In the annals of ruses used to provoke fear in the voting public about government…

The parallel universe in Japan continues and is delivering superior outcomes, while the rest look on clueless

It’s Wednesday and I have some commitments in Melbourne (recording a podcast with the Inside Network) and that requires some travel. So time is tight. Today, I update the latest from Japan courtesy of yesterday’s release from the Bank of Japan of its ‘Statement on Monetary Policy’. The parallel universe continues and is delivering superior outcomes, while the rest of the world’s policy makers, smitten with neoliberal nonsense, have their heads in the sand and the economies are turning to dust. I also provide some links to the video recording of the launch of the Japanese version of Reclaiming the State, which was held in Kyoto in November 2023. And I provide some links to a major article that I was featured in with one of Japan’s leading magazines. And if that isn’t enough, we have Voodoo Child.

Yesterday (December 19, 2023), the Bank of Japan released its latest – Statement on Monetary Policy – which updates their thinking on interest rates, inflation, yield curve control (YCC) and other matters.

The financial markets have been falling over themselves with their predictions that the Bank would relent on their zero interest rate policy and the YCC.

But, the Bank continually demonstrates a key principle of Modern Monetary Theory (MMT) – that the currency issuer is in control and the financial markets really only have scope when the currency issuer allows it.

The latest decisions from the Bank of Japan are:

– “The Bank will apply a negative interest rate of minus 0.1 percent to the Policy-Rate Balances in current accounts held by financial institutions at the Bank.”

Which means that the commercial banks will pay the Bank if they have excess reserves.

– “The Bank will purchase a necessary amount of Japanese government bonds (JGBs) without setting an upper limit so that 10-year JGB yields will remain at around zero percent.”

Demonstrating that the currency issuer can always set yields on government bonds at all maturities.

– “The Bank will regard the upper bound of 1.0 percent for 10-year JGB yields as a reference in its market operations”.

As above.

The Bank also noted that:

On the price front, the year-on-year rate of increase in the consumer price index (CPI, all items less fresh food) is slower than a while ago, mainly due to the effects of pushing down energy prices from the government’s economic measures

Fiscal policy can thus help to drive down inflation.

The Bank noted that “The year-on-year rate of increase in the CPI (all items less fresh food) is likely to be above 2 percent through fiscal 2024, due to factors such as the remaining effects of the pass-through to consumer prices of cost increases led by the past rise in import prices. Thereafter, the rate of increase is projected to decelerate owing to dissipation of these factors.”

All while interest rates haven’t moved and the government has used fiscal policy to provide some cash relief to households enduring the cost-of-living pressures.

And the overall message to the financial markets was clear:

The Bank will continue with Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control, aiming to achieve the price stability target, as long as it is necessary for maintaining that target in a stable manner. It will continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds 2 percent and stays above the target in a stable manner. The Bank will continue to maintain the stability of financing, mainly of firms, and financial markets, and will not hesitate to take additional easing measures if necessary.

The question that the mainstream economists should be paraded out in front of the public and forced to answer is how can Japan do this and experience economic growth (albeit moderate) while the rest of the world is contracting due to misconceived monetary and fiscal tightening and is recording inflation rates above the Japanese rate?

The New Keynesian mob never directly answer questions like that because they cannot.

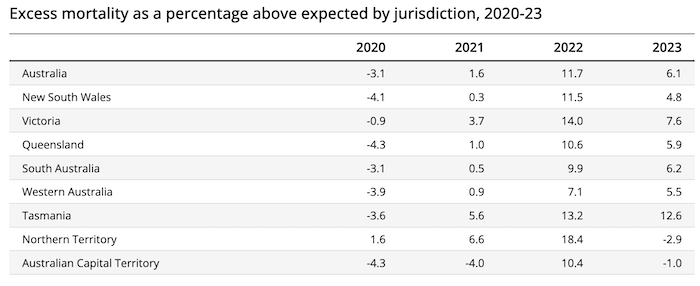

Excess Mortality Data – August 2023

On December 18, 2023, the Australian Bureau of Statistics released the latest data – Measuring Australia’s excess mortality during the COVID-19 pandemic until August 2023.

The last data was up to March 2023.

So we are getting a better time series that will allow for more robust research on this topic.

The ABS say that the intention of the data series is to answer the “research question”:

How does the number of deaths which has occurred during the COVID-19 pandemic (2020-2023) compare to the number of deaths expected had the pandemic not occurred?

They offer the following definition:

Excess mortality is typically defined as the difference between the observed number of deaths in a specified time period and the expected numbers of deaths in that same time period.

The excess could be directly from Covid 19 or other complicating factors.

But it tells us that since the pandemic, the death rate among Australians has risen significantly and well beyond what we would expect given a range of controls.

The summary results:

– Mortality is 6.1% higher than expected for the first eight months of 2023.

– Mortality in July and August of 2023 is closer to expected levels.

– Mortality in the first eight months of 2022 was 14.1% higher than expected.

As Australia enters a new Covid wave, we can expect this excess to rise in the coming months.

The following Table summarises the evolution of this data.

When there were strong restrictions and people wore masks (2020) there was a positive outcome.

The year the restrictions were abandoned and people stopped looking out for each other, the excess mortality skyrocketed.

You will notice that I always wear a mask in public.

It is a small cost to play for at least some protection for myself and those around me.

Episode 8 of the Smith Family Manga comes out this Friday

The Smith Family are still on holidays in Japan and meet the Fujii Family for a visit to an historic shrine.

Inevitably, the talk turns to monetary matters and Hiroshi skillfully sucks Ryan into articulating a position counter to his prejudices.

And Ryan doesn’t even appreciate he is being taken down a path that he cannot come back from.

For access – The Smith Family and Their Adventures with Money.

Tokyo Interviews

When I was in Tokyo recently, I gave a series of interviews to journalists on my views about Japan and the world economy.

One long interview was for the – Toyo Keizai Magazine – which is one of the largest publishers of articles covering politics, business and economics and is based in Tokyo.

Its – Weekly Toyo Keizai – magazine was founded in 1895 and has a wide circulation in Japan.

This week they published my interview with them in two parts:

1. Part 1 – MMT創始者「国債は発行せず金利もゼロでいい」 ビル・ミッチェル教授インタビュー【前編】 (published on-line December 16, 2023)

2. Part 2 – MMT創始者「財政赤字でも金利は上がらない」 ビル・ミッチェル教授インタビュー【後編】 (published on-line December 17, 2023)

The Titles translate to:

Part 1 “Interview with Professor Bill Mitchell, founder of MMT: “No government bonds should be issued and the interest rate should be zero.” [Part 1]”

Part 2 “Interview with Professor Bill Mitchell, founder of MMT: “Interest rates will not rise even if there is a budget deficit” [Part 2]”

I am told the articles have received a good reaction in Japan and got wide coverage.

So at least people are reading about Modern Monetary Theory (MMT) from one of the originals.

Event to launch the Japanese translation of Reclaiming the State

On Sunday, November 5, 2023, Kyoto University organised an event to launch the Japanese translation of our 2017 book – Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World (Pluto Books, September 2017).

The translation was done by Chikako Nakayama (Professor, Tokyo University of Foreign Studies) and Masanori Suzuki (translator).

The speakers at the event included the translators, Professor Satoshi Fujii (Professor, Kyoto University Graduate School), Keita Shibayama (Associate Professor, Kyoto University Graduate School), and myself.

There was a panel discussion following the presentations.

This video records the entire event.

Music – Jimi Hendrix

This is what I have been listening to while working this morning.

One of the great tracks and will be on my list to play at the end (-:

This is the full version of – Voodoo Chile – which came out on his 1968 double-album – Electric Ladyland (released October 16, 1968, recorded May 2, 1968) in New York.

All 14:50 minutes of it.

I bought this album in 1969 from the Import Shop in Bourke Street, Melbourne as soon as it came in.

I was still in high school but dreamed Jimi Hendrix.

As most know by now, the riff is derived from the song by – Muddy Waters – Rollin’ Stone.

As an aside, the latest Rolling Stones album has a version of Rollin’ Stone, which is pretty special.

On this track are:

1. Stevie Winwood – Hammond organ (from Traffic at the time).

2. Jack Cassidy – Bass (from Jefferson Airplane).

3. Mitch Mitchell – Drums.

4. Jimi Hendrix – Vocals, Guitar.

When I was young, this song and playing took one to the ‘outskirts of infinity’, which is one of the lines sung by Jimi Hendrix in the verse.

I still am amazed at the spontaneity of the playing.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

I went to Maitland hospital 2 weeks ago and my wife and I were the only people wearing masks.

Can’t say I’m surprised.

Hi Bill,

Great Wednesday post as usual.

I had a question about the quote from the BoJ. In their quote they say that they:

“will continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds 2 percent and stays above the target in a stable manner”.

Doesn’t this statement imply that the price level should be understood as a function of the monetary base (amount of money in circulation)? This seems like a very Monetarist conception of the price level, i.e., like saying that inflation is ‘everywhere and always a monetary phenomenon’ (Friedman etc). In my (limited) understanding of heterodox economics, I’ve read that the money supply and the price level are not connected, or only tenuously connected.

I was curious about this quote as it makes it seem like the BoJ are labouring under the misconception that inflation is a result of money supply expansion. Perhaps there’s something I’m not getting here, or is the BoJ operating in line with monetarist thinking?

Cheers,

gabe

Parallel universes indeed. One reads the UK Guardian economics correspondent: ‘there is growing expectations across advanced economies that a weaker economic backdrop will force the world’s most powerful central banks to row back on their toughest cycle of interest rate hikes in decades.’ Japan is in a different and unknown or never to be referred to universe.

Gabe’s question is very good. I think the consequences of the COVID response probably supports the Friedman view.

Sergio: yes, Andrew Leigh posted me an article (by Forbes iirc) that “proved” MMT causes inflation, as shown (in his view) by the effects of the government covid -rescue packages…

Governments letting corporations do as they please is the issue not MMT.

Shame on anyone gullible enough to believe otherwise.

I second Gabe’s question about what BOJ intends by “expanding the monetary base.” Their goal is to increase inflation to a rate of 2+ percent. Does BOJ subscribe to the fractional reserve deposit multiplier understanding of bank lending? Does BOJ not furnish whatever reserves a commercial bank requires, thus mooting the importance of monetary base? Quantitative easing has caused gigantic increases in monetary base for many years — to what effect?

As Gabe says, this is straight out of Milton Friedman’s policy toolkit.

Bill M. and other MMT economists have very much downplayed the significance of the money supply, citing the monetary authority’s inability to control it, and the absence of strong historic correlation between money supply and inflation rate.

On the US Fed’s website, Ben Bernanke explained back in 2006 that monetary aggregates had not been a primary tool of Fed policy for 24 years: “It would be fair to say that monetary and credit aggregates have not played a central role in the formulation of U.S. monetary policy [since 1982].” https://www.federalreserve.gov/newsevents/speech/bernanke20061110a.htm

Why is Bank of Japan BOJ focusing on the monetary base today?