I started my undergraduate studies in economics in the late 1970s after starting out as…

Fiscal policy saved the world

There was an article in the Melbourne Age this morning (August 12, 2014) – As jobless numbers climb, RBA is perilously close to a rare mistake – that is running a theme that is increasingly being played out by the financial commentators. Basically, that monetary policy saved the world from the GFC but that central bankers may lose their resolve and hike interest rates too quickly. While I certainly do not advocate interest rates going up anywhere (that I am familiar with), what seems to be forgotten is that monetary policy is relatively useless at encouraging growth. It was fiscal policy that saved the world.

Pesek stated that:

There has been no recession on the watch of Reserve Bank of Australia governor Glenn Stevens or under his predecessor, Ian Macfarlane, who served from 1996 to 2006.

Implying the two are related. There certainly wasn’t a recession (defined as two consecutive quarters of negative real GDP growth) but the state of the labour market would suggest that the Australian economy has been in relatively poor shape since the GFC began.

Moreover, the purity of the RBA is not something that should be taken as a given. In the late 1980s, they held interest rates at very excessive levels, despite inflation falling, that by 1991 Australia entered its worst recession since the Great Depression.

There was also fiscal drag on the economy as the Labor Government sought to claim fiscal credibility by running the first surpluses in many years. Both of these poor policy choices contributed to the major 1991 recession.

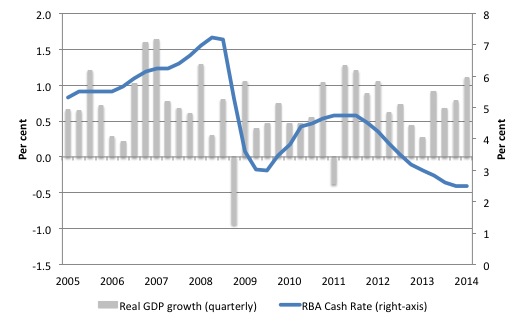

However, more recently, the RBA also hasn’t performed very well. The following graph shows the RBA Cash Rate Target (its policy rate that it sets every month) with the quarterly growth in real GDP from the March-quarter 2005 to the March-quarter 2014. I created quarterly data for the monthly interest rates by averaging so you don’t get to see the step pattern that accompanies time series that are adjusted on a monthly basis. But the smoothing doesn’t alter the story.

Prior to the GFC revealing itself, the RBA (and the Treasury) were obsessing about inflation and they drove the target interest rate up and kept pushing it up even though GDP growth was well and truly in retreat in early 2007.

As real GDP growth plunged in the December-quarter 2008 (after a sequence of monthly rate rises), the RBA finally cut rates hard but still left them well above rates elsewhere, which had the effect of pushing our exchange rate up and crowding out our exporters.

But their inflation obsession reappeared very quickly and they started hiking rates again, far to early, with the consequence that the economy fell back into negative growth against in the March-quarter 2011.

The tightening monetary policy was also accompanied by the reversal of the large fiscal stimulus by the Federal government at the start of 2011.

So the RBA has history and is not the prudent institution many consider it to be.

Pesek claims that the RBA:

… is perilously close to making the kind of policy mistake that’s been so rare at the RBA

Which is? Given the slow down in growth and the rapidly rising unemployment rate on the back of very poor employment growth over the last 24 months, the RBA should, according to Pesek’s logic, be cutting rates rather than leaning towards increasing them again.

He points out that China is now likely to slow and:

In Australia, Prime Minister Tony Abbott’s austerity push seems at odds with global trends, and with the experience of many Australian households and businesses.

The latter point is clearly correct. If the Federal government succeeds in cutting its fiscal deficit then it will certainly undermine growth at a time when the private domestic and external sectors are not going to replace the lost net spending.

Any suggestion that we should have higher interest rates in this environment is silly. But then lowering rates won’t do much at all.

That is a hard message to get across to people who are inured with the idea that interest rates matter and that fiscal policy is a relatively ineffective intervention. Certainly, the neo-liberal era has ingrained that into people but like most things that have been asserted by economists over the last several decades, that is another myth.

Pesek’s point is that with the Federal government fiscal policy is heading in the wrong direction. We agree totally on that.

He said that:

Abbott needs to be diversifying the economy toward growth engines that rely less on China.

That means increased investments in infrastructure, education and training to increase competitiveness.

Yet Abbott and Treasurer Joe Hockey are moving in the other direction, showing excessive concern about a rather modest budget deficit. The drag from Abbott’s fiscal priorities puts the onus on the central bank.

This was the sort of logic that the previous Labor Treasurer used perversely. He claimed that by pursuing fiscal surpluses they were leaving maximum room for the RBA to cut rates.

The logic was – as the Australian government we will deliberately undermine jobs and push unemployment up and that will force the RBA to cut rates – even if they didn’t express it that way.

The problem is that fiscal policy and monetary policy are not perfect substitutes when it comes to economic stimulus or its opposite. I will return to that point presently.

Pesek clearly doesn’t appreciate that point though. He claimed that the RBA is “best placed to offer support in the short run”. but may underestimate the contraction coming in China and not cut rates quickly enough.

But his final point is that:

For better or worse, though, central bankers are the only ones doing anything to maintain growth these days. With fiscal policy makers constrained by pro-austerity forces from Washington to Canberra, the onus is on Stevens and his peers to continue the fight against downside risks.

A central proposition drawn from Modern Monetary Theory (MMT) is that monetary policy is relatively ineffective when compared to fiscal policy.

There has been a long debate about the relatively effectiveness of the two arms of macroecomomic policy.

Many argue that John Maynard Keynes considered monetary policy to be a superior tool for stabilising the economic cycle than fiscal policy.

A famous article by Norwegian economist Axel Leijonhufvud – Keynes and the Effectiveness of Monetary Policy – which was published in Economic Inquiry, Volume 6, Issue 2, pages 97-111, March 1968, noted that the American Keynesian tradition in the post World War II period:

… has been associated with a decided preference for fiscal over monetary stabilization policies … In the development of this school of thought, certain arguments to the effect that monetary policy is generally ineffective have historically played a large role.

He then argued that Keynes, himself, did express “doubts about the efficacy of banking policy and … argued for public works programs” (that is, fiscal policy initiatives) but that his position was more complicated than the American Keynesians made out.

Leijonhufvud wrote that Keynes was aware that expenditure could become insensitive to interest rate changes and that monetary policy was not a suitable tool when an economy was caught in a deep recession and no one wanted to borrow.

The current debate about monetary policy evokes a strong sense of déjà vu, given that these points were debated and understood during the 1930s.

The expression – ‘pushing on a string’ – describes the situation where central banks may be able to inhibit credit creation by the commercial banks (by making the price it provides reserves prohibitive) but it cannot force the banks to lend.

The analogy tells us that the influence of monetary policy on total spending in the economy is likely to work in one direction (pulling the string) but not the other (pushing).

On December 16, 1933, as the Great Depression was worsening and policy makers were relying on monetary policy solutions, similar to the emphasis in the current crisis, Keynes, who is often credited with the ‘pushing on a string’ analogy, wrote an – Open Letter to President Roosevelt – and said:

Some people seem to infer from this that output and income can be raised by increasing the quantity of money. But this is like trying to get fat by buying a larger belt. In the United States today your belt is plenty big enough for your belly. It is a most misleading thing to stress the quantity of money, which is only a limiting factor, rather than the volume of expenditure, which is the operative factor.

In that context, he said that the government “must be called in aid to create additional current incomes through the expenditure of borrowed or printed money”.

In a similar vein, on March 18, 1935, the US House of Representatives Committee on Banking and Currency considered the introduction of the Banking Act of 1935, which was designed to “provide for the sound, effective, and uninterrupted operation of the banking system …” (Committee on Banking and Currency, 1935).

On that particular afternoon, the Federal Reserve Bank Chairman, Marriner Eccles was interrogated by Congressman Thomas Alan Goldsborough about what the central bank could do to address the parlous state of the US economy.

The US economy was mired in a deep depression, not unlike the situation that the euro-zone finds itself in today. The unemployment rate was around 21 per cent.

Their exchange was clear (p.377):

Governor Eccles: Under present circumstances, there is very little, if anything, that can be done.” (p.377)

Mr Goldsborough: You mean you cannot push on a string.

Governor Eccles: That is a very good way to put it, one cannot push on a string. We are in the depths of a depression and, as I have said several times before this committee, beyond creating an easy money situation through reduction of discount rates and through the creation of excess reserves, there is very little, if anything, that the reserve organization can do toward bringing about recovery …

The GFC and its aftermath has demonstrated categorically the power of fiscal policy (spending and taxation). When private spending collapsed, the solution was simple and well-known.

The US government knew what to do: ease monetary conditions and introduce a large-scale fiscal stimulus. The Chinese government did the same, as did the Australian government and several others.

All the governments that followed the basic rules of macroeconomics that spending equals income, which drives employment, were able to offset, to varying degrees, the private sector meltdown.

Australia’s fiscal stimulus package was large enough and was introduced early enough (in late 2008 and early 2009) to allow it to avoid a recession altogether.

The Australian Treasury – providing a briefing at a conference in Sydney on December 8, 2009 – The Return of Fiscal Policy.

They noted that the fiscal interventions, which combined cash transfers and investment:

… were designed to ensure that support was provided to the economy as quickly as possible …

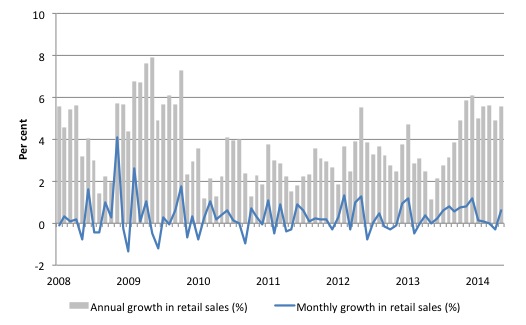

The classic graph is the retail sales data from Australia, which shows was statisticians call the ‘intervention effect’ very clearly. The following graph shows the annual (bars) and monthly (line) growth in Australian retail sales from January 2008 to June 2014.

If you study what happened in early 2009 once the fiscal stimulus was brought into place. A huge recovery ensued and fell away once the stimulus was prematurely withdrawn.

The Australian Treasury concluded that:

… the first cash transfers to households were distributed in early December 2008. Retail trade jumped by 4 per cent in that month, having shown almost no growth earlier in 2008.

So even though interest rates were declining, the stimulus to retail spending only came with the fiscal intervention.

The Treasury also note that the fiscal stimulus saved the construction sector, which normally is one of the first sectors to go into recession as aggregate spending collapses.

Their overall conclusion was that:

… the expansionary macroeconomic policy response was large enough and quick enough to convince the community – both consumers and businesses – that the slowdown would be relatively mild … Macroeconomic policy supported economic activity, which in turn convinced consumers and businesses that the slowdown would be relatively mild. This in turn led consumers and businesses to continue to spend, and led businesses to cut workers’ hours rather than laying them off, which in turn helped the economic slowdown to be relatively mild.

And that:

… absent the discretionary fiscal packages, real GDP would have contracted not only in the December quarter 2008 (which it did), but also in the March and June quarters of 2009, and therefore that the economy would have contracted significantly over the year to June 2009, rather than expanding by an estimated 0.6 per cent.

So it was fiscal policy that saved Australia from recession, not monetary policy.

The Treasury concluded that even though interest rates had come down quickly and significantly (by record proportions in fact):

… this fall in real borrowing rates would have contributed less than 1 per cent to GDP growth over the year to the September quarter 2009, compared with the estimated contribution from the discretionary fiscal packages of about 2.4 per cent over the same period.

So fiscal policy was 2.4 times more effective than monetary policy at meeting the problem wrought by a collapse in private spending.

Subsequent evaluations by government bodies including the American Congressional Budget Office (CBO) and many other economists found that the fiscal interventions were highly successful albeit too conservative and withdrawn too early.

The fact that many of these same governments sooner or later were bullied by the conservative political lobbies into withdrawing or modifying the stimulus packages, which then undermined the emerging recoveries they had earlier created, doesn’t alter the point.

Conclusion

The GFC clearly demonstrated that the claims by neo-liberal macroeconomists that the ‘business cycle was dead’ were far-fetched.

It also exposed the failure of mainstream economic ideas about efficient markets and deregulation.

In turn, the success of the fiscal interventions also demonstrated that the mainstream claims that increasing deficits would only lead to increased inflation were grossly amiss and reflected their ideological preference for small government rather than any evidential knowledge.

But this should be taken to believe that the two arms of policy shouldn’t work together. Fiscal policy is best accompanied by – Overt Monetary Financing where the central bank and the treasury work close together and no debt is issued to the private sector.

That would end the system of corporate welfare and ensure that sufficient spending went where it was needed – into the expenditure stream.

Newcastle Property Developer Scandal

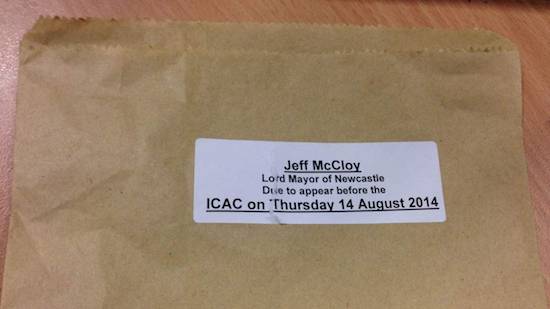

Apparently, these brown paper bags are turning up in letter boxes around Newcastle. Corrupt politicians in the local area (who resigned yesterday) have told the Independent Commission Against Corruption (ICAC) that the Lord Mayor of Newcastle (McCloy), who is a leading property developer in the region handed out illegal donations of $10k in brown paper bags to the now-gone politicians.

It’s classic stuff.

McCloy refuses to resign as Mayor and will face the music in ICAC on Thursday. He denies the politicians account of events.

That is enough for today!

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

Interest rates are a blunt tool.High rates may reduce inflation but they also cause a lot of collateral damage. I had a young family and a (thankfully small) mortgage when interest rates were well into the double digits.

Conversely, we now have excessively low rates which are keeping the housing bubble inflated to the extent that many young people are taking on ridiculously high debt loads or can’t get into the market at all. Like all bubbles,this one will not end well.

If the “many” consider the RBA to be a prudent institution then they are,unsurprisingly,off with the pixies.

The RBA,like the Treasury,is run by a bunch of neoliberal economists high on growth hormones. No wonder Joey boy chomps on his dummy (sorry, ceegar).

That’s to keep the Roid Rage in check.

Bill, I agree that fiscal policy was and is the most effective here.

But I think that monetary policy played a significant part in Australia, owing to what appears to be a uniquely Australian quirk to mortgage lending, one discussed by Sean Carmody. In most other places, it was only new borrowing that became cheaper as most mortgages are fixed for the life of the term – and in a major collapse, borrowers tend to be too afraid to borrow and lenders afraid to lend. But with 90% of Australian mortgaged households on variable rate mortgages, the cost of servicing existing debt got cheaper as well. This must surely have had some impact.

As pordagus says, keeping these very low rates in place is simply blowing the price of ownership of the basic human need for shelter from the elements out of all proportion, saddling our young people with debt loads that would have been unimaginable when I bought my house 14 years ago, if not pricing them out altogether.

But then, with our federal politicians alone holding a third of a billion dollar investment property portfolio between them, I wouldn’t expect anything will ever be allowed to jeapordize that.

I also agree that fiscal policy was and is the most effective measure as Bill describes it. I feel I have to note my agreements with Bill and MMT prescriptions since I am not backwards in noting my disagreements and concerns particularly about the issue of growth. It is a real dilemma that we need economic growth, particularly employment growth, when at the same time we face the Limits to Growth.

We need both short term and long term solutions to deal with this dilemma. The short term solution is fiscal stimulus. I agree with that. I also fully agree with the Job Guarantee proposal. The long term solutions will revolve around converting our entire energy and production infrastructure from unsustainable to renewable and sustainable. That in itself is a huge, public, dirigist, employment-generating project we need to pursue.

Relatively soon, we also need to shift from capitalism to worker cooperative socialism. Capitalism is the system predicated on and requiring endless growth. Capitalism will not be able to develop and sustain a steady state economy. I mean a steady state economy in terms of eventually having a stable population, stable production of basic human material needs and a stable quantitative level of infrastructure*. This does not preclude qualitative growth (knowledge, arts, sciences, technology) which could proceed for a long time.

* Note: Remember, we cannot pave over the whole world. Remember, we cannot keep abusing the biosphere and expecting it to sustain us indefinitely. Climate change is a real and burgeoning danger. Deforestation is real. The destruction of the wild fisheries is real. The looming exhaustion of fresh water aquifers and rivers is real. The loss of topsoil is real. Peak oil is real. Peak minerals (for the rarer but crucial minerals) is real. I could go on but I shouldn’t need to. The best global footprint analyses indicate we are already over a sustainable footprint with existing population and existing technologies. The precautionary principle demands that we start dealing with these concerns from now. A managed transition to a stable plateau of population and stable material production will be far preferrable to over-shooting too far and facing a catastrophic collapse, a Seneca cliff scenario.