The other day I was asked whether I was happy that the US President was…

SNB decision tells us that the crisis is entering a new phase

Switzerland – homeof the secret bank vaults, which house treasures stolen from people (particularly the Jewish victims) by the Nazis during WW2 and ill-gotten cash by capitalists who wish to evade scrutiny of prudential and tax authorities of their domiciled nations. Now it is the canary, which has just sung to tell us that all the hubris about Eurozone recovery cannot cover up the reality that the crisis is not yet over and requires root and branch reform to the policy ideology that exposes the floored design of the monetary union. The – Decision – last week (January 15, 2015) by the Swiss National Bank (SNB) to both break the peg of the Swiss franc to the euro and cut its interest rate on sight deposits to -0.75 per cent signals the surrender by that nation to the reality surrounding its borders. The interest rate decision was required after it decided to scrap the exchange rate peg, given that it didn’t want a credit crunch killing the domestic economy. The appreciation of the exchange rate, which has been held artificially low by the peg, will already undermine domestic spending. The SNB said its decision as reversing its previous “exceptional and temporary measure”, which “protected the Swiss economy from serious harm” as the exchange rate became overvalued. But the decision itself was rather extraordinary given it was seemingly so surprising for most and central bankers are meant to be cautious types.

But the decision has a logic that is easily understood by those who are not trapped within the Euro Troika narrative.

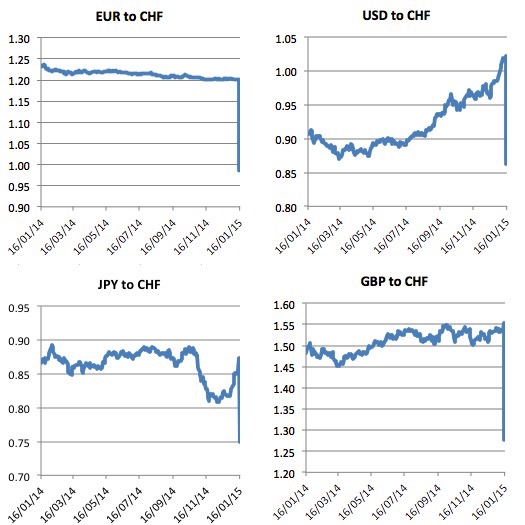

What the decision means is that the exchange rate quickly appreciated from its pegged value and is looking like being stable at the new parities.

This is what happened (graphically, using daily data):

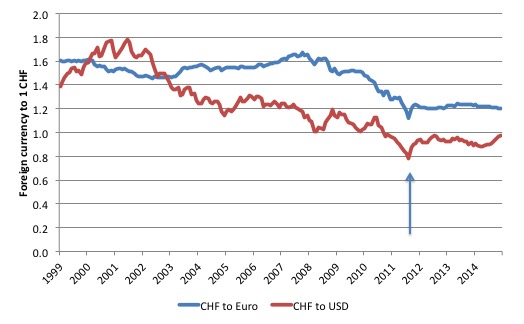

But this is a longer-term view (using monthly data) and I have expressed the currencies in reverse order in this graph so an appreciation is a fall in the graph. The reason for presenting the data in this way is because the SNB provides the raw data in two different forms and I was just saving myself time. But then, of course, once I had created the graphs I realised that typing these three lines took me more time than computing the reciprocal in Excel!

The arrow shows the appreciation that particularly against the USD but also the yen and the euro, which led the SNB to impose the peg on September 6, 2011. At the time, it was clearly a decision aimed to protect the export sector, which is the largest as a percentage of GDP in the world (around 73 per cent, compared say to South Korea (54 per cent), Germany (46 per cent), China (27 per cent), Japan (16 per cent) and the US (14 per cent).

At the time, the SNB released a press statement – Swiss National Bank sets minimum exchange rate at CHF 1.20 per euro – which said:

The current massive overvaluation of the Swiss franc poses an acute threat to the Swiss economy and carries the risk of a deflationary development … With immediate effect, it will no longer tolerate a EUR/CHF exchange rate below the minimum rate of CHF 1.20. The SNB will enforce this minimum rate with the utmost determination and is prepared to buy foreign currency in unlimited quantities.

That means it acknowledged its currency sovereignty and its capacity to create “unlimited quantities” of it to pursue its stated goals.

As the graphs show, the decision clearly stabilised the CHF against the euro and the other leading currencies.

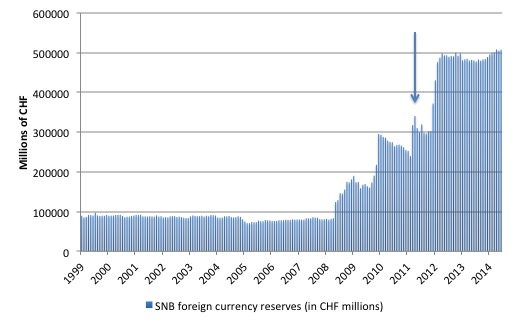

Of course, the operations associated with the strategy increased the SNB’s holdings of foreign currency reserves (particularly the euro). The arrow marks the announcement in September 2011.

Some might think that the SNB balance sheet looks very similar to that of the US Federal Reserve, or that of the Bank of Japan, or the Bank of England for that matter. Hasn’t QE increased the reserves of these central banks in the same way as the SNB reserves grew?

The answer is that the SNB hasn’t been engaged in QE, which we understand to be the purchase of sovereign bonds in exchange for bank reserves. Rather, the SNB has been buying the currencies of other nations in exchange for francs and so the valuation of its reserve holdings are highly exposed to movements in those currencies.

This leads to the mainstream argument that the SNB made the decision because they expect the ECB to announce the introduction of quantitative easing (QE) this week, which would lead to a huge increased demand for Swiss-currency denominated financial assets from parties who would have previously invested their surplus funds in euro-denominated assets.

The demand for Swiss francs and sale of euros that would accompany this type of portfolio shift would then have required the SNB to purchase further substantial volumes of euros to maintain the peg.

So? The SNB foreign exchange reserves would have risen accordingly and build on record levels already held by the bank. So? First, this would mean that the ECB would continue to call the shots on Swiss monetary policy, which means that Switzerland’s currency sovereignty would be compromised.

Second, the mainstream argument is that the SNB would be fearful of holding even more foreign currency reserves given they have already risen by around 800 per cent since 2009.

Why? It would expose them to paper losses on their foreign currency holdings (as the exchange rate appreciated) and to minimise those losses the SNB decided to stop building euro-denominated reserves.

I would not support that interpretation. The SNB has no need to be concerned about these paper losses given it is the currency-issuer. Unlike a private bank, the SNB could operate with permanent negative capital.

Please read my blog – The ECB cannot go broke – get over it – for more discussion on this point.

While the central bank officials would hardly acknowledge the logic in that blog in public, the fact remains that they know it is fact and would hardly have made the decision on the basis of the myth that they can go broke.

I also don’t think the recent conservative demands that the nation return to the gold standard explain the SNB decision.

I am guessing that the SNB has realised that with such a consertative fiscal position being run by the Swiss government and policy austerity surrounding its borders that deflation is inevitable and that they may as well return to a more normalised position (historically) now before the ECB changes its strategy.

On January 16, 2015, Eurostat released its latest inflation indicator for December 2014 – Annual inflation down to -0.2% in the euro area – which confirmed that Europe is now caught in a deflationary spiral, which is likely to accelerate given the cuts in oil prices. Switzerland’s annual inflation rate fell by 0.1 per cent in December 2014.

Greece is deflating quickly (-2.5 per cent) which reinforces my earlier suspicions about the claimed recovery. Please read my blog – Alleged Greek growth could be an illusion – for more discussion on this point. As an aside, the German paper, Der Spiegel quoted from my blog last week (January 13, 2015) in this article – Ist die griechische Statistik erneut geschönt?.

A deflationary environment is not consistent with a broad-based and robust recovery. It tells us that domestic demand is weak and getting weaker, notwithstanding the fact that the declining oil prices (a supply side boost) are, in part, responsible for the falling price levels.

Deflation means that debtors are now worse off in real terms and this is likely to discourage any major credit boom in the period ahead. With governments running austerity stances and net exports a zero sum game across nations, recovery in most nations required domestic demand to expand.

But with private domestic debt levels already high (as a hangover from the pre-GFC credit binge), the motivation to expand private investment by firms is unlikely to be high in a deflationary environment, especially as consumers will be putting off major purchases in anticipation that goods and services will continue to get cheaper over time.

The accompanying interest rate decision was designed to take some upward pressure of the CHF by providing a disincentive to purchase CHF-denominated financial assets.

But there is a broader point that needs to be examined which exposes the mainstream myth that investment is reliant on private saving. This myth is buttressed by a related myth that fiscal surpluses increase national saving and make more funds available for private investment.

Please read my blog – Budget surpluses are not national saving – for more discussion on this point.

The deflationary environment will further undermine the investment climate in the world. By investment I am using the economist’s definition – spending by business firms on productive capital such as equipment, buildings etc – rather than speculative spending on financial assets.

We have seen saving ratios rise again as a result of the GFC and the policy response to the rising fiscal deficits brought about by the crisis has been to invoke contractionary initiatives (austerity).

So has investment increased to eat up all those available funds in the loan markets? With all those bank reserves (liquidity) why hasn’t bank lending gone crazy?

The answers are No and What! No, investment ratios have continued to fall or flatten out at depressed levels. What – is reference to the absurdity of the argument that banks loan out reserves. Please read my blog – – for more discussion on this point.Please read the following blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – for further discussion.

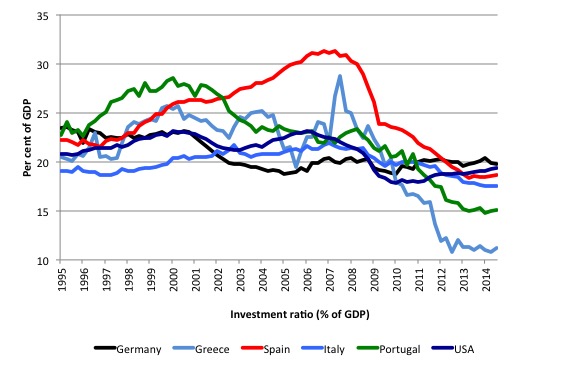

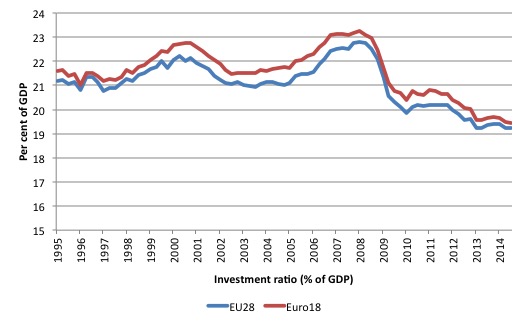

The following graphs show the investment ratios (total fixed capital investment as a per cent of GDP) for the EU/Eurozone and then some selected Eurozone nations.

What these graphs tell you is how entrenched Europe is in economic stagnation despite the tepid growth in recent quarters.

Households are adopting cautious spending strategies given the high unemployment and the suppressed real income growth. Net exports will not drive widespread growth in all nations of the Eurozone, especially now that China is slowing.

Fiscal austerity is denying the public sector as a growth source.

Which leaves private investment as the saviour. But the investment ratios are showing that firms are not willing to return to pre-crisis levels of investment scaled against the size of the economy.

The decline in the PIGS (Ireland is omitted for lack of comparable data) is spectacular and the situation in Italy is deteriorating further (the data goes to the third-quarter 2014).

The situation in the US is somewhat different and the Investment ratio has slowly improved since 2010, which is consistent with the recovery that is underway in that nation. I have noted elsewhere that the US recovery was supported by an on-going fiscal deficit, a support that the mindless policy makers in Europe have denied their economies.

The SNB decision has to be seen in that light, although that doesn’t provide any inside intelligence as to what was the actual reasoning that led to that decision.

With unemployment low, it might have been that the SNB is prepared to let its export sector suffer a bit of contraction (via the exchange rate appreciation) and push the political consequences back onto the Government, which can then adjust its contractionary fiscal policy to compensate for the decline in net exports.

I suspect the SNB’s decision will cause the Swiss more angst than they might have thought. But the SNB is only one arm of economic policy and the decision will now shine a spotlight on the conservative fiscal stance that the Swiss government adopts.

I also suspect that the SNB didn’t want to be seen as moving lock-step with the ECB, which is certainly not a model on which to base monetary policy settings.

Conclusion

Time will tell what the medium-term consequences of the decision will be.

But what it tells me right now is that the crisis is entering its ‘mature’ phase where the prolonged fiscal austerity and entrenched mass unemployment throughout Europe is now causing deflationary forces to accelerate, which will further undermine the chances of recovery.

The SNB’s decision is an acknowledgement of that – they seem to have decided to cut and run and take the consequences now.

I have to attend to meetings in Colombo now!

That is enough for today!

(c) Copyright 2015 Bill Mitchell. All Rights Reserved.

I do not totally agree with you Bill if I may – core EU inflation latest print is 0.8% + we can see the move in oil prices as a small fiscal stimulus –

So my pseudo theory on the logic behind SNB move is the following: they could have seen that financial conditions in EU (bonds yield, EUR exchange rate) have been improving somewhat and industrial production is slowly recovering. As a result, the could also conclude that QE will be for the time being lower than expected (as ECB usually act big when there is stressed conditions). SNB guys are not beginners for sure and have been managing their FX exposures somewhat like a hedge fund. So they knew obviously that surprising the market with a de-peg would trigger a significant amount of sell stop orders and create a large upward move in CHF against other currencies.

Which means that in anticipation of last week move they could have been selling their EUR exposure (on the back also of large gain in its USD exposure last year) or covering part of it with puts options (see large movements in EURCHF and USDCHF options market in December) so that they could avoid a large losses in its EUR portfolio while stopping the PEG – which – with the size of its balance sheet – locally politically challenging (even if indeed SNB for sure understand MMT), as illustrated by local political discussion and vote (i.e on gold reserve).

Moving now, surprising the market, provide the SNB with several and significant advantage 1. back to an independent monetary policy (not anymore in fonction of ECB) 2. limited losses on EUR portfolio vs. traditional way of doing it with announce etc.. 3.potentially making significant paper gains on EUR should they have been buying last Thursday, or should they have been hedging their portfolio with options 4. setting a much asymmetrical trading environment for them should they need to buy more EUR independent of ECB decisions.

In conclusion, If this theory proves to be true, the SNB made a very smart move.

Dear Bill

Switzerland was running big current-account surpluses during its peg. To me, this suggests that the peg was too low. If it had been set at 1.1 or 1.05 CHF to 1 euro, those surpluses would have been smaller. Was Switzerland being just as mercantilistic as Germany or the Netherlands?

This peg would have quite necessary if Switzerland had been able to exercise control over capital inflows. The last thing that a country needs are foreigners who only buy short-term financial assets because they have little faith in their own currency. When short-term capital can flow freely across borders, it plays havoc with the exchange rate, thereby creating instability in the tradable sector. The exchange rate should be determined by trade flows, not financial flows.

Regards. James

I just read at http://www.flasbeck-econimics.de that since 1995, Switzerland has had cumulative current-account surpluses of 1090 billion CFT, 590 billion from trade surpluses and 500 million from investment income surpluses. Yet the net international investment position of Switzerland only increased from 320 billion CFT to 785 billion, a difference of 465 billion. It demonstrates again the absurdity of running current-account surpluses.

Diamond analysis, once again, cheers bill!

When will the nightmare of austerity end? Humans should surely be the main motivation for tgis who,e shstem with the earth and biosphere as cimpirtantuf not more so. Nationalise the banks and start a new system.

I think you make a good point about the SNB being the canary in the coal mine and starting to get central banks back to reality. The interesting point for the Swiss franc is that reality seems to be a safe haven for financial criminal activity.

http://www.nakedcapitalism.com/2015/01/michael-hudson-crisis-europe-machinations-rentier-class.html

I would not support that interpretation. The SNB has no need to be concerned about these paper losses given it is the currency-issuer. Unlike a private bank, the SNB could operate with permanent negative capital.

That is certainly true, Bill. From the standpoint of its operational integrity, the SNB can run with negative balance sheet equity indefinitely.

However, just as with the US system, the SNB distributes a maximum of 6% of its income statement profits to its shareholders, 2/3rds of which are public entities; and then any additional profits are distributed back to the public, with 1/3rd going to the confederation and 2/3rds going to the cantons. If the SNB suffers balance sheet losses on its currency holdings leading to negative income, the public sector is stiffed until the income goes positive again and previous losses are recovered. Perhaps no huge deal for the confederation government, but the cantons are not currency sovereigns and have real budget constraints.

Swittzerland – home of the secret bank vaults, which house treasures stolen from people (particularly the Jewish victims) by the Nazis during WW2 and ill-gotten cash by capitalists who wish to evade scrutiny of prudential and tax authorities of their domiciled nations”

These are not nations as we were thought to believe..

They were local usury jurisdictions that have scaled up to a possibly unsustainable levels under the euro system.

Switzerland is the great bank in the mountains for people who have come to realise everything they have been thought was /is a lie.

In Ireland we are experiencing yet another bout of ” growth” which even more then past euro inflations is a bout of pointless activity so as to seek scarce tokens……

Just to add I narrowly escaped the taxman today while on the road.

The police force of Ireland is another taxing agency.

There is very little need for tax in a country without the epic waste that is usury

Please please please no more growth.

A return to purchasing is needed , not growth , most of us have enough of ” growth’..

Dan Kervick is right. Furthermore, does anyone know if there is a law on the Swiss books prohibiting the SNB from operating with negative equity?

Bill,

You could be right and the decision to revalue the Swiss franc could be about the problems in the Eurozone and with the Euro.

On the other hand the Swiss politicians and bankers could have been reading up on some MMT theory! They could be moving towards the idea that imports are a net benefit to their economy and exports a net cost.

Even if they haven’t, they must be wondering what is the point of swapping more goods and services for fewer goods and services, to the tune of 16% of GDP, and accumulating foreign reserves in currencies they can never spend.

I love the faux pas of … “floored design of the monetary union” …

Austerity has floored most of Europe that were the same victims of German politicians in two world wars in Europe.

A flawed political propaganda is the lie of the flat rate state pension, where the Coalition government told us that all who retired from 2016 would get the full £155 state pension.

Nope.

Some people retiring next year, 2016, have had flat rate state pension forecasts from government,

of just £55 per week.

Current pensioners get £133.10 per week and this is far, far below the breadline already and the lowest state pension of all rich nations bar poor Mexico.

Find out why here:

https://you.38degrees.org.uk/petitions/state-pension-at-60-now

The rich get richer, the poor, get poorer. The 40-60 year olds in the UK are already poorer than their parents and grandparents for the first time since the 1950s.

I dunno … I think they got spooked by the #ghostOfZimbabwe on this. Unpegging basically creates the very situation they’ve been trying to avoid (obviously); they tried to get cute with the -ve interest rate play, but the neoliberal bias is too strong in financial markets – Confidence Fairies and all – so all the market players see is: (EU’s gonna be printing money = bad), (Swiss not printing money or running deficits = good). Does anyone think the effect of EU QE is gonna be that profound on the Euro?!! Yanis Varoufakis wrote and article for The Economist yesterday that had a couple reality-based observations. I’ll quote one here:

“Regarding the asset-purchase programme’s philosophy, we very much doubt that, at this juncture, purchasing government bonds in proportion to each member-state’s equity in our central bank is either necessary or desirable. If the programme allocates, say, €500 billion to sovereign-bond purchases, this would translate into a paltry €40 billion allocated to Spanish debt-a sum that will have no appreciable effect on Spain’s deflationary spiral while potentially boosting the interest-rate differential between German bunds and peripheral bonds.”

EU QE is not going to have a major effect at all if this is true, and the markets are likely to be underwhelmed. Given that scenario, the SNB may well look back and the unpegging as unnecessary, and who knows, it may well return sooner than later.

Thanks Bill!