It’s Friday again, my blog Lay Day, which means I fast track the blog entry in favour of other writing tasks. But one thing that is worth noting today (and I’m sort of catching up on recent events in my reading of them), is a speech that the Governor of the bank of Canada (its…

Friday Lay Day – Economists remain in denial of reality

It is my Friday Lay Day blog and it is going to be relatively quick. There was an article in the Wall Street Journal (December 23, 2015) – Economists Say ‘Bah! Humbug!’ to Christmas Presents – that says a lot about how my profession struggles to appreciate reality in all its dimensions. Every year, it seems that this type of article is written. It discusses whether giving gifts at this time of year “represents an inefficient reallocation of resources”. As my friend Scott tweeted this morning it is just another example of (mainstream) rebuking parallel lines for not remaining straight.

The article quotes an academic US economist:

Anyone who has had microeconomics knows … that an income transfer, as opposed to a gift in-kind, gets you to a higher level of utility.

In fact, I studied microeconomics for many years along with all of those who have a PhD in economics and the mainstream of that study demonstrated to me, repeatedly, how irrelevant orthodox economics is if one seeks an understanding of society, people within society, historical traditions, culture – in other words, reality.

We spent hours writing equations, taking derivatives, seeking local and global optimal solutions, drawing graphs with various triangles marked, and all the rest of it, in our earnest search for how many angels there were on the top of the pinheads that we had before us.

We couldn’t see the pinheads nor did we ever really count the number of angels. Such is mainstream microeconomics.

I also love the following quote which resonates strongly in this context. Post Keynesian economist Paul Davidson [in the book by Bell and Kristol The Crisis in Economic Theory, Basic Books, 1981, p.157] describes how mainstream economics uses methods and approaches that renders it unable to embrace real world problems:

There are certain purely imaginary intellectual problems for which general equilibrium models are well designed to provide precise answers (if anything really could). But this is much the same as saying that if one insists on analyzing a problem which has no real world equivalent or solution, it may be appropriate to use a model which has no real-world application. By the same token, if a model is designed specifically to deal with real-world situations it may not be able to handle purely imaginary problems.

Post Keynesian models are designed specifically to deal with real-world problems. Hence they may not be very useful in resolving imaginary problems that are often raised by general equilibrium theorists. Post Keynesians cannot specify in advance the optimal allocation of resources over time into the uncertain, unpredictable future; nor are they able to determine how many angels can dance on the head of a pin. On the other hand, models designed to provide answers to questions of the angel-pinhead variety, or imaginary problems involving specifying in advance the optional-allocation path over time, will be unsuitable for resolving practical, real-world economic problems.

Note that I am not against simplified (abstract) modelling. Clearly, it is essential if you want to gain some traction on a real-world problem that is complex. But the models have to be capable of capturing real-world dynamics.

In the Wall Street Journal article, we read that so-called “pure-minded economists … cringe it profligate spending untethered to express need or desire”.

They talk of an “efficient gift”, which is “highly liquid” with an “lower expense ratio”.

The father of Monetarism, Milton Friedman “praised the efficiency of spending money on oneself”.

Several academic articles have been written by economists seeking to prove the point that there is “no evidence of significant welfare gains in any gift category”.

Mainstream economists do not consider culture, institutions, intimacy and other human realities important enough to include in their analytical frameworks. They produce analytical models which assume these things away as being of nuisance value only.

They produce models that generate predictions about human behaviour that have nothing to do with the essential drivers of that behaviour.

They don’t consider, for example, that there is value in a gift beyond its so-called utility value.

Clearly, the capitalist sector invokes us to indulge massively at this time of the year and judgement may lapse in that regard by consumers. But that is not the essence of the argument made by mainstream economists.

The point is that the value of the gift is in the sentiment that lies behind it quite apart from any utility value the object might have.

Anyway, it took me a long time to fully appreciate this and I’m sorry I didn’t appreciate it earlier. But I am happy that the fall import of thinking about somebody and putting time into the manifestation of those thoughts in terms of some simple object one exchanges (that is, a gift) came to me. Despite my professional background.

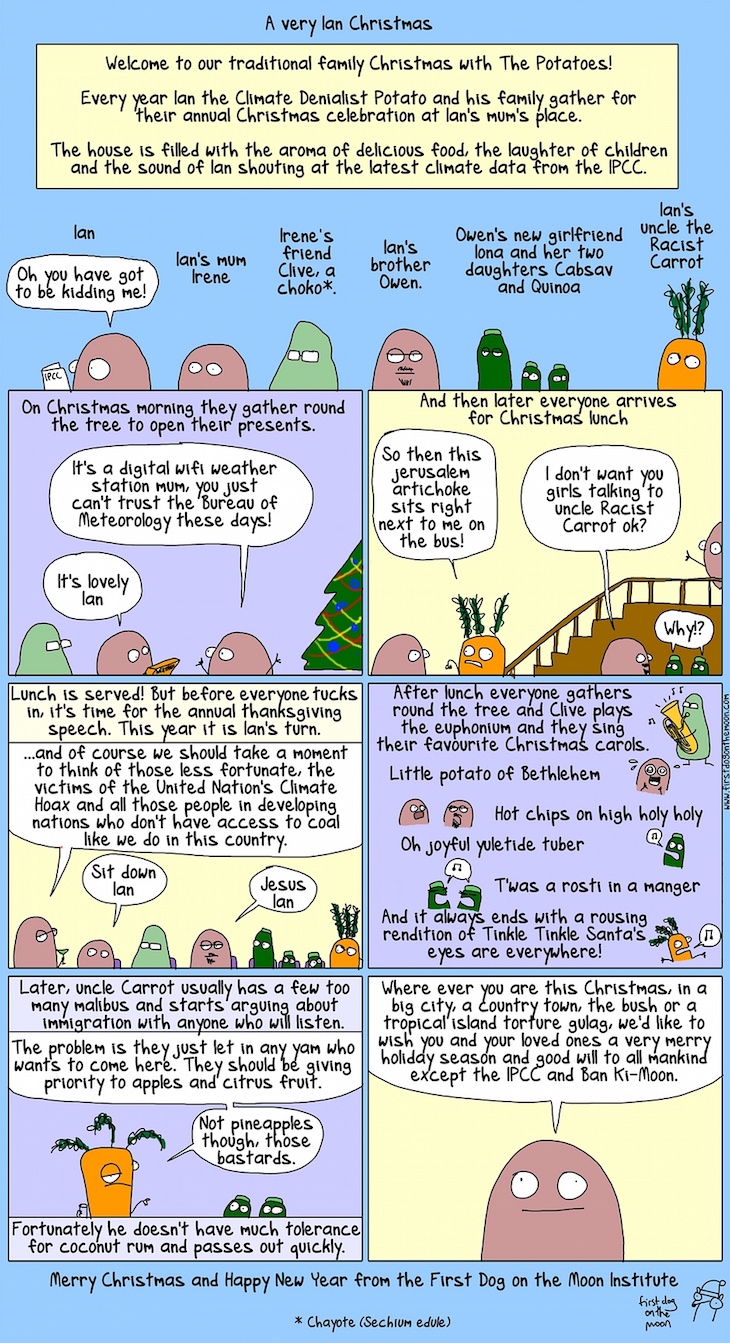

Xmas cartoon from First Dog on the Moon

Here is the Xmas cartoon from the First Dog on the Moon which has Ian the Climate Denialist Potato wishing us seasonal greetings.

In the context of economists talking about the serious market failure involved in giving gifts at this time of year I thought it was apposite.

Music – Lyn Taitt and the Jets

This is what I have been listening to this morning. It is from the double CD-collection – Hold Me Tight – Anthology 65-73 – which was distributed by Trojan Records in 2005. This song – I Don’t Want to See You Cry – was on the CD1 (Track 4).

Lynn Taitt was a guitar play from Trinidad and Tobago who was a pioneer of Rocksteady.

His early musical origins were in local steel drum bands prior to mastering the guitar. He moved to Jamaica to perform at the 1962 Jamaican independence celebrations. He then formed and played with a number of Kingston-based bands and in 1966 formed the incomparable Lyn Taitt and the Jets.

The Jets included Headley Bennett on saxophone, Hopeton Lewis on vocals, Gladstone Anderson on keyboards, and Winston Wright on organ.

Lyn Taitt died in 2010. Here is a good obituary – Lynn Taitt has passed away.

He was one of those relatively unknown guitar players (outside of those who study rocksteady and reggae music) but one of the best players ever. He was incredibly influential in Jamaican music up until 1969. That year marked a major change in Jamaican music, with the transition from rocksteady to reggae spawned by the new producers like Lee ‘Scratch’ Perry and new engineering ideas from the likes of Osbourne “King Tubby” Ruddock.

Lyn Taitt moved to Canada at that time and never returned to live in Jamaica.

This track is one of many gems on the double CD collection, which is virtually impossible to buy anymore.

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Thanks Bill. Hope you enjoy the reality of all the real feelings and emotions of this festive season with family as I will. Just be present and try to enjoy it is my plan.

No doubt Mr. Waldvogel and his utility-scroogenomics will be assessing the marginal utility of the joy of giving against the disutility of the gift as experience by the receiver and drawing the relevant graph as part of his MBA course.

No-on talks about the disutility to the world of Christmas being a fleet of cargo ships delivering a mountain of plastic, sweatshopped crap from China docking at their main port.

The Quakers did a good job in getting rid of Christmas until Charles II brought it back. Still, good wishes to Bill for his work of educating us-may your time be peaceful and full of true friendship.

A Swiss potato family of 110.000 is trying to save the climate bij signing … a petition calling for the central bank to be given solar power to create money in the financial system.

http://www.telegraph.co.uk/finance/economics/11999966/Switzerland-to-vote-on-banning-banks-from-creating-money.html?utm_source=dlvr.it&utm_medium=twitter

Mainstream economists are not only in denial, they are in metadenial; they deny they are in denial. And the concept of utility that they use has no empirical utility. Ask anyone other than a researcher in game theory what a utile is. They should be forgiven for thinking you are asking about bathroom tiles, which could be said to possess greater utility than the concept itself.

I hope that’s clear. Season’s greetings, everyone.

Sometimes I suspect that many mainstream economists understand a lot less about their own theory than the long-suffering heterodox student who nonetheless had to study those theories for perhaps seven years. 🙂

Within the neoclassical framework:

(i) if utility functions are interdependent, then the utility of the giver (who might enjoy giving the gift) needs to be factored in to the comparison between a cash transfer and a gift or in-kind transfer;

(ii) even without interdependent utility functions, if the gift receiver likes getting a gift rather than cash, the utility may be greater with the gift.

In relation to (ii), the possibility that the receiver will prefer a gift to cash is probably much higher than in the case of paternalistic welfare policies that are justified along these lines (and, within the neoclassical framework, logically so, repugnant as the arguments often are).

For example, I would be surprised if the academic US economist’s assertion about what “[a]nyone who has had microeconomics knows” would accord with Gary Becker’s view, expressed in his 1992 Nobel Lecture (published in the JPE 1993, vol. 101):

Of course, all economists would be aware of the trivial Econ101 analysis that suggests the cash transfer is best in utility terms, but the assumptions to get that result are very narrow. An individual’s utility function must not only be independent but s/he must only care about the relative dollar values of the cash and the gift. The argument would also seem to require zero search costs, perfect information, etc., but I am a bit rusty on the details by now …

Anyway, under these narrow conditions, cash will obviously be preferred because it can be used either to purchase the same gift or any other product of comparable value that the individual might prefer. I doubt many mainstream economists would wish to side with such a narrow analysis – outside, that is, of an Econ101 brainwashing session.

Presumably that’s what this exercise was, except with the hapless Wall Street Journal reader playing the role of the Econ101 student.

If the main stream economists are so concerned about “utility and value” one might think they would have railed against and effectively shut down the current financial sector.

The idea that the commercial aspect of the Christmas season is a bane on mankind, yet the parasitic society destroying financial sector is above their reproach is laughable.

There’s an un-spoken of utility in the money gift in that it presents a wonderful opportunity to reinforce the hierarchy.

It’s fine within the family, but try slipping 20 bucks into the Xmas card you’re sending to the boss.

Hope you found time for a break Bill.

No “break” at Nobbys sadly, looks like a washing machine.

Robert Trivers an american evolutionary biologist nailed the evolutionary role of self

deception .Self deception helps the deception of others.The economic faith is one means

by which the rich maintain their lineage of power and others attempt to ride their coat tails.

If only FDOTM had a decent news site to publish on. The Grauniad is just disgraceful of late.

The Australian office probably the worst of all 3.

I would just like to point out that the WSJ’s view is not widely shared by economists: http://www.igmchicago.org/igm-economic-experts-panel/poll-results?SurveyID=SV_1z4X7kmHnVYo28d