The other day I was asked whether I was happy that the US President was…

Eurozone recovery is much weaker than the headline figures might suggest

It is fiscal statement (aka ‘budget’) frenzy in Australia at present, with the Treasurer about to bring down the annual policy strategy tonight. There is so much claptrap in the press and electronic media that I have tried to avoid saying anything about it. I may stick to that. I have been trying to understand the French election results though. That has occupied my attention a bit given the success of Macron (where a record number of voters stayed away and he barely scraped through the first round). He will be proven to be duplicitious I think. He is a Eurocentric neo-liberal who is anti-union, largely, anti-regulation and state intervention and believes the ‘market’ and an incentivised middle-class will do the trick for France. He is caught up in the Europe thing and so cannot see that the Eurozone straitjacket will ensure a growing underclass is retained. There was some interesting research published by a private investment bank (BOAML) – Job Quality and Escape Velocity – which provides a rather sombre view of the much-touted Eurozone ‘recovery’ over the last three years.

First, what the hell is ‘Escape Velocity’ you might ask?

It is one of those pieces of jargon that economists like to use (in this case purloined from physics) to make their nonsense even more impenetrable for the average person. To give them an air of authority – as if they are saying something that is important but it really pretty basic.

In its original meaning, Escape Velocity is “the minimum speed needed for an object to escape from the gravitational influence of a massive body”.

Economics use the term to mean the rate of growth the economy has to achieve to ‘escape’ a recession and resume its long-run trend rate of growth in a sustained way (sequence of consistent quarters of similar growth).

So, why don’t they just say something like ‘sustained recovery’, which would make much more sense to everyone.

The other implication of the term is that one the ‘escape velocity’ is reached, policy support should be withdrawn.

Several problems emerge in the use of the term.

1. Recessions, especially drawn out affairs such as the GFC and its aftermath, reduce the potential growth rate (because capital formation is stifled) and make it difficult for the economy to resume its previous long-term trend rate of growth without invoking inflationary pressures.

That is why governments should use all the policy levers at their disposal to head of a recession.

2. What is a normal economic policy position? The mainstream (and many so-called progressives) claim that it means a neutral monetary policy (interest rate to stabilise inflation) and a surplus or balanced fiscal position.

Whether that fiscal balance is achieved as an average over some cycle or as an absolute goal is contested. But most economists (not those in the Modern Monetary Theory (MMT) camp though) think the fiscal balance has to be zero when the ‘escape velocity’ is reached.

In making these assessment, the mainstream economists (and the ‘balancing’ progressives) usually ignore reference to situations where there are persistent external deficits and/or the private domestic sector is holding record levels of debt (and becoming very susceptible to small changes in economic outcomes).

For example, if the non-government sector desires to save overall, then for growth to be sustained there must be an on-going fiscal deficit, of whatever magnitude that is required to satisfy the non-government desire.

That is a stock-flow fact, not my opinion.

So, just talking about ‘escape velocities’ opens up a host of contested ideas and concepts, which really define the difference between neo-liberal economic thinking and MMT.

But that is not what I want to write about today in this blog.

The Bank of America’s report is in the context of the recent growth in the Eurozone, which many commentators are claiming is reaching the point where the excess supply capacity is being eaten up by the growing demand.

The inference is that the ECB will soon have to start increasing interest rates and governments will have to further tighten fiscal policy to avoid a wages breakout and an inflationary spiral.

If you believe that then you would believe almost anything.

The Euro area unemployment rate is still at 9.5 per cent (some 30 per cent above the level in March 2008 – the low-point of the last cycle).

Emmanuel Macron’s France endures an unemployment rate of 10.1 per cent as at March 2017 (40.3 per cent above the March 2008 level).

Italy 11.7 per cent (82 per cent above), Greece 23.5 per cent (186 per cent above), Spain 18.2 per cent (91 per cent above), Austria 5.9 per cent (43 per cent above), Ireland 6.4 per cent (23 per cent above), the Netherlands 5.1 per cent (41 per cent above), and so on

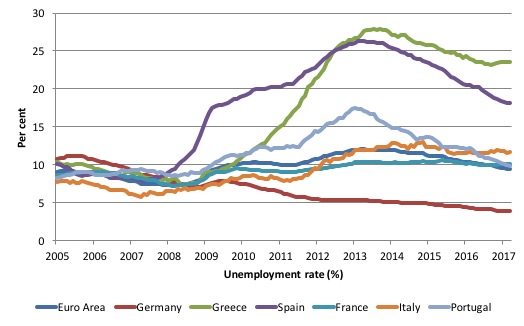

The following graph shows the evolution of unemployment rates in selected Eurozone Member States since January 2005 up until March 2017.

From this perspective, no normality has been restored in the Eurozone as a bloc.

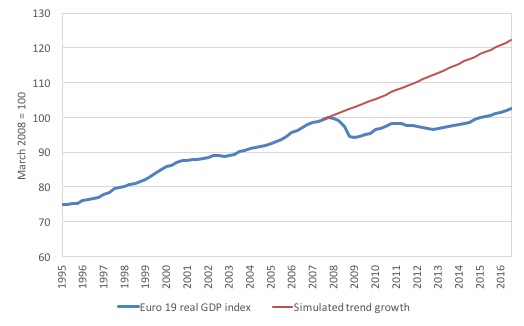

The next graph shows the path of real GDP in the Euro19 Member States from March 1995 to December 2016 (indexed to 100 at the March-quarter 2008 – the peak before the GFC).

The simulated line is based on extrapolating out the actual growth path from 1995 to the December-quarter 2007 using the average quarterly growth rate over the period.

Actual real GDP is only 2.4 per cent higher than it was in the March-quarter 2008 for the Eurozone as a whole.

The average growth rate since the September-quarter 2015 (when the Eurozone finally passed the level of GDP attained before the crisis) has been 0.45 per cent per quarter compared to the average rate of 0.57 per cent between March 1995 to December 2016.

So the rate of growth is still well below the pre-crisis level and the output gap is massive. I qualify that statement by noting that the red line is probably not the current sustainable trend rate of growth given the massive collapse of capital formation in the Eurozone since the crisis.

In fact, potential GDP has probably fallen significantly.

While many in the financial markets are claiming that the ECB has to start hiking interest rates soon because, allegedly, the ‘escape velocity’ in the Eurozone has now been passed the data would suggest otherwise.

Of course, the financial market commentators have vested interests in trying to push the debate in the direction of higher interest rates.

Please read my blog – Why banks are pushing the US central bank to increase interest rates – for more discussion on this point.

On May 2, 2017, Eurostat published an updated note – Temporary employment in the EU.

Temporary employment covers:

Employees with a limited duration job/contract are employees whose the main job will terminate either after a period fixed in advance, or after a period not known in advance, but nevertheless defined by objective criteria, such as the completion of an assignment or the period of absence of an employee temporarily replaced.

We learn that “26.4 million employees aged 15 to 64 in the European Union had a temporary contract in 2016”. This is equivalent to 14.2 per cent of the total employees.

In nations such as Portugal (22.3 per cent), Spain (26.1 per cent) and France (15.6 per cent), temporary jobs are growing rapidly.

The share in total employment has fallen slightly since 2007.

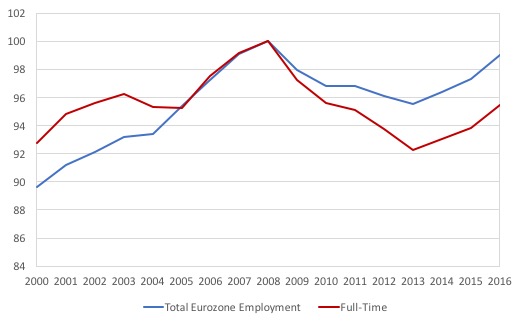

Annual Eurostat data shows that between 2008 and 2016, total employment fell in the Eurozone as a whole by 1,458 thousand persons.

Temporary jobs have fallen (net) by 553.4 thousand (2.8 per cent decline) and full-time jobs have fallen by a staggering 5,322.8 thousand jobs (4.5 per cent decline).

The growth area has been in the form of part-time jobs, which increased by 3,862.8 thousand jobs (net) between 2008 and 2016 (a rise of 14.3 per cent).

The following graph shows the evolution of total and full-time work in the Eurozone between 2000 and 2016 (indexed to 100 at 2008).

The pre-crisis growth period was very different to the current recovery.

The growth of part-time work in the Eurozone and the fall in full-time employment is the motivation for the Bank of America’s study.

They found that while there is now employment growth occuring in the Eurozone (albeit modest) that growth is biased towards jobs of “deteriorating quality” and the deterioration is significant.

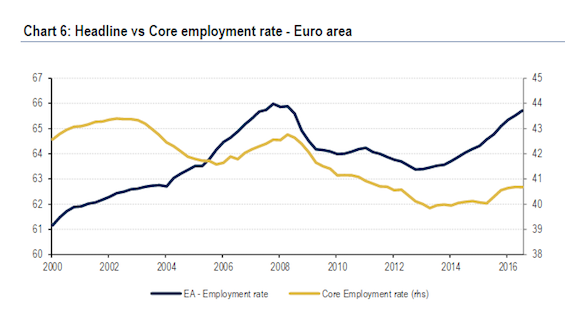

They created a time series called the “core employment rate” by excluding part-time and temporary contracts from total employment.

The following graphic shows their calculations.

So while the total employment rate is nearly back to where it was prior to the pre-GFC peak, the core rate is several percentage points below its peak.

The Bank report concluded that:

The near-entirety of the rebound in the headline employment rate since 2013 can be ascribed to ‘lower quality’ jobs

Even though temporary jobs have declined in the Eurozone as a whole they have risen in the European Union (by 397.3 thousand since 2008). Much of that is in the United Kingdom (an increase of 223.2 thousand).

Further, temporary jobs have risen in some key Eurozone nations such as Italy (up 138.4 thousand), France (up 282.1 thousand), the Netherlands (up 95.5 thousand).

In relation to part-time employment, some staggering statistics emerge. All the net job creation in France since 2008 has been of a part-time nature (recognising that temporary jobs can be either full-time or part-time).

202 per cent of jobs created (net) in Italy have been part-time, recognising the collapse of full-time work there. 52.4 per cent of jobs created (net) in Eurozone powerhouse, Germany have been part-time.

Why would that matter?

A sustained recovery in the Eurozone will have to come from a pickup in domestic demand. With the austerity bias in government spending, that means that private domestic incomes are going to have to grow much faster than they currently are and that requires much stronger wages growth.

In Issue 3 of the ECB Economic Bulletin 2016, the ECB noted that:

Wage growth has remained relatively low in the euro area despite an environment of improving labour markets … Wage growth has not only been low, but also consistently over-predicted …

The large remaining amount of slack is a key factor pulling wage inflation down. Even if the labour market in the euro area is improving, the high unemployment rate still points to ample labour supply. The measurement of the amount of slack in the labour market is surrounded by high uncertainty and the observed unemployment rate might understate the actual labour market slack in the economy. For example, the share of underemployed people, i.e. those working on a part-time basis but who would like to work more hours, and the share of discouraged workers over the crisis and this is not fully captured by the observed unemployment rate.

This observation underpins the conclusion that the Eurozone recovery is in fact much weaker than the headline figures might suggest.

And things haven’t improved much since the ECB published that article.

The Bank of America report concluded that:

Given the importance of ‘core employment’ for discretionary spending, we think this creates a source of fragility for demand. The Euro area economy is clearly on the right track, but the recovery is actually still in its early stage, in our view. The full normalisation of the labour market is not yet in reach.

I also read this week the claims by some investment bankers that the growth in part-time work in Europe since the crisis was a normal pattern in a recovery (Source).

Well, it is true that in the early days of a recession, part-time work might continue growing. But eventually, if the recession persists, all forms of employment contract.

In the recovery, the normal adjustment is to increase hours of work rather than add extra persons, while firms work out whether the growth will be sustained.

That is quite a different adjustment to that claimed.

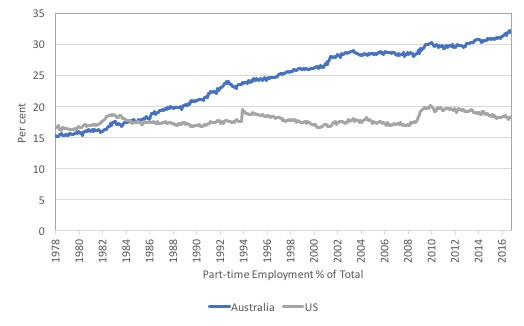

Consider the case of the US, which is captured in the following graph. It shows part-time employment as a percent of total employment in the US and Australia from February 1978 to November 2016 (it is seasonally-adjusted, monthly labour force data).

The focus should be on the US performance in the context of today’s discussion.

Even before 1978, the US ratio was slowly rising from 13.5 per cent in January 1968 and by January 1970 it had reached 14.9 per cent.

From that point, it rose to 16.6 per cent by February 1978. By November 2016, the US ratio was 18.3 per cent. But as you can see, in the recent recovery the ratio fell, which is the normal pattern in recovery. Compare the early 1990s recession to for further evidence.

Conclusion

So talk of ‘escape velocity’ might sound fancy but it only serves to obscure what is going on in the Eurozone. After 8 years of crisis, the Eurozone economy is still in a very fragile state and the well-being of workers, trashed by the persistent unemployment and austerity cuts, is now being rendered an additional blow in the form of the growth of casualised and precarious work and flat incomes.

Some success story!

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

In today’s comments on Mike Norman’s blog in a post about Michael Hudson blissex takes Hudson, Norman and you to task about Europe. I am not qualified to dispute him but I thought that you might be interested in his defense of the EU.

OpenID blissex said…

«Rolling over the debt making even more loans is basically a Ponzi scheme»

But rolling over and expanding the debt when the interest rates are low is the #1 prescription by economists like M Hudson and B Mitchell for the USA and UK to finance keynesian-style spending: they claim that it is not a Ponzi scheme, that right-wing economists are wrong to say that any given level of government debt reduces growth, and that the only thing that matters is the cost of rolling over the debt.

Why does the level of debt matter for Greece?

«keep the appearance that “everything is awesome”»

The reason why the greek debt cannot be written down is that very generously most of it has been bought and rolled over the eurozone governments via eurozone institutions, making the very big gift to Greece of avoiding a formal default and reducing the cost of rolling it over.

Those eurozone institutions are like IMF not allowed to write off debts without a corresponding increase in their capital, and the governments of the eurozone countries with a lower GDP per capita than Greece have vetoed that, because they would not be able to explain to their citizens why they would be taxed more to make fiscal transfers to Greece.

«It will never be “paid back”»

Everybody knows that. That’s not part of the issue. Indeed the eurozone institutions that have bought the greek debt have made a 40-60% discount on it to Greece, by reducing the interest rate to near zero levels despite Greece being bankrupt and extending the duration of the debt to many decades. A very big generous gift that the UK, USA, IMF have not made to the greek government.

Currently repayments on that debt take around 3-4% of greek GDP, a very small amount, that is covered by the 3-4% of GDP of net direct fiscal transfers that Greece receives from the EU. So effectively the burden on the greek economy of the debt is zero.

The question is really why the greek government should be entitled to fiscal transfers of 25% of GDP forever, and who should make those fiscal transfers.

Didn’t Prof. Mitchell deal with this in a Saturday Quiz 3 or 4 weeks ago? The quid pro quo for the generous 3-4% transfer payments has been imposition of a set of domestic austerity policies that are destroying the Greek nation. Raul Ilargi Meijer documents the effects of these policies pretty regularly on the Automatic Earth blog.

Why the negotiators are persisting with this horror is as much a mystery to me as it must be to you.

Always remember feeling very pleased with myself at school when I learned how to calculate the escape velocity of the earth using a couple of Newton’s formulae and the conservation of energy. Does that help ?

‘Much of that is in the United Kingdom (an increase of 223.2 thousand).’

Most of this is due to the result of the UK’s version of the ‘Harz Reforms’ – the Government first groomed the populace by using language framing that marginalised the unemployed/ill/vulnerable and then subjected them to an intense period of sanctions (the Job Centres becoming known as ‘sanction centres’). The stress created was so great that people with mental health issues became more ill and many dropped out of the system to avoid the hassle. Many became ‘self-employed’ even though they were earning very little, just to avoid the hell of being humiliated at the Job Centre.

After all this, the Government claim that it is leading Europe in employment growth!

With Theresa May expect Round 2 of this garbage.

And in other news, Merkel has given Macron’s Eurobonds Proposal a Big Fat NOPE.

http://www.reuters.com/article/us-france-election-germany-idUSKBN18412U

So much for the reformer of Europe.