I started my undergraduate studies in economics in the late 1970s after starting out as…

Friend of the state, Friend of the people award

Earlier this week my professional association (which I decline to join) – the Economics Society (ACT Branch) awarded its inaugural Enemy of the State/Friend of the People award to a microeconomist for advocacy in defence of economics and its application to public policy. The stunt reflects the major historical revisionism that is now a daily occurrence and appears worse than anything that occurred in the communist states. Those who think they have an entitlement to make huge profits (helped by government guarantees) yet return to behaviour that brought the world economy unstuck are now in attack mode. There is denial, outright deception, constant hectoring. To redress this issue, I am now calling for nominations for the Modern Monetary Theory’s (MMT) Friend of the state, Friend of the people award. It will be awarded to all persons (we believe in collectives) who understand how our monetary system operates and how it can be managed via fiscal policy to serve public purpose and advance the welfare of the most disadvantaged.

Others are also noting this mounting revisionism.

Paul Krugman’s recent New York Times article (October 11, 2009) – Misguided Monetary Mentalities is interesting in this respect. He writes:

One lesson from the Great Depression is that you should never underestimate the destructive power of bad ideas. And some of the bad ideas that helped cause the Depression have, alas, proved all too durable: in modified form, they continue to influence economic debate today. What ideas am I talking about? The economic historian Peter Temin has argued that a key cause of the Depression was what he calls the “gold-standard mentality.” By this he means not just belief in the sacred importance of maintaining the gold value of one’s currency, but a set of associated attitudes: obsessive fear of inflation even in the face of deflation; opposition to easy credit, even when the economy desperately needs it, on the grounds that it would be somehow corrupting; assertions that even if the government can create jobs it shouldn’t, because this would only be an “artificial” recovery. In the early 1930s this mentality led governments to raise interest rates and slash spending, despite mass unemployment, in an attempt to defend their gold reserves. And even when countries went off gold, the prevailing mentality made them reluctant to cut rates and create jobs.

The public debate now is being crippled by this gold-standard mentality. As the free fall into Depression has been arrested by the fiscal policy intervention I have been pondering on whether we have really made progress in the area of economic thinking.

Naively, I thought the crisis was a chance for people to abandon old ways of thinking – which were always in my view flawed but for various reasons maintained its domination – not the least being the relentless promotion of anti-government ideas by the conservative media and the neo-liberal-cum-Austrian think tanks that the media gives free publicity to on a daily basis.

Sort of like papering over cracks in walls. Eventually the walls have to be replaced but for a time the paper stalls that decision.

When it comes to berating those such as me who dare to suggest that direct public sector job creation is a sensible way to restore income security for the most disadvantaged workers in the economy who almost always bear the brunt of an economic downturn – and even in better times don’t actually live high on the soya bean (billy blog is vegetarian remember) … the conservatives shout something about digging holes and filling them in again … as if that is enough to shut off ideas and debates.

How many Austrian-leaning economists who are among the most obnoxiously vocal of the conservatives actually analyse what people do on a daily basis to earn their livings? How many of them know that millions of people work for private sector bosses n fairly poor conditions, receive pay below the poverty line and produce very low levels of output – not because they are lazy or inefficient – but because they work in areas that the capitalist can’t be bothered adequately provisioning the workplace with enough capital to make them productive.

How much stuff in K-Mart (or equivalent) would you consider to be quality output? Not much at all. This is not a criticism of the workers – they do what they have to do given that capital, predominantly in our system, determines via its investment the jobs that will be forthcoming.

The point is that I don’t see much virtue in the sort of investment decisions that private capital makes. Millions of jobs are created in these low-paid, low-capital provisioned areas making … useless junk that breaks, pollutes, and disappoints. Soon after it is purchased it becomes land-fill further stretching our environmental challenges.

So when I suggest we employ people within the public sector who are unable to find work elsewhere to, for example, provide personal care services to the elderly – to maintain them in their own houses instead of forcing them to go against their better judgement into a nursing home – how is that worse than standing on an assembly line punching out bits of plastic that end up in land-fill soon after they leave the shop?

There is no argument about that. Maintaining someone’s dignity in their own home as long as their health permits instead of forcing healthy people out of their homes because their frailty in old age renders them unable to upkeep their homes, do their gardens, wash their clothes, do their shopping etc … is a highly productive pursuit.

To oppose that in favour of the plastic widget makers has to reflect ideology – a hatred of public life. But the hypocrisy has no limits – do this lot hand back all public benefits? Have they worked out that even if they “pay taxes” (thinking wrongly that this act is contributing to public provision) – what percentage they actually contribute relative to use?

Anyway Krugman recognises this dilemma:

But we’re past all that now. Or are we? America isn’t about to go back on the gold standard. But a modern version of the gold standard mentality is nonetheless exerting a growing influence on our economic discourse. And this new version of a bad old idea could undermine our chances for full recovery … In recent weeks there have been a number of statements from Fed officials, mainly but not only presidents of regional Federal Reserve banks, calling for an early return to tighter money, including higher interest rates. What’s even more extraordinary, however, is the idea that raising rates would make sense any time soon. After all, the unemployment rate is a horrifying 9.8 percent and still rising, while inflation is running well below the Fed’s long-term target … Yet some Fed officials want to pull the trigger on rates much sooner. To avoid a “Great Inflation,” says Charles Plosser of the Philadelphia Fed, “we will need to act well before unemployment rates and other measures of resource utilization have returned to acceptable levels.” Jeffrey Lacker of the Richmond Fed says that rates may need to rise even if “the unemployment rate hasn’t started falling yet.” I don’t know what analysis lies behind these itchy trigger fingers. But it probably isn’t about analysis, anyway – it’s about mentality, the sense that central banks are supposed to act tough, not provide easy credit.

While I don’t think Krugman understands MMT as a working paradigm, he certainly expresses a sound sense of priorities – we should be using policy to bring down unemployment as the most important expression of public purpose. I even read somewhere this week that a Fed official was trying to argue that the output gap wasn’t that bad at present (which means he is implying the NAIRU has risen).

Every time unemployment soars due to deficient aggregate spending, the neo-liberals come out and claim it is structural – attitudes to work must have changed, people must have become instantly unskilled etc.

There was a lovely quote I read once in the distant past (I am trying to recall it) but the message was – if you believe the mainstream economics version of the Great Depression then you would think that suddenly around 30 per cent of the labour force in most countries became lazy and decided to enjoy leisure over work.

Now here are some of the revisionists that have come out in the last week.

First the liars.

Bloomberg reported overnight that the Chief Financial Officer of Goldman Sachs the investment bank/hedge fund sorry bank (depending on which what is more convenient on the day for them) said:

We operate as an independent financial institution that stands on our own two feet … We don’t think we have a guarantee … If we felt that we had an implicit guarantee we would not be holding nearly $170 billion of cash on our balance sheet. We would not have reduced our balance sheet by $400 billion, we would not have reduced our exposures to all illiquid assets … (n)one of our bondholders have ever talked to us about that,” Viniar said. “I don’t believe any of our bondholders think that we have a guarantee and we don’t think we have a guarantee.

Goldman Sachs was one of the first financial institutions to get US Treasury handouts. They just posted another huge profit in the third quarter. The report said that the company, the “most profitable … firm in Wall Street history, returned the $10 billion received from the U.S. Treasury plus dividends in June.”

Further, just over a year ago, as Lehman Brothers collapsed, the two giants on Wall Street, who some might allege run the US given their power and influence within government – Goldman Sachs and Morgan Stanley “were both allowed to convert to bank holding companies, gaining the ability to borrow money directly from the Federal Reserve”. On first blush, Goldman’s are probably in violation of the rules that govern bank holding companies (excessive leverage ratios). Would anyone who analyses these things in detail like to offer us some insights?

If they are why are they allowed to continue trading? One of my colleagues concludes that “Goldmans has become the US Government”.

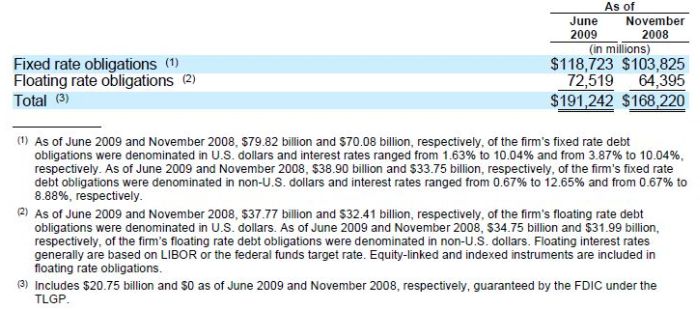

More clearly, since the crisis in 2008 they have issued $21 billion odd of debt which was guaranteed by the Federal Deposit Insurance Corporation (part of the US government).

Here is an extract from their last financial reports showing the government guaranteed debt that was issued (thanks to Marshall for the scan). Look at footnote 3 for a start. I read that as receiving a government guarantee (via the FDIC). You can view all the Q10 filings at the SEC. Just search for what you want.

I guess that not only do they want to have the risk-taking capacity of an investment bank but they also want the security of being able to borrow directly from the Federal Reserve. The only problem … which seems to have been conveniently overlooked by the US authorities is that you cannot have both.

And for Australian readers, who are making choices about banking you might like to know that Goldman have entered into an agreement with the National Australia Bank – ASX announcement. That is one less of the four you should be dealing with (at least).

Now what about our newly celebrated Enemy of the state, Friend of the people award recipient? This was issued by the Economic Society of Australia – the professional association (not!) for economists. It just shows you how poor a state our profession is actually in.

The winner (loser!) Henry Ergas is a right-wing micro-economist who spent a long-time working with the OECD. He has long advocated widespread privatisations particularly in the telecommunications area. But in general he adopts the view – if it is public sell it so that a minority of private wealth holders can get their hands it and shed labour.

He has been a long-time advisor to Telstra (the privatised national telco) which is about to be undercut by the national government’s national broadband plan because it has been gouging the market for years using its monopoly control of the lines into our houses to prevent competition. Innovation has lagged behind world standards as a result (we have slow broadband which is not available in many areas) and the ridiculously high prices merely delivered huge rents to the executives that took over the public company. There is nothing that would reflect any efficiency at all in the way Telstra operates.

He also writes in the News Limited deficit-debt hysteria daily The Australian (sadly our only national newspaper). Every day this newspaper carries anti-government spending so-called opinion pieces. They are getting more rabid as time goes on. Ergas also does pro-bono work for the conservative opposition in this country. He is hardly an independent voice.

His most recent article (published October 16, 2009) in The Australian had this to say:

What will the US get for the many hundreds of billions of dollars it has committed? A collection of terminally ill auto companies on taxpayer-funded life support, a social security system mired in claims it can never meet, and a fiscal position worthy of a failed African state … Restored to its former glory, the Keynesian orthodoxy, no less confused than before, is a packet of aspirins always at one’s elbow, permitting every temptation to be indulged … That it is easier and more pleasurable to spend other people’s money than to assess whether it is being spent wisely is not a proposition one can argue with.

His columns are full of this gold-standard mentality. The problem is that I have never seen any coherent macroeconomics research from him over the years and when he does make macro statements (without any background research authority to draw on) he reveals that he totally misunderstands the way the modern monetary system operates. His world is the microeconomics textbook world which doesn’t understand fallacy of composition and assumes nonsensical things about the way people and institutions behave.

The model that emerges is one of deregulation and market freedoms. But we should always remember, that despite all the rhetoric about efficiency and welfare maximisation, Ergas and others who are staunch market liberal advocates have presided over a policy period that has seen increased World poverty rather than reduced it.

Further, the failure to adequately regulate the financial sector and the extolling of unfettered greed as a virtue is the main reason the world economy is now at its knees. These characters have had their turn – they should be ignored.

As an aside, he was the butt of a Minister’s jokes the other day when his private consultancy went broke. Companies ultimately go broke because they are mismanaged (the managers are ultimately responsible). So this is despite him continually telling us that we need proper management of public spending and casting judgements to the effect that governments just waste money and that all activities require the discipline of the market. All that sort of nonsense.

Anyway, that was a good reminder of why I would never join my professional association. Fancy being a member of a body whose membership awards ignorance.

So in that context, I am today calling for nominations for the MMT Friend of the state, Friend of the people award for all persons who understand how our monetary system operates and how it can be managed via fiscal policy to serve public purpose and advance the welfare of the most disadvantaged.

I will set up a self-printing certificate system and you can show your kids or partners or just yourself (no family values bias here) that you are looking after the economy and the rest of it.

Finally some more cant.

In the forthcoming November/December 2009 edition of the Foreign Affair there is an article written by C. Fred Bergsten which carries the title The Dollar and the Deficits: How Washington Can Prevent the Next Crisis.

He is the director of the ultra right Peter G. Peterson Institute for International Economics. You can read the entire article via the Institute Home Page. Delete the link once you have read it because you wouldn’t want your partners or children finding out you have been visiting this sort of crazy place!

His opening gambit is this:

Even as efforts to recover from the current crisis go forward, the United States should launch new policies to avoid large external deficits, balance the budget, and adapt to a global currency system less centered on the dollar … This is not just an economic imperative but a foreign policy and national security one as well.

Really, so the hordes will invade America fair if they don’t get rid of their federal budget deficit and stop enjoying the net imports.

He then says that

… These huge inflows of foreign capital, however, turned out to be an important cause of the current economic crisis, because they contributed to the low interest rates, excessive liquidity, and loose monetary policies that – in combination with lax financial supervision – brought on the overleveraging and underpricing of risk that produced the meltdown.

No, it was the lax supervision and allowing banks to morph into something else as well as the outright fraud and dishonesty that created the financial mess.

Bergsten then links the deficits:

To a large extent, the US external deficit has an internal counterpart: the budget deficit. Higher budget deficits generally increase domestic demand for foreign goods and foreign capital and thus promote larger current account deficits. But the two deficits are not “twin” in any mechanistic sense, and they have moved in opposite directions at times, including at present …

These two balances are linked intrinsically in a national accounting sense to a third balance – the private balance between household saving and business investment. The three balances have to add to zero.

The interesting research issue is to work out the behavioural drivers of each balance. It is clear that the government balance is related to the non-government balance (the sum of the external balance and the private domestic balance) $-for-$ by the creation and destruction of net financial assets that follows government monetary and fiscal policy changes. So the government sector can push a dynamic into the non-government balance.

But also, the saving desires of the non-government sector can, via the automatic stablisers, can force the government into deficit (depending on the current account).

Bergsten continues to reveal he does not realise that we are in 2009 not 1970:

If the rest of the world again finances the United States’ large external deficits, the conditions that brought on the current crisis will be replicated and the risk of calamity renewed.

The reality is that the US is financing the ROW via the external deficits. The only reason the ROW is willing to net ship real goods and services to the US and deprive their own citizens of the use of these resources is because they want to accumulate net assets denominated in USD. That is why the real terms of trade (what actually gets shipped) are so much in America’s favour. They should relax and enjoy it.

Bergsten then decides that:

Balancing the budget is the only reliable policy instrument for preventing such a buildup of foreign deficits and debt for the United States. As soon as the US economy recovers from the current crisis, it is imperative that US policymakers restore a budget that is balanced over the economic cycle and, in fact, runs surpluses during boom years … The US government’s continued failure to responsibly address the fiscal future of the United States will imperil its global position as well as its future prosperity. The country’s fate is already largely in the hands of its foreign creditors, starting with China but also including Japan, Russia, and a number of oil-exporting countries. Unless the United States quickly achieves and maintains a sustainable economic position, its ability to pursue autonomous economic and foreign policies will become increasingly compromised.

Last time I checked the US Government issued US dollars and only spent those in pursuing its fiscal policy. I have never heard of China, Japan nor Russia issuing US dollars and giving them to the US Government so that it can spend them. America’s fate is in its own hands. A foreign observer such as myself would look at Goldman Sachs receiving billions in public handouts and profiting on government guarantees alongside the 9.8 per cent unemployment (and rising) and conclude that they are very capable of messing things themselves.

While there are material gains to trade, the overriding fortunes of the US people will rest on how well the US Government finances the desire to save of the non-government sector through deficits. The composition of those deficits will determine equity and poverty attenuation and so that issue should be carefully considered and designed.

But China could stop buying any US government paper tomorrow and nothing would significant (in a welfare sense) would change within the US.

We also encounter the loanable funds doctrine:

… budget deficits stimulate inflows of foreign capital. Domestic saving is inadequate to meet the demand on the world’s credit markets created by US government borrowing and to fund a healthy level of private investment. This shortfall is met with capital from abroad.

Private investment is never constrained by a lack of domestic saving. Private investment is funded by loans which create the necessary deposits in the banking system. The reserves are then added to conform with central bank requirements. The private investment generates higher saving as a matter of consequence.

Bergsten then brings the crowding out bogey out:

The chief mechanism through which higher internal deficits lead to higher external deficits is the exchange rate of the dollar. The additional debt that the government takes on to finance the budget imbalance increases US interest rates, which is undesirable in purely domestic terms because higher interest rates crowd out private investment and choke growth.

The US Fed sets interest rates. Budget deficits drive down overnight rates. The Federal Reserve might choose to have higher interest rates but these will not be related to the debt-issuance and the debt-issuance has nothing to do with financing government spending.

Bergsten then rehearses some cures and concludes that the:

The only healthy way to reduce the United States’ external deficits to a sustainable level is to raise the rate of national saving by several percentage points. Such an increase could be achieved with a combination of increased private saving and a reduced federal budget deficit. Prior to the crisis, household saving in the United States was essentially zero; it has recently rebounded to the 5-7 percent range. This is presumably a reaction to the sharp decline in household wealth created by the fall in housing and equity prices during the crisis … budget policy is the only reliable policy tool for increasing US national saving. There are, of course, a number of purely domestic reasons to avoid large budget deficits, from inflationary pressures to concerns over intergenerational equity to the relative inefficiency of government spending.

It goes on like this for some paragraphs without adding much more to the already twisted logic that is contained here. Here is the way to understand it … simple and clear … if you are running an external deficit (and the US has not recent history otherwise) then if you want US households to save then you have to run a federal budget deficit (given all the states are forced to run balances). Simple and clear.

If you try to run a zero budget balance on average over some cycle then you will also be aspiring to a zero private saving over the cycle for a stable net export position.

You simply cannot escape that. You may want to run budget surpluses to slow the economy down but then you will drive private domestic savings into deficit unless the external account is in surplus. You may try to get a positive current account but then you have to explain to your citizens why you are lowering their living standards and you have to explain to the developing world which the IMF is forcing export-led growth strategies on, why you are not prepared to accept net shipments of their real goods and services any longer.

Quite simply, an external surplus is a nonsense for the US. Further, relying on increasing private indebtedness for growth is a nonsense for the US or any country. That means … folks … the US government will be in permanent deficit. Get used to it.

As an aside, in an NPR interview – The Economic Costs of Natural Disasters – on the Talk of the Nation show (broadcast December 29, 2004), just a few days after the devastating Tsunamis hit South East Asia, the same C. Fred Bergsten talked about the costs of the disaster (thanks to Peter Martin for reminding us of this again).

After making some glib remark about the human losses, Bergsten then spent the rest of the interview telling everyone that it was important to realise that the economic costs were not so enormous. He said:

Perverse as it seems, disasters like this usually have positive long-term effects … reconstruction … [creates] … more efficient facilities … The net effect of these things is to boost economic activity and to improve the underlying prospects as well … Modern state of the art equipment put in place … If poor countries wanted to develop the best thing to do was to get in a war, lose it, and then get US assistance under a Marshall Plan to come out from under and you will be better off….

While we can moralise about how bad that sort of discussion might be given that, at the time – there were tens of thousands dead and many still missing when the interview was recorded, I have another issue. And I don’t demean the moral issue – mainstream economics as a discipline is morally bankrupt and has a deplorable track record in conceptualising human life and potential.

Confining ourselves to the narrow world that Bergsten wants to be in – economic growth, more modern and attractive tourist hotels and golf courses (pity about the generational gaps in the local population wiped out in the disaster – a minor detail when considering the long-run) – he failed to convey the view that these countries only really got back on their feet in the way Bergsten refers because of massive government fiscal assistance – both locally and from other fiscal jurisdictions.

And casting back, during the Second World War for example, the European Recovery Program he refers to (the Marshall Plan) was an act of the US Congress involving something like $USD17 billion, which was a hefty fiscal whack in those days.

One thing is certain – budget surpluses have never underpinned any advances in human welfare and productive infrastructure provision.

Conclusion

Progressive Blogs of the World Unite!

There was a great article in the Sydney Morning Herald this morning – A simple Twitter brings down the mighty cone of silence which has changed my previously negative view of Twitter. Not that I am about to start twittering or whatever the applicable verb is.

The article is about a major legal case in London this week concerning a “British oil trading company Trafigura” which used some crafty lawyers to stop all public disclosure of the fact that they had been “dumping of toxic waste in the Ivory Coast’s biggest city, Abidjan”.

The author writes:

Thousands were injured by waste containing tonnes of phenols, hydrogen sulphide, corrosive caustic soda and quantities of mercaptans. Trafigura denied it was dangerous, but nonetheless paid £100 million ($175 million) to the Ivory Coast Government to clean up the mess and agreed to compensation of £1000 each for the 30,000 people made ill.

The media was stopped by injunction from reporting this. Then a labour parliamentarian “placed a question on what we call the notice paper … [asking] … what measures ministers were taking to protect whistleblowers and press freedom following the injunction obtained by Trafigura”.

Immediately the “The oil trader’s lawyers … managed to extract from the court an injunction so wide not even the fact the injunction existed, let along what it was about or the identities of the parties, could be published”.

The law firm also menaced the media to stop reporting this aspect. The upshot is that the:

… “The Guardian is also forbidden from telling its readers why the paper is prevented – for the first time in memory – from reporting parliament.” All that could be reported was that the case involved ”the London solicitors Carter-Ruck, who specialise in suing the media for clients, who include individuals or global corporations”.

But then the Guardian editor posted this on Twitter: “Now Guardian prevented from reporting parliament for unreportable reasons. Did John Wilkes live in vain?” – which “set off a chain reaction that was beyond the lawyers and the courts to stop. Out there in blogosphere, the reaction was astounding … [and] … By midday on Tuesday ”Trafigura” was among the most searched words in Europe … An hour before The Guardian was to go to court to seek permission to publish the question, Trafigura and Carter-Ruck threw in the towel. The new ”other” media turned a secret into a notorious avalanche of information.”

So the lesson for me is simple. The mainstream media just reports these revisionists who lie and deceive the public to protect their self interests which are never the interests of the disadvantaged (or probably the vast majority of us).

But the Internet can get messages out and networked better than the conventional media these days. We should be using it more effectively in the macroeconomics debate.

Of the thousands of readers that visit my blog each day – I hope you take it on yourselves to spread the message so as to bring some balance back into this debate.

And you can all receive the Modern Monetary Theory’s (MMT) Friend of the state, Friend of the people award. That would be nice to frame and put up on your wall (its been a long week!).

Tomorrow

Saturday Quiz is coming and it will be even harder than before.

Count me in! I spend most nights arguing the MMT position (as i understand the basic concepts) around the political blogs.

Even many progressives have a hard time coming to terms with ideas such as federal taxes not actually paying for government spending and deficits financing private sector savings but I keep working on them.

I think Krugman’s approach is very complementary to MMT. He doesn’t focus on the operational details of the monetary system at all. But if you consider his views on the importance of fiscal policy in a liquidity trap, and his rejection of the Chicago school as per his “dark age” descriptions, it pretty much implies MMT as the only compatible and facilitating monetary analysis. It’s a fairly good fit.

Billy,

You are absolutely indefatigable and utterly relentless, not to mention unbelieveably prolific. How do you do it? Where do you find the time? The energy? Hats off to you, my good man.

I try to participate occasionally in some of the blogs, and I actively engage privately in trying to explain MMT to many people, and I have to say it can get very frustrating. It seems the overwhelming majority just can’t seem to get their head around the idea that sovereign governements, post gold standard, are NOT revenue constrained. Here in the UK it has reached virtual hysteria stage, where they’re now talking of selling off hard assets to “cut the deficit” and handle the “debt mountain”. The pressure on the government, from all quarters and as transmitted through the media, is huge to “deal with the gigantic debt problem”.

And then you have the ugly side to it, as you are increasingly pointing out recently. The truly mean face of market-based philosophies and approaches, and their proponents, is coming out more and more. They would make it seem merely because something is enacted or implemented by the government, it is per se, automatically bad! I’ve been reading some stuff recently from some very “reputable” sources that are claiming that a dollar spent into the economy by the government has been “proven” to have a NEGATIVE multiplier!

Billy, just keep doing what you’re doing.

Best Regards

Perhaps the first award should go to Daniel Kostzer? Depends on if you want someone from the current situation or not, I suppose. Maybe someone related to the NREGA in India?

Also, it’s called a “tweet.” and you should do it, if only to continuously alert people to good/bad things you are finding in the press, speeches, blogs, etc. You may be able to increase your readership a bit, too. I don’t think it would take much of your time at all, and you may find some interesting things there along the way.

Best,

Scott

That’s a fantastic piece bill.

They seem to be getting longer though!

I dropped it into housepricecrash.co.uk, it’ll be very interesting to see what floats to the surface there as a result.

ATB,

Scep

100% on the 11/14 quiz !

Your site is terrific, thank you.

“Naively, I thought the crisis was a chance for people to abandon old ways of thinking…”

What’s that Marx quote? “”History repeats itself, first as tragedy, second as farce.” It will take another crisis to truly shake this mentality – but shake it it will!