I started my undergraduate studies in economics in the late 1970s after starting out as…

Framing today’s leadership failure in history

It seems my attempt to escape the Lands of Austerity last week unscathed was a pipe dream. I have been slowed over the last days by a European flu of some sort. So I have less energy than usual which doesn’t tell you very much but might explain why I might write less today than on other days. I am also behind in my reading. But I did read a little over the weekend, especially the documents and statements pertaining to the IMF annual meetings, which had the effect of worsening my condition. I also dug out an old 1933 document which helped restore my equanimity. It allows us to frame today’s leadership failure in history.

Over the weekend, the IMF held its annual meetings and a range of high profile contributors turned up to give their assessment of the state of the world economy at present.

The IMF is constantly trying to assert its dominance in the debate although its qualifications to take on this role are poor.

Just trip back to July 2007 – as the crisis was manifesting. In that month, the IMF offered an Update to its April World Economic Outlook and said:

The overall balance of risks to the global growth outlook remains tilted modestly to the downside, as it was at the time of the April 2007 World Economic Outlook. Nevertheless, there have been some changes in the IMF staff’s assessment of individual risk factors. With sustained strong growth, supply constraints are tightening and inflation risks have edged up since the April 2007 World Economic Outlook, increasing the likelihood that central banks will need to further tighten monetary policy. The risk of an oil price spike remains a concern. As discussed in the accompanying Financial Market Update, financial market risks have also increased as credit quality has deteriorated in some sectors and market volatility has increased.

A number of other risks, however, look more balanced. In particular, while the correction in the housing sector is continuing, overall downside risks related to U.S. domestic demand have diminished somewhat. Upside risks to growth in the euro area and emerging market countries discussed in the April 2007 World Economic Outlook have partially materialized and have been built into the baseline projections. Further, some progress has been made toward reducing risks of a disorderly unwinding of global imbalances, although protectionist pressures are a continuing concern.

From which you conclude they were still obsessed with inflation and had no inkling whatsoever about what was to occur in the coming year – although the portents were already clear a decade earlier as economies operating under the yoke of neo-liberalism systematically redistributed real income to profits (away from wages) and deregulated financial and labour markets.

A year later and despite the US economy slowing significantly due to the sub-prime meltdown, the IMF wrote in their World Economic Outlook Update (July 17, 2008) that:

Risks to the global growth outlook are seen as balanced around the revised baseline.

They had revised their previous gung-ho forecasts of real GDP growth down a bit in the previous year – and were claiming that the US would experience only a moderate and temporary slowdown.

It is hard to see how the IMF can claim expertise in matters macroeconomics. Their models are wrong and forecast poorly and that reflects the underlying poverty of their theoretical position. The IMF are definitely part of the problem and the solution requires their influence be negated.

As noted, over the weekend, the IMF (and the various committees it supports) held their annual meetings. On September 24, 2011, the US Treasury Secretary made a Statement – to the 84th meeting of the Development Committee in Washington. The Committee is a “a joint forum of the World Bank and IMF that facilitates intergovernmental consensus-building on development issues”.

The Statement focused on the developments coming out of what is now known as the “Arab Spring” and was aimed at addressing what the newly-formed democracies (assuming that is what they become and remain) should do next.

He said the “success of these emerging democracies will hinge on building strong and inclusive economies that improve people’s lives, especially the lives of young people”. Which is an unexceptionally correct assessment to make.

Young people are the future of every economy which makes you wonder why governments such as those which Geithner is a senior member of tolerates persistently high youth unemployment rates when they have the fiscal capacity to employ them and put their skills to good use, which might mean developing more skills.

The US Bureau of Labor Statistics reported (August 24, 2011) that:

… the share of young people who were employed in July was 48.8 percent, the lowest July rate on record for the series, which began in 1948 … Unemployment among youth increased by 745,000 between April and July, more than last year’s increase of 571,000, but well below the levels seen in 2008 and 2009 (1.2 and 1.1 million, respectively) … The youth unemployment rate … [was] … 18.1 percent in July 2011.

Of-course for blacks the youth unemployment rate is 31 per cent and Hispanics 20.1 per cent.

So what right has the US to be lecturing the newly-emerging Arab democracies about how to take care of their precious youth?

To highlight the lack of judgement of the US Treasury Secretary he then said that the:

International financial institutions will be central to this effort … [and specifically] … we welcome the role of the International Monetary Fund (IMF) and the World Bank in helping Libyan authorities to develop transparent and accountable mechanisms for managing the country’s public finances.

The last thing the new Arab states need is the intervention of the IMF and the World Bank, especially the former. The IMF agenda will quickly turn these nations into neo-liberal havens which suppress public goods and transfer ever-increasing proportions of real income to profits (often companies owned by their mates).

The youth in those nations will go the way of the youth in many advanced countries – into unemployment. One hopes that the emerging leadership in those nations quickly understand the fiscal capacity they are taking on and avoid being ensnared in the neo-liberal IMF trap.

The US Treasury Secretary also made a – Statement – to the Twenty-Fourth Meeting of the International Monetary and Financial Committee (IMFC) on September 24, 2011 (another Committee of the IMF).

In that Statement you learn why the US is in such a mess. The US Treasury Secretary said:

In order to spur economic growth in the short term, President Obama recently proposed a $447 billion package of public investments, tax incentives, and targeted jobs measures …

I briefly considered the US President’s “jobs package” in this blog – It is easy to create jobs – and concluded that the potential for stimulus was very limited.

Given that the US Congressional Budget Office has estimated that the 2010 GDP gap (actual (or projected) GDP minus potential GDP) was -5.7 per cent and the 2011 gap would be around 5.1 per cent. I explained in that blog why there are good reasons for believing these estimates understate the true shortfall in aggregate demand.

But taking the CBO estimates as a “lower bound”, these percentage gaps translate into US dollar terms as a $US884 billion shortfall in aggregate demand in 2010 and a projected $US805 billion shortfall in aggregate demand in 2011.

That gives you some gauge against which to measure the American Jobs Plan – which proposes a $US447 billion combination of tax cuts and spending outlays. When you consider that $US240 billion of the plan is actually tax cuts and some of that will be saved, you start to see why the plan is unlikely to stimulate much growth at all.

It simply isn’t enough.

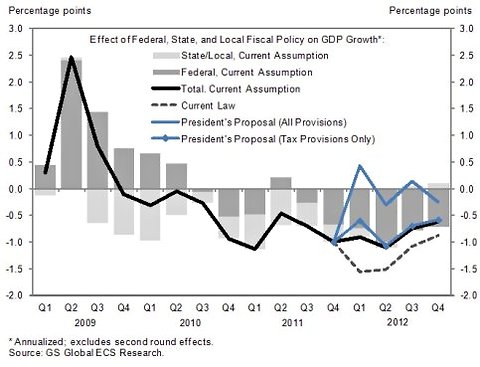

Another way of appraising what the US government is planning to do is shown by this graph which was published in a recent report by Goldman Sachs (subscription only) which was reproduced by Paul Krugman in his recent blog (September 18, 2011) – Austerity USA.

Paul Krugman correctly notes that it shows “just how much fiscal policy has been a drag on the economy since the second half of last year, and also shows that the Obama jobs plan, even if enacted in full, would only be enough to put it in neutral”.

I also wondered about how supportive of aggregate demand the US government system has been over the last several years. Well I thought we should document that in a graph to be clear. The Administration (such as Geithner in this statement) continually tell the American people how much they are doing to support jobs and the Tea-Pots and other lunatics like to tell everyone ad nausea how wildly out of control US government spending is.

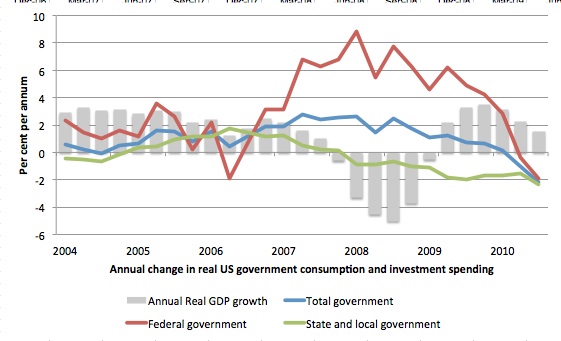

Consider the following graph which is taken from National Accounts data available from the US Bureau of Economic Analysis. It shows the annualised growth of real government spending in the US (blue = total government sector consumption and gross capital formation; red = Federal and green = State and local) juxtaposed against real GDP growth (grey bars) from 2004 to the second quarter 2011.

What you observe is very striking. As the US economy was starting to slow in 2007, State and local government spending turned pro-cyclical (started to slow as well) and by the December quarter 2008 actually contracted and has been contracting ever since. In other words, the State and local government sector were making the crisis worse.

At the Federal level you see the stimulus impact – so definitely counter-cyclical spending occurring through 2008 which helped provide the way for the recovery in real GDP in early 2010. The rate of growth in Federal spending started slowing in the March quarter 2009 and by the September 2010, real GDP is starting to slow again under the weight of collapsing public spending.

By the March quarter 2011, government spending growth (both levels) is negative and firmly pro-cyclical.

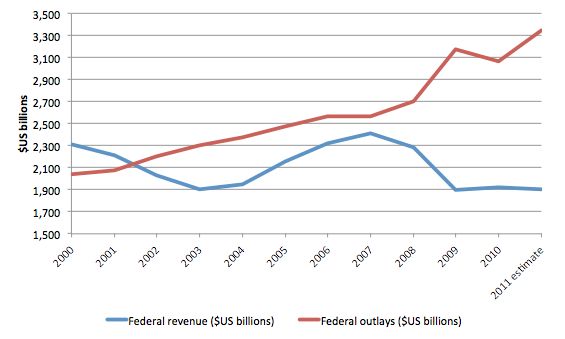

The next graph gives the other side of the story (almost) using different data though. The data is annual and comes from the US Office of Management and Budget and shows Federal revenue and outlays ($US billions) from 2000 to 2011. The 2011 figure is the OMB’s estimate and does not reflect current information available in the NIPA which is produced in the previous chart.

The point is obvious even as the spending growth was in decline, the deficit continued to expand because there had been such a major collapse in tax revenue (because the private sector spending had also collapsed and real GDP was contracting).

None of that is rocket science but provides a backdrop to the comments that Geithner made. The public sector in the US is undermining growth now and the Jobs plan will not reverse that stance.

So after lying about how much support the US government is providing at present, the US Treasury Secretary said:

… we remain committed to credible steps to restore fiscal sustainability in the medium term … Together, pro-growth policies in the near term and meaningful deficit-reduction in the medium term will strengthen the U.S. economy and preserve sufficient fiscal space for the U.S. to respond to future external shocks.

Whenever you read that deficit reduction provides “fiscal space” which allows a government to “respond to future external shocks” you can immediately conclude the person doesn’t know what they are talking about or understands how the monetary system works but chooses to lie about it.

First, the US government is trashing spending and its “consolidation” plan which is being driven by the Tea-Pots is totally inappropriate for projected state that the US economy will follow over the next few years. The cuts proposed ($US4 trillion) are politically-motivated and have no economic (or financial) justification. They represent a failed political system.

Second, running a deficit or surplus this year (which just means the flow of spending is greater than the flow of revenue or vice versa) doesn’t add or subtract from the capacity of a sovereign nation to run a deficit or surplus next year, or any year.

Nor does it change the capacity to run large or small deficits in future years. When a government runs a surplus there is not some magic pudding created. A budget surplus destroys non-government sector net financial assets denominated in the currency of issue. It reduces the purchasing power of the non-government sector. But that purchasing power is destroyed forever. It is not stored anywhere within the public sector.

There is no meaning to the statement that a currency-issuing government can save in its own currency. Such a government can run whatever deficit is appropriate in each period which sometimes might mean a budget surplus (if net exports are sufficiently strong enough).

The neo-liberal bias towards surpluses introduces a pernicious bias towards slow growth and persistently high unemployment. There is no justification for a “medium term” fiscal consolidation in the US based on current performance. Unemployment is very high and rising.

I note some mention in recent days of the famous testimony in 1933 by Marriner Eccles, a former Chairman of the US Federal Reserve. You can read the whole February 1933 US Senate Committee on Finance testimony (36 pages of it) HERE. I have read it often. It is a very powerful statement of what the priorities of government should be and how they can successfully pursue those priorities.

Early in his testimony he says:

Before effective action can be taken to stop the devastating effects of the depression, it must be recognized that the breakdown of our present economic system is due to the failure of our political and financial leadership to intelligently deal with the money problem. In the real world there is no cause nor reason for the unemployment with its resultant destitution and suffering of fully one-third of our entire population. We have all and more of the material wealth which we had at the peak of our prosperity in the year 1929. Our people need and want everything which our abundant facilities and resources are able to provide for them. The problem of production has been solved, and we need no further capital accumulation for the present, which could only be utilized in further increasing our productive facilities or extending further foreign credits. We have a complete economic plant able to supply a superabundance of not only all of the necessities of our people, but the comforts and luxuries as well. Our problem, then, becomes one purely of distribution. This can only be brought about by providing purchasing power sufficiently adequate to enable the people to obtain the consumption goods which we, as a nation, are able to produce. The economic system can serve no other purpose and expect to survive.

Which agrees with the notion that there are plenty of jobs but not enough funding to make those jobs operational.

And for Marriner Eccles that meant one thing – the government should demonstrate leadership and use its fiscal capacity to advance public purpose:

The Government controls the gold reserve, the power to issue money and credit, thus largely regulating the price structure. Through its power of taxation it can control the accumulation and distribution of wealth production. It can mobilize the resources of the Nation for the benefit of its people. As an example of Government control and operation of the economic system look to the period of the war, at which time, under Government direction, we were able to produce enough and support not only our entire civilian population on a standard of living far higher than at present, but an immense army of our most productive workers engaged in the business of war parasites on the economic system, consuming and destroying vast quantities produced by our civilian population; we also provided the allies with an endless stream of war materials and consumption goods of all kinds.

The testimony is full of that the US Treasury Secretary should study, rote-learn, and badger his President with:

Is it necessary to conserve Government credit to the point of providing a starvation existence for millions of our people in a land of superabundance? … we are losing $2,000,000,000 per month in unemployment. I can conceive of no greater waste than the waste of reducing our national income about half of what it was. I can not conceive of any waste as great as that. Labor, after all, is our only source of wealth … There could be no waste in post offices or in roads or in schools. You would have something to show for it.

Compare that sort of understanding with that presented to the IMF by the US Treasury Secretary over the weekend:

Fiscal policy everywhere has to be guided by the imperatives of growth. Where deficits and interest rates are too high, governments have no choice but to consolidate. Where fiscal positions are stronger and interest rates low, some countries have room to take more action to support growth, and others can at least slow the pace of consolidation.

That juxtaposition tells you why the US is in a state of decline and why the advanced world is heading back towards recession. That trajectory is totally unnecessary and reflects the fact that the political leadership has failed.

What sense can be made of the statement that “fiscal policy everywhere has to be guided by the imperatives of growth” but that governments should cut back (fast or slower)? It is a nonsensical statement because it relies on the assertion that there is valid meaning to the concept of a deficit being too high in the face of low inflation and rising unemployment.

Rising unemployment means that there are not enough jobs being created to match the preferences of the labour force. It means in a monetary economy that once the non-government spending decisions have been taken, that there is insufficient public spending.

I see no situation at present where a public deficit is “too high”.

The US Treasury Secretary is clearly eyeing up a job down the road in Washington once the American public get rid of the current president. He said in relation to the IMF that:

We have acted decisively to give the Fund the resources and facilities to respond to crises. Now is the time for the Fund to take a leadership role and focus on what counts in strengthening the international monetary system.

The problem is that they haven’t turned off the computer models or re-programmed the ideology of the Fund. No progress will be made until there is a wholesale change in the way the IMF thinks and a jettisoning of its neo-liberal mentality.

As a footnote, I am sick of reading articles – which are increasing in frequency and which claim that there is little we can do about the crisis because the governments are out of “bullets”.

For example in this Sydney Morning Herald article (September 25, 2011) – Buckle up for apocalypse Dow – we read an assessment from a “bank economists” that:

… there’s no alternative but for a long grind ahead … with an economic resolution that will take years not months to work through. It’s like staring into the abyss of a lost decade of flat growth, like Japan has been going through.

For a start even though Japan’s growth in the 1990s was slow it never entered recession and unemployment went up marginally. Please read my blog – Are they all lining up to be Japan? – for more discussion on this point.

Moreover, there is a clear alternative that would turn the real growth malaise around and dramatically reduce unemployment within one quarter. Introduce a Job Guarantee and support it with substantial outlays on public infrastructure development including enhancing the quality of public education, public health and public housing.

This resigned mantra that we just have to bear up with a decade of stagnant growth and high unemployment is another neo-liberal ploy while the capacity of the public sector is further undermined (by so-called “essential fiscal consolidation”) and increased proportions of real income is redistributed to a financial sector which evades meaningful regulation.

Another bank economist quoted in the article claimed:

Right now financial markets are worried that governments don’t have any bullets left to fire … and those that do have bullets – such as the European Central Bank – are incapable of firing them.

Which just goes to show that the “financial markets” (meaning people like him) don’t understand the capacities of our national government. All currency-issuing governments at present could immediately announce an offer to employ anyone who wanted a job tomorrow at a minimum wage and pay the wages from that day.

Any national government that issues its own currency (and floats it on international markets) could announce large scale public infrastructure programs which would stimulate demand and lift confidence.

Further, the ECB is not incapable of firing its “bullets” – it is intervening regularly in the secondary bond markets and effectively acting as a fiscal authority for the Eurozone states. The EMU could continue without issue if the Euro bosses scrapped the Stability and Growth Pact restrictions on public deficits; abandoned the harsh austerity programs they are forcing on nations; and ensured the ECB maintained its bond purchases to whatever level were needed to support demand and jobs growth in the member states.

The real problem is not financial – there are enough “bullets”. The real problem is political – our leaders have failed us and need to be sacked.

One way of helping in this regard is to support grass roots movements such as October 15, 2011. I think this sort of development which can be inclusive of all cultures, races, gender, age groups and exploit the subversive capacity of the Internet is worth supporting.

Conclusion

Perhaps the next IMF boss can issue the 1933 testimony of Marriner Eccles to all staff and run a quiz to see who stays and who goes onto the unemployment queue.

Of-course, those who go onto the queue will then be able to enjoy the comforting thought that their unemployment is voluntary and an optimal choice between labour and leisure with the latter winning. They will also be able to enjoy any cuts in unemployment benefits that some misguided government might introduce because they will know that the benefits erode their incentive to work.

I have run out of time today (and energy). More tomorrow.

That is enough for today!

When you read what some of these idiots say, you wonder how humanity has survived natural selection processes throughout our evolutionary past. Jared Diamond has a thesis that might explain this. He argues that the evidence suggests that so-called primitive people are generally smarter than those from more “advance” societies simply because the stupid ones die, while in “advanced” societies stupid people are protected. In fact, it could be argued that stupid people are rewarded in more “advanced” societies.

One possible exception to the correlation between stupidity and success would be organized, successful psychopaths, who are generally not stupid though their hubristic tendencies may be unbounded, thereby leading them to say and do things that may not be in their best interests (though of course they “calclulate” that they are). Some of our bankers fit this description.

@Larry,

Our version of capitalism doesn’t especially reward the most intelligent and capable. Established mega wealthy families have to spawn complete dimwits to lose their wealth. If a new niche opens up, there is a quick lottery where a few lucky entrepreneurs win entry to the club.

In the corporate world it is the dependable, butt polishing, yes men who succeed generally. The sharp brains who actually invent all the good stuff, get a thank you note and a 50p voucher for Tesco. It’s a harsh lesson for many, to learn the company owns all your brain activity while you are in their employ. If we went back to small stone age communities style the corporate yes man type would be made to carry the turds out of the cave every morning, befitting their natural ability.

Andrew,

I had to publish that on my Facebook wall mate, that is the best and funniest comment I have heard on the modern corporate landscape in ages, what we would give to see those lily livered yes men type bosses shoveling out Turds, priceless!!!

Latest reports indicate the IMF does not have the cash to rescue the Euro zone. Similarly the ECB will pass on losses of the rumoured 50% Greek haircut back to European Central Banks meanwhile will not Ireland et al also expect some debt forgiveness? Quickly pass on the deflating parcel!! Here in the UK I can not get an answer to how much UK is expected to contribute to IMF (13%?) or the EFSF – money we could use for a job guarantee programme.

Re “fiscal space” clap trap, the basic hang-up in the brain of Geithner and in the brains of the rest of the West’s elite is their belief that deficits necessarily result in more debt, which in turn means more interest payments. As Keynes, Milton Friedman, numerous other economists have pointed out deficits can perfectly well accumulate as zero interest paying monetary base. (Personally I’d like to see Bill push the latter point a bit harder.)

The response of the morons to the latter monetary base idea would of course be that more monetary base means more inflation. But the latter inflation idea now looks decidedly silly given the recent astronomic and unprecedented increase in the US base, combined with an absence of hyperinflation.

As to the idea that a large monetary base would result in excessive bank lending in a few years time, the morons need to have it explained to them that banks lend when they see viable lending opportunities, not just because they’re sitting on a pile of reserves.

It can’t be that difficult to get the above into their heads can it?

Despite the fact that Eccles seems attached to some ideas that MMT writers wouldn’t support – like the gold standard – his willingness to take on powerful vested interests in finance on behalf of the public interest and public purposes, and his clearheaded understanding that a maldistribution of wealth and a stubborn determination to protect and support the nominal asset values of creditors, are inspiring by the standards of today’s leadership.

Dear Bill – hope you will be feeling better soon! If people want global change and know exactly what they don’t want – then they need to define exactly what they do want too; that’s the difficult bit!

One thing that I know is that people have wanted peace on this planet for as long as we have been here. On this basis alone, ‘intelligence’ could be redefined.

Peace in the end, is a feeling inside of each and every human being. It seems the so-called rational and irrational mind has no idea how to feel that feeling. Mind does know however, only too well – how to make a mess of a beautiful world and needless drama out of human existence.

Seen the sun rise at Nobby’s lately?

Cheers,

jrbarch

@Ralph

I think you have succinctly nailed the problem within the heads of the elite. Now, if we realize they are all of the “yes man” personality type. Few critical thinking skills and an overwhelming desire to tow the party line we are right royally screwed.

Modern political parties have no principles, they just desire to be in power. They only adopt policy that pleases their sponsors and plays well in focal groups. Difficult to understand and controversial ideas are not going to get any airtime.

The institutional groupthink is deafening in it’s intensity. It needs a serious groundswell movement to shift their opinion. Warren is quite rich but MMT doesn’t have many billionaire backers. The left couldn’t organise a tea party or even a coffee morning.

As a side note kudos to Steve Keen, for getting some of George Soros pocket change for his debt model. I hope the endorsement helps him get more widespread credibility. Lets keep our fingers crossed Bill gets his own sugar daddy, although he is the antithesis of corporate yes man. (Hope you don’t mind Bill)

Dear Bill,

could you possible write opinion piece to some leading European newspapers? Now is the time when far-reaching changes are proposed and made, and it would be good to get some publicity for MMT. Good ideas don’t just spread around automatically, without some effort.

KM said that the “value of Labor to Capital is subsistence” I have never seen a businessman who didn’t want to pay his employees as little as possible so that is an apparently correct theory. I always thought that KM was wrong about Capitalism failing because he did not anticipate Labor Unions with government support. It is beginning to appear that KM might have dismissed Labor Unions as not sustainable in the face of Capitalist power.

Monopoly is a game where there is one winner and everyone else loses. The only way to keep the game going is to redistribute the money when one person has most of it. I think the game needs a progressive tax square, and an inheritance tax square.

Oldfart?

Actually, Monopoly was originally called the landlords game and was invented to support the concept of Henry Georges single tax. Illustrating the negative aspects of land accumulation and eventual monopoly.

There is an income tax square (which the winners never land on just like real life). To make the game last a really, really long time (for ever) it really needs a few heavy hitting land value tax squares to replace those pesky community chests.

@Dan Kervick

There is another sense in which Eccles was anti-MMT (before MMT was invented). Prof. Mitchell’s constant refrain is that we should accommodate the desire of the private sector to save. Eccles thought the opposite: that this desire was irrational and should be opposed. From his above-mentioned senate testimony:

“It is utterly impossible, as this country has demonstrated again and again, for the rich to save as much as they have been trying to save, and save anything that is worth saving. […] It is for the interests of the well to do – to protect them from the results of their own folly – that we should take from them a sufficient amount of their surplus to enable consumers to consume and business to operate at a profit. ”

Note that he was well aware that the ‘savings desire’ was not equally distributed across the population, and that this was the root of the problem.

Prof. Mitchell’s constant refrain is that we should accommodate the desire of the private sector to save. Eccles thought the opposite: that this desire was irrational and should be opposed.

I’m not so sure that this is opposite, so much as looking at the economy at a distributional rather than an aggregate level. Net spending levels don’t dictate how much should be spent where or how much should be taxed where, only the difference between the what is spent and what is taxed. The emphasis on the aggregate here is the result, I think, of the starting point of first having to refute the largest, most foundational falsehoods that drive maintstream economic discourse. If pundits and politicians weren’t so obsessed with deficits and debts while ignoring the economic conditions that create/require them, distributional considerations would probably be more prominent in MMT discussions, but, as it is, there’s not much point in spending a lot of time on step 2 when most people haven’t managed step 1.

To be clear, my last comment relates to the Eccles’ reference specifically to “the rich” as opposed to “consumers.” I should also add that distributional considerations my be considered outside the purview of MMT, strictly speaking, and that advocates of MMT may have differing opinions on what should be done below the aggregate level of net spending.

@WHQ

Although macro-economics is traditionally thought of as a study of aggregates, rather than distributions, to me a systems approach is the most helpful: the economy is a single complex system made up of many, interacting parts. The question is then, which are the most important components and interactions in determining the state of the system? Often, it is true, aggregate stocks and flows may be the most helpful, but if MMT is truly a relevant theory of macro-economics then it has to examine every factor, including distributional issues if need be, if empirically they prove to be important (as I believe to be the case).

To provide an analogy, one of the many limitations of ‘mainstream’ economics is that it largely ignores the importance of finance in determining macro-economic outcomes.

dnm, I agree. I just think we’re at a point where discussing MMT with followers or proponents of mainstream economics is like trying to explain covalent bonds to someone who doesn’t believe in molecules. You have to convince them of the existence of molecules before you can start discussing electron affinities and such. I’m also not sure where the limits of what constitutes MMT and what constitutes “sub-MMT” policy advocacy are. Maybe sub-aggregate discussions are matters of what flavor of MMT a particular economist subscribes to, in some hierarchal fashion. (Or maybe all of this is just a useless abstraction in my head that doesn’t really matter; it wouldn’t be the first time that happened.)