I started my undergraduate studies in economics in the late 1970s after starting out as…

The “gas now, pay later” myth

Today I was reflecting on a book I read a few weeks ago which has been picked up by progressives and the mainstream alike as a visionary construction of the latest crisis and its remedies. It is so comprehensively wrong that I am amazed celebrated. It reinforces another theme that the mainstream conservatives are increasingly rehearsing in the media and in policy debates – governments have exhausted their options and have to take fiscal austerity measures as the only way to bring their public debt ratios under control. The point is clear – there is very little concrete argument about how the proponents of austerity see growth returning. There is a lot on cutting peoples’ living standards via prolonged unemployment, the retrenchment of pension and health entitlements etc; transferring public assets via privatisations – but not a lot on how austerity promotes growth. Further, the idea that sovereign governments have exhausted their fiscal space is just a total fallacy. They may have exhausted their political space but that is quite a different matter requiring a different solution.

In today’s UK Guardian there was an article – A worldwide financial crisis couldn’t happen again. Could it? – that exemplifies the growing sense I have that policy makers are steering the world economy back into recession.

The article compares the viewpoints of the optimists who “see economies shaking off recession and corporate results improving” with the perspectives of the pessimists who “see a growing debt crisis and a new slump that the world would be powerless to halt”.

The direction of fiscal and monetary policy at present in many countries would suggest that the pessimists will be closer to the mark but for the wrong reasons. Indeed, the very arguments they present as informed economic commentary are the very reasons their predictions are likely to be fulfilled.

So it is case of not understanding the problem and its solution; implementing the opposite policy stance; and making things worse as a result.

The article says that:

The bears are not so sure there are solutions, at least not any obvious ones. They argue that all the rescue remedies enacted in the first phase of this crisis – guarantees and recapitalisation for the banking system, public-sector assumptions of private-sector liabilities – cannot be repeated. In Crisis 2010, there is no obvious candidate to shoulder the burdens that governments took on in 2008 and 2009.

This is the central hypothesis that is around now. You hear it expressed in all sorts of different ways – the government has run out of money; the government has no bullets left in the locker; the government has exhausted etc.

So just as fiscal policy was compromised in the mid-1970s when the OPEC oil price hikes led to rising costs and policy-makers were unable to comprehend that you do not solve a nagative supply shock with a negative demand shock, once again, the debate is being pursued on false premises. A sovereign government quite simply cannot run out of money.

There might be voluntary institutional arrangements in place that force the government to jump through certain hurdles before it can spend but if push-comes-to-shove a sovereign government will always find a way to spend if it needs to.

A sovereign government can purchase anything that is available for sale in any period in the currency of issue.

The book I was reading a few weeks ago (The Origin of Financial Crises) was written by one George Cooper. The Guardian chooses to hold him out as an authority and claims he “argues that Keynesian stimulus – where policymakers seek to stimulate demand to help growth and jobs – was enacted at the wrong time and is now closed off”. They quote Cooper as follows:

We have cocked up the macroeconomic situation big-time … If this is the next leg down – and personally I think it is – the problem we have got is that both safety nets are down. You can’t fiscally stimulate and you can’t cut rates any more. In the near term, we should expect more quantitative easing as a step to the inevitable end game of outright monetisation or printing money.”

My reaction to this statement: almost unbelievable. I have no problems with the conclusion that the fiscal interventions were not managed as well as they might. For a start they were too late and too frugal (which I know is not what Cooper is thinking about). I would have introduced a Job Guarantee immediately to provide an unconditional buffer stock of jobs in every city and region to avoid the rapid rise in unemployment.

I would have spent much more on public works programs particularly with investment aimed at education, health, and (most importantly) renewable energy.

I would have put zero funds into the banking system – instead I would have nationalised any failing banks and recapitalised them under that basis. Please read the following blogs – Operational design arising from modern monetary theory and Asset bubbles and the conduct of banks for further discussion on this issue.

But to conclude that you cannot “fiscally stimulate … any more” is plain nonsense. Sovereign governments have to fiscally stimulate more at present to avoid a return to recession.

The general point that should never be lost is that irrespective of the past fiscal position, a sovereign government can spend what it likes in the current period. There are no financial constraints imposed on a government now who has been running deficits in the past. And … most significantly, past surpluses do not enhance the capacity of the government to spend now.

The only path-dependence worth acknowledging is that a nation that has been deficits in the past, particularly if they have been discretionary, will be more likely to have a growing economy on its hands than a nation that has been running surpluses. Not always but typically.

Further, quantitative easing is not what mainstream economists call outright monetisation. QE merely swaps long-term bonds (or other assets) for bank reserves in the false belief that banks need prior reserves to lend. “Monetisation” is when the central bank buys Treasury bonds and then credits banks accounts to ratify treasury spending.

Please read my blogs – Quantitative easing 101 – for more discussion on this point.

Cooper then went on to claim that we are all in a “Japanese-style scenario where the state buys its own government debt, the private sector deleverages, risk on the taxpayer’s balance-sheet rises and growth is hampered. When authorities print money to create inflation, there is little good news for households”. Specifically:

In aggregate, this all has to be paid for by society as a whole. It’s either going to be paid for by high tax rates or going to be paid for by inflation running ahead of wage growth … What this debt crisis is telling us is growth over the last couple of decades has been artificially elevated by excess debt and we now have to start paying that excess debt back by having a couple of decades of subdued growth.

Hmm, I love it when they talk about a Japanese-style scenario and then get obsessed with inflation. Japan has been struggling with deflation for nearly 2 decades and has the largest public debt ratio around.

There is no inflation threat at present that I can see. Unless demand grows faster than the real capacity of the economy there will be no generalised inflation. The size of the public debt ratio is irrelevant in making this risk assessment.

Please read my blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – for more discussion on this point.

Further, we have to be careful what we call the debt crisis. The private debt build-up, which in part, brought the financial system unstuck is the problem because non-government entities are financially constrained. The only way they can pay down the debt (as a sector) is to resume saving. That means aggregate demand growth falters and unless the spending is replaced by the government sector, recession is the result. That is what got us into this mess.

But the public debt build-up for sovereign nations (that is, excluding currency board nations; EMU economies etc) is not a problem at all and does not reflect the fact that the public contribution to growth has “been elevated for the last couple of decades”.

The increasing public debt ratios just reflect the collapse of private spending and the voluntary and unnecessary institutional arrangements that governments have in place whereby they issue debt $-for-$ to match (but not finance) their net public spending.

Nothing more than that.

In the May 27, 2010 article from The Economist Magazine – A sticky gas-pedal – this mythology is further elaborated on.

We read that “America contemplates yet more fiscal stimulus and leaves the pain for later”. The obvious question is what pain are they talking about?

The only pain that matters relates to the lost income opportunities, the unemployment, the lost housing occupancy, the rising health strains brought on by recession, and all the other pathologies that are well researched in the literature.

This idea that by if you don’t cut back now there will be more pain in the future is the ultimate neo-liberal con job.

The Economist says that:

America’s long-term fiscal challenge is huge, by some measures bigger than that of the euro zone. By 2015, for instance, the IMF reckons America will have a structural deficit (ie, the deficit that would prevail at full employment) of more than 6% of GDP compared to 4% for the euro area.

As you will note in the next section, the IMF has not track record in predicting anything with any accuracy. But moreover what is so special about a 6 per cent structural deficit (per cent of GDP) anyway? Assuming that estimate was accurate that just tells me about the growth in non-government spending. Concentrating on the size of a financial ratio, when applied to a sovereign government is completely missing the point of how the deficits arose in the first place.

Lessons of Argentina

The lessons of Argentina in 2000 have not been learned. Argentina was roped into a currency board with the US in the 1990s which guaranteed peso-convertibility into US dollars. What this effectively meant was that US monetary policy dominated Argentina – it could not set its own interest rates. This was fine for a short-period while the US economy was growing but by 1996, as the US Federal Reserve tightened monetary policy and risk premia on Argentinean debt rose the appreciating currency started to choke trade.

They had relied on an export-led growth strategy (the “IMF model”). As expected, real growth collapsed and unemployment rose dramatically. The automatic stabilisers pushed the budget deficit and public debt ratio up. So we had a strong US economy trying to choke inflation via contractionary monetary policy pushing that policy onto a weakening Argentine economy via the currency board.

The neo-liberals got to work and demanded labour market deregulation, privatisations and fiscal austerity measures to be introduced. The attention was focused, as it is now, on the meaningless public finance ratios. They became the goal of policy rather than being seen as symptoms of deteriorations in the more appropriate policy targets (for example, growth, unemployment etc).

Conservative academics, as now, produced an array of papers with dazzling (to most) mathematical narratives about how the government could restore growth by dramatically cutting the public deficits. They all argued that unless you take action now to reduce the public debt ratio (heavily denominated in foreign currency because of the currency board) then there would be lower growth in the future. Same arguments as now. Mindless repetition of results drawn from economic models that have no application or meaning in a real monetary system.

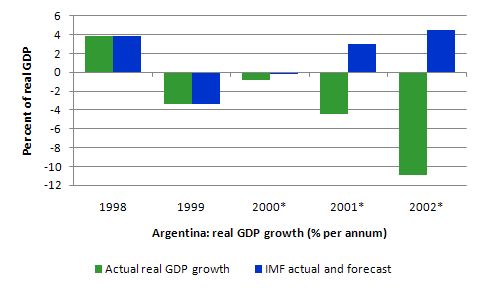

The IMF bullied the Argentine government into introducing a harsh debt reduction plan via fiscal contraction. In their Second Review Under the Stand-By Arrangement and Request for Augmentation released in January 2001. They claimed that there would some modest growth damage in the first year but solid growth would return in 2001 and 2002 (see graph below).

The government was also pushed into introducing a raft of neo-liberal policies such as privatisation, deregulation etc all packaged and promoted as “structural reform”, which is code for reducing the size of the public sector and putting more resources into the hands of private enterprise. The austerity program attacked pension and health care systems – dramatically cutting back the generosity of entitlements, coverage etc.

As a result of the hectoring by international agencies and conservative forces within Argentina, the government introduced a harsh fiscal austerity program in late 2000 under the guise of the “Fiscal Pact of November 2000”. The IMF projections were all favourable – debt reduction, growth, reduction in unemployment etc. The Pact was reinforced with more fiscal lunacy in July 2001 in the form of the Zero Deficit Law. The IMF agreed to provide short-term finance given the private bond markets had push risk premia through the roof.

This graph is taken from the IMF paper on Argentina referred to above and data available from the Argentine Statistical Office. It shows actual real GDP growth from 1998 to 2002 (blue bars) – so what occurred; and the IMF actual and projected real GDP growth in late 2000 (so the observations for 2000 on a projections). The projections were captured in the IMF policy recommendations which pressured the Argentinean government into implementing a harsh fiscal contraction.

So while the IMF were lauding their macroeconomic credential and blackmailing Argentina into taking more loans from them in return for harsh fiscal austerity, the actual economy was behaving nothing like their model projections. In 2001, the IMF predicted that the economy would grow by 3 per cent whereas, in fact, it shrunk by -4.4 per cent. Things became much worse in 2002 – while the IMF was telling everybody that real GDP growth was going to be 4.5 per cent, by the time the austerity policy impacts had played out the real economy had shrunk a further 10.9 per cent. So by 2002, there was a 16 percentage point gap in the forecast and reality – that is huge.

The IMF should have been disbarred from having anything further to do with any economy after that fiasco – which was just one in many devastations there policy advice caused aroudn the world. And they are still playing the same cards.

The reality that followed is well documented. This faulty policy strategy saw demand collapse further and unemployment skyrocket. The harsh decline in conditions ultimately led to a social and economic crisis that could not be resolved while it maintained the currency board. In December 2001, the people rioted.

At this point, the government realised it had to adopt a domestically-oriented growth strategy. As soon as Argentina abandoned the currency board, it met the first conditions for gaining policy independence: its exchange rate was no longer tied to the dollar’s performance; its fiscal policy was no longer held hostage to the quantity of dollars the government could accumulate; and its domestic interest rate came under control of its central bank.

One of the first policy initiatives taken by newly elected President Kirchner was a massive job creation program that guaranteed employment for poor heads of households. Within four months, the Plan Jefes y Jefas de Hogar (Head of Households Plan) had created jobs for 2 million participants which was around 13 per cent of the labour force. This not only helped to quell social unrest by providing income to Argentina’s poorest families, but it also put the economy on the road to recovery.

Conservative estimates of the multiplier effect of the increased spending by Jefes workers are that it added a boost of more than 2.5 per cent of GDP. In addition, the program provided needed services and new public infrastructure that encouraged additional private sector spending. Without the flexibility provided by a sovereign, floating, currency, the government would not have been able to promise such a job guarantee.

The data is instructive. The resumption of growth has been strong and persistent (8.8 per cent in 2003, 9.0 per cent in 2004, 9.2 per cent in 2005, 8.5 per cent in 2006 and 8.7 per cent in 2007). Real wages have also risen modestly over the same period.

Please read my blog – Why pander to the financial markets? – for more discussion on this point.

Reality check

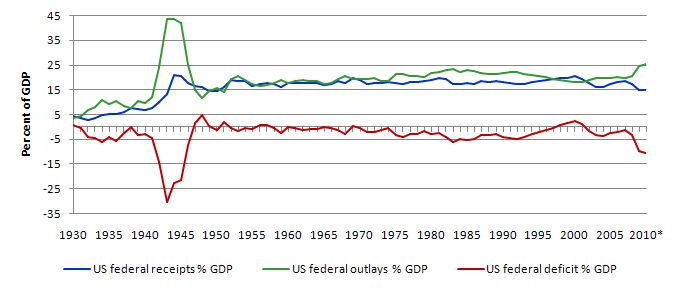

The following graphs are taken from the excellent datasets available from the US Office of Management and Budget and show the federal deficit, outlays and receipts as a percentage of GDP from 1930 to 2010. History is not even being repeated at present. The fiscal expansion was nothing like that which occurred during the prosecution of the Second World War.

The reason the US economy grew again after the War is because they did not try to invoke harsh austerity packages to attack the financial ratios. They managed the transition from war-time policy to peace-time policy via an acceptance of the (by then) Keynesian consensus that growth was dependent on demand and that the public deficit could underpin spending.

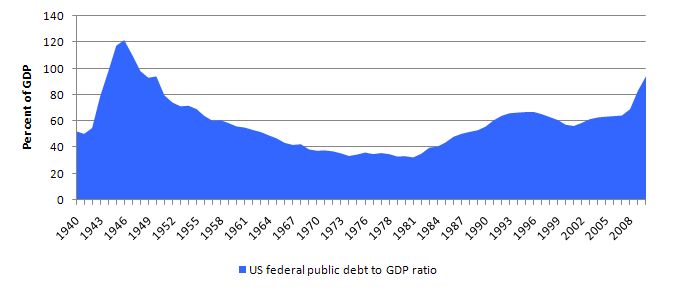

Growth reduced the public deficit as taxation receipts rose and spending could be wound down in an orderly manner relative to the growing size of the economy. Growth also saw the public debt ratio drop significantly It also reduced the public debt ratio drop significantly during the 1940s and into the 1950. There were no oppressive intergenerational burdens to be paid. The early baby boomers in the US and elsewhere enjoyed the growing prosperity of the peacetime 1950s. It was a time of optimism not austerity.

The following graph shows the US public debt ratio from 1940 to 2010. The same story applies.

Some argue that the economies around the world will not be able to sustain the strength of economic growth that emerged after the Second World War. Question: Why not? Answer: No reason – it is just a matter of sustaining aggregate demand within the capacity of the real economy to absorb it. The austerity approach will guarantee that economies will fail to achieve this growth.

Gas now and whenever you need it to avoid paying anytime

On May 28, 2010, the UK Guardian carried a story from Leeds academic Malcolm Sawyer. I have had some interesting academic exchanges with Malcolm over the years – for example, the debate between himself and Randy Wray and me in the Journal of Economic Issues in 2005.

But in this article – David Cameron’s back-to-front economics – the essential point is well made. Sawyer said:

A large budget deficit is a sign that the economy is working well below capacity and that there is insufficient demand in the economy … There is now a clear danger that each country across Europe is attempting to reduce its budget deficit by cutting expenditure. This will have relatively little effect on the actual budget deficit but will both increase unemployment in the country concerned and reduce its demand for the exports of other countries. As their employment and income then decline, their budget deficits will actually get worse because of reduced tax revenue: the worst of both worlds.

So the “gas now, pay later” crowd assume that somehow – out of the austerity – as incomes are cut, pensions reduced, charges increased and unemployment rises – that there will be “a substantial revival of private spending whether on consumption, on investment or from exports, well in excess of anything foreseen at present”

I agree with Sawyer that there is virtually no likelihood of that happening.

The lessons from history are clear. Cutting the gas now will not only increase the burden now but the costs of the lost income and related effects endure for years into the future.

Conclusion

The people in all countries where austerity is being imposed should simply engage in mass revolts in the streets at this stage and overthrow their governments.

That is enough for today!

Hi Bill,

I have been reading your blog for a while now and I appreciate the thought provoking essays. I agree that increased unemployment and a further depressing of demand through austerity campaigns on the part of governments does not seem a good idea right now. I am not trained as an economist so this comment may be a dumb one. I get your message that ” a sovereign government can purchase anything that is available for sale in any period in the currency of issue.” The bit I can’t quite get my head around is what if the problem is that there is not enough available for sale? How does your analysis blend with the view of those in the “limits to growth” camp? I can see you have thought about this because you commented, “I would have spent much more on public works programs particularly with investment aimed at education, health, and (most importantly) renewable energy.” I can’t help feeling this current economic crisis along with the environmental crisis we are seeing in the Gulf of Mexico are two sides of the same coin. We do not have enough fossil based energy left to keep growing in the way we have in the past and this is the true reason for the need for austerity even if some commentators are framing it differently. If we have reached the “limits to growth” then with a growing population there will not be enough “real” stuff for sovereign governments to buy. Or am I off on a tangent?

Another Food for Thought comment about the sources of imperfection. Before I dealt with asymmetry and heterogeneity. Here I deal with disintegration.

Units are composed of integral and fractal parts. A fractal is a rough or fragemented geometric shape of a unit of occurrence that can be split into parts from a whole. Fractals are exhibited as functions that are non- differentiable. Their response/feedback or reaction is based on recursion and exhibited as an iteration process. For more analysis, see B. Mandelbrot(1982, !999) and also the popularization of the concept by Taleb(2005).

The properties of a fractal part/unit is non-smoothness and self-affinity. Non-smoothness implies a shape with a surface that displays “kinks” and “bumps” and self-affinity is a degree of similarity across any reduction/magnification between parts and the whole of a unit. The non-smoothness property generates a sudden and variable pattern of jumps over multiple versions of fractal parts that split the whole unit of occurrence. This means that the jump rate over the shape o the unit follows a pattern whose generation mechanism is vertical and non-uniform whish means non-standard. On the other hand, the self-affinity property allocates a scale invariant shape whose pattern across the unit parts is subject to a power factor of affinity.This pattern does not decay exponentially but as an asymptotic hyperbola (power law) with a Pareto distribution. This allocation mechanism is horizontal and affine which means it is not a normal distribution.

The non-smoothness property of fractal parts raises the disintegration of the whole (which is also non-differentiable) and the self-affinity property of fractal parts decreses the disintegration of the whole. The drive for completion raises self-affinity and reduces non-smoothness. We can assure the stability of the process if we close ths “square” of non nonlinear dialectics of interdependent properties of parts. This requires that an increase in self-affinity decreases non-smoothness and a decrease in non-smoothness increases self-affinity.

At a given level of completion, the unit occurrence has a mix of self-affinity and non-smoothness which corresponds to a degree of disintegration. This implies a shape pattern that is non-uniform (generation) and affine (allocation) for the unit of occurrence and its behavior. This behavior follows an iteration process that is sudden with unanticipated jumps. The disturbance displayed by a unit feedback of recovery and impression is variable and significant. Behavior forms beliefs that are recursive and shift with unexpected intensity. The parameters of unit behavior and feedback variation of occurrence across unit parts exhibit a pattern of iteration and multicollinearity. Furthermore, over the course of trials and horizon(time,space) of occurence they dispay a pattern of volatility and heteroscedasticity. Across units spending habits are scale invariant and over their horizon of spending plans/projects are unstable and subject to bouts of optimism/pessimism. In summary, disintegration is another source of the Keynesian equilibrium stasis.

“Before I dealt with asymmetry and heterogeneity.”

P, can you provide the primary links to these?

thx

Panayotis

I must admit I don’t understand your concept of “Food for Thought”. Most probably this is my fault? My take on your food: Basically you are enumerating the features of an iterative function (system) for constructing fractals. You do this in almost impenetrable wording. My translation: A fractal is a geometric figure with two special properties. First, it is irregular, fractured, fragmented, or loosely connected in appearance. Second, it is self-similar; that is, the figure looks much the same no matter how far away or how close up it is viewed. Such a geometric figure can be derived from simple iterative functions.

Next you mix in some economic terms. In what I would call academic Voodoo manner. My translation: Aggregate Spending/Saving Decisions of human beings might be better modelled through fractal functions. We might for instance introduce a human bias error function. Property 1 of a fractal function reflects the fact that human decisions are at times volatile, unstable and not expected. Property 2 somehow ensures that wherever we look we are still watching our assumed aggregate human being behavior. Conclusion: People behave at times (un)expected but in a consistent manner. This may or may not effect the aggregate demand/supply equilibrium. Did I pass? 😉

Bill,

Is the public/debt ratio graph correct? That looks like total debt/gdp. Since intergovernmental debt is meaningless, total debt/gdp is meaningless.

Stephan,

The purpose of the comment is as the other commnts on imperfection is to discuss the sources of imperfection. It is not a test! These sources each with different properties result in a situation that justifies and AFFECTS the Keynesian equilibrium/disequilibrium concept. It is meant as a discussion that can bring responses that will help my understanding of this topic as my theoretical work is dependent upon it. The fact that you understood most of the current comment on disintegration pleases me. However, you left no comment except critisizing my style of writing and the terminology I use. It is written for my communications with other scientists and I thought of placing it here as I was encouraged by Bill to do so.

Anon,

If you are asking about my previous comments on imperfection look at the blog posts of last week. More elaborate presentation of these sources are in my theoretical work on the general framework of occurence.

Panayotis

YES. I criticize you. For the simple reason to obscure things by language and terminology. I’m not a native English speaker. My main reason for migrating my knowledge gathering from German to English was: German academics are most accomplished in presenting the most banal scientific findings and discussions in wording inaccesible to any but a small circle of official legitimated enlightened academic brothers in arms. I for my part consider this practise as putting up smoke-screens and think it’s worthwhile to expose this academic con job.

Now my understanding is you’re also not a native English speaker? Thus my critic is: instead of considering this as an advantage you obviously seem to aspire to even top other scientists in sophisticated language meandering. Wrong way in my opinion. I’m not a scientist but as far as I can judge your endeavour to further Keynesian modelling by introducing another layer of complexity is a waste of time. Why? Because it does not change the overall conclusion at all. To add further complexity to any model can only be justified on the ground to gain some further insight. Otherwise it adds only noise and confusion. The quants added complexity ad infinitum to their securization models. Result? The models became pure noise.

Let me put it in another way. You acquire new weapons to defend your model against the assault from the neo-liberal enemy. They will then retaliate by coming up with some further sophistication of DSGE or ACE models. This is a complete futile endeavour. For me this is like refining my elliptic geometry theory to weapon up against all this hyperbolic geometry nutheads.

Just my 2 cents! Hope for your understanding!

Julie:

Yes, there is a real economic and resource issues associated with MMT, but I believe the policies that MMT supporters put forth would result in more service employment, as opposed to resource extraction and manufacturing (of which there is a glut). With the exception of some federal departments in the US, most public employment is service oriented (e.g., education, health care). The main resource that is readily available for sale is labor.

The economic impact of employing more people in public services would not result (IMHO) in much significant real resource expenditure. We are talking about people who already live in homes, eat, have clothes, but live under uncertain circumstances. Having a reliable job would improve their lives dramatically and I would expect some portion of their income increase to go to private debt reduction.

Jobs in education use little real resources – we need more people researching and becoming skilled in alternative energy, environmental remediation, better urban planning, public transit, etc. The value received from such expenditures far outweigh the nominal monetary “cost”.

Getting people to use less energy requires public communication and assistance to retrofit and restructure our daily processes. It is a long-term commitment requiring skilled people out in communities – we are currently barely scratching the surface of what is possible.

Also, when people are worried about their economic survival, they tend to ignore long-term (which I agree is becoming more and more short-term) environmental issues – employment stability is also a way for more public political involvement.

Future growth and prosperity is all about the quality in education we give our children. The deficit hawks and the neo-liberals fight nail and tooth to give us a bleak future as possible, shame on them.

It’s wrong to believe that growth is all about manufacturing and hard goods. Service and soft stuff is what the engine of growth is.

All human activity is in its fundamentals about soft values, knowledge. No natural recourses have any economic value without knowledge. Today even more than ever before, more and more of the balance sheet of e.g. Fortune 500 companies balance sheets value is today dominated by knowledge. We produce more and more hard goods with less and less input of both labor and other recourses. If today’s ideas that manufacturing of goods is the real value maker one could thought how the world have been if of such a ideas have prevailed when agriculture was the predominantly value creator and occupied 75% or more of the labor force.

“we should never let the score keeping per se retard the game as long as there are real resources available to engage in productive activities”

Paul Davidson

What is key to your analysis but is not explored is the global background that creates the conditions that force governments into subsidizing private demand with public. Due to declining profits in manufacturing going back decades, itself a due to global manufacturing overcapacity and global uneven development, the expansion of high finance and credit/debt creation needed to supplement declining aggregate incomes for the majority has been combined with government fiscal deficits. However, the attempt is ultimately to maintain the status quo, which will show its weakness as crisis become more frequent.

http://www.japanfocus.org/data/BrennerCrisis.pdf

pebird: “Yes, there is a real economic and resource issues associated with MMT, but I believe the policies that MMT supporters put forth would result in more service employment, as opposed to resource extraction and manufacturing (of which there is a glut). With the exception of some federal departments in the US, most public employment is service oriented (e.g., education, health care). The main resource that is readily available for sale is labor.”

I sense a hidden agenda in the debt/deficit fear mongering. Instead of a service economy, where providing a service to the public yields a livable wage, the fear mongers want a servant economy, where live-in servants provide service to the rich. (To be fair, I think that a lot of them do not have that vision, but believe that unemployment is the means by which wages seek their own level, and if that means indentured servitude, so be it. The Market knows best.)

Stephan,

No this comment was not about Germany and German scholars and any complaints you might have with them. You criticize my terminology and language but you offer no input for the substance of the argument. The point remains that you seem to understand most of what I said and this shows that the message was clear. However, you fail to grasp the main purpose of the comment which is an effort to clarify what imperfection is which is a legitimate concern of many scientists. Furthermore, to provide an analysis of the foundations of the Keynesian concept of equilibrium. If you do not like what you read you always have the right not to read it! There might be others that want to consider alternative ideas. Regarding the taxonomy and terminology of the comment it was designed to explain the concepts in a way that both a layman but also a scientist can understand. You claim that you are not a scientist but you seem to have followed at least some of the argument. This means that my purpose was successful at least in you case. Have a nice evening, I assume you are in Germany!

bill: “there is very little concrete argument about how the proponents of austerity see growth returning.”

You know, I was dismayed and angered by the failure of the U. S. Congress to extend unemployment benefits. Apparently in an election year they are more afraid of spending money than helping the economy. It seems like bailing out the big banks was the best we could do, and we cannot afford to spend anything on millions of people who are out of work through no fault of their own.

But then I realized that it was all part of a secret plan for economic growth. Stopping unemployment benefits will incentivize the lazy bums who have been sponging off of tax payers for almost two years to get off their duffs and go back to work. That will reduce unemployment and lead to economic growth. In addition, those who opt for early retirement, that is, who do not go back to work, will no longer be counted as unemployed in the statistics. As a result, unemployment will drop. Absolutely brilliant!

bill: “There is a lot on cutting peoples’ living standards via prolonged unemployment, the retrenchment of pension and health entitlements etc; transferring public assets via privatisations – but not a lot on how austerity promotes growth.”

No pain, no gain.

Min: another way to put it – there is no bond market, but a bondage market.

Dear Bill,

I am currently living in Argentina, so I hear some of the views of people that experienced this first hand. Most say that the austerity measures are the worst way to go. Your graphs are statistical evidence supporting these words. However, I can’t help to think from my time in this part of the world, the level of inequality, amongst other things had a part to play in the severity and problems of austerity measures.

I do think the MMT is more than likely right but flawed by not taking account of the behavioural elements and particularly in the context of the 3-4 year political cycle of popularly elected democratic governments.

On the positive side I do think that a decent recession brings about some important behavioural changes. For example without negative feedback you get bubbles, hubris and out of control private credit growth. The experience here in Argentina emphasised to the community, the need to live within their means and be more frugal than wasteful, which isn’t a bad thing and of benefit in a recession (as opposed to a depression). Avoiding recessions through pure fiscal stimulus (or 0% interest rates, for the reason following) seems like the “magic pudding” that keeps on giving. Democratically elected governments in 3-4 year election cycles would use the “magic pudding” to get re-elected without concern to the general economic benefits.

I have many more questions I should have to post in the future.

Thanks for your commentary it is very interesting.

Julie Ward: We do not have enough fossil based energy left to keep growing in the way we have in the past and this is the true reason for the need for austerity even if some commentators are framing it differently. If we have reached the “limits to growth” then with a growing population there will not be enough “real” stuff for sovereign governments to buy.

Good question, Julie. I have seen blog posts and comments elsewhere in which the left accuses MMT of promoting a pro-growth model that ignores overuse of real resources. Like you, they are argue that the real problem is energy and that progressives should be focused on energy policy, not ramping up the economy again so it can burn more fossil fuel and waste more resource in the pursuit of growth for its own sake, or, to speak more plainly, for the enrichment of a few at the expense of the rest, including future generations.

My answer has been that it is not an either-or situation. We can have both, and some other things, too. Bill has always observed that economics is about real resources and how to use them most advantageously. While the private sector pursues its own agenda in doing this, government is organized to advance public purpose. A sound economic policy is one that balances employment, price stability, and the investment – public and private – needed to provide for a growing population.

Failing to act not only incurs the loss due to foregone opportunity, but also risks social unrest if conditions deteriorate sufficiently to provoke. Indeed, the legitimacy of the government may ultimately be threatened, as history attests. It doesn’t take a weatherman to see the dark clouds gathering at present.

The problem now is that owing to debt deflation, the public desires to save. Deficit spending being insufficient, aggregate demand is falling off a cliff, resulting in an output gap that entails unemployment and underemployment levels that have not been seen since the Great Depression in the US, for example. Moreover, adopting fiscal austerity while the private sector is still deleveraging during a “balance sheet recession,” as Richard Koo calls this, is a recipe for deflation. Deflation is the real monster of price instability, since it is so difficult to counteract once it takes hold. Needless to say, this is not an environment conducive to investment. And the contagion has gone global.

So, while it is necessary to consider the ramifications of growth with respect to real resources and the environment, allowing or even creating a depression is not the best way to handle this matter. Humanity has to figure out how to support itself on the real resources available and to make better use of those resources through both conservation and innovation.

As a monetary theory, MMT shows what options the modern monetary system makes available, but that is only a part of the solution. Other branches of economics deal with areas like energy. Then, there has to be a broad overview bringing all relevant knowledge to bear on policy-making.

Humanity is still some way from this point. It may take a crisis – and there are several developing – to provide the incentive to get an act together before the curtain comes down. MMT is here to show how money is never the problem for monetarily sovereign governments in a fiat system, since they can always stimulate aggregate demand through deficit spending and target disbursements to generate a flow of funds where it is needed, typically at the bottom where people need to be provisioned and will immediately spend, creating circulation.

I don’t think that one can reasonably argue that MMT recommendations would overstimulate growth at this time, or necessarily set the economy on its previous track. However, the criticism that MMT principles can be used to stimulate the economy back onto it pro-growth track does have some merit and needs to be addressed. My answer would be that MMT is a tool, and like any tool it can be used to produce a variety of results. That is why the people need to be discriminating when choosing policy-makers in elections.

Dear Bill,

Your conclusion in this blog post is the most important contribution you made in it. It is something I have been arguing that it could happen not because we just want it but becuse it has a high probability under the circumstances. This is why I beleive the analysis should incorporate the feedback loops induced by the ethical considerations( fairness of decisions, equity of practices) of policy and the emotional reaction generated in the community. The analysis must be expanded beyond market and private behavior considerations and deal with the incentives generated by civic units or members of the community such as public duty and solidarity. When unfairness and inequity is peceived to intensified civic behavior becomes dominant and battle policies based on private interest and market competition as proposed by mainstream economists. The conflict between the two has a high probability that it will lead in crisis and a regime switch as it happened in Argentina.

Julie Ward: “We do not have enough fossil based energy left to keep growing in the way we have in the past and this is the true reason for the need for austerity even if some commentators are framing it differently. If we have reached the “limits to growth” then with a growing population there will not be enough “real” stuff for sovereign governments to buy.”

Tom Hickey: Good question, Julie. I have seen blog posts and comments elsewhere in which the left accuses MMT of promoting a pro-growth model that ignores overuse of real resources. Like you, they are argue that the real problem is energy and that progressives should be focused on energy policy, not ramping up the economy again so it can burn more fossil fuel and waste more resource in the pursuit of growth for its own sake, or, to speak more plainly, for the enrichment of a few at the expense of the rest, including future generations.

“My answer has been that it is not an either-or situation. We can have both, and some other things, too. Bill has always observed that economics is about real resources and how to use them most advantageously. While the private sector pursues its own agenda in doing this, government is organized to advance public purpose. A sound economic policy is one that balances employment, price stability, and the investment – public and private – needed to provide for a growing population.”

My original interest in economics blogs was over the question of sustainability. That was a couple of years ago, before the financial crisis. It is possible, I think, to have both energy balance and economic growth, but only in a largely service economy, where humans provide value to each other instead of extracting it from the environment. Austerity, it seems to me, hinders the transition to a service economy by relegating non-professional service providers to low incomes and low status. In the U. S. the Dems seem to have bought into the idea that there is not enough money to maintain social programs that would yield a more egalitarian society. MMT punctures that myth.

That is a great post, thanks Professor Mitchell.

You seriously have to attempt to become more influential because it is clearly obvious that there are not enough of like-minded people around at present!

Dear Takis,

I’ve been taking note of your comments but have nothing specific to add at the moment but encouragement. As I have said before, I am in basic agreement with the tack you are taking.

I would like to suggest that you consider substituting another English term for “solidarity,” which does not have clear application in English, as it does, for example, in French. I suspect that many Americans would negatively associate solidarity with socialism owing to its “European” flavor. Perhaps a better choice would be something like “reciprocity,” which has a meaning that both clear to most English speakers and is also neutral to positive in connotation.

More money cannot extract more oil than what is left. The money however can be directed to efforts to find a cleaner energy source. Ultimately it is going to be technology and sustainable consumption that is going to help us sustain the current population needs . Under the MMT framework governments are not constrained in anyway to pursue the advancement of such technologies. Tax cuts/increases , direct funding are just some of the means.

Dear Tom,

Thank you for your encouragement and suggestion. I need to think if there are any differences in meaning between the terms and decide whether reciprocity captures the substance of my concept. I need to make sure that it has no proprietary and shelfish connotation in it so it does not violate my requirements. Otherwise, it is a great suggestion that could save me some trouble! I wished both of them were Greek words since the Greek language uses words that are concept based and this helps the thought process!

pb, I don’t think it is just a matter of how oil is left. The issue is larger than that with respect to petroleum.

What many Neoliberals, Austrians, and TeaParty folks in the US don’t get in their protests against government involvement in the economy (it leads to statism, you know) is that the governing elite made a very conscious decision for government involvement because of the importance of the economy and resource access to “national security.” I suspect that the people protesting government “intrusion” are the same people who want a strong stance toward national security, since I don’t hear then calling for cutting expenditure on the military. They clearly haven’t thought through their position, which is obviously contradictory.

Oil is a vital resource and the US is willing to bring to bear not only its economic clout but also its military might to insure a secure supply of cheap energy. The US is committing huge sums to this, and the Pentagon can in some ways be thought of as the publicly provided protection service for the energy industry. This adds to the externality affecting the price of oil, further separating the nominal price from the true cost.

If Warren Mosler is correct – and I suspect he is, then the West is ceding its power to the Saudi’s who are effectively controlling the price. This is creating an unstable situation, even before the onset of peak oil creates an unsustainable one.

The only way out for the West economically and geopolitically is energy alternative, considering that the externality associated with carbon use (coal, natural gas) is increasing unacceptable as a danger to health and the environment, and a growing threat to ecological sustainability. A comprehensive economic and energy policy is necessary to accomplish this in a timely fashion, which is ASAP.

It is common knowledge that any recovery is likely to be stifled by rising energy costs as the price of petroleum rises, creating cost-push inflation and supply bottlenecks. It is also a drag on the global economy through the geopolitical instability that this dynamic engenders.

So, yes, this is a big deal for a number of reasons that are all converging quickly.

“Some argue that the economies around the world will not be able to sustain the strength of economic growth that emerged after the Second World War. Question: Why not? Answer: No reason – it is just a matter of sustaining aggregate demand within the capacity of the real economy to absorb it. The austerity approach will guarantee that economies will fail to achieve this growth.”

You are dead on right about this. The powerful elites DO NOT want us returning to a world like the 50s & 60s where the poor and middle class started getting ahead. they want to return us to serfdom

ep3, that’s my view, too. I think that the right has wrong about statism=socialism=collectivism=totalitarianism being the road to serfdom. Rather, it is the neoliberalism that leads to corporate statism, when oligarch capture the apparatus of the state through wealth and its influence on politics.

This is the testimony of history. Aggressive elites always are bent on gaining power and keeping it through establishment of conventions and institutions that benefit them and reinforce the normality of this view. The “invisible hand” of “free markets” is just another version of the “divine right” of kings, and the “mandate of heaven” of emperors, as well as the “natural superiority of the well-born” of aristocracies, which are really just oligarchies of the powerful and greedy, there being nothing optimal about such individuals as self-actualized persons. Same game, different names. Goes right back to alpha baboon.

Meher Baba, 1932: Since arriving in America, I have been asked many times what solution I have brought for the social problems now confronting you – what did I have to offer that would solve the problems of unemployment, prohibition and crime that would eliminate the strife between individuals and nations, and pour a healing balm of peace upon a troubled world?

The answer has been so simple that it has been difficult to grasp. The root of all our difficulties, individual and social, is self-interest. It is self interest which causes corruptible politicians to accept bribes and betray the interests of those whom they have been elected to serve, which in turn causes bootleggers for their own profit to break a law designed, whether wisely or not, to help the nation as a whole. This in turn causes people to connive for their own pleasure in the breaking of that law, thus causing disrespect for law in general and increasing crime tremendously. Self-interest in other forms causes the exploitation of the great masses of humanity by individuals or groups of individuals seeking personal gain, which impedes the progress of civilization by shelving inventions which would contribute to the welfare of humanity at large, simply because their use would mean the scrapping of present inferior equipment; which, when people are starving, causes the wanton destruction of large quantities of food, simply in order to maintain the market prices; which causes the hoarding of large sums of gold when the welfare of the world demands its circulation. (Source)

See a pattern here?

Yep, thanks everyone the US is moving that way and we are about become serfs because of the elite. It would be so easy to move on to new tech to solve energy problems and employe millions but the dinosaurs just won’t let go yet. Pitchforks and into the streets might be about the only answer. Sad

The question about real constraints brings up an interesting point – it is one thing to have a debt deflation when the crisis is primarily systemic (e.g., classic oversupply with debt overhang), but if there is a long-term resource constraint (say peak oil, or peak water, or peak …) in addition to a systemic crisis, then debt REALLY gets out of whack.

Debt workout is difficult enough, but when the economy needs serious restructuring to respond to long-term real constraints with growth prospects unclear, then debt loads will have little relation to future income streams. Perfect storm. If I were a private lender, I don’t know that I would necessarily want currency vs. real resources to divvy out – little incentive to restructure debt.

Dear Bill,

Panayotis says: Monday, May 31, 2010 at 23:40

Stephan,

The purpose of the comment is as the other commnts on imperfection is to discuss the sources of imperfection.

For anyone seeking sources of imperfection , may I suggest a mirror.

Realising that, when you multiply 6.7 billion sources of imperfection together, what would be the logical outcome of that?

Realising that, it would seem that the only way a source of imperfection could find some sort of perfection, would necessitate being in touch with something that was actually Perfect – hoping it would kind of rub off!

Realising that, somebody said a very long time ago: “The worldly mind is born in darkness, lives in darkness, dies in darkness”. A fairly strong statement, especially for technology and science; I wonder what it means?

Now let me see: there is more education, more knowledge, more wealth on this earth than there has ever been before.

There is also more ignorance on this earth than there has ever been before: more people impoverished, more people sick, more people suffering, more people dying; more wars, more killings, more people homeless, more intolerance, more stupidity, more environmental destruction, more financial thuggery, more governmental corruption, more societal stress, more bullying ….. than there has ever been before.

Interesting!! I wonder if I could come up with a mathematical formula for that??

And somebody saying there is no door in the mind through which a solution is found??? Just more questions, and more questions, and more questions; more ego conflict and more ego conflict and more ego conflict …. bit confronting for the ubiquitous old ego eh!! I mean, ego really likes the mind, and really likes to believe it is in control, and values itself accordingly.

However, there was a door pointed out – and this was in the ‘heart’ rather than the mind. Confusing eh!

How could kindness be an answer to such insurmountable problems??? I don’t know? I suppose if we could be bothered we could try it, and find out?

But empirically its confusing. I mean, the mind cannot even compute kindness – how do you measure kindness: one little ounce tastes just as sweet as a tonne. How do you measure Love? How do you measure the delight that comes from Sunshine? How could something you can’t even measure, can’t even think about, but can only experience – be a solution – that’s just ridiculous!

Oh, its all too difficult. I will leave you instead with a textbook quote from ‘Monkey Magic’ – definitely an erudite source:

“Evil destroys. It opposes even other evil. Evil must have good to feed upon. Goodness nourishes itself. When evil has captured the good, evil dies. Then the good will grow again. In these truths is there hope for the world.”

Now, back to the fomulae ….

Cheers,

jrbarch

Jrbarch,

You suggest that I look in a mirror since I want to examine the sources of imperfection. Then you talk about humanity, kindness, evil, etc. and then back to the formulae! Let me assure you that occasionally I do look in the mirror and I am also concerned about humanity, kindness evil, etc. I hope it satisfies your concerns in your very humane and kind comment. By the way do you look in the mirror or you are too perfect to do so? Have a pleasant day, night, I do not know your time zone!

It seems to me, that if you you ‘printed’ 1% of GDP every year – it would amount to a method of raising tax, but without the administrative overheads.

At first sight, this would penalise the poorest most, beause it would devalue the currency – but if you put the money raised into taking lower paid people out of tax, then this would help the poorest, whilst raising demand in the economy – and thus stimulating the ecomonomy.

The downside is that you would have to stop markets from panicking, as a result of inflation being 1% higher, but that is just a matter of communication and transparency.

I feel quite intimidated saying this, as the rest you have degrees and stuff, but I hope I am on the right track.

“The downside is that you would have to stop markets from panicking, as a result of inflation being 1% higher, but that is just a matter of communication and transparency.”

I’m not sure that you would have to worry too much about that, unless you were an import dependent nation. Arguably everybody other than the US is import dependent since Oil is denominated in dollars.

At the moment we are in a period of competitive devaluation. All the currencies are stuffed in one way, shape or form. So right now would be the best time to be radical.

“It seems to me, that if you you ‘printed’ 1% of GDP every year – it would amount to a method of raising tax, but without the administrative overheads.”

So is monetary policy. Raising interest rates by 0.5% is just politically easier than putting up income tax, but is not as easily explained by the media how that happens.

For me the most sensible use of the MMT ideas is as Bill suggests. You create money to buy the output of those that have been let down by the non-government sector, and you do that as an automatic stabiliser.

Dear Bill,

Apologies to Panayotis at 9:42 – I did say “anyone seeking sources of imperfection” actually meaning anyone (can place me at the head of the imperfect by nature list if you like) – rather than to refer obliquely only to Panayotis. Am sure as a scientist, he/she is also a very concerned and charitable person. My intent was to be sceptical about the use of the mind, compounded by the problem of the human ego – when I see that if people are happy, they are much more cooperative and understanding, and generally get along just fine! You know that silly song:

What the world, needs now ….

Cheers,

jrbarch

jrbarch,

Your apologies are accepted! What I do not understand is how it is related to my comment about the sources of imperfection which is meant as an effort to deal with this problem and answer queastions on the reality that Keynes assumed to be present.

Dear Panayotis,

Oh, I see you what you are saying. You will have to forgive me for using your comment as a springboard to extrapolate from a specific situation to a more general one. This in no way invalidates your pursuit. I always wonder what things will be like in 3000 years time (will we be as primitive as 3000 years ago appears to us?) – and see more evolutionary potential in the heart as a conditional energy for the mind. I don’t think, as human beings, we should be too proud of ourselves, given our track record. Anyways, good luck with your undertakings!! (We better hand Bill et al his blog back now)! Cheers …

Sincerely,

jrbarch

Dear Jrbarch,

Thank you for your wishes! I post these food for thought comments to induce ideas as my work continues and is not finished altough it is generating feedback and criticism among scientists which I welcome!