Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – November 28, 2015 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you understand the reasoning behind the answers. If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern Monetary Theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

People are richer they purchase bonds that the government issues to match its net deficit spending relative to a situation where the government just instructed the central bank to ensure all public spending cleared the payments system.

The answer is False.

This answer relies on an understanding the banking operations that occur when governments spend and issue debt within a fiat monetary system. That understanding allows us to appreciate what would happen if a sovereign, currency-issuing government (with a flexible exchange rate) ran a fiscal deficit without issuing debt?

In this situation, like all government spending, the Treasury would credit the reserve accounts held by the commercial bank at the central bank. The commercial bank in question would be where the target of the spending had an account. So the commercial bank’s assets rise and its liabilities also increase because a deposit would be made.

The transactions are clear: The commercial bank’s assets rise and its liabilities also increase because a new deposit has been made. Further, the target of the fiscal initiative enjoys increased assets (bank deposit) and net worth (a liability/equity entry on their balance sheet). Taxation does the opposite and so a deficit (spending greater than taxation) means that reserves increase and private net worth increases.

This means that there are likely to be excess reserves in the “cash system” which then raises issues for the central bank about its liquidity management. The aim of the central bank is to “hit” a target interest rate and so it has to ensure that competitive forces in the interbank market do not compromise that target.

When there are excess reserves there is downward pressure on the overnight interest rate (as banks scurry to seek interest-earning opportunities), the central bank then has to sell government bonds to the banks to soak the excess up and maintain liquidity at a level consistent with the target. Some central banks offer a return on overnight reserves which reduces the need to sell debt as a liquidity management operation.

What would happen if there were bond sales? All that happens is that the banks reserves are reduced by the bond sales but this does not reduce the deposits created by the net spending. So net worth is not altered. What is changed is the composition of the asset portfolio held in the non-government sector.

The only difference between the Treasury “borrowing from the central bank” and issuing debt to the private sector is that the central bank has to use different operations to pursue its policy interest rate target. If it debt is not issued to match the deficit then it has to either pay interest on excess reserves (which most central banks are doing now anyway) or let the target rate fall to zero (the Japan solution).

There is no difference to the impact of the deficits on net worth in the non-government sector.

Mainstream economists would say that by draining the reserves, the central bank has reduced the ability of banks to lend which then, via the money multiplier, expands the money supply.

However, the reality is that:

- Building bank reserves does not increase the ability of the banks to lend.

- The money multiplier process so loved by the mainstream does not describe the way in which banks make loans.

- Inflation is caused by aggregate demand growing faster than real output capacity. The reserve position of the banks is not functionally related with that process.

So the banks are able to create as much credit as they can find credit-worthy customers to hold irrespective of the operations that accompany government net spending.

This doesn’t lead to the conclusion that deficits do not carry an inflation risk. All components of aggregate demand carry an inflation risk if they become excessive, which can only be defined in terms of the relation between spending and productive capacity.

It is totally fallacious to think that private placement of debt reduces the inflation risk.

You may wish to read the following blogs for more information:

- Why history matters

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- The complacent students sit and listen to some of that

- Saturday Quiz – February 27, 2010 – answers and discussion

Question 2:

The sectoral balances perspective of the national accounting framework tells us that the private domestic sector cannot save if a nation’s external sector is in balance and the government runs a balanced fiscal position (government spending equals its revenue).

The answer is False.

Read the words correctly. We are asking whether the private domestic sector is unable to generate a flow of saving in a given accounting period when the fiscal position is balanced and the economy is effectively closed (external balance). This is distinct asking whether the private domestic sector is saving overall as a sector, which relates to whether the private domestic sector is spending more than it is earning. The private domestic sector can still be saving (meaning consuming less than disposable income) while still spending more than it is earning.

This is a question about sectoral balances. Skip the derivation if you are familiar with the framework.

First, you need to understand the basic relationship between the sectoral flows and the balances that are derived from them. The flows are derived from the National Accounting relationship between aggregate spending and income. So:

(1) Y = C + I + G + (X – M)

where Y is GDP (income), C is consumption spending, I is investment spending, G is government spending, X is exports and M is imports (so X – M = net exports).

Expression (1) tells us that total income in the economy per period will be exactly equal to total spending from all sources of expenditure.

We also have to acknowledge that financial balances of the sectors are impacted by net government taxes (T) which includes all taxes and transfer and interest payments (the latter are not counted independently in the expenditure Expression (1)).

Further, as noted above the trade account is only one aspect of the financial flows between the domestic economy and the external sector. we have to include net external income flows (FNI).

Adding in the net external income flows (FNI) to Expression (2) for GDP we get the familiar gross national product or gross national income measure (GNP):

(2) GNP = C + I + G + (X – M) + FNI

To render this approach into the sectoral balances form, we subtract total taxes and transfers (T) from both sides of Expression (3) to get:

(3) GNP – T = C + I + G + (X – M) + FNI – T

Now we can collect the terms by arranging them according to the three sectoral balances:

(4) (GNP – C – T) – I = (G – T) + (X – M + FNI)

The the terms in Expression (4) are relatively easy to understand now.

The term (GNP – C – T) represents total income less the amount consumed less the amount paid to government in taxes (taking into account transfers coming the other way). In other words, it represents private domestic saving.

The left-hand side of Equation (4), (GNP – C – T) – I, thus is the overall saving of the private domestic sector, which is distinct from total household saving denoted by the term (GNP – C – T).

In other words, the left-hand side of Equation (4) is the private domestic financial balance and if it is positive then the sector is spending less than its total income and if it is negative the sector is spending more than it total income.

The term (G – T) is the government financial balance and is in deficit if government spending (G) is greater than government tax revenue minus transfers (T), and in surplus if the balance is negative.

Finally, the other right-hand side term (X – M + FNI) is the external financial balance, commonly known as the current account balance (CAD). It is in surplus if positive and deficit if negative.

In English we could say that:

The private financial balance equals the sum of the government financial balance plus the current account balance.

We can re-write Expression (6) in this way to get the sectoral balances equation:

(5) (S – I) = (G – T) + CAD

which is interpreted as meaning that government sector deficits (G – T > 0) and current account surpluses (CAD > 0) generate national income and net financial assets for the private domestic sector.

Conversely, government surpluses (G – T < 0) and current account deficits (CAD < 0) reduce national income and undermine the capacity of the private domestic sector to add financial assets.

Expression (5) can also be written as:

(6) [(S - I) - CAD] = (G - T)

where the term on the left-hand side [(S - I) - CAD] is the non-government sector financial balance and is of equal and opposite sign to the government financial balance.

This is the familiar MMT statement that a government sector deficit (surplus) is equal dollar-for-dollar to the non-government sector surplus (deficit).

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)) plus net income transfers.

All these relationships (equations) hold as a matter of accounting and not matters of opinion.

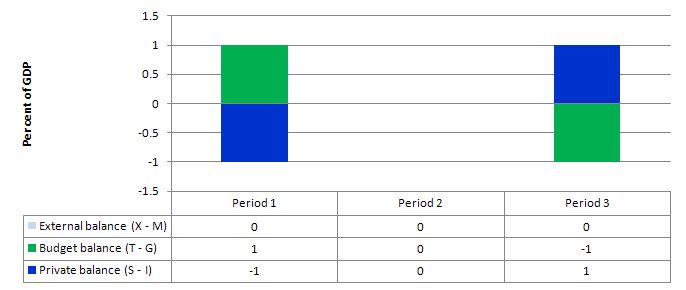

Consider the following graph which shows three situations where the external sector is in balance.

Period 1, the fiscal position is in surplus (T - G = 1) and the private balance is in deficit (S - I = -1). This means that the private domestic sector is spending more (via consumption and investment taken together) than it is earning. So it is dissaving overall. Note that households could still be saving (that is, not spending all of their disposable income). But as a sector, the combination of firms and households would be dissaving.

With the external balance equal to 0, the general rule that the government surplus (deficit) equals the non-government deficit (surplus) applies to the government and the private domestic sector.

In Period 3, the fiscal position is in deficit (T - G = -1) and this provides some demand stimulus in the absence of any impact from the external sector, which allows the private domestic sector to save (S - I = 1).

Period 2, is the case in point and the sectoral balances show that if the external sector is in balance and the government is able to achieve a fiscal balance, then the private domestic sector must also be in balance. This means that the private domestic sector is spending exactly what they earn and so overall are not saving.

The movements in income associated with the spending and revenue patterns will ensure these balances arise. The problem is that if the private domestic sector desires to save overall then this outcome will be unstable and would lead to changes in the other balances as national income changed in response to the decline in private spending.

So under the conditions specified in the question, the private domestic sector cannot save overall. The government would be undermining any desire to save by not providing the fiscal stimulus necessary to increase national output and income so that private households/firms could save overall.

You may wish to read the following blogs for more information:

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

- Barnaby, better to walk before we run

- Flow-of-funds and sectoral balances

Question 3:

The so-called ‘progressives’ tend to argue that if austerity is to be imposed it is better to increase taxes (particularly on high income earners). Conversely, ‘conservatives’ demand spending cuts and privatisation. In terms of the initial impact on national income, which policy option will be more damaging – a tax increase which aims to increase tax revenue at the current level of national income by $x or a spending cut of $x?

(a) Tax increase

(b) Spending cut

(c) Both will be equivalent

The answer is Spending cut.

The question is only seeking an understanding of the initial drain on the spending stream rather than the fully exhausted multiplied contraction of national income that will result. It is clear that the tax increase increase will have two effects: (a) some initial demand drain; and (b) it reduces the value of the multiplier, other things equal.

We are only interested in the first effect rather than the total effect. But I will give you some insight also into what the two components of the tax result might imply overall when compared to the impact on demand motivated by an decrease in government spending.

To give you a concrete example which will consolidate the understanding of what happens, imagine that the marginal propensity to consume out of disposable income is 0.8 and there is only one tax rate set at 0.20. So for every extra dollar that the economy produces the government taxes 20 cents leaving 80 cents in disposable income. In turn, households then consume 0.8 of this 80 cents which means an injection of 64 cents goes into aggregate demand which them multiplies as the initial spending creates income which, in turn, generates more spending and so on.

Government spending cut

A cut in government spending (say of $1000) is what we call an exogenous withdrawal from the aggregate spending stream and this directly reduces aggregate demand by that amount. So it might be the cancellation of a long-standing order for $1000 worth of gadget X. The firm that produces gadget X thus reduces production of the good or service by the fall in orders ($1000) (if they deem the drop in sales to be permanent) and as a result incomes of the productive factors working for and/or used by the firm fall by $1000. So the initial fall in aggregate demand is $1000.

This initial fall in national output and income would then induce a further fall in consumption by 64 cents in the dollar so in Period 2, aggregate demand would decline by $640. Output and income fall further by the same amount to meet this drop in spending. In Period 3, aggregate demand falls by 0.8 x 0.8 x $640 and so on. The induced spending decrease gets smaller and smaller because some of each round of income drop is taxed away, some goes to a decline in imports and some manifests as a decline in saving.

Tax-increase induced contraction

The contraction coming from a tax-cut does not directly impact on the spending stream in the same way as the cut in government spending.

First, imagine the government worked out a tax rise cut that would reduce its initial fiscal deficit by the same amount as would have been the case if it had cut government spending (so in our example, $1000).

In other words, disposable income at each level of GDP falls initially by $1000. What happens next?

Some of the decline in disposable income manifests as lost saving (20 cents in each dollar that disposable income falls in the example being used). So the lost consumption is equal to the marginal propensity to consume out of disposable income times the drop in disposable income (which if the MPC is less than 1 will be lower than the $1000).

In this case the reduction in aggregate demand is $800 rather than $1000 in the case of the cut in government spending.

What happens next depends on the parameters of the macroeconomic system. The multiplied fall in national income may be higher or lower depending on these parameters. But it will never be the case that an initial fiscal equivalent tax rise will be more damaging to national income than a cut in government spending.

Note in answering this question I am disregarding all the nonsensical notions of Ricardian equivalence that abound among the mainstream doomsayers who have never predicted anything of empirical note! All their predictions come to nought.

You may wish to read the following blogs for more information:

Of interest ….

Unifor economist Stanford leaving Canada for Australia, Windsor Star, 27 Nov 2015