Well my holiday is over. Not that I had one! This morning we submitted the…

Those Imbecilic Keynesianisticists are loose – lock up your … whatever!

It is Wednesday – a blog lite day – sort of. I am travelling a lot today and I have a large report to finish. But I couldn’t resist typing out the term “Keynesianisticists”, which refers to those imbeciles who think Modern Monetary Theory (MMT) has any credibility – it hasn’t!. These MMTers types – imbecilic is being kind – are parading around telling people that governments cannot run out of spending power as long as there are things for sale in the currency they issue on a monopoly basis. I have only one word for them – Zimbabwe – well two words – add Venezuela. And Lebanon thrown in! And I should know. I have predicted “9 of the Past 5 Recessions” (a Paul Samuelson quote from 1966). I told people that bond yields would rise sharply, they fell. I told people the share market would collapse, it boomed. I told people the gold price would soar, it fell. But that is nothing compared to what those Imbecilic Keynesianisticists want us to believe. Believe me, I know what I am talking about. They are imbeciles, they are imbeciles, imbecile is too kind a word, they are imbeciles, imbeciles, I am an imbecile … stop the record. Time to catch an aeroplane!

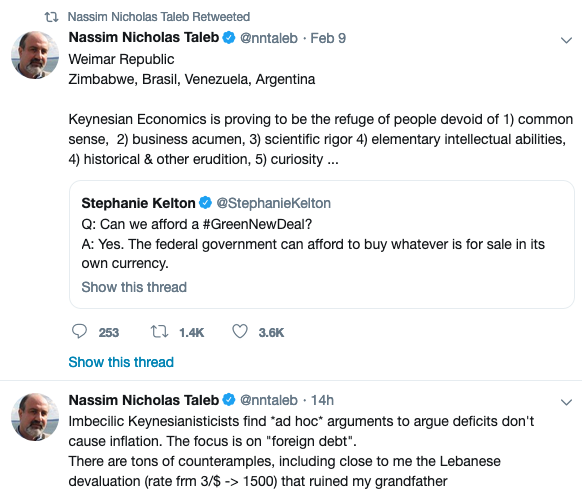

Here is the Tweet stream that told us more:

Go on tick the boxes about those MMT proponents – you know you want to give that lot some comeuppance:

– “devoid of common sense” – tick!

– “devoid of business acumen – tick!

– “devoid of scientific rigor” – tick!

– “devoid of elementary intellectual abilities” – er, ahh, what was that big word … intellegible or something – but tick anyway, just to be sure. I wouldn’t want to stand out. Mr Taleb, he da man!

– “devoid of historical and other erudition” – definitely, tick!

– “devoid of curiosity” – tick!

Not much left is there. Imbecilic Keynesianisticists seems about right.

Well who is this guy who has such a prescient view about those imbecile MMTers?

Remember – Nassim Nicholas Taleb – the ‘black swan’ man?

Yes, that one.

The guy who made a fool of himself in the early days of the GFC when the mainstream economists and the sychophantic financial commentators were out in force declaring that various currency-issuing governments would go broke because bond yields would soar and hyperinflation would be triggered by the massive fiscal deficits that governments were running.

On February 5, 2010, Mr Taleb was quoted in the article – Taleb: “Every Single Human Being” Should Short Treasuries – as telling a conference in Moscow about his knowledge of financial markets.

At the time, I considered Mr Taleb’s judgement in this blog post – On human bondage (February 5, 2010).

I noted that my mate, Marshall Auerback described Mr Taleb as a blind squirrel who accidently stumbled on a few acorns – very North American imagery I thought.

The point being that if you run your mouth at some fast pace in a more or less random fashion you are sure to say something that is sensible once in a while.

Mr Taleb’s book “The Black Swan” had some good analysis in it but nothing much more than Mandelbrot had laid out in his fractal geometry which inspired chaos theory.

So a few acorns here and there but overall no understanding of how the monetary system operates.

Anyway, Mr Taleb who keeps telling his readers how clever he is (if you have been unlucky enough to read his book you will know what I mean) was telling people at the time:

It’s a no brainer to sell short Treasuries … Every single human being should have that trade … [and] … Short the S&P vs Long Gold, in a 5 to 1 ratio.

This is because the US economy was apparently approaching Armageddon day. Yes, another doomsday approaches.

In that interview, Mr Taleb also said:

Deficits are like putting dynamite in the hands of children … They can get out of control very quickly … The problem we have in the United States, the level of debt is still very high and being converted to government debt … We are worse-off today than we were last year. In the United States and in Europe, you have fewer people employed and a larger amount of debt.

At the time, I challenged Mr Taleb to name the date of the END, which meant that we could have sent him our commisserations when it was obvious he had failed to ‘stumble on the acorn’.

Well we can clearly reflect on Mr Taleb’s prognostications given the passage of time.

And perhaps, that assessment conditions how seriously we take anything that such a person might now say about economic matters.

The evidence is in. Mr Taleb doesn’t know much about these matters.

What does it mean to “short Treasuries”?

For those who don’t understand what his call – for every single human being (including the newly born), those in dire poverty, those who don’t know what a Treasury is, and all the rest – to short Treasuries means, then let me explain.

When the prices that government bonds are bought and sold at in the secondary bond markets (after they have been auctioned to the selective bidders in the primary market) fluctuate there is an opportunity to make profits by predicting which way the sale price will go.

A person who believes the buying price of the bond will fall in the future can make money by ‘shorting’ it in a trading contract.

There are various ways to ‘short’ a bond, including using bond exchange-traded funds (ETF), ETF put options, Treasury put options, Bond futures, etc etc.

They all amount to the same thing – you offer to sell an asset (a government bond in this case) at some future date (specified in a contract) that you do not currently own.

So you might offer to sell a bond at some future date at its current market price and hope that when the time comes to deliver on the sale, you can purchase the bond at a lower price and make a profit.

The price of a bond is intrinsically linked to its yield.

Simplifying, in macroeconomics, we summarise the plethora of public debt instruments with the concept of a bond.

The standard bond has a face value – say $A1000 and a coupon rate – say 5 per cent and a maturity – say 10 years. This means that the bond holder will will get $50 dollar per annum (interest) for 10 years and when the maturity is reached they would get $1000 back.

Bonds are issued by government into the primary market, which is simply the institutional machinery via which the government sells debt to the primary dealers.

Once bonds are issued they are traded in the secondary market between interested parties. Clearly secondary market trading has no impact at all on the volume of financial assets in the system – it just shuffles the wealth between wealth-holders.

In the context of public debt issuance – the transactions in the primary market are vertical (net financial assets are created or destroyed) and the secondary market transactions are all horizontal (no new financial assets are created).

Please read my blog – Deficit spending 101 – Part 3 (March 2, 2009) – for more discussion on this point.

Further, most primary market issuance is now done via auction. Accordingly, the government would determine the maturity of the bond (how long the bond would exist for), the coupon rate (the interest return on the bond) and the volume (how many bonds) being specified.

The issue would then be put out for tender and the market then would determine the final price of the bonds issued.

Imagine a $1000 bond had a coupon of 5 per cent, meaning that you would get $50 dollar per annum until the bond matured at which time you would get $1000 back.

Imagine, given the current expectations in the ‘market’, that bond investors wanted a yield of 6 per cent to accommodate risk expectations (inflation or something else).

So for them the bond is unattractive and they would only trade it at a bid price lower than the $1000 to ensure they get the 6 per cent return they sought.

The mathematical formulae to compute the desired (lower) price is quite tricky and you can look it up in a finance book if you are so inclined.

The general rule for fixed-income bonds is that when the prices rise, the yield falls and vice versa. Thus, the price of a bond can change in the market place according to interest rate fluctuations.

When interest rates rise, the price of previously issued bonds fall because they are less attractive in comparison to the newly issued bonds, which are offering a higher coupon rates (reflecting current interest rates).

When interest rates fall, the price of older bonds increase, becoming more attractive as newly issued bonds offer a lower coupon rate than the older higher coupon rated bonds.

Further, rising yields may indicate a rising sense of risk (mostly from future inflation although sovereign credit ratings will influence this).

But they may also indicated a recovering economy where people are more confidence investing in commercial paper (for higher returns) and so they demand less of the ‘risk free’ government paper.

So you see how an event (yield rises) that signifies growing confidence in the real economy is reinterpreted (and trumpeted) by the conservatives to signal something bad (crowding out). In this case, the reason long-term yields would be rising is because investors were diversifying their portfolios and moving back into private financial assets.

Now Mr Taleb wanted everyone – every single human – to be short – meaning, if they were rational, that the price of bonds was expected to fall dramatically because yields had risen.

He obviously wanted people to believe that yields were going to rise significantly because of fears of government insolvency, and all the rest of the claptrap that the mainstream economists go on about.

On his Twitter account he self-promotes himself as a flâneur, which means (translating) that he just strolls or saunters around checking stuff out. Although there are other meanings that Mr Taleb probably thinks applies to him.

Well he should check this out!

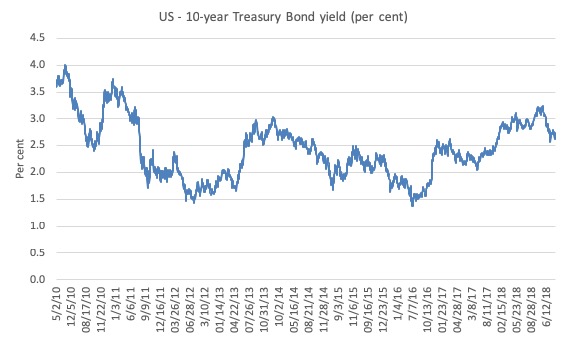

What happened to bond yields?

The following graph shows the evolution of the ten-year US government bond yield since Mr Taleb’s statements (February 5, 2010) to February 8, 2019.

The trend has been downwards with fluctuations.

Going short means you have to have an idea of the contract delivery date. You might accidently ‘stumble on the acorns’ and get some of the volatility in the yields correct (there were ups and down through the period) but the overriding trend has not been up!

Big losses would have been highly likely from following his advice.

Remember, these sort of predictions have been made for decades about the Japanese government 10-year bonds.

The famous ‘widowmaker’ trade where smartie-type Mr Taleb’s in hedge funds bet on rising JGB yields (and falling prices) only to find out that the opposite happens and they make massive losses.

Next stop – 10th floor window! The widowmaker!

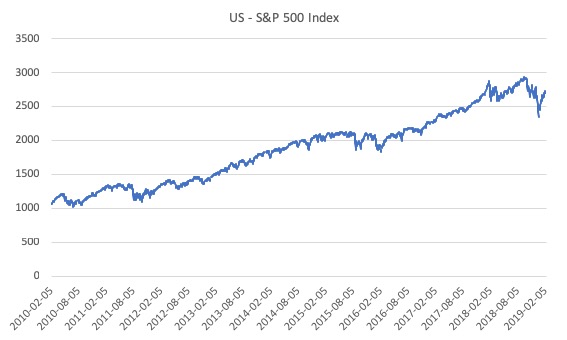

And what about the S&P

Mr Taleb recommended we all go short on the S&P index because collapse in the economy would lead to a collapse in the S&P.

Bring on the graph.

Graph enters – shows S&P index from February 5, 2010 to February 11, 2019.

It shows that big losses would have been incurred by trying to short the S*P 500.

And what about gold?

What if we had all followed Mr Taleb’s advice and went long in gold?

Going long means you hold the asset and hope for capital gain over the longer term as its price appreciates.

In 2010, the average gold price was $US1,420.25, having risen substantially in the previous year as the GFC played out.

And now, you gold bug longees?

The London Bullion Market gold price on Monday, February 11, 2019 was $US1306.75.

Suck it up!

But then I am one of those “Imbecilic Keynesianisticists”.

Yeh, I know Zimbabwe yesterday, Venezuela tomorrow, then we take Berlin (sorry Leonard)!

And Lebanon?

1. Currency peg against the US dollar (1500)

2. A central bank that borrows foreign exchange from commercial banks at exhorbitant interest rates.

3. Stagnant growth due to regional instability – Lebanon is suffering from the fallout of the Syrian War, the struggles between Sunni and Shia elements stemming from Saudi Arabia and Iran, respectively.

Impact: dramatic falls in tourism, a fall in real estate prices and Foreign Direct Investment.

Impact: massive refugee flows into Lebanon from Syria. Population of Lebanon around 6 and a bit million. Number of Syrian refugees – more than a million.

Infrastructure cannot cope with that sort of population influx. Fiscal deficits have to rise in those cases because the private sector is hardly going to pick up the humanitarian bill

4. Rapid decline in private activity due to on-going military strife create massive insecurity in the region.

But those Imbecilic Keynesianisticists are behind this calamity. They started the Syrian War didn’t they with their stupid ideas.

Go Nuke Da (GND) lot of them.

Music for today …

Yes, the album had drum machines, disco feels, and the rest of it – but it still had some great guitar playing from Jeff Beck and some great singing from Mick Jagger.

I am referring to the February 1985 solo album by the last mentioned – She’s the boss – which caused deep frictions within the Rolling Stones and marked a period where Mick Jagger, obsessed with his own stardom, lost track of what quality music really is.

I bought the album when it came out – yeh, a tragic collector of records. It is mostly forgettable.

But this song – Hard Woman – has some great vocal phrasing and I always liked it – with some nice guitar at the end.

And while on one member of the Glimmer Twins, the other member, Keith Richards was not to be outdone and in 1988 released his first solo album – Talk is Cheap. It was a much better effort than Mick’s collection of solo records.

The backing band was the X-Pensive Winos (all great players) with a guest appearance by former Rolling Stone Mick Taylor (another fabulous guitarist).

Here is a good sample from the album – You Don’t Move me (anymore)!

The sound is of raw guitars (beautiful) with some funk thrown in, rather than the disco dance from Mick Jagger. You get the understanding that the engine room of the Rolling Stones at their best was Keith Richards and at their worst Mick Jagger. Not that the ‘worst’ was that bad.

Fabulous playing.

If you have read Keith Richard’s book from 2010 – Life – (I recommend it – I have a personally-signed copy) – then he talks about the friction that Mick Jagger created between the pair when he signed a three-record deal with CBS behind the back of other Rolling Stones member.

He refers to Mick Jagger’s first solo album in this way (pp.462-463):

Mick’s album was called She’s the Boss, which said it all. I’ve never listened to the entire thing all the way through. Who has? It’s like Mein Kampf. Everybody had a copy, but nobody listened to it. As to his subsequent titles, carefully worded Primitive Cool, Goddess in the Doorway, which it was irresistible not to rechristen “Dogshit in the Doorway, I rest my case. He says I have no manners and a bad mouth. He’s even written a song on the subject. But this record deal of Mick’s was bad manners beyond any verbal jibes.

Just by the choice of material, it seem to be he had really gone off the tracks. It was very sad. He wasn’t prepared not to make an impact. And he was upset. But I can’t imagine why he thought it would fly. This is where I felt Mick had lost touch with reality.

Pretty direct.

If you are in Melbourne tonight and want to hear music …

Then my band – Pressure Drop – is playing at the Maori Chief Hotel, 117 Moray St, South Melbourne, from about 20:00 to late.

This is a great little inner city pub in Melbourne which has consistently supported live music. Such venues need the support of all of us.

And, what else is there to do on a Wednesday night in Melbourne anyway?

Lots of great dub, rock steady and reggae coming up tonight. We will throw some jazz in there somewhere too!

I can also discuss Modern Monetary Theory (MMT) during breaks in the sets!

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

There are 10 or so standout rock guitarists, I guess, and some would agree on this arbitrary figure, but for some reason Beck is #1 for me. His playing just seems ‘effortless’; I think because he’s immersed in it, and it’s become part of him. True, broadly, of the other greats, but… just my take.

This is a great watch/listen.

https://www.youtube.com/watch?v=VMl5B6eq9as

He’s blunt, and endlessly entertaining. To McLaughlin, on being offered yet another guitar to try… “just piss off!” ((-:

Oh, thank you for making bond/prices/yields make sense; I’d not factored in the temporal/comparison element before, because it’s not usually explained in those terms.

Funny, I was just listening to Jeff Beck on spotify (while at Lake Awoonga), thinking you don’t hear enough about him. It was People Get Ready, with Rod Stewart, great telecaster sound I think.

Also-

The solo Jagger album Wandering Spirit I always thought is excellent, underrated.

Aren’t (or wern’t) Venezuala, Zimbabwe (and Weimar) either: dysfunctional, despotic, or disastrous regime’s? I have not seen any direct references to those facts by the critics such as your mate Mr Taleb. Is he saying that the western world is heading that way? One thing is obvious, they start with a letter at the tail end of the Alphabet, so maybe the UK and US are next in his line?

If the GFC could be predicted, it becomes a bit silly to call it a Black Swan. Better to deny reality then and sell some books.

Bill, you are brilliantly hilarious in this post. I laughed my ass off. On a more serious note, since you mentioned Mandelbrot, I would recommend The (Mis)Behavior of Markets by Mandelbrot and Hudson (readable) and (the more technical) Structure and Scaling in Finance. The latter has some of his path-breaking papers from the sixties, especially the one on cotton, wheat, and railroad ties. I have always thought the juxtaposition of this set of food and transport items amusing.

Willem, IIRC, Taleb called the GFC a black swan after the event. I have found reading Taleb a struggle due to his ginormous ego.

@the adjuster:

My humble take on your examples:

Venezuela & Zimbabwe are heavily dependant on imports to satisfy even the most basic needs –> need foreign currency –> high external debts not payable in own currency –> inflation. Very MMT consistent.

Weimar’s currency was pegged to gold, thus the reparation costs Germany had to repay were effectively denominated in a currency it did not issue, thus i won’t discuss it any further.

The bad government/administration argument thoroughly applies to Venezuela, in my opinion, since they failed to put their soaring raw oil export income to good use and invest in the countries food production, fuel supply, industry/infrastructure and most basic pharmaceutical needs. Roughly in that order, too. Probably the most blatant blunder is the fact it’s biggest import as a huge oil producing country are mineral fuels (!!!). After machinery in general and other manufactured products, the next biggest import are cereals, which they could have very well have produced themselves in such a fertile latitude. Furthermore, animal/vegetable fats and cereal & milk preparations are also among the top ten importss. As I mentioned, pharmaceuticals and other chemicals round up the top ten. With such a high demand for products denominated in a foreign currency and with oil as your almost only source for $US, Venezuela was bound to fall with it’s price. All data from from 2017.

I’m admittedly ignorant on Zimbabwian history, but I am guessing it has history of colonialism, social revolts, little to no infrastructure and high reliance on food imports. With little to nothing to offe to the foreign markets, they have had levels of external debt anywhere between 30% and 160 % in order to secure the funds for those imports and have thus seen their currency fluctuate (soar) accordingly. In my opinion, without a considerable (probably total) debt forgivness and no-strings-attached foreign aid, their situation, as that of many developing countries, is dire and hopless.

Herman the German,

I do not believe anything that we in the USA or in Germany are being told about the situation in Venezuela. For example the German Press is refering to the coup leader as the interim President of Venezuala. Yet an interem President would have the support of a nation’s military as well as its judicial system. At this point he clearly does not have that. Therefore he clearly only the wanna be interim President.

I think it is unfair for outsiders to accuse the Venezuelan government of incompetence. One would have to have been present during the discussions that led the governments policy decsions to have any idea at all whether or not such decisions were neglegent. It is easy to bitch and say that they failed to do this that or the other thing with out knowing what the immeditate and serous problems were at the time that needed immediate attention.

Furthermore why should Chavez and Maduro get the blame for Venezuelas lack of developement. If I am not mistaken the country had other people in charge for hundreds of years before they came along. Yet they were swept in to power because of the failings of those who had been in power for centuries. Now those same former failures think that they should be back in power because the current government did not solve Venezuela’s long standing problems in a few decades.

Furthermore a huge part of the problem that Venezuela faces is the outright sabotage of the economy by those who were previously in power. Yet I bet that the current government has been afraid to arrest and charge such counter revolutionaries with sedition and treason because it was afraid of what the US leadership would then do.

Loved this article.

On the other hand,

how does one predict 9 out of only 5 recessions?

I would also like to add that i have heard reports that the wannabe interim President of Venezuela has been involved in secret talks with members of the Venezuelan military to take control of the country on behalf of the coup leader. Should a person not wonder how such secret talks could be set up with out the assistance of the US government?

The coups leaders attempts to take control in this way do not bother me in the slightest though.

Because the fact of the matter is that the people of Venezuela are not qualified to pass judgement of the economic performance of their government. In reality there is no country on this planet where the people are qualified to pass judgement of the countries economic performance.

Not only that but there is not a single government on the planet that can claim to be a legitimate independent policy decision making body for the territory that it controls. To say that a country has the right to determine its “national” policies is nothing more than libertarianism on a grander scale. Does anyone have any doubts about where libertarian social and economic policies lead? Does anyone have any doubt that libertarianism leads to extinction?

I have made the case in the past that soldiers are obligated to disobey orders to wage a war of aggression against another country as such orders are illegal reguardless of where they originate. The crux of the arguement being that the people of a nation do not have the authority to wage a war of aggression and therefore they can not delegate that authority to a government.

But this line of thinking actually needs to be taken further. Humanity currently defends to legitimacy of government by saying that it rests on the consent of “the people”. But “the people” no more have the capacity to give that consent than an underage person does to consent to a sexual act. Not only do “they” lack the developement to be capable of giving informed consent, there is no reasonable way of saying who should or should not have a say in the formation of a “nation’s policies”. Why should people in Tiajuana be prohibited from taking part in US elections? Why should people in San Diego be prohibited from taking part in Mexican elections?

Such a view would seem to make me an anarchist. That is not the case. Anarchy is just a deragatory term for libertarian. No there is a loop hole.

Tom,

How does one predict 9 out of the last 5 recessions? Via a bad joke that doesn’t come off.

Black Swan was virtually unreadable. I normally stick it out to the end when i start a book but i heroically got 3/4 of the way through and had to admit defeat. It could have been an interesting book with a more engaging less self obsessed author. There’s a video of him making a complete arse of himself on Youtube if you fancy a giggle.

I’m guessing this is the ‘they fight you’ phase by the way – it really feels like it at the moment now the GND is in the public eye, they’re all coming out of the woodwork.

Brilliant stuff. Auerbach put it brilliantly…

I was disturbed by his attack on NGOs after Sontag dismissed him when he said he was a trader. I can understand Sontags response, given the harm caused by traders, but she did miss out on some acorns. Tales then attacked NGOs in general. A tragic case of his application of generalization/induction from 1 incident that should have become obvious if he looked at some of the excellent work of certain NGOs.

But I think taken is open minded, and if bashed enough will engage. He was quite critical of Davos: too many yes men and empty suits. His appellation intellectual-yet-idiot iyi is useful too, particularly for the dsge types – of whom he says they have no idea of risk. He says instead of risk management, schools should understanding risk.

Perhaps a more serious engagement on his issues, beyond failed prediction, after all that is not interesting if one accepts the monetary system is unstable (min sky, Marx , late Fischer &c), and he would be interesting to see engage with mmt questions.

He is blasé… But you can rope him in like you did us :p

Hilarious blog post Bill. I’ve read your writings and I’ve also read Nassim’s books. I like his ego, I like his creative explanations and anecdotes on chaos theory and Benoit Mandelbrot– he does lack precision when it comes to the monetary system and you’ve shown it. Nassim will be quick to criticize talking heads and pundits for making frequent and conflicting testimonies without having ‘skin in the game’– which is very similar to your mate Marshall’s observation that if you ‘run your mouth at some fast pace, you are sure to say something that is sensible once in a while’. His ideology of skepticism towards theory, models, and statistics is admirable but I do think he can go too far with it into tinfoil hat territory when it comes to areas of knowledge where he is still developing.

H the G said:

“Venezuela & Zimbabwe are heavily dependant on imports to satisfy even the most basic needs -> need foreign currency -> high external debts not payable in own currency -> inflation. Very MMT consistent.”

Is it?

MMT argues there is no foreign currency constraint and that imports are good and exports a cost.

If you don’t have real resources you have to bring them in from offshore paid either with exports or foreign debt.

The foreign currency constraint arises immediately.

With a short position, doesn’t it require someone else to take the opposing gambit? Thus if every human shorted the Treasury it would be impossible because someone has to be on the other side of the deal? (If I learned anything from The Big Short!)

Dear Henry Rech (at 2019/02/14 at 8:03 am)

MMT does argue that at all. Imports are good and exports a cost doesn’t mean there is no foreign currency constraint.

I have continually noted that a nation is only as materially well-off as the real resources it can muster either within the borders or via trade. To trade, most nations need foreign currency.

That constitutes a prima facie case for exports.

best wishes

bill

Bill,

“Imports are good and exports a cost doesn’t mean there is no foreign currency constraint.”

I clearly didn’t say that.

I am essentially saying what you said in your comment – if you need more real resources than those at your domestic disposal then you need to acquire them offshore which requires foreign currency.

The need for foreign currency is one aspect of the “foreign currency constraint”.

Hermann is correct about Venezuela and its import dependency: over 80% of its food consumption is imported – the recipe for disaster. The figure is even higher for the basket of basic goods out of which CPI is calculated. Chavez’ mistake was not attacking this problem from the very start. Yet the opposition did the same or worse in terms of economic performance in the past. Just look up GDP per capita when Chavez took office after decades of public mismanagement – it was about the same as in the early 60’s so that’s 40 years worth of lost growth . Should tell you a thing or two as to where the real problem lies.

Hey Bill. Krugman, NY Times on line, is talking some junk on you guys. He sounds just like a republican to me – he doesn’t know enough to venture an opinion. You should offer to rebut his opinion within the Times. I think it was Feb 12 entry. I’d love to see you guys on that forum.

It seems that economists, while being apparently being brilliant mathematicians, have only the vaguest grasp of logical modalities.

The possible is necessarily necessary if it serves their argument.

The necessary is unpredictable unless unique.

The “black swan” analogy has always fallen somewhat flat with me. Being a denizen of South Australia, white swans are interesting curiosities found only in zoos. Strangely enough, even here the “compexity” crowd seem unable to find a different example of the shortcomings of inductive reasoning, so it can’t be a very useful analogy.

@ Curt K.

I support the new inteventionists as little as you do but it is a fact that Venezuela has been historically awfully mismanaged and all the good things that the Chavez regime did, e.g. the investments in healthcare and education, can’t hide their effective dependency on imports for mere survival. The political farce currently playing out will most likely change nothing in this regard.

@ Henry Rech

I guess the part that set your alarms off is this one:

“-> need foreign currency -> high external debts not payable in own currency”

The external debts arise only when the country’s own exports are insufficient to pay for the imports. Zimbabwe is too underdeveloped to offer as much as it would need to and the price of Venezuelas main export (oil) took a nosedive in 2014. Actually, I think it was more a correction after about ten years of inflated prices.

Herman the German (17:50)

The crucial point being that the current regime is being held responsible for that state of affairs by those who wish to put other people in power.

Brendanm, the black swan, found in Australia at the end of the 17th century, led in the 20th century, as formal logic was being developed, to one of the most common examples in logic, All swans are white. Since they aren’t all white, this universal generaliztion is obviously false. Related to this is an example made famous by Alfred Tarski, ‘Snow is white’ is true if and only if snow is white, which means that the sentence ‘snow is white’ if true just in case snow is white, and false otherwise. The example may appear to be trivial, but it isn’t.

Your modal logic example only works in certain modal logics. Which one did you have in mind? In certain modal logics, a necessary proposition, if true, is true everywhere, hence, entirely predictable.

Addendum: Swan comment that got left out:

It is this relationship between black and white swans in logic that I think led Taleb to focus on black swans. The reasoning is that swans were assumed to be white until the black ones were discovered in Australia, which was, not to put too fine a point on it, unexpected. Taleb then added the attributes of extreme impact and post hoc rationalization to his concept of the black swan. So, black swans fitted what he wanted to say. It has certainly become a common meme. The concept has no relationship to inductive reasoning principles that I can see.

Tarski then utilized the notion of whiteness for his definition of ‘truth’. But selected snow instead of swans as being more appropriate for his purpose.

Jeff, I recommend this video from youtube of an interview with Taleb where he shows that he has no understanding of how the national monetary system works or the functions of taxation. It is entitled Taleb Says World Is More Fragile Today Than in 2007, which was published by Bloomberg on 31 october 2018. He may be right about the impending recession but for the wrong reasons. It may be of interest, as he gives reasons for why he thinks what he does about the national economy, and his reasoning is completely wrong. One could be left with the gobsmacked feeling, how could anyone believe this bullshit, yet he is not the only one.

Bill, you’re a formidable take-down artist indeed. I love the “flaneur” reference followed by a jaunty stroll through historical data that simply devastates Taleb’s cocky pronouncements.

I read Taleb avidly for a few years, listened to quite a few lectures online too. I learned a lot from his de-bunking of conventional Morningstar-style “statistics” about financial markets inappropriately based on Gaussian bell-curve distributions.

He heaps scorn upon the economics profession (as you do, but yet not *quite*). I think Taleb’s Wall Street trading savvy informed by real mathematics has led to towering hubris about macroeconomics. Also his pragmatic bent seems to have bound him tightly to the household fallacy of sovereign currency issuer finance.

Jagger and Richards tips were great. Keep ’em coming.

Richard Genz, virtually the only support that Taleb had in the early days for his critique of financial commentary was from Mandelbrot, who had come up with a similar critique 30 years earlier, that the markets did not conform to Gaussian distributions and that any equations that assumed normality were seriously erroneous. I don’t remember Mandelbrot making any comments about macro, however, unlike Taleb. I also read Taleb’s work, mostly dealing with statistics. I noticed a tendency to go beyond his supposed remit, like going from critiques of micro to critiques of macro without a pause. I don’t think it is his pragmatism that leads Taleb to hold the sovereign currency issuer fallacy; rather, I honestly think he believes that his statistical understanding can be generalized without significant modification from the micro to the macro domain. And he is not alone in this.

@larry

If you think black swans were ‘found’ in the 17th century, I would suggest you purge your colonial prejudices with some further reading

https://www.theguardian.com/commentisfree/2019/feb/14/as-an-aboriginal-child-i-had-to-listen-in-class-while-taught-captain-cook-discovered-australia.

Just to clarify, both my examples were of incorrect argument structures used in the twitter exchange Bill quoted.

#Brendanm,

There is a usage in English where ‘to discover’ means to find something for yourself or your group.

I had this argument with a Native American 40 years ago. She said Columbus had not ‘discovered’ the New World. But, she got a phone call from a friend and spoke with him. During the call I heard her say, “I am so glad that I discovered the best little French restaurant and bakery just 2 blocks from my home.” So, she used the exact usage that she condemned.

.

If you don’t like this meaning for to discover, what word do you suggest that we use instead?

Ah, it would hve helped had you been a tad clearer about what you were doing. I guess we can’t all be clear all the time.

The black swans were discovered by Europeans in the 17th century, a context I took for granted in my comment. It should have been clear that I wasn’t claiming that indigenous Australians, or no one at all, didn’t know about them.

@ Larry

Thanks for your comment and yes it was very interesting learning about Mandelbrot’s pioneering work (which Taleb fully credited). I think he worked on huge datasets re: commodity trading to establish non-normal distributions in those prices. Just going from memory here, could be wrong.

You wrote

“I don’t think it is his pragmatism that leads Taleb to hold the sovereign currency issuer fallacy; rather, I honestly think he believes that his statistical understanding can be generalized without significant modification from the micro to the macro domain. And he is not alone in this.”

Well, Taleb offers more than pure statistical understanding in his recent works, like Skin In the Game. He relies a lot on “common-sense” reasoning which is what reminded me of the household/sovereign government fallacy. For example he told PBS reporter Paul Salman

“There are experts who are experts, and experts who aren’t. What marker is there? How would we know? We know very well that a pilot, a plane pilot, is an expert. Why, because there’s skin in the game, there’s some kind of contact with reality. A dentist is an expert. Your tailor is an expert. But you can never tell if an employee of the Federal Reserve Bank of the United States is an expert. As a matter of fact, I’m certain that they’re not experts. Economic forecasters, [but] they are not experts. So, they are what I call the “faux experts.”

We know where they are. It’s very simply someone who makes a decision that doesn’t have visible consequences for the person to be affected. And that’s what I call the no-skin-in-the-game expert.” https://www.pbs.org/newshour/economy/making-sense/beware-faux-experts-who-dont-pay-for-their-actions-nassim-taleb-says

So unless you have “contact with reality,” your expertise is not to be trusted.

As a trader, Taleb has that contact with reality (wins/losses), as well as his math, and so he felt on solid ground in his forecasts about Treasury rates, gold prices etc. It didn’t work out well as Bill’s data reveals.

He’s a most unusual fellow who credited Trump with tuning in to popular disenchantment w/ pseudo-experts (e.g. climate scientists????….) while giving Trump’s own fraudulence a pass.

Elsewhere he describes macroeconomic management as being ungrounded, and therefore untrustworthy: “Metrics are always always gamed: a politician can load the system with debt to “improve growth and GDP”, and let his successor deal with the delayed results.”

I do think there’s a good discussion to be had about human factors and incentives that have to be addressed by the politicians and technocrats and voters too who would actually implement an MMT macroeconomic program. Vulcan rationality is in short supply where I live.

Richard, you are right that Taleb refers to intuition and common sense. I think he ought to know better, as there are statistical paradoxes that common sense and intuition can not solve.

I am thinking of Simpson’s paradox, where you obtain one effect, say, a trend, in separate groups and the opposite effect when the groups are combined. A famous example is gender bias, or what seems to be such, in grad school admissions at UC Berkeley. Some individual departments showed a bias against men while others showed a bias against women. The pooled data, however, showed a bias in favor of women overall. How is intuition supposed to deal with this sort of thing? Instances of Simpson’s paradox can be found in places one might not expect. A statistician should be aware of this sort of problem. I think Taleb is being disingenuous.

Common sense is way over rated.

Some people say that it is obvious using common sense that AGW or ACC must be wrong because the Earth is huge and people can’t do enough of anything to have any effect on it.