These notes will serve as part of a briefing document that I will send off…

What if the IMF are right?

Yesterday, after sort of saying it the day before and getting close to saying it late last week, and having to wait for the central bank governor to say it first, our Prime Minister, then in quick lock-step, our Treasurer both said the R-word. What gives with this political posturing. The Opposition is largely irrelevant at the moment anyway. The reluctance of the Government to admit the obvious is repugnant. It has been very obvious that the economy is in very bad shape and had been heading that way for some years despite the chimera of prosperity – as the snowball of future recession was growing in size with the private sector debt and the fiscal surplus. Right now, the Government needs to introduce policies that really arrest what we have known for months – that employment is going south and unemployment heading in the opposite direction. Perhaps today’s terrible projections from the International Monetary Fund will sharpen their focus on large-scale public sector job creation initiatives.

Several pieces of economic news overnight and into today spell it out clearly. That august organisation the IMF predicts that the global economy will contract by 1.3 per cent this year. This is the first time the World economy overall has contracted since World War II. How much faith we should have on this forecast, given that the IMF said in January this year that the world would actually grow by 0.5 per cent in 2009 is another question.

Its two-year projections for the major countries are shown in the following graphic: For 2009, it is predicting that the UK will decline by a staggering -4.1 per cent; the US by 2.8 per cent; Germany by 5.6 per cent; Italy by 4.4 per cent; France by 3 per cent; and, Japan by a massive 6.2 per cent. For the UK, Italy and Germany are expected to record negative growth in 2010 as well.

As output growth plummetts in these wealthy economies, things get much worse for the smaller economies such as those in Africa. Trade volumes are also forecasted to fall by 11 per cent globally this year and be basically flat in 2010. This is a major issue for Asian economies and puts a major question market on the “export-led” growth mania that has been inflicted on the poorer countries by the IMF and the World Bank at the expense of sound regional development and skills augmentation within the countries.

For Australia, the IMFs projections are quite severe. They suggest that we will contract by 1.4 per cent this year and record a very tepid 0.6 per cent growth rate next year. In the same forecasts they suggest that the unemployment rate would rise to 7.8 per cent by 2010 from its current level of 5.7 per cent. Well I did some simulations today and I don’t get a concordance between the output growth estimates and the labour market projections. Here is what I came up with.

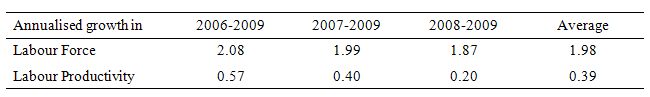

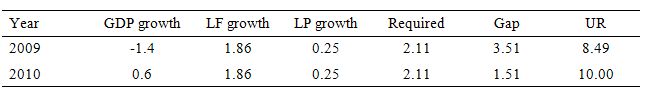

In March 2009, the official unemployment rate was 5.7 per cent having risen in the first 13 months of the downturn from its low-point of around 3.95 per cent (February 2008). The following table provides information about the annualised growth rates in the Labour Force and labour productivity (market sector) computed using the relevant ABS data.

You can see that the labour force growth rate has been slowing somewhat as the economy stalled. Those who cannot find work and do not need to stay in the labour force for benefit-eligibility reasons are prone to drop out although they share the motivation of the unemployed for work. While not all of the cyclical labour force exits are discouraged workers (hidden unemployed) the vast majority are. In my simulations I use the last year’s growth rate which may be a little optimistic but will be fairly close to what actually happens given our underlying demographics.

One of the untold stories from the Howard days is how bad our productivity performance was under their command. We have dramatically lagged behind what an advanced nation should be achieving in this regard. No surprise given the slant of legislation towards low-skill, casualised work and the wilful neglect of the education and vocational training sectors that occured during their period in office. Anyway, the reality is that this poor productivity performance actually insulates the economy in this downturn from even larger increases in unemployment. I decided to use 0.25 per cent per annum in my simulations which is just below the average for the last two years. Given the near “flat line” status of labour productivity growth, this assumption doesn’t particularly skew the results beyond what is likely to be a reasonable outcome, other things equal.

So the question is: if the IMF are correct in the output growth forecasts, and, on available evidence, their estimates are reasonable if not optimistic, then what will the unemployment rate do over the next 21 months? That is what I decided to write about today.

The rule of thumb that applied economists use is derived from the well-known Okun’s Law (named after Arthur Okun, the famous US applied economist). Basically, if you assume average hours worked to be more or less constant, then two things add to the jobs needed to absorb any unemployed over a year: (a) labour force growth – clearly increasing labour supply; and (b) labour productivity growth – which reduces the employment requirements per unit of output produced. So for the unemployment rate to remain constant, real output growth (GDP) has to add as many jobs to the economy to absorb the labour force growth and counter the declining need for labour arising from productivity growth.

If GDP growth is greater than the sum of Labour Force growth and Labour Productivity growth then the unemployment rate will fall by the percentage point difference between the two sums.

Conversely, if GDP growth is less than the sum of Labour Force growth and Labour Productivity growth then the unemployment rate will rise by the percentage point difference between the two sums.

So if Labour Force growth is 1.87 per cent in 2009 and Labour Productivity growth is 0.25 per cent in 2009, then we can say that the required GDP growth rate to keep the unemployment rate constant would be 2.12 per cent. So if GDP growth in 2009 is -1.4 per cent then we can forecast that the unemployment rate will rise by 3.52 per cent plus 1.4 per cent which would take it to around 8.3 per cent by the end of this year.

To see what a monthly profile would be I made some assumptions about how the IMF forecasts might be spread out over the next two years. I studied the pattern of GDP growth during the last two recessions (1982 and 1991) to get a stylised descent and recovery path. This data (from the National Accounts is quarterly). I then built a little model based on monthly periodicity (“fitted a curve”) which more or less replicated the stylised growth pattern that is common during recesssions but met the constraint that for 2009 the average annual GDP growth rate was -1.4 per cent and in 2010 the average annual GDP growth rate was 0.6 per cent (the IMF forecasts for 2009 and 2010). This was an interesting exercise actually. You can see a chart of that model HERE. The model isn’t perfect and is just a representation to gives us some guide as to what we might expect. As it turns out the profiles generated below are credible. For the annual estimates, the model is irrelevant because we can just use the per annum projections which are what they are!

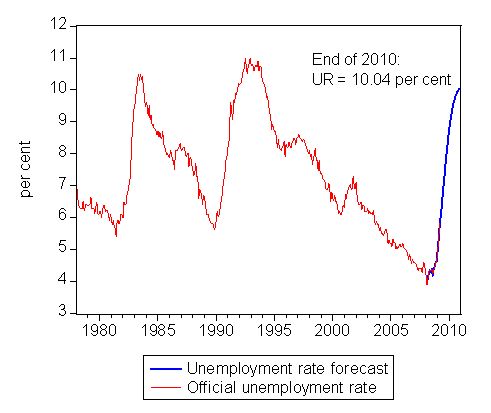

The following graph shows the official ABS unemployment rate from February 1978 to March 2009 (red line) which is the actual data and then the simulated unemployment from March 2009 to December 2010 (the blue line) using the model discussed above. By the end of 2010, the estimated unemployment rate would be 10.04 per cent, which means this recession is on a scale similar to the last two. You can clearly see that the projected pattern of deterioration is simliar to the last two recessions which suggests to me that the model I used is not that unrepresentative.

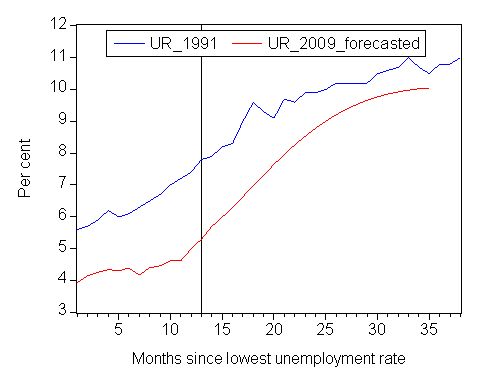

The next graph compares the dynamics of the unemployment rate in the 1991 recession (plotted from its lowest point prior to the onset of the downturn to its maximum point some 38 months later – the blue line) and the forecasted unemployment rate based on IMF output growth rate assumptions (red line). Note that the low-point unemployment rate in the current episode was February 2008. The vertical line is at March 2009 after which time the data is simulated by my model (that is, “made up”). You can see that even though we are starting this recession of with a lower rate of unemployment per se the projected rise nearly catches up with the 1991 levels over the same period of contraction.

The following table shows the summary annualised projections which are just simple Okun calculations. Using the IMF real output growth estimates, the table shows that by the end of this year the official unemployment rate (UR) will be close to 8.5 per cent and rising to around 10 per cent by the end of 2011 unless things change. So it is not clear to me how the IMF gets its unemployment rate projections unless they are forecasting significantly lower labour force and labour productivity growth which is possible.

Of-course, in the current downturn I have stopped the simulation at the end of 2010. It is highly unlikely that that will be the end of the rise in the unemployment rate as it is probable that the GDP output growth rate will still be less than the sum of the labour force and labour productivity growth rates into 2011. As long as GDP growth is less than required (explained above) then the unemployment rate will rise.

The other point to note is that while all this is going on, the rate of underemployment will also be rising. Total labour underutilisation is almost certain to approach 20 per cent by the end of 2011 if the IMF projections are correct and I can add up correctly.

Of-course, the Federal government can do something relatively easily and quickly to arrest the descent into this appalling state. Now is not the time to be politically skating about the self-evident truth. The labour market needs rapid action in the form of direct job creation and it should be the headline announcement in the coming Federal budget. I know it won’t be but that just shows the lack of macroeconomic leadership that we endure.

Sadly, our Federal government, while now game enough to mutter the R-word is still choking over the D-word. Our Treasurer has told the ABC radio news that he will “not guarantee that unemployment will not rise above 10 per cent and refused to rule out raising taxes.” This is in the context of the upcoming Federal budget and the news that the basket-case UK economy is putting taxes up for the rich.

So the previous forecasts that the unemployment rate might rise to 7 per cent nationally by the middle of next year are now being jettisoned. That is good because they were always just spin.

But can you believe the logic of the man and the Government he represents? In one breath he is admitting unemployment could sky-rocket above 10 per cent and then in the next breath he is hinting that he will increase taxes. What is his logic? Well we know what it is? He is still in the dark about budget deficits. He must loath the thought of being the first Treasurer in 12 years to come in with a reasonable deficit. I applaud the Government for pushing on the automatic stabilisers. They just need to relax and realise that it is absolutely essential that the deficit provides the underpinning for employment and output growth. Higher deficits will, in fact, be required over an extended period into the future given the scale of this economic crisis.

Sadly, all day yesterday the R-word and the D-word were being augmented with the dreaded T-word.

Our PM said yesterday (more times than I care to mention):

In the current unprecedented global conditions a temporary deficit is not an option it is an inevitably … Framing a budget in the current in the current context is incredibly tough, framing the budget in these circumstances has never been framed at a more difficult time … That is why temporary deficits are necessary and temporary government borrowings are necessary as well, necessary to support businesses and support jobs until the private sector recovers.

Later the PM said:

… every responsible government around the world is being forced into greater levels of temporary borrowing.

The T-word!

Well no responsible government is being forced into greater levels of borrowing. They are doing it by choice largely because they don’t really understand their options under a sovereign currency monopoly. They are also doing it to maintain their monetary policy stance which involves a non-zero short-term interest rate. You might like to refresh your recollection of macroeconomic theory by re-reading (or reading for the first time) – Deficit Spending 101 – Part 1; Deficit Spending 101 – Part 2; and Deficit Spending 101 – Part 3.

Anyway, to really show how bad our collective of politicians are, the last quote comes from the Opposition Treasury spokesman, described recently in the national press as a buffoon. I thought that was apt. He told ABC radio news that “Kevin Rudd will never deliver a surplus budget” implying that was bad. Well as long as the private sector desires to save some of its income each period, Kevin Rudd should never deliver a budget surplus. Unless, that is, he wants to set up the conditions for the next major downturn.

Please can someone save us from these characters!

Digression: the IMF again

As a digression, the column by Polly Toynbee in the Sydney Morning Herald on Wednesday, April 22, 2009 about the IMF is worth reading.

Recounting Ghana’s experience with the “neo-liberal quack remedies” imposed on them by the IMF and the World Bank and their current need for a cash injection to save the country from crippling energey prices etc, she writes:

Cutting public services, making the poor poorer, putting cash crops and trade before welfare was the old IMF way. It was the IMF that insisted on meters for Ghana’s water supply, demanding full cash recovery for the service, steeply raising costs for the poorest. The World Bank insisted on a private insurance model for Ghana’s health service that has been administratively expensive and wasteful. The new government rejects it, promising free health care for children. The IMF wants subsidies for electricity removed, again hitting the poorest hardest. Ghana has now voted for more social democratic solutions. Freedom from the IMF feels like a second freedom from colonialism to many countries.

But then:

The IMF protests that it has changed: it no longer prescribes so oppressively, and countries seeking loans can set their own goals. This is disingenuous. Every government knows what it has to do to get credit, so Ghana has already said it will lower its deficit from 15 per cent to 9.5 per cent of gross domestic product in one year, steeply cutting public sector costs. The Government grits its teeth. IMF power makes it the sole credit-rating agency for all other donors and lenders – an IMF thumbs-down means money from everywhere is cut off.

She concludes:

It’s a strange irony that Barack Obama and Gordon Brown embrace a Keynesian fiscal stimulus and in its name pour out global largesse to the IMF to distribute. But loan recipients risk a Friedmanite tourniquet, cutting off their economic lifeblood.

Same old same old.

“But loan recipients risk a Friedmanite tourniquet, cutting off their economic lifeblood. ”

Which version Mark 1 , Mark 2, or Mark 3?.

cheers

Hi Bill,

Average working hours are down, from 34.8 to 34.2 in past year. That has moderated the increase in unemployment (but pushed up underemployment). This may have been a labour hoarding phase, with employers cutting hours rather than shedding workers. How sensitive are your projections to the assumption of constant average working hours? What would happen to the projected unemployment rate if the labour hoarding phase ends and hours bump back up again?

Cheers,

Mark

Dear Mark

Thanks for the information. I was aware of the fall but in this sort of “back of the envelope” modelling you have to hold something constant. Your point is correct that the “costs of the cycle” (lower hours, lower productivity, lower participation etc) all help to reduce the rise in official unemployment and therefore disguise the severity of the downturn. This was the point that Arthur Okun made “unemployment is the tip of the iceberg”. But the projections are not very sensitive in fact – and are downside biased as you would guess. See my blog today for some more on that. If we get back to higher labour force growth and higher productivity growth then the unemployment rate will rise higher than I have projected. It is all pretty rough modelling though as you know.

best wishes

bill