I started my undergraduate studies in economics in the late 1970s after starting out as…

How many more experiments do we need

Everything is Greek today in the financial press. The number of commentators who are concluding that Greece has to exit the Eurozone are increasing. It is obvious and it is only the obsessive desire of the Euro bosses to preserve the interests of a few banks at the expense of the welfare of millions that is keeping the EMU together at present. If they stepped outside their mainstream straitjacket for a moment they would see that the ECB could guarantee all French and German bank assets at the stroke of a pen. This mainstream blindness comes out in all sorts of ways. The problem is that social science of which economics is a branch (yes I am in that school rather than placing economics in “business”) – suffers in relation to the other sciences because it is hard to pin down things given the lack of controlled environments. With human behaviour essentially shifting the mainstream economists can get away with all sorts of lies and deceptions most of the time because it is too hard to prove otherwise. But sophisticated analysis is really not necessary. Over the last two decades we have had some real-life experiments going on before our very eyes that allow us to see through the cant that is mainstream theory. How many more experiments do we need before my professional colleagues are totally discredited?

Paul Krugman recently gave a paper – Mr. Keynes and the Moderns – which is dated June 18, 2011 and was prepared for the Cambridge Conference commemorating the 75th anniversary of the publication of The General Theory of Employment, Interest, and Money.

In that paper he paraphrases Keynes as saying that:

… this misguided notion derives its plausibility from its superficial resemblance to the accounting identity which says that total spending must equal total income.

He is referring to the mainstream view that “if people do not spend their money in one way they will spend it in another” which lies at the heart of the mainstream view that spending imbalances (between consumption and investment) in relation to aggregate supply will always correct themselves and therefore fiscal intervention is unnecessary.

In that paper Krugman refers to a February 2009 article by Chicago academic John Cochrane – Fiscal Stimulus, Fiscal Inflation, or Fiscal Fallacies?

Cochrane is the AQR Capital Management Distinguished Service Professor of Finance (formerly the Myron S. Scholes Professor of Finance) at the University of Chicago and describes himself as being an “authority on finance, macroeconomics, and monetary economics”.

I wondered why the title of his chair changed from the “Myron S. Scholes Professor of Finance”. Given the skill demonstrated by Scholes I think the association was apt. Scholes decided academic life was not sufficient and was a joint founder of the failed hedge fund Long-Term Capital Management, which lost over $US4.6 billion dollars in 1998 and collapsed in 2000. The company was also been found to have been involved in tax avoidance schemes. This Finding and Opinion from the United States District Court, District of Connecticut is hilarious.

LTCM had claimed $US100 million in losses as part of its dealings with the US Inland Revenue Service (IRS). The court disallowed the claim and were less than complementary with regards to the veracity of Scholes’ evidence. Among other negative findings about Scholes the Court found that:

Scholes’ allocation rational appears more likely a contrivance to show expected profitability and objective economic substance than a serious economic analysis … Scholes’ illogical insistence … [his evidence] … does not square with his contemporaneous statement to his partners … Scholes proffered the dubious explanation … [etc … many more instances]

There are also hilarious quotes from an E-mail his wife wrote and the fact that Scholes claimed he wasn;t an expert on tax law despite tendered evidnece that he had written a book on tax law.

Anyway I digress – just reflecting on a great American corporate hero.

Cochrane’s article is aimed at declaring fiscal stimulus packages ineffective but inflationary. He defines “fiscal stimulus” as:

… the proposition that by borrowing money and spending it, the government can raise the overall state of the economy, raising output and lowering unemployment.

Modern Monetary Theory (MMT) would not use that terminology. The borrowing and the spending are quite different functions in the monetary system even though the way the institutional structures have been set up in the advanced nations they look to be in some way causally related.

Government borrowing is just swapping previous government spending which is accumulated in financial assets somewhere (that is, saving) for another asset (a government bond) which is really just an elaborate interest bearing (risk-free) bank account.

Government spending is not dependent on this financial transaction and the borrowing doesn’t reduce the capacity of the private sector to spend in its own right as is assumed by the mainstream macroeconomics textbooks.

Cochrane then says:

One form of “fiscal stimulus” clearly can increase aggregate demand. If the government prints up money and drops it from helicopters, this action counts as fiscal stimulus, since the money counts as a transfer payment. In practice, our Treasury would borrow the money, and use it for tax rebates, subsidies, bailouts, or any of the many ways that our government sends people checks. Then the Federal Reserve would buy up the debt with newly created money. The result is the same: A trillion dollars more money in private hands, just as if it had been printed and dropped by helicopters. People naturally don’t want to sit on a trillion dollars of extra cash. They spend it, first creating demand for goods and services, and ultimately inflation.

This is perhaps the only prediction that is utterly uncontroversial among economists.

Given his Chicago affiliation it is no surprise that he chooses to use the “helicopter” terminology which was coined by Milton Friedman. It is not a very accurate depiction of the way governments spend. As I have noted previously, governments do not “print money”. They credit bank accounts (or do the same thing by issuing cheques).

But even if the government did drop dollar notes from a helicopter it would have the same impact as the electronic equivalent. The “fiscal expansion” clearly adds to the net financial assets in the non-government sector (by creating bank deposits) and increase net non-government worth. The way in which these deposits might arise could vary but the end result will be the same.

As noted above, if the government borrowed from the non-government sector (that is, borrowed back its past spending) there would be no fundamental difference to the previous situation. All that would be occurring is a financial asset swap and the non-government bond holder has no more net worth than before they purchased the bond.

The point is that Cochrane is correct in denoting a “helicopter” type action as a fiscal policy initiative and increases net worth. Monetary type operations – like quantitative easing or open market operations (selling and buying bonds) do not change the net worth of the non-government sector.

Where we depart is in the claim that such fiscal operations will be inflationary. They might be if carried beyond the level dictated by the initial logic to expand the economy – that is, there is excess capacity and idle labour that can be brought back into productive use at the current set of wages and prices.

There is nothing “ultimately” about it. To be simple, assume the output gap in nominal terms is $100 billion and the government manages to get $100 billion into the hands of the non-government sector (even if it was just a per head cash transfer). This will not likely stimulate inflation because once saving is taking into account the extra spending will be less than required to close the output gap.

The first accounting identity (referring back to Krugman’s reference to Keynes above) that Cochrane falls foul of is the MV = PY statement which is the famous Quantity Theory of Money. Here M is the stock of money, V is the velocity of circulation (or the times that M turns over per period), P is the price level and Y is real GDP. The relationship just says that total spending (MV) has to be equal to nominal GDP (real GDP times the price level) as a matter of accounting.

But as a behavioural theory linking M to P (which is what the mainstream attempts to use this relationship for) you need to add some assumptions. The assumptions they make are that V is constant (which it clearly isn’t in empirical terms) and the Y is always at full employment. The latter assumption is clearly comical.

Once you assume away all the interesting things about the economy (that is, the business cycle – by assuming full employment always) then it is trivial that if M rises so will P. But if Y is below full employment then extra spending can clearly stimulate the real side of the economy without increasing prices. The vast array of evidence over many years supports the notion that increases in aggregate spending when the economy is below full employment stimulate real output and only if aggregate demand is pushed beyond the real capacity of the economy do price pressures build (excluding supply-induced inflationary episodes).

Cochrane eschews this approach to stimulus thoughe:

The inflation that will result from a trillion dollars of money permanently dropped on the economy, and the real economic dislocation of such a major inflation, is frightful to contemplate.

Again confusing an accounting statement with a behavioural outcome but this is just the standard line – and if we were to poll macroeconomics students in any university who had been taught in a conventional manner they would predict inflation arising from a fiscal stimulus which was not accompanied by a commensurate sale of bonds to the private sector.

Cochrane then considers the impact of a:

… “fiscal stimulus” in which the government borrows money and spends it, but with the clear plan that the debt will eventually be repaid with future taxes, not just by printing money.

He concludes that such a stimulus will not work. Why?

In trying to be erudite, Cochrane then makes an extraordinary error:

Most fiscal stimulus arguments are based on fallacies, because they ignore three basic facts.

First, if money is not going to be printed, it has to come from somewhere. If the government borrows a dollar from you, that is a dollar that you do not spend, or that you do not lend to a company to spend on new investment. Every dollar of increased government spending must correspond to one less dollar of private spending. Jobs created by stimulus spending are offset by jobs lost from the decline in private spending. We can build roads instead of factories, but fiscal stimulus can’t help us to build more of both. This form of “crowding out” is just accounting, and doesn’t rest on any perceptions or behavioral assumptions.

Second, investment is “spending” every bit as much as is consumption. Keynesian fiscal stimulus advocates want money spent on consumption, not saved. They evaluate past stimulus programs by whether people who got stimulus money spent it on consumption goods rather than save it. But the economy overall does not care if you buy a car, or if you lend money to a company that buys a forklift.

Third, people must ignore the fact that the government will raise future taxes to pay back the debt. If you know your taxes will go up in the future, the right thing to do with a stimulus check is to buy government bonds so you can pay those higher taxes. Now the net effect of fiscal stimulus is exactly zero, except to raise future tax distortions. The classic arguments for fiscal stimulus presume that the government can systematically fool people.

Krugman’s paper addresses this first “fallacy” and says that “(t)hat’s precisely the position Keynes attributed to classical economists … “the notion that if people do not spend their money in one way they will spend it in another”.

Another accounting confusion from a professor of finance (Cochrane).

What is fixed here? According to Cochrane it is total saving. If that is finite and one entity (government) draws on it then another entity (business) cannot enjoy it via borrowing itself to fund investment or selling things to consumers who would spend it.

Cochrane’s perception is of a loanable funds market which is independent of income levels. The original conception of the loanable funds model was designed to explain how aggregate demand could never fall short of aggregate supply because interest rate adjustments would always bring investment and saving into equality.

At the heart of this erroneous hypothesis is a flawed viewed of financial markets. The so-called loanable funds market is constructed by the mainstream economists as serving to mediate saving and investment via interest rate variations.

This is pre-Keynesian thinking and was a central part of the so-called classical model where perfectly flexible prices delivered self-adjusting, market-clearing aggregate markets at all times. If consumption fell, then saving would rise and this would not lead to an oversupply of goods because investment (capital goods production) would rise in proportion with saving. So while the composition of output might change (workers would be shifted between the consumption goods sector to the capital goods sector), a full employment equilibrium was always maintained as long as price flexibility was not impeded. The interest rate became the vehicle to mediate saving and investment to ensure that there was never any gluts.

Thus saving (supply of funds) is conceived of as a positive function of the real interest rate because rising rates increase the opportunity cost of current consumption and thus encourage saving. Investment (demand for funds) declines with the interest rate because the costs of funds to invest in (houses, factories, equipment etc) rises.

Changes in the interest rate thus create continuous equilibrium such that aggregate demand always equals aggregate supply and the composition of final demand (between consumption and investment) changes as interest rates adjust.

According to this theory, if there is a rising budget deficit then there is increased demand is placed on the scarce savings (via the alleged need to borrow by the government) and this pushes interest rates to “clear” the loanable funds market. This chokes off investment spending.

So allegedly, when the government borrows to “finance” its budget deficit, it crowds out private borrowers who are trying to finance investment.

The mainstream economists conceive of this as the government reducing national saving (by running a budget deficit) and pushing up interest rates which damage private investment.

This trilogy of blogs will help you understand this if you are new to my blog – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3.

The basic flaws in the mainstream story are that governments just borrow back the net financial assets that they create when they spend. Its a wash! It is true that the private sector might wish to spread these financial assets across different portfolios. But then the implication is that the private spending component of total demand will rise and there will be a reduced need for net public spending.

Further, they assume that savings are finite and the government spending is financially constrained which means it has to seek “funding” in order to progress their fiscal plans. But government spending by stimulating income also stimulates saving.

Additionally, credit-worthy private borrowers can usually access credit from the banking system. Banks lend independent of their reserve position so government debt issuance does not impede this liquidity creation.

Krugman’s paper concludes that:

… a rise in desired spending will normally translate into a rise in income.

And rising income increases saving.

So once again the mainstream view expressed by Cochrane relies on assuming rigidities that do not exist in reality. The falsehoods then permeate the whole body of mainstream macroeconomic theory – from banking, to investment theory, to consumer behaviour, to government deficits etc. It all becomes erroneous because of the way the problem is first set up.

As to Cochrane’s second basic fact – that “investment” is spending “as much as is consumption” – so what? There is no bias in fiscal design to cash handouts. Sometimes they can be preferable (especially if a quick spending response is required from the private sector) but stimulus packages can also dovetail into national infrastructure planning and stimulate investment. Either way, the goal is to increase economic activity and how that is done – by consumption or investment is a question for consideration. I don’t see this as a “basic fallacy” among those who advocate fiscal expansion.

Cochrane’s third basic fallacy was that those who advocate fiscal expansion “must ignore the fact that the government will raise future taxes to pay back the debt”. No they don’t. They just understand history a bit better than Cochrane. When have taxes been raised by any government to “pay back the debt”. Taxes might be increased at any time to reduce private spending capacity. But the reality is that in most situations governments do not pay back their debt. Which is not to say they do not honour their obligations at the maturity date of a particular debt instrument.

We are talking in macroeconomic terms here rather than focusing on individual bond maturity. The evidence is clear that fiscal stimulus exerts a positive effect on private spending and fiscal austerity forces private households and firms to increase saving.

Cochrane is just rehearsing the standard mainstream notion that is referred to as “Ricardian Equivalence”. The idea is simple and wrong. Consumers and firms are allegedly so terrified of higher future tax burdens (needed, the argument goes, to pay off those massive deficits) that they increase saving now to ensure they can meet their future tax obligations. So increased government spending is met by reductions in private spending-stalemate. But, neoliberals argue, if governments announce austerity measures, private spending will increase because of the collective relief that future tax obligations will be lower and economic growth will return.

Funny how private sector confidence is falling the UK as the government embarks on its austerity push. After one year of austerity – and two austerity budgets – we should be seeing private sector confidence and spending rising by now. Why is consumer confidence low in Ireland given it has been pursuing austerity since early 2009?

For a detailed treatment of these issues please read the following blogs – Will we really pay higher taxes? and Will we really pay higher interest rates?.

The notion of Ricardian Equivalence goes back to David Ricardo’s C19th discussion as to whether households (more generally the private sector) considered government debt as part of their net wealth. Ricardo argued that they might not because they would also factor in that they would eventually have to pay it back via higher taxes.

This idea was revived in 1974 by Robert Barro who added some mathematics to the idea and if they face “perfect capital markets and infinite horizons” will accurately anticipate all future taxes and discount the debt holdings as wealth.

According to this view, if the government runs a deficit (tax cuts and/or spending increases) to stimulate the economy and the non-government sector, anticipating that over the lifetime of the agents within this sector taxes will have to rise to exactly pay the deficit back (manifested as the public debt), start saving now. The net effect is that there is no stimulus.

What Barro and Cochrane imply is that the government does “our work” for us. It spends on our behalf and raises money (taxes) to pay for the spending. When the budget is in deficit (government spending exceeds taxation) it has to “finance” the gap, which Cochrane claims is really an implicit commitment to raise taxes in the future to repay the debt (principal and interest).

Under these conditions, it is alleged that current taxation has equivalent impacts on consumers’ sense of wealth as expected future taxes. So the government spending has no real effect on output and employment irrespective of whether it is “tax-financed” or “debt-financed”. That is the Barro version of Ricardian Equivalence which Cochrane is rehearsing.

To repeat earlier material, Ricardian Equivalence can be attacked on two fronts: (a) theoretical; and (b) empirical.

On a theoretical level, the theory imposes highly restrictive assumptions which have to hold in entirety for the logical conclusion Barro makes to follow? Even without questioning whether his reasoning is a sensible depiction of the basic operations of a modern monetary system, we can examine the plausibility of the assumptions.

Should any of these assumptions not hold (at any point in time), then his model cannot generate the predictions and any assertions one might make based on this work are groundless – meagre ideological statements.

The assumptions that have to hold are: First, capital markets have to be “perfect” (remember those Chicago assumptions) which means that any household can borrow or save as much as they require at all times at a fixed rate which is the same for all households/individuals at any particular date. So totally equal access to finance for all.

Clearly this assumption does not hold across all individuals and time periods. Households have liquidity constraints and cannot borrow or invest whatever and whenever they desire. People who play around with these models show that if there are liquidity constraints then people are likely to spend more when there are tax cuts even if they know taxes will be higher in the future (assumed).

Second, the future time path of government spending is known and fixed. Households/individuals know this with perfect foresight. This assumption is clearly without any real-world correspondence. We do not have perfect foresight and we do not know what the government in 10 years time is going to spend to the last dollar (even if we knew what political flavour that government might be).

Third, there is infinite concern for the future generations. This point is crucial because even in the mainstream model the tax rises might come at some very distant time (even next century). There is no optimal prediction that can be derived from their models that tells us when the debt will be repaid. They introduce various stylised – read: arbitrary – time periods when debt is repaid in full but these are not derived in any way from the internal logic of the model nor are they ground in any empirical reality. Just ad hoc impositions.

So the tax increases in the future (remember I am just playing along with their claim that taxes will rise to pay back debt) may be paid back by someone 5 or 6 generations ahead of me. Is it realistic to assume I won’t just enjoy the increased consumption that the tax cuts now will bring (or increased government spending) and leave it to those hundreds or even thousands of years ahead to “pay for”.

Certainly our conduct towards the natural environment is not suggestive of a particular concern for the future generations other than our children and their children.

If we wrote out the equations underpinning Ricardian Equivalence models and started to alter the assumptions to reflect more real world facts then we would not get the stark results that Barro and his Co derived. In that sense, we would not consider the framework to be reliable or very useful.

Ricardian Equivalence also fails at the empirical level – that is, it doesn’t stack up with the facts. Even when Barro first attacked the 1981 US tax cuts the theory failed to predict anything useful or actual. At that time, the proponents of the theory predicted there would be no change in consumption and saving should have risen to “pay for the future tax burden” which was implied by the rise in public debt at the time.

What happened? If you examine the US data you will see categorically that the personal saving rate fell between 1982-84 (from 7.5 per cent in 1981 to an average of 5.7 per cent in 1982-84).

In other words, Ricardian Equivalence models got it exactly wrong. There was no predictive capacity irrespective of the problem with the assumptions.

Please read my blog – How are the laboratory rats going? – for more discussion on this point.

Not to be daunted the mainstream academics wheel this myth out whenever the topic of fiscal stimulus is raised. The empirical reality at present also doesn’t accord with their theory.

Some simple facts

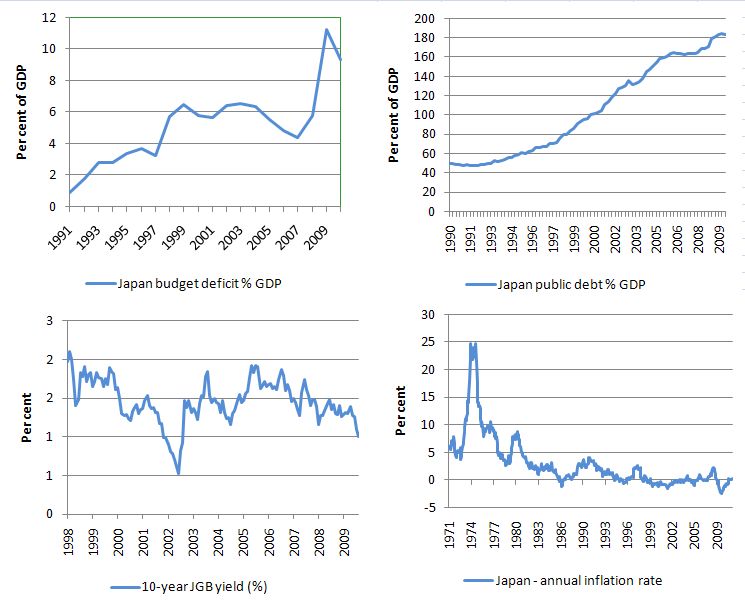

International inflation data is available from the RBA while other data is available from the Japan Statistics Bureau. US data is available from the US Office of Management and Budget.

I used to put an earlier version of this graph up for my advanced macroeconomics students and asked them to explain what might be going on. It clearly runs counter to mainstream predictions from Cochrane and his ilk.

How could a mainstream economist explain the coincidence of outcomes depicted here? Rising budget deficits and rising public debt ratios with falling interest rates and inflation are totally contrary outcomes to those predicted by the sort of models that Cochrane deals with.

It is worth noting that the graphs depict outcomes which are totally consistent with the central predictions of MMT.

To disabuse you of the notion that Japan is a special case which is a common line of defence by mainstream economists we can consider the US.

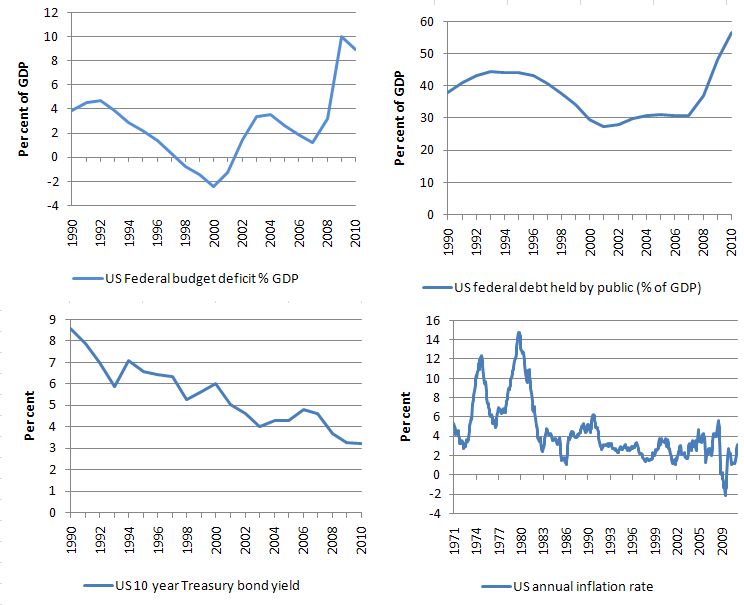

The US is among many new laboratories that have opened up during the current crisis. In his Cambridge paper, Paul Krugman noted in relation to the US that:

Well, we’ve has as close to a controlled experiment as you ever get in macroeconomics …

He was referring to the US and provided some graphical evidence relating US federal debt and bond yields.

The following graph provides the same four depictions as the Japanese graph above. While the trends are less obvious in the US it is clear that rising budget deficits and public debt ratios do not push up interest rates and inflation. Again, quite the opposite has been the case.

The reason is that the mechanisms that the mainstream invoke to explain their predictions are simply not applicable to the real world. They belong in stylised models that have no relation to the economy we live in.

Digression

I note that one commentator quoted from a Monetarist blog along the lines that low interest rates are not a cure because:

… by curing one symptom of the problem (insufficient spending) … [they] … will make the underlying cause worse. Low interest rates encourage borrowers to borrow more; they also encourage lenders to lend less. It is not at all obvious that low interest rates will cause gross debt to increase further.

MMT does not advocate low interest rate as a counter-stabilisation policy strategy. The preferred option is to eliminate monetary policy from any counter-stabilisation duties at all – by setting interest rates low and constant. The implication is that all cyclical adjustment has to be done by fiscal policy in liaison with a Job Guarantee.

It is not clear that interest rate adjustments have much impact on aggregate demand anyway. The distributional consequences of such a policy change are uncertain and under some conditions an interest rate rise might actually increase demand and inflation. Monetary policy is also incapable of regional and demographic targetting and is indirect in its impact which makes it difficult to monitor in a timely way. The tendency for central banks is to push rates up for too long and once they realise the impact is negative it is generally too late. The point is that with such uncertainty and a lack of appropriate and timely monitoring, MMT does not consider monetary policy to be an effective and reliable tool to fine-tune aggregate demand.

Conclusion

I am cursing volcanic ash at the moment and have run out of blog time.

That is enough for today!

The middle of that Paul Krugman paper starts talking about the liquidity trap conditions and appears similar to the sort of argument Richard Koo keeps making. Krugman’s complaint against MMT seems to be something to do with what he calls the ‘limits of seigniorage’ .

Which suggests that they believe that there will be a point where everything will return to ‘normal’ and their normal models will start working again.

Where are they going wrong in their view points?

I have been confused by this juxtaposition before, so I should ask about it:

“Thus saving (supply of funds) is conceived of as a positive function of the real interest rate because rising rates increase the opportunity cost of current consumption and thus encourage saving. Investment (demand for funds) declines with the interest rate because the costs of funds to invest in (houses, factories, equipment etc) rises.”

I think I get the first point – higher interest rates reward saving and discourage consumption. But I can’t make sense of the second sentence. Even gramar-wise, I can’t parse “the costs of funds to invest in… rises”. Too many plurals in there. But no matter how I interpret it, I don’t get how lower interest rates make the cost of funding *anything* higher.

Dale,

It’s missing the words ‘investment goods’ or ‘assets’. Arguably the brackets are superfluous.

Investment is essentially seen as borrowing (or at the least running down of savings). The general idea is that as interest rates rise in aggregate less money will be borrowed and spent on investment goods (houses, factories, etc).

So savings is a line sloping upward from left to right on a graph and Investment is a line sloping downward on the graph and where the cross is the ‘equilibrium’ between them.

It’s a beguiling idea, but wrong in an economy with a dynamic amount of credit money available.

Some of you may be interested in what Bill Gross @ Pimco has to say regarding Ricardo, and the government as employer of last resort. http://www.pimco.com/EN/Insights/Pages/School-Daze-Good-Old-Golden-Rule-Days.aspx

Niel,

I’m no expert, but I read that ‘limits of seigniorage’ formlation as a fear of currency revulsion. Like the MV=PY model Bill dissects above, the neo-classical model has no space between a mild uptick in inflation, hyper-inflation and currency revulsion, each but a progressing phase of the apocalypse. With FAITH in this model, the last four years has been a perfect horror as all the preconditions for hyper-inflation and revulsion in the model have been met (sites like this link serve ministry to this myth :http://gonzalolira.blogspot.com/) and like Harold Camping they want to get into Monatarist Heaven when the Rapture happens.

Koo and Krugman seem to recognize that most of humanity, most of the time has lived in this impossible purgatory and that the end just might not be nigh, but the prestige that ties them to their professional affiliations won’t let them confront this honestly. To admit this vast space we all inhabit into their world view would be to open huge doors to their left for which it is their position to be gate keepers.

Dale and Neil,

The wording is awkward, as I think Bill short-cutted (speaking of awkward wording!) the ‘quantity of funding demanded’ phrase in the parenthesis and could have included “rises in” the interest rate to clarify the reasoning for the negative slope. Recalling that firms’ marginal efficiency of investment schedules are the intraperiod driver of this partial equilibrium logic, it is easier to envision the relationship by just saying that more investment projects will clear feasibility hurdles and require funding given lower rates (which are necessarily nominal, intraperiod). I think Bill was thinking of moving backward, to the left, up the curve… as he phrased the sentence.

But Neil, I think you are stepping across an important point–maybe ‘the point’ of Krugman’s commentary on Keynes’ refutation of the classicists–with your comment:

“It’s a beguiling idea, but wrong in an economy with a dynamic amount of credit money available.”

That intraperiod, marginal efficiency of investment, micro-grounded partial equilibrium analysis is fine as far as it goes, but the Keynesian point is that its logic is fraught with fallacies of composition if applied in a macro-context. What you stepped over is that the IS curve in the neo-classical synthesis is a representation of a multitude of the ‘equilibriums’ you noted at all of the potential national income levels (the Ys) within the relevant range of analysis for the period. I think you are correct in recognizing credit money availability is a factor in nudging that stack of potential investment equilibriums to the right, with end of period reconciliations at higher Ys, but C also matters (whether nudged by credit money or otherwise) to the Ys, and of course G… and they can both matter, intraperiod, to I. It’s not over until it’s over, and then the sectoral identities hold for that analyzed instant, and then we “get up, and do it again”. (H/T to J. Browne’s “Pretender”)

Neil: “Where are they going wrong in their view points?”

Presumes IGBC.

A question I’ve been searching for and cannot find an answer to – where do new euros come from? The eurozone lacks a central treasury to spend money into existence. So where does the euro come from? Are all new euros solely the product of lending by private banks and conversions of foreign currency into euros? Are there any other sources?

Slightly off-topic. According to the IMF Spanish workers have it too easy and that is the cause of their 20+% unemployment! Structural reforms are needed! (I know from your book this is a sore point with you Bill!)

Spain needs bolder job market reforms, IMF warns

12:34 EST Tuesday, Jun 21, 2011

(from Toronto Globe and Mail)

FRANKFURT – Spain, which has so far avoided a debt crisis like the one afflicting several smaller euro zone countries, was urged Tuesday by the International Monetary Fund to press ahead with more job-market reforms aimed at cutting its unemployment rate of 20.7 per cent.

The central government also needs to crack down on spending by local governments to maintain its progress in reducing the budget deficit, the IMF said.

“The policy response to Spain’s economic challenges over the last year has been strong and wide-ranging, helping strengthen market confidence,” the IMF said in its review of Spain’s economy released Tuesday.

But it warned that “downside risks dominate” the outlook and that “a bold strengthening of reforms is needed to substantially reduce unemployment.”

Spain has struggled with the aftermath of a collapsed real-estate boom but has avoided being drawn into a financial crisis like the one afflicting Greece, Ireland and Portugal. Its economy turned in modest growth of 0.3 per cent in the first quarter from the quarter before, and it has less debt than the troubled three, measured against the size of its economy.

But Spain remains plagued by high unemployment and social discontent about tough reforms. If bond markets were to turn sour on the government’s prospects, it would mean a substantial worsening of Europe’s debt crisis because Spain is too big to be bailed out the way the three smaller euro zone countries have been rescued.

The government cut its deficit to 9.2 per cent of economic output last year, better than expected, and is on its way to a 6-per-cent deficit for this year. But the IMF warned that the central government must overperform because half of the regional governments lagged behind their targets in cutting spending.

It praised Prime Minister Jose Luis Rodriguez Zapatero’s efforts last year to reduce unemployment by making it easier and cheaper for employers to hire and fire workers. The reforms included giving firms more flexibility to opt out of collective wage agreements.

But the IMF says much more is needed and that reform should “err on the side of boldness.”

It urged the government to decentralize collective bargaining to the individual company level; move away from indexing wages to inflation; and cut severance payments to at least EU average levels. Restrictions on dismissing established workers have made companies wary of hiring people, especially younger workers entering the job force.

Walter, Euros are created by the European Central Bank same way as US dollars (at least in the form of vertical money) are created by the Fed. However, the way in which Euros get to Euro countries is a bit of a laugh. See here:

http://blogs.reuters.com/great-debate/2009/07/28/europe-borrows-from-peter-to-lend-to-peter/

Tom and Neil,

Yes, it appears to me that stipulating a GBC transforms a bunch of elective policy options (e.g. G bond issuance, deficit vs. surplus offsets over long run of business cycles, wage adjustments to resolve unemployment, G debt to GDP limits) into compulsions of RBC (and to a lesser degree, Neo-Keynesian) models.

Sifting through the “limits of seigniorage” critique, I can discern two themes:

1) Exercise of MMT spending mechanics will antagonize the currency confidence fairies, with uncontrollable exchange rate overshoot (beyond production generating/unemployment curing devaluation phases)…thereby instigating cost-push inflation and store-of-value uncertainties.

2) Seigniorage eliminates funding frictions that now stall or kill fiscal policy initiatives. Because policy transmission mechanisms (for fiscal policy) are especially politicized and porked (and suffer from implementation lags, tend to be unfortunately pro-cyclical, are difficult to target only toward regions with weak economic activity, are asymmetrically biased toward tax cuts, etc.), we won’t like the allocative outcomes even if we craft implementation tools that properly slow the spending rate as we arrive at full employment conditions. Better to rely (except– as recognized by the Saltwater guys– under liquidity trap conditions) on conventional monetary policy mechanisms, which are perceived to be more nimble and allocatively neutral.

The first is obviously opinion/belief based and could therefore be valid in markets if wealthholders act on such beliefs, even if better outcomes could be realized with optimized functional finance. The second seems to view fiscal policy primarily through a “project prism” (think shovel-ready bridges to nowhere) rather than as a more comprehensive and systematic implementation of automatic stabilizers that could sustain effective demand, whether for private or public goods and sevices. I know Bill has frequently pointed out that MMT spending procedures can be allocatively neutral (and has been clear in disclosing his preferences –i.e. an employment priority), but it is hard for the logic of that message to penetrate the prevailing rhetoric.

Its appropriate that Krugman would take up Cochrane, at an academic conference on Keynes with no Keynes scholars and no Post-Keynesians, since it seems highly likely that a majority of the audience would share in Cochrane’s fallacies.

Cochrane is just rehearsing the standard mainstream notion that is referred to as “Ricardian Equivalence”. The idea is simple and wrong. Consumers and firms are allegedly so terrified of higher future tax burdens (needed, the argument goes, to pay off those massive deficits) that they increase saving now to ensure they can meet their future tax obligations. So increased government spending is met by reductions in private spending-stalemate. But, neoliberals argue, if governments announce austerity measures, private spending will increase because of the collective relief that future tax obligations will be lower and economic growth will return.

That ‘Ricardian Equivalence’ thing is just retarded. Have they not noticed you pay tax out of current income, and current expenditure, for the current year. Your future tax will look after itself, unless they are predicting that in future governments will be taxing retrospectively??

Also, doesn’t the imposition of compulsory superannuation contributions, at 9% of gross income, totally blow this Ricardian argument out of the water. If we truly were the rational actors this theory supposes us to be, there would be no need to compel us to save for our retirement as we would naturally do it of our own volition, as due to the aging population we would be scared that the governement would be unable to provide for our retirement.

I was positively surprised by Krugmans article, because I could not find anything to criticize. He seems to gone back to neo-keynesian roots. How funny that keynesianism is progressing by regressing. 🙂 He even talks about post-keynesianism in a veiled way, talking about chapter 12:s. Throughout history post-keynesianism has remained quite niche branch of economics, and he is right in the criticism that it has focused overtly on investment decisions. It was only in the 90’s when focus shifted and MMT was developed.

Consensus is seen as critical. “National consensus is a prerequisite for success,” insisted European Council president Herman Van Rompuy after holding talks with Papandreou on Monday.

…and what’s all that noise outside he asked his bodyguard.

Breathtaking.

Excellent article and I agree completely. Just want to say I really enjoy reading this blog.

Real world experience shows that people will not set aside enough money for this year’s taxes, let alone future tax increases. That’s part of the reason why governments the world over force employers to deduct a percentage of the employee’s pay and remit it to the government against the employee’s tax liability for that year.