The other day I was asked whether I was happy that the US President was…

The EMU reform ruse – Part 4 and Final

This is the final part of my four-part discussion of a so-called progressive proposal advanced by German academic Fritz Sharpf to reform the Eurozone into two tiers: a ‘Northern’ hard currency tier and a ‘Southern’ non-euro tier with the latter nations tying their currencies to the euro. We have seen that rather than providing a framework for convergence between the current Eurozone Member States, Sharpfs’ proposal would not liberate the weaker nations from the yoke of the euro, In fact, the proposal would just tie the exiting nations to the euro in a slightly different way – one that will not provide sufficient flexibility to make much difference. Further, Sharpf recommends that the ‘Northern’ nations should retain the euro and operate within the current European Commission orthodoxy. Yet he admits that this regime kills the democratic process. In other words, his proposal sustains that technocratic illegitimacy which would not appear to be the basis for a progressive solution. Finally, while he dichotomises the current 19 Eurozone Member States into a Northern and Southern grouping, there is no reliable way to allocate the Member States across the groups that would remain in the euro and those who would exit. What criteria would reasonably allocate nations to stay in the so-called Northern hard currency zone with the euro? For example, I do not think that a democratic France can ever function reasonably in a hard currency arrangement with Germany. The hard currency zone would effectively just revert to a ‘mark zone’ tantamount to the last EMS arrangement prior to the euro. That configuration was totally unworkable and that dysfunction would repeat itself. In other words, the proposal makes little operational sense. My view is that the vast majority of the Member States would be in the ‘Southern’ group, which would effectively end the EMU in any functional sense. Hardly a proposal for reform.

Proposal 2: The Two-tiered European Community

In questioning the current orthodoxy, Sharpf also notes that if the ECB strictly behaved within the Maastricht rules then the need for even more aggressive internal devaluation would be required as the “sanctions would be inflicted by anonymous market forces”.

That is, the Member States currently in trouble would soon go broke as they would have trouble raising funds from the bond markets at acceptable yields, given they do not issue their own currencies.

In this context, Sharpf concludes that:

It is hard to see why Southern governments, after all the sacrifices that they have already been forced to make under the present regime, should opt for an alternative that would not loosen economic constraints but remove the present protections against state insolvency.

The same might be said of his Proposal 2.

Why would the Southern states, who would be forced to exit under his plan, not then fully exploit their new found currency capacities to improve domestic demand conditions immediately, which would then, after a while push their external balances into deficit, and once there was sufficient volumes of their own currency in the system, place downward pressure on their exchange rates?

Greece only has a current account close to balance because the enduring Depression has killed import growth. Turn the growth back on and they will soon be back in deficit.

As I noted in Part 1, the real exchange rate data shows that despite the painful internal devaluation that has been imposed on many Eurozone nations, only Ireland has improved its international competitiveness against Germany.

I also cannot see the ECB agreeing to unconditionally provide euro and other foreign currency reserves to the exiting nations who are running their fiscal policy outside the parameters of the Northern states.

Can you imagine Germany, which proudly runs fiscal surpluses while its major transport network is falling apart (bridges etc) tolerating Greece running the fiscal deficits it needs to restore some sense of prosperity?

While Germany sits on current account surpluses of around 7-8 per cent and thus creating massive imbalances within the Eurozone, they lecture everyone else about fiscal rectitude.

My estimate is that Greece should be running deficits close to 8 to 10 per cent of GDP to move the economy in the right direction.

In other words, the exiting nations would be under extreme pressure to act within the Stability and Growth Pact parameters or risk ECB sanctions that would compromise their currency positions on international markets and place a recessionary-bias on domestic policy.

Europe has been there before – the pre-euro monetary systems from the Bretton Woods system, the ‘snake’ in and out of the ‘tunnel’ and the ERM. All failed.

Sharpf seems to ignore those realities and claims that:

In order to enjoy these benefits, however, ERM II members would have to forswear the temptation of competitive devaluation … membership in the ERM II would not relieve states from the discipline of having to manage the conflicting requirements spelled out in the Mundell-Fleming Trilemma.

The Mundell-Fleming Trilemma or Impossible trinity refers to concept that a nation cannot “have all three of the following at the same time”:

– a fixed foreign exchange rate

– free capital movement (absence of capital controls)

– an independent monetary policy

In effect, Sharpf is just telling us how the ERM maintained any sense of stability (and there wasn’t much) in the 1980s and 1990s.

The fixed exchange rate parities forced the Member States to tie their monetary policy to the strongest economy (Germany) and, at times, impose capital controls.

Even then nations such as France and Italy were always struggling with a domestic recession bias to keep imports suppressed and attract capital inflow (high interest rates).

It was an unworkable system – in the sense it was unsustainable.

The Eurozone just replaced the forced exchange rate movements with internal devaluation pressures and a bias towards elevated levels of unemployment and suppressed wages growth.

Under his second proposal, Sharpf wants the the exiting (‘Southern’) Member States to still operate within the Single Market, which upholds the so-called ‘Four Freedoms’ (“free movement of goods, capital, services, and labour”).

He thinks the Single Market would protect the exiting nations. I think it would tie them into the same dilemma they face now – an austerity bias with entrenched unemployment, precarious work, and rising underemployment.

Article 63 of the Treaty on the Functioning of the European Union says:

… all restrictions on the movement of capital between Member States and between Member States and third countries shall be prohibited.

Of course, this prohibited the capital controls that the weaker nations used to protect their currencies under the various fixed exchange rate regimes that followed the Second World War up to the adoption of the common currency.

This means capital controls of various kinds are prohibited, including limits on buying currency, limits on buying company shares or financial assets, or government approval requirements for foreign investment.

So if the exiting nations were required to enter the ERM II (thus fix their exchange rates against the euro (this is effectively the same arrangement as fixing their rates to the old Deutsche mark under ERM I, given that Germany dominates movements in the euro) and were prohibited from using capital controls then they would be in a similar position to where they are now.

There would be very little policy room.

The technocrats from Brussels would be still bullying them around as any attempt at expanding fiscal policy to restore any sense of full employment would make it hard to maintain the agreed fixed exchange rate parities.

To be truly free, these nations have to allow their exchange rates to float and adjust to trade imbalances. Sharpf’s proposal prohibits that.

The Northern club myth

A further major weakness with Fritz Sharpf’s conception lies in his insistence that there is, indeed, a Northern-Southern dichotomy in the Eurozone.

His whole analysis rests on some meaningful distinction between the “Northern and Southern countries”, the former group who apparently would either be “well-served” by the European Commission model of enforced structural convergence, or, alternatively, “are politically committed to continue on a course of structural transformation under external supervision”.

This distinction, in itself is unsatisfactory, especially when Sharpf, himself, recognises that the forced structural convergence approach is forced onto a nation through “austerity and supply side reforms”, there has been “a disaster for political legitimacy”.

He says that the this approach has had:

… the effect of destroying the democratic legitimacy of government in some member states and of ruling out advances toward democratic government in Europe for a long time to come.

Which then raises the question: how can there be a genuine political commitment arrived at and sustained through the democratic process for on-going austerity and internal devaluation which does not advance the well-being of the citizens in these nations?

The answer is simple: there cannot be!

Further, Sharpf noted that:

Before they joined the Monetary Union, the member states of the EMS had been described as either hard- or soft-currency economies whose different inflation dynamics had resulted in periodic revaluations or devaluations of national currencies. These differences are represented by cumulative exchange-rate adjustments vis-à-vis the deutsche mark (DM) in the decade before the EMS was shaken in the turbulences following German unification.

The periodic (and forced) realignments in the parities during the EMS, of which there were many (see Part 2 and Part 3 of this series), were not driven by differential inflation rates exclusively.

They mostly originated from external imbalances (trade strength) and the Bundesbank’s refusal to honour its commitments under the arrangement to intervene symmetrically.

The reality is that the trading structures of the so-called ‘hard’ currency nations were quite different, with the Netherlands, Austria and Finland closer to Germany than France in trade strength.

France, clearly, always struggled with maintaining the agreed parities and it was only when Mitterrand (pressured by Delors) shifted to a ‘fort franc’ austerity approach that the tension between Germany’s economic policies abated somewhat.

Of course, the consequence of that shift in policy within France was accompanied by elevated levels of unemployment and a decline in its industrial strength.

Since Germany arose from the shame of the Second World War, helped via the Marshall Plan (which is ironic given its current approach to poorer European nations), it has dominated the European economy. The other nations have always been chasing a catch up game.

We get an idea of who Sharpf thinks might be in his Southern group – Spain, Greece, Portugal, and Ireland, although I am sure Ireland would want to debate that membership.

Ireland also is unique because it is largely dependent on the United Kingdom rather than the other euro nations.

But, even if the ‘hard currency’ group was well defined during the EMS period (and I dispute that), which countries would be in this Northern club now – after the disaster of the common currency?

Clearly, as “Germany is presently doing well under these rules” (the SGP etc), the Northern club has one member we can be certain of.

Sharpf talks about Germany’s “Northern allies” and considers that during the EMS period (pre-euro):

… the hard-currency group had included Austria, Germany, the Netherlands and Finland whereas Greece, Portugal, Spain, and Italy appeared as the core members of a soft-currency “club med,” which to a somewhat lesser extent also included France, Ireland, and Belgium.

But while I dispute (as above) the continuity of the ‘hard currency’ group during the ERM I period, times have indeed changed.

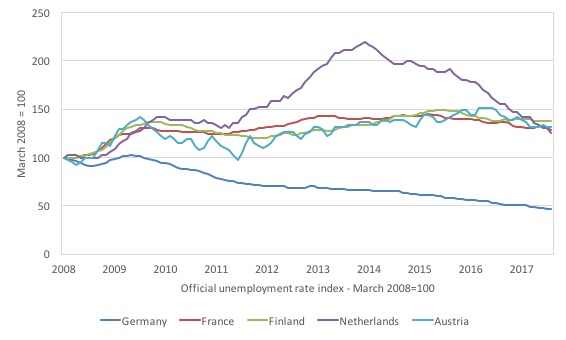

Here is the unemployment history for the ‘Northern club’ since March 2008 (the index is set to 100 in that month). As is clear, there is no comparison between the performance of the German economy in this respect and the other nations (France, Netherlands, Finland and Austria).

The other nations have elevated unemployment rate levels since the beginning of the GFC – France up 28.8 per cent; Netherlands up 25 per cent; Austria up 31.7 per cent; Finland up 38.1 per cent)

While Germany’s official unemployment rate was 3.6 per cent in October 2017 (and 7.7 per cent in March 2008), France’s unemployment rate is 9.4 per cent (7.3 per cent March 2008), Finland 8.7 per cent (6.3 per cent), and Netherlands 4.5 per cent (3.6 per cent), Austria 5.4 per cent (4.1 per cent).

Further, Finland has been seriously weakened by its participation in the Eurozone, in addition to technological shifts that have all but wiped out its electronics and news print industries. EU sanctions have also undermined its export dairy products sector.

Finland, has been one of the worst performed Eurozone nations in recent years and its era of large current account surpluses in line with Germany are over.

It is also engaging in an on-going attack on wages, pensions, public infrastructure funding, education and health funding and the like.

It is not yet a poor nation like Greece but the dynamic is heading in that direction.

It would be foolish for Finland to stay in a currency group with the likes of Germany and the Netherlands.

It is likely that only Germany and the Netherlands could co-exist in a currency group. But even then the Netherlands has issues with its under performing labour market. I ignore Luxembourg with its tax havens in this clustering.

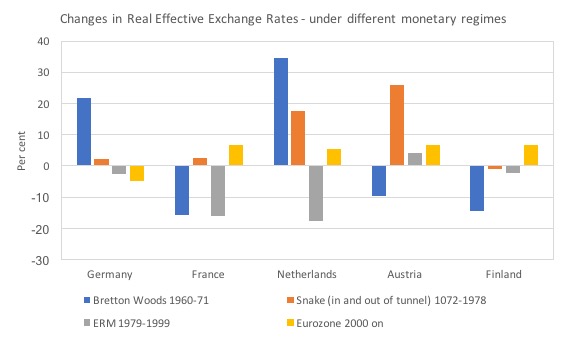

Here is another way of looking at Sharpf’s Northern club.

It shows the percentage changes in real exchange rates (calculated against the EU 15 and taken from the AMECO database) for the four major currency arrangements since 1960. AMECO data begins then.

A rise is a loss of international competitiveness against the benchmark a fall an increase.

The changes are the outcome of a number of different factors: relative inflation rates, trading strength, productivity relativities, cost structures, nominal exchange rate revaluations or devaluations, and internal devaluations (under the euro) to list the most important.

You can see that since the late 1970s (when the ERM began), France, Austria, the Netherlands and Finland have all lost international competitiveness against Germany.

That dynamic is hardly supportive of these nations remaining in a currency union together without a ‘federal’ fiscal mechanism (that is, under the current Eurozone rules).

Making the shift

Sharpf does propose some “assistance in transition” to the exiting nations:

… countries like Greece – for whom EMU has become a prison regime with destructive impacts on the domestic economy, the welfare state, and the political system – would need assistance in making the transition to ERM II.

What would that involve?

1. “technical support to facilitate the installation of a new currency”

2. “humanitarian support would have to assist the rebuilding of minimal public and social services in areas where they have been devastated by austerity requirements”.

3. “growth enhancing assistance”. This is a curious idea, as Sharpf, himself, notes.

Within the current orthodoxy, there is a resistance to providing fiscal transfers within the union (although the ECB is effectively doing the same thing by indirectly funding on-going fiscal deficits).

But the Euro elites are good at saying one thing and doing another – if it serves their own narrow interests, which in this case is to keep the currency afloat.

However, as Sharpf notes, once external competitiveness can be delivered through exchange rate fluctuations rather than the dire structural ‘internal devaluation’ process, the resistance to providing funding, which under the current orthodoxy would provide incentives to delay structural shifts, would be unnecessary.

The assistance could take the form of “financial support for productive investments and essential imports” in a similar way to how the Marshall Plan helped German reconstruction.

According to Sharpf, this assistance could be justified by:

… claims to solidarity and burden sharing that invoke a common responsibility for damages in icted by an ill-designed Monetary Union.

Which raises the question of why the same claims could not be available to a nation that decides to exit now? If there was a true sense of European solidarity then the richer nations would take some responsibility for the EMU disaster.

It could also be in their interests if it was part of a debt restructuring plan, given that the exiting nation has the Argentinean option of defaulting on all foreign currency (euro) debt if it so chooses.

Conclusion

In summary, Fritz Sharpf’s proposal is flawed because it doesn’t lift the euro tyranny in any effective way from any of the 19 Member States.

The weaker states would still be bound to the fluctuations in the German economy via the exchange rate peg. That would just revisit the flaws and ultimate failure of the first ERM attempt.

And who would truly be able to prosper sharing a currency and interest rate with Germany?

I do not see Sharpf’s proposal as being anything a progressive Left party should adopt or promote.

Outright exit is the only way to go for a struggling Eurozone nation.

They should restore currency sovereignty and float it on international markets (noting it would appreciate in value immediately until there were sufficient volumes of the new currency circulating in international markets).

They would also be able to set an independent interest rate and introduce nation-specific regulations (such as capital controls).

The Eurozone dysfunction continues

And as a parting note, the European Commission released this statement on December 1, 2017 – Commission will not propose to weaken the deficit criteria of the Stability and Growth Pact:

The story run by some German media that the European Commission would propose to weaken the deficit criteria of the Stability and Growth Pact is purely invented. These rumours have nothing to do with the reality. It was never considered within the Commission and has nothing to do with the proposals the Commission is currently working on to deepening Europe’s Economic and Monetary Union.

Got it?

Dysfunctional straitjacket not up for reform or change of any kind.

Never considered.

It is time the Europhile Left woke up and realised what they are dealing with here.

This is a neoliberal oligarchy that is purging the democratic systems of a voice and maintaining an austerity machine.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

Enlightening and brilliant as ever

“They would also be able to set an independent interest rate and introduce nation-specific regulations (such as capital controls).”

I was under the impression that the European Single Market did not allow capital controls, as one of the so-called “Four Freedoms” of movement: i.e. Labour, Goods, Services and Capital (Treaty of Maastricht, Art. 63: “all restrictions on the movement of capital between Member States and between Member States and third countries shall be prohibited”)?

You make a good point @Mr Shigemitsu. (In fact Bill writes about this in his latest book).

.

The implication would seem to be that they would have to leave the Single Market.

.

(Whether or not we remain in the Single Market after Brexit, is a big issue at the moment for us in the UK. I hear my “liberal left” EU-phile friends and acquaintances trumpeting the “Four Freedoms” as though they were some deep eternal values worth fighting and dying for – without perhaps realising their full implications).