I started my undergraduate studies in economics in the late 1970s after starting out as…

Playing Ball is not a better way

On Monday, September 26, 2011 the British Shadow Chancellor gave a speech (his first major speech in that role) to the Labour Party Conference in Liverpool. The Full Transcript of the Speech is courtesy of the New Statesman. Balls ended his speech by saying “There is a better way” and I agree – the current macroeconomic policy settings in the UK are destructive and will be regretted. The problem is that Balls’ path to prosperity is not that better way which means the British people are in the same boat as a lot of electorates – caught between the devil and the deep blue sea. Playing Ball is not a better way.

Neo-liberalism has had a notable impact on the policy terrain. Despite it claiming to prioritise individual choice and freedom it has rendered the political landscape nearly devoid of choice. What used to parade as proud “Labour” Parties which represented the workers and the interests of the disenfranchised are now right-wing, pro-market deregulators.

At the same time, the conservative parties which have always represented the aims of the elites are more right wing than ever and the epitome of the denial of freedom, choice and opportunity.

But on the key economics issues there is little to separate the major parties in most nations (particularly the English-speaking world). Ed Balls’ speech however dressed up in Labour rhetoric emphasises the stifled nature of the options our major parties are prepared to work within.

The short Balls’ story is that – the “markets” have to be obeyed even if our perception of what they want is amorphous in the extreme. We think they like budget surpluses. We think they hate budget deficits. Therefore whatever else we do we have to satisfy the “markets” as a matter of priority. That sort of policy starting point represents the ultimate abnegation of social responsibility by government.

The starting point for responsible government has to be a recognition that the elected representatives are in charge. Please read my blog – Who is in charge? – for more discussion on this point.

Just to settle your nerves a bit and to get a perspective on how the “markets” represent standards we should aspire to consider the following video which I saw on the ABC last night (but know it to be sourced from the BBC). It is an interview with a London-based market trader (one Alessio Rastani) about the options facing the Eurozone and their implications. The interviewee waxed lyrical about the values of citizenship and social responsibility.

Here is the transcript of some of the segment if you cannot be bothered listening – this piece of wisdom came after about 1 minute:

I’m a trader, I don’t really care about that kind of stuff. I go with what … If I see an opportunity to make money I go with that. So for most traders, it’s not about … we don’t really care that much how they’re going to fix the economy, how they’re going to fix the whole situation, our job is to make money from it. And … personally, I’ve been dreaming of this moment for three years. I had a confession which is … I go to bed every night and dream of another recession. I dream of another moment like this. Why? Because, people … don’t really seem to remember, but the ’30s Depression … the Depression in the ’30s, wasn’t just about a market crash. There were some people who were prepared to make money from that crash and I think anyone can do that.

Later he told us that “Governments don’t rule the World. Goldman Sachs rules the world”.

My experience tells me that this is not an isolated statement of “values” from the FIRE sector. These are the values that all the major parties seem to think should be prioritised.

Anyway, what was wrong with what Balls proposed?

I agree with his overall sentiment that “”George Osborne’s economic plan is hurting … but it’s just not working” although I would say that it is working very well in the sense that it is achieving exactly what a person who understands macroeconomics would predict. Those predictions, of-course, are contrary to the political and ideologically-motivated predictions from the Government.

I also agree that the political capital of the British Labour Party is in need of rejuvenation following their failings while in government and they need to “win the public’s trust for an alternative future – a better way forward” for the economy.

The British economy is in a parlous state at present and clearly the dominant policy paradigm is failing. So what should the alternative be?

Balls defined his better way from the outset in this way:

– yes – a credible plan to get our deficit down;

– but action now – a plan for growth and jobs;

– and long-term reforms to build a stronger, fairer economy;

And from that you know that British Labour is impossibly compromised by the tension of adhering to a neo-liberal construction of deficits while at the same time being aware that the people want jobs and equity.

That tension cannot be resolved because it is the ideological (and erroneous) deficit mania of the neo-liberals that has infested all the major political parties in Britain and elsewhere which simultaneously undermines the capacity of the economy to produce full employment and increases inequality. It is that ideology that demands an increasing redistribution of real income away from workers to profits.

It is a total package. Buy into the mainstream depiction of budget deficits (and debt and interest rates and inflation) and you also buy into the NAIRU view of the labour market and accept the urgency of deregulation and a belief in “self-regulating markets”.

The true alternative that British Labour should now be developing – to really differentiate itself from the neo-liberal marasme.

I agree with Balls when he said that this was a global crisis with “(d)emand sucked out of the economy” which is “threatening the jobs, pensions and living standards of families here in Britain and across the world” and that:

… the world must remember the lesson of the 1930s: that there is no credibility in piling austerity on austerity, tax rise on tax rise, cut upon cut in the eventual hope that it will work when all the evidence is pointing the other way.

I said to you a year ago – you either learn the lessons of history – or you repeat the mistakes of history – that is the choice the world faces today.

We are now seeing a further repetition of the macroeconomic policy mistakes that were made in 1937, in 1997 (Japan) and at other times when the stakes were not as high. The pattern is repeating – a major collapse in private spending occurs -> governments introduce fiscal stimulus measures to stabilise the real economy -> growth resumes and starts to gather pace -> the conservatives scream that the budget deficits will bankrupt the nation and use their superior financial resources and media control to pressure the government politically into withdrawing the stimulus and imposing austerity -> the economy nose-dives and progress is lost for some years -> the financial indicators also worsen.

Fiscal austerity will not achieve the aims that its proponents have set out especially when it is a global trend rather than being isolated to one nation which can then exploit growth elsewhere to grow via its external sector.

Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

I agree with Balls that the approach of the British government at present represents “a complete abdication of responsibility”.

He then went on to compare the approach taken by the Government and the Labour option. The difference seems to rest on timing. He said in relation to the Government’s austerity plan that:

… we in this Party argued for a steadier, more balanced approach – halving the deficit over four years.

We said that going too far, too fast would choke off the recovery and put jobs at risk;

We warned that cutting spending and raising taxes too fast would create a vicious circle here in Britain too – and make it harder to get the deficit down.

So you read nothing here about the role of the budget deficit in providing support for the non-government sector and growth. There is no alternative to cutting public net spending proposed. The alternative is a matter of timing.

From the perspective of Modern Monetary Theory (MMT), there is a chronic lack of demand in the British economy at present which is evidenced by the high unemployment and rising poverty.

While the fiscal stimulus measures provided support for some growth – it was a very drawn out recovery period – it took a long time for growth to show it head. It was clear even before the 2010 national election in Britain that the budget deficit was too low. It was no providing enough support in the face of a determined effort by households to increase its saving and a reluctance by firms to invest.

The alternative economic vision would discuss the centrality of government net spending in providing for spending support for the economy to allow the private sector to reduce its debt exposure and restore private confidence. It would be extolling the virtues of budget deficits not falling into the mindless call for “fiscal consolidation”.

Trying to halve the British deficit in four years (from 2010) given the state of private demand would have also damaged the growth recovery.

A responsible role for a currency-issuing government is not to be concerned with “getting the deficit down” unless it is clear that the economy is close to full employment and pushing up against the inflation barrier. Neither situation applies to the British economy now or in 2010. I analyse the inflation situation later.

Balls doesn’t get that at all:

Yes – a credible economic policy does needs a plan to get the deficit down.

No it doesn’t when you have high unemployment, chronic regional disparities in economic outcomes, and no demand-pressures on inflation. That is the problem for Balls – he is trapped in the “get the deficit down” mantra.

The next section of the Speech contained the much-touted apology for mistakes made when Labour was in power. Some of these “mistakes” relate to spending increases and/or tax cuts which suggests that Balls has clearly bought the line that the previous administration was excessive. I didn’t see evidence of that but it is a minor point.

Where I would have preferred to see some recognition of error was in the approach to financial markets.

Remember the classic 2005 – Speech – by the Gordon Brown to the Confederation of British Industry (CBI).

The better, and in my opinion the correct, modern model of regulation – the risk based approach – is based on trust in the responsible company, the engaged employee and the educated consumer, leading government to focus its attention where it should: no inspection without justification, no form filling without justification, and no information requirements without justification, not just a light touch but a limited touch.

The new model of regulation can be applied not just to regulation of environment, health and safety and social standards but is being applied to other areas vital to the success of British business: to the regulation of financial services and indeed to the administration of tax. And more than that, we should not only apply the concept of risk to the enforcement of regulation, but also to the design and indeed to the decision as to whether to regulate at all.

The risk-based approach badly failed and was always going to fail.

Who was Gordon Brown’s “light touch” champion? Answer: the former City Minister Ed Balls who also pushed for increased financial deregulation while working in the British Treasury. On September 13, 2006 he was boasting to the Hong Kong General Chamber of Commerce and the British Chamber of Commerce about his neo-liberal leanings:

In my first speech as City Minister at Bloomberg in London, I argued that London’s success has been based on three great strengths – the skills, expertise and flexibility of the workforce; a clear commitment to global, open and competitive markets; and light-touch principle-based regulation … And most recently in this decade we have been determined to respond to events and new challenges and enhance London’s global standing and light touch regulation … Today our system of light-touch and risk-based regulation is regularly cited – alongside the City’s internationalism and the skills of those who work here – as one of our chief attractions. It has provided us with a huge competitive advantage and is regarded as the best in the world.

There are many examples on the public record of this appalling judgement and lack of foresight. Balls was the City Minister who oversaw the Northern Rock fiasco and the attempts by RBS to consume ABN Amro (failed).

So if I was going to really outline an alternative approach and I was acknowledging the spectacular policy failures while previously in government I would have said more than this:

And yes – we didn’t regulate the banks toughly enough and stop their gross irresponsibility – here in Britain and all around the world.

Britain led the way in the deregulation. Balls and his mates lived the neo-liberal myth that the financial markets would self-regulate. The failure of that “vision” has been dramatic and very costly to millions of people in Britain.

I would have made this aspect of my past a central focus of my speech. I would have provided a very detailed account of what I was going to do to stop banks speculating and how I was going to wipe out unproductive financial transactions (the majority of the sector, that is).

He later accused David Cameron, George Osborne and Nick Clegg of being:

Reckless. Ideological. Unfair.

He should have had his own hand up at that stage given the performance of the past Labour government.

He then went on to outline the “five immediate steps the government can and should take right now”.

Step one – repeat the bank bonus tax again this year – and use the money to build 25,000 affordable homes and guarantee a job for 100,000 young people – it can’t be right to be cutting taxes on the banks when almost 1 in 5 young people are now out of work.

Step two – genuinely bring forward long-term investment projects – schools, roads and transport – to get people back to work and strengthen our economy for the future.

Step three – reverse January’s damaging VAT rise now for a temporary period – a £450 boost for a family with two kids – immediate help for our high streets and for struggling families and pensioners too.

Step four – announce an immediate one year cut in VAT to 5% on home improvements, repairs and maintenance – to help homeowners and the many small businesses that are so dependent on the state of the housing market.

Step five – a one year national insurance tax break for every small firm which takes on extra workers, using the money left over from the government’s failed national insurance rebate for new businesses – helping small businesses to grow and create jobs.

If a job guarantee for 100,000 people is essential why not offer it to everyone who wants a job?

How many jobs will the five-step plan produce? Balls provide no detailed information. You see how marginal some of these measures are against the background of lost demand and you realise that this is not a very daring plan at all.

The reason? We read on:

But I have to level with you all – and the country… a plan for growth now will help get the economy moving again and stop the vicious circle on the deficit – but by itself it won’t secure our economic future or magic the deficit away

… before the next election – and based on the circumstances we face – we will set out for our manifesto tough fiscal rules that the next Labour government will have to stick to – to get our country’s current budget back to balance and national debt on a downward path.

And these fiscal rules will be independently monitored by the Office for Budget Responsibility.

And when they privatise the banks again they will use the gains “from the sale of bank shares to repay the national debt” an approach he claims is “fiscal responsibility in the national interest”.

But what if the “circumstances we face” are such that a rising budget deficit is required to maintain growth? The problem with the Balls’ rhetoric is that there is no recognition (as noted above) that the budget deficit is not something you “bring down in the medium term” as if it is a thing that can be manipulated in that way without consequence.

What happens if the British consumers remain shy for years as they work to reduce the huge exposure to debt (which arose as a consequence of light regulation promoted by Ed Balls and Co)?

What happens if the external sector continues to deliver current account deficits?

What happens if private investment remains weak for several years?

What will these fiscal rules mean in that context? Please read my blog – Fiscal rules going mad … – for more discussion on this point.

A true alternative would place the desirability of continuous budget deficits in the context of non-government saving overall. Rather than adopt the mantra that the essential role of government was to “bring the deficit down” he should have been educating the public on the role of deficits and their virtues.

I would also note that a classic neo-liberal ploy is to advocate the creation of so-called “independent” monitoring bodies which become attack dogs on government to maintain “fiscal discipline”. A true Labour party would recognise the primacy of the democratic process and the rights of the electorate to expect their representatives to take responsibility for economic policy making and to judge those representatives on their performance at regular intervals.

These unelected and unaccountable “independent” bodies are typically stacked with neo-liberals and stifle the freedom of the elected government to pursue public purpose. Just read the distorted analysis that comes out of the OBR or the US CBO now.

But what about inflation?

On September 13, 2011, the UK Office of National Statistics (ONS) published the latest Consumer Price Indices, August 2011.

The headline was that annual CPI inflation “stands at 4.5 per cent, up from 4.4 per cent in July”. The retail price index also rose. I won’t go into the debate about whether the RPI or the CPI is the best measure of inflation. Maybe another day.

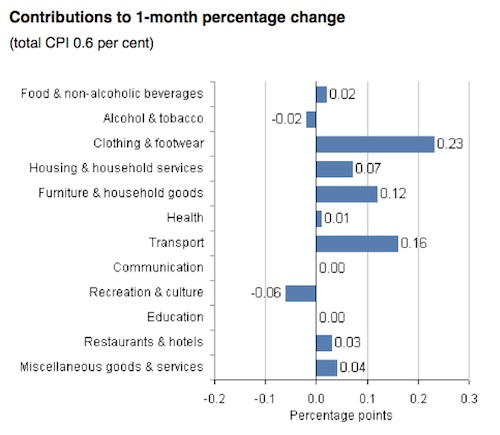

The following graph is taken from the ONS data publication for August 2011 and shows the Contributions to 1-month percentage change in the British CPI (which was 0.6 per cent in total) by main item in the index.

The individual contributors are clear but the obvious point of interest is what has driven these components?

In the latest Bank of England Inflation Report, August 2011 you will read:

The strength of inflation continued to reflect the effects of past increases in both the standard rate of VAT to 20% and the prices of energy and other imported goods and services … Most measures of companies’ and households’ one year ahead inflation expectations fell back in 2011 Q2 … There is a good chance that inflation will reach 5% later this year, boosted by utility price rises, and reflecting the continuing impact from past increases in VAT and in oil and other import prices. Inflation is likely to fall back through 2012 and into 2013 as those effects wane and downward pressure from slack in the labour market persists.

From which you understand that the fiscal austerity measures which have driven up the VAT increases (from 17.5 per cent to 20 per cent) has filtered through to the major retail components. A once-off change in the VAT moves the price level up but is unlikely to be a source of continued inflation given that the economy is so weak and the ability of workers to defend real wages is compromised.

To find out more about the way the British government has deliberately increased the inflation rate as part of its misguided fiscal austerity measures you may be interested in reading a Report compiled by the UK Centre for Retail Research, which is a high profile private research group formerly associated Nottingham University.

The other driving factors are external – energy prices and higher import prices (arising from the depreciation of sterling).

I agree with the Bank of England’s assessment that domestic demand factors are not driving the rise in the inflation rate in Britain and the peak is nigh. Given how much slack there is in the British labour market and retail sector at present there is considerable scope for non-inflationary fiscal stimulus.

Guardian Panel’s reaction to the Balls speech?

I note also that the UK Guardian (September 26, 2011) carried a story – Ed Balls’s conference speech: panel verdict – where three commentators also gave an appraisal of the speech. So we might juxtapose their opinions with my own as well.

One commentator, Jonathan Freedland (a Guardian columnist) thought the speech was effective – “cogently made the case that to “pile austerity on austerity” made no sense when the economy is shrinking and that growth, not debt, was now the critical priority”.

That was a strong statement by Balls but it turned out to be fluff when you then heard of this plan and his overriding claim that “fiscal consolidation” was a priority.

Freedland notes that the “much ballyhooed apology … went wider than anticipated, apologising for a raft of Labour mistakes – including those strongly associated with his former mentor Gordon Brown”.

As noted above, I thought the apology was weak because it didn’t repudiate the neo-liberal mindset as being the source of the destruction. Balls did not show any recognition that the neo-liberal approach cannot provide a sustainable basis for steady, equitable growth.

The next panel member, Ann Pettifor, who is a progressive economist said that “Apologies are just not enough”. She said:

… Balls must go further.

First, he must declare loudly and forcefully that Labour will never again be captive to neoliberal central bankers like Alan Greenspan; or private bankers like Sir Fred Goodwin of RBS.

Labour must never again be seen to be in the pockets of the finance sector …

Second, Balls must stop talking about the deficit; about “tough decisions on tax and spending” – the last thing the economy needs. It is private debt – 469% of British GDP and six times the public debt – that is the real crisis facing Britons. It is debt-deflation, and debt-deleveraging, and collapsing private investment that pose the gravest threat to us all.

Given this, there is an urgent need for government spending on environmentally sound projects to generate economic activity – jobs, the income, the savings that will help protect us from Armageddon.

I completely agree with that assessment.

The final panel member, was Sheila Lawlor who directs a British think tank (Politeia). Her assessment is completely at odds with the last panel member (and mine). She thinks that the previous government left the new government “a bare cupboard stuffed with IOUs piling up”.

No it left it with low unemployment and growth although it was reliant on private debt accumulation which was unsustainable.

Lawlor thought that Balls’ commitment to “tough fiscal discipline” would be welcome by the “markets” and she claimed this was “rhetoric of responsibility”. She lives in the fantasy land – the fiscal contraction expansion land – and claims that Balls should be advocating immediate cutting of the deficit “fast and far” as “a surer option than government spending programmes” and “that significant cuts bring benefits for growth and financial stability at a time of volatile markets”.

I expect she will have to change her opinion in the coming months as the British economy continues to struggle under the weight of the fiscal contraction. She won’t but she should.

Conclusion

My feeling is that the British Labour party has not learned the lessons of its failure. It is still entwined with their neo-liberal lust and still somehow think that it is sensible to advocate the same sort of policy ambitions that represent the core of that ideology.

They clearly haven’t realised that taking a “hard line” on fiscal policy is exactly the same mindset that drove them into “light regulation” both of which undermined the capacity of the economy to create full employment and stable growth.

To have full employment and stable, equitable growth the government has to be prepared to maintain aggregate demand and ensure markets are tightly regulated and the distribution of income is more equitable.

Capitalist economies cannot go on redistributing real income away from wages towards profits. There has to be a fundamental realignment in the relationship between real wages and productivity such that they grow together. I suspect the British Labour party hasn’t put the pieces together.

The rising income inequality led to a need for more private debt to maintain growth at a time where the government was praising fiscal drag. It was a cocktail that was always going to explode and so it did.

The better way has to address those endemic conflicts in the current policy mix and reverse the regulative environment to dramatically reduce the size of the financial sector, force banks to be banks rather than casinos, and force employers to pay higher real wages.

Outlining that sort of future would be a demonstration of leadership by a “labour” party. Neither the British Labour Party, the US Democrats or the Australian Labour Party understand that.

I have to catch a plane now so …

That is enough for today!

If Japan has been in the situation we are facing now since 1997. There’s nothing to make me think the Anglo world will not follow a similar path for 20+ years. The neoliberals just ignore facts and try to explain the Japanese situation as an exception. Maybe if enough countries turn Japanese they might actually question their assumptions. Not holding my breath, they have proved adept at inventing ever more complex economic theories to paper over their flaws in basic understanding.

It’s difficult to find a problem you never look for.

or…..you could listen to the tripe over in the US (prob better you’re on a plane and can’t see it). Kotlikoff has just put out 5 precriptions to ‘heal’ the economy’s ills…. I won’t post the entire thing, but here are the 5 gems:

1. Stop paying IOR …. because it’s a bribe to banks to ‘not lend’ the extra money it’s been ‘printing’. “Banks don’t want to lend the money because they worry about the state of the economy. But if the Fed encouraged banks to lend en masse to companies that would be able to repay in a normal economy, their collective lending would help produce that normal economy. So here’s one no-brainer. Have the Fed stop paying interest on reserves and start encouraging the banks to make loans.” Goodness gracious….

2. Workers to invest in jobs – “President Barack Obama could call on the workers and shareholders in these companies to voluntarily hire 7.5 percent more workers and do everything possible to maintain the higher level of employment going forward.” And to pay for it….. “Existing employees could agree to a 7.5 percent wage cut in exchange for immediately vested shares of their companies’ stock of equal value. If their companies aren’t incorporated, company owners could segregate a portion of the company’s profits to be paid, over time, to those workers taking the immediate pay cut.”

3.”Compel corporate America to invest – Large companies are purportedly sitting on roughly $2 trillion in cash. They are waiting for the economy to improve before they invest, but it won’t improve until they all do so.” …. But didn’t you just say the Fed should compel banks to lend to these ‘cashed-up companies in #1, dip***t??

4. Get prices and wages unstuck – “Some prices and wages are set too high, thereby damping demand for output …” Really? Wages too high? And they dampen demand for output? … “If the act (Davis Bacon) were suspended or repealed, federal spending on much-needed infrastructure projects could create a lot more jobs.” Okaayayyyyy

5. Achieve fiscal sustainability – “The government’s huge official debt and enormous future Social Security and health-care liabilities raise the gigantic

question: Who will pay these bills? In such an environment, companies aren’t going to invest and households aren’t going to spend. ” *rse about….again ….. “Our economy is very sick, and its appointed doctors haven’t found a cure. It’s time for new doctors with new medicine. ” … I’ll say, and you’re not one of them!

Ah well… the BBC will be left smarting over that interview in more ways than one, apparently…

From the Telegraph:

“How a man who has never been authorised by the Financial Services Authority and has no discernible history working for a City institution ended up being interviewed by the BBC remains a mystery.”

http://goo.gl/CwFQP

Although what he expressed a minute into the interview is still, as you put it, in line with FIRE sector “values”, he may not actually hold any real professional position in that sector at all.

Job sharing would not be so bad idea. For our planet’s sake we need to work&consume less and enjoy leisure time more. But again neoliberals are pushing in the another direction because more people produce more they have to tax and budget deficits go down in their theory.

“are not right-wing, pro-market deregulators.”

Is that now, rather than not?

“Stop paying IOR”

But no mention of stopping paying interest on bonds, which is a much larger amount and genuinely completely pointless.

We’ve got a long way to go…

“dramatically reduce the size of the financial sector, ”

“Official data show that in 1986 the UK’s exports of financial services were £2 billion. In 2008 they were £52.8 billion, implying a compound annual growth rate over 22 years of 16 per cent.

But the £52.8 billion figure does not allow for a range of ancillary activities, such as the legal, accounting and information technology back-up required by the financial products of the modern world. In recent years the “City cluster” – with the ancillary activities included – has probably accounted for exports of £70 billion a year or more, roughly equivalent to 5 per cent of our national product and almost a fifth of our total exports of goods and services.

http://standpointmag.co.uk/node/3827/full

Hi Bill,

If Britain unilaterally increased government spending without “financing” it by selling bonds would you agree that the effect on the pound would be to weaken it against foreign currencies? Would the result of that not be a large increase in inflation due to the rising cost of imports? Or do you think the benefits of the weaker pound in making British exports more competitive would help the economy more?

Isn’t the most reliable way forward for the US, EU and UK to all increase spending together?

Also, do you think financial institutions and their “people” are using neo-liberal dogma to create a volatile economy they can profit on? As in, they know they’re going to cause national economies to suffer but intend to capitalise on it?

All the best,

Alex

Balls’ main job is, of course, as a politician, and much of his script is driven by the political climate rather than economic one (as it was in the past).

The background to his speech was a classic what I believe is called “framing the argument”. Such is the neo-liberal capture of the media that his speech was trailed (and this may have been punted by Labour’s PR as much as the media) as an attempt by Labour to “restore it’s economic credibility”. This framing is dominated by the current Tory line that the crisis was solely caused by Labour (and south European) profligacy. The fact that this line has little to do with reality does not change the problem that Labour has.

Balls tried to finesse some of this by apologising for some failures – but not the crucial (neo-liberal) ones. And it is the crucial ones that are the most important, because they are the same policies being followed by the Tories, and ones which they supported when in opposition. Repudiating them should set Labour free.

However, the government=household metaphor is a powerful one with the public that is hard to shift.

This trader may know and I would think you do too, Bill, is that Jesse Livermore did exactly what the trader has dreamed of doing and says anyone can do. Whether “anyone” can do what Livermore did and this trader is doing is another matter. That there are people who pray for recessions is undoubtedly true. The solution is to make profting from them more difficult, which is what was done in Livermore’s time and eventually led to his suicide – the work he loved to do he couldn’t do any more, life had become boring.

“marasme” = “miasma”?

@gastro geroge

I’m with you on that, Balls (indeed the whole of the Labour party) is desparate to be seen as ‘responsible’ with respect to the economy and have pasted themselves into the neo-liberal corner which, if Bill is right, they never left!

Alas that means that British populace at large gets only one ‘view’ of whats wrong and how to put it right. The ‘view’ is compounded by a rabidly Conservative press (some notable exceptions).

If I didn’t fear for my job, my economic well being and the general welfare of all British Citizens it would be hysterically funny. Ain’t nobody laughing…

Dear Neil Wilson (at 2011/09/28 at 16:21)

Thanks. Fixed now.

best wishes

bill

Dear larry (at 2011/09/28 at 20:04)

I was using the French spelling (as I recall it).

best wishes

bill

Further to ”

Alex says:

Wednesday, September 28, 2011 at 19:04 ”

I personally can’t see how ending the selling of bonds to “finance” spending would cause the pound to devalue anymore than it would if that spending was “financed” by selling bonds. This may just be because I am quite new to MMT and need a bit more info on the matter.

The problem most people seem to have when I have talked about MMT is inflation and currency devaluation. I can find info on the inflation issue but I’m struggling to find anything definitive about MMT and currency devaluation – if anyone can point me in the right direction I would greatly appreciate it.

Another great blog by the way!

The above trader represents what a lot of traders/investors are saying – that the end is nigh. In this respect they are not representative of Jesse Livermore, who believed in the madness of crowds and made it a rule to never take advice.

“would you agree that the effect on the pound would be to weaken it against foreign currencies?”

You may get a short term speculative dip as people who think like you bet against it, but very shortly after that the real economy would assert itself. That is primarily because people don’t understand what you’re doing and chase what they believe rather than reality.

If you state clearly that you are removing funds from foreign currency hoarders and spending it directly into the economy, and you signal that well ahead of time then it is very likely that the currency will move up.

Which is what happened to Sterling during its period of QE, which if you recall is nothing more than swapping lots of bonds for lots of bank reserves at slightly different interest rates.

One of the problems with economics and economic commentators is that they have a very linear view of causality. Their knowledge of system dynamics is very primitive. As even Wikipedia points out “even seemingly simple systems display baffling nonlinearity”.

John T Harvey does Post Keynesian research in this area and he says the relationship is ‘complicated’.

So you just have to prepare policies to handle the floating system. You need to build up buffer stocks in vital imports so you can smooth any sudden changes in the exchange rate and give time for the substitutions to happen.

@Neil T

Quite. It’s always difficult with politicians to determine what they really think, and what is political posturing, but I think the record of the last Labour Government shows that they have no real understanding of the problem and how to get out of it. If Balls is moving in the correct direction, it’s only by a very small step.

What depresses me most is the state of UK journalism (I can’t comment about elsewhere). You would be hard pushed to find any journalist who has thought to ask Osborne, when he blames Labour for the crisis, “but you supported the same policies, and continue to follow them now”. This even extends to the BBC (maybe I shouldn’t say even) where intelligent commentators like Stephanie Flanders and Paul Mason are trapped by debt-mania. Maybe I shouldn’t even say intelligent, but at least Paul is prepared to talk to ordinary people, and not just insiders.

Bill,

Thanks for analysis of Balls statement – it appears English voters have TINA again for the next election. Will have to rely on the Scots SNP to show what differences can be made as for example on tuition fees, NHS prescriptions etc. Only hope is for the rest of UK to question why we not receiving same. Labour have uphill struggle to regain credibility hence the fluff statements.

Alex,

Re selling bonds, it is impossible to say what the effect is until you know what govt is trying to do. Funding govt spending by bond sales is probably stimulatory if interest rates stay constant. But if interest rates rise enough at the same time, there is no stimulatory effect. If govt REDUCES interest rates, the effect is even more stimulation.

So if the relevant govt were simply trying to fund spending from borrowing rather than tax, and intended leaving everything else constant, aggregate demand in particular, it would sell bonds and raise interest rates. Net result: no rise in AD and no deterioration in the balance of payments. One side effect would be to draw “hot money” in from abroad to buy those bonds, which would boost the value of the pound, not, as you suggested, reduce its value.

Re “is the most reliable way for different countries to act together”, the answer is yes. Whether it’s interest rate changes, changes in bank regulations or anything else, any country which goes it alone tends to pay a price.

I bet someone disagrees with some of that!

One of the reasons that the US and the UK are able to run current account deficits is that overseas countries desire to hold UK and US financial assets.

It will be more difficult to finance any CAD if there are fewer government issued financial assets?

gastro george,

“This even extends to the BBC (maybe I shouldn’t say even) where intelligent commentators like Stephanie Flanders and Paul Mason are trapped by debt-mania.”

I think Stehanie is well aware of MMT, and occassionally drops subtle hints. Being a journalist for the BBC though, she cannot mention things directly unless a politician, “respected think tank” etc mentions it otherwise she is accused of bias, or of pushing a specific agenda. I think if a politician were to mention this openly in a speach, she’s probably be relieved that she can now talk about it.

I definitely know she is well aware, but I can’t tell if she agrees with MMT per se.