The other day I was asked whether I was happy that the US President was…

The German undervaluation obsession is resistant to ‘reform’

Martin Höpner, who works at the Max-Planck Institute for the Study of Societies in Cologne, recently sent me a copy of his latest paper – The German Undervaluation Regime under Bretton Woods: How Germany Became the Nightmare of the World Economy (published January 2019). He presented this research at a Makroskop workshop in Wurzburg on October 13, 2018 – I was on the same panel as him at that workshop and enjoyed some very productive conversation about these issues. It is a very interesting historical analysis of the way that the German elites (central bank, industry groups, banks, politicians, and trade unions) have collaborated since the 1950s to suppress domestic consumption and maintain the nation’s export competitiveness, even though this has undermined material prosperity for workers. The relevance of the analysis to current debates about the Eurozone and its capacity for reform are that the undervaluation regime is entrenched in Germany’s institutions, its history, its culture, and its power elites and have been that way for many decades. What the Europhile progressives, who still think reform is possible, have to show is that this entrenched position can somehow be abandoned. They have never provided any convincing argument to substantiate that hope/belief. That is why I continue to call them out as dreamers – good intentions but naive to history.

The German disregard for its European partners

In my 2015 book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale – one of the recurring themes was the way that the German Bundesbank manipulated the value of the Deutschmark in the pre-Eurozone period after the Second World War to ensure that its export sector would retain competitiveness.

This was a central part of the Post War German strategy.

The Bundesbank also reneged on undertakings that Germany gave to its European partners to conduct official foreign exchange rate intervention on a symmetrical basis.

It was one of the reasons that the pre-EMU exchange rate regimes were largely unworkable in Europe.

Even after the Bretton Woods system collapsed in 1971 the European EEC nations insisted on trying to forge ahead with their own version of fixed exchange rates.

When Helmut Schmidt succeeded Willy Brandt as German Chancellor on May 16, 1974, he signalled a hardening of the German policy position to a more conservative ‘fight inflation first’ strategy.

In Schmidt’s inaugural speech on May 17, 1974 to the Bundestag, he maintained the ‘Das Modell Deutschland’ (the German Model) was the way forward, a mix of hard-line attitudes to inflation with social policies to take the pressure off the collective bargaining process.

He sought to contain real wages growth and redistribute national income back to profits to encourage investment, which he claimed would stimulate employment growth in the long-term.

This ended the temporary embrace of Keynesian policy approach that the German Council of Economic Experts had adopted in the late 1960s. That group of economist morphed into a supply-side (neo-liberal) organisation

At the same time, the Bundesbank was entrenching itself in the growing Monetarist dogma. Its early attempts to follow the Milton Friedman rule to set monetary targets failed dramatically, as similar attempts across the globe failed.

That should have meant an end to the Monetarist putsch.

But, while acknowledging it could not control the ‘money supply’, the Bundesbank continued to define its role as maintaining long-term price stability.

Over this period the mark was increasing in strength against the US dollar because of a continued lack of confidence in the US dollar in world markets and the German government was clearly aware of the difficulties this posed for maintaining the competitiveness of Germany’s export industries.

The mark also appreciated against the French franc and the Italian lira over this period.

As Germany hardened its view of fiscal deficits, the unemployment rate rose.

In 1974, before the policy position hardened, the unemployment rate in Germany was 2.8 per cent. By 1987 it was 10.5 per cent, having risen year-by-year over Schmidt’s tenure.

The strains reached breaking point when the mark appreciated strongly against the US dollar in 1977 and early 1978, and the French franc simultaneously weakened against the mark.

The perverse currency movements were imposing costs on the German export industries and provided the motivation for Germany to seek a better way of shifting some of the adjustment burden from its economy onto the weaker currencies of its European trade partners.

In other words, it wanted to reduce the asymmetry in the system that was biased against Germany.

The Bundesbank feared that a lack of discipline in the weaker currency nations would force it to take responsibility for maintaining exchange rates, and, in the context of an appreciating mark, this would compromise their capacity to control the money supply and expose Germany to higher inflation.

Conversely, the weaker currency nations (France, Italy, the United Kingdom) were concerned that they would have to accept the restrictive Bundesbank monetary policy settings or else face major capital outflows.

Under the ‘snake’, the exchange rate regime that the European nations introduced after the collapse of the Bretton Woods system, the dominance of German monetary policy (higher interest rates) forced its trading partners to endure higher unemployment than they desired.

The upshot was that all parties had incentives, for different reasons, to move to a more symmetrical system of exchange rate management.

The creation of the European Monetary System in 1979 was an attempt to introduce this symmetry in exchange rate arrangements in Europe.

The Exchange Rate Mechanism, proposed by Belgium to break the France-German impasse on who should take responsibility for maintaining currency stability in Europe, specified that when currency fluctuations moved beyond an agreed band, each relevant central bank would intervene.

So, for example, if the French franc reached the lower band of its parity against the mark the latter would have reached the upper band of its agreed parity against the franc.

This would mean that both the Bundesbank and the Banque de France would have to simultaneously sell marks and buy francs in the foreign exchange markets.

In theory, there would be less pressure on any one currency to adjust and less monetary disturbance in the respective economies. In reality, the adjustment process was not symmetric because the liquidity effects of the respective interventions were quite different.

Once the system became operational on March 13, 1979, the Bundesbank soon exerted its authority (influence).

To stop the mark from breaching the upper value limit, the Bundesbank was often forced to sell marks usually in return for US dollars or other currencies.

This pushed more marks into circulation, which the Bundesbank considered exposed the German economy to an excessive inflation risk.

In effect, despite agreeing to symmetrical intervention, the Bundesbank reneged and forced devaluations on its partners as well as forcing the other Member States to inflict austerity on their populations in order to quell imports and take some pressure of their currencies.

The Bundesbank also refused to cut interest rates in the early period of the EMS which further exacerbated the currency instability in the weaker (trade) EEC Member States.

One could argue that even though the later innovation – the EMU – has made things more complicated, nothing has fundamentally changed in Europe today.

Further, while Germany’s inflation obsession can be clothed in a philosophical argument that inflation is intrinsically anti-democratic in the sense that it is a ‘non-voted tax’, the ceding of economic sovereignty under the EMS by the other Member States to the Bundesbank was the beginning of the loss of democracy in Europe, which has accelerated since the GFC.

All of this experience in the 1970s and 1980s should have told European Member States that it would be impossible to enter a monetary union with Germany and prosper.

The German economic power and dogmatic refusal to participate properly in these exchange rate arrangements should have been like a red light.

The Germans were gaming the world long before the Eurozone

Martin Höpner’s research paper, cited in the Introduction, traces this German recalcitrance back to the early Post War period – during the early days of the Bretton Woods period.

He calls Germany:

… an undervaluation regime, a regime that steers economic behavior towards deterioration of the real exchange rate and thereby towards export surpluses. This regime has brought the eurozone to the brink of collapse. But it is much older than the euro. It was established during the Bretton Woods years and has survived all subsequent European currency orders.

He compares the traditional “wage-led” approach to growth with “the German solution: the adoption of an export-driven demand regime since the mid-1990s, a regime in which foreign demand acts as the de- cisive growth driver.”

While most analysts seem to be concentrating on the most recent incarnation of export-led gaming by Germany of its Eurozone partners, the fact is that Germany based its industrial development strategy after the Second World War on the creation of an “undervaluation regime” as a means of steering economic:

… behavior towards the deterioration of the real exchange rate and thereby towards the accumulation of export surpluses

Martin Höpner traces the introduction of this policy mindset to Germany after:

German policy-makers discovered Germany’s distinct ability to generate export surpluses after the payments account crisis in 1950/51. The Bretton Woods regime turned out to provide perfect conditions for the institutionalization and further consolidation of a regime that survived all subsequent European exchange rate orders until it became, under the euro, the nightmare of the eurozone and, even more, the world economy.

The strategy meant that Germany promoted its export surplus generation as the expense of domestic stabilisation.

Martin Höpner thinks that an “undervaluation regime is a special example of a mercantilist regime”, the latter which promotes both the growth in exports and the suppression of imports.

While Germany certainly began the Post War period in that mindset, these ideas “lost relevance as the liberalization of trade and capital markets progressed”, especially in the 1960s.

This was the period of “Neo-mercantalism” which “relies on undervaluation” and two requirements held:

1. “competitive disinflation vis-à-vis trading partners”.

2. “resistance against correction of the resulting real exchange rate distortions by means of revaluation.”

These two requirements or behaviours were prominent in German policy making in the 1950s and beyond.

Undervaluation:

… makes the export sector grow relative to the exposed sectors of trading partners and, as a consequence, leads to the export of industrial unemployment. In undervaluation constellations, export firms find advantageous environments for market niche capture, market power growth, and the accumulation of large amounts of technological knowledge …

Most importantly, such a regime strengthens the international position of central banks, and, where fixed exchange rate regimes are in place, it:

… puts them in a strong position regarding currency market interventions. Countries with enduring current account surpluses then become donor countries in the international arena, a surely more attractive position than the opposite, becoming debtor countries.

Germany certainly used that position throughout that 1960s and beyond to its own advantage – at the expense of its various European partners.

Martin Höpner questions the logic of this strategy:

Undervaluation implies the deterioration of your own terms of trade. Letting this happen is a weird economic strategy because it implies you get back less than you offer in international trade. This is the perversion of everything we would usually describe as the “rational” goal of commodity exchange: getting back (at least) as much as you have given … In the undervaluation constellation, by contrast, giving away is not a means of receiving more, but becomes an aim in itself.

Which is consistent with the basic Modern Monetary Theory (MMT) insight on trade.

Many people still find it hard to understand this point but the fact is that we do not produce to produce.

Rather we produce to consume goods and services. That is the end goal.

So if we can persuade nations to produce but not consume and allow us to consume their production instead without returning any production to them, then we are ahead in material terms.

As we simplify in MMT – exports are a cost and imports are a benefit.

That is undeniable and I find it odd that various economists (even those of heterodox persuasion) turn themselves inside out trying to deny it – and thus criticise MMT, which has made that point very clear.

Martin Höpner is in no doubt:

… undervaluation implies the imposition of consumption abstinence upon citizens and makes them partly work to give away their products too cheaply. And so far we have considered only the loss of wealth which results from distorted prices in actual trade. The usual outcome of undervaluation, however, is a trade and current account imbalance. In such a constellation, a certain proportion of goods is not being traded against other goods, but to a significant degree against increasing numbers of uncertain financial claims against foreign countries.

And the German approach was not “a volatile phenomenon”, which would soon reverse itself and the real terms of trade accordingly.

It was, rather, the product of a “the operation of a regime with long-term stability”.

Further, some think that the export strength flows through to the domestic economy.

Martin Höpner disputes this conventional claim:

Consider wage policy. Holding down wages relative to others boosts competitiveness but also holds down internal demand. Consider fiscal policy. From the point of view of the export sector, the best budgetary policy is the one that minimizes firms’ cost pressures and, in general, any kind of inflation impulse. The domestic sector, by contrast, relies on high internal demand and its most important part, the public sector, on high taxes. Consider monetary policy. Strict monetary policy is a necessary condition for competitive disinflation but, at the same time, problematic for internal growth. It is therefore an open question whether undervaluation is functional for overall growth.

The overall impact on productivity is unclear, too.

The regime also “provokes beggar-your-neighbor accusations on the part of trading partners and thereby fuels transnational conflict”.

These sorts of disputes were prominent in the 1960s as the Bretton Woods system was on its last legs.

They are still around – for example, Trump and China!

Of interest, were the reasons the undervaluation regime initially was imposed in the early 1950s:

1. A balance of payments crisis in the early 1950s at a time when the newly created German central bank was short of foreign currency reserves, needed to participate effectively in the Bretton Woods fixed exchange rate system.

2. Pressure from the US to reduce domestic consumption to free resources for military production in the context of an emerging Korean crisis.

Neither ‘reason’ persisted for more than a short period, which leaves the question open as to why the Germans chose to export unemployment to other nations.

Martin Höpner argues that we have to explore the role of the elites in Germany who had the ability “to impose a hegemonic discourse upon broader society” to advance their own interests.

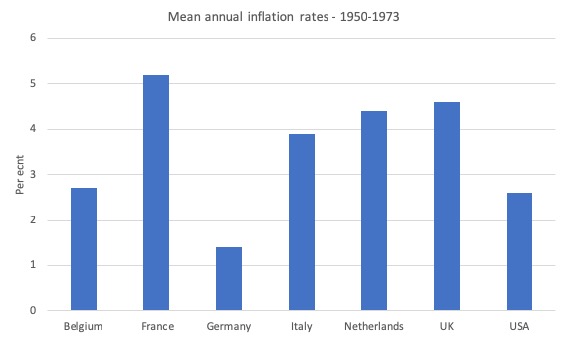

He notes that during the Bretton Woods period (roughly 1950-1973), Germany’s average annual inflation rate was 1.4 per cent.

The following graph shows the performance of the other key EEC Member States and the US over the period 1950 to 1973.

De- and revaluations of the parities among the European nations during this time were rare because nations were reluctant to approach the IMF for permission to change their exchange rate.

As a consequence, the trade deficit nations(such as France and Italy) tended to absorb the external imbalance and resulting downward pressure on their currencies through a combination of elevated interest rates (relative to Germany and the US) and domestic austerity (to choke off imports).

When that became politically difficult to sell, they would, reluctantly, devalue against the US dollar and the Germany mark.

As the Bretton Woods system was on its last legs, we witnessed massive shifts in parities with the German mark revaluing against the US dollar by 9.3 per cent in 1969 and the France simultaneously devaluing by 11.1 per cent.

In 1971, as the nations agreed to try to resurrect the fixed exchange rate system via the so-called Smithsonian Agreement, there was a massive realignment (revaluation) of the European currencies against the US dollar.

But the German mark revalued more than the other European nations.

There was a further massive revaluation against the US dollar in early 1973 but the system collapsed some months later.

The European nations then entered the snake in the tunnel arrangement, which similarly collapsed soon after.

The problem has always been the massive structural differences between the economies of Germany and the other European nations, which precluded any sort of currency arrangement being stable.

All the progression to a common currency meant was that the pressures arising from the trade and capital flow imbalances were shifted from pressure on the exchange rates to pressure on domestic wages and prices – the so-called internal devaluation pressures.

Either way, the arrangements have devastated workers in nations that have less trade strength relative to Germany yet which have insisted on entering the various currency arrangements with Germany.

Martin Höpner concluded that:

… all countries suffered from overvaluation relative to Germany for almost all the time shown … the German undervaluation translated into export surpluses … the German trade balance shifted from negative into positive in 1952 and remained there during the entire period. After 1966, every German trade surplus was larger than 2 percent … Germans (including migrant workers) transferred more money into foreign countries than vice versa.

In the early 1950s, “the German trade sector was much smaller than today. It started at around 10 percent of GDP in the early 1950s and roughly doubled until the end of the Bretton Woods years (just like it roughly doubled under the euro.”

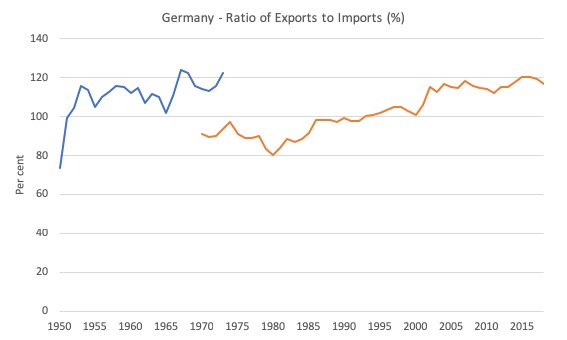

The following graph shows this ratio from 1950 to 2018. The blue line is the data provided in Martin Höpner’s paper while the second line is current official data from the German statistical agency.

Clearly, there is a level issue in the two datasets but the message is similar.

The ratio of exports to imports has steadily risen and now stands at around 120 per cent.

Martin Höpner comes to the only conclusion possible:

Germany’s relative disinflation and its resistance against exchange rate corrections resulted in significant real exchange rate distortions and these resulted in significant trade distortions. The resulting trade distortions were only slightly lower than those under the euro today. The undervaluation regime was, in other words, very effective.

The rest of his paper analyses the behaviour of the elites driving the undervaluation regime.

1. Bundesbank – its “inflation aversion” set it apart from other central banks. It would increase interest rates whenever it suspected any inflationary tendencies.

It would threaten the government with interest-rate austerity during this period unless it disciplined “wage and fiscal policy”.

The result was that in “ten of the twenty-four years” between 1950 and 1973, the German government “generated budget surpluses” through a “strictly rules-based” obsession.

The result was suppression of domestic demand and enhanced international competitiveness.

So even before the Hartz era in the early 2000s, after Germany had entered the Eurozone, its government was imposing a sort of internal devaluation to ensure its competitive position was retained at a time that its exchange rate was under continual upward pressure.

And, this is the second way in which the Bundesbank contributed to the undervaluation regime. It resisted the upward pressure on the mark which “clearly contributed to the prevention, delay, and minimization of revaluations.”

This behaviour persisted:

Even though Germany accumulated massive export surpluses, current account surpluses, as well as foreign currency and gold reserves.

The German central bank has always been prepared to inflict economic (and social) damage on the partner European Member States to satisfy its own, irrational, inflation anxieties.

2. German industry groups – were “the most pronounced (and loud) opponents of revaluations”/

They were supported by the German agriculture sector which was “highly organized” and was “a protectionist sector par excellence”.

The financial sector also collaborated with the industry sectors to maintain the undervaluation regime because they were tightly intertwined with Germany industry through the provision of domestic credit.

3. Trade unions – were organised in German in a very hierarchical manner, with immense power and influence being exerted by the Confederation of German Trade Unions. Their influence was at a peak in the Bretton Woods period.

This ‘monopoly’ organisation was heavily influenced by Bundesbank dictates as to what wage rises would be consistent with price stability.

The trade unions were also in collaboration with the Finance Ministry and industry groups (through the “tri-partite Konzertierte Aktion”) which led to wage suppression being imposed on workers.

It is fair to say that the trade unions were conflicted during this period and it could not be concluded they were vehement supporters of the undervaluation regime.

They also didn’t seem to understand the dual nature of the worker as a worker and the worker as a consumer.

Martin Höpner tells us that there were no organised consumer organisations to argue that the undervaluation regime resulted in:

the imposition of consumption abstinence upon citizens …

The trade unions were mute on that point and were minority players in maintaining the resistance to revaluation.

4. Political parties – CDU/CSU was “largely captured by export interests” and the SPD only came to realise that revaluation was desirable in the late 1960s.

Prior to that they were vehement supporters of the undervaluation regime.

The overall conclusion is that:

Capture by export (and agricultural) interests may have indeed been largest among the Christian Democrats, but the SPD followed suit most of the time.

Relevance to the Eurozone

It is clear that this undervaluation bias has inflicted massive damage on Germany’s Eurozone partners.

Martin Höpner concludes that:

… has brought the eurozone to the brink of collapse … Today, the world economy, and the eurozone in particular, experience Germany’s ex- port surplus orientation as a nightmare …

But it should be understood as a regime not just a set of “‘wrong’ policy choices”.

That regime is built-in to Germany’s institutional structure and the ideologies of the dominant elites.

It began in the 1950s “long before Germany became an export-driven growth model”.

And it explains, in part, why the architecture of the Eurozone is so flawed and dysfunctional.

Conclusion

The point that Martin Höpner wants to make (in my words) is that all the debates about reforming the Eurozone are really missing the point.

He writes that:

… the German undervaluation regime should shift our attention from the dysfunctional policies within the eurozone to the euro itself … it opens our eyes to the fact that the common currency may be easier to break than the dysfunctional heterogeneity within it.

That is the point I also made in my 2015 book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale.

The Europhile progressives still think reform is possible.

They are dreaming.

How are they going to reverse (entirely abandon) the ideology and practices that drive the persistent German obsession with undervaluation, that are entrenched in its institutions, its history, its culture, and its power elites and have been that way for many decades.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

One should perhaps add that Martin Höpner is not an economist, but a political scientist, who publishes regularly in the left-leaning Makroskop Journal. This is not meant to disqualify Mr. Höpner, but it is important to understand that he follows a leftist agenda.

To me, who experienced a large part of German economic history first hand, the narrative presented here bears little resemblance to reality. Germany was not “gaming the world”; to describe Germany as “mercantilist” is complete fantasy. German export competitiveness is based on non-price factors, i.e. on quality. German cars and machinery are in demand not because of a weak DM, but because of their high technical standards and the prestige of their brands. German fiscal discipline, work ethics, productivity and prosperity has been the envy of countries like France and Italy, who frequently relied on currency devaluation to make up for deteriorating competitiveness. It is very unfortunate and exasperating that less productive countries and various leftist groups have developed the narrative that Germany is to blame for the short-comings of other countries.

Brilliant insight: “It is a very interesting historical analysis of the way that the German elites (central bank, industry groups, banks, politicians, and trade unions) have collaborated since the 1950s to suppress domestic consumption and maintain the nation’s export competitiveness, even though this has undermined material prosperity for workers. The relevance of the analysis to current debates about the Eurozone and its capacity for reform are that the undervaluation regime is entrenched in Germany’s institutions, its history, its culture, and its power elites and have been that way for many decades.”

Dirk,

I believe you are somewhat delusional.

Manufacturing excellence is not a gift from God to the Germans. How otherwise could we explain the under-development of your services sector? Any excellence in quality to speak of in your services sector that the French aren’t capable of matching?

Or is it just a coincidence that other countries that followed the steps leaped from rice cultivation excellence to semiconductor exporting powerhouses?

Maybe it all started with an obsession for gold, like with Smaug. And then the illusion and obsession persists even after the Bretton Woods dragon is slain, like Thorin, hopefully one day to awaken from the greedy needy nightmare after much damage had been inflicted. Germanic tales often portray dragons and gold.

@Dirk Faltin

You have only addressed part of the argument. No-one is questioning the quality of Germany’s non-price factors. But the argument would be that those non-price factors should have lead to German workers enjoying a massive rise in living standards to compensate them for their high quality work, which could have been easily achieved by running a balanced trade policy and/or higher domestic spending. This would have meant those workers importing more (cheaper) goods and services from other countries. That would be playing fair and would assist the other countries to develop their respective industries, which is only reasonable when you are expecting those countries to trade with you. The people at the top choosing to inflict unemployment on such a competitive nation *and* its trade partners so as to maintain a trade surplus and control inflation, rather than seeking to ensure such productive workers are always in work, beggars belief, don’t you think?

I think that one of Keynes’ arguments was that we live in ‘monetary economies’ where the incentive to produce is to accumulate financial claims (money) as the goal- rather than ‘produce to consume’. This is pretty clear especially as far as corporations are concerned- they don’t

produce in order to consume. If anything, it is the opposite. They consume in order to produce product for sale at a profit, and the less they have to “consume” in order to profit, the more successful that corporation is. Germany just seems to have been running its operations like a very successful corporation over the years- they meet their goal of accumulating financial claims (money) while successfully limiting their input costs (consumption).

From the article above- “Many people still find it hard to understand this point but the fact is that we do not produce to produce.

Rather we produce to consume goods and services. That is the end goal.”

Bill and MMT might wish that this was the end goal. And there is a good case to be made that this should be the end goal. But unfortunately, that often isn’t the end goal. In capitalistic monetary economies, the end goal is often the accumulation of financial claims.

@Jerry Brown: That is a correct observation, although it doesn’t change the need for reform of the underlying driving forces, see

https://www.researchgate.net/publication/271506661_Money_and_sustainability_the_missing_link_a_report_from_the_Club_of_Rome_-_EU_Chapter_to_Finance_Watch_and_the_World_Business_Academy

Dirk. It’s not too hard to understand. You see, the wealthy and the powerful all over the world want to drive down wages, so that the people of their country can’t afford to buy everything they produce. The wealthy and the powerful want the savings, so that they can export them to another part of the world and build up claims and buy assets there. The wealthy and the powerful see no advantage to sharing. It’s the kind of adversarial, selfish, self-serving stance that will always lead to conflict and war. Don’t think governments serve the general population. They don’t. They serve the wealthy and the powerful, who are so good at acquiring wealth and power to themselves. Serving the enjoyment and well being of the general population is taken as a waste of resources that would be better used consolidated into a center of coercion.

CounterPunch today published a most interesting article by James C. Kennedy, entitled “The Poisonous History of Neo-Classical Economics.” I suggest that all MMTers pull it up and give it a read. I’d provide the link, but often when I try to do this, I’m rejected as “spam.” What struck me about the article was its similarity to (or compatibility with) MMT in its analysis of neoliberal or neo-classical economics–how that system currently operates to gorge elites at the expense of ordinary citizens, and how it was able to maneuver itself into a TINA position during the past 40 or 50 years. I’d love to hear the reactions to this article from other readers of this blog, and perhaps, if he has the time, from Bill himself.

Newton, while I would not discourage MMTers from reading it, I would point out Kennedy’s final sentence — “I am openly promoting the re-revolution of classical economics.” This is nowhere near good enough.

I understand that German workers standard of living is harmed by an undervalued currency. What I don’t understand is why? Who benefits, and how? Is it, as some commenters above have claimed, purely about accumulating financial claims? Which is of course a delusion, not a benefit.

Creigh Gordon,

As I listen and read more and more, it seems that the elites are completely addicted to money and power.

So yes, thats the answer. It should be accepted that vast majority of them want more and more even when the rest of the population live in abject poverty.

It’s just as natural as a ball coming down to the Earth when you release it. Its just as natural as debt growing faster than economies. Its just how the world works, I find.

Sooner or later, everyone should figure it out and resist that or everything gets ground into dust.

I am confused. Is this post arguing that the German Mark was under-valued? But if that was the case, then the appreciation of the German Mark in the 1970s and 1980s was a step towards correcting this problem, not something to be lamented, right?

I am also confused about the attitude taken towards Germany’s “internal devaluation” (assuming it even exists. Doesn’t Germany pay its workers well? Aren’t the benefits, training, and corporate representation that German workers get the envy of the world?). According to the logic of MMT, if Germany’s “internal devaluations” meant that it continually net-exported real goods and net-imported financial claims from the rest of the world…why would the rest of the world have any reason to be angry about this? Why wouldn’t it be thanking Germany? Thanks to the willingness of German workers to earn less and keep their exports competitive, doesn’t the rest of the world get to consume more real resources according to MMT? Shouldn’t Bill Mitchell be saying, “Even more please!…sucks to be you, Germany! Thanks for letting the rest of the world take advantage of you!”?

I think Jerry Brown’s comment is spot-on. As much as we would like a world where investors produce for the sake of consuming real resources later on, many investors produce in order to accumulate financial claims. Because those financial claims represent power. And I think Bill Mitchell’s post betrays an implicit understanding that this power is also a type of “real good” with his lament that Germany has been accumulating financial power at the expense of its trade partners.

Dear Matthew Opitz (2019/03/27 at 6:24 am)

Thanks for your comment. But you miss the point entirely.

Germany’s behaviour is problematic for other nations because they have been, or are, tied intrinsically to Germany via fixed exchange rate arrangements, or, latterly, a common currency.

Without those arrangements, all that Germany would be doing by its undervaluation strategy was reducing the well-being of its own workers.

But once the other nations were tied into this strategy they faced on-going austerity and/or higher interest rate regimes and all the social costs involved in that.

That is the point.

The other issue about the power that financial claimants have on a nation is important but not the point of the blog post. I have dealt with that previously.

best wishes

bill

I’m very sorry to have to say that you seem to have it wrong when you say that:

“Many people still find it hard to understand this point but the fact is that we do not produce to produce. Rather we produce to consume goods and services. That is the end goal”.

This ignores the essence of capitalism which is M-C-M’ rather than C-M-C’ (as so described by Marx), or “Monetary Production” (as so described by Keynes). As any capitalist will tell you, they are just trying to “make money”.

The problem with talking about capitalism as though it were a “consumer society”, and to say that “we produce to consume”, is to focus attention away from what capitalists actually do (make money), and just look at the production of commodities as exchangeable use-values, traded in the “free market” to satisfy the needs of consumers.

This may very well be what the “consumers” hope would happen, but it is an illusion created in the capitalist mode of production, and a wilful illusion at that. It is just the sort of obscurantism (reducing everything to the value of “free markets”) that needs to be dispelled.

To tell you the truth I am genuinely confused as to why you, as one of the main creators of MMT, would seemingly forget that MMT deals with the role of MONEY and the way it works in the economy, and is therefore ideally placed to analyze capitalism, and cut through the “consumerism” myth.

I apologize in advance for my ignorance, and would genuinely like to know the answer to this.

I told you-all this several weeks ago.

Nations like Germany and China should not be allowed to do what they do year after year.

They need to invest their ‘ill gotten gains’ in other nations because they can’t invest more in their own nation.

Prof. Blyth says that Germans were buying old high interest Greek bonds and lending to the Greek people when they should have realized that Greece and its people would never be able to find the increased income to pay the Germans back. Greece should have defaulted on the Germans. Stuck it to them.

This is the Achilles heel of a nation like Germany. They have to buy assets [land, buildings, comp.] in other nations or lend them the money to buy German products. Either way the nation can just take their asses back or default on the loans. What can Germany do? Invade?

Germany will cry ‘foul’. But, it is the Germans who did the foul by doing what Bill described above.

On a different note —- what Bill is saying IMHO is that *nations* produce in order to consume.

What others are saying is — Capitalists produce to earn financial claims on others.

IMHO, both statements are true.

A 3rd note —

I don’t understand why China has kept accumulating dollars and US T-bonds for so long. What do the Chinese leaders plan to use all those dollars for? Just holding them seems pointless.

@Dirk Falkin

You do us a service insofar as your post summarizes the narrative which celebrates the German policy arrangement as a triumph to be admired — a narrative that no doubt receives applause and support from those advantaged by it, and at least to a certain extent dazzles domestic actors who are exploited along with uninformed foreigners.

However, do not delude yourself that it cuts any ice with observers fortunate enough to have inoculated themselves against such blandishments with at least a cursory understanding of macroeconomics, monetary operations, international trade policy and their implications.

IMHO, international trade law needs to be reformed to punish nations* that have a trade surplus year after year.**

I propose that the WTO require every other nation to impose an additional “punishment” tariff on all German*** exports of 1% for each year that it has run a trade surplus. And raise it 1% each year it continues to have a trade surplus. If it reforms and ends its surpluses then the tariff can be lowered, slowly or otherwise.

.

.* . This is much like my desire to tax the wealthy heavily to redistribute the money back down to the masses, to create an equilibrium situation where the money doesn’t accumulate at the top of the income distribution because of the unavoidable advantage the rich have in the money making game.

** . I suppose that an exception is oil exporting nations with small populations which need to accumulate assets for when the oil runs out. Or the world stops burning oil because of ACC/AGW.

.*** . Here Germany represents all nations that run trade surpluses year after year.

@Steve_American,

I’m not sure that China is still maintaining US Treasury holdings on the scale it once did.

It has certainly begun investing massively in infrastructure projects, particularly in Africa, and Eurasia (Belt & Road Initiative), presumably diverting its foreign earnings to funding those developments.

Repatriating foreign currency earnings and exchanging them for domestic currency is risky if your entire economy has been based on cheap exports via an undervalued exchange rate.

And, as we MMTers well know, the Chinese govt, as monopoly creator of RMB, doesn’t need dollars in order to spend money in China.

But I think China is moving ahead from that policy of simply accumulating dollar financial assets now, and is set to put far more constructive use to its earnings than just leave them wallowing in US govt bonds.

I was reading the other day about the failed project to build a high speed rail link between LA and San Francisco. We in the UK are also still debating the HS2 project, though to be fair it’s a sledgehammer to crack a nut for the London to Birmingham route, when the entire northern rail system is falling apart.

I’m spending next month travelling around China for the first time, and have been booking high speed rail trips on bullet trains between cities and towns I’d never previously even heard of, each with populations greater than London, Birmingham, LA or SF.

The Chinese must be laughing at us, if they stopped for a minute to even bother to notice how pathetic our governments and industries have become.

Mr Saunders. I agree with you. Completely. The purpose of capitalism is to accumulate private wealth, not to provide goods and services. Unbridled aggression results in war, theft, murder, slavery – predatory behaviors. I do think there is some real expression of mutuality through exchange. Say’s Law is baloney. Capitalists don’t look to enrich anybody but themselves. Within certain boundaries of civil behavior they seek to exploit situations and circumstances for their own advantage. They seek to maximize the surplus value of a given situation that they can extract, so that they can acquire a more fluid form of wealth, or power, from some other participant, who actually has wealth or power to be traded. They seek to capitalize on people, situations, events – for the acquisition of private wealth and power. It’s necessarily a zero sum game if not interrupted and controlled.

@Prof Bill – Considering the current account deficit, Singapore has a massive one (as a % of their gdp) – 19.5% according to [Bill deleted link to site with advertising I do not care to promote] . Is that harmful as it seems like for germany or is there a difference here?

@Yok and Ron Saunders……….I would have thought that the entire purpose of accumulating intangible financial claims is that they may be exchanged for something useful (goods, services, favours from high flyers etc). The more financial claims one accumulates, the greater the amount of such real, tangible wealth – and power – one can command. Those rich in financial assets use them to literally consume things and quantities of things beyond the means of the average person – mansions, Rolls Royce’s, yachts, Armani suits, favours from policy makers etc. If you look at anyone very rich in financial assets you will typically see that they have a consumption lifestyle to match.

I think that China has a use for that gigantic pile of USD in keeping some flexibility around their exchange rate (ie. keeping the value of the renmimbi low), but that is pure speculation on my part

Am I alone in detecting a distinctly sinister note in the unreserved praise heaped by Dirk Faltin upon his own country and the scarcely-concealed contempt which his post exhibits towards the citizens of so-called “less disciplined” nations, with whom Germany was presumed (erroneously and naively as it turns out) to have committed itself in good faith to cooperate, for the mutual benefit of all, and whom it then proceeded to exploit without a qualm?

Its elites’ disregard of their own citizens’ interests doesn’t make their deliberately predatory behaviour towards those of their supposed partner-nations any less reprehensible.

Let Faltin protest – from his hard-right standpoint – Germany’s virtuous innocence as vehemently as he pleases, the historical record from the early ‘fifties onwards speaks for itself. The indictment which Höpner mounts, and Bill’s analysis corroborates, is damning.

@ robertH

No, you are not. Mr Falkin’s position is most common here in Germany: all the troubles of southern European nations are self inflicted due to their own shortcomings and deserve not our sympathy but, at best, some tough love in the form of the imposition of disciplinary austerity measures. In my perception, there appears to be an obsession about the administration of the punishment despite the evidence that it only worsens the problem. Beatings will continue until morale improves and all that.

The German elite is either unwilling or incapable of recognizing that not only can’t the German approach be reproduced successfully by all nations at the same time, thus it needs “losers” to sustain its “winners”, but is doomed to fail in the long run since it deteriorates the economies of the countries that are supposed to import the products they base their success on.

Ultimately, the Euro will fail and the Germans will blame it on the “lazy” countries, wheras the anti-german resentment in the latter will most likely increase.

“… since it deteriorates the economies of the countries that are supposed to import the products they base their success on.”

It should be noted that through increased global trade and a diminishing reliance in European markets as buyers of German exports, the whole charade gets to go on even longer.

@ Steve_American

“I don’t understand why China has kept accumulating dollars and US T-bonds for so long. What do the Chinese leaders plan to use all those dollars for? Just holding them seems pointless.”

Don’t know the numbers but aren’t China using substantial parts of its surplus in international valid currencies to expand globally, railroads and other investments in Africa, a complex system of new “Silk roads” and so on and importing stuff to boast its military capacity and so on.

They done this with focused hard work, planning and USD created out of thin air (US deficits). Clinton and his Wall Street pals did know what they were doing promoting this policy?

One can understand Chinas surplus strategy (be a cheap producer), it’s a massive task to develop a modern industrial structure, they needed foreigners to open factories in China so they could learn. E.g. producing a car of high quality that not needs to be recalled for various faults aren’t a Piece of cake.

Chinas rise in producing was hard blow to the rising South East Asia, they even undercut Bangladesh in textile production.

Someone calculated that the rise in Chinas export to US from the late 1990s to early 2000s did match the contraction of US import from SEA.

But what are Germanys national strategy with its export surplus policy’s?

Creigh Gordon

Wednesday, March 27, 2019 at 4:31

I understand that German workers standard of living is harmed by an undervalued currency. What I don’t understand is why? Who benefits, and how? Is it, as some commenters above have claimed, purely about accumulating financial claims? Which is of course a delusion, not a benefit.

As it seems the financial gains of export surpluses mainly accumulate at the top. Maybe it was somewhat different in early industry when labor was a much more significant part of a factory. Today it isn’t. Globalization of supply chains have blown up most countries export percent relative to GDP, export industry are now the largest importer and the net value contribution isn’t at equivalent to the nominal export number.

It’s not primarily workers in Germanys export sector that suffer by the policy to keep import down. It’s “everyone else”, severely neglected investment and maintenance of public infrastructure of all kind, the working poor that work in the domestic economy in like so called mini-jobs and so on. Poverty in Germany is at its highest since German reunification.

This wouldn’t have been possible without the so called “left”, aka Social Democrats ant the Greens.

The result of 3-4 decades of neoliberal economics. Not that there wasn’t people and even economists that warned that this would be the result and was the aim of neoliberal economic underlaying the fantasies of trickling down when those who gained was investing it in real production to the gain of all of us.

This suppose to be the most successful economy in EU! For whom one could ask.

lasse. I see it as class warfare. There are always people seeking to profit at the cost to the community. Beyond that, I believe that some people identify with conquering. The drive expresses as a desire to subordinate and subjugate. Sharing, the common good, or what is better for the greatest number of people are irrelevant here. In fact these things are despised. What we see is a particularly mean spirited venality, where power covets all power, wealth covets all wealth. Winner takes all. I can understand the genius of ants and bees; special endowment has no liberty, no avenue for individual expression, only a complete subordination to the community.

Newton. I think Mr Kennedy sees reality of outcome very similar to MMT. Economic history that I’ve learned differs from his. He seems to think aside from 1970s on things were pretty good. I don’t. Only with the New Deal, was wealth shared justly. The Great Depression caught the wealthy and powerful unprepared. Their self serving lies they believe themselves, so they had no way out, aside from fascism. Within that breach, when the wealthy and powerful here couldn’t bring themselves to overthrow FDR, they receded, but never went away. With the persistence and single-mindedness that goes with the lust for wealth and power they’ve stolen and lied their way back to their previous position. Friedman liked to call himself a scientist. He was a political hack. He realized when young, the inevitable logic of wealth and power, realized the only way to succeed was to serve it, that all intellectual thought was irrelevant fluff.

Adam Tooze who is an English historian, a professor at Columbia University and Director of the European Institute – in his latest Chartbook newsletter referenced the same paper by Martin Hopner which brought me here via Google.

An appraisal of the Hopner paper by Prof. Mitchell is of more use to me than the original paper as my depth of understanding is clearly a fraction of Prof. Mitchell’s.

One observation from me may be useful however.

The consumers in the intraEuropean trade deficit nations of Italy, Britain, France and many others may benefit from Germany’s devalued exported products and have higher material living standards as a result of those transactions; and the German worker although losing as a consumer gains more from having a good job and by having stable industries that can evolve and adapt to new market opportunities as is now happening with EV’s. The German worker still has many good value products and services available for purchase. With good wages and less speculation in real estate they actually have considerably more discretionary purchasing power.

This to my mind is analogous to Italy, Britain, France and others living well on a UBI, and Germany instead living with a Job Guarantee in place. The former benefits from consumption and the latter benefits from working and the productive output and income from that work.

Too many people living on a UBI will eventually drain the productive capacity out of your nation while having a full employment nation will help build productive capacity, competitiveness and even sustainably allow relative currency appreciation – as per Switzerland or Japan for example which then necessitates productivity improvements and transitioning to higher value adding economic activities – good path no doubt?

To my mind the MMT concept that exports are a cost and imports are a benefit is true for an individual consumer but when applied generally across the entire national economy this inverts and I would maintain that living in Wolfsburg is better than living in Manchester.

Any true Socialist should also prioritise the collective benefit over individual benefit.

Trade deficit nations should instead be seen by the MMT academics as ‘UBI like free-loaders’ that are enjoying the present but sacrificing their future prospects through having a smaller than needed productive sector – that will also inevitably become less and less internationally competitive over time as technologies and innovations advance and the workers become more educated or skilled in those nations that maintain a large productive base e.g. Germany, Japan, South Korea or China.

By the way I am not endorsing Germany’s currency devaluation policies or the imposition of the destructive single currency zone nor the restrictive fiscal and high interest rate policies dictated by the German elites upon the rest of the EU.

Ongoing current account surpluses should lead to appreciation of the national currency and if you want your manufacturing or other production sectors to retain competitiveness then your nation must import other stuff and your people need to travel more or similar to restore a current account balance?

Entrapping other nations into your currency zone as Germany has done is clearly cheating and imposing unemployment upon them so that you can have more employment in your country. F-OFF YOU LEECH!

The MMT policy prescriptions for the EU and universally of returning to free floating national currencies and adjusting fiscal policy using the Job Guarantee to ensure full employment and maximal fiscal utilisation with price stability is in everyone’s interests including the German elites that are on a path to nowhere while tens of millions of Europeans endure decade after decade of totally avoidable mass unemployment and governmental austerity.

Germany will also need to transfer some of its manufacturing operations out of Germany to the South and East of Europe and elsewhere and learn to import more. The German people will also come out ahead if the whole reform process occurs as required but the bankers may need to be politically neutered first.