The other day I was asked whether I was happy that the US President was…

What the hell is a government solvency constraint?

Today my RSS feed was full of all sorts of information and it took me some time to get through it all. The reason? I just purchased an Amazon Kindle DX and it arrived this morning. As a frequent traveller I seem to carry too many books and papers given I read a lot and so the Kindle is my proposed solution – everything is going to being stored on it – novels, travel documents, bus timetables, academic papers, mp3s, you name it. My bags will now be lighter and that continual shuffling of papers to access the right one at the right time is going to be a thing of the past. So I got to know it a bit today! Anyway, one paper I did read today was from the European Central Bank (ECB) entitled – The Impact of Numerical Expenditure Rules on Budgetary Discipline over the Cycle. It is so bad you would gasp for air reading it. It is replete with statements that just appear without scrutiny and are taken for granted but, which in fact, are at the basis of the whole argument about fiscal rules and are hardly acceptable.

First some history.

The Eurozone began on January 1, 1999 but the Maastricht Treaty obligations came into force with the adoption of the Stability and Growth Pact on June 17, 1997 by the European Council. At that point the participating nations agreed to the SGP as a means of ensuring “budgetary discipline after creation of the euro” in addition to endorsing the new exchange rate mechanism which would stabilise the value of the euro and related currencies.with the adoption of the in 1993 as the Full monetary integration for the initial 12 members came into force on January 1, 2002.

All EMU member states agreed that as part of the deal whereby they would adopt the euro they would meet the so-called Maastricht convergence criteria. These morphed into the SGP which was designed to force ongoing discipline on the EMU member governments.

The numerical criteria that define the SGP are well known:

- An annual (comprehensive) budget deficit below 3 per cent of GDP (that is, all public transactions are included at all levels of government); and

- A public debt ratio below 60 per cent of GDP.

The rationale of controlling government debt and budget deficits were consistent with the rising neo-liberal orthodoxy that promoted inflation control as the macroeconomic policy priority and asserted the primacy of monetary policy (a narrow conception notwithstanding) over fiscal policy. Fiscal policy was forced by this inflation first ideology to become a passive actor on the macroeconomic stage.

As a result of the establishment of the European Central Bank (ECB), European member states now share a common monetary stance. The SGP was designed to place nationally-determined fiscal policy in a straitjacket to avoid the problems that would arise if some runaway member states might follow a reckless spending policy, which in its turn would force the ECB to increase its interest rates. Germany, in particular, wanted fiscal constraints put on countries like Italy and Spain to prevent reckless government spending which could damage compliant countries through higher ECB interest rates.

Aided by the growth period following the 1991 recession, the fiscal constraints were met by all aspiring member states. Emboldened by this success, and more alert because the date for the Euro introduction was approaching, the Euro countries decided in the 1997 Amsterdam Treaty that the rules should be sharpened. The deficit should be either zero or in surplus, and when it threatened to reach 3 per cent of GDP, countries should take appropriate measures.

So in effect, the vast majority of the European economies have been operating under the strict numerical rules since they entered the Maastricht convergence process in the mid-1990s.

And what has been the outcome?

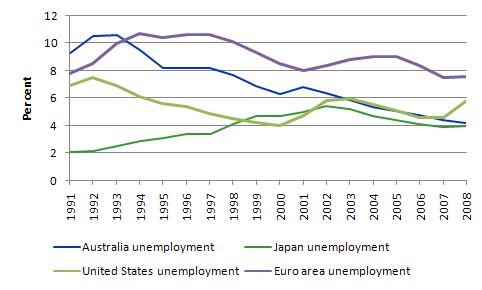

The following graph comes from the OECD Main Economic Indicators and shows the unemployment rates for Australia, Japan, the US and the Eurozone from 1991 to 2008 (annual observations) . This was largely a growth period for the World economy although Japan stood out in that regard because this period encompassed its lost decade. Even with that lost decade, Japan still delivered relatively low unemployment rates.

By any reading, the performance of the Eurozone countries over this growth period was parlous. It is no surprise that they would not be able to grow their economies fast enough to absorb the pools of long-term unemployed given that their governments were severely constrained by the application of the convergence criteria and then the formal implementation of the SGP.

It is hard to construct this sort of historical experience with the ideological claim that fiscal policy was too expansionary in the Eurozone during this period. Which then makes the pro-cyclical policy positions that are being forced on the member nations at the height of the crisis farcical.

Anyway, this is the context that you read the latest ECB paper noted in the introduction.

One of the basic premises of the paper is that governments cannot be trusted to manage their fiscal policy positions:

As a consequence, additional revenue in booms will not fully translate into a larger surplus but will partly result in extra spending relative to the optimal level required by tax smoothing. By contrast, in downturns spending will fall since, due to “excess spending” in booms, the surplus generated in previous periods will not suffice to meet the solvency constraint.

That last phrase says it all – “the surplus generated in previous periods will not suffice to meet the solvency constraint”.

What exactly is a solvency constraint when applied to a sovereign government? They do not discuss this proposition any further and leave it by implication tied to the sort of rules set by the Stability and Growth Pact. The issue of sovereign risk is now central in the policy debate and I have devoted some time in the past days to it. Please read the blogs – Same old arguments = lack of leadership and When a huge pack of lies is barely enough – for recent discussion.

There is no coherent framework within mainstream economics for establishing what they mean by a solvency constraint.

Does it mean when the credit rating agencies downgrade a nation? Well Japan had several downgrades around a decade ago and they haven’t defaulted yet and in the meantime their public debt ratio has increased signficantly?

Does it refer to the crossing of some public debt ratio threshold? By implication (of the SGP) it does but how is that derived analytically? Answer: they cannot derive such a threshold. Any such threshold is asserted. This is the sort of rubbish that Rogoff has been peddling (an 80 per cent threshold).

The overriding point that I have made regularly is that a nation that issues its own currency and floats it in the foreign exchange market (and doesn’t borrow in foreign currencies) has no possible solvency constraint.

So conditioning an analysis of fiscal rules as if there is this constraint is flawed at the most elemental level. You quickly realise that the technical pyrotechnics (regressions etc) that follow and are used to “prove” their position are all flaky disguises for the imposition of their ideological position – that budget deficits are bad and budget surpluses are good.

The ECB outlines what they consider to be theoretical arguments for adopting fiscal rules. They claim there is:

… a broad consensus on the beneficial role of rules to restrict government expenditure has emerged. In particular, many policy observers have argued that they may mitigate pro-cyclical expenditure overruns in upturns and reduce the need to make up for such spending profligacy in ensuing downturns.

The broad consensus is among mainstream macroeconomists who advocated policy positions that led to the global financial crisis. Why their viewpoint has any further credibility is the question.

The other point is that the authors are subtely trying to justify the case for harsh austerity fiscal positions during the current recession. So a pro-cyclical response now to “make up for such spending profligacy” in the growth period.

So the message is that if the government adopts fiscal austerity when the economy is trying to grow, the imposition of that brake will leave their budget positions in such a state that they will not breach any fiscal rules. As such, when a recession comes along they will not have to contract as much (given the automatic stabilisers will push the budget balance towards or over the limits defined by the rules).

If you think about that for a second you will be breathless. The audacity of this nonsense is truly breathtaking. So the fiscal rule becomes the benchmark (and as I note soon will always be biased towards contraction) and fiscal policy is judged solely according to that standard.

The idea that during a time when the private sector is expanding, the government should deliberately constrain the ensuing growth such that it maintains a pool of unemployed wallowing in social alienation and poverty when income-producing opportunities could be created by expanding fiscal policy. That is bad enough.

But then they are saying that after a growth period – if the governments had actually acted responsibly and supported growth and non-government saving by maintaining discretionary budget deficits – then because the budget deficits will rise due to the cyclical impacts (automatic stabilisers) – the government has to invoke harsh discretionary cut backs (pro-cyclical) just when the economy needs greater fiscal support. That idea is truly breathtaking and evil.

How did we get into a position where this sort of analysis is supported by major economic institutions and people are paid high wages to produce it?

The ECB paper lists a number of reasons why self-imposed fiscal constraints are optimal. They argue that they “correct coordination failures inherent in the budgetary process” arising from the complexity of “multiple decision-makers which cater to diverse constituencies and compete for overall fiscal resources available to society, thus giving rise to a common pool problem.”

They conclude that:

…. fiscal policy is biased towards inefficiently high levels of government spending which might be mitigated by restricting governments’ discretion through fiscal rules.

While they assert that the imposition of the SGP reduced this wastage they are silent on the persistent of the greatest waste of them all – high unemployment. Over the history of the Eurozone, one robust fact is that government spending has been deficient by several percentage points of GDP.

The ECB say that a further reason for “implementing numerical fiscal rules”:

… is to prevent policymakers from exacerbating macroeconomic volatility through procyclical fiscal policies. In particular, a widespread consensus on the beneficial role of rules to restrict government expenditure has emerged, as summarised by the European Commission’s assessment that: Enforced national expenditure rules … help to counteract forces leading to pro-cyclical fiscal policy in good times and thus prevent the need to retrench in bad times. On these grounds, several policy observers have advised governments to strengthen domestic expenditure rules as a means to improve fiscal discipline over the business cycle.

Taken in an historical context, this is an extraordinary statement. Refer back to the discussion preceding the unemployment graph to see why. They are prone to interpreting fiscal policy as being pro-cyclical when in fact it is nothing of the sort.

Please read my blog – Structural deficits and automatic stabilisers – for more discussion on this point.

I also noted in this blog – IMF agreements pro-cyclical in low income countries – how the IMF was imposing just the sorts of policies the ECB claim are wasteful on low income nations.

The ECB paper also says that:

These theoretical considerations provide an explanation for empirical findings suggesting a positive relation between public spending and the cyclical position of the economy.

So what is the problem with that? Aggregate demand drives output and income growth. Aggregate demand is decomposed into private consumption, investment, the excess of exports over imports and government spending. The implication of the authors is that there is a prioritised ordering of these components and only the “private” aspects should drive an upswing such that the public component should contract in the upswing.

What is the economic basis for that observation? Answer: it has no foundation in economic theory at all. It is just an ideological statement reflecting an anti-public sector sentiment.

In Modern Monetary Theory (MMT) governments should advance public purpose which is a multidimensioned goal and includes the provision of first-class public infrastructure (schools, hospitals, aged-care facilities, transport, etc) and fostering sufficient employment growth to ensure all the available labour supply can find jobs.

So discretionary budget deficits (properly measured – more on this soon) are perfectly appropriate and necessary if the non-government sector desires to net save out of its income.

When there is an external deficit, and the private domestic sector desires to net save overall, then discretionary budget deficits have to fill the spending gap to ensure actual output growth does not contract.

So the finding of pro-cyclical government spending is not necessarily a sign that fiscal policy is de-stabilising the real economy. It all depends.

What good fiscal policy requires is an attention by the government to the overall state of aggregate demand in the economy. Clearly net public spending doesn’t become destructive until real output opportunities are exhausted given a desired level of private spending.

It is a political issue whether public spending should compete for resources with private spending. Economic theory cannot resolve that issue despite the claims of the mainstream that the former is wasteful and the latter productive. Once again it all depends and case-by-case analysis is required. Some public spending is incredibly wasteful – for example, the entire US military outlays. But then some private spending is also very wasteful.

Econometric approach adopted

Here are some observations on their econometric approach for those who are interested in these sorts of technical matters.

The ECB authors aim “to capture the discrepancy between governments’ actual expenditure policy for a given period and their previously formulated expenditure plans”. So the plans reflect the fiscal stance but the actual outcomes may differ as a result of cyclical movements in the economy.

They find (Table 1) that “total general government expenditure at the sample average exceeds its planned levels by more than 1% of GDP”.

They are cogniscant of the need to disaggregate “government expenditure to compute deviations between plans and outcomes for discretionary and nondiscretionary

spending items. For that purpose, we differentiate between expenditure items which are readily manipulated by policy-makers (i.e. discretionary) and those

which are, in the short-run, exogenous from the government’s perspective (i.e. nondiscretionary)”.

So they are trying to separate the impact of the automatic stabilisers which are beyond the control of government and the changes in spending that reflect shifting policy choices (discretionary component). Their analysis fails to achieve a reliable distinction here (it is subject to a number of technical limitations which they acknowledge).

They conclude, however, that “actual discretionary spending on average exceeds planned levels, interest expenditure tends to fall short of plans”.

They also seek to capture the impact of cyclical surprises – so does government spending reinforce the cyclical unwittingly. They “use the gap between actual and trend GDP as a measure for the cyclical position of the economy”. What they aim to do with the research is examine the “discrepancies between the actual cyclical position of the economy in period t and the cyclical position that governments expected for period t at the time when they produced their fiscal forecast, in period t-1” and how this impacts on government spending outcomes.

The analysis is biased in favour of their starting hypothesis – that fiscal rules reduce the “pro-cyclical” nature of government spending. This bias emerges because they use a flawed output gap measure comprising a comparison between the actual output and trend output. They adjust things to suit which add further convenient biases, but the essential point is that trend output is just a reflection of the path taken by actual output.

It tells you nothing about the true output gap which is the difference between actual output and the output level that would be consistent with full employment (given current productivity growth rates).

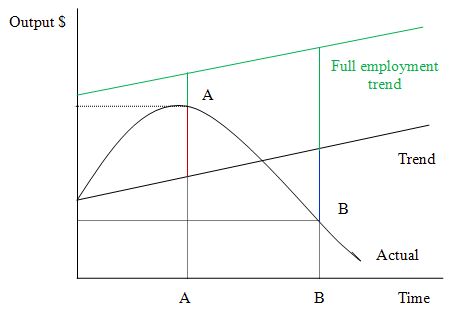

The following diagram illustrates the problem in these sorts of analyses. On the vertical axis is real output (both actual and trend) while the horizontal axis just depicts time periods. The trend line is estimated via various econometric models and typically involves some underlying notion of the NAIRU. Trend estimates typically understate the full employment output growth path (which I have hypothetically captured with the green trend line).

Actual output is the curve and at A the output gap would be measured as positive (that is, the economy is producing above trend) whereas at B the output gap would be negative.

However if you compare points A and B against the output levels required to generate full employment you will see that this economy has a persistent negative output gap of varying proportions and that the estimates of the cyclical gaps will be biased downwards (in favour of a more optimistic view of the growth path) using the actual trend estimates.

In turn, this will bias the decomposition of government spending into discretionary and non-discretionary. That is, biasing the estimates of the automatic stabilisers downwards and inflating the estimates of the discretionary component.

In turn, using these biased output gap measures in regression analysis will assuredly bias the results in favour of finding pro-cyclical discretionary government spending when in fact the budget reaction maybe mostly driven by the automatic stabilisers and the discretionary component would be too low given the size of the true (full employment) output gap.

These sorts of biases plague mainstream empirical work because they always benchmark the cycle using the NAIRU or something similar without regard to what is actually required to generate enough jobs to fully employ the available workforce.

Anyway, they then run a series of regressions using these flawed measures as explanatory variables and find that “an output gap surprise of one percentage point on average goes along with a deviation between spending outcomes and plans of almost half a percentage point in the same direction. At the same time, the negative coefficient for the interaction term indicates that this pro-cyclical pattern is less pronounced in countries with strong expenditure rules”.

Apart from the measurement issues highlighted above, the regression results are less than satisfactory from a statistical perspective with levels of statistical significance on their key variables at times above the acceptable 5 per cent. Their methodology is also subject to major questions concerning identification of the structural parameters given almost certain endogeneity of various right-hand side variables.

For those who don’t know what I am talking about here the rub is this – the results are useless.

So what is wrong with fiscal rules?

Please read my blog – Fiscal rules going mad … – as background.

The requirement that budget deficits should be zero on average and never exceed 3 per cent of GDP not only restricts the fiscal powers that governments would ordinarily enjoy in fiat currency regimes, but also violates an understanding of the way fiscal outcomes are effectively endogenous. Any economist with even the simplest understanding of the way in which automatic stabilisers operate will see the lack of wisdom in a SGP-type rule.

A sharp negative demand shock which causes an economic downturn will reduce tax receipts and increase benefits, automatically increasing the deficit. Reducing government expenditures in that situation to meet the rule will worsen (prolong) the recession, which is then likely to involve the country in further SGP-type rule violations.

The vicious circle of spending cuts implied is unsustainable and amounts to fiscal vandalism. In other words, fiscal policy becomes pro-cyclical under the SGP-type rule violating any sensible ambitions that are the ambit of responsible fiscal management.

Another problem relates to the bias in the way fiscal adjustment is conceived. In particular, it is automatically assumed that discretionary actions to reduce the budget deficit will involve spending cuts rather than increasing taxes. We cannot help but have the impression that some politicians are not primarily concerned about the size of the budget deficit, but covet the 3 per cent rule as a welcome excuse to force their ideological predilection for small government.

In other words, the ideological bias against public activity, particularly in the social security sphere, is dressed up as prudential economic management to give the crude religious zeal an air of authority and respectability.

SGP-type rules cannot be seen in isolation of the acceptance by EU countries of the voluntary monetary policy straitjacket that the ECB acceptance imposes. While the ECB now has a monetary policy monopoly across the EU countries, it is not politically responsible for its actions. The EU countries have voluntarily allowed the ECB to be an unelected and independent body whose sole aim is to control inflation. The fundamental democratic principle that the citizens have the ability to cast judgement on the policies of their representatives at regular intervals has been abandoned in this setup.

This voluntary monetary policy straitjacket suggests that countries have to use fiscal policy to react to economic shocks which affect the real economy. However, the SGP has imposed an inflexibility on this discretion and stagnant economic outcomes have been the norm.

It is often said that the European economies are sclerotic, which is usually taken to mean that their labour markets are overly protected and their welfare systems are overly generous. However, the real European sclerosis is found in the inflexible macroeconomic policy regime that the Euro countries have chosen to contrive. The rigid monetary arrangements conducted by the undemocratic ECB and the irrational fiscal constraints that are required if the SGP is to be adhered to, render the nation states within the Eurozone incapable of achieving low levels of unemployment and increasing income growth.

These observations lead to our more embracing criticism of the Brussels-Frankfurt consensus from the perspective of the functional finance paradigm. There is a difference between governments being financially constrained and situations where governments accept voluntary financial constraints. The SGP coupled with the common ECB monetary policy is an example of the latter but does not negate the fact that EU countries could exploit the powers that issuing fiat currency provides them. They would make this choice if they wished to pursue a macroeconomic strategy aimed at restoring full employment with price stability.

Conclusion

I am observing two sorts of research papers creeping in my RSS inbox lately. Those that are pushing the sovereign debt risk argument and those that are trying to provide justifications for the austerity packages that are being forced onto nations at present by various supra national agencies. Both types of paper are flawed at the most fundamental level.

But it is further evidence of the way my profession – at least the mainstream and dominant arm of it – is trying to clawback its sense of relevance as the worst of the economic crisis passes (or subsides for the moment). The mainstream economists were totally discredited by the collapse of the world’s financial system and laid low for some time. Now in all their arrogance they are seeking to re-impose their flawed perspectives.

I had hoped they would be wiped out by the crisis with students in universities around the world revolting and demanding a new curricula. It was not a very strongly held (or practical) hope given the overwhelming control the mainstream has on all elements of the process – the hiring of academics; the undergraduate and postgraduate programs; the editorial boards of journalsl; the access into top policy positions etc.

But on an optimistic front the mainstream is damaged and that weakness is worth exploiting for all its worth.

The Fiscal Sustainability Teach-In and Counter-Conference

The Fiscal Sustainability Teach-In and Counter-Conference will be staged in Washington D.C. next Wednesday (April 28, 2010) and details of venues and other relevant arrangements are available at the home page. All are welcome.

This is the first grass roots effort to promote MMT. The day has been chosen to rival the sham Peter G. Peterson Foundation conference exploring the same topic.

If you are near to Washington DC and have the means it would be great to meet you next week.

You will also note that I have included a fund raising widget on my right side-bar at present. Any help for the organisers will be very appreciated. Just click the image and open your bank accounts! Apparently this will only accept funds if you are in the US. The alternative strategy is to use the contact page that the organisers have set up and pursue your enquiry that way.

At present they really need some financial support. It is a shoe-string, community-driven event being organised by committed volunteers who are motivated by the fact that they care and realise something is wrong with the dominance of conservative, free-market think tanks like the PGPF in the public debate.

Saturday Quiz

The Saturday Quiz will be back sometime tomorrow – even harder than last week!

That is enough for today!

Regarding the Kindle, it’s a good idea to have a traveling device to take with you. But, I find I’m leaving my Kindle at home and doing everything on my iPhone. (An iPod will work as well.) The kindle reader app on the iPhone is very convenient, since you can hold it in one hand and flip pages with your thumb while eating or taking notes with the other. And, the Kindle won’t fit in my shirt pocket.

Bill,

Peter George Peterson is married to Joan Ganz Cooney who is one of the creators of Sesame Street.

She was also the one responsible for bringing Jim Hensons puppets / muppets to the show.

Jim Henson is unfortunately no longer with us but have no fear because there will be more muppets at the Peter G. Peterson Foundation conference than there ever were on Sesame Street.

Cheers and good luck with the real conference.

Perhaps one might simplify the Euro SGP analysis by saying that it constrains its countries against any macroeconomic action if they have external deficits. Those in surplus do OK under the rules, since they have some fiscal headroom, but those in deficit are screwed from the outset and have no way of adjusting. It essentially off-loads or transforms macroeconomic economic policy into mercantalist policy.

It essentially off-loads or transforms macroeconomic economic policy into mercantalist policy.

A beggar thy neighbor policy among European nations is scary considering their history, especially with Germany doing most of the beggaring as an export economy. It doesn’t portend well. Old animosities are bound to arise.

Hello,

Slightly off topic, but could someone explain what the difference is between gross government debt and net government debt???

E.g., Japan has a gross government debt to GDP ratio of 200%, but a net one of less than 100%.

Is the net figure one that removes debt bought back by the central bank?

Please help me understand this.

Bill: the answer to your question depends on the answer to another question: what is the shape of the Long Run Phillips Curve?

The authors of that ECB paper (presumably) answer “vertical”. What is your answer?

Two points are to be made here.

1. Mainstream theory has also an interest rate channel that uses in favor of austerity measures and fiscal rules. It claims that with austerity measures when fiscal rules are violated, interest rates will decline and they will induce a rise in spending and employment leading to a “virtuous” path of the economy. This is FALSE. As my work shows (presented in a number of comments in this blog), bondholders and market speculators see that austerity measures reduce employment and income and this raises future deficits endogenously, so the potential loss from default (as they perceive an inability to refinance/issue debt) also rises. Thus, in order to hold debt they demand higher spreads and interest rates will tend to rise rather than fall. Furthermore, they invert the yield curve, depending on how long is the course of the austerity program. This is demonstrated by the data showing the actual movements of spreads and also in situations that short period (3 years) austerity plans are implemented the yield curve is actually inverted. (O.E.D).

2. Another mainstream myth is that all fiscal policy leads to inflation. However, in the case of fiscal/development policy of voluntary/horizontal (discretionary) nature that allocates spending to remove social/public orientation inefficiencies/inadequacies with programs of infrastructure spending, human capital formation, skills development and innovation with alternative technologies to deal with shortages of strategic inputs, inflation is reduced even if FULL EMPLOYMENT OF RESOURCES IS REACHED!

Nick Rowe,

Are you serious ? Go and read Bill’s Phd Thesis.

Hi, NIck, nice to see you here. BTW, did you get a chance to look over the Ruml paper? Bill surfaced it here:

Taxes do not fund anything

Tom: thanks for the welcome!

I confess I didn’t read it. (Too busy arguing with a guy who thinks that marginal costs have no effect on prices!). But I have just read Bill on the subject (followed your link), and I get the gist. Yep, sounds just like Abba Lerner’s Functional Finance (which I read more decades ago than I care to remember). But the answer to whether taxes are necessary (given ability to print inconvertible money, etc.) is at root the same question that Bill is addressing here. And they both depend on the answer to the question: What’s the Long Run Phillips Curve look like?

Off-topic: I wish I knew the answer to Andrew’s question above too. I’m pretty sure “net debt” excludes government bonds held by the central bank (it ought), and should exclude some other government assets too (ones that earn the government income, for example). But it’s hard to believe that comes to 100% of Japan’s GDP.

One more point, following my previous comment.

Austerity measures can lead to inflationary expectations. In order to be sustained, an austerity program consists of discretionary measures which means a reduction in allocation spending programs such as infrastructure and other public investment projects. Market participants interprete this as inflationary risks long term and they raise their expectations for inflation. Furthermore, austerity measures have a revenue side as raises in value added taxes, sales taxes, insurance contributions and other utility/service fees that have a permanent effect upon prices long term and this will lead to higher inflationary expectations. As any analysis on interest rates will show, increases in inflationary expectations raises rates especially at the long tail of the term structure.

Nick/Andrew,

Net Debt is Liabilities minus Assets

The balance sheet of the Japanese government is funny.

The GDP is of the order ¥500T. The liabilities for 200% debt/GDP ratio should then be ¥1Q (quadrillion!)

The assets side has Tangible Assets such as Buildings, Land etc. However it also has the item Loans. The balance sheet is here This seems to be the latest, though it is of March 31 2002! The item Loans is described in the pdf and its loans to government institutions mainly. Loans to itself! Effectively its zero!

The debt/GDP is then ~ 200%, the 100% number is meaningless.

Yet another point about austerity programs.

In a case of revenue constrained fiscal policy by some market discipline, austerity measures are not optimal if we consider the option of debt restructuring (I have mentioned this before with no feedback). Debt restructuring with maturity extension with a haircut in the form of a discount/par bond can have the same effect on public “deleveraging” without the income contraction impact of austerity. Some are concerned by two issues. First, the effect on the domestic financial sector to the extent it owns this restructured public debt. However, this effect could be neutral in the presence of a secondary market that has discounted this debt and banks are required to mark to market. In other words, the proposed restructure is validated in bank portfolios. Furthermore, the extent of foreign ownership of the proposed to be restuctured debt is important. The higher the foreign ownership the less the impact on the domestic financial sector. The second issue is future financing of debt. The key, again is whether it is oriented towards domestic savings. Interest payments to the domestic private sector is like a fiscal stimulus program that mantains forward private savings and income. Furthermore, public debt finance occurs without any crowding out of private loans as long as effective demand is lower than full equilibrium demand. Again, is neutral as the funds are recircled back to the financial sector without any additional external leakage, except for a deficit current acount balance of payments. In summary, the key for a successful debt retructuring program is for the restructured debt to be foreign owned and the subsequent debt to be financed domestically.

“But on an optimistic front the mainstream is damaged and that weakness is worth exploiting for all its worth.”

It would be nice (unless I missed a post) to hear from someone with some kinship to MMT while at the same part of the mainstream (big) institutions. Richard Koo, as I mentioned at Warren Mosler’s blog, seems to not only get it but put his reputation (Head economist at Nomura) behind weighing heavily in favor of many of the MMT recommendations I read on this blog.

One of his speech (globaleconomicanalysis.blogspot.com/2010/04/richard-koo-on-why-this-recession-is.html) has a few humorous notes where he derides the OECD and IMF people as the “know nothing about anything”. More to the point, his flow of funds analysis is explicit : the increased desired to save (the consequence of the previous debt binge) can only be met by deficit spending and uses Japan as a supporting example, that the US should follow overall (that is excepting failed QE attempts : see seekingalpha.com/article/197235-who-controls-bank-of-japan).

His views can also found in his february testimony to the US congress http://www.house.gov/apps/list/hearing/financialsvcs_dem/richardc.koo.pdf