I started my undergraduate studies in economics in the late 1970s after starting out as…

Typists go home … UK runs out of money!

I read the headline in the UK press this morning – UK can’t afford another fiscal rescue – as a sure sign that all current and future keyboard operators within the UK Government had resolutely decided to refuse to enter a number in any government spending account from now on. This clearly would make it hard for the Government to continue spending given that a sovereign government like in the UK just spends by crediting private bank accounts and only a typist or two is needed to make that happen any time the government desires. I wondered what the Government had done to their operational staff that they would take such drastic action. So I started out to investigate what seemed to be a major yet fascinating industrial relations dispute between a government and its typists.

I was wrong. In fact, it was just those dopes at the IMF issuing their latest ill-informed statement about something that they think will make them sound important. Apparently, the IMF thinks the UK has run out of money.

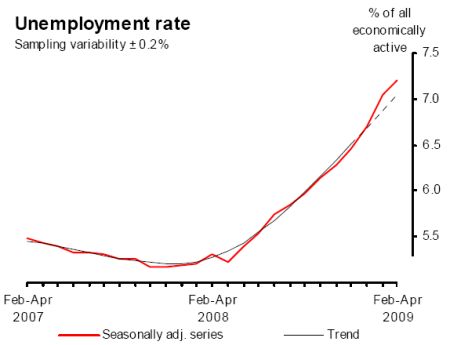

First, I thought it worth taking a second to focus on the real problem in the UK at present. Here is it in all it pathetic starkness taken from the official data supplied by the UK National Statistics Office. I could spend some considerable time analysing the demographic (youth terrible, ethnics very bad) and regional (some in meltdown) features that underlie the national (average) unemployment data shown here.

But the message would only get grimmer. It is obvious that the UK is in dire need of sustained fiscal support and will need that support for some years to ensure that the dive in aggregate demand that has driven the unemployment rate up is reversed and then sustained.

Sustaining aggregate demand means that fiscal deficits will have to provide the spending left by the savings desires of the non-government sector. In Britain, private saving is rising as highly indebted households struggle to render their financial circumstances somewhat less precarious than disastrous.

So you get the picture of what the real problem is and why the role of the Government is crucial to addressing it.

Now, enter the IMF. The Telegraph Article says that the IMF prepared a report for the recent G20 meeting in Basel which:

… has laid bare how the UK’s indebtedness has left it unable to provide the vital stimulus the economy could need over the next 18 months.

Every other G20 country apart from the UK and Argentina has been able to budget for temporary spending increases or tax cuts next year to help drag their economies out of recession …

I tried getting hold of the said report but it appears to have been one of the confidential briefings. I have spies everywhere though and it will surface soon enough.

Anyway, the Report apparently invokes the authority of none other than the ratings agency Standard & Poor’s which has been big-noting itself lately by trying to tell the UK government that it is danger of being insolvent. Please read my blog – Ratings agencies and higher interest rates – to see the stupidity of those claims. Here is a story from the Daily Telegraph, which seems to be specialising in horror financial sci-fi these days. At least one commentator in the article had the wit to note that “it should be noted that this is the same rating agency that rated leveraged sub-prime as AAA” … and got paid by the organisations that were creating the debt!

Apparently, the IMF is claiming that Britain has run out of money. It entered the recession with the:

… worst structural budget deficit in the Western world, leaving it with little room to borrow in order to lessen the impact on profits and unemployment. Although the IMF last week said it now expects the British economy to return to growth next year, its calculations over the implications of the deficit underline the fact that any recovery will be tepid.

The British Government, already bowing to the mounting debt-deficit hysteria, has announced a plan to cut the deficit in half over the next five years despite the evidence that its recovery will be very weak over that period. But the IMF is not happy with that plan. It considers that fiscal consolidation will have to begin now and the budget will have to be “back in balance over the electoral term”. There is an election coming up next year! The IMF is reported to be demanding drastic cuts to public debt levels in Britain as part of this consolidation process.

If the UK Government followed the IMF advice then in my opinion the officials who provided the advice and their bosses (including the senior management) should be pursued for crimes against humanity.

The actual facts that Britain faces are these:

- The UK Government is sovereign in sterling and can never be insolvent.

- The public debt that the UK Government has accumulated as it fights the real crisis its is overseeing will never expose it to any technical danger of default.

- The same public debt is being accumulated voluntarily under the misplaced belief that the deficits have to be “financed” or rather the neo-liberal motivation that the deficits should be matched pound-for-pound by public debt issuance.

- There is very little danger of inflation occuring from demand pressures as long as the GDP growth rate is as far below capacity as it currently is and is forecasted to be over the coming 5 years.

- The UK Government could be more effective in meeting the labour market challenge by offering a minimum wage job to anyone who wants a job and currently doesn’t have one. This would represent the minimum fiscal stimulus required to generate full employment. Then they could work on improving things further with the security that everyone was in work.

- The ratings agencies are irrelevant when it comes to assessing government solvency.

- The British Government has as much fiscal capacity left as there are idle resources available to bring back into activity. If they want to spend more than that limit then they have to raise taxes and squeeze private spending. They are a long way from that at present.

While I don’t have the above-mentioned report, I do have the G20 briefing that the IMF provided to the recent G20 Meeting at Basel. The IMF said (page 38) that:

Household saving in advanced economies is expected to be sustained at higher rates than over the past decade, notably in economies like the United Kingdom and the United States. Many households had previously relied largely on relaxed credit conditions and wealth accumulation through asset booms to finance spending.

Households have subsequently been battered by a steep loss in financial wealth and, in a number of countries, by reductions in housing wealth. Moreover, tighter restrictions on credit availability as deleveraging continues and concerns about high unemployment are likely to weigh on consumption for some time. Although the recent jump in precautionary saving is likely to subside as the global economy finds a more secure footing, prospects of higher private saving carry implications for global demand, since other sources must be found to make up for a slower growth in demand, notably, by U.S. consumers.

This section of the Report followed a prior analysis of the need to urgently ensure fiscal consolidation is achieved by all governments. They argue that it will not be enough to rely on the cyclical improvements providing increased tax revenue. In terms of the development of “convincing strategies for fiscal sustainability”, the IMF notes (Page 35) the German plan to outlaw deficits (see my blog on this mad plan) and lists other “less formal” rules that other countries are proposing. Under the targets (for fiscal sustainability) – Table 6 – the majority are about outlawing or eliminating budget deficits as the way towards fiscal sustainability.

Question: What “other sources” of expenditure will sustain aggregate demand if the government returns to budget surplus which means it is subtracting from demand?

Net exports? Yes if you are Norway, no as a general rule. Not every country can run surpluses by definition and Norway will eventually exhaust its natural resources anyway.

Investment? Never has sustained aggregate demand at sufficient levels to ensure continuous full employment. It is also highly variable and prone to collapse.

What is left? Government budget deficits – they are the only reliable way to ensure high employment levels.

I also read something in the Guardian yesterday by English economist David Blanchflower who is known to be sympathetic with the OECD approach to labour markets. Read: I don’t like his outlook.

But this article sounded promising – it started with the point that:

British economic history warns us to beware false dawns. Those calling for spending cuts have got it wrong – again

So that was a good start. The article then quotes a warning delivered by John Maynard Keynes in 1930 as the Great Depression was in its early period:

The duration of the slump may be much more prolonged than most people are expecting and – much will be changed both in our ideas and in our methods before we emerge. Not, of course the duration of the acute phase of the slump, but that of the long, dragging conditions of semi-slump, or at least sub-normal prosperity, which may be expected to succeed the acute phase.

Wise enough words. Blanchflower considers the probability of a further slump now in the UK (towards depression) is unlikely but also thinks the path back to growth will be slow. All the national activity indicators in Britain at the moment are terrible.

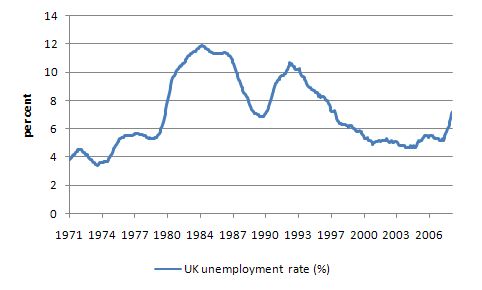

Of significance is the devastation that a recession leaves. Take a look at the following graph (from UK Statistics) of the national unemployment rate since the early 1970s.

The low-point unemployment rate before the 1982 recession was 5.3 per cent in July 1979. It rose for the next 5 years before peaking at 11.9 per cent in March 1984. It then took 196 months to get back to 5.3 per cent (16 odd years). The human cost of that prolonged high unemployment – mostly totally ignored by economists who work at the IMF and Treasury Departments and in academic positions – were huge.

The simplest calculation reveals that the daily income losses alone of having that many people idle dwarf any reasonable estimate of microeconomic losses arising from the so-called “structural inefficiencies” or microeconomic rigidities (a favourite of the IMF) that have dominated public debate over the neo-liberal era. It is just plain madness to ignore huge costs and then go about pursuing small costs (if they exist). One of the problems is that in pursuing these micro costs the government almost always will increase the macroeconomic costs.

There is a lovely quote by the late James Tobin, which economists who read the blog will relate to:

Its take a heap of Harberger triangles to fill an Okun Gap!

For afficionados, you might like to read this Letter to a Younger Generation which was written in 1998 by Arnold Harberger who is now 84 years old. He reflects on this quote.

For non-economists, the triangles are a screwy graphical technique neo-classical economists use to measure allocative inefficiencies (so-called welfare losses) and Okun Gaps are how far output is from being sufficient to provide for full employment (after the work of the great Arthur Okun, who died prematurely at the age of 51).

The point of Blanchflower’s article is that recessions of the past have been prolonged and the recoveries have been tortured affairs. Add to that the parlous state of economic forecasting and you have problems. On economic forecasting, Blanchflower says

Economists are uncertain about the likely path of recovery. For example, less than a year ago Britain’s National Institute of Economic and Social Research was predicting that the UK economy would “escape recession”, forecasting positive economic growth in both 2008 and 2009. On 10 June this year, the NIESR said, “The monthly profile points to March as having been the trough of the depression.” But on 7 July it had changed its mind again, arguing, “March can no longer be considered the trough of the recession.” A month is a long time in economics these days.

In the light of the discussion about the vagaries of economic forecasting I thought back over the last few years of IMF forecasts published in their World Economic Outlook releases. One is easily provoked to ask: what right has the IMF to speak about anything macroeconomic anyway?

The whole lunacy of the IMF making economic statements at all, also reminded me of a Press Release I saved once from the US Congress Joint Economic Committee in 2003 which among other things said:

Essential components of the International Monetary Fund (IMF) framework to forecast financial crises “performed poorly” or were inaccurate …

… the new IMF vulnerability assessment framework faces challenges because it relies on the IMF’s World Economic Outlook, which has a “poor track record of forecasting recessions, including those directly associated with a financial crises.” The World Economic Outlook (WEO) also does a “poor job in forecasting the current account.” The Fund’s early warning system models were also found to be unreliable. The GAO reports that “the IMF acknowledges that their forecasts are overly optimistic and validates our finding on the weakness of the WEO component of the vulnerability assessment framework. This raises questions regarding the purpose and credibility of the WEO forecasts.” The IMF asked the GAO to remove a section of the report documenting the very high rates of problems with lending safeguards identified by the Fund in recent years.

“This GAO report shows that there are significant weaknesses in the IMF’s ability to anticipate financial crises,” Saxton said. “The GAO report also corroborates my concerns about the failure of the IMF to have even minimal lending safeguards in place for most of its history …

If you read that General Accounting Office (GAO) Report you will conclude that the IMF have no authority on these matters.

As an aside, if you read the report, then on Page 68 you will see a letter from the IMF to the GAO. The IMF sought to censor parts of the Report which are very critical and damaging to the IMF agenda. I will write more about IMF bullying at another juncture – closer to home … in fact, very close!

Also, by way of clarification, the crisis in question was the 1997 Asian meltdown. The IMF guaranteed that they had put in place procedures after that crisis to better assess vulnerability. And as we are now witnessing, 10 or so years later things went to 11! (guitarist analogy for over the top because most amps have volume controls that stop at 10. As a digression my old Fender Bassman amp volume control goes to 12 which was some sort of statement in 1959 when it was made!).

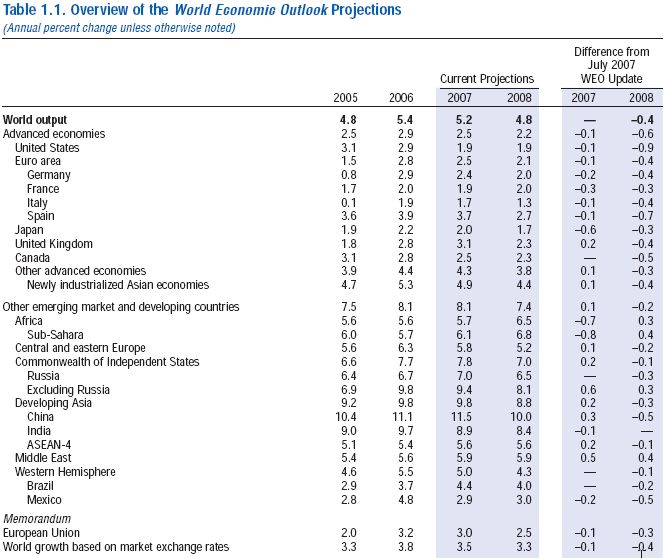

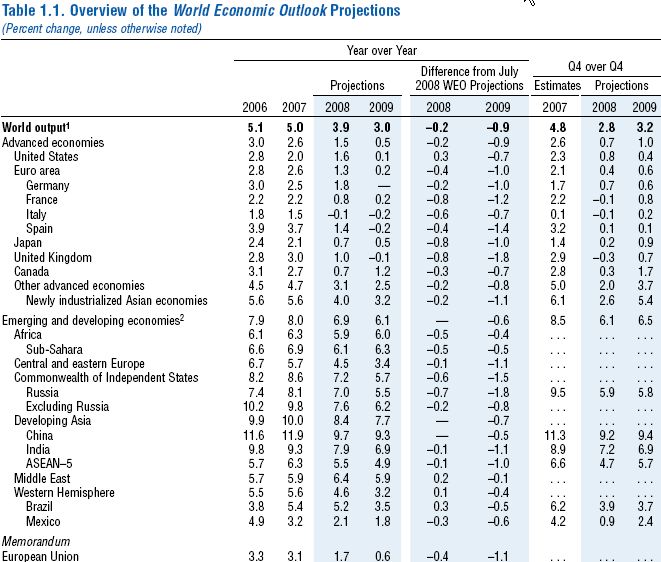

To give you some idea of how the IMF forecasts have shifted in recent years as the real world proves them wrong at every point in time I took two tables from their World Economic Outlook (2007 and 2008). I could have spent even more time providing their interim forecasts and updates but the this would just reinforce the obvious conclusion that you can draw from a comparison of these tables.

The first Table is taken from the IMF World Economic Outlook 2007 (Table 1.1).

Compare it to the next Table which is taken from the IMF World Economic Outlook 2008 (Table 1.1). You can become very concentrated and print the two out and work out all the differences. But I wouldn’t waste time and paper. The fact is that they got it wrong – badly. Then kept getting it wrong – badly. It says something about their analytical models and the theoretical structures they use to produce the statistical models that generate these forecasts. Their failure to predict major economic changes is long-standing.

Conclusion

I think it is a safe bet to assume that the government typists are still employed in Britain and given it enjoys a fiat monetary system then they should be able to follow Blanchflower’s advice (see below) without any nominal (financial) constraints at all. As the real constraints get closer then the deficit tap has to be tightened but that is so far away that it should not entertain any minds at present.

The rising deficits are funding the rising desire of the private sector to save in the currency of issue and that is an essential aspect of getting the British economy back onto a sustainable growth path.

If the British Government was to follow the IMFs advice then it would leave a legacy of years of poverty among the ranks of the unemployed and their families. With the potential of ethnic division in that country and the concentration of disadvantage among certain ethnic groups who have shown a propensity to violence I would be doing everything I could to spend spend spend and create jobs jobs and more jobs.

The only people that should be losing their jobs at present are the senior officials at the IMF.

Blanchflower concludes that in the light of the parlous economic circumstances facing the British population:

… public spending cuts make absolutely no sense. The government should be increasing spending now – and by a lot – not least because it can borrow at such a low long-run rate of interest. In such circumstances, infrastructure and education are smart investments for all our futures. Most of the self-proclaimed experts calling for public spending cuts missed the recession in the first place.

So I have a question for Gordon Brown, David Cameron and Nick Clegg. What plans do you have to get unemployment down any time soon? If you want to transform a recession into a depression, go ahead and cut public spending. I would advise against it and so, I believe, would John Maynard Keynes. Voters want jobs.

Wise counsel other than his lapse on the “debt front”. But then he is a deficit dove and doesn’t understand that the British government is not revenue-constrained.

Bill:

A good analysis of the UK situation thanks. One think I am not able to understand is that if the concepts are easy to understand why is taking such a hard time convincing economists? I was trying to explain to my friend who was concerned about growing deficits and public debt in the US. I went through the whole routine borrowing a lot of what I have learnt from deficit spending 101 and the gold standard myth of this blog. Yet this is what he had to say

\”Thermodynamics 101 – Energy cannot be created, hence a perpetual motion machine is impossible.

All our combined physical experiences (so far) show that the above is true.

Similarily – What prevents deficit spending from growing infinitely? If a sovereign govt can simply spend as much as it wants because it has the power to issue currency, what prevents every sovereign govt from doing so?

I think if i can understand the above question, i might be able to understand this economic theory. There must be a very good reason why this is not mainstream :)\”

Then I had to go on about how taxes create a demand for currency and the govt being limited by the actual amount of reosurces (labor and real goods) and back to loans create deposits.

After about 2 rounds a question pops in my mind. Am I really missing something that it is so hard to convince this other person?

Why does the mainstream not see that they have it backwards when it is o easy to see that?

These are the guys that are responsible for runframing and running macro economic policy around the world. Thanks Vinodh

Dear Vinodh

Thanks for your thoughtful input to my blog. Your thoughts are useful to us all.

First, the fiat monetary system is not a physical process. While there has been efforts to apply the laws of thermodynamics to economic systems (it is called thermoeconomics) I doubt that it has ever gained traction with more than a few people.

Second, there is nothing stopping a sovereign government acting totally irresponsibly and spending beyond the real capacity of the economy at any point in time to absorb that spending. Zimbabwe is a case in point. So one has to rely on political processes; a sense of public purpose; common-sense, and the fact that the economy will meltdown (via hyper-inflation) if the government abuses the fact that it can spend at any time. So while it is true they can buy any real resources that are available for sale they cannot go beyond that and not cause inflation (more or less).

Third, it seems simple once you grasp it but for many economists, who have been conditioned by years of erroneous text-book learning it is a big ask to get them to admit their “education” has been mis-directed. You might want to explore the literature in philosophy of science which covers the ways degenerating knowledge paradigms hang on like grim death to the tools, techniques and postulates that define the paradigm even when it is non-functional.

The problem is as you note in the last sentence – the costs of this ignorance are huge and never really affect the economists who are making the mistakes out of wilful arrogance or blissful ignorance or somewhere in between.

But keep spreading the word. There is a song by Paul Kelly (Australian folk singer) called From little things big things grow (You Tube link). It is not about spreading alternative economic thinking but the message is the same – you have to keep at it – be persistent – be prepared for the relentless attacks – and know their stuff better than they do! The song is about the Wave Hill industrial walkoff by the way, which arguably set the train rolling for land rights for indigenous people in Australia.

best wishes

bill

Vinodh,

Galileo had to drop two objects of different mass from the Leaning Tower of Pisa to disprove Aristotle.

The reason it is so difficult to introduce people to ‘Alternate Economic Thinking’ is purely psychological. “I know how the markets work” “I have a degree from … ” is how people think. People rarely would accept that they are wrong and have been learning wrong stuff half their lives.

I have been trying to spread the word for a few years. But something happened recently that made getting my (our) point of view across… California. I asked one of the doubters where California was getting the warrants it was using to pay for state spending. I said “is California taxing them from the people so it can spend them?. Of course not; they didn’t exist until California spent them into circulation. Then California agreed to take them back in tax payments or pay interest on them”. Then I said “what constraint is there on how many warrants California can issue? Can they run out of them?” All of a sudden the doubter’s look of confusion turned to a look of enlightenment.

Dear MarkG

Lovely!

best wishes

bill

Even with all the money in the world and more of it , you cant get more oil if the world has run out of oil. Surely there is link between what money can do and constraints in the real world.

Ofcourse that is not the issue here I guess , I think the talk is more about using money to utilise the idle capacity that is lying around, to create more productive capacity so as to get returns in the future to pay off the deficit.

..and it is also interesting that it is China , which probably is lesser of the affected countries by the GFC which is diverting funds to infrastructure projects instead of enticing people into buying non productive assets like plasma tvs and houses.

Dear Nirvan

Fiscal policy cannot overcome a finite natural resource supply (although it can help to reduce dependencies on scarce resources). As you read more of my blog you will see I continually highlight the link between the state of nominal demand (spending) and the real capacity of the economy to absorb it. You have to keep within the real capacity or enter the world of inflation. But as you say in the second paragraph we are a long way off that point at present.

Further, there is no concept that the government needs to “pay off a deficit”. A deficit is a flow (not a stock) which by definition is gone as soon it is spent. What you mean I guess is the concept of paying back the debt that has accumulated alongside the net spending increases. That debt has to be paid back by law but the government can always do that independent of state of the business cycle. There is no need for growth to generate revenue which will be then made available for debt repayments. The government is not revenue-constrained so can pay back its debts whenever it likes.

best wishes

bill

Thanks Bill for the reply

Could you please explain the idea “Government not being revenue constrained” or point me to a blog that clarifies this, How does the government manage to pay back the debt independant of the business cycle when there is falling tax revenues, in a downturn for example?

Dear Nirvan

Regular readers will at this point be saying – Bill makes this point over and over again! Shut him up! But I come from a country where “too much sport is barely enough”. And repitition helps keep the message being heard.

But if you Follow this link, which is a search string of my blog you will find pages of entries where I deal with this. Go back to the early entries and work forward in time and you should be able to gain an understanding of what I mean by this comment.

best wishes

bill

I think all countries will eventually exhaust their natural resources. What does the Seasonal adj. series mean and where did that graph come from?

cheers

Dear Katrina

Seasonal adjustment – why not look it up. It is smooth out unusual seasonal patterns. I cited the reference – UK Statistics.

best wishes

bill

Hi Bill,

I think it’s hard to understand the meaning without putting it in context.

Katrina: think of the example of consumer spending. If spending was up in December compared to September, you wouldn’t get too excited because you’d say it’s just being boosted by Christmas shopping. So, the obvious question is, how does the December data look compared to September if you adjust (somehow!) for increases due to the Christmas season. This idea is the crux of seasonal adjustment. If a data series has some kind of repeating seasonal trend over the year (due to factors like Christmas, winter, summer, holidays, etc), then it is useful to strip out this seasonality from the original series. The result is called the seasonally adjusted series.

Hi Sean,

Nice article in Crikey today- it provided a nice summary to the debt and deficit debate of the past few weeks.

Regards

Tim

Tim: Glad you saw it and liked it! Since it included links back here, I do hope some people do take the time to explore some of Bill’s posts.