I grew up in a society where collective will was at the forefront and it…

Seattle workers better off after significant minimum wage rise

I recently wrote about minimum wage principles in relation to a progressive manifesto and the desire to reduce income inequality, which has risen sharply in the neo-liberal era where mainstream ‘free market’ economics has been the dominant narrative. Please see – Reducing income inequality – for that discussion. That blog considered some evidence that refutes the mainstream economics mantra that implementing minimum wages undermines the employment opportunities for low-wage workers. The standard lie that is rammed down the throats of economics students is that whenever governments impose minimum wages the market retaliates and minimum wage workers are worse off as a result. There are layers of erroneous concepts embedded in that orthodoxy, which I have dealt with many times before. But a significant point is that the real world is doing a good job to expose the lies of the ‘competitive’ model without recourse to any deep theoretical debates about whether ‘marginal productivity’ can be identified (it cannot), or whether the labour demand curve is downward sloping (it isn’t), which also includes a debate about whether productivity declines with extra employment (it doesn’t!). An interesting research paper released July 2016 by researchers at the The Seattle Minimum Wage Study Team based at the University of Washington in Seattle – Report on the Impact of Seattle’s Minimum Wage Ordinance on Wages, Workers, Jobs, and Establishments Through 2015 – provides further evidence to contest the veracity of the mainstream economics myths.

The Seattle study is not unique. It should be considered further evidence in a massive litany of knowledge that refutes the claim that increasing (or imposing) minimum wages reduces the employment of low-paid workers – either in actual job opportunities or hours of work available.

[Reference: The Seattle Minimum Wage Study Team (2016) Report on the Impact of Seattle’s Minimum Wage Ordinance on Wages, Workers, Jobs, and Establishments Through 2015, Seattle, University of Washington..]

For a summary of the recent evidence about the relationship between minimum wages and employment this article is worth consulting – The truth about the minimum wage.

The Seattle study addresses “two fundamental questions”:

1) How has Seattle’s labor market performed since the City passed the Minimum Wage Ordinance, and particularly since the first wage increase phased in on April 1, 2015?

2) What are the short-run effects of the Minimum Wage Ordinance on Seattle’s labor market?

The first question seeks to explore the more general question – whether Seattle workers are “better off” than before the minimum wage was increased (which might be the result of non-minimum wage factors), while the second question pursues the more specific issue – “are we better off than we would have been if Seattle had not adopted a higher minimum wage?”

Pretty straightforward.

The context for the Seattle Study is as follows:

1. The Seattle Minimum Wage Ordinance “went into effect on April 1, 2015” and raised Seattle’s minimum wage from $US9.50 to $US11.00 per hour. By 2017, the minimum wage will be $US15 per hour (depending on type and size of business). By 2021, all Seattle businesses will be subject to the $US15 per hour minimum.

2. The percentage increase for minimum wage workers was thus around 12 per cent, which was more than twice the wage increase for comparable workers in proximate geographical locations – so, a substantial hike.

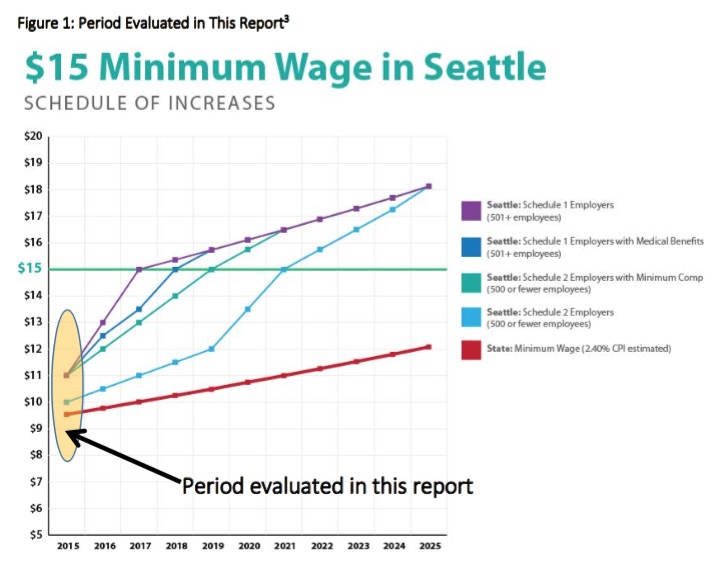

The following graph (Figure 1 from the Study report cited above) shows the study period (in ellipse) and the planned minimum wage movements by firm type up to 2025 in Seattle.

I won’t go into the methodology the Study deployed (“difference in differences strategy”), which in part, relies on defining a counterfactual and then comparing the actual outcomes with that state. You can read the study yourself if you are interested in learning how this type of research is performed.

The counterfactual is based on observing “outcomes of a valid comparison group”, which comprises geographically proximate areas to Seattle and “a set of regions in the state of Washington that have matched Seattle’s labor market trends in recent years”.

Essentially, the statistical methodology allows the researchers to split the observable change since the Minimum Wage Ordinance into three components – “Impact of the Minimum Wage”, “Economic Climate” and “Business as Usual”.

Suffice to say that the techniques are standard and acceptable.

The baseline minimum wage was the state of Washington’s $US9.32 per hour and six quarters after the Ordinance there was a “clear decrease in the share of Seattle’s workers earning between $9 and $11 per hours, which suggests that the minimum wage caused an upgrading of worker’s wages”.

In mid-2014, “there were 19,056 … workers … earning between $9 and $10 per hour … but only 7,330 at the end of 2015.”

Further, “As the number of workers earning under $11 shrank, the number earning $11-13/hour rose significantly, and the number earning $13-19/hour rose enough to be noticeable”.

The Study reveals that similar trends (“lower share of workers eanring less than $11 per hour”) occurred in the reference groups, which leads to the conclusion that:

… broader macroeconomic forces, and to some extent typical seasonal fluctuation, may have been the cause of the decline in the share of workers earning less than $11 per hour …

… an improving economy may be the cause of the change in the distribution of wages.

We have known for a long time that recession (and recovery) creates a number of changes in the labour market that often get confused for structural imblances.

Recessions impact on a number of economic aggregates in addition to the most visible impact – the rise in unemployment. The great American economist Arthur Okun coined the term The Tip of the Iceberg and I borrowed that for the title of a book I co-authored in 2001. The point is that the costs of recession and the resulting persistent unemployment extend well beyond the loss of jobs. Productivity is lower, participation rates are lower, the quality of work suffers and real wages typically fall.

The facts associated with the current downturn are consistent with this general model.

However, within this context, Okun outlined his upgrading hypothesis (in the 1960s and 1970s) and the related high-pressure economy model, which provided a coherent rationale for Keynesian demand-stimulus policy positions. Two references are Okun, A.M. (1973) ‘Upward Mobility in a High-Pressure Economy’, Brookings Papers on Economic Activity, 1: 207-252 and Okun, A.M. (1983) Economics for Policymaking, Cambridge, MIT Press.

Okun (1983: 171) believed that:

… unemployment was merely the tip of the iceberg that forms in a cold economy. The difference between unemployment rates of 5 percent and 4 percent extends far beyond the creation of jobs for 1 percent of the labor force. The submerged part of the iceberg includes (a) additional jobs for people who do not actively seek work in a slack labor market but nonetheless take jobs when they become available; (b) a longer workweek reflecting less part-time and more overtime employment; and (c) extra productivity – more output per man-hour – from fuller and more efficient use of labor and capital.

The positive side of this thinking is that disadvantaged groups in the economy were considered to achieve upward mobility as a result of higher economic activity. The saying that was attached to this line of reasoning was “all boats (large or small) rise on the high tide”.

Okun’s (1973) results are summarised as follows:

The most cyclically sensitive industries have large employment gaps, and were dominated by prime-age males, offered high-paying jobs, offered other remuneration characteristics (fringes) which encouraged long-term attachments between employers and employees, and displayed above-average output per person hour.

In demographic terms, when the employment gap is closed in aggregate, prime-age males exit low-paying industries and take jobs in other higher paying sectors and their jobs are taken mainly by young people.

In the advantaged industries, adult males gain large numbers of jobs but less than would occur if the demographic composition of industry employment remained unchanged following the gap closure. As a consequence, other demographic groups enter these ‘good’ jobs.

The demographic composition of industry employment is cyclically sensitive. The shift effects are in total estimated (in 1970) to be of the same magnitude as the scale effects (the proportional increases in employment across demographic groups assuming constant shares). This indicates that a large number of labour market changes (the shifts) are generally of the ladder climbing type within demographic groups from low-pay to higher-pay industries.

So prior to the neo-liberal onslaught and during the period that governments were cogniscant of their responsibilities to maintain full employment (and actively used fiscal and monetary policy to attack high unemployment relatively quickly), a recovery reversed the damage caused by the recession. This research was, in part, the basis of my own PhD thesis.

The evidence supported the proposition that when the economy is maintained at high levels of employment, workers in low paying sectors (or occupations) also receive income boosts because employers seeking to meet their strong labour demand offer employment and training opportunities to the most disadvantaged in the population. If the economy falters, these groups are the most severely hit in terms of lost income opportunities.

The upgrading thesis also focused on the mapping of different demographic groups into good and bad jobs. The groups who experience the greatest relative employment gains when economic activity is high are those who are stuck in the secondary labour market, typically, teenagers and women.

While these groups were proportionately favoured by the employment growth, the industries with the largest relative employment growth are typically high-wage and high-productivity and employ mostly prime-age males. Expansion is therefore equated with ladder climbing whereby males in low-pay jobs (as a result of downgrading in the recession) climb into better jobs and make space for disadvantaged workers to resume employment in their usual sectors. In addition, favourable share effects in predominantly male industries provide better jobs for teenagers and women.

So there were many benefits from growth which spread out across rising participation, rising wages, rising hours of work, rising employment and falling unemployment.

But the downside is that the iceberg takes a long time to melt if (a) it is large; (b) if the recovery is not robust enough; and (c) if the policy stimulus is poorly designed and targetted. Recovery alone is not sufficient. Real GDP growth has to be consistently strong for some years before the iceberg melts and the upgrading bonuses accrue.

Please read my blog – The aftermath of recessions – for more discussion on this point.

The Seattle Study suggests that the robust growth in the state of Washington in the US has been beneficial to low-wage workers even with the Minimum Wage hike.

In terms of wages, the Study found in relation to the cohort of workers subject to the Minimum Wage Ordinance that the “median wage for this cohort of workers increased from $9.96 to $11.14 over the next six quarters”.

Was this all down to the rise in statutory minimum wages? The research “provides strong evidence that the minimum wage likely caused these workers’ wages to rise”, although there is evidence that that “some of the gain in wages seen in Seattle for these low-wage workers is likely due to the strong economy”.

In all, 73 cents of the median hourly wage rate rise is estimated to be due exclusively to the Minimum Wage Ordinance once other effects are accounted for.

On employment, “the rate of employment of these workers increased by 2.6 percentage points”, but was “modestly” lower than the employment increase in the comparative regions.

A similar result was found for hours worked where “Seattle’s employment situation for low-wage workers improved after the Minimum Wage Ordinance was passed. Hours worked increased” but it appears that the “Minimum Wage Ordinance modestly lowered hours of work” relative to what might have happened.

But total quarterly earnings is a function of wage rates, hours worked and employment status.

How did low-wage workers fare in Seattle? The Study finds that “(q)uarterly earnings for Seattle workers earning less than $11 per hour at baseline increased by $463” which reflected the stronger economy, in addition, to the Minimum Wage Ordinance.

For low-wage workers in continuous employment, the Study finds that “if you kept working, you were modestly better off as a result of the Minimum Wage Ordinance, having $13 more per week in earnings and working 15 minutes less per week.”

However, when considering what “what happened to jobs and hours worked at businesses reliant on low-wage labor”, the Study found that “that the minimum wage had little or no net impact on the number of persistent jobs” in these firms.

Mostly the employment effects were accounted for by seasonal trends (which impact significantly on these businesses in Seattle) and the sensitivity of these types of businesses on the state of the cycle.

The Seattle Study’s main conclusions are that:

1. The Ordinance was associated with a higher net rate of business openings in Seattle.

2. “Seattle’s strong economy may make it capable of absorbing higher wages for low-wage workers”

2. “In the 18 months after the Seattle Minimum Wage Ordinance passed, the City of Seattle’s lowest-paid workers experienced a significant increase in wages … The minimum wage contributed to this effect, but the strong economy did as well.”

A review of the study by Jared Bernstein (August 10, 2016) – So far, the Seattle minimum-wage increase is doing what it’s supposed to do – concluded that minimum wage:

… increases have their intended effect of lifting the pay of low-wage workers with little in the way of job losses … It means that the vast majority of low-wage workers end up with higher earnings. Even if some workers lose some hours of work, their annual income often goes up (which, in fact, is another finding from the study).

In other words, “Minimum-wage opponents who claim that increases will cripple local economies, either overall or even in their low-wage sectors, thus get no help from the Seattle results.”

Bernstein notes that the usual array of critics – many of whom “are paid by the low-wage employer and lobby to shoot at anything that moves” – have come out to debunk the results of the Study.

They claim “employment went down” – but the Study finds that “employment actually went up in Seattle relative to past trends”

The reality is that since the Minimum Wage Ordinance was introduced:

… low-wage workers’ employment, hours and wages all rose substantially. Neighboring areas that had similar trends in these variables before the increase – and that, by the way, were also bound by the highest state minimum wage in the country when the increase took effect – saw even larger employment and hours gains. In other words, relatively high minimum wages in Seattle and in Washington more broadly have had their intended impact and have been perfectly compatible with a strong economy, one that’s handily beating national averages.

Conclusion

Once again, the real world is not kind to the orthodox approach. The Minimum Wage Ordinance helped low-wage workers in Seattle in general.

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

Report on the Impact of Seattle’s Minimum Wage Ordinance on Wages, Workers, Jobs, and Establishments Through 2015

Link doesn’t work.

Dears GLH (at 2016/08/15 at 3:53 pm)

Fixed now. Thanks for the help.

best wishes

bill

Is this ‘credible’ evidence?

“Early evidence from the Bureau of Labor Statistics (BLS) on Seattle’s monthly employment, the number of unemployed workers, and the city’s unemployment rate through December 2015 suggest that since last April when the first minimum wage hike took effect: a) the city’s employment has fallen by more than 11,000, b) the number of unemployed workers has risen by nearly 5,000, and c) the city’s jobless rate has increased by more than 1 percentage point (all based on BLS’s “not seasonally adjusted basis”). Those figures are based on employment data for the city of Seattle only (not the Seattle MSA or MD), and are available from the BLS website here (data are “not seasonally adjusted”).”

“Bernstein notes that the usual array of critics – many of whom “are paid by the low-wage employer and lobby to shoot at anything that moves” – have come out to debunk the results of the Study.”

Nick Hanauer (entrepreneur, venture capitalist, troublemaker) calls the low-wage employer group the ‘Parasite Economy’. He’s really quite scathing of the Walmart approach to wages, and champions the idea of paying workers properly so they can afford to buy the output of capitalism. It’s just a revival of the Henry Ford notion that if you pay people, capitalism flourishes because they spend more on stuff.

There’s a pretty good 30 mins interview here with Nick that is worth watching. It goes through all the arguments, including suggesting that the minimum wage in the USA should be $29 per hour if it tracked the earnings of the 1%.

Bill,

Firefox issues a warning for the report link. If you change the protocol to http instead of https it works.

Bill, when you say the report exposes the veracity of mainstream myths, you surely mean it exposes their “lack of veracity”.

Wages aren’t the long (or even medium?) term solution because of automation.

And that automation is and has been financed with what is, in essence, the legally stolen purchasing power of the workers and general population via unethical fiat and credit creation.

Yes, we have had Progress but at a terrible, dangerous cost. I suggest we repent and provide restitution to the victims.

Neil:

Thank you for the link to Nick Hanauer. It is an excellent interview. I will be learning more about him from his website, http://www.nickhanauer.com.