In the annals of ruses used to provoke fear in the voting public about government…

The neoliberal ‘progressives’ and their bankster mates are becoming rattled

You know, an Italian won the British Open golf championship yesterday (the first Italian to ever win a golf major) because of the uncertainty surrounding Brexit negotiations. The causality is impeccable. I am sure about that, although it might take me a while to work it out. But if a British golfer cannot win their Open Championship (Rose tied for second, two shots back) then it must be because of Brexit. Everything else that goes wrong is, so why not the golf? It is the same when three former US policy makers, central bankers, Wall Street-types, claim that the US no longer “have to tools to counter the next financial crisis”. They know full well that that statement is a blatant lie. But they say it. To remain relevant as their stars dim? To do service to their conservative mates? All of the above and more. But the media grab the headline and the American public and the public in general is dealt another piece of neoliberal misinformation that helps entrench the hold on power by the elites. But things are changing, and these entrenched elites and the vested interests they serve don’t like it a bit.

To begin, the sell-out progressives in the social democratic movements around the world, have began to articulate a new narrative. I should add that articulate would imply it was articulate, which is to give what is going on too much credence.

More of a guttural rant out of fear of losing relevance.

You heard it from the Blairite progressive traitors when Jeremy Corbyn was overwhelmingly elected British Labour Party leader.

We heard it during the French national election when Jean-Luc Mélenchon broke from the Socialist Party to run under the banner of La France Insoumise.

And the decibels have been rising in recent weeks since the New York Primary victory of Alexandria Ocasio-Cortez.

A recent example is the story in the Time Magazine last week (July 20, 2018) – Democratic Centrists See a ‘Silent Majority’ Ready to Rebuild – which reports that the Chairman of the so-called “New Democrat Coalition fretted that his party could still blow its chance by veering too far to the Left in reaction to President Donald Trump”.

Really too far to the Left! Yes, that is what the spokesperson for these ferrets said. Sorry ferrets.

The spokesperson, by the way, was one “former Goldman Sachs banker-turned-Congressman” (Jim Himes), and the story came out of the “Opportunity 2020 conference” which has focused on the “fears that Democrats might embrace too strongly an agenda pushed by those like Sen. Bernie Sanders, the independent from Vermont who sought the Democratic nomination in 2016, hurting them among the more conservative districts and states they need to win to retake power in Washington”.

Power not leadership, note!

We read that “between strategy sessions” at this Conference, “Third Way President Jonathan Cowan told TIME” that:

The party is not going to go in the direction of Sanders-style socialism, because it’s not winning on the issues and it doesn’t win politically except in a very, very limited number of places.

Okay.

And so the story went. Sanders and Co. are dangerous and their headlines “inspire idealists to open their wallets for low-dollar donations” as opposed to large-dollar donations from Wall Street. Idealists participating in the political process would “spell disaster” according to Third Way.

Another Democratic Party support group – so-called “Heartland Engagement” – is reported as claiming the “Silent Majority who just wants normalcy, just wants to see that people are going to go out to Washington and fight for them in a civil way and get something done.”

Not the “far, far, far Left”.

Which left me trying to calibrate how far is “far, far, far”, presumably pretty far.

But from what? The likes of Third Way and Heartland Engagement, which on any reasonable reckoning is pretty far to the right of centre, which means, using all the powers of logic I learned in Logic 101 within my Philosophy studies, means that “far, far, far Left” might not be very “Left” at all, given the “centre” has moved so far to the Right.

But you get the picture.

All these progressive traitors are running scared because the idealists are getting the headlines and derailing their cosy plans to regain power after stuffing up monumentally by supporting Hillary Clinton’s tilt at the White House.

The Time Magazine also presents some curious arithmetic.

On the one hand, we read that leftists haven’t done very well anyway (they cite a case where a “far-Left” candidate lost a 2017 primary for Governor in Virginia

Note that the Virginia governor candidate (so-called “far-Left” candidate) was attacked by NARAL pro-choice America because he had voted to prohibit federal funding for abortions under the Affordable Health Care for America Act. That is “far-Left” in the US.

A whacky world indeed.

Evidently, his “far-Left” credentials go back to his support from legislation that would have required the cash the banks paid back to government to be used to create new employment in construction and that he was critical of Larry Summers saying “Lawrence Summers as someone who wouldn’t know anyone making less than six figures, unless that person was driving him around” (Source).

That sort of orientation is “far-Left” these days.

Okay, so he didn’t do too well in his attempt at becoming the Virginian governor.

But on the other hand, Time claims that “where progressives have prevailed in primaries, they’re largely inconsequential.” For example, the victory by “Alexandria Ocasio-Cortez over the number-four Democrat in the House, Joe Crowley … will do nothing to help Democrats reach the 218 votes needed to claim the majority.”

Time quotes a Democrat mayor in Columbia as saying “The game of politics is a game of addition, not subtraction. It’s the game of multiplication, not division”.

Really.

So, first, progressive candidates win primaries against non-progressive Democrat candidates. Result: the number of progressive candidates at the next election increases – addition.

Second, this starts to purge the Democrats of these non-progressive voices – multiplication.

Some other Democrat representative at the “Opportunity 2020 conference” told TIME magazine that “We’ve got to focus on how we get back into power … The question is going to be who goes beyond Left and Right. We are so far beyond the old labels that it’s not even funny.”

Really.

So why are they so concerned to label these upstarts who are messing with their cosy little elite within the Democratic movement – “far-Left” and claiming they are “far, far, far Left”.

If the old labels are dead, why are they still using them as frames?

Answer: fill in the missing blanks with obvious.

And what about this Third Way organisation who hosted the “Opportunity 2020 conference”. Who are they?

The Washington-based (DC) organisation claims its purpose it to advance “center-left” ideas in the American political context through “high-impact advocacy campaigns” which they hope will change “how Democrats view the shape of their next electoral majority” (Source).

Apparently, Third Way released its latest report at the Conference which was the result of “a year-long assessment launched after the 2016 election”.

Media coverage of the Conference related that (Source):

Included in its report were a dozen big-picture policy recommendations – such as adopting a robust apprenticeship program and expanded unemployment insurance to help workers find new jobs – and encouragement to bypass talk of income inequality for an emphasis on creating opportunity.

The participants at the Conference were urged to drop any reference to “moderate” in favour of promoting themselves as “opportunity Democrats”

So these “opportunity Democrats” don’t want to use frames such as income fairness because that might reinforce voters attention on the dramatic increase in income inequality in the US.

Which is no surprise really.

I read an article in The Nation (December 11, 2013) – Third Way: ‘Majority of Our Financial Support’ From Wall Street, Business Executives – that discussed how this centre-left organisation were attacking Senator Elizabeth Warren about her policies to rein in Wall Street excesses and how the group were funded by Wall Street executives.

There you have it.

Why would Third Way want the Democrats to turn their focus away from income inequality?

Why would they want the Party to turn their focus away from banking regulation?

Answers: fill in the missing blanks with obvious.

Anyway, I am finding this tension among the social democratic movements to be very interesting at present. The Third Way-types are being challenged finally by a more coherent progressive narrative that is faithful to the traditional mission of the social democratic parties.

That mission was abandoned by the Third Way-type careerists all around the world.

There is a fightback starting. Finally. And it is causing strife. Good.

And then we move on to a report I saw last week from the American network CNBC (July 18, 2018) – America may not have the tools to counter the next financial crisis, warn Bernanke, Geithner and Paulson.

Last Tuesday, Bernanke, the former central banker, and two former US Treasury Secretaries (Henry Paulson and Timothy Geithner) attended a “roundtable” and claimed that the GFC was the result of policy makers allowing the:

… financial system outgrow the protections we put in place in the Great Depressions and … made the system very fragile and vulnerable to panic …

Loose banking regulations and excessive risk-taking helped plunge the U.S. into its worst economic crisis since the Great Depression of the 1930s.

Their mission it seems was to warn again the abandonment of the Dodd-Frank Act that Obama introduced to deal with the banking crisis.

There is on-going outrage about this relatively weak piece of legislation from various banking and ‘freedom’ lobbies, many of whom claim the Act pushes up costs for banks and therefore destroys jobs.

The argument amounts to saying that the jobs are disappearing because corruption, criminal behaviour and other types of misconduct.

Sure, that is the point.

The more apposite criticism of the Act is that it was tepid and doesn’t rein in the Banksters sufficiently.

Anyway, apparently at this ’roundtable’, Henry Paulson, who became Secretary of the US Treasury on July 10, 2006 coming from his position as CEO at Goldman Sachs and was a runner up for the Time Magazine ‘Person of the Year 2008’ award (would you believe), told the gathering that:

If we don’t act, that is the most certain fiscal or economic crisis we will have … It will slowly strangle us.

Reflect back a little.

Flashback to March 28, 2007 as the financial crisis was starting to manifest, Paulsen was told the Financial Services and General Government sub-committee of the U.S. House Appropriations Committee that “There are some encouraging signs that we’re at or near the bottom … It looks to me like the housing issue is going to be contained” (Source).

Impaired judgement index given the reality hit 11 at that stage.

But then a month later (April 21, 2007), Paulson gave a speech at the so-called The Committee of 100 (a New York business group) that “I don’t see (subprime mortgage market troubles) imposing a serious problem. I think it’s going to be largely contained” (Source).

Move on to May 7, 2008, Paulsen gives an interview with the Wall Street Journal – Paulson Sees Credit Crisis Waning – and claimed that the “the worst is likely to be behind us”.

And so it went (I could cite several more cases of denial) until he was forced by reality to abandon the US has “a safe banking sustem, a sound banking system” (July 20, 2008), and instead, start to justify handing Wall Street billions of US dollars in public hand outs to prop up the failing investment banks.

Well he is back in the frame as the CNBC report suggests.

He was referring to concerns by “economists, echoing numerous market players and public officials … over U.S. debt” which is “double its 2007 level”.

The questions the journalists should have asked are:

What crisis – fiscal or economic – will the US public debt engender?

How does a 77 per cent public debt to GDP ratio, “strangle” any US citizen (“us”)?

What could he be referring to?

The US government will always be able to honour all of its liabilities that are denominated in the currency it issues.

If you consider that statement to be fact, then no crisis is imminent.

Further, some might argue that as the debt ratio rises (and the debt volume increases in absolute terms) the interest payments on that debt might increase (both in volume terms but also if yields are rising), which squeezes the capacity of the US government to spend on other things.

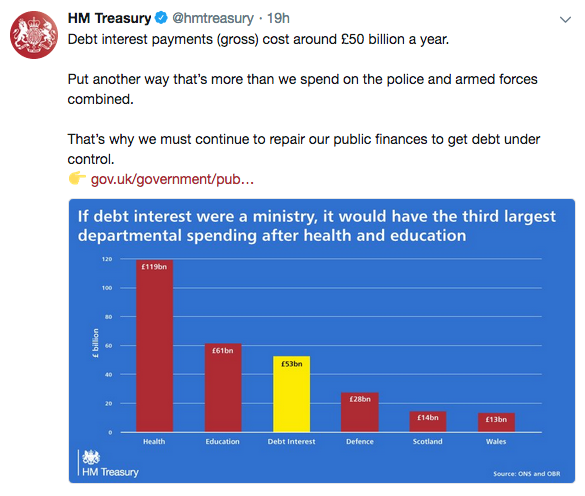

Indeed, there was a Tweet from the British Department of Treasury yesterday that came on my screen that is along these lines (about British fiscal affairs):

There are two angles to this point.

1. The idea that one type of expenditure has to squeeze out another type of public expenditure is only true if the government has some fiscal rule that necessitates that.

Otherwise, given that the currency-issuing government is never revenue constrained such a compulsory substitution is clearly false.

2. But, government spending of any type (so I am including interest payments here) add to net financial assets in the non-government sector and may add to the total spending stream.

If the economy is already operating at full capacity (and that is a rare state for advanced economies over the last three to four decades), then rising interest payments will mean the government has to reduce spending elsewhere – either from its own fiscal program or by increasing taxes to squeeze the non-government spending capacity to purchase goods and services.

Alternatively, it can opt to squeeze yields down to low levels via central bank action (buying up bonds) and control the government outlays in that way.

Whichever option(s) is (are) chosen would come down to political choices but they would be taken at a time of buoyancy rather than recession or stagnation (high unemployment).

In general, there is no threshold point beyond which public debt (absolutely or scaled against GDP) becomes a problem for a currency issuing government.

The real question Paulson should have been asking is: Why does the US government issue debt at all, given it is an unnecessary adjunct to its spending programs?

The answer is that the Wall Street tycoons love the debt – it is corporate welfare for them.

At the same roundtable, Timothy Geithner:

… expressed concern that the emergency powers they were able to draw on in 2008 are “somewhat weaker” today.

Apparently, the reforms that have been legislated since the GFC have ended the Government’s (Federal Reserve, Treasury and Federal Deposit Insurance Corporation):

… ability to make emergency loans to support troubled banks.

Remember, Timothy Geithner succeeded Paulson as the Secretary of the Treasury in January 2009 coming from a position as President of the Federal Reserve Bank of New York and a background as an assistant to Robert Rubin and Larry Summers in the Clinton Administration. Pedigree!

He oversaw the $US165 million handed out to AIG financial executives as bonus payments after the federal government had given the company more than $US170 billion in bailout funds. AIG had given even larger bonuses in late 2008 to its executives.

He was also implicated in the bailout of banks that were insured by AIG, including the urging of the Federal Reserve Bank of New York (while he was president) to suppress public information about the bailouts.

He was strongly supported by Democrats however despite his constant claims that the fiscal deficit in the US had to be cut despite the lingering entrenched unemployment.

But, of course, the facts are different.

The US government doesn’t face a reduced financial capacity to deal with emergencies if it has been running fiscal deficits in the past.

Just as past fiscal surpluses do not provide it with more capacity in the future.

As I explained above, past fiscal deficits might influence the political capacity to run deficits in the future in the sense that they have already created full employment and so there is a tighter limit on the sensible range of overall expenditure growth.

But that is the real resource limit that Modern Monetary Theory (MMT) focuses on. There is nothing financial in that statement.

And, if the US was to (and will) encounter a new economic downturn, marked by declining growth rates in non-government spending, then the US government can always intervene to sustain employment either through spending increases of taxation cuts or a combination of the two.

The fiscal mix used in meeting the non-government sector spending shortfall (defined as relative to the expenditure growth required to sustain output growth at full capacity) will depend on political factors mainly.

Does the government want more public sector activity (command over real resources) or more private domestic activity? The answer to that question would influence the mix in the fiscal stimulus between spending increases and tax cuts.

But it can never be said that there is an intrinsic lack of capacity to meet such a situation.

As I wrote in this blog post – There is no financial crisis so deep that cannot be dealt with by public spending – still! (October 11, 2010).

And finally, former central bank chairperson Ben Bernanke was apparently worrying at the ’roundtable’ about:

… the nation’s ballooning deficit … [and] … criticizing the timing of the Trump administration’s tax cuts and fiscal stimulus package amid nearly full employment.

The journalist also reported that this trio claimed that:

Far higher debt and deficit levels than those of a decade ago also mean there is less insulation in the event a potential stimulus package is needed. Obama in 2009 implemented the controversial American Recovery and Reinvestment Act to offset the drop in private sector spending, at a price tag of more than $800 billion.

What’s more, the Fed has less room to lower interest rates in the event that more stimulus is needed – the bank’s benchmark rate target is now just 1.75 to 2 percent compared to 5.25 percent in summer of 2007.

Falsehood: “higher debt and deficit levels … mean there is less insulation in the event a potential stimulus package is needed”.

How did they come up with that conclusion?

What is the limit? When private bond markets stop buying the debt at low yields? When the central bank runs out of credit typing strokes to buy public debt that the private bond markets decline?

But the central bank cannot ‘run out of credit typing strokes’.

QED.

Falsehood: And it doesn’t matter a hoot that interest rates are closer to the zero bound now than they were before the GFC. Why? Because it was largely fiscal policy that turned the GFC into a recovery.

Monetary policy (interest rate changes) is relatively ineffective as a counter-stabilisation tool. That was demonstrated very clearly during the GFC as central banks claimed they were trying to elevate inflation rates and haven’t succeeded despite massive asset increases on their balance sheets arising from QE.

Remember the famous Bernanke exchanges during the GFC.

Scott Pelley asked Bernanke on the US 60 Minutes program (December 3, 2010) about QE and the growing fear that it would unleash an inflationary spiral.

The transcript included this Q&A (Source):

Pelley: Many people believe that could be highly inflationary. That it’s a dangerous thing to try.

Bernanke: Well, this fear of inflation, I think is way overstated. We’ve looked at it very, very carefully. We’ve analyzed it every which way. One myth that’s out there is that what we’re doing is printing money. We’re not printing money. The amount of currency in circulation is not changing. The money supply is not changing in any significant way. What we’re doing is lowing interest rates by buying Treasury securities. And by lowering interest rates, we hope to stimulate the economy to grow faster. So, the trick is to find the appropriate moment when to begin to unwind this policy. And that’s what we’re gonna do.

Okay, no printing presses.

QE lowers interest rates only.

Lower interest rates may or may not stimulate spending depending on a host of other things including the state of confidence, unemployment dynamics etc.

We also might recall an earlier interview between Scott Pelley and Ben Bernanke on the US 60 Minutes program (March 12, 2009) – Ben Bernanke’s Greatest Challenge.

The interview was largely a litany of mainstream statements but at one point Bernanke provided a very clear statement about how governments that issue their own currency actually spend.

At around the 8 minute mark of the segment, Bernanke starts talking about how the Federal Reserve Bank (the US central bank) conducts its ‘operations’ (in this case, how it conducts government spending).

Interviewer Pelley asks Bernanke (Source):

Is that tax money that the Fed is spending?

Bernanke replied, reflecting a good understanding of what we call central bank operations (the way the Federal Reserve interacts with the member banks):

It’s not tax money. The banks have accounts with the Fed, much the same way that you have an account in a commercial bank. So, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It’s much more akin to printing money than it is to borrowing.

That is, the US government spends by creating money out of ‘thin air’. They can always do that.

Which negates all these scaremongering statements about running out of capacity now to address a new economic downturn.

We have now lived through nearly a decade of major shifts in government policy.

We have experienced large fiscal deficits to stimulate growth, which were accompanied by constant claims from the conservatives and mainstream economists that governments would run out of money, that bond markets would drive yields through the roof, that inflation would accelerate in hyperinflation.

All we saw was rising deficits and stronger growth. Where austerity was imposed we saw the opposite.

We have experienced massive expansions of central bank balance sheets (QE) in the UK, Japan, Europe, the US, which were all accompanied by the sort of claims that hyperinflation would result and currencies would be trashed.

We have observed none of those things happening.

And has our behaviour changed dramatically? Not in any unpredictable (broadly) ways.

When unemployment started rising we increased our saving ratios – as you would expect.

When the fiscal stimulii started to work – we loosened our spending again – but modestly.

Investment has been slow to pick up because it is asymmetric due to the irreversibility of capital formation. All as expected.

Borrowing didn’t go through the roof at zero interest rates. Why not? Because credit worthy borrowers were cautious in the milieu of high unemployment and previous credit binges.

And, of course, the Japanese have been going through this process for a quarter of a century. They have seen credit rating agencies embarrassed as they downgrade Japanese government debt to junk status only for the public to observe nothing of consequence follows.

They have seen on-going deficits, low to zero interest rates, low inflation (bordering at times on disinflation), high gross public debt levels.

I haven’t seen major behavioural shifts in the economic behaviour of Japanese residents.

Conclusion

So why are these three economists spreading these falsehoods?

They want to leverage opinion against Trump presumably. At least Bernanke knows there are no intrinsic financial limits to government spending in the US.

And that is even when we consider the debt limit hoopla that the politicians tease each other with from time to time.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

Political parties need votes to get elected, but they need money to run elections. As long as the average voter is reluctant to contribute to political parties, it is hard for political parties to ignore big donors, who are usually rich. Complete public financing of political parties is the solution. It doesn’t take much because elections really aren’t that expensive.

If Canada made 250 million dollars available to political parties each year, then political parties would no longer need to do any fund-raising. This sum would be divided among political parties according to the number of votes that they received in the previous election, except for parties that garnered fewer than 4% of the votes. The UK and other countries could do the same.

In an election, every vote is equal. In fundraising, every dollar is equal. A millionaire who donates 20,000 is the equal of 400 voters who each donate 50. Fundraising is plutocratic rather than democratic. Let’s abolish the need for it.

Regards. James

A spot of dark sarcasm in the class room hey?

And what about Barry O’s statement at the peak of the crisis of him standing between the Banksters and the Pitch Forks when the latter all thought they were about to be forked out of the big White House and business? Meanwhile – timorous Timmy G and his smirking sneer showed the world he was full of Bushwaa!

Look forward to listening to you in person at NYC this September! So close to Wall Street. Not to be a pest, but I would like your take on the Venezuela struggle. It is almost impossible to glean any real information as to what went wrong there. There is an authoritarian regime in control. But that, in my view, does not necessarily by itself equate to all the financial issues. Anyway. Good health to you and keep up your excellent academic and educational work.

Enjoyed this very much, even though I am not an economist. It strikes me that America rose from the ashes of the depression, built a mighty army to defend the world and went on to at least twenty five years of prosperity – until Viet Nam brought it all down over the next decade. We were young then and could do whatever we wanted. Now we are old and the calcified leaders of today can’t find their way to understand what once was. But there are a few brave souls, young people in the main, who just might give us another shot at something great. I hope for that but the old guard will not surrender easily.

I’m so tired of wall street parasites having any say in anything regarding national policies/politics. Go home and sleep with your money and shut up.

They act like there is no reason for people to go further left and the whole society is systematically dysfunctional. What you expect people to just keep doing the same thing expecting a different result?

These people are bunch of greedy frauds, period. I never hear them whining about pointless wars or tax cuts resulting in a larger deficit. They never talk about unfair access to resources this arbitrary wealth redistribution results in.

By the way, Tim Geithner is now working at Mariner Finance that prey on desperate people who need money by issuing high interest loans. I was reading this article titled: Former Obama Officials Are Riding Out The Trump Years By Cashing In.

But according to Third way, this center left is just fine.

To be honest, I can never hold their jobs because I just can’t lie like that.

James Schipper’s suggestion for party funding is a good one (and the amount of about 6.75 Canadian dollars per Canadian seems reasonable), but I think I might have a slight preference for George Monbiot’s version: it is the same except that instead of a party receiving state funding in proportion to its number of votes, the funding is in proportion to the party’s number of members, where the membership fee is fixed by law for all parties at some reasonably modest amount, perhaps a few tens of pounds or dollars. He describes it in each of these two articles:

https://www.monbiot.com/2014/12/08/there-is-an-alternative/

https://www.monbiot.com/2017/01/26/all-about-that-base/

…

“Every party would be entitled to charge the same small fee for membership (perhaps £50 or $50), which would then be matched by the state, with a fixed multiple. Any other political funding, direct or indirect, would be illegal. This would also force parties to re-engage with voters.”

…

The main difficulty I see with this kind of approach is that it does not work so well for non-party campaigning, as in a one-off referendum for example (e.g. the recent Irish one on abortion, or the Brexit referendum, or Scottish independence…)

I second Chris Herbert on the Venezuela crisis.

I suspect it is a combination of US economic bullying, CIA meddling, oil export price collapse, and right-wing business interest culminating in the current crisis.

But what do I know, some right wing commentator says it is socialism.

Mark Weisbrot has many good pieces on Venezuela, from a basically consistent with MMT perspective.

As he notes, by far the biggest thing that Venezuela is doing wrong is not floating their currency. Their multiple fixed system has caused enormous damage – equal to many of its external problems combined. Venezuela has a very bad case of the bizarre, upside-down belief that fixed rates are the leftist, progressive, socialist way while floating is Milton Friedman capitalist & bank friendly. Would be laughable if so many millions did not believe this absurdity, which is particularly virulent in Latin America and Europe and much of the “left”.

@James Schipper,

I agree with you in principle about political funding, but in practice, there are difficulties.

The UK already has some limited public funding for political parties. It’s called “Short Money” (After Edward Short, a Labour politician who proposed it back in the 1970s). It’s only available to opposition parties, and it’s based partly on the number of seats they achieved and partly on the number of votes they achieved, in the most recent election.

There have been attempts to reform political funding in the UK in the past, but they have come to nothing. I suspect mainly because the large parties are quite happy with things as they are thank you. The Tories will always have their wealthy donors financing the party which will keep them wealthy. The Labour party in the past had the trade unions, but more recently, especially in its New Labour phase, seemed more than happy to be cosying-up to wealthy donors, and the Lib Dems also has its share of wealthy friends.

It’s a bit tougher for principled, smaller parties like the Green Party, or unprincipled 🙂 smaller parties like UKIP.

But just say there is a political case for a new party, with a huge groundswell of public opinion behind it, if all funding has to depend on previous election success, how is this new party to fund its first election campaign?

I think there are other objections to public funding of political parties. Even if MMT says that public money does not come from “my” taxation, it would still rankle with me that public money is going to parties whose policies I fundamentally disagree with.

I think a better answer is to control election spending more tightly (I think it’s easy to get around the rules, at least at national level), and also restrict individual donations much more severely.

I think that private firms and organisations should probably be banned from donating to political parties, but that might mean you’d have to stop trade unions doing the same thing. However, they could encourage their members to join the appropriate political party, and contribute that way. I think parties should continue to be able to raise money from membership subscriptions, and indeed party membership is to be encouraged, although there would have to be limits to individual subscriptions, as there should be to donations.

It’s a tricky area.

Greg Jericho is off on a noeliberal tangent again in the Guardian.

https://www.theguardian.com/business/grogonomics/2018/jul/24/australias-tax-base-is-collapsing-and-we-are-on-a-collision-course-with-reality#comment-118633005

Dear Bill,

Great job there of steering the Liberal-Progressive dance-du-jour back to its salient points for a more clear understanding. Also that those of us on the left politically can more clearly distinguish their vacuous Democratic Party (don’t drift left) narrative, to which so many Liberal friends succumb.

Lot’s there.

Where’s there’s not ‘lots’ is in joining the Bernank’s 60 minutes money-banking narrative to having ANYTHING to do with how government is spending …. euphemistically for MMT – keystroking..

Sorry, Bill, but being not an MMTer, your effort is transparently off-the-mark.

In the 2010 interview, in discussing inflationary fears raised by QE I (I believe) the Bernank pointed out that the Fed was NOT printing money or increasing the supply of available money for spending …. by anybody. (especially not Guv).

The Bernank –

“”One myth that’s out there is that what we’re doing is printing money. We’re not printing money. The amount of currency in circulation is not changing. The money supply is not changing in any significant way. What we’re doing is lowing interest rates by buying Treasury securities.””

My Note : The Fed is buying those Treasuries on the Open Market and not at issuance.

In the 2009 interview, the Bernank was not speaking about inflationary concerns being raised, but the concern for using taxpayer dollars to bail out the banks.

Pelley : “”Is that tax money that the Fed is spending?

The Bernank : “”It’s not tax money. The banks have accounts with the Fed, much the same way that you have an account in a commercial bank. So, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It’s much more akin to printing money than it is to borrowing.””

Bill : “That is, the US government spends by creating money out of ‘thin air’. They can always do that.”

Sorry, Bill.

Bernank said absolutely nothing about how government spends. U.S. or otherwise.

He spoke only of the central bank LENDING to the banks….. , not anyone spending,

Wanna clear up this inter-bank narrative?

Thanks.

Joe Bongiovanni – Director

The Kettle Pond Institute for Debt Free Money

“The Kettle Pond Institute for Debt Free Money”

“Debt Free Money”?

I think that description pretty much disqualifies you from commenting on an MMT forum.

So Mr Ellwood,

Are you saying that all money is debt? Thus money cannot be debt free?

That is a banker’s axiom if I ever heard one. LOL

If that is what MMT believes it is clear they are not in touch with the history or the law.

You are right about one thing, “the large parties are quite happy with things as they are.”

Mr Switzer,

No, I’m not saying it – it just is.

I don’t know what it says on your currency, but on my British (£20 in this case) pound notes, it says

“I promise to pay the bearer on demand, the sum of twenty pounds”.

If that doesn’t sound like a debt obligation (on behalf of the government, via its central bank, the Bank of England in this case), I don’t know what does.

No doubt Bill, sorry, “Mr Mitchell”, might be able to say it more elegantly though.

@Mike Elwood

“If that doesn’t sound like a debt obligation (on behalf of the government, via its central bank, the Bank of England in this case), I don’t know what does.”

But surely you must be aware that, as a matter of English law, not everything that sounds like a debt obligation is indeed a debt obligation. That phrase is a remnant from the gold standard era, and it is obsolete in terms of legal effect. The bearer of the £20 of today is not in a contractual relationship with the Bank of England, let alone with the ‘government’. You cannot sue the Bank of England for breach of contract should they refuse to exchange your bill for another.

Professor. “Investment has been slow to pick up because it is asymmetric due to the irreversibility of capital formation.” What does that mean? What is being said there?

yok–

my total layperson’s guess is that this means that money entering the system does not automatically result in investment outlays by companies, because they are hesitant to spend on machinery and such that would be a liability if the market did not pick up and buy what the machines were purchasing.

in other words, i think this is what is called “pushing on a string”. companies increase production when they believe stuff can be sold profitably. this is saying that companies have been hesitant to increase production no matter how cheaply they can pay for it.

money that has entered the system in this way, as far as i can tell, has been used to inflate the stock market and try to re-inflate the housing market. the latter being less successful because the “real” economy (what people have to spend) has not increased very much, with wages flat and jobs being created at the lower end (irregular hours, zero hours, part time, low paid, contract workers, temps).

but what do i know? i’m just a mook like the rest.

Yes, all money is debt because the currency issuer is promising: “I owe you that amount of extinguishment of your tax liability if you present it to me in payment of the taxes that I have imposed on you.” That promise by the currency issuer to allow you to redeem the money for extinguishment of the taxes it has imposed on you is what creates demand for the currency.

Generous public funding of parties and politicians is a dubble edge sword. It make parties independent of attracting members. Politics become a professional career where they sell their “product” with the help of marketing agencies, like you sell soap. They don’t need members footwork. Members that are sure that their party in power will deliver to them.

We can see how European socialdemocracy totally lost it the last 30 years. In September, what probably was the strongest socialdemocratic party in Europe will make their worst election ever, probably significantly lower than the previous worst, the semi democratic election 1907.

Sweden have generous public party funding. The party “bosses” control the money, the people we elect to parliament is there to push the button the party bosses tell them to push.

The so called extreme right populist party have a real chance to be largest party.

You are absolutely right Lasse.

Party funding really needs to have some relationship to how much popular support a party can command, and one measure of that is party membership.

Party membership in the UK has been generally falling for decades. What this means, it seems to me, is that parties have been captured by an ever smaller group of vested interests.

Now, of course, parties have always represented interests of various kinds. That is almost a definition of a political party. But these interests seem to have been getting narrower.

The Labour party in the UK used to represent the working class, and was originally the political wing of the trade union movement. That situation has completely changed. New Labour, much as I loathed it and what it stood for, was a kind of recognition of that fact.

The Tory Party always represented the rich and powerful, and business in a general sense, and that included a lot of small businesses, which, like it or not, were part of the backbone of the country. Actually Labour could also usefully represent small businesses, even if it seems like a contradiction; I don’t think it was.

But the Tories now seem more interested in the large “corporates” and aren’t even particularly good for their small business former constituency (although these people still instinctively vote Tory). Ironically, Labour could be much much better for genuine small businesses, especially local small businesses.

But I digress. So yes, let there be government funding of political parties, but let it reflect the party membership.It could also reflect the amount that parties have been able to collect by small, and I emphasis small, donations from individuals. This would have to be strictly policed with strong penalties (=prison sentences) for anyone attempting to break the small donation rules, be they individual or party official). With such provisos in place, then state funding could be made very generous, so long as it was based on the genuine figures that represent wide support among the populace.

I think donations from non-residents (i.e. people who were not registered to vote in the relevant country) would have to be illegal.

@Mike Elwood: “If that doesn’t sound like a debt obligation (on behalf of the government, via its central bank, the Bank of England in this case), I don’t know what does.”

wallflower:But surely you must be aware that, as a matter of English law, not everything that sounds like a debt obligation is indeed a debt obligation. That phrase is a remnant from the gold standard era, and it is obsolete in terms of legal effect. The bearer of the £20 of today is not in a contractual relationship with the Bank of England, let alone with the ‘government’.

Such objections were handily treated by Mitchell-Innes a century ago. It doesn’t matter what the law merely says – it matters what “The Law” – i.e. the state, the government does. The MMT analysis and ordinary language are deeper than the written law here. A £20 note indeed represents a debt obligation, an obligation to be accepted for taxation, for payments to the state as explained above. That’s how it works in real life. Who cares whether the state or central bank says they are “obligations”? If they treat them as obligations (for centuries) in the dictionary meaning of that word – and they do – they are obligations.

Works the other way too – “legal tender” laws don’t have any real effect – they are a mere flatus vocis unless the state or somebody creates a genuine demand for its obligations somehow.

@Some Guy

“Such objections were handily treated by Mitchell-Innes a century ago.”

No they were not.

First of all, let’s remember how these objections came about. The 1913 article that Mitchell-Innes published in The Banking Law Journal states that ‘it is necessary to explain the primitive and the only true commercial or economic meaning of the word ‘credit’ (p 392). Then he goes on in the same paragraph: ‘the words “credit” and “debt” express a legal relationship between two parties’. Passim, you can find his analysis of government money as credit in the same legalistic terms as defined above. The critique he received for this article was well deserved and should be imputed solely to his writing. He pointed to legal relationships but there was no legalistic evidence that govt money ‘were tokens of indebtedness’.

In the ‘Credit Theory of Money’ (1914), Mitchell-Innes restates his point more candidly: ‘A government dollar is a promise to pay, a promise to satisfy, a promise to redeem, just as all other money is. All forms of money are identical in their nature’ (p 154). Later on, he says ‘every time a coin or certificate is issued [by the government], a solemn obligation is laid on the people of this country’. But then only two phrases later: ‘it is true that a coin does not purport to convey an obligation, there is no law which imposes an obligation and the fact is not generally recognised’ (p 160).

So how did Mitchell-Innes reconcile this contradiction? He apparently brings two arguments. Firstly, he says it is true that there is no law which imposes an obligation but ‘the right depends on no statute, but on common or customary law’ (pp 160-161). So the obligation is legal but the evidence for its existence is not to be found on statutes, but it is rather part of customary law. Leaving aside the whole jurisprudential debate on how customary law would operate on the vertical relations between the individual and the state, Mitchell-Innes clearly misunderstood the nature of customary law when he wrote that ‘it does not matter at all what object the government has in view in issuing their tokens’ (p 161). You can’t have customary law without ‘opinio iuris’, and you can’t have opinio iuris if your conduct is not guided by an acknowledgement of a norm, be it unwritten or otherwise. By Mitchell-Innes’s own admission, the government has a very different idea of what they are doing from him and his ‘credit theory of money’.

His second argument is even weaker. Money issued by the government entails a ‘public debt’ because ‘it is inherent in the very nature of credit throughout the world’ (p 161). Surely this is argument is fallacious, since it assumes that there is already a ‘debtor/creditor’ relation inherent in the process of government money creation, and that premise is exactly what he has failed to establish.

So yes, I don’t think Mitchell-Innes ‘handily treated’ those objections. He made a strong case against metallism, but let’s not get carried away. And if Mitchell-Innes’s arguments don’t hold, then maybe we could be less gullible to slogans like ‘the government cannot hold its own liabilities (ie ‘currency’), therefore tax collection is money destruction by way of logical necessity’.

“It doesn’t matter what the law merely says – it matters what “The Law” – i.e. the state, the government does.”

But practice alone can’t be a reliable indicator for the existence of a promise or an obligation. The point has been made over and over again in legal theory. Perhaps a bit of a Hume’s guillotine here.

“The MMT analysis and ordinary language are deeper than the written law here. […] That’s how it works in real life.”

Let’s not conflate ordinary language and common intuitions with MMT gobbledygook. Even by Mitchell-Innes’s assessment his analysis is counter-intuitive for the general public (he states that clearly several times). In real life, the government wants to collect every outstanding tax liability and the citizens are not naturally inclined to pay, not the other way round. A promise to accept currency for tax payments would therefore be superfluous, it is the command to pay your taxes in legal tender and the coercion behind it that matters.

“A £20 note indeed represents a debt obligation, an obligation to be accepted for taxation, for payments to the state”

The £20 note says ‘I promise to pay the bearer on demand, the sum of twenty pounds’, and not ‘this is a debt obligation, an obligation to be accepted for taxation, for payments to the state’. It could very well say what you just said at no extra cost, and then it would have made it much easier for you to make the argument that you make. But it doesn’t. So, if what it says on the £20 note is not nonsense, then how does that promise work? Do you exchange your £20 note for another one at BoE’s front desk? Or mail them the note and ask for another one in return?

Going back to your argument, if what the law (written or unwritten) says is irrelevant, then what is the nature of this obligation? Is it a £20 worth of a moral or a social obligation? Lastly, an obligation to accept currency would not be a debt. Not all obligations are debts. These putative ‘debt obligations’ that come with £20 notes don’t appear on any balance sheets whatsoever. So on your view, neither lawyers or accountants could tell what they really are, and yet you seem to know that they are £20 debt obligations of sorts. How could that possibly be?