The other day I was asked whether I was happy that the US President was…

The EMU reform ruse – Part 2

This blog continues the discussion from yesterday’s blog – The EMU reform ruse – Part 1 – where I consider the reform proposals put forward by German academic Fritz Sharpf, which have been held out by Europhile Leftists as the progressive way out of the disaster that the Eurozone has become. Yesterday, I considered his first proposal – to continue with the enforced structural convergence to the Northern model – the current orthodoxy in Brussels. Like Sharpf I agree that the agenda outlined in the 2015 The Five President’s Report: Completing Europe’s Economic and Monetary Union would just continue the disaster and would intensify the political and social instability that will eventually force a breakup of the monetary union. Sharpf’s second proposal is that the EMU dichotomise into a Northern hard currency bloc while the Southern states (and others less inclined to follow the German export-led, domestic-demand suppression growth model) reestablish their own currencies and peg them to the euro with ECB support. While it is an interesting proposal and certainly more adventurous than the plethora of proposals that just tinker at the edges (for example, European unemployment insurance schemes, Blue Bond proposals and the like), it remains deeply flawed. While it is assumed that the Northern bloc would comprise core European nations such as Germany and France, it is not clear that either would prosper under the new arrangement. France and Germany were never been able to maintain stable currencies prior to the EMU. Further, the ‘exit’ proposal ties the poorer nations into a vexed fixed exchange rate arrangement, which would always compromise their domestic policy freedom, just as it did under the earlier versions of the Snake or the European Exchange Rate Mechanism (ERM). Far better to just break the whole show up and let the nations go free with floating exchange rates.

The pre-EMU exchange rate disasters

As background to better appreciate why Sharpf’s proposal for the ‘Southern’ nations will not free them from the EMU disaster we need to briefly consider the pre-EMU monetary arrangements in Europe, which were dominated by various failed attempts at fixed exchange rate arrangements.

I document these arrangements in considerable detail in my 2015 book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale.

At the end of World War 2, the victorious nations set about imprinting their authority on the rest of the world. A major step in this hegemonic strategy was the creation of the Bretton Woods system of fixed exchange rates in July 1944, which pegged all participating currencies against the US dollar, which itself, was pegged against the value of gold.

The system required the central banks of participating nations to maintain their currencies at agreed fixed rates against the US dollar.

The newly created International Monetary Fund (IMF) was empowered (with contributions from the member states) to offer short-term funding to any nations that could not earn sufficient foreign currency reserves via trade to maintain the agreed exchange rate parities.

The US government, in turn, agreed to convert US dollars into gold at a fixed price.

The Bretton Woods system was under pressure from the start because countries with trade deficits always faced downward pressure on their currencies.

In order to maintain their exchange rates they had to: buy their own currencies in the foreign exchange markets using their foreign currency reserves; push up domestic interest rates to attract capital inflow; and constrict government spending to restrain imports.

The nations with weaker currencies were thus often faced with recessed growth rates, higher unemployment, and depleted foreign reserves, and this created political instability.

The effective operation of the system required the nations to have more or less similar trade strength, which was of course an impossibility and ultimately proved to be its undoing.

Further, the commitment by the US government under Bretton Woods to guarantee US dollar convertibility into gold, which led to an on-going depletion of US gold reserves. During the 1960s, a large quantity of gold reserves shifted from the US to Europe as a result of persistent US balance of payments deficits.

The use of the US dollar as a reserve currency exposed the instability of the Bretton Woods system.

The economist Robert Triffin warned in the early 1960s that the system required the US to run balance of payments deficits so that other nations, who used the US dollar as the dominant currency in international transactions, were able to acquire them.

In the 1950s, there had been an international shortage of US dollars available as nations recovered from the war and trade expanded.

But in the 1960s, the situation changed. Nations started to worry about the value of their growing US dollar reserve holdings and whether the US would continue to maintain gold convertibility.

These fears led nations to increasingly exercise their right to convert their US dollar holdings into gold, which significantly reduced the stock of US-held gold reserves.

The so-called Triffin paradox was that the Bretton Woods system required the expansion of US dollars into world markets, which also undermined confidence in the dollar’s value and led to increased demands for convertibility back into gold.

The loss of gold reserves further reinforced the view that the US dollar was overvalued and, eventually, the system would come unstuck.

The way out of the dilemma was for the US to raise its interest rates and attract the dollars back into investments in US-denominated financial assets.

But this would push the US economy into recession, which was politically unpalatable.

It was also increasingly inconsistent with other domestic developments (the War on Poverty) and the US foreign policy obsession with fighting communism, which was exemplified by the build up of NATO installations in Western Europe and the prosecution of the Vietnam War.

The US spending associated with the Vietnam War had overheated the domestic US economy and expanded US dollar liquidity in the world markets further.

The resulting inflation was then transmitted through the fixed exchange system to Europe and beyond because the increased trade deficits in the US became stimulatory trade surpluses in other nations.

These other nations could not run an independent monetary policy because their central banks had to maintain the exchange parities under the Bretton Woods agreement.

Nations tried to get around the recession-bias dilemma by devaluing their currencies, which was allowed under exceptional circumstances within the system. The system, however, could not cope with so-called competitive devaluations or ‘beggar-thy-neighbour’ strategies that governments began to use, especially in the 1960s, to get a competitive advantage over other nations.

The British government devaluation on November 18, 1967 was the first rather significant nail in the Bretton Woods coffin and reflected the tensions that had been building up throughout the decade.

The British devaluation created a massive surge in demand for gold as speculators anticipated that the US would also devalue the dollar.

The strain on US gold reserves was reaching a crisis point and foreign exchange markets were behaving nervously. The continued weakness of the pound was mirrored across the Channel in the growing strength of the German mark as its industrial might created on-going trade surpluses.

The second major event that precipitated the end of the Bretton Woods system began in May 1968 when the French franc came under extreme pressure as a result of the civil unrest led by the student strike.

Meanwhile, the Bundesbank was up to various tricks to prevent the mark from having to be revalued – which would dent the nation’s competitiveness and undermine its powerful export sector.

That system collapsed in August 1971, when the US President Nixon ended the convertibility of the US into gold and floated the US dollar.

The problem for the European nations was that the Common Agricultural Policy (CAP), which was one of the first shows of common purpose after the Second World War, has such a complex structure of agricultural prices and subsidies, that currency fluctuations made it largely unworkable.

This biased the European Community towards maintaining fixed exchange rates despite the obvious fact that their attempts were fraught and led to a recessionary-bias in the weaker trade nations, such as France.

At the famous Hague Summit in December 1969, which was held during a period of increasing currency turmoil as the Bretton Woods system was in its last death throes, the European Council agreed that they should “lay down a definitive financial arrangement for the common agricultural policy by the end of 1969”.

As an integral part of this financial arrangement, the Communiqué said that:

… a plan in stages should be worked out during 1970 with a view to the creation of an economic and monetary union. The development of monetary co-operation should depend on the harmonisation of economic policies.

So the CAP was central to their obsession with fixed exchange rates.

When the US pulled the plug on Bretton Woods, the world political leaders introduced a series of ad hoc initiatives in the 1960s to defer its inevitable collapse.

There was the Smithsonian Agreement, which failed as did other attempts and variations.

The Europeans introduced their own variant – the ‘snake in the tunnel’ – which allowed the currencies of the European Member States to fluctuate within a narrow band (the ‘tunnel’), although it encountered difficulties immediately as the German trade strength required the Bundesbank to sell marks in exchange for US dollars to keep the German currency from breaking the upper allowable band.

The German ‘inflation angst’ was too much for them to overcome and they eventually floated their currency, recognising that they could not run their own domestic policy in the way they desired and maintain the agreed parities.

They rejoined the snake soon after. The French, in particular, were insistent on maintaining strict currency parities.

Currency instability continued into 1972 and the Basel Accord of April 24, 1972 committed Europe to the ‘snake in the tunnel’ arrangement, even though the rest of the world was realising that it was better to float their currencies.

The ‘snake’ didn’t stay within the ‘tunnel’ for very long. By June 1972, Britain withdrew from the arrangement, unable to maintain the parity without scorching their economy with deep recession.

Italy was also under pressure from speculators who knew the system was unsustainable. Italy floated in January 1973. Other nations followed suit.

On March 12, 1973, the ‘tunnel’ was abandoned and a number of currencies devalued. But despite all the political posturing about the stability of the system, the underlying economic fundamentals in Europe meant that the currency pressures were unstable. Germany faced continual upward pressure on its currency and France the opposite.

This meant that the Bundesbank continually had to purchase the ‘snake’ currencies and the other central banks were continuing to intervene on a significant scale to stabilise currency movements.

For the next several years, currency chaos persisted, with various core members of the snake entering and exit as their circumstances became untenable.

By 1978, after a series of withdrawals from the system and revaluations (up and down), the reality dawned on the Europeans – the system was unworkable.

Enter the next disaster – the European Exchange Rate Mechanism (ERM).

The Europhiles kept hammering the message that there would be advantages in creating a common currency.

The withdrawal of the French franc in March 1976 from the ‘snake’ exemplified the problem facing the non-German membership: either they had to continually devalue their currencies or create high domestic unemployment to reduce imports.

Neither option was politically tenable. Even after the revaluation of the mark in October 1976, the remaining currencies were under pressure.

The CAP was also causing problems, particularly in France. The CAP became more complicated in 1969 when the mark was revalued and the French franc devalued. The CAP required that the EC harmonise agricultural prices expressed in terms of a common “Agricultural Unit of Account” (AUA), which was set in terms of gold parity of the US dollar as used in the Bretton Woods system and introduced in 1962.

One AUA corresponded to one US dollar. In turn, these common CAP prices were converted into national currencies using the exchange rate parities.

Stability of the fixed agricultural price system across the membership thus depended on the stability of national currencies because if one currency depreciated, the fixed prices would yield a competitive advantage to that nation’s farmers and vice versa.

Simple solutions were ignored and, instead, the European Commission introduced even more complexity (a shadow price system – so-called ‘green rates’) which was designed to insulate farm prices from the fluctuations in the market exchange rate.

It effectively amounted to a surrender of common agricultural prices and a violation of the Commission’s own laws (surprise surprise), but the denial was so strong that the European Commission put its own spin in it.

Eventually, the French and German governments agreed to replace the ineffectual ‘snake’ with a more integrated level of monetary cooperation.

Britain were party to the talks but realised the proposals were not in its national interest.

The proposal to emerge in April 1978 was the European Monetary System (EMS) and was introduced formally in mid-1979.

The Exchange Rate Mechanism (ERM), a compromise struck by Belgium to overcome on-going French and German disagreements over the nation of the system was just another fixed exchange rate system but the difference was that the Member State central banks agreed on symmetrical intervention to maintain the parities.

For example, if the French franc reached the lower band of its parity against the mark the latter would have reached the upper band of its agreed parity against the franc.

This would mean that both the Bundesbank and the Banque de France would have to simultaneously sell marks and buy francs in the foreign exchange markets.

In theory, there would be less pressure on any one currency to adjust and less monetary disturbance in the respective economies.

In reality, the adjustment process was not symmetric because the liquidity effects of the respective interventions were quite different.

Within weeks of the system being introduced, the Bundesbank showed who was boss. They considered the symmetrical intervention arrangements exposed the German economy to an excessive inflation risk.

So it was no surprise that they reneged on their part of the deal and the currency instability worsened.

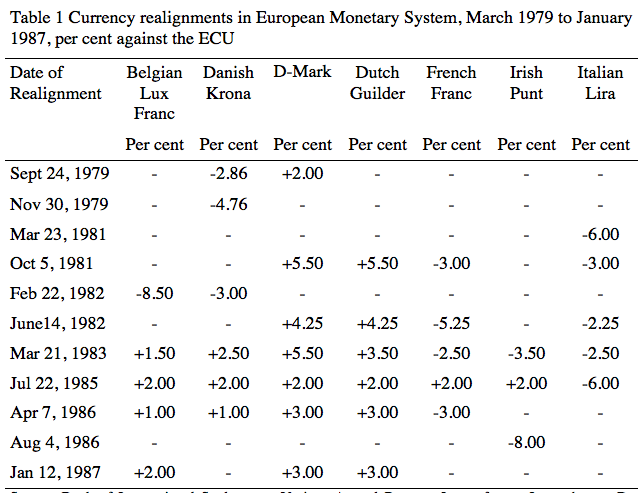

This Table is taken from my 2015 book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale and shows the extent to which nations had to realign their currencies during the period the ERM was in place.

Fritz Sharpf claims that:

After an initial period of frequent adjustment, the EMS worked reasonably well, not only in dampening currency fluctuations and inflation rates but also in achieving a pattern of nominal exchange rates that reflected economic fundamentals and avoided the dynamic divergence of real effective exchange rates and the emergence of persistent external imbalances.

Which is a very rose-coloured glass view of the reality.

The ERM was a shambles.

And, moreover, any sense of stability only entered the picture when the the French government fell lock-step into the increasingly dominant Monetarist policy approach that involved using rising unemployment as a policy tool to discipline the inflation process.

Mitterand’s shift in policy in March 1983, the so-called ‘tournant de la rigueur’ (turn to austerity) combined with Jacques Delors’ obsession with the ‘fort franc’ (strong franc), not only ended the few years of social advance in France but meant that France was becoming more like Germany, an essential pre-condition that Delors exploited later in the decade to push through the Maastricht plan.

Fritz Sharpf lauds the ERM for helping to:

… reduce average in ation rates in Europe by obliging member states to use monetary and scal policies in order to keep their currencies within 75 percent of the agreed-upon exchange-rate bandwidth

Sure enough, the reduction in domestic inflation that resulted from the ‘scorched earth’ austerity approach was celebrated as the first serious sign towards a convergence reality, while the sharp rises in unemployment were brushed under the carpet and forgotten.

And, this shift in sentiment marked the start of the war on the victims of this folly in macroeconomic policy, which gathered pace through the 1980s and culminated in the 1994 release of the OECD Jobs Study, which became the bible for those intent on ignoring the fact that the unemployed cannot search for jobs that are not there.

The ERM was only somewhat stable because neoliberalism had taken over – a malaise that infests Europe to this day.

The primacy of the Germans was apparent.

By giving primacy to the Monetarist position on inflation, Germany became the de-facto monetary authority in Europe. In effect, the decision by the EMS Member States to peg against the mark and subjugate their own policy independence meant that the Bundesbank became the central bank for the EEC.

Once the French realised that instead of a European-level body compromising their policy sovereignty it was the Bundesbank that was in control, their attitude to fast-tracking a full European monetary union changed. A period of considerable acrimony between France and Germany followed, the details I will leave aside here.

Essentially, the upshot was the push by Delors for the Single European Act and then Maastricht. The deluded French thought this was a way to reassert their authority within Europe against the dominance of Germany.

But it was not all neoliberal-recession biases (which supressed imports etc) that gave the ERM any sense of stability by the second-half of the 1980s.

This is a crucial point to understand.

The weaker European Member States maintained capital controls, which attenuated the flow of funds into and out of their nations.

Throughout this period, the IMF, true to form, had been urging the nations to liberalise capital flows, which of-course, once achieved would further tighten the Bundesbank policy straitjacket for the other nations in relation to defending their parities.

Delors, in particular, the so-called ‘Socialist’, swallowed the IMF line and in pushing for the Single European Act (1987) as the first step to Maastricht, also undermined the very thing that was giving the ERM any sense of currency stability – capital controls.

The Single European Act of 1987 was Delors’ attempt to nullify the German dominance of the EMS, which had effectively become a mark zone. The Act eliminated capital controls.

Italy, for example, had relied on capital controls to give it domestic policy space and maintain the currency parity. Once they were abandoned the currency was exposed.

The abolition of controls eliminated one policy tool that governments had to maintain stability and this became evident in 1992.

The capital controls in the words of Barry Eichengreen and Charles Wyplosz (1993):

… protected central banks’ reserves against speculative attacks …

They did this by reducing the possibility of the exchange rate being driven below the agreed fluctuation bands (which would require central banks to sell foreign currency in return for its own).

In other words, the capital controls gave the central bank renewed policy autonomy, in the sense that they could pursue domestic objectives such as economic growth and low unemployment, which may have also meant that a particular nation’s inflation rate was higher than its competitors.

The capital controls gave them this leverage.

Once capital controls were eliminated, central banks became vulnerable, as they had to focus policy on defending the nominal exchange rate parities.

And with the rising instability associated with the treaty, this vulnerability became acute in the early 1990s.

The referendum failure in Denmark on June 2, 1992 brought some reality back into European financial markets by pricking the false bubble of currency stability.

It was obvious that Italian and British competitiveness had been severely eroded by their higher inflation rates and that their currencies were substantially overvalued, particularly against the mark.

A new bout of currency instability came after the Maastricht Treaty was signed and culminated in Black Wednesday (September 16, 1992) which ended Britain’s brief return to the ERM under the Euro-centric Prime Ministership of John Major.

Former British MP and Chairman of the Conservative Party, Norman Tebbitt referred to the European Exchange Rate Mechanism (ERM) as the “Eternal Recession Mechanism”.

This was a reflection on the crippling interest rates that Britain had to maintain to stop the sterling from breaking the agreed parities, given the high German interest rates that were in place by the Bundesbank to ease their inflation fears after the German government increased its fiscal deficit to help quicken the unification process.

In a UK Guardian Op Ed (February 10, 2005) – An electoral curse yet to be lifted – Tebbitt reflected on Black Wednesday (September 16, 1992), which he considered to be “Bright Wednesday” because “with one bound we were free”.

The event led to Britain’s withdrawal from the ERM and its exchange rate has floated ever since.

Tebbitt wrote that:

The whole wretched experiment in giving control of our currency to an organisation not under British control was a woeful self-inflicted wound on the Conservatives … I think entry into the ERM – enthusiastically supported by Labour, the Liberals, the TUC, the CBI and the whole woolly, wet, bien pensant Europhile consensus – might have been forgiven, but the purblind refusal to admit the mistake and get out earlier was too much for electors, especially Conservative voters.

The 1992-93 crisis demonstrated that the system of fixed exchange rates or even tightly linked exchange rates between economies that were disparate in structure and performance would always fail with mobile capital.

The famous Emminger letter of November 1978 demonstrated that Germany was never going to play ball with its European partners if they thought it would compromise their own national policy objectives.

How about having that sort of ‘family member’? The problem remains today in Europe. Germany will cooperate if it suits them and frustrate or reject if it doesn’t.

The EMS was in self-destruct mode by 1993 with devaluations and threats of exit.

The problem was not ‘laxity’ or excessive fiscal stimulus, but the fact that a fixed exchange rate system such as the EMS (and its predecessor the Bretton Woods system) was incompatible with the economic and political reality.

Nations cannot absorb high unemployment for lengthy periods without major consequences such as social instability and increased political extremism. The Germans, above all, should have learned that lesson from the 1930s.

The various agreements to maintain fixed parities between the European currencies all largely failed because of the different export strengths of the Member States.

But instead of taking the sensible option and abandoning the desire for fixed exchange rates, the European political leaders accelerated the move to a common currency when the Bretton Woods system collapsed in 1971. The lessons from the Bretton Wood’s fiasco were not learned.

That background conditions what I have to say about Fritz Sharp’s second proposal for a two-tiered European monetary system.

Conclusion

In this part, I have shown that attempts to stabilise currencies within Europe using fixed-exchange rate systems or pegs of any sort have largely failed.

Further, currency sovereignty requires exchange rates to be flexible so that domestic policy has the scope to advance well-being within the nation rather than be tied to managing a currency parity.

There are further issues that arise from Sharpf’s proposal, which I will consider next. I have split this analysis into three parts because his proposal is complicated (47 pages) and contains a lot of detail that requires dissecting. Each blog in the series is too long as it stands!

In Part 3, I will explicitly consider several problems that arise from Fritz Sharp’s proposal to create a Two-tiered European Community.

I am travelling most of tomorrow so I am not sure I will get Part 3 available until Monday. We will see!

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

I think that was an excellent summary of the exchange rate mechanism and I am sure that you are correct that each country should be sovereign in its own currency. But, I believe that the real problem here is not the currencies but trade. I have been reading some of the protectionists material written in the nineteenth century by people like Henry Charles Carey and what I found recently was Carey’s separation of commerce from trade. Commerce, which Carey defined as exchange of goods, is different from trade which is a tool of commerce. Trade comes about because of distance and since trade adds extra cost to commerce it extracts wealth from the real economy. At first I thought that I misunderstood what I was reading but I had to accept that Carey had the real take on trade. So, I think now that that the real problem is trade and that currency issues are just a symptom of the disease.

Reform proposals? To me it looks like a redefinition of Eurozone power relations in which the Southern countries are set aside, curtailing influence in the political and monetary processes. To me, it looks like some conspiracy, a project if you like, to bring the Southern countries further into debt and social malaise as a result of pegging and in the mean time providing profits for the Northern countries. Profiting from the poor and at the same time imprison them. Yesterday I wrote that nature and human life was absent in these political narratives. WE, the seemingly powerless have disappeared from politics alltogether and the fist thing that strikes the eye, is the absence of a more or less spontaneous vox populi. So next up, the disappearing of the Southern countries, lest the turmoil in Spain with Catolania as example.