I have been thinking about the recent inflation trajectory in Japan in the light of…

Central banks and climate change

Today, I discuss a recent paper from the Bank of Japan’s Research and Studies series that focused on how much attention central banks around the world give to climate change and sustainability and how they interpret those challenges within their policy frameworks. The interesting result is that when there is an explicit mandate given to the central bank to consider these issues, the policy responses are framed quite differently and are oriented towards solutions, whereas otherwise, the narratives are about how climate change will impact on inflation. In the latter case, the central banks do not see their role as being part of the solution. Rather, they threaten harsher monetary policy action to deal with inflation. I also consider the most recent US inflation data. Finally, some live music from my time in Kyoto this year.

Central banks and climate change

On September 29, 2023, the Bank of Japan published a paper in their Research and Studies series – Central Bank Mandates and Communication about Climate Change: Evidence from A Large Dataset of Central Bank Speeches – which analyses the language used by central bankers in their speeches to assess how focused on climate change they are when articulating policy positions.

I am very interested in the use of language and how shifting patterns of word usage can be used to detect institutional characteristics.

At present, I have a very large dataset from the beginning of the IMF drawn from their Annual Reports, which we are about to analyse using the techniques from the field of cognitive linguistics and stylistics (this is a project with Dr. Louisa Connors, who has a PhD in this area of research).

So I was very interested in the approach taken in the Bank of Japan research paper (co-authored with a US Federal Reserve Board official).

Their aim was to analyse speeches from central bank officials to “empirically examine the role of the mandate in shaping central bank communication about climate change” and to assess differences among banks as to how important a “sustainability objective” is to these banks in terms of “broader government policies”.

The emphasis is on the mandate that central banks are given by their governments and the summary result is that:

… mandate considerations play an important role in shaping central bank communication about climate change.

The authors state that in terms of “the propagation of climate-related risks through the financial system” it is unclear “what role, if any” central banks have “in responding to it.”

To progress, the researchers analyse 18,264 Speeches from officials across 108 central banks between 1997 and 2022.

Most of the banks come from advanced nations.

They experiment with four different stylistic techniques:

1. Hand selection from BIS database – where ‘climate change’, ‘green finance’ and ‘sustainability’ are classifications for publications.

2. Simple dictionary method – pairing ‘climate change’ in speeches.

3. Supervised word scoring method – scoring where ‘climate change’ is or is not included. A dictionary is constructed with various other words relating to climate, such as ‘green transition’, ‘green finance’, ‘carbon emission’, ‘Paris Agreement’, and ‘green bond’.

4. Unsupervised word embedding method – complicated.

The latter three techniques are – Natural language processing – tools, which:

… involves processing natural language datasets, such as text corpora or speech corpora, using either rule-based or probabilistic (i.e. statistical and, most recently, neural network-based) machine learning approaches. The goal is a computer capable of “understanding” the contents of documents, including the contextual nuances of the language within them. The technology can then accurately extract information and insights contained in the documents as well as categorize and organize the documents themselves.

They found the word scoring method produced the best identification of speeches.

Previous research covering 135 central banks found that “over half operate under a mandate that includes a sustainable growth or development objective … to support broader government policy priorities”.

The question they sought to answer was whether climate action is explicit within central bank policy decision-making or whether it is dispensed with in general terms under the so-called “price stability and financial stability” objectives that are always the subject of legislative mandates.

They found technique 3. to be the best in terms of comprehensiveness, with the other techniques missing what they considered to be key documents.

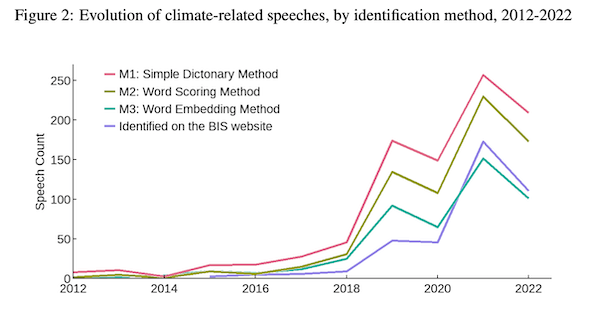

They also noted that between 2012 and 2022, central bankers have increasingly made ‘climate-related’ speeches.

This graph (their Figure 2) shows the evolution.

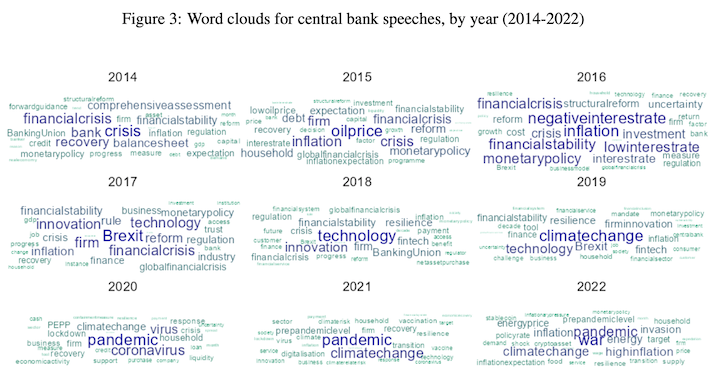

And this word cloud collection shows the evolution of language used in central bank speeches between 2014 and 2022.

The shift from GFC to Brexit to climate change and pandemic is very notable.

They then differentiated the ‘climate-related’ speeches into two categories:

1. Those with explicit objectives to support sustainability.

2. Those with only implicit objectives to support government policy, “which may comprise sustainability objectives”.

They also assigned “mandate similarity metrics” to each speech – that is “the extent to which the content in a given climate-related speech is related to each of the three objectives.”

The three objectives are price stability, financial stability and sustainable development.

Advanced nation central banks emphasise ‘price stability’ more often, while emerging nation banks focus more on sustainable development.

The former talk about climate change more often in the context of the “impact of climate change on inflation”, while the latter focus on “finance” for transitions.

They also found that when the central bank has an explicit legislative mandate to include sustainability in its decision making, the resulting speeches are more likely to focus on actually addressing climate issues.

However, when there is no mandate, the talk tends to focus on how climate change impacts price stability, rather than reflecting a commitment to dealing with transitions away from carbon.

So most advanced nation central banks remain obsessed with ‘price stability’ and interpret everything within that lens, thus avoiding being a progressive voice in the debate as to how policy makers should deal with green transitions.

The point that a Modern Monetary Theory (MMT) economist would make is this.

The government’s central bank has a crucial role to play in the government’s attempts to fast track away from carbon in an effective and equitable manner.

While much of the transition is the work of engineers dealing with new technologies and sociologists and psychologists dealing with the resulting community disruption and required changes, the economic policy divisions of government – the treasury and central bank – have a significant role in ensuring that the transition process is not encumbered with irrelevant questions about ‘how are we going to pay for it?’

Central banks should make it clear that they can type whatever numbers are necessary into bank accounts to ensure that resources are allocated into the transition and away from the carbon-intensive sectors.

And Treasury divisions should assess the appropriate scale and speed of the transition to ensure that productive resources can shift and/or be retrained (in the case of human labour power) in such a way as to avoid major (inflationary) bottlenecks occuring.

None of the speeches analysed in the paper discussed here consider those issues.

There is still a long way to go.

US Inflation

The US Bureau of Labor Statistics released the – Consumer Price Index Summary – for November yesterday, which shows that inflation increased by just 0.1 per cent for the month and 3.1 per cent for the 12 months.

Essentially, the supply-side problem is abating fast and had nothing much to do with any ‘excess spending’ influences.

In 2021, I indicated that this was a transitory inflationary episode driven by the extraordinary disruption that the pandemic caused, which was exacerbated by the Ukraine situation and OPEC greed.

I think the data bears that assessment out, which means that the Bank of Japan got it right (and the rest got it badly wrong).

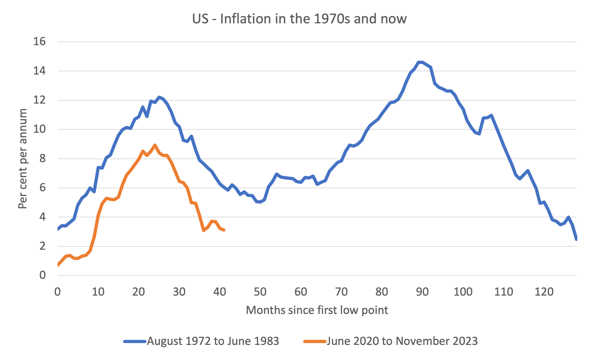

This graph compares the 1970s episode, which was triggered and then prolonged by two OPEC oil price hikes to the current episode.

I drew the 1970s episode such to show how long it took to get back to the starting point inflation rate.

The current episode peaked earlier and well below the 1970s first wave, and has dissipated more quickly.

Upcoming events

I haven’t been to Europe since Covid struck in early 2020.

At that time, I was in Rome when the Italian government responded to the unknown threat by closing down areas near Milan.

I was lucky, by a day, to get back home before the Australian government locked the borders to incoming movements (Australian citizens included).

In January and February 2024, I will return and I am looking forward to catching up with friends and colleagues again in person rather than via Zoom.

There are at this stage three known public events that I will be speaking at.

1. Friday, January 27, 2024 – central London – a GIMMS event at the Unite the Union (Diskus Theatre), 128 Theobalds Road, London, United Kingdom – daytime. I will provide more details including ticketing when I know more.

2. Saturday, January 28, 2024 – London – an event for the Workers Party of Britain. More details will be available soon.

3. Thursday, February 1, 2024 – Helsinki – a public lecture/debate sponsored by the University of Helsinki. I will also be teaching as usual at the University in the two weeks from January 23 to February 1.

More details will be available soon. You will be able to follow the first week of lectures via Zoom (I will be doing them from the UK), and, if you are in Helsinki for the second week, you are welcome to join the face-to-face class, where I hope all students will wear masks to protect me and the others in the class.

So I hope to see those who can make it to any or all of these events in a month’s time or so.

Music – Live from Jittoku, Kyoto

On October 31, 2023, I joined some of the top musicians in Kyoto at the famous ‘live house’ Jittoku for a night of rock and roll.

We chose some popular songs that we didn’t have to rehearse.

The place was packed and although the iPhone recorded sound is not that hot you can get a sense of the night.

Here are three songs from the 8 or 9 that we played together.

A lot of fun and I will join them again next year.

Cocaine – J.J. Cale

Imagine – John Lennon

Sweet Home Chicago – Robert Johnson

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

It seems to me that, for the sake of our planet and its flora and fauna, the day can’t come soon enough when Treasury and Central Bank are amalgamated into a Resource Support Department.

Bill, this seems to be missing a word or two: ‘The authors state that “the propagation of climate-related risks through the financial system” and …’

I usually don’t care much for right-wingers’ tropes, but sometimes I find myself asking: what’s the use of central banks?

All they do could be done by the government.

And the only answer I find to the question is: monetary policy is to be decided by the Rockefellers and Rothchilds, not by our representatives.

And so we got central banks.

Again to the right-wingers, there’s a sentence ascribed to a US politician, Ron Paul, that goes like this “It is no coincidence that the century of total war coincided with the century of central banking.”.

Thanks Bill loved the guitar work on “Sweet Home Chicago.”