Stevens, Governor: Monetary Policy Decision, we read:

Recent information is consistent with the expectation that the world economy will grow at a below-trend pace this year … Australia’s terms of trade have peaked, though they remain high … In Australia … output growth was somewhat below trend over the year. There are differences in performance between sectors, and considerable structural change is occurring. Labour market conditions softened during 2011 … Credit growth remains modest … generally the housing market remains soft … underlying … inflation was around 2½ per cent in 2011 … It is currently expected that inflation will be in the 2-3 per cent range over the coming one to two years …

At today’s meeting, the Board judged the pace of output growth to be somewhat lower than earlier estimated, but also thought it prudent to see forthcoming key data on prices to reassess its outlook for inflation, before considering a further step to ease monetary policy.

In other words, the RBA expects inflation to be well within their targetting range (2-3 per cent) and have now acknowledged that their earlier optimistic outlook, which they shared with the Commonwealth Treasury has not been vindicated by the data and that the Australian economy is slowing.

The Treasurer’s take on this is obvious. Last week (March 29, 2012), he made a speech in Sydney – The revenue base and the 2012 Budget – which was aiming to set the scene for the upcoming May federal budget. I considered that speech in this blog – A seriously reckless act.

Stung by the criticism that he has received in the week since he made that speech, the Treasurer has once again come out in writing this time to defend his position. In today’s Op Ed – Return to surplus is the right move at the right time – he distills the argument down to three justifications for the pursuit of a surplus when the economy is obviously well off trend growth (which in itself was inadequate anyway given the high labour underutilisation that persisted at the peak of the last cycle).

He claims his critics (including Tim Colebatch) ignore “some crucial facts, which help explain why delivering a surplus is such a vital economic imperative”.

So his reasons again.

First, he claimed that the Government were Keynesian in the downturn (providing a hefty fiscal stimulus) and so have to be “Keynesian” in the upturn (and withdraw the stimulus):

… it was right to step in and support demand when it was needed, it is right to step back and provide space for the private sector to grow.

The problem is that the cycle is not symmetrical like that.

Apropos of yesterday’s blog- Policy failure in Europe scales new heights – when an economy is operating at below full capacity, not only does unemployment rise, but rather cyclical impacts are observed.

So participation rates fall, hours worked fall, and real wage growth tends to be suppressed.

In the early stages of the recovery, these “below the iceberg” cyclical impacts begin to reverse as the economy moves back towards its pre-crisis growth rate.

Some recovery occurs in real wages growth as the economy recovers. But we should not construct that growth as a sign of inflationary pressures. He is merely the economy moving back towards its growth path. Indeed, the thawing of the iceberg provides substantial benefits to the broad workforce and should be encouraged not frustrated.

During this phase, private spending growth is typically tentative and the overall economy requires on-going fiscal support until full capacity is reached. At that point, the prior fiscal intervention should be eliminated – but not before.

The Australian government’s strategy is to deliberately create unemployment in major areas of the economy (both sectoral and regional terms) so that the growth in the mining sector can proceed without wage pressures are unfolding.

This is what the Treasurer means when he says they want to “provide space for the private sector to grow”. What they are really doing is damaging large parts of the private sector to advantage a much smaller mining sector.

That is not a “Keynesian” strategy. It is a neo-liberal strategy designed to suppress the overall growth of real wages.

The government is deliberately pushing the most populated areas of the country into recession to “free up” resources for the mining sector to grow, when the latter employs very few people (around 3 per cent of total employment) and contributes only a small proportion of overall economic output (perhaps 5 per cent direct and indirect).

When you think about it in those terms it is a ridiculous strategy and the Government deserves all the criticism that they receive for pursuing such a mindless approach to fiscal management.

In this blog (March 20, 2012) – Inflexible governments undermine our standards of living – I made the case that Australia’s dichotomous growth outlook (mining strong, the rest weak) did not justify the conclusion that the policy settings should deliberately starve the sectors that employ the most Australians of demand.

I noted that there is some presumption that the mining sector should grow as far as the demand for resources will take it, even though it is clear that the majority of Australians are not enjoying the benefits of that growth.

It is appropriate to run restrictive policy settings if the overall economy is growing strongly and running the danger of provoking an inflationary spiral.

But that solution doesn’t apply if a particular sector is growing out of proportion with what the economy can bear overall. If the Government really believes that labour shortages in the mining sector are going to drive widespread wage inflation in Australia then it should simply introduce policy initiatives that will reduce the growth of mining.

At the same time it should be maintaining its stimulus for the rest of the economy, which not only employs the overwhelming majority of workers are also produces the overwhelming majority of our national income.

The beauty of fiscal policy (as opposed to monetary policy) is that specific sectors can be targetted for stimulus or contraction while maintain the opposite overall policy stance. If there are inflationary bubbles emerging in one sector – for example, real estate – then targetted taxation initiatives are appropriate and very effective.

Using a broad (blunt) instrument like the overall interest rate to target specific sectors is poor policy and largely ineffective (given the vagaries about the direction of monetary policy impact and its timing).

If the mining sector has to be slowed down then the mining tax should be higher among other strategies that could be deployed.

I note that other commentators have taken this point up in recent days – that is, the answer to Australia’s current two-speed economy is not to push the slow part into recession but to reduce the growth rate of the fast part (the mining sector).

In his Op Ed today, the Treasurer further attempted to justify his strategy:

Indeed, it’s exactly because our economy is moving back towards trend growth that returning to surplus is the responsible course for fiscal policy.

Crucially – and this is what Mr Colebatch overlooks – the Treasury forecasts for growth in the next financial year already take into account that the budget will return to surplus.

Obviously, our consolidation has a dampening impact on growth but this is offset by the strengthening growth in the private sector.

In other words, the Treasury’s forecasts of growth around trend are based on our announced policy setting including our commitment to return the budget to surplus.

The problem is that this doesn’t make any sense when one examines the data and the movement in Treasury forecasts. I did some figuring today to bring all the recent forecasts and actual outcomes together.

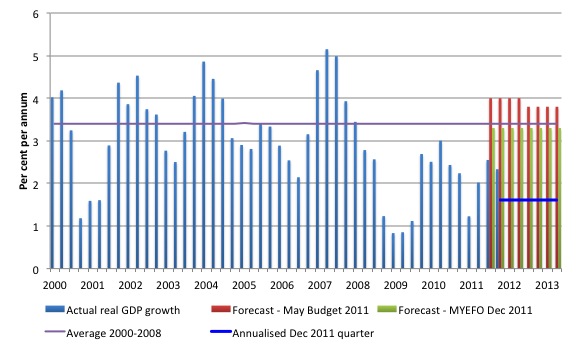

Consider the following graph which plots the actual annual real GDP growth from the March quarter 2000 to the December quarter 2011 (blue bars) using data taken from the ABS National Accounts. The bars spanning the fiscal years 2011-12 and 2012-13 are respectively, the May 2011 Budget forecasts for real GDP (red bars) and the updated Mid-Year Economic and Financial Outlook (MYEFO) forecasts which were presented in December 2011. The purple line is self-explanatory (average annual real GDP growth in the period leading up to the crisis – 3.5 per cent) and the blue line is the annualised growth rate (1.6 per cent) based on the December quarter (0.4 per cent) extended out to June 2013, the end of the current official forecasting period.

As I have noted previously, trend growth is not the relevant benchmark if the economy has been operating at below full employment for many years. Over the last three decades, government policy has deliberately maintained a state of the entrenched labour underutilisation and so the “trend growth rate” is a poor benchmark to use if we care about full employment.

But separate to that argument are the facts. The Australian economy is currently not “moving back towards trend growth” at all.

The Australian economy started slowing in the March 2008 quarter and has not gone close to achieving the growth rate that was enjoyed in the 5-year period before the crisis. The pace of growth was gathering on the back of the fiscal stimulus in the December 2009 to June 2010 quarters but then fell away as the fiscal stimulus was withdrawn.

The pursuit of the fiscal surplus is now constraining growth at a time when private domestic spending growth remains relatively subdued and is showing signs of slowing (as in the December quarter National Accounts).

Moreover, the Treasury’s forecasts (which apparently have the surplus built into them) are looking very optimistic. First, the May 2011 forecast for 2011-12 and 2012-13 was for growth above that achieved in the previous growth cycle. There was no way the economy was ever going to grow at that pace and by December last year, they revised those forecasts down (in the MYEFO) to below the average growth in the 5-year period before the crisis (green bars).

But you can see that if the direction that was suggested in the December quarter 2011 data (blue line) persists then Australia is heading for stagnant growth (well below that required to reduce unemployment) and if things get worse, we will be in recession.

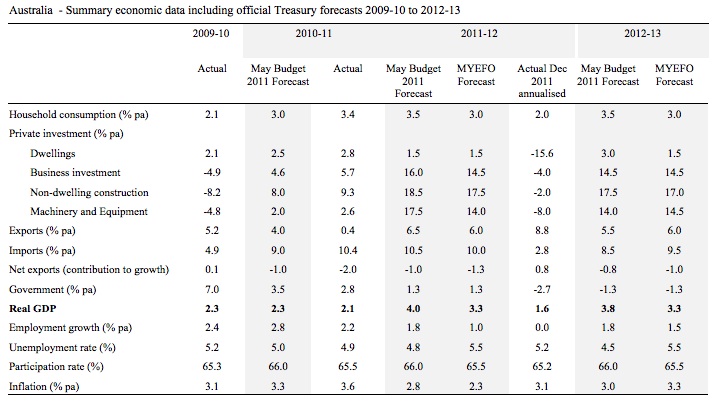

The accompanying Table summarises various component forecasts presented in the 2011 Budget, the MYEFO (December 2011), and the actual results for the December 2011 quarter national accounts (annualised) and the actual 2011 results from the Labour Force survey.

It tells you why we should not be confident that the Treasury forecasts are likely to be sound.’

You can see that they underestimated the growth boost from the fiscal stimulus (compare the actual 2010-11 with the May 2011 Budget forecasts). This is typical of all neo-liberal leaning organisations – such as the IMF – they consistently underestimate the impacts of fiscal stimulus and its withdrawal.

But then examine the three columns pertaining to 2011-12 – the current fiscal year that ends in June 2012. The third column under that heading is just the annualised December quarter 2011 data for the national accounts. The labour market data are the 2011 outcomes.

So while the Treasury estimates employment growth would be 1 per cent this year, we know that last year it was zero per cent and the latest data is not particularly inspiring. The unemployment rate is currently below the forecast for 2011-12 but that is because participation has fallen below what the Treasury expected as the economy slows again.

As the RBA indicated in yesterday’s statement the underlying inflation is likely to be between 2-3 per cent (erring towards 2 per cent) over the next two years, which means the Treasury forecasts are overly negative in this regard.

In terms of National Account aggregates, it is clear that the December-quarter data is suggesting a very poor horizon relative to the forecasts. I don’t want to claim that the December-quarter growth times four (which is what I have here) is a definitive forecast. But it is the direction of change that is important. Down not up!

The Treasurer then moved on to his second justification for pursuing a budget surplus.

He said:

When setting interest rates, the Reserve Bank takes into account all the economic influences on monetary policy, including the stance of fiscal policy.

Moving the budget back to surplus in 2012-13 also ensures we’re not adding to price pressures in the economy, providing monetary policy with maximum possible flexibility to respond to economic developments.

This is the point that Peter Martin noted his article today – that if the RBA lowers rates next month then the Treasurer is vindicated.

No he isn’t.

First, the RBA will cut rates because it fears a recession that will be driven by the fiscal contraction (see the forecasts in the above Table for government spending growth).

It currently has claimed that interest rate settings are close to what they term as “neutral” (neither expansionary or contractionary). I reject that notion but on their own logic, if they cut rates it will be because there needs to be expansion – they will be moving way from their perception of a steady-state neutrality.

Second, then it comes down to whether aggregate demand is better managed by variations in fiscal policy or by variations in monetary policy. As noted above, monetary policy is not a desirable policy instrument to manage aggregate demand.

Monetary policy is blunt – that is, cannot be targeted. The timing of its impacts are highly uncertain because it affects demand indirectly. Moreover, the direction of the impact is not unambiguous because it relies on distributional effects between creditors and debtors and those on fixed incomes that are uncertain.

In the current context, fiscal policy can more easily target a slowdown in the mining sector while promoting growth in in other sectors, which are the major employers of Australians.

The fact that the Australian government is defining fiscal policy as a passive partner to monetary policy is classic neo-liberalism. This mentality, the inflation-first approach to counter-stabilisation, has defined the period leading up to the crisis.

This approach to policy has deliberately stifled growth and entrenched higher than necessary rates of labour underutilisation in the name of price stability. There have been massive costs, in the form of forgone output and the broader costs associated with unemployment, incurred as a result.

Moreover, it is the reason economies have still not shown signs of leaving the crisis behind.

Finally, the Treasurer claimed that they have to pursue a surplus because:

We are now one of only eight countries to be awarded the coveted AAA status with a stable outlook by all three major credit rating agencies.

This is the first time in Australia’s history this has been achieved and has been repeatedly described as partly a result of our strict fiscal policy.

The sovereign debt ratings are about government debt. The ratings agencies might be concerned at present about the high levels of foreign debt that the private banks are holding but running a budget surplus will do nothing to allay those fears.

But, moreover, what the ratings agencies think about sovereign debt is largely irrelevant as many nations in the past have demonstrated.

Please read my blogs – Who is in charge? and Ratings agencies and higher interest rates and Time to outlaw the credit rating agencies – for more discussion about on this topic.

The Treasurer was supported by comments made by the Treasury boss Martin Ferguson who was quoted today as saying:

Having deployed our fiscal ammunition during the GFC, the imperative today is to return to surplus and to pay down debt to begin to recharge our fiscal ammunition for future use if needed, and to ensure that fiscal policy plays its part in delivering macro-economic stability in stronger economic circumstances.

First, the military analogy is totally inappropriate for a currency-issuing nations such as Australia. An army can certainly run out of ammunition but the Australian government can always implement fiscal expansions whenever they are warranted by the overall state of aggregate demand.

Second, there is no imperative to pay down the outstanding federal debt. In 2001 the sovereign debt market dried up as a result of the previous governments manic obsession with surpluses and debt-retirement.

What happened? Answer: the private investment banks and future traders went berserk and demanded the government increase its debt issuance even though it was running surpluses. What we learn from that exercise was the government debt is an elaborate form of corporate welfare rather than a “funding” source for government.

Moreover, the Basel III guidelines will require more substantial debt issuance than less, although the central bank has already indicated a ruse to get around this.

Please read my blog – Bond markets require larger budget deficits – for more discussion.

Third, and related to the first point is that the government does not increase its capacity to spend in the future by running surpluses now. That is a complete fallacy that comes from a total mis-construction of the nature of a surplus.

The surplus does not allow the government to store up future spending capacity in the same way that saving allows a household to increase its future consumption possibilities.

Surpluses reduce the private sector capacity spend and save as well as undermining the delivery of public services, public infrastructure investment and vital developmental capacities in public education and training provided.

They can only be justified if the economy is at full capacity and heading for an inflationary outbreak.

Tim Colebatch is clear about the upcoming May Budget (which he considers will be tragic):

Next month Julia Gillard and Wayne Swan will give us a budget that will probably send most of Australia into recession.

In one year, we will go from a deficit of 2.5 per cent of GDP or more, to a surplus. By a mix of revenue rises and spending cuts, Labor will pull 2.6 per cent of GDP out of the economy. That is 2½ times the fiscal contraction imposed by the Hawke government in 1986-87, or the Howard government in 1996-97. It is the stuff recessions are made of.

Why do it? Because Labor has pinned its credibility to its pledge to deliver a budget surplus in 2012-13. The promise it made in 2009 has become a mantra, repeated 1000 times over, and to be delivered regardless of economic conditions.

He also reflects on the inaccuracy of the Treasury forecasts. These forecasts drove the surplus mania in 2009.

He notes that then the “Treasury had assumed that by now the economy would be booming, and the government would pass the baton to the private sector to take Australia on. It projected economic growth in 2011-12 and 2012-13 of 4.5 per cent, each year”.

But now growth has flagged and there has been zero employment growth.

Time Colebatch says:

Much of the country is close to recession. Job growth has stopped. Retailing is flat, manufacturing is weak, housing in free fall. The high dollar is slowly strangling trade-exposed sectors; high interest rates are cramping the rest.

Is the private sector ready to take the baton? Into these headwinds? No way.

I saw an interesting Bloomberg Op Ed today – U.S. Economy Needs Stimulus, Not Soothsayers – by US economists Betsey Stevenson and Justin Wolfers.

It highlights the inaccuracy of the economic forecasts that are used to frame economic policy. The authors say that:

We have very little idea where the economy will be next year.

Truth be told, our best guesses just aren’t very good. Government forecasts regularly go awry. Private-sector economists and cutting-edge macroeconomic models do even worse.

Which raises what imperative?

The need for caution! It might be that the forecasts are too pessimistic in which case things will be better than expected and as the authors note in relation to the US:

If unemployment falls to 6.5 percent, there’s no overwhelming reason for concern. Historical experience suggests that inflationary pressures are unlikely to build unless the jobless rate drops to 5 percent or 6 percent. Even if inflation does accelerate, the Fed has ample power to reverse course by raising interest rates to slow growth.

In other words, the worst thing that could happen is that some inflationary pressures could emerge.

But what if the forecasts are overly optimistic and there is a long track record out there of governments and conservative institutions (IMF, OECD etc) making overly optimistic forecasts during times when the government is proposing to contract fiscal policy.

After all, it is easier to sell a harsh fiscal austerity program, if you tell the citizens everything is going to be fine.

In this case, the authors write:

By contrast, the longer-run consequences could be dreadful, if we find ourselves with 8.5 percent unemployment fully six years after the recession began. Europe’s experience in the 1970s and 1980s demonstrated that persistently high unemployment can become entrenched, leading to further unemployment in the future — a process economists call hysteresis. Skills atrophy, hope fades and people lose contact with the networks that can help them find work. If this occurs with the millions of U.S. workers who have been without jobs for more than a year, it will be costly and very difficult to undo.

In other words, the cost of too little growth far outweighs the cost of too much. If we readily bear the burden of carrying an umbrella when there’s a reasonable chance of getting wet, we should certainly be willing to stimulate the economy when there’s a reasonable risk that doing nothing could yield a jobless generation.

Conclusion

The Australian Treasurer would be well advised to reflect on that.

After he has done that he might like to ring his peers in the G-20 and tell them to back off the austerity and given growth a chance.

That sounds like a song title!

That is enough for today!

I was quite depressed reading our esteemed treasurer’s piece in the “Age” yesterday. I’m probably not the first to notice this, but there do seem to be some stunning parallels between the themes explored in “The Matrix” and the religion of neo-liberalism. If we view neo-liberalism as a third order Simulacra ( as per Baudrillard) , and given that such simulacra have limited( if any) relationship to reality, its not surprising that that Mr Swan continues to take the blue pill. The trouble is that governments as well as established schools of economic “thought” are so hopelessly enamoured of the simulacra of neo-liberalism that no amount of contrary evidence will make them take the red pill to “see how deep the rabbit hole goes”. Indeed, it is a feature of higher order of simulacra that since they no longer have a connection to reality, they are unable to be changed by it. That is, they exist as hyperreal models of a world that doesn’t exist in the “Desert of the Real”.

“Monetary policy is blunt – that is, cannot be targeted.”

In fact it is targeted – at exactly the wrong things. High domestic interest rates will do absolutely nothing to slow the investment boom in mining (because that’s being funded pretty entirely by foreign investment), but will kill the already-staggering housing industry and drive up the dollar because of the carry trade, worsening the Dutch Disease.