The other day I was asked whether I was happy that the US President was…

Austerity fails – its in the numbers

The latest Eurostat public finance data for Europe on July 22, 2013 – Euro area government debt up to 92.2% of GDP demonstrates the failure of the Euro policy agenda on its own terms. It is clear the indecency of the policy elites is reflected in the way they use nomenclature. Massive rises in unemployment and poverty is called modernisation or labour market reform. The argument bifurcates at that point. How can you argue with someone who thinks like that? But we all know what a financial ratio is. They are without nuance. A public debt ratio is what it is. And when the leaders say they are doing everything they can to reduce them and the cost all this “modernisation” is a price worth paying to reduce the public debt ratios we can conclude that they are failing if the debt ratios continually rise as they impose harsher austerity (sorry, increase the degree of modernisation). That is what the hard numbers are shouting. And that means that someone in Europe should just blow the whistle and call time is up and get rid of the whole swathe of policy leaders.

There was an article in the New Statesman last week (July 18, 2013) that summed up what is happening in Greece (and we can extend it to the rest of the Eurozone). The article – Nothing to see here: Athens is now closed to democracy – presents a salutary insight into what is happening in Greece at present.

It reports that major parts of Athens are now regularly shut down – “no protests or assemblies allowed” – when Eurozone leaders visit the capital. The most recent closure accompanied the visit by German Finance Minister Wolfgang Schäuble.

Many similar, seemingly arbitrary incursions of freedoms are documented:

… riot police were used to stop a small village from protesting the destruction of its natural environment, imprisoning anarchists without trial for longer than the law allows or shutting down public institutions (like say the state broadcaster) on a moment’s notice without a vote in parliament.

Clearly states have to limit freedoms in many ways to ensure order is maintained and individuals don’t injure other individuals.

But the article asks:

… if the Greek “success story” is true, why is such protection (usually reserved for dictators and conquerors) needed at all?

The author conjectures that “the very nature of the political system we call ‘democracy'” has changed and:

Greece’s Troika of lenders (comprised of the EU, the ECB and the IMF, but spearheaded financially and ideologically by Germany), in their efforts to close the country’s financial deficit, has created and perpetuated a most despicable, and harder to close, deficit: one of democracy.

The birthplace of the concept of an open forum is now a site of oppression. Why? The reasons are that all the hype from the Euro leaders about the success of the austerity is transparent to the victims.

The truth is that:

The privatisations programme has brought the Greek government nothing but shame. Unemployment now stands at more than 28 per cent, and an expected drop of more than 70 per cent in tax revenue during the month of June is predicted to blow a hole in the budget of almost a billion euros. All of these things threaten the government’s spin.

While the Euro leaders claim there is “light at the end of the tunnel” they systematically send batallians of riot police into the streets, shut down urban transport systems to prevent mobility, impose curfews, and control the media.

The author concludes that:

… if the Greek budget shows a primary surplus this year, itself highly unlikely, the democratic deficit created by these past five years of austerity and authoritarianism will take generations to close.

Mr Schäuble has been busy extolling the virtues of the destruction of Greece. He calls it modernisation and reformation. The UK Guardian article (July 19, 2013), he wrote – We Germans done want a German Europe – is full of self-congratulation about the “fruit” that is now on the trees of a productive Europe.

I wonder where the blossoms were.

Eurostat reports of 28 per cent official unemployment and other evidence that those who remain in employment have significantly diminished conditions (wages, pension entitlements and job security) is considered by Mr Schäuble to be moderninsation.

Mr Schäuble wrote that:

Institutional improvements in Europe have increased the likelihood of sound budgets in future years. We have introduced more binding fiscal rules, brakes on national debt and a robust crisis-resolution mechanism that gives us time to pursue the necessary reforms.

Rules, brakes, and all the rest of the mindless strictures deny the reality of the situation. There has been nothing done by the Euro leaders to prevent budget deficits increasing by the same magnitude again when the next major cyclical downturn arrives.

That is what budget balances do – they cycle with private economic activity. That cycling pattern helps to put a floor in a major private spending collapse, which discretionary fiscal stimulus can then build upon to restore growth quickly and attenuate the rise in unemployment.

Mr Schäuble and his cronies have not only tried to deny the extent of the cyclical swings but have also brought in rules that force governments to work against responsible intervention. By imposing a 2 per cent budget deficit to GDP rule when the automatic stabilisers (the rise in the deficit as a result of lost tax revenue and increased welfare outlays) in the downturn led to budget shifts well in excess of that level, the European leaders are forcing governments to adopt pro-cyclical discretionary policies.

This is the worst fiscal practice. The rising deficits were evidence that the economies were collapsing. At that point the last thing that a government should do is make it worse by trying to fight against the automatic stabiliser impact and cut discretionary net spending.

That is not sound finance. It is destructive and irresponsible lunacy.

And the proof of that destruction is in the latest Eurostat public finance data for Europe on July 22, 2013 – Euro area government debt up to 92.2% of GDP.

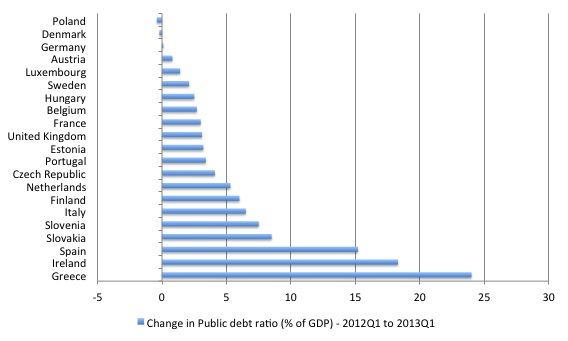

The following graph shows the percentage point change in the public debt ratio (as a percent of GDP) between the first-quarter 2012 and the first-quarter 2013 for the majority of European nations. There is considerable variation. Part of the variation relates to the starting level but most of it relates to the depth of the real recession that each nation experienced and the impact that recession is having on the automatic stabilisers.

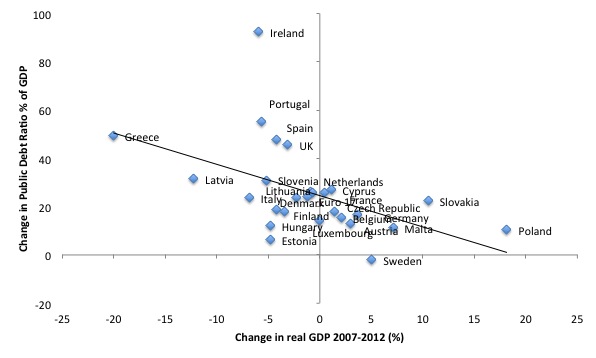

The following graph shows the percentage change in real GDP (volume index) between 2007 and 2012 (horizontal axis) and the same change in the public debt ratio (as a percent of GDP) (vertical axis) for the majority of European nations. The black line is a simple linear trend.

The causality could run either way but the evidence suggests that it runs from real GDP changes to changes in public debt ratios. The furore over the Rogoff and Reinhardt work was not really about their spreadsheet incompetence but the direction of causality. The implication of their 80 per cent threshold for “safe” public debt ratios was that once it went above that ratio, growth suffered.

There is no solid evidence to support that view. To some extent over the period analysed it is moot anyway in trying to understand why the debt ratios grew so much.

Any person will understand that the meltdown in 2008 was not a public debt event. It was a collapse in confidence that led to a spending withdrawal that cause real GDP to decline sharply.

This was followed by the imposition of fiscal austerity in most nations which further dented growth. The rise in the deficits and, under the current institutional arrangements, the rise in debt issuance, saw public debt ratios grow rapidly.

The causality is clear in this case.

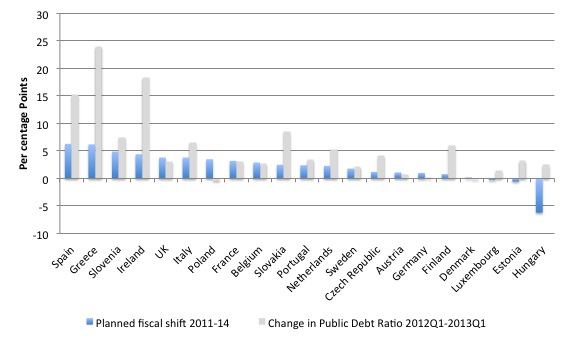

The really harsh fiscal austerity began in 2011 (although Ireland was first cab off the rank in early 2009).

The – Fiscal Consolidation Survey 2012 – produced a table which showed the intended fiscal change between 2011 and 2014 on policy parameters operating at the time of publication. They called a reduction in the deficit an “improvement” and defined it as:

… the change from the overall fiscal deficit in 2011 to the targetted deficit in 2014.

The shift (mostly reported by national budget plans) is thus an indicator of the degree of fiscal austerity being imposed.

The following graph shows the percentage point change in the public debt ratios between the first-quarter 2012 to the first-quarter 2013 (grey bars) sorted by the extent of proposed fiscal austerity underway in 2011 (through to 2014).

The results are clear enough and more detailed analysis would only reinforce them. The public debt ratio bias is upwards the more severe the fiscal consolidation.

So if the aim of the fiscal consolidation was to reduce the debt ratios (which it was) then we would conclude it has been a failure to date.

So what is going on?

While Modern Monetary Theory (MMT) places no particular importance in the public debt to GDP ratio for a sovereign government, given that insolvency is not an issue, the fact remains that in the case of the Eurozone nations there is a funding issue and so debt ratios do matter.

The ECB could solve the problem immediately if it agreed to fund the deficits necessary to restore growth and reduce the public debt ratios but its intransigence has made the crisis deeper.

Each Eurozone nation has to fund its spending because of the simple fact that it surrendered its currency sovereignty the day it agreed to use a foreign currency – the Euro.

It can either fund from taxation revenue or bond-issuance on a sustainable basis. The bond markets know that each nation (Germany included) carries solvency risk although the practical extent of that risk varies significantly across the member nations and that variation is largely reflected in the differential bond yields.

But while the UK, US etc have zero solvency risk, every Euro nation has some.

The other, more significant issue, given the ECBs capacity to deal the bond markets out of the equation (for example, as they have done via their secondary bond market purchases), is the loss of tax base that recession brings.

A persistent recession makes it very hard for a government to keep a deficit at some rule-driven level because the endogenous component – the tax revenue – falls dramatically. The longer the recession – the worse the revenue loss becomes.

It is very simple. A nation should try to maintain growth by shifting the composition of final spending when there are large variations in private spending. That is the role of the budget deficit – to rise and fall as the private spending falls and rises.

In doing so, to avoid recession, more public spending as a share of total spending has to occur. Deficits rise and the public debt ratios rise because under current institutional arrangements, the numerator (debt) rises and the denominator (GDP) falls or grows less slowly for a time.

Rising deficits usually mean declining economic activity (especially if there is no evidence of accelerating inflation) which suggests that the debt/GDP ratio may be rising because the denominator is also likely to be falling or rising below trend.

Further, historical experience tells us that when economic growth resumes after a major recession, during which the public debt ratio can rise sharply, the latter always declines again.

It is this endogenous nature of the ratio (that is, its cyclical dependence) that suggests it is far more important to focus on the underlying economic problems which the public debt ratio just mirrors.

Once you understand the accounting relations involved (and the economic behaviour that generates the accounting aggregates) it is clear that fiscal austerity is likely to increase public debt ratios because it causes unemployment and lost production which reduces the tax revenue for the government.

Take this relationship, which is just an accounting relationship between flows of currency:

The budget deficit in year t is equal to the change in government debt over year t plus the change in high powered money over year t. So in mathematical terms it is written as:

In English this just says that the Budget deficit = Government spending + Government interest payments – Tax receipts must equal (be “financed” by) a change in Bonds (B) and/or a change in base money (H). The triangle sign (delta) is just shorthand for the change in a variable.

However, this is merely an accounting statement. In a stock-flow consistent macroeconomics, this statement will always hold. That is, it has to be true if all the transactions between the government and non-government sector have been corrected added and subtracted.

In terms of MMT, the previous equation is just an ex post accounting identity that has to be true by definition and has not real economic importance.

But for the mainstream economist, the equation represents an ex ante (before the fact) financial constraint that the government is bound by. The difference between these two conceptions is very significant and the second (mainstream) interpretation cannot be correct if governments issue fiat currency (unless they place voluntary constraints on themselves to act as if it is).

However, with the ECB refusing to use its currency-issuing power to fund deficits in the Eurozone the change in base money is negated.

So the Euro nation has to treat this equation as a constraint – it has to issue debt to fund a budget deficit.

This relationship can then be rejigged to see what influences the dynamics of the public debt ratio.

A primary budget balance is the difference between government spending (excluding interest rate servicing) and taxation revenue.

The following equation shows the change in the public debt ratio (Δ B/Y):

The symbol, Δ is the Greek for change.

In English, this says that the change in the debt ratio is the sum of two terms on the right-hand side: (a) the difference between the real interest rate (r) and the real GDP growth rate (g) times the initial debt ratio; and (b) the ratio of the primary deficit (G-T) to GDP.

The real interest rate is the difference between the nominal interest rate and the inflation rate. Real GDP is the nominal GDP deflated by the inflation rate. So the real GDP growth rate is equal to the Nominal GDP growth minus the inflation rate.

It is thus easy to understand why the debt ratios are rising in the austerity-hit nations.

The formula can easily demonstrate that a nation running a primary deficit can reduce its public debt ratio over time.

Furthermore, depending on contributions from the external sector, a nation running a deficit will more likely create the conditions for a reduction in the public debt ratio than a nation that introduces an austerity plan aimed at running primary surpluses.

But if growth is not sufficient then the public debt ratio can rise.

Here is why that is the case. While a growing economy can absorb more debt and keep the debt ratio constant or falling an increasing real interest rate also means that interest payments on the outstanding stock of debt rise.

From the formula above, if the primary budget balance is zero, public debt increases at a rate r but the public debt ratio increases at r – g.

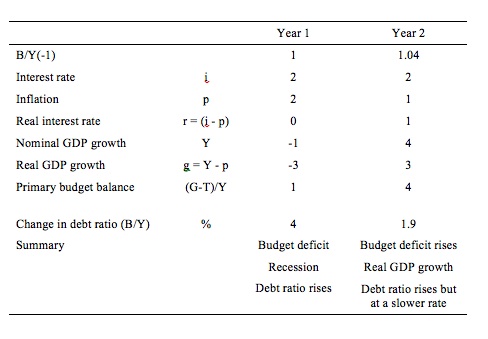

So do some arithmetic to ensure you understand this. Refer to the Table below which shows the calculations.

Start by assuming a public debt ratio at the start of the Year 1 of 100 per cent (so B/Y(-1) = 1) which means that outstanding public debt is equal to the value of the nominal GDP. In the public debate a public debt ratio of 100 per cent would be very large and invoke all sorts of claims about solvency and persistently negative growth (the Spreadsheet Experts!).

If we also assume that in the current year (Year 1) that the nominal interest rate is 2 per cent and the inflation rate is 2 per cent then the current real interest rate (r) is 0 per cent. That is not far off the reality in Europe at present.

If the nominal GDP grows at -1 per cent and there is an inflation rate of 2 per cent then real GDP is growing (g) at minus 3 per cent. Again not far off the reality facing many nations in Europe.

Under these conditions, the primary budget surplus would have to be equal to 3 per cent of GDP to stabilise the debt ratio (check it for yourself).

In Year 1, the primary budget deficit is actually 1 per cent of GDP so we know by computation that the public debt ratio rises by 4 per cent.

The calculation (using the formula in the Table) is:

Change in B/Y = (0 – (-3))*1 + 1 = 4 per cent.

The situation gets more complex in Year 2 because the inflation rate falls to 1 per cent while the central bank holds the nominal interest rate constant at 2 per cent. So the real interest rate rises to 1 per cent.

The data in Year 2 is given in the last column in the Table below. Note the public debt ratio at the beginning of the period has risen to 1.04 because of the rise from last year.

The Euro leaders get a surge of reality as they see the situation meltdown in Year 1 and instruct the ECB to fund deficits to promote growth. Various visitations to nations of the leaders urge nations to go for growth. No streets are closed as foreign leaders visit each other’s nations to instill confidence and unity into their respective economies.

So a representative nations increases the budget deficit to 4 per cent of GDP (by introducing a Job Guarantee and injecting funds into public education and health and other large-scale infrastructure programs.

Nominal GDP growth recovers quickly as it always does on the back of a significant fiscal stimulus. It rises to 4 per cent which means real GDP growth (given the inflation rate) is equal to 3 per cent.

The corresponding calculation for the change in the public debt ratio in Year 2 is:

Change in B/Y = (1 – 3)*1.04 + 5 = 1.9 per cent.

That is, the public debt ratio rises but at a slower rate than in the last year. The real growth in the economy has been beneficial and if maintained would start to eat into the primary budget balance (via the rising tax revenues that would occur).

In a few years, the growth would not only reduce the primary budget deficit but the public debt ratio would start to decline as well.

So when the budget deficit is a large percentage of GDP then it might take some years to start reducing the public debt ratio as GDP growth ensures.

The best way to reduce the public debt ratio is to stop issuing debt but that would require a dismantling of the Eurozone – a thoroughly recommended option.

But irrespective of that nuance, governments should go for growth and use expansionary deficits as the growth engine and then all the financial ratios that people worry about will take care of themselves.

Conclusion

The Eurostat data continues to undermine the austerity aspirations. Sound finance is not a sequence of harsh rules and sanctions. Rather it is the recognition that the government’s fiscal position is a fundamental determinant of the state of economic activity.

The components of the financial ratios that people seem to get stuck on all respond in the appropriate way to growth. Austerity is anti-growth and forces the financial ratios to respond in the way that is not desirable.

And, along the way, unemployment and poverty rises and people get angry and officials starting reducing liberties.

And, it is not before long that the goon squads form and start snatching people in the dead of night from their homes because they had the temerity to criticise the regime.

By that time, our governments have become regimes and revolution is the only hope.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Bill,

Just above your conclusion, you say the abolition of the Euro would be a good idea. Then you say, “But irrespective of that nuance, governments should go for growth . . and then all the financial ratios . . will take care of themselves”.

If the EZ “went for growth” they’d get high levels of inflation in core countries and/or core countries would have to buy yet more of that dodgy Greek debt. So “go for growth” just ain’t going to happen. Thus I think the phrase “will take care of themselves” is over-optimistic.

And even more pessimistically, the deflation being imposed on the periphery is not having the internal devaluation effect that’s supposed to (if those figures you directed me to a week or two are correct).

So “will take care of themselves” is much too optimistic. My take is that the EZ faces a stark choice they haven’t yet recognised: abolish the Euro or endure another decade of high unemployment in the periphery.

Dear Ralph (2013/07/25 at 19:02)

You wrote:

You have a strange notion of full capacity, almost at the extreme version of monetarism.

There is massive scope for non-inflationary growth in Europe at present. If the nations that are closer to capacity feel inflationary pressures as the demand for their exports rises from the newly growing nations then they can tighten policy or buy more imports (holidays in Greece) from the poorer nations. It seems you have no imagination for the way fiscal policy used to be run before the neo-liberals became dominant.

Further, the dodgy Greek debt only became “dodgy” because the nation was facing a massive collapse of its production levels. An unprecedented collapse.

With growth, comes the response of the tax base, and the wherewithal to service the debt (should the ECB be stupid enough to insist that nations match their increased deficits with increased debt).

The financial ratios will definitely take care of themselves if stimulus is allowed.

The preferred option though remains – abandon the Euro.

best wishes

bill

Situation in europe seems to be tug of war between all institutionally forced and encouraged pension savings and governments who refuse to fund those savings.

They don’t want to give up either of those pensions savings they say are important and cutting government deficits are of the most utmost importance. It all just looks crazy, why would you legislate all this savings that must happen and then refuse to fund it?

Answer o/c is that they are getting all their policy advice from junk economics.

Dear Bill,

Re “buy more imports”, that just won’t happen to any great extent on my above assumption that internal devaluation is progressing far too slowly.

I agree that the “massive collapse of its production levels” contributed to the dodginess of Greek debt. But I don’t agree that that’s the “only” reason. Another reason is periphery lack of competitiveness. I.e. a country whose currency is over-valued will run a continuous balance of payments deficit at full employment till it devalues (or in the case of the EZ, till it does an internal devaluation). I.e. it will run further and further into debt till it devalues.

“Should the ECB be stupid enough to insist that nations match their increased deficits with increased debt.” I agree with Milton Friedman and Warren Mosler than a monetarily sovereign country’s deficit should accumulate as monetary base rather than debt. However, and EZ country cannot do that, can it? I.e. the Greek central bank cannot create Euros: it can only come by them by borrowing far as I can see.

Best wishes,

Ralph.

Seems to me this was the same sort of stuff Hayek was saying to justify Pinochet. We’ll have to shut down democracy, but only for a little while as we put the economy back together the right way without all that socialism junk. And we know what that turned into, and that Hayek and Friedman never paid a price for supporting Pinochet. Neither did Thatcher.

Frankly, I’m expecting a military coup in Greece, just as soon as Germany et all decide maybe that their military needs a haircut too. You’d think they’d be smarter, but not after that boner they pulled in Cyprus.

Can someone clarify for me, the following :

In the first identity r appears to be the average coupon rate for Govt bonds.

In the second equaton r is now the real interest rate.

2 questions.

Are the 2 r’s different r’s ?

What does the nominal interest rate represent ?

I will play around with them. Just thought it might save me some time.

Ta

I think its a mistake to call these guys German ,English or whatever.

They represent Hanseatic interests.

The remaining industry which orbits their sphere requires vast amounts of external inputs outside the national orbit.

These inputs are becoming scarce.

Therefore these forces must shut down (southern) countries , therefore more resources can be burned in the North Sea countries which is experiencing a crisis in primary production (North Sea oil & gas depletion

)

The Sterling area is the fulcrum from which the Eurozone turns

Its rotten core is the City of London.

What is happening is logical from their standpoint although its perhaps doomed.

Their worldview cannot bring themselves to accept that their entrepot economies cannot function for much longer as this would destroy their profits – therefore the next best thing is to create a smaller entrepot – using the previous resource rations of Greece , Italy , Iberia etc etc.

Its a sort of cannibalistic process which is the natural world can eventually lead to a process of “Insular dwarfism” when the environment becomes stressed over many generations.

Well the environment has become stressed over many generations now via the process of creating artificial scarcity so as to preserve global rent flows to London and other financial centers……..this has now created real scarcity through the process of core human and physical capital destruction.

Indeed it has created a army of Flores like Hobbit men who just look down and watch for various bits of marine life to wash ashore.

naked capitalism posted a good article about Irish (union) economic history – in particular….

“Finally, for those watching the history of currency unions closely, it is interesting to note that the Irish pound was ended in 1826. One major (albeit dated) study of Irish economic history argues that “the suppression of paper money in 1826 the tragic effects of the Great Famine twenty years later were made inevitable”. If this latter point about the Irish pound is true, it implies that Ireland has fallen into another trap similar to the one that plagued it in the 19th century. The difference is that this time Ireland’s politicians gave up autonomy rather then having it yanked from them. Words such as tragedy and farce don’t begin to describe their crisis.”

http://books.google.ca/books?id=T_x5dIwTzOQC&printsec=frontcover#v=onepage&q&f=false

The tension between more local industrial interests which require local inputs and the British banking system which wanted to scale up to capture & concentrate global capital flows is easily seen with the Guinness family having fingers and toes in all economic and monetary sinks.

indeed its hard to imagine England having the surplus capacity to industrialize without the rape of Ireland starting from the Tudor conquest.

Unions work to concentrate capital ,thats what they do and thats what they have always done.

This happens IN ALL UNIONS , including the US.

Its hard to argue against this as its generally accepted the US of A is a giant shithole today.

Its the money vortex phenomena as argued by Damon Vrabel in a clear simple and concise fashion a few years ago.

Humans motivated by ideology and faith (The Troika) have a very high capacity to ignore empirical evidence. This remains the case while the pains of their oppressions and mistakes are inflicted on others. The solution is to ensure the pain of their mistakes is inflicted on them. How to arrive at that solution is the tricky bit whilst they control the oppressive apparatus.

As Gandhi pointed out, and proved in action, the few cannot control the many if the many withdraw their consent. It is the workers who run a country, any country. All it takes is concerted action by the workers. Since the Greek Parliament is unresponsive to the people, the workers should simply withdraw all services from the Parliament; no cleaning, no deliveries, no food, no garbage collection, no taxis, no limos, no good or services of any kind.

Arriving officials from Germany could be allowed into the country but then not allowed out. No taxis, no limos, no hotel service, no departing jets refueled and so on. Bob Hawke and the unions did it to Frank Sinatra. Ah, those were the days.

http://www.themonthly.com.au/issue/2009/october/1295849506/shane-maloney/frank-sinatra-bob-hawke

Seriously, the Greek workers and Greek public need to implement national strikes and peaceful non-cooperation. Take a leaf out of Gandhi’s playbook book.

Yes Ikonoclast, you are correct, PROVIDING that the Ministry of Truth (aka Propaganda) can be neutered. And you can interpret the word “Ministry” in the broadest sense, to include the owners and controllers of the mass media, all of whom have their own political agenda.

The history of humanity is a story about the manipulation of the gullible and stupid (arguably the majority) by those who are both intelligent and ruthless. Ruthless meaning that they will do whatever it takes to secure and consolidate their power base, including corrupting the political and legal processes.

The “Irish” central bank has urged (told) the government not to ease up on austerity.

We are dealing with free banks which have taken or been given total political authority.

http://www.rte.ie/news/business/2013/0726/464796-central-bank-warns-on-easing-austerity/

From Londons perspective failure is in fact success as it involves the transfer of real resources to the various financial city states.

This is a classic means of control.

Make domestic goods and services expensive so as to free up resources for further buying of external goods – helping globalization and destroying whatever internal cohesion or redundancy remains within these sad little Euro nations.

Despite the propaganda water is not a scarce resource in Ireland.

http://www.rte.ie/news/2013/0726/464799-water-meters/

The ongoing agenda to destroy what remains of the nation state remains.

The function of these new “workers” is to transfer rents to financial centers now in control of very basic utilities.

Not to build core capital in primary industry as this would reduce scarcity and thus rental flows.

London simply cannot grow without the exponential rise of the absurd market state.

Hi Bill,

I have just started learning about MMT and this blog is great. Just wanted to say there seems to be an error in the following calculation. you have put “5” instead of “4”. This article is very important especially for pointing to the fact that Euro states are limited by not being able to print their own currency and contains clues to the evil of the world economic system. It would be a perfect stating point for a study of the whole system.

Change in B/Y = (1 – 3)*1.04 + 5 = 1.9 per cent.