I grew up in a society where collective will was at the forefront and it…

Long-term unemployment in America falls when employment growth increases

A few weeks ago, I updated my research on the way employment growth accesses the different unemployment duration pools using Australian data. In that blog post (October 19, 2020) – The long-term unemployed are not an inflation constraint in a recovery – I showed that the claim that the long-term unemployed constitute an inflation constraint because employers will not choose to offer them jobs due to perceived scarring is a popular neoliberal assertion but has no basis in the actual data. The orthodox economists use that assertion to justify microeconomic (supply-side) policies (training, activation, etc) rather than direct job creation. The reality is that when employment growth is strong enough, both short-run and long-run pools of the unemployed are accessed by employers. In the latter case, employers alter hiring standards and offer on-the-job training to ensure they do not lose market share. I have received several E-mails stating that the US is different and the long-term unemployed are shunned by employers, which means that trying to stimulate the economy will hit the inflation constraint sooner than if there was a Job Guarantee in place. Logically, there is no reason the US labour market operates differently in any fundamental way to the Australian labour market so I decided to examine the validity of the ‘irreversibility hypothesis’ using US data. Guess what? The hypothesis doesn’t hold up in the US either.

You should read the earlier analysis cited above for background and additional detail. This blog post is more focused on the data rather than the concepts lying behind the data.

Definitions

While most nations use an unemployment duration of 52 weeks to define the threshold beyond which a person is classified as being long-term unemployed, the US used a threshold of more than 26 weeks.

Patterns of unemployment duration

First, what is the pattern of unemployment duration?

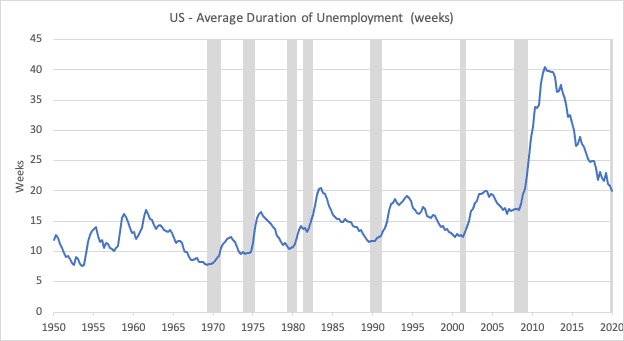

The next graph shows the pattern of unemployment duration in the US since the first-quarter 1950 up to the March-quarter 2020. The grey bars show the official (GDP) recessions after 1967. There were recessions before that date but I haven’t shown them here.

The pattern is typical. During a recession, the average duration rises and the longer the recession the higher the average becomes as the duration categories move from short-term (less than 5 weeks in the US classification) through to the longer-duration categories.

You can clearly see how bad the GFC was. It took a long time for recovery to commence which meant that more unemployed workers remained in that state for longer.

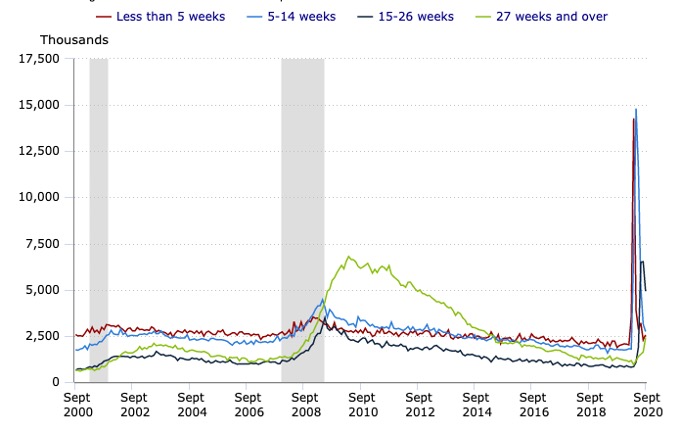

The next graph is taken from the BLS and shows the unemployment numbers (000s) for the four duration categories that they provide data.

The grey bars are recessions.

The graph provides interesting information about how the pool of unemployment builds as the cycle turns down. After a long period of growth, long-term unemployment (currently defined as more than 26 weeks of continuous joblessness) falls to low levels and workers enter and exit the unemployment pool regularly as jobs are created and destroyed.

As I noted in the previous graph, the GFC recession was so deep and drawn out that the long-term unemployment pool rose substantially and took time to fall again, once growth ensued.

The longer the recovery was delayed the more workers flowed into the LTU category.

Once the downturn started (late 2007), the short-duration categories obviously take the initial unemployment and rise sharply.

As the recession persists, you start to see the longer-duration categories rising sharply.

The irreversibility agenda

As unemployment started rising across the globe in the 1970s, orthodox economists concentrated on the supply side of the labour market, hypothesising that full employment should be redefined to occur at much higher unemployment rates than in the past.

The orthodox approach, however, has been to consider long-term unemployment to be a (linear) constraint on a person’s chances of getting a job.

The so-called negative duration effects (scarring etc) are meant to play out through loss of search effectiveness or demand side stigmatisation of the long-term unemployed.

That is, they become lazy and stop trying to find work and employers know that and decline to hire them. Over this period, skill atrophy is also claimed to occur.

It is also claimed that employers will bypass the long-term unemployed and if they come up against labour supply constraints as a consequence they will increase wage offers to those already in employment rather than take on these ‘damaged’ and ‘dirty’ workers.

The wage chase then causes inflation.

So the long-term unemployed represent an inflation constraint until they are subjected to attitudinal training so they work with others, training etc.

In other words, stimulating the economy will only induce inflationary pressures if there is a significant pool of long-term unemployed.

Mainstream economists and policy makers thus postulate that there is a formal link between unemployment persistence, on one hand and so-called ‘negative dependence duration’ and long-term unemployment, on the other hand.

However, no formal link that is credible has ever been established.

Despite the lack of evidence, the entire logic of the 1994 OECD Jobs Study which marked the beginning of the so-called supply-side agenda defined by active labour market programs was based on this idea.

This was the period when governments abandoned their Post World War 2 commitment to full employment, and, instead, adopted the diminished, supply-side goal of full employability.

The import of that shift was that governments stopped dealing with downturns in non-government spending, especially when the downturn was severe, with direct job creation programs, and, instead, introduced supply-side programs – training, attitudinal coaching, CV preparation and all the rest of it.

Labour market recoveries from downturns in the full employment era were much more rapid because governments used their fiscal capacity to address the spending gaps.

In the neoliberal era, a major downturn which drives unemployment up sharply, results in a slow, drawn out recovery where unemployment takes many years to recover.

So the irreversibility hypothesis is core neoliberal mythology that militates against government’s using their fiscal capacity to reduce unemployment after a collapse of non-government spending.

Does long-term unemployment have strong irreversibility properties in the US labour market?

There is little credence in the irreversibility hypothesis when we examine the US data.

Once you examine the dynamics of the data you quickly realise that short-term unemployment rates do not behave much differently to long-term unemployment rates.

The irreversibility hypothesis is unfounded.

Clearly, if the government allows a downturn in non-government spending to descend into recession and refuses to stimulate the economy in any significant manner then long-term unemployment rises just because of the movements of the short-term unemployed through the duration categories.

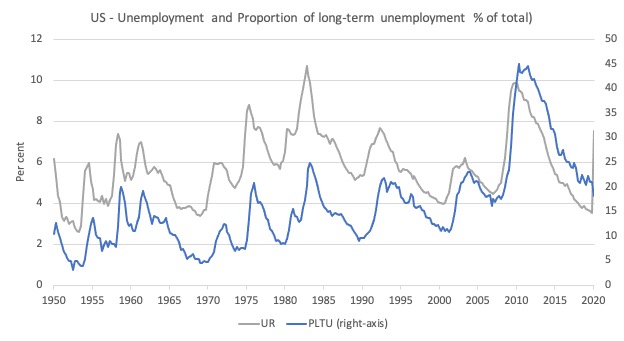

But the data shows that the relationship between long-term unemployment and the unemployment rate is very close as can be seen in the following graph.

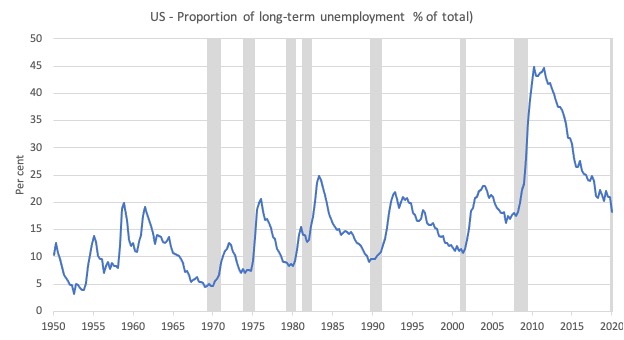

The following graph shows the proportion of long-term unemployment (greater than 26 weeks) in total unemployment from 1950 to the March-quarter 2020. It clearly looks very similar to the average duration graph.

It rises and falls during and after recessions. The deeper the recession, the larger the increase and the longer it takes to resolve.

The next graph adds the dynamics of the overall unemployment rate to the LTU proportion over the same period. If the behaviour of the long-term unemployment pool was markedly different from short-term unemployment, then we should see dissonance between these two time series.

The evidence is clear.

As unemployment rises (falls), the proportion of long-term unemployment in total unemployment rises (falls) with a lag.

Several studies have formally examined this relationship for different countries.

My earlier work has found that a rising proportion of long-term unemployed is not a separate problem from that of the general rise in unemployment.

This casts doubt on the supply-side policy emphasis that OECD governments have adopted over the last two decades.

So while the mainstream economics profession may claim search effectiveness declines and this contributes to rising unemployment rates, the overwhelming evidence is that both are caused by insufficient demand.

The policy response then is entirely different.

To argue that long-term unemployment is a constraint on growth and therefore needs supply-side programs rather than direct job creation, you would have to find that even during growth periods, long-term unemployment was resistant to decline.

I also did some more sophisticated regression modelling this morning which takes us beyond what I would report here (too complex).

The estimates of a number of different econometric models revealed no significant difference in the cyclical behaviour of the short- and long-run unemployment pools.

The results tell me that employers recruit from all the duration pools more or less simultaneously.

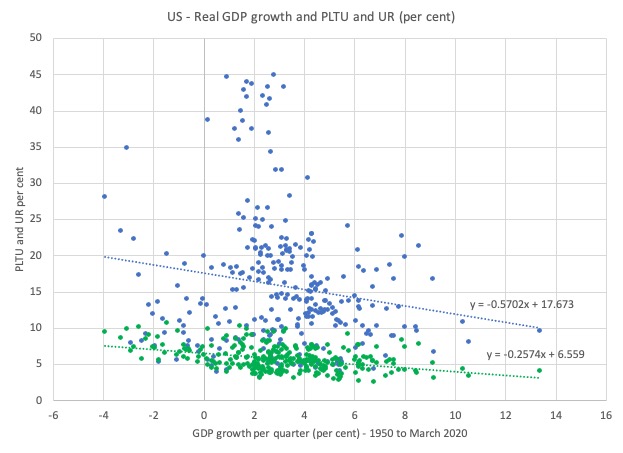

And you can get a feel for that from this graph, which shows quarterly GDP growth on the horizontal axis from 1948 to March 2020 and the PLTU on the vertical axis (blue markers) and the overall unemployment rate (green markers). The dotted lines are simple regression lines and the equations are shown. My own econometric equations were more complex than this but the results are not that much different.

So as real GDP growth strengthens the proportion of long-term unemployed in total unemployment (PLTU) falls consistently as does the overall unemployment rate.

The former falls faster than the latter.

Conclusion

The evidence very strongly supports the view that long-term unemployment rises and falls with net job creation. The stronger is employment growth the more quickly long-term unemployment falls.

When recoveries are stalled and slow, the long-term unemployed get trapped in that state.

And in the periods examined, there is no evidence that as the pool of long-term unemployed was declining (simultaneously with the short-run pool) that inflation was accelerating.

It is far better for the government to ensure there is strong spending support when non-government spending declines to prevent the build up of long-term unemployed in the first place.

This should not be taken to mean that the introduction of a Job Guarantee would not improve the situation considerably.

Clearly, if there is a Job Guarantee in place, then in the early days of a recovery, when the Job Guarantee pool might be bigger than usual, the wage offers required to bid the workers back into the private labour market may be modest and there are plenty of workers available, so it is unlikely that there would be any inflationary pressures.

It is also true that Job Guarantee workers are more attached to the labour market than the unemployed.

But the hysteretic mechanisms that see firms relax and tighten hiring standards and combine training slots with jobs slots at different points of the economic cycle also mean that the long-term unemployed are absorbed along with the short-term unemployment when economic growth is strong enough coming out of a recession.

In a deep and long recession, the number of long-term duration Job Guarantee workers will be higher than if the recession is short and sharp.

If the recovery is strong enough, then they will get absorbed back into the employed workforce just as they would be if they were long-term unemployed.

But once the economy gets close to capacity and the Job Guarantee pool is minimised, then any extra bidding from that pool will be stronger than before and the margin over the Job Guarantee wage that would arise will be larger than before. The point is that the price anchor provided by the Job Guarantee becomes moot when the pool of jobs becomes very small, just as in the case when the unemployment pool is small.

The difference between the two buffer stock mechanisms, however, is that if there are inflationary pressures in the non-government sector, and the government tightens policy settings to suppress them, then under the unemployment buffer stock approach, workers lose their jobs, whereas under a Job Guarantee workers are redistributed from the inflating sector to the fixed price job sector.

While neither system is ideal, the employment buffer approach is vastly superior to using the unemployed as a front line fighting force to discipline distributional struggles between labour and capital.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

I have often wondered why politicians do not, or are not willing, to draw on all of the MMT proposals for a better way of governing a country. I have concluded that it is all a matter of politics. Politicians draw on the prejudices of the electorate In order to get elected. If the electorate believe that 2+ 2 equals 5 then a politician will have to agree. He/she cannot disagree if they want to be elected. An opposition must have the same view!! The average person, who is a voter, only understand his own budget and applies that reasoning to their country’s budget. So no party can propose an alternative; they will NEVER be elected. It would be political suicide to suggest an alternative view. The last time the world dealt with a similar solution was in the depression and WW11 but we don’t want to go through either of those to provide an MMT solution. So this is when I pull my age!! All you clever youngsters will have to find the solution to make the electorate realise that their own budget is not the way a government works. Good luck.

“The average person, who is a voter, only understands his own budget and applies that reasoning to their country’s budget. …All you clever youngsters will have to find the solution to make the electorate realize that their own budget is not the way a government works.” Surely so, Patricia, but do enough “clever youngsters” themselves understand what MMT is telling us? I know that Bill has been engaged in outreach to the young for quite some time, and bless him for it, but how about the rest of us? You and I are likely of the same vintage, and speaking for myself, I know next to nothing about how the clever young communicate these days, the means and modes of how they might be “MMT-evangelized.” When we were coming of age, we experienced, from the opposite end, a similar disconnect called the generation gap. One would think that we, now on other end of this reappearing divide, would have gained a bit of wisdom from the 60s and 70s about how to narrow the generation gap, to the extent it can be narrowed. I, too, wish the young “Good luck,” but if we old ones have any wisdom to leave with them, shouldn’t we be talking more among ourselves about potentially effective ways to share it? If you or any of Bill’s readers have ideas in this regard, about how to make MMT more compelling to those currently coming of age, what better place than here to explore them?

Patricia Smith, it doesn’t help much when that simplistic, household budget, view of the national economy is rammed down the throat of the average man by every politician, progressive or other, and at every turn, there is an”informed journalist” such as Leigh Sayles, or David Speers, on our national broadcaster, demanding that every politician explain how the federal government pays for its promises.

The problem is exacerbated when that view and no alternative is fed consistently to the populace by the Murdoch press which owns over 70% of the nation’s newspapers which perpetually support the fossil fuel economy and neocon economic principles to the exclusion of all other systems of thought.

I always thought a paper of when Maggie Thatcher took on the miners and ship builders by a MMT economist would be very interesting. When Maggie decided to move skills and real resources from underground and the ship yards and put them in the service sector. Or even just moving skills and real resources from low end manufacturing to high end manufacturing jobs.

The transition period over a certain timescale would be a very interesting analysis indeed. The transition from underground to above ground in the service sector. The transition from ship yard to services and the move from low end to high end manufacturing.

A skilled economist could look at the data and analyse what happened during these transitions to Labour and wages and output and demand and what dog and bone supply side monetarist policies were put in place etc,etc.

Then do a comparison study of what these transition periods would have looked like using MMT job guarentee standard policies.

I think it would show only one winner and just how many human beings especially in rural areas got left behind. Especially in Scotland as virtually all the jobs in Scotland were in mining, shipbuilding or low end manufacturing. Who were then left behind and expected to morph into Bill gates or put on a pinnie and serve haggis to foreign tourists for 2 Bob a week.

I really don’t know why nobody has done it. Even the financial crash. What actually happened and this is what would of happened if a JG and MMT type policies would have been in place. The comparison study would be stark.

Surely we would win hands down and it would have saved these endless years of social media wars by just shoving a few papers down their throats.

Very relevant to this article and very interesting development in Austria, but the amount spent (7,4m euros), is rather limiting. A three year pilot would need much more than this unless it only involves a small amount of people. https://www.independent.co.uk/news/uk/politics/unconditional-job-guarantee-trial-austria-marienthal-oxford-universal-basic-income-b1451788.html

Thatcher (and Reagan) actually did help the cause of MMT… somewhat. They just did not do so completely (for obvious ideological reasons) and thus ended up propagating a disaster. When they “globalized” and shed manufacturing jobs, the slack was taken up by workers in the global south. That should have been a major success story for Great Britain, enabling more importing. But being a supply-sider and monetarist Maggie botched it, did not understand MMT and the JG, thought she was stealing from the tax payer, and thus put millions of workers into unemployment to “fight inflation”.

But the enduring legacy of Thatcherism and Reaganomics is that manufacturing will likely never fully recover in the UK and USA, and *need not recover*. That is not a bad thing, if you understand the monetary system. Better jobs can open up, can be directly created for public purpose, and it is the neoliberal mentality to fail to invest which has blocked such progress.