I started my undergraduate studies in economics in the late 1970s after starting out as…

When corporate welfare invades the day of rest

Ah Sunday. I don’t go to my office at the University. I ride lots of kms on my bike. I mix working at home on my research with digging in my food production system (garden). And … if I am stupid, I read the financial press and study the data trends. At that point, any sun that is around becomes a dark cloud and I sink into a malaise and wonder why modern monetary theory (MMT) ….

To begin with, I note that Mike Carlton is back writing for the SMH after he was sacked last year for refusing to file a story, while journalists at the SMH were on strike.

Yesterday’s column All hail the shameless neo-cons was another biting hitout at the whining conservatives who always feel hard done by if they aren’t getting dollops of corporate welfare from the government but as the cash is handed over they scream the budget should be in surplus and housing, employment, health and education programs should be cut to shreds to stop inflation, higher taxes, debt blowouts and whatever other catastrophes accompany low-income workers getting better access to health care.

He wrote (with some editing from me):

A thread, though, does emerge from the gloom. The dolts who got it so catastrophically wrong in what you might call the Bush/Blair/Howard interregnum are now howling from the rooftops that it’s high time the whole mess was cleaned up, and why hasn’t it been, and what’s going to be done about it, and what a bunch of wimpy hypocrites Barack Obama and Kevin Rudd have turned out to be. Their gall is monumental.

….

In ancient Rome, no great man moved without the say-so from his Haruspex. The Haruspices (plural), wise men all, would pore over the entrails of sacrificed sheep or goats and, from the signs revealed, would divine, say, whether the Ides of March was time or not to assassinate Caesar in the forum. In this useful work they were assisted by augurs, priests who studied the flight of birds: ptarmigan heading north augurs well for sacking Carthage. Two millenniums on, how we laugh at such mumbo jumbo. Instead, we have economists.Curiously, though, while the practice of economics might be more scientific (debatable, I admit) the results are just as haphazard. Do economists get anything right? Ever? … The … [mainstream profession] … plainly didn’t have a clue. Still less were they repentant afterwards …

But the dopiest of the lot are those who work for the big banks. Their mission in life, in so far as they have one, is to get their heads on television, carefully positioned in front of their employer’s logo. (And why ABC TV news lets them get away with that not-so-subliminal advertising I do not know.) …

As an aside, the last point is particularly interesting. In the 1980s and before that the national media including the ABC used academic economists to provide daily commentary on financial markets and the economy. I am not saying I agreed with any of it (except my own comments!) but it was the established practice. During the 1990s I noticed a shift occurring (I was getting less interviews) as the media started parading the so-called bank economists out to give the daily commentary despite their obvious vested interests.

The ABC is particularly remiss in this respect and gives these commentators hours of free advertising per week. Most say the same thing and none that I ever hear know anything about how the modern monetary system actually operates. They seem to parrot mainstream textbook renditions of the daily events and reinforce the collective ignorance.

Anyway, Mike Carlton’s article was a good starting point for some other news stories this weekend.

Following up on my blog on Friday about how Goldman Sachs received around $US30 billion in loan guarantees but denied it and, further, were allowed (along with JP Morgan) to become a bank holding company which meant they could borrow directly from the Federal Reserve despite not seeming to have brought their balance sheet in line with the requirements befitting that status, I read further corporate welfare pleas in yesterday’s business pages.

This is about Australian banks and the article bore the title Don’t pull the lifeline, which suggests that something important is about to die unless supported in intensive care by all the available technology that can be brought to bear.

According to the article, the banking sector is calling on the Australian government:

… to retain the wholesale funding guarantee into the new year, warning it is too early to cut the program that has underwritten debt raisings because global credit markets remain fragile.

For overseas readers this relates to the emergency bank guarantee scheme that the Federal government introduced in November 2008 as the financial fears were mounting and Australian financial institutions were facing significantly restricted access to funding from international wholesale funding markets. It was considered that this would cause a liquidity crisis in Australia and increase the liklihood of a major recession.

So the Australian Government introduced the government guarantee on the deposits and wholesale funding of Australian deposit-taking institutions (ADIs). You can read the full list of institutions on Sean Carmody’s blog.

The stated aim of policy was to:

- assist Australian banks, credit unions and building societies in accessing on-going funding in domestic and international credit markets;

- ensure financial system stability;

- maintain credit flows in the economy as international capital markets were in meltdown;

- maintain the competitive position of ADIs relative to the foreign banks that had received similar guarantees on their bank debt from their own governments.

After November 28, 2008, deposits over $A1 million and wholesale funding would be guaranteed if a fee, based on the credit rating of the institution, was paid. Anything under $A1 million was guaranteed per se.

So for AA credit-rated ADIs the fee is 70 basis points whereas for an A credit-rated institution, the fee is 100 basis points. Some of the smaller banks pay up to 150 basis points extra for bonds issued under the guarantee.

So within the structure of the policy, there is a competitive edge given to the bigger institutions.

There were also some other resource re-allocative elements in the policy relating to the scope of the guarantees. For example, deposits within managed funds were not guaranteed (presumably to discourage higher risk behaviour).

Anyway, the guarantee (which offers the Federal Government’s AAA-credit rating to the banks) is according to one of the larger mortgage providers (Suncorp) still necessary. Their boss was reported as saying:

We received strong feedback from overseas investors about their confidence in the stability of the Australian banking system and Suncorp’s own prospects … [But international debt markets were] … not yet at the point … [where the Government should consider withdrawing the funding guarantee] … The underpinning support of the guarantee will still be required …

However, the guarantee and some anti-competitive mergers approved by the federal government have combined to provide the big four banks are major advantage in the mortgage markets.

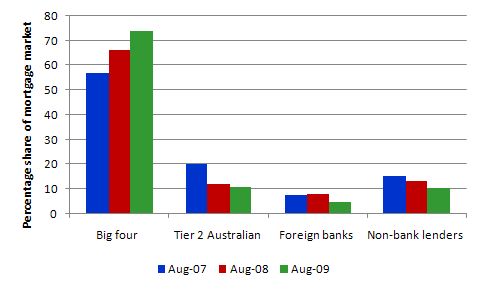

The following graph shows the changing shares in the Australian mortgage market since 2007. The data comes from the excellent banking statistics published by the Australian Prudential Regulation Authority, which oversees the financial system.

It shows that in August 2007, the big four banks held 56.8 per cent of outstanding mortgages in Australia, whereas by August 2009, that share had risen to 73.8 per cent. Two banks (Commonwealth Bank – 25.3 per cent; and Westpac 23.2 per cent) hold 48.5 per cent of the market. The increased share has come mainly from these two banks. The share of mortgages held by ANZ and NAB have changed very little since the GFC began.

This increase is in part reinforced by the anti-competitive mergers that the federal government allowed to proceed in 2008 – the Westpac takeover of St George and the Commonwealth Bank takeover of Bankwest.

You can recompute the shares to simulate what might have been the case if those mergers were prevented – the share in August 2009 would be 62.9 per cent.

In recent months, the big four have been funding nearly all the new mortgages in Australia. They have also refused to pass on the central bank interest rate cuts in recent months and are now threatening to push rates up more than the central bank increases.

It is clear that the increased competition in the mortgage markets provided by the smaller banks and non-bank lenders has been reversed as a result of the crisis and the way the government has reacted to it.

The banks claim this is because their funding costs have risen. The problem with the argument is that without full disclosure of by how much we are left with the sneaking suspicion that the banks are just padding their margins to push for higher (publicly-subsided) profits than before. I read recently a report (I just cannot locate it right now) that analysed this issue and concluded that the funding cost increases were much smaller than implied by the banks and not enough to justify their mortgage pricing.

Since the guarantee some $182 billion funds have been raised and $127 billion have been government guaranteed. Our funding guarantee scheme is “the cheapest in the world at half the rate charged by the US government”.

Since the guarantee “the big four banks have enjoyed a 13 per cent growth in deposits” and in the current year they forecast profits totalling $17 billion.

The one offset to the anti-competitive slant is that the government has been willing to buy AAA-rated mortgage securities under certain circumstances. But clearly this is not denting the oligopoly.

The point is that the government was insane in not insisting on a better deal for the public when it gave the golden guarantee to the banks and structured it in favour of the 4 dominant players. This is especially in the context of all the boasting of how well placed our banking system was to avoid the crisis anyway. There has been no end of self-congratulation going on about how good the Australian system is. I disagree but that is the topic of another blog.

Anyway, continuing the golden theme, there was this report in the Sydney Morning Herald (October 17, 2009) – Golden days are here again with bonus bonanza.

The report said:

Put the Krug on ice. Golden days are here again for elite investment banks. Goldman Sachs is gearing up to pay its biggest-ever bonuses to its 31,700 employees after raking in profits at a rate of $US35 million ($A38 million) a day. It’s the clearest signal yet that London and Wall Street are returning to their old ways of money-making prosperity … There were similarly booming results a day earlier from rival US bank JPMorgan Chase, and together Wall Street banks are forecast to pay a record $140 billion in bonuses this year.

Clearly, the US Government has a bit of a problem here while “unemployment continues to rise, home repossessions are up and shops are falling victim to tepid sales” while at the same time Goldman Sachs has been profiting from the huge emergency funding they received from the US Treasury.

While some of the profits boost has come from surging share markets, it is clear that the “demise of weaker banks has taken the edge off cut-throat competition in investment banking, giving survivors more breathing space”. So the story happening here in Australia is the same the world over.

Further, the “issuance of billions of dollars in public borrowing has made the secondary debt markets a lucrative area for traders. And an implicit government guarantee that banks are “too big to fail” has shored up confidence.”

The latter reminded me of how the greedy get themselves caught up in their own rhetoric. Back in the late 1990s, many of the major players in corporate life in Australia were extolling the virtues of the federal government pursuit of budget surpluses (as long as their dollop of welfare was part of the cuts that were made of-course).

But then it became clear that the government bond market was becoming very thin as the government paid out outstanding debt. There was a major outcry from institutions such as the Sydney Futures Exchange about the disappearing bond market. Why did they care? Well they and other investment banks etc use government debt as the risk-free pricing benchmark for other contracts. It is also a guaranteed income to them in times of uncertainty. Purchasing fixed-income assets like government bonds can guarantee returns for investors.

At the time there was a government enquiry and it was decided that even though the government would persist in running surpluses they would guarantee a certain volume of debt would be issued each year to satisfy the special pleading of the top-end-of-town. I wrote about it here – A plague is ahead … if you are interested in knowing more.

But it raised the point – the debt was not being issued to finance government net spending because the latter was negative! QED for MMT!

Some of my US mates like to point out to me that I do not really understand the political structure of their country. They reliably inform me that Goldman Sachs is actually the US Government and Barack Obama and co work for them. Anyway, now I have some independent verification. This news report – Goldman Sachs in Talks to Acquire Treasury Department – informs us that the de facto relationship between Goldman Sachs and the US Treasury is about to become formalised.

And just when you thought it was over, here is something that appeared in the Australian Financial Review Investor column this morning. This is a section in the Sunday newspapers that holds itself out as providing expert advice to households and others on their investment planning and seeks to explain what is happening in the economy that might influence investment outcomes. You would hope the columnists knew something. You would be wrong if you thought they did.

A senior journalist at the AFR, David Potts claimed today that:

The main global game has become the retreat of the US dollar. And there’s no better way to kick-start the biggest economy than by boosting exports and cutting imports.

So dealing with this is a blog in itself. But if you take your investment advice from a person who writes this sort of stuff then buyer beware.

But thinking it is optimal (“the best”) to encourage growth by deliberately reducing the standard of living of your population (encouraging net exports) is a curious way of seeing the world. The best way to kick-start an economy is with fiscal policy because you can ensure the domestic resources are utilised more fully by the residents (which includes providing employment for those without any).

Further on, he says:

And don’t count on the stronger … [AUD] … dollar prompting the Reserve Bank to stay its hand on rate rises, either. No, it’ll be selling Australian dollars, for which there are plenty of buyers. Those profits will flow to the federal budget as a juicy dividend. Big enough, perhaps, to spare some cutbacks or, shudder, tax rises next year.

Again, reinforcing the erroneous ideas that: (a) the Australian government is revenue-constrained; (b) that it will have to cut its deficit independent of the movement in desired saving by the non-government sector; and (c) that taxes will rise if it doesn’t.

I notice that in the same segment they have what they call “Shares Race” they give out a virtue investment portfolio to 8 people and then track their share investments over a period. The top investor is the Dartboard, and fourth place is an Astrologer. Potts, the expert is well behind on 6th.

As an aside, I actually think my blog will improve once News Limited imposes charges for their Internet sites because I will read less of this sort of rubbish (noting that the AFR is a Fairfax rag that is going broke anyway).

Conclusion

Time to get out in the sun.

Tomorrow I am off to Central Asia for 8 days on a Asian Development Bank mission to advise Central Asian Governments on macroeconomic risk assessment. So over the next week the blogs will be coming from Almaty and I will clearly be introducing a cultural note or two.

hi bill,

if you get the chance try and get your hands on the weekend austalian business supplement “the deal”

interesting piece on greenspan, just in case your sunday disposition was getting a bit too bright and cheary. 🙂

here’s quote

alan greenspan ; “the conversation about re regulation i must say i find rather incomplete. my view is that you should be required to demonstrate why it is to the net benefit of society and the financial system”

where’s mr greenspan been one wonders over the last 12 to 18 months, perhaps tucked away in a monestery repenting for his sins,

perhaps he has gone blind and he cant see the wreckage of the GFC around his ankles as tripps over it

quite laughable sometimes the delusions people suffer , if it wasnt so sad

Hi Bill

[quote]”While some of the profits boost has come from surging share markets,”[/quote]

You see the irony is that even the equity markets have only rebounded as strong as they have purely because of govt. intervention. One of the stated purposes of QE in the UK was to boost asset prices. Indeed the policy seemed to be one of chasing away the dash to safehaven assets like govt. bonds, and into equities at the height of the crisis, where investors would get better returns than govt. bonds. Let me know what you think about this idea.

Also, previously you mentioned that bond sales were as much about interest rate control and an enforced tradition. I agree totally with MMT that bond sales do not ‘fund’ govt. spending, but is it a new position to suggest that bond sales are a form of corporate welfare ? Guaranteed income stream for the big banks and investment banks. In which case can they not just treat it as another trading market, and stop with the nonsense about it being how govts. raise funds. All this nosh about our ‘foreign creditors’ and ‘bond market vigialanete’

btw, i don’t really think there’s much difference between the bush/blair/howard era and the current obama/brown/rudd administrations. It’s clear that the current power brokers have learned nothing, despite all the admirable talk about curbs and reforms they continue to evade implementing any reform….expectant of a back to normal scenario.

The idea that obama is forgiven for all this jawboning because he promises to do something about healthcare is an utterly infantile position to hold. for those who think that. he doesn’t fool me that easily.

Bill:

Funny link – Goldman buying Treasury. Of course we see that Adam Storch, a 29-year old Goldman staffer (or “executive”) is being appointed to be the SEC Chief Operating Officer. Now, this is the first Chief Operating Officer in the SEC’s history, so it makes perfect sense to appoint a someone with almost 5 years of industry experience to this new role.

Clearly Goldman needs a good mole (or gopher) to nose/dig around the SEC. Back channels are becoming front channels as we speak.

Sigh – Sundays can be so depressing. I also screwed up the Saturday quiz – so much for my weekend.

PEB

Dear Bill and all,

Great articles. And I refer to both yours, Bill, and the one by Roger Bootle.

As you know, whatever contribution I could possibly make to this blog would be purely marginal and almost accidental. I hope this occasion is an exception.

Before proceeding, I would like anyone who read both, Bill’s and Bootle’s, articles to humor me and rate them on the scale below (I will explain this shortly):

(1) I agree completely that the economy should stress creation over distribution.

(2) I somewhat agree that the economy should stress creation over distribution.

(3) I completely disagree that the economy should stress creation over distribution.

I don’t know how many of the readers might have any knowledge about Marxian economics (although I suspect Bill must be quite familiar with it), but these articles could very well have been written by a Marxist. Any Marxist would agree -and I certainly do- that, as a normative ideal, the economy should stress creation over distribution.

Note that in Marxian economics the emphasis is on the creative side of the economy and on those who create. Distribution, one can find in any basic Marxian reference, only takes something from one, and gives it to another: it does not add anything to the commodity, but creates opportunities for conflict.

I don’t really know how dated Marxian economics might be. I am sure that in many respects, it is quite dated, as many critics have pointed out. But there is one element Marxian economics -and Marxism in general- stresses: conflict of interests.

In contrast, in basic microeconomics one finds statements that producers are “small”: their input purchases (except in oligopsonies and monopsonies) do not affect input prices; their productions (except in oligopolies and monopolies) cannot affect product price.

As long words like “monopsony” seem to have fallen in disuse, one occasionally finds in the modern media references to “buyer’s market”, but the end message is that conflict among producers, or among buyers, or among suppliers and consumers, if it ever exists is strictly limited. This allows neoclassical economists to say that the economy is not a zero-sum game: modern neo-classical economics describes an economy without conflicts.

In an economy where creation takes precedence, this description might be relatively more accurate, but in economies like ours, where distribution is increasingly predominant (through financial globalization and active fiscal and monetary policies), I suspect it loses a lot of credibility.

Cheers,

Marco

PS: Ah! So why did I make that peculiar request? Well, for one, because I may be a little peculiar myself; and also because in many other blogs (hopefully not in this one) one may create a fair bit of controversy by using the “M” and “S” words. A matter of ideology (which was also implicit in many things Bill said about education).