I started my undergraduate studies in economics in the late 1970s after starting out as…

Sometimes compromise is the worst thing

I guess I had to write something about the “compromise” aka cave-in yesterday in the US capital. You can only conclude that the US President wanted this agenda and needed a smokescreen (mad Republicans) to put it in place. There is a lot of evidence that Obama wanted to attack pension and medical entitlements. Now he can. Not for long though – he is a one-term president in the making. When you put all the elements together sometimes compromise is the worst thing.

This picture seems to have been used by various commentators and conservative advocates as representing the sentiment of the US people. They wanted their politicians to compromise and save America from bankruptcy. The problem is that such representations only reinforce the mis-information that is driving the entire “debt debate”.

My answers to the questions are: No, America is not Greece because it maintained sovereignty over its currency and thus can use fiscal policy at all times to advance public purpose. Second, compromise is usually a good strategy but that doesn’t hold in this case.

The US Bureau of Economic Analysis recently released (July 29, 2011) the Advance Estimate of the National Income and Product Accounts data for the second quarter 2011.

They found that:

Real gross domestic product — the output of goods and services produced by labor and property located in the United States — increased at an annual rate of 1.3 percent in the second quarter of 2011, (that is, from the first quarter to the second quarter)

That is not sufficient to reduce the unemployment levels and indicates that the US recovery is stalling.

More recent data confirms that. Yesterday (August 1, 2011), JP Morgan released their latest Global Manufacturing PMI (Purchasing Managers Index) and concluded that the:

Growth of global manufacturing sector moves closer to stagnation.

The analysis said that the “(g)rowth of production slowed to a near standstill, as levels of incoming new business declined slightly for the first time in over two years”.

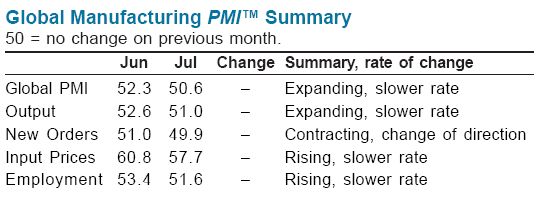

This graph shows the recent evolution of the Global Manufacturing PMI. The way the PMI – which is a diffusion index – works is as follows. A survey asks respondents to indicate whether there is an improvement in a measure (P1 = percentage indicating that), no change (P2 is the percentage indicating that) and deterioration (P3 is the relevant percentage).

The PMI then is calculated as P1 + 0.5*P2

So if all the respondents said the measure had improved then the PMI would be 100 per cent and if all the respondents indicated a deterioration the index would be zero. A PMI of 50.0 means that the optimists exactly offset the pessimists and the measure is deemed to be unchanged.

More telling was the more detailed breakdown of the Global Manufacturing PMI which is captured in the following graphic. The key point is that both existing activity is slowing and marginal activity (New Orders) is contracting. When new orders decline and undesired inventories start to build up firms start to layoff workers and the downturn accelerates as the multiplier effects of the reduced income reverberate throughout the economy.

Also yesterday, the The Institute for Supply Management released their July Manufacturing ISM Report On Business which they have been doing since 1948. They survey “400 purchasing managers in the manufacturing sector on five different fields, namely, production level, new orders from customers, speed of supplier deliveries, inventories and employment level” and assemble a diffusion index for each field.

The Institute for Supply Management (ISM), is the largest supply management organisation in the world.

The ISM said that:

The PMI registered 50.9 percent, a decrease of 4.4 percentage points, indicating expansion in the manufacturing sector for the 24th consecutive month, although at a slower rate of growth than in June. Production and employment also showed continued growth in July, but at slower rates than in June. The New Orders Index registered 49.2 percent, indicating contraction for the first time since June of 2009, when it registered 48.9 percent. The rate of increase in prices slowed for the third consecutive month, dropping 9 percentage points in July to 59 percent. In the last three months combined, the Prices Index has declined by 26.5 percentage points, dropping from 85.5 percent in April to 59 percent in July.

So the picture is emerging – the expansion largely the result of fiscal stimulus support has ended and the manufacturing sector is slowing. More worrying is the fact that new orders are contracting and price deflation is emerging (a sure sign that demand is weakening).

The US respondents were reported as saying: “Europe weak, U.S. soft, Asia strong”. However, the JP Morgan global results (compiled from a number of different PMI sources) indicated that China has now started to slow. Therefore how long Asia will remain strong is uncertain.

And then I thought about the unemployment situation in the US. Some say I am obsessed with unemployment. I agree – I see it as the worst economic evil that capitalism delivers to the workers – the deprivation of even the chance to be exploited.

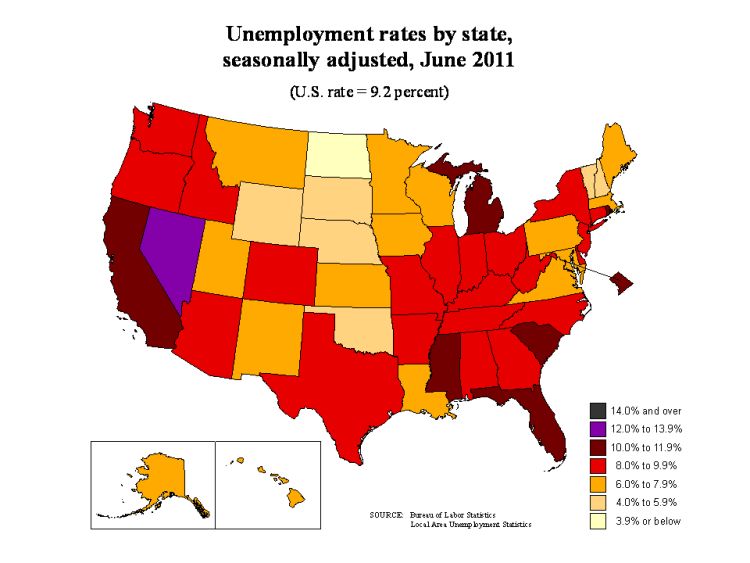

While we talk about the US national unemployment rate being 9.2 per cent that is an average and hides considerable regional disparities. The following map is produced by the US Bureau of Labor Statistics and shows unemployment rates by state as at June 2011.

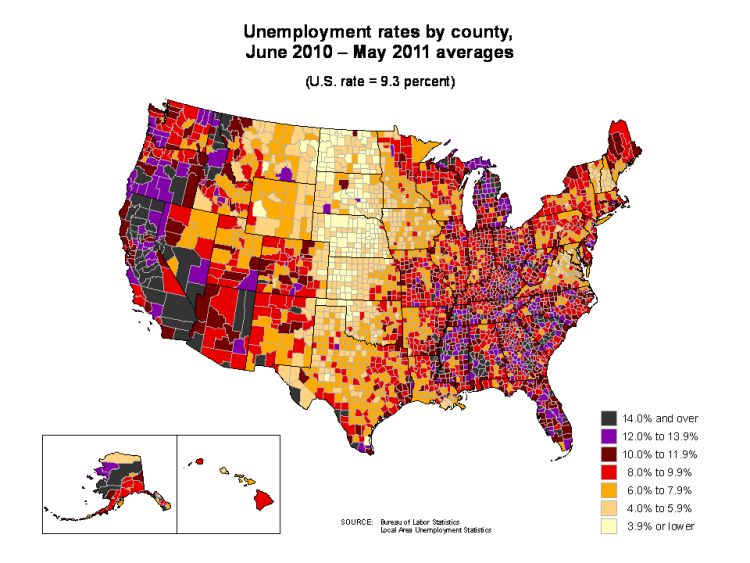

To drill down into the “average” even further the next map shows the situation by county (averaged for June 2010 to May 2011) when the national unemployment rate was 9.3 per cent. You can see that many areas of California have rates of unemployment over 14 per cent and many areas in the East hover between 12 and 13.9 per cent (as do many counties in California).

The daily loss of output and income that this level of joblessness generates is enormous not to mention the social breakdown that accompanies long-term unemployment.

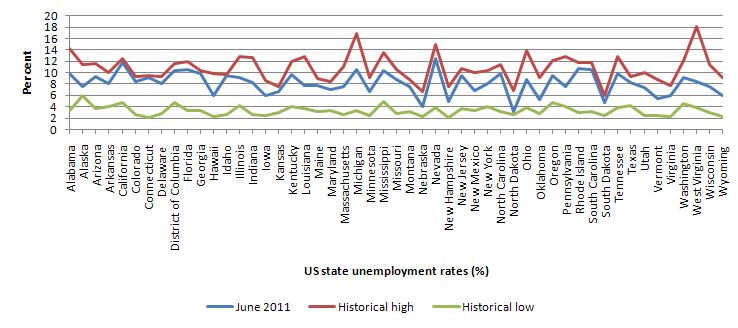

To put the maps into historical perspective, the following graph is taken from US Bureau of Labor Statistics data and shows the June 2011 state unemployment rates in relation to their historical lows (green) and historical highs (red). The history extends from when this particular data series began in January 1976.

In most cases, the local economies are performing around their worst despite a recovery that has been in progress for nearly 2 years.

Question: if you were in charge of this economy and you already had nearly 10 per cent unemployment and 44 per cent of the unemployed were long-term and you saw that a key sector was now in the process of contracting would you consider a “compromise” that will cut spending and reduce economic activity in the coming months to be a demonstration of responsible leadership?

Answer: Only a one-term President who lacked empathy for his people would sign such a “compromise” when clear alternatives were available that would render the conservative attack on fiscal policy futile.

What is it about macroeconomic fundamentals that the US President and the 279 House of Representative member who voted yes for debt ceiling “compromise” understand? Answer: very little it seems. Didn’t their advisors bring to their attention the latest PMI data or have large unemployment maps posted on the walls of the White House and the Capitol building?

And then you read this Sydney Morning Herald commentary (August 2, 2011) from its “international editor” – The magic credit card brings US to its knees. Why do international editors who mainly comment on politics think they can offer wisdom about macroeconomics and when they do so they wheel out Reinhart and Rogoff as credible testimony?

The writer’s overall perspective is that the years of “American exceptionalism – the idea that the normal rules of national conduct do not apply” are over “because exceptionalism tempted the country into grave misjudgments” and that “this is a good thing”.

Whatever we think of Americans it is not a good thing when their government turns on its own people by withholding essential fiscal support and pushing more into unemployment and poverty.

I agree with the writer that the military aggression of the US – its “manifest destiny” – has not only damaged other nations and killed millions of innocent people but it has also damaged the US in the eyes of the world and certainly hasn’t made us all safer.

The writer tries to link this aggression to unsustainable fiscal policy decisions. I don’t support the US government outlaying billions on its military to invade other nations but if they were not to spend the dollars equipping murderers (its army) then they would have to be spending it elsewhere – on schools, hospitals, jobs, public infrastructure, renewable energy etc.

A debate about the composition of US federal spending is not the same as a debate about the level of fiscal support the US government should provide its economy. At present, the latter is inadequate as evidenced by the persistently high unemployment (see above).

Hartcher (the writer) claims in relation to Iraq:

The war to date has cost American taxpayers at least $US800 billion ($727 billion) on a narrow definition, and $US3 trillion ($2.7 trillion) on the broad definition used by the Democrat economist Joseph Stiglitz. It has cost more than 4000 US soldiers their lives and the country a great deal of national credibility. Intended to demonstrate the scope of US power, it illuminated its limits.

It hasn’t “cost” the taxpayers a cent in the sense that taxpayers do not fund government spending. Please read my blog – Taxpayers do not fund anything – for more discussion on this point.

All the costs have to measured in real goods and services deployed (which includes the lives of its soldiers). I don’t mean to demean the actual people by using economics jargon like (real goods and services) to describe labour input. It has also cost the nations that the US invaded much more in real terms.

But while we might bemoan the waste of real resources none of this has any relevance to the financial capacity of the US federal government to prosecute such mis-adventures. In other words, there has been no financial crisis arising from the American folly in Iraq.

The real resources were purchased by a government which issues the currency as a monopolist. Such a government can always purchase available resources which are for sale the currency they issue. The crisis, in my view, was how they used those real resources. And that debate is not about fiscal policy. The fiscal reality is that the purchases added to aggregate demand and provided stimulus to growth.

Hartcher claims the:

The second great indulgence was the vast financial bubble that seemed to be the best of times. But it was, in fact, laying the basis for the global economic crisis of 2009.

I agree with this but this is not about public debt and certainly not about the need for “smaller” government. In fact, the conservative forces that are pushing for a reduction in government economic influence now were the same lobbyists who undermined the oversight of the government on the financial sector and allowed the Wall Street criminals to wreak havoc.

Further, with the external deficit that America enjoys, the only way the private sector will reduce its high debt levels is if the government sector runs deficits to support growth and income generation.

Hartcher then blames the Bush administration for not running bringing the deficit into check. He actually quotes – disapprovingly – the then Vice President who said that:

… deficits don’t matter.

Which was the only thing that Cheney probably ever said that was sensible. Deficits per se do not matter. You have to calibrate the size of public net spending with the other things that are going on in the economy. There is never any sense that can be made from saying that the deficit is high or low.

In relation to what? Is a deficit that is 10 per cent of GDP bad and one that is 1 per cent of GDP good? Is a surplus good and a deficit bad? You cannot make any statements like that. It depends on the state of the economy and the interplay of the sectoral balances which are the manifestations of the myriad of private spending and saving decisions that are made each day.

In some cases a deficit that is 10 per cent of GDP will be a demonstration of policy excellence and in other cases it will be outright madness.

Hartcher then provides some arithmetic:

Before Bush, Bill Clinton had managed to bring down two surplus budgets. When Bush and Cheney took power, the federal government had outstanding debts of $US5.6 trillion ($5.1 trillion). When they left eight years later, the debts were $US10 trillion.

Today, after a recession has eroded revenues and stimulus outlays have increased spending, the debt is $US14.3 trillion. That is about 99 per cent of GDP – above the tipping point, where the interest starts to snowball the debt into an ever-growing liability.

I love arithmetic. Note that he quotes a ratio then proceeds to make a conclusion about a level (interest payments). But at any rate, there is no snowballing of interest payments when the public debt ratio goes beyond 100 per cent of GDP.

For a given nominal GDP growth rate and a constant long-term bond yield rate there is no explosion in interest payments at higher public debt ratios. The flow is higher but they grow at a constant rate across all public debt ratios.

He then quotes the publisher of Grant’s Interest Rate Observer (they charge heaps for their articles):

We have the seeming gift of our ability to pay our bills in this currency that we alone can print … This gift is, in fact, a great detriment. It’s no help to us that we have this magic credit card.

Which just tells you that you would not want to subscribe to the Magazine.

All nations that issue their own currency have the “seeming gift of our ability to pay our bills in this currency that we alone can print”. Hartcher thinks this makes America special. The reality is that the US is no more special in this regard than the smallest nation on the planet that issues its own currency. For example, South Sudan – the newest nation is planning to issue its own currency.

Further, that gift can never be a detrimental factor as long as governments use it to pursue public purpose – full employment and price stability and equity.

What is of “no help” is when the US government puts the “gift” away and pretends that it lost it. Which is what happened overnight with the “compromise”.

The article peters out into claims that China is getting sick of funding the US government and various other commentators have declared the US dollar undesirable etc.

Conclusion

Compromise is usually a good thing – when the outcome advances the welfare of the negotiating parties and/or the welfare of those that are depending on the negotiators.

Compromise when the third parties are damaged by the wilful egos of the negotiators – which is the case of the US “deal” is not a good thing.

I agreed with Paul Krugman’s (pre-vote) assessment of the “deal” – The President Surrenders. He said:

A deal to raise the federal debt ceiling is in the works. If it goes through, many commentators will declare that disaster was avoided. But they will be wrong.

For the deal itself, given the available information, is a disaster, and not just for President Obama and his party. It will damage an already depressed economy; it will probably make America’s long-run deficit problem worse, not better; and most important, by demonstrating that raw extortion works and carries no political cost, it will take America a long way down the road to banana-republic status.

When US politicians claim that America is great the whole world is now laughing at them.

That is enough for today!

Anyone who is not an optimist on the economy certainly hasn’t been watching CNBC.

By the way, if this debt deal is so great, why did the long bond fall so much yesterday as the deal was going through the house? A little over a week ago the thiry year was 4.3, it closed yesterday at 4.08. It seems someone sees things a little different than these popular tee vee news (not) people.

Even UK news, which usually treats most things American with due seriousness doesn’t quite believe what is happening over there. Obama may well go down in history as one of the worst presidents of the past 100 years competing with Warren G. Harding for this piece of opprobrium. Unfortunately, it is uncertain whether Obama will be a one time president. That he might not is a scary thought.

Maybe Obama’s smarter than we think

http://www.blackagendareport.com/obama-fake-debt-ceiling-crisis_smarter-than-you

Perhaps the United States will get lucking and the Republicans will accidentally nominate a closet Keynesian and maybe the U.S. will discover easily accessible oil reserves under 2/3s the country…

As bad as Obama has been on this, the alternative is worse. There’s no way Congress would have let him have a larger stimulus earlier. And even Democrats are obsessed with debt reduction. Let’s be real, the far right wants to cause chaos to get a black man out of the White House.

Again, Obama has seemed lost on this issue. But he’s really hemmed in.

The difference between Obama and Bush is that I think Bush would be a good bloke to have a beer with and shoot pool. However both are shocking examples of what democracy can throw up. But these things are relative. Obama doesn’t have to be better than Lincoln, he just has to be perceived as being better than mentally impaired people like Bachman or Palin or whatever else the Republicans can find.

Max,

God, don’t make me defend these people but Obama, Romney and Huntsman are not incompetent or dolts. Yes, Palin and Bachmann are insane but they are not viable.

Isn’t this like every other country where they are limited by politics and the caprices of voters?

Obama has done a lot of good. But I agree has been spineless throughout the debt ceiling debate. On the other hand, the President doesn’t propose budgets. It’s not realistic to expect him to draw up his own plans. And whatever he proposed would be used against him.

Bill,

Thank you for yet another offering that logically diagnoses our economic condition. I really appreciate the distinctions you draw between your own preferences stemming from value judgements and the policy actions that derive from your analysis and theoretical framework. That discipline further validates your approach, and stands in stark contrast to the implicit value judgements, hidden assumptions, and logical contradictions that are tangled like a rats’ nest within the conventional wisdom of the New Dark Ages.

Anyway, I appreciate your diligence and persistence, as I think all of your readers do, and am astounded by your output on this forum.

I miss George W. He was an honest hypocrite.

Adam, Obama is not spineless. He zapped Osama and is very energetic at crucial moments: he tried many times to force through his “grand” $4 trillion fiscal final solution, which even Boehner ran away from. Obama completely buys into a Wall Street-centric worldview, neoliberalism, and down-home neo-Reaganomic rhetoric for use when explaining the profound and miraculous similarities between a family budget and the federal budget, with illustrations by Norman Rockwell. I think the link kindly provided by castr is excellent on this.

Obama was the prime mover behind the scenes of the recent extended fake “default crisis” that never actually existed but that properly terrified most Americans and scared them into pious belief. Obama has consistently been a deficit hawk. Right after he was inaugurated, in the middle of the great recession, he told reporters his plan was to reduce the deficit by 50%!!! Is this out of Herbert Hoover and Andrew Mellon or what? In 2009 Obama rejected a large stimulus. Then, instead of demanding a second, he created his “Catfood” Commission that ginned up a bogus “deficit crisis” to replace and erase the unemployment crisis. And this April in a big speech he called for a $4 trillion austerity program and claimed that FDR was not(sic) wrong(!) about making big budget cuts in 1937 that almost destroyed the recovery before FDR increased deficit spending again. Obama truly believes in Hooverism. No kidding. And now he has persevered in giving the Republicans chance after chance to come up with an austerity program big and savage enough to satisfy the Republican T-bones and himself. He probably hopes to reach the full $4 trillion with the Star Chamber-like secret super-committee that will virtually usurp all congressional debate on the budget for the next few years and, figuratively at least, receive real-time telepromting and teleconferenceing input from Wall Street and the IMF. This super-committee to control austerity enforcement is a coup d’etat waiting to be accurately named. The US is in the same fix as Greece now, though it shouldn’t be.

As for the Republicans being the ones blocking more deficit spending, that’s doubtful. Business is very worried about the downturn, and many conservative pundits are seriously worried about the austerity program causing a double dip. If Obama had made a couple of big speeches this spring to the American peple he almost surely could have outflanked the Republicans and gotten at least some stimulus to restart the recovery. At very worst, he could have shown up the Republicans as job-killers and made jobs-creation and protecting Medicare the center of Campaign 2012. But that’s not Obama’s goal. And now he’s undercut almost all Democratic candidates running on progressive programs next year — all their opponents will have to do is quote Obama. Let’s hope he’s a one-term president as Bill has predicted. Bill’s predictions have a high success rate, so I have the audacity to hope.

Another step towards the friendly fascism. If the US is fully acquired by corporate interests, it will be difficult to overturn. There will be some hungry entrepreneurs but I don’t think they can assemble sufficient strength. We could be seeing American feudalism lasting centuries. How sad.

@GLH, If the yield on bonds has fallen from 4.3% to 4.08%, that implies an increased market value for bonds ~ a lower yield is a higher market price for a fixed face value debt instrument traded on secondary markets.

Even if the funds were actually “borrowed”, given the full economic returns on policies such as shifting our transport system off of imported oil, a long bond rate of 4.08% would be a time to make those investments.

Bill, Thank you very much for this blog. I learned a lot about my own country from it! I’d like to ask one question, if I may. You mention that, moral questions aside, military spending is a form of deficit spending that increases aggregate demand and that military spending is not simply a drag on the economy as many Democrats argue in the US. Is this basically your point? I feel that some Democratic-leaning commentators in the US put too much emphasis on the simple slashing of military spending, and they thereby tend to slight the overwhelming role played by deficit-related outlays and revenue shortfalls in the content of the current deficit. In much US public discussion of both unemployment (which is underemphasized) and the deficit, glamorous, simple cuts in military spending (instead of shifts from military to other forms of public spending) often short-circuit a full discussion of unemployment and economic recovery. For example, Dean Baker recently wrote a piece carried by HuffPost in which he pointed out that almost 80% of the final 2009 deficit figures for the US given by the CBO were deficit-related. Many comments from progressive readers, however, expressed strong skepticism, and some accused him of outright lying or ignorance, often claiming that the Bush tax cuts and overseas wars were the main causes of the deficit. I think this reaction was caused by the tendency of the current Democratic leadership to studiously avoid talking seriously about unemployment and stimulus and to talk mainly about costs left behind by Bush as well as (unnecessary) cuts in highly visible “entitlements” such as Medicare and Social Security which actually add little or nothing to the deficit, though medical costs do need to be contained in the near future.

To help me understand the interrelation between military spending and overall recession costs and deficit spending, especially deficit spending on unemployment-reduction, which of your blogs do you suggest? Thank you very much!

BTW, I think you are very right that the austerity of Obama and the Republicans is economic madness, but their real goals are elsewhere. The Republicans use “fiscal responsibility” as a smoke screen for deconstructing the government, for lowering taxes, and for deregulating, while Obama seems to think like an IMF banker (Geithner) and sees Mainstreet USA as a basically third-world economy to be disciplined and groomed for secure wealth-extraction by elite banks and corporations, who will fund his reelection and allow him to win by outspending his opponents. Unemployment does not seem to be not a major consideration for Obama. He probably agrees with Greenspan that too much employment would should be avoided because it would cause inflation.

I couldn’t have said it better myself. Thank you Bill!!! My wife is Australian (born and raised in Sydney) and I am American. We currently live in the US, but do eventually plan to take up shop in Oz. I love Australia and my only hope is that it doesn’t fall into the tryannical trap that seems to be leeching off of all the 1st world nations….I see your blog and the work you do as a direct resistance to such a thing happening and I love it!!! Keep on man and maybe I’ll join you in AU soon enough!!! Cheers

“Obama has done a lot of good.”

Could you cite an example, Adam? Any example?

We ended up with a continuation of W\’s wars. We ended up with \”Health Care Reform\” that originally sprang from the loins of the heritage Foundation. The economy isn\’t recovering and nothing has been done to improve the plight of the unemployed. But at least we\’re now living in a post-partisan world!

Sounds like a failed presidency to me.

Bill,

I want to echo Lee Rosin’s thoughts. You have been one of the few lone voices of sanity in this mess. MMT provides a framework against which fiscal policy decisions can be judged. Mainstream Economics (and by extension economists) have proven to be dismal failures in predicting anything accurately. The further I read about mainstream economic theories, the less they seemed to correspond with reality or how the economy actually worked. And that made no sense.

As an engineer, I use models of physical systems all the time. If my model gave me the wrong results, such as predicting a wing would deflect 1″ up in a load test and instead the wing deflected 2″ down, then its time to scrap the model and figure out why it didn’t work. Instead mainstream economists think “the model is fine, I just need to add another ‘correction factor’ “. They never seem to challenge their own underlying assumptions.

That is what I like about MMT. It challenged all the assumptions from the ground up and is rigorously consistent will real-world accounting. And it is imperative that economics and accounting be linked and consistent.

I thank you for all of your detailed posts explaining how the monetary system actually works, what fiscal policy stances actually make sense within the current environment, and the real constraints of a fiat monetary system. I too am amazed (and grateful) for your tremendous amount of output and dedication.

@ binve – following

Wasabi — couldn’t agree more. What’s more I think it was pretty clear during the election campaign in 2008 that he didn’t really have a solid grasp of economic issues but he had nothing to beat and a clear public desire for an alternative …but the alternative turned out to be a more articulate version of George W Bush. The difference between Bush and Obama is that Bush would probably never make it as a TV news reader. Obama looks good in a suit and speaks well and can read an autocue. This seems to be the main criteria nowadays for becoming a successful politician (in many countries).

Mario,

Sorry to tell you, the political narrative in Australia is roughly the same as the US and UK. I can’t think of any sane country as a haven right now.

Venezuela? Cuba?…….anyone?

The problem is that even if Obama minted a $2 trillion coin or agreed with MMT and appointed Bill as head of the Fed the financial powers have it within their power to destroy the value of the currency through just the public expectation of hyper-inflation (which the population – no the world – have been brainwashed into believing).

It appears to me that there is a presently an intentional, managed decline of the western economies, but to what end?

Thanks for the blog, Bill. Very interesting.

.

I’m confused about something though. Krugman says :

.

Ok, because of the nature of the deal it’s surely bad news, I suppose. However, if the debt ceiling has been raised then that implies raised aggregate spending….which is what MMT recommends, yes? It’s certainly a better result than immediate cuts and no rise in the ceiling, isn’t it?

.

Plus there’s been no tax-rises yet – another positive from MMT perspective, no? Considering the political climate in USA I don’t see that Obama could have got much more. I mean, MMT simply isn’t in the main debate is it, so what to expect?

So, it isn’t perfect, but it’s better than anything the right were suggesting? Or am I missing something?

“It appears to me that there is a presently an intentional, managed decline of the western economies, but to what end?” by Alex

I can’t shake this feeling either and the only thing I can come up with is… so that the finite resources (oil) can be hoarded by those who have hoarded all the money. Who cares about retarding growth when we may soon not be able to grow.

This all depends on a belief in peak oil, etc. of course.

@Alex

I don’t think this intentional. I agree with Bruce Webb in his assessment that the current ruling plutocracy seems incapable of even running capitalism for their own benefit. The historical assumption about capitalists (starting in the 18th century) is that they must accumulate capital. Which means they must not only impose austerity on the working class but also on themselves. Karl Marx on the subject:

Are they doing this? Nope. They instead loot the system through bailouts and high-end tax cuts. Very short-sighted. To be fair Marx also spoke of “a Faustian conflict between the passion for accumulation, and the desire for enjoyment.” My take: today’s capitalists are losers.

The problem is that even if Obama minted a $2 trillion coin or agreed with MMT and appointed Bill as head of the Fed the financial powers have it within their power to destroy the value of the currency through just the public expectation of hyper-inflation (which the population – no the world – have been brainwashed into believing). How? The paper tiger “financial powers” do not have this power, otherwise they would not so diligently subvert the state. When people still struggle to pay their credit cards, mortgages, rent, insurance and taxes, they will forget yesterday’s hyperinflation hysteria.

@Skeptic, Alex

I think we are heading towards a future where the growth that elites have become accustomed to will diminish. Perhaps they recognise this at some level; certainly the US and UK governments are anticipating an imminent global oil/liquids peak, but the public remains largely in the dark, and there are few signs that the necessary restructuring of our economies are taking place at the level of urgency that is required.

At any rate, as the surplus diminishes I would expect the elites to become more rapacious in order to maintain their share of a shrinking pie. The trend towards police state activity in many western countries appears to suggest that preparations are being made for the increased social disorder that may result.

Very interesting and worrying thoughts – you know you’re in trouble when the answer you hope is right is that they’re all incompetent!

It all just seems a little too co-ordinated to me…