I am stuck in London courtesy of the terrorist policies of Donald Trump and his…

US inflation has peaked and monetary policy had nothing much to do with it

It’s Wednesday, and I have two things to write about briefly before exposing readers to some more music. First, the evidential base for my ‘this inflationary period is transitory’ narrative gains more weight. The latest CPI data from the US Bureau of Labor Statistics shows that inflation has peaked in the US and falling rapidly in the goods sector, which started this episode off. The second topic relates to measuring progress in the development and spread of new ideas. It is often difficult to know how far a new framework has penetrated the broader debate. But sometimes things happen that remind me of how far we have to go in changing the framing and language surrounding fiscal capacity and the related topics, that Modern Monetary Theory (MMT) has brought to the fore. We finish with some calming guitar playing.

US Inflation

Yesterday (December 13, 2022), the US Bureau of Labor Statistics released their latest – Consumer Price Index Summary – which showed that:

1. “The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in November on a seasonally adjusted basis, after increasing 0.4 percent in October.”

2. “Over the last 12 months, the all items index increased 7.1 percent before seasonal adjustment.”

3. “The energy index decreased 1.6 percent over the month as the gasoline index, the natural gas index, and the electricity index all declined.”

4. “The all items index increased 7.1 percent for the 12 months ending November; this was the smallest 12-month increase since the period ending December 2021.”

5. “The all items less food and energy index rose 6.0 percent over the last 12 months. The energy index increased 13.1 percent for the 12 months ending

November, and the food index increased 10.6 percent over the last year; all of these increases were smaller than for the period ending October.”

The word – peak – comes to my lips.

Recall these blog posts:

1. Central banks are resisting the inflation panic hype from the financial markets – and we are better off as a result (December 13, 2021).

2. The current inflation still looks to be a transitory phenomenon (March 28, 2022).

I made the point that the pandemic caused sectoral imbalances to emerge which resulted from the reswitching of expenditure from services to goods as restrictions prevented many services from being supplied.

The pandemic did three things in this context.

First, the government stimulus payments, though imperfect, helped maintain incomes and spending capacity among households.

Second, the lockdowns prevented consumers spending on services by and large – hospitality, entertainment, travel etc.

And with income still intact, the spending shifted to goods-production – renovations, gadgets, flat-screen TVs, you name it.

Households brought forward spending plans on some things while normal spending patterns were short-circuited by the inability to spend on other things.

Third, the lockdowns and health concerns also reduced the capacity of the goods-producing sector to meet the new demand. This is what we are referring to when we talk about supply-side bottlenecks.

If workers are locked down, getting sick, and ports and freight terminals are disrupted, the normal smooth supply chain is interrupted and so there are inventory shortfalls, delivery delays and the like.

Then overlay market power – which allows producers, wholesalers and retailers to profit gouge the shortages via mark-up increases and you see the problem.

In the blog posts cited above, I demonstrated the excess demand in the goods sector being mirrored by the excess supply in the services sector.

So the pandemic created a combination of supply constraints and rapidly shifting demand patterns.

These shifts are, in part, the drivers of the inflationary pressures.

That was all before Mr Putin invaded the Ukraine, which has exacerbated the supply constraints, particularly with respect to food.

And it was before OPEC+ decided to withhold supply in order to push up prices and their profits.

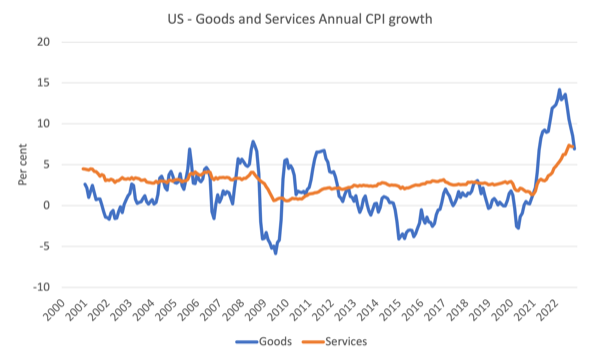

Given this discussion, the following graph is interesting.

It shows the annual CPI inflation rate for the broad categories – goods and services.

What you observe is the goods sector starting to quickly resolve the capacity pressures as more ships sail, more factories resume production and freight charges decline (dramatically).

At the same time, CPI movements in the services sector have been driving the most recent inflationary pressures as a result of food and energy (transport) components but even they are abating.

The most recent monthly CPI growth for the goods aggregate was -0.73 per cent and 4 of the last 5 months have been negative.

The November services CPI result was 0.30 per cent (month-on-month), down from 0.36 per cent in October and 0.71 per cent in September 2022.

So, once again, it looks very much like this is a transitory period of price pressures mostly explained by supply constraints with some not insignificant input from the Ukraine situation and OPEC+

One of the problems now is that with inflationary pressures abating at the same time that the US central bank has been hiking interest rates, the mainstream economists will falsely connect the two things in a causal way.

I say falsely because the rising interest rates – which are allegedly meant to quell aggregate spending and force firms to lay-off workers and compress profit margins – will have had little to do with the abatement.

Retail sales data for the US shows that spending is higher in October 2022 than it was in March 2022.

There is no sign yet of a recession yet the CPI pressure is down significantly and I expect it to keep abating.

When you know there is more to do

The other day, an academic friend sent me an ‘Open Letter’ to sign and distribute.

The aim was to get as many progressive economists signing up and then buying space in the mainstream media to publish it.

It came originally from the Australia Institute, which pretends to be a ‘progressive’ think tank.

The content (below) was addressing the proposed ‘Stage 3 tax cuts’, which the previous conservative federal government legislated and which the new Labor government (one could call them the ‘conservative lite’ version) has claimed it will honour.

To get elected they told voters they would not reneg on the cuts which are due to come into operation next year.

The beneficiaries of the cuts are overwhelmingly high income earners.

So we get a ‘lets tax the rich’ sort of knee jerk reaction by progressives, who don’t think about it much more than that.

The text of the ‘letter’, however, goes even further.

I read the text and replied telling my correspondent that I would never sign such a thing and that he should stop distributing it.

I wrote (in addition to some personal banter as a friend):

1. It suggests the federal government has financial constraints and needs revenue to spend

2. It talks about costs in financial terms rather than real resource costs.

In other words, it just reinforces the mainstream framing which I find unacceptable and the anathema of a progressive position.

He replied saying he hadn’t really read it – but I note now that the document has been published in the press that he signed. Disappointing.

The letter was addressed to the Prime Minister and went like this:

Australia is a low tax country compared to other developed economies. Australia Institute research shows the majority of the stage 3 income tax cuts will go to high income earners in general and men in particular. In turn the Stage 3 tax cuts will make inequalities worse. Parliamentary Budget Office modelling shows they will cost more than a quarter of a trillion dollars over the next decade.

We the undersigned all agree that the Stage 3 tax cuts are unfair and, given the inflationary environment and the emerging pressures of higher priority Government commitments on the budget, unaffordable.

We believe that politicians should take their promises seriously, but we also believe that the economic circumstances have changed radically since the stage 3 tax cuts were legislated in 2018.

We urge the Prime Minister and the parliament to reconsider the size, shape and timing of the Stage 3 tax cuts and to align current tax policy with current economic conditions.

So you should be able to see my objections.

1. There is an emphasis on “cost” and an acceptance that the Parliamentary Budget Office is an authority to be quoted and respected. It is a neoliberal outfit, like all these institutions around the world that claims fiscal policy should be able creating surpluses and all the rest of it.

2. “Cost” is defined in financial terms which for a currency-issuing government such as Australia is a meaningless concept and steers our focus away from real resource constraints.

The ‘cost’ of the tax cuts can only be measured in real resource terms. The ‘letter’ is silent on that.

3. It invokes the current misconception that the current inflationary pressures are due to over-spending – that is, the mainstream agenda.

4. It claims that the Australian government is financially constrained and needs the cash that would be represented by the lost tax revenue to fund higher priority things. This is patently false.

There is no applicable concept of ‘affordability’ when applied to the federal government.

It can afford anything that is for sale in the currency it issues.

Typing some numbers into bank accounts cannot compromise fiscal capacity.

The ‘letter’ was the basis of a report in the mainstream media today – Top economists urge government to rethink stage three tax cuts (December 14, 2022) – which means their paid publicity stunt achieved its target – publicity.

The journalist has just rehearsed the framing and language of the ‘letter’, which means the readers are further mislead by these economists on the nature of the monetary system.

The language repeats:

– “unaffordable” – government has a financial constraint.

– “growing cost on a budget already struggling under the weight of increasingly expensive programs” – financial constraint reinforced.

– “unaffordable given the changes in the economic outlook since 2019” – as if the government can run out of money because its deficit went up during the pandemic.

– “blowouts in government spending and soaring interest rates have led to a major deterioration in the budget outlook” – government debt is becoming burdensome.

– “long-term budget damage” – financial constraint reinforced as well as the concept that a fiscal balance can be ‘bad’ or ‘damaged’.

– “makes the structural fiscal deficit worse” – rising fiscal deficits are bad.

All the mainstream framing and language that supports the neoliberal agenda.

It creates and reinforces the fictional world and lying to people about the true nature of fiscal matters.

Many of the so-called progressive economists in Australia signed up to the letter.

Some of them have been colleagues over my career.

If they feel the need to support this sort of lies and nonsense, then we are a long way from breaking through.

Apparently political gotcha tactics that the Australia Institute revel in a more important than the truth.

That is the state of progressive thought in 2022.

A long road ahead.

Music – Jimmy Dludlu

This is what I have been listening to while working this morning.

Jimmy Dludlu – is one of the hottest guitarists around but one of the least known.

I first heard of him when he released his first album in 1997 – Echoes From The Past – and have followed him since.

He was born in Mozambique but was educated in Cape Town.

His jazz brings together the conventional sounds of the great guitarists such as Wes Montgomery combined with West and Central African beats and sounds.

This song – Simone – is off his 2002 album – Afrocentric.

The musicians are:

1. Jimmy Dludlu – vocals and guitars.

2. Moreira Chonguica – saxes.

3. Lucas Khumalo – bass.

4. John Hassan – percussion.

5. Tiale Makhene – percussion.

6. Mark Goliath – keyboards.

7. Soweto String Quartet.

Very cool.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Not to mention, Bill, that they praise the Nordic model & are correct to do so for the wrong reasons though.

If you compare and contrast the Nordic countries income tax structures, they are flatter than the Australian income tax system. There is a near negligible tax in their social security system and other than that they have a high (admittedly it varies across countries) VAT/GST up to 25%.

In some countries the VAT is even progressive. 0, 10, 25% depending on the good or service.

This is very similar to what you wrote in your “Progressives should move on from a reliance on ‘Robin Hood’ taxes” blog post.

I do wonder if the reason rates were jacked up was just so the banks could say “see, it worked”, while sucking billions of free money from governments and mortgagees.